The idea of earning a living as an options trader is appealing.

But you’ve got to walk before you can run. It’s essential to understand the fundamentals before you trade, like the different types of options and key options trading strategies.

Let’s start with the 2 key types of options: calls and puts.

In this article, I’ll introduce you to the two different types of options that act as the foundation for all types of options trading.

Then, I’ll offer up a little education on what you can do with this knowledge, including common options trading strategies and how most options traders actually make money. But first…

Looking to uplevel your options trading?

Benzinga’s option alert service is the best way to trade and learn about options.

This top-notch options alert service is led by options trader and mentor Nic Chahine.

Chahine not only shares his high-conviction and highly profitable options trades, but he also provides thorough analysis so you can learn as you trade. Here’s what you get:

- High-probability option trades

- Transparent access to trade explanations and analysis

- Market analysis

- Education

Plus, for a limited time, you can get free access to the next Benzinga Boot Camp to learn how to trade stocks and options like a pro.

What are Options?

Options are a type of contract that gives you the right, but not the obligation, to buy or sell a referenced, underlying asset, like a stock.

As an option contract buyer, you’re granted this right because you pay a premium to the option seller.

Think of the premium as the cost to hold the option. Regardless of what happens with the option, whether it is exercised or expires worthless, the option seller always keeps the premium.

Options are considered derivatives because they derive their price from an underlying security.

For example, you can purchase or sell Apple options. These are contracts whose price is tied to Apple’s (NASDAQ: AAPL) stock.

There are two types of stock options: calls and puts (or call options and put options).

Before we get to what they are and how they work, you need to understand a few more things about options…

More Options Mechanics

Every option contract includes a strike price or a milestone price on the underlying security. It’s the price level that the buyer and seller use as a reference for determining profit and loss on the contract.

The current price of the underlying is referred to as the spot price. Depending on the type of contract, the spot price must be above or below the strike price to be eligible to be exercised.

“Exercised” in this context means the owner of the contract can execute a trade on the underlying shares.

- Exercising a call option gives the owner the right, but not the obligation, to BUY the underlying security.

- Exercising a put option gives the owner the right, but not the obligation, to SELL the underlying stock.

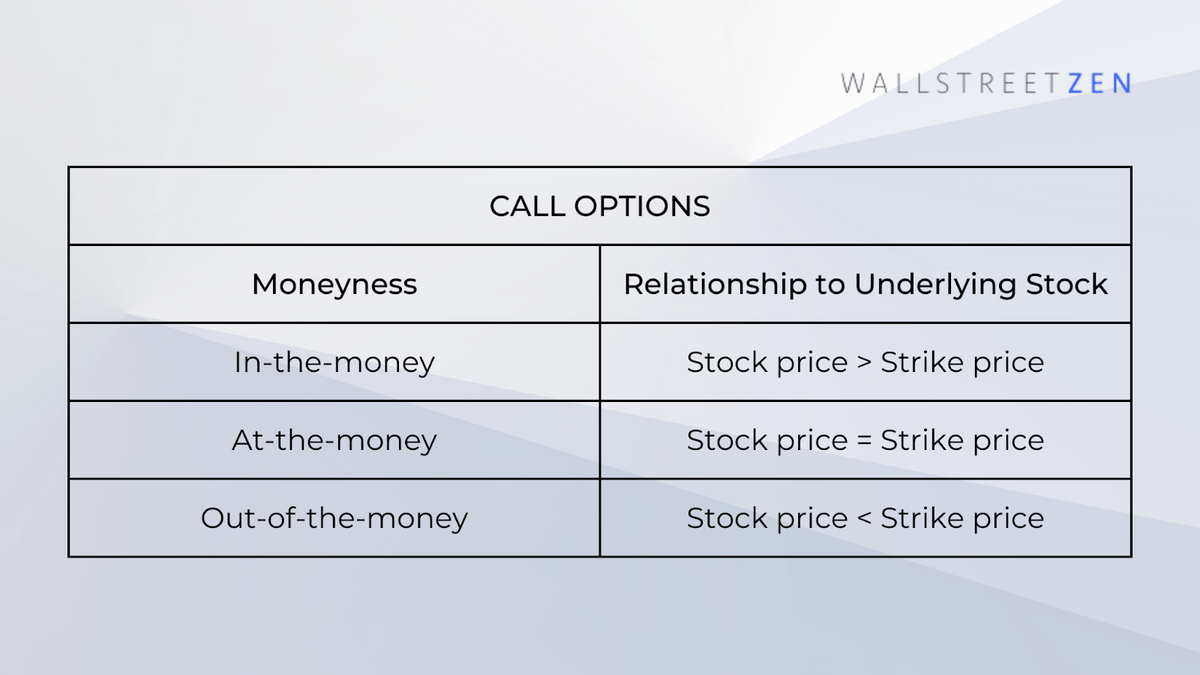

When an option is in a position to be ‘exercised,’ it necessarily means the option has value to the owner. We refer to this as the option being ‘at-the-money’ or ‘in-the-money.’

