Nic Chahine, Benzinga’s star options trader, created Benzinga Options – an options alert service that provides high-conviction and highly profitable trades. Plus, he teaches strategies, shares market analysis, and helps you become an independent options trader.

Most options traders focus on buying calls and puts.

If you are doing this, you are probably looking for ways to leverage a good guess about the direction of a stock or index. SPY options trading is one of the most popular strategies for traders. And why not? After all, options provide a lot of leverage so your profits can stack up quickly – or so it seems.

But this approach usually leads to losses. Thankfully, the losses are limited by the cost of the options, so you might be able to keep the losses small if you’re careful.

But a lot of traders get frustrated with how often they have to lose before raking in a big winner.

Traders looking for a more consistent way of extracting income from option trading are far more likely to be happy with strategies that feature selling options than buying them. Trading options for a living is certainly very difficult, but not impossible.

Selling options is slightly more involved than buying them, so you’ll need to learn a bit more to get started down the path of learning to sell options.

Buying vs Selling Options

If you’ve traded options at all, then you know how much influence the price action of the underlying stock influences the option price. But you’ve probably also noticed the influence isn’t one for one. If stock ABC moves up dollar in price, the at-the-money option may only increase by fifty cents.

That’s because the trader who sold you that option charged you a premium. The amount of the premium will vary depending on how much time is left before expiration and how much fluctuation is typical for the underlying stock.

In effect, the seller prices the option assuming you might have a winning trade. Therefore, the seller can “win” even if the stock works against him.

In other words, the option buyer needs to win big in order to profit anything – otherwise the seller wins. As the option seller, the odds are stacked in your favor.

A shrewd option seller will select from one of several strategies that both limit their risk of making big payouts while increasing the probability that they can consistently take in profits each month.

Any selling strategy assumes that the trader will lose some trades, so they plan to sell options each month (or week where possible).

Here are my favorite 7 options strategies for income:

- Covered Calls

- Cash-Secured Puts

- Protective Collar

- Call Credit Spread

- Put Credit Spread

- Iron Condor

- Iron Butterfly

moomoo is one of the top platforms for options trading.

The platform offers top-notch charting software for both its mobile and desktop platforms, free Level 2 data, access to a proprietary earnings hub, and easy-to-use stock screeners are just a few of its key selling points.

The platform offers competitive pricing for options trading, with zero commission on U.S. options trading. While there is still an exchange fee, the overall cost structure is more attractive for retail traders compared to other platforms that charge higher commissions or more significant fees.

The 7 Best Options Strategies for Monthly Income

1. Covered Calls

My favorite option strategy for income is selling covered calls.

This strategy is commonly used with stocks that an investor doesn’t want to sell now but would sell if it reached a certain price. By making a commitment to sell his shares at a specific price within a specific timeframe, the investor can receive a premium and lower his risk.

Here is how to construct the trade:

- Own 100 shares of stock

- Sell 1 out-of-the-money call option contract

Let’s assume you bought 100 shares of stock ABC for $50 per share.

Your current position looks like this:

- Breakeven: $50 per share

- Cost basis: $5,000 ($50 * 100 shares)

- Max gain: Unlimited

- Max loss: $5,000

Now let’s say you would be willing to sell ABC for $60 per share if it reached $60 or more in the next 3 months. The $60 call expiring in 3 months is trading for $1.50.

Instead of taking a “wait-and-see” approach, you decide to sell the $60 call option and collect $150 in premium.

You’ve just sold a covered call. The call is “covered” by the 100 shares you own – if the buyer exercises the call, you can simply sell him the 100 shares you already own.

After selling the call, here is how your current position looks:

- Breakeven: $48.50 per share

- Cost basis: $4,850 ($50 * 100 shares, minus the $150 in premium collected)

- Max gain: $1,150 ($60 – $50, * 100 shares, plus the $150 in premium collected)

- Max loss: $4,850

By selling the call, you lower your cost basis (reducing your risk), lower your max loss, and cap your max gain.

But remember, you said if ABC hit $60 per share in the next 3 months you would sell it anyways. So you’re actually increasing your max gain from $1,000 to $1,150 by selling the call and committing to selling it at $60.

There are 3 scenarios for how your position can play out:

- ABC closes anywhere above $60, let’s say at $65. Your shares are called away from you at $60 per share. You made $1,150 ($60 – $50 * 100 shares, plus $150 in premium).