- At-the-money means the underlying security price is the same as the strike price. This is true whether the contract is a call or put option.

- In-the-money means the option contract has value to the owner:

- Call options: the underlying security is above the strike price.

- Put options: the underlying security is below the strike price.

- Out-of-the-money means the options contract doe not have value to the owner:

- Call options: the underlying security is below the strike price.

- Put options: the underlying security is above the strike price.

An option only becomes valuable to the owner once it’s at- or in-the-money. Otherwise, the option cannot be exercised. Here’s more info on ITM vs OTM options.

The 2 Types of Options:

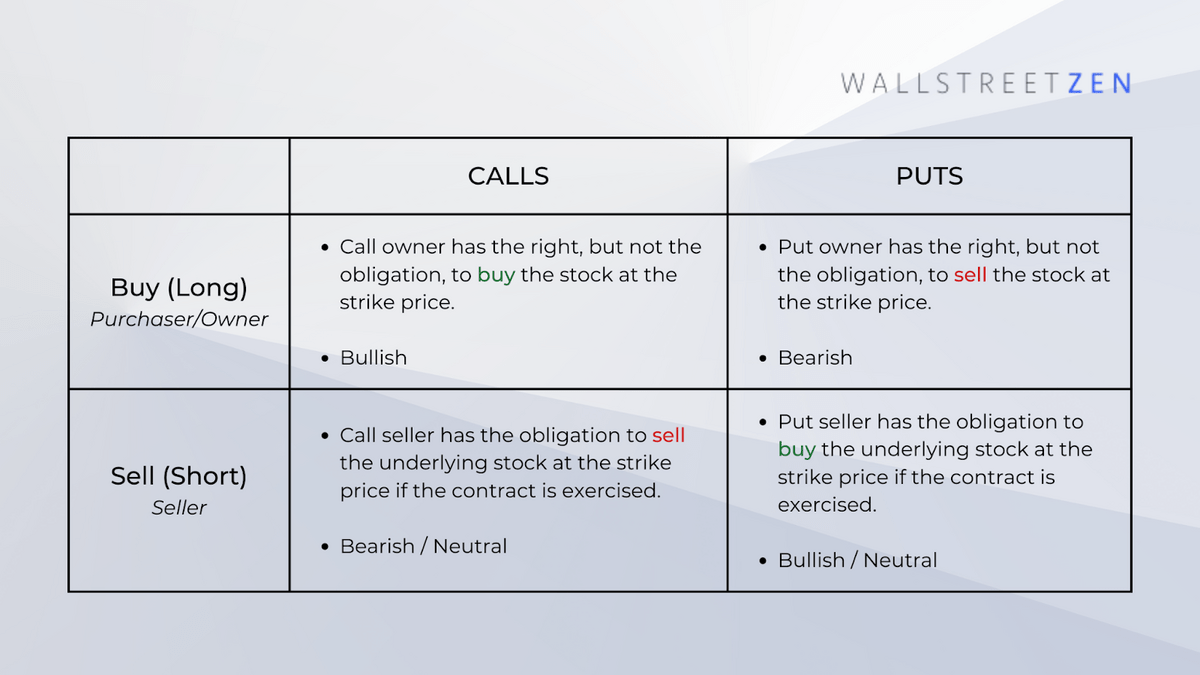

There are two types of stock options: call options and put options. Before we dig deeper, a few basics:

- Traders can buy or sell both calls and puts.

- Like stocks, when someone buys a call or put option, we say they are long the option (i.e., long Apple options).

- Alternatively, when someone sells a call or put, we say they are short the option.

1. Calls

As noted earlier, options give you the right but not the obligation to buy or sell the underlying security. Call options, specifically, refer to the right to buy the underlying security.

The owner (purchaser) of the call option has the right to buy the underlying stock provided the conditions necessary to exercise the contract are fulfilled.

- Call option buyers are considered bullish since they expect the underlying security price to rise.

- Call option sellers are considered bearish or neutral since they expect the underlying security price to fall or remain flat.

Since option sellers receive a premium payment, they get paid even if the underlying stock price does not drop. That’s why a trader neutral on, for example, Apple’s stock, may decide to sell call options.

Buying calls is one of the simplest bullish option strategies, though there are many others to choose from.

2. Puts

Alternatively, put options give you the right to sell the underlying stock if particular conditions are met.

- Put option buyers are considered bearish since they expect the underlying security price to fall.

- Put option sellers are considered bearish or neutral since they expect the underlying security price to rise or remain relatively flat.

Like call option sellers, put option sellers can be bearish or neutral. They get paid even if the underlying stock stays flat. In fact, they get paid a premium no matter what occurs with the stock price.

Why Trade Options?

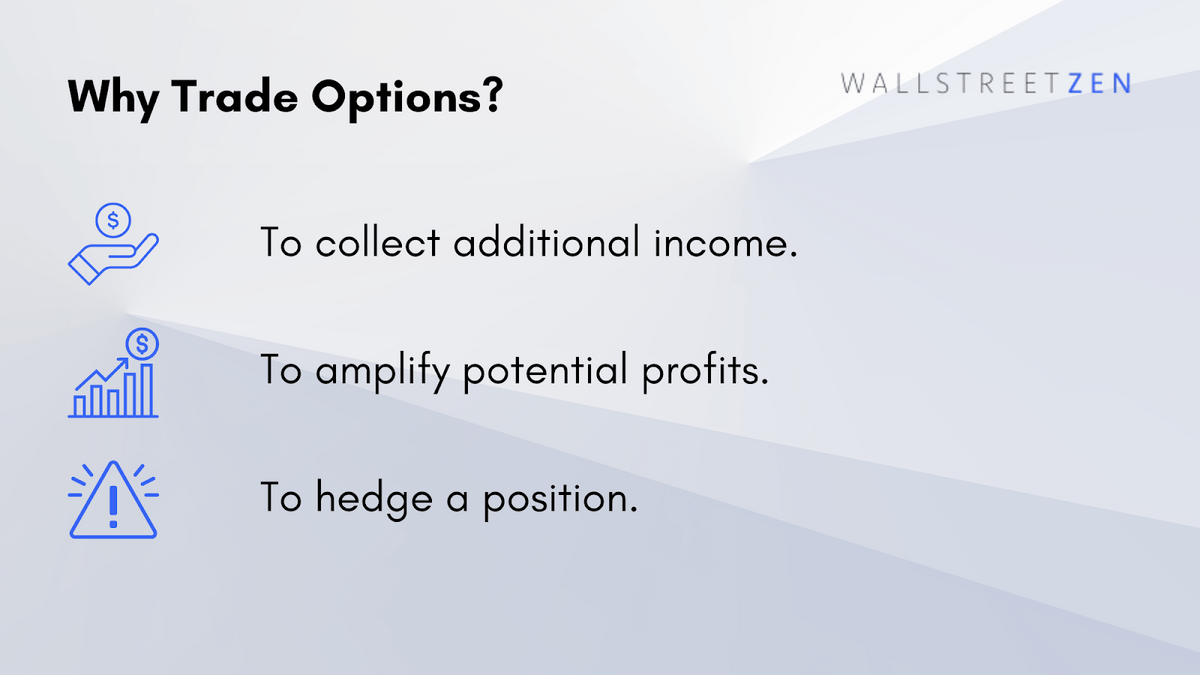

There are several reasons to trade options. Some of the most common include:

- To potentially earn additional income by collecting premiums (i.e., selling call options or selling put options).

- To speculate on the direction of a stock. Options are a form of leverage, meaning traders can make outsized bets unavailable to them when buying the underlying security directly.

- To hedge against a potential loss. For example, if you hold Apple (NASDAQ: AAPL) shares but think the stock may fall in the near term, you might decide to buy put options as insurance.

Common Options Strategies

There are countless options strategies available, from straightforward covered calls to more exotic, complex trades involving numerous contracts.

Here are a few common types of options trading:

Goal | View | Strategy | How to Trade? |

|---|---|---|---|

Collect additional income | Neutral / Bearish | Covered Call | Sell a call on shares of an underlying security you already own. |

Speculate | Bullish OR Bearish(Betting the stock’s price will make a meaningful move) | Straddle | Buy a call AND a put at the same strike price. If the stock moves sufficiently one way, the buyer can profit. |

Hedging | Neutral to Bearish | Protective Put | Buy a put on shares you own to protect against the downside. |

Wanna dive into options trading strategies?

Check out Selling Options for Income, an at-your-own-pace options course.

In this course, you’ll learn everything you need to know to get started … even if you’re a total newbie. This highly-actionable course enables you to get started trading options on the very first day.

Payoffs for Options: Calls and Puts

Option payoff is the amount received or paid.

Option profit (loss) is the net amount received or paid after accounting for the premium.