- ABC closes at $60. The option expires worthless, you keep your shares and made $1,150, your max gain. You can now sell another covered call.

- ABC closes anywhere below $60, let’s say at $45. The option expires worthless, you keep your shares and the premium. You are down $350, but would have been down $500 if you hadn’t sold the covered call. You can now sell another covered call.

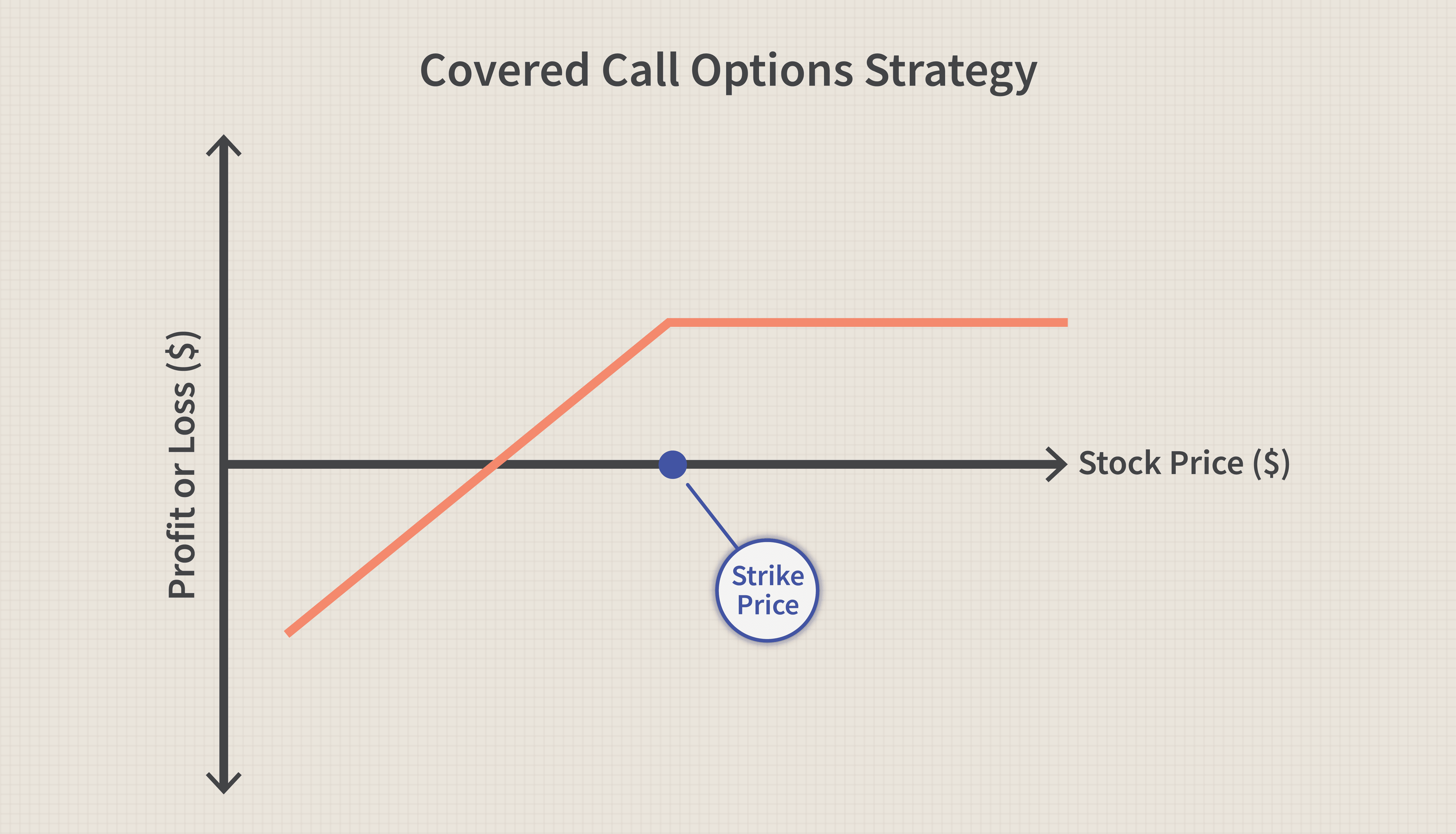

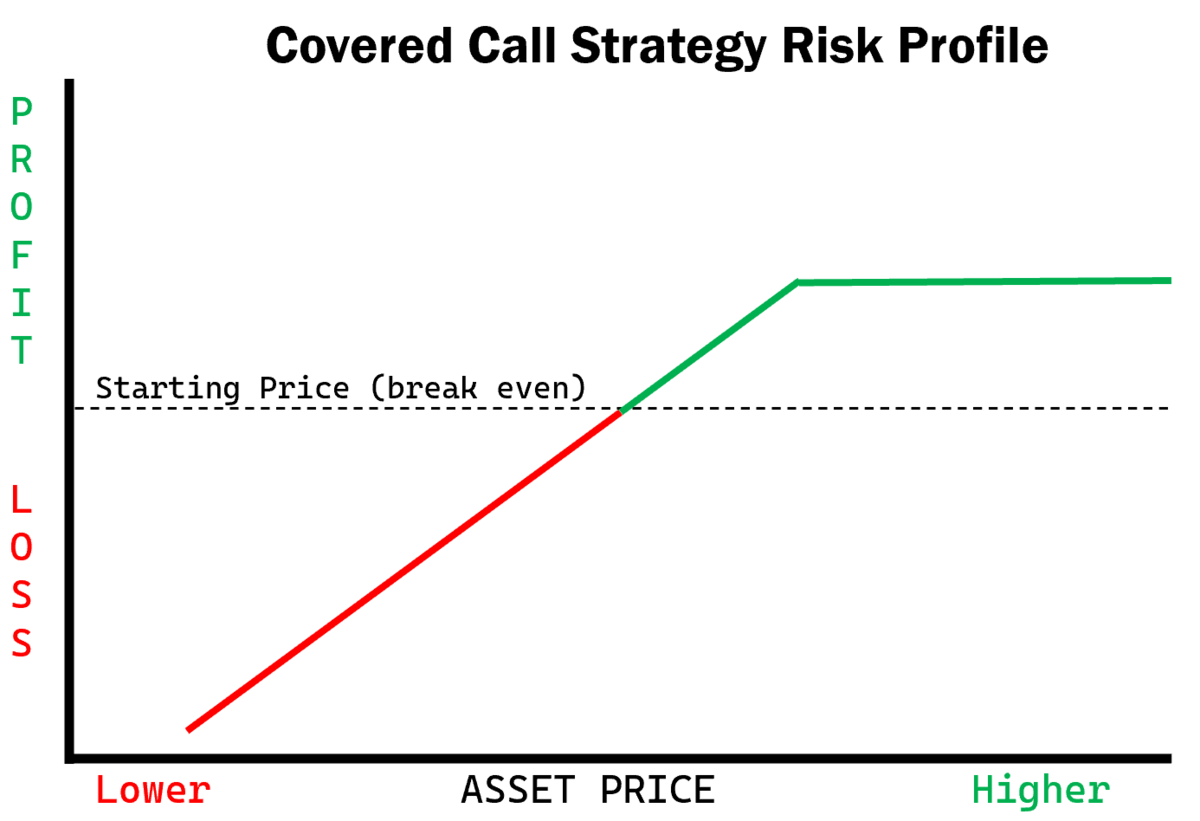

You can graphically represent the risk and rewards of options strategies by diagraming them in a risk profile. A covered call strategy has a fixed amount of gains it can produce and will take on more losses as the underlying stock price drops.

Therefore, the strategy has a risk profile that shows more risk for lower prices and capped gains for higher prices:

Lincoln made a free checklist for selling covered calls (and selling cash-secured puts, #2 below). You can download the checklists for free here.

2. Cash-Secured Puts

The next way you can start trading options for income is by selling cash-secured puts.

Oftentimes this strategy is thought of as buying stocks at a discount, because the goal is to regularly sell options and gain premium until you end up having to buy the stock when the option buyer exercises their right to put it to you.

Construction:

- Sell a put option on a stock you think is likely to go higher or on one that you’d like to own if it fell to a lower price

- Make sure to allocate enough cash to buy the stock if it is put to you

Let’s assume you are willing to buy 100 shares of stock ABC for $47 per share, but it’s currently trading for $50.

You can sell a put at the $47 strike for a credit of $2.00, essentially getting paid to potentially buy ABC at the price you want it.

- Breakeven: $45 per share

- Cash needed: $4,700 ($47 * 100 shares)

- Max gain: $200

- Max loss: $4,500 ($4,700 – $200)

The max loss only happens if the stock gets put to you and drops to 0 before you sell it (which is true for any stock you own). The max gain happens as long as the stock stays above $47.

But even if the stock price drops and gets put to you, your cost basis is reduced by the amount of credit you took in.

There are 3 scenarios for how your position can play out:

- ABC closes anywhere above $47 and you keep the $200 credit.

- ABC closes anywhere between $47 and $45 and the stock is put to you at the price of $47. You still come out ahead because you keep the $200 credit.

- ABC closes anywhere below $45. The stock is put to you at $47 and you make a loss. The size of the loss depends on how far below $45 the trade closes. But even though you are making an unrealized loss on the stock, you’ve reduced your exposure compared to having bought the stock initially at $50 instead of doing the trade.

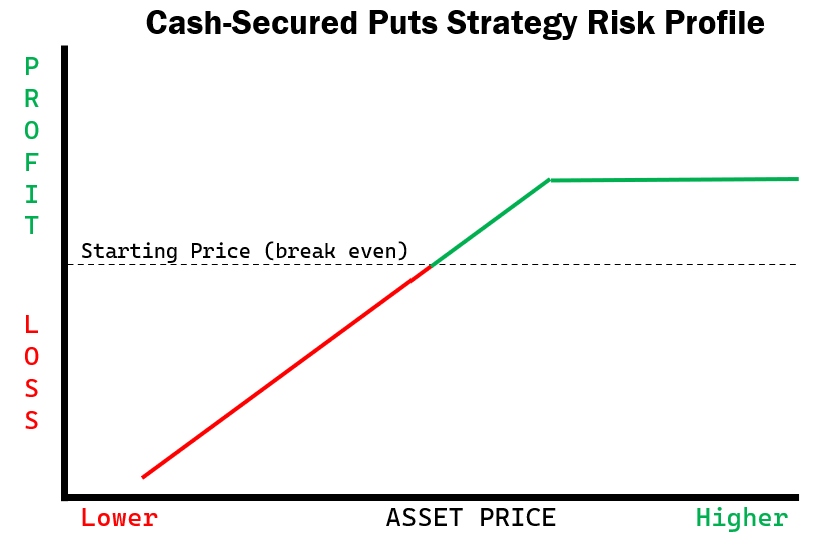

A cash-covered put strategy has a fixed amount of gains it can produce, and will take on more losses as the underlying stock price drops. So the risk profile you diagram is essentially the same as the covered call strategy:

Want Lincoln’s FREE covered call and cash-secured put selling checklists?

Want to learn more about these 2 strategies?

Check out his Selling Options for Income ecourse and start selling options the right way.

3. Protective Collar

Another way you can trade options for income is with a protective collar.

This strategy is a great way of trading options for monthly income, while holding stocks and protecting them against the risk of falling prices.

The strategy works when you hold at least 100 shares of an optionable stock, sell a covered call option, and simultaneously buy a protective put option.

Construction:

- Buy 100 shares of stock

- Sell an out-of-the-money call option

- Buy an out-of-the-money put option

Let’s assume you are willing to buy 100 shares of stock ABC for $50 per share, but you are going to sell a call option to collect as much premium as possible after you buy ABC shares.

You want to use the premium to buy a put option that will protect against serious price drops.

Your initial position starts with buying 100 shares at $50. Next you sell an out-of-the-money call option, let’s say at a strike price of $55 for a credit of $1.50 (or $150 for one contract). Finally, you purchase a put option for less than the amount you collected, let’s say the $45 strike for the price of $1.25 (or $125 per contract).

- Net credit between call sold and put bought: $0.25

- Breakeven: $49.75 per share

- Cash needed: $4,975 ($49.75 * 100 shares)

- Max gain: $525

- Max loss: $475

You now have four scenarios for how your position can play out:

- ABC closes anywhere above $55 and you gain $5.00 per share on the change in value of the stock and the $25 credit from the options. Your shares of ABC are called away from you.

- ABC closes anywhere between $55 and $49.75. Both options expire worthless, but you keep the $25 credit and come out ahead because the stock price is above your break even price. You still hold 100 shares of ABC.

- ABC closes anywhere between $49.75 and $45. Both options expire worthless, and you keep the $25 credit. This helps offset the unrealized loss you are making because ABC is trading below your breakeven price. You still hold 100 shares of ABC.

- ABC closes below $45. You put the stock to another trader at the price of $45 and you realize a loss of $475 because you sold $4.75 lower than your breakeven price. The $25 credit helped to reduce your risk slightly because this would have been a $500 loss if you hadn’t executed a collar trade.

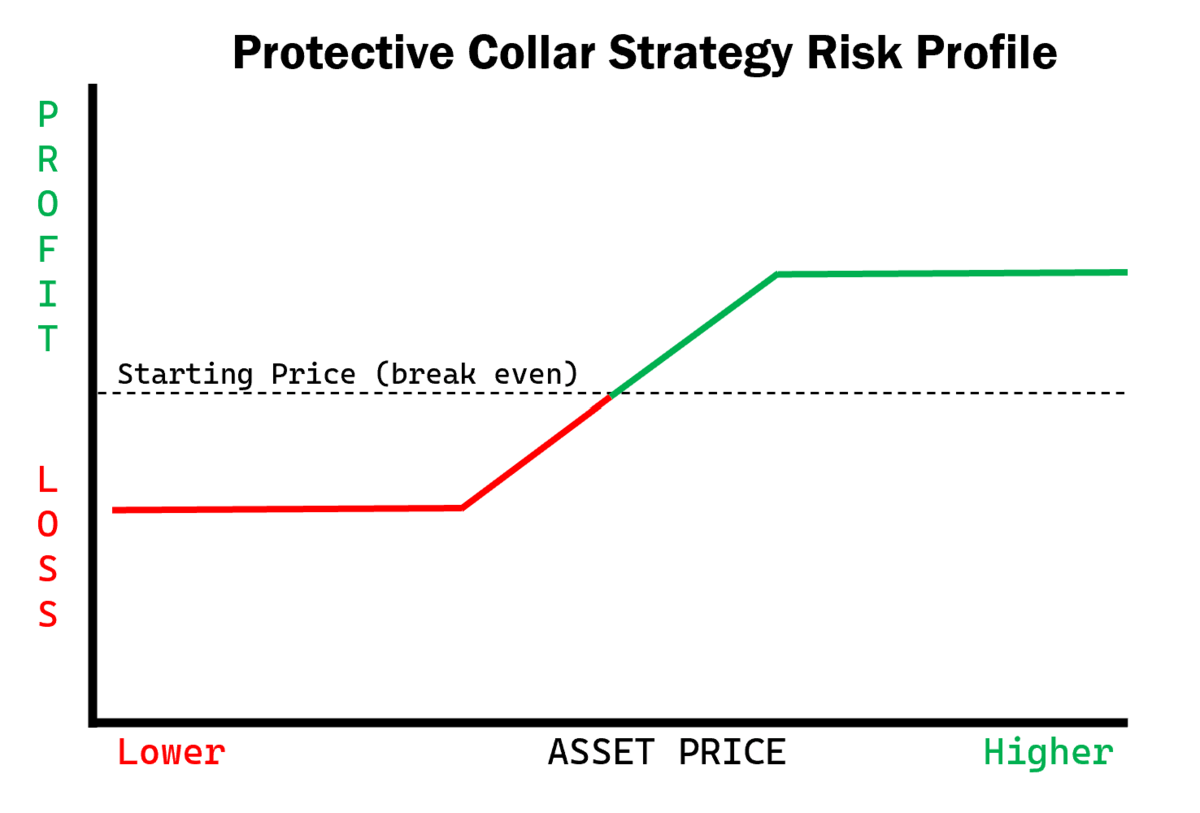

You can graph the risk and rewards of a protective collar trade by showing a fixed amount of gain or loss on the chart. That gives the strategy a well defined risk profile:

4. Call Credit Spread

My favorite option strategy for income without holding stocks is by using a call credit spread.

This strategy uses two different options and does not involve trading with the stock at all.

Most option traders know that, independent of price changes, option contracts lose value over time. This characteristic is known as time decay, or theta, and it means option prices will decline more rapidly as the expiration date approaches.

One of the best methods for capturing the value of this time decay is to sell call credit spreads. This trade is capable