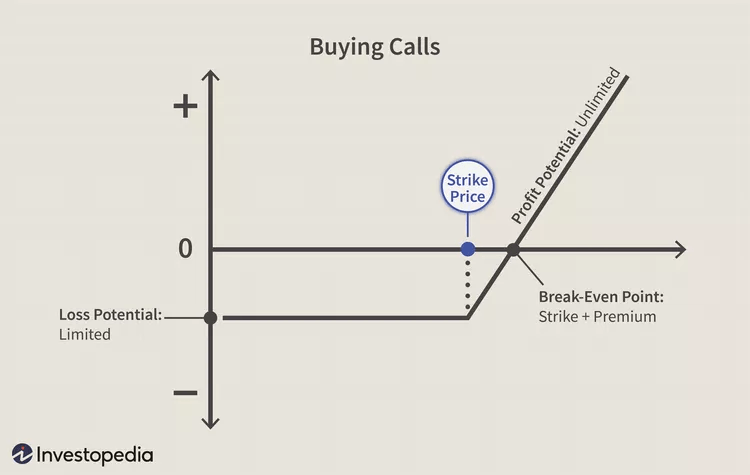

Payoffs and profits can be confusing, so let’s look at a straightforward trading strategy: buying a call option.

- Call buyer payoff = spot price less strike price

Think of it this way. If you own the call option, you expect the price to rise. If the spot price (current stock price) when the contract is exercised is $110, and the strike price is $100, then the payoff equals $10 ($110 less $100).

- Call buyer profit = payoff less premium

Since you had to pay for the option contract, the difference between the spot and the strike price doesn’t reflect the actual profit.

Instead, you must also subtract the premium paid. In the example above, imagine the premium is $2. Therefore your profit is $8 ($10 payoff less $2 premium).

When purchasing a call option, your potential loss amount is limited. Regardless of how the underlying stock performs, the most you can lose is the price paid for the premium.

Of course, if the price of the underlying rises, your payoff will increase. Once the underlying crosses the strike price, the option is in-the-money, meaning it’s profitable to the owner.

While the downside of owning a call option is limited, the upside is unlimited. That is, there is no ceiling on how high the underlying stock price can reach and, therefore, no cap on your potential profit.

Other Types of Options

We’ve mostly covered option contracts as they relate to stocks, but there are different options as well.

The following are some other forms options you might come across.

1. Index Options: These are similar to stock options, but the underlying security is not a single company stock but a broad index. A popular index used as an underlying security is the S&P 500. For example, traders might buy a call option on the SPDR S&P 500 ETF.

2. Forex/Currency Options: Instead of a stock, you can buy or sell options on a particular currency, like the US dollar.

3. Commodity Options: Like currency or stocks, you can buy and sell option contracts on particular commodities, like gold.

4. Employee Stock Options: This is often what people often think of when they hear “options.” But they’re different options than the contracts we’ve been talking about.

Employee stock options provide employees equity in the company should specific criteria be met. Typically, companies enact a vesting period before the options can be exercised.

With these options, there’s no strike price. Instead, a company will allow employees to purchase shares at a predetermined price after a certain period. Employee stock options are meant to incentives the employee, aligning interests with the employer.

Options tools of the trade

- The best options alerts + education: Benzinga Options

- The best options trading brokerage: eToro*

- The best digital options course: Selling Options for Income

- The best options charting platform: TradingView

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Final Word: Different Types of Options

Options are versatile instruments allowing traders to implement unique and profitable strategies that can otherwise be difficult or impractical to execute.

Whether looking to express an outsized bet on a particular stock, temporarily hedge a position, or collect a recurring income, options offer an effective method to express trade decisions efficiently.

While there are only two main types of options, there are virtually no limits to the complexity of trades that can be implemented.

Not only can each option contract (call and put) be bought or sold, numerous options can be used to construct a single unique and profitable strategy.

FAQs:

What are the 4 types of options explained?

There are 4 main types of options positions: 1) Buying a call option (long call), 2) Selling a call option (short call), 3) Buying a put option (long put), and 4) Selling a put option (short put).

What are the three types of options?

While there are only two primary types of options contracts — calls and puts — there are countless trading strategies, like covered calls, protective puts, and long straddles, just to name a few.

What are the 4 levels of options trading?

There are typically 4 levels of options trading offered by brokerages, with risk levels increasing at each stage. The first level involves permission to buy and sell options as long as you maintain a corresponding position in the underlying security; the second involves permission to buy and sell options without a corresponding position; the third involves permission to implement more complex option strategies; the fourth grants permission to implement riskier trades.

What are the 2 types of option contracts?

The main 2 types of option contracts are call options and put options. Call options give the buyer the right, but not the obligation, to buy the underlying security, while put options give the buyer the right, but not the obligation, to sell the underlying security.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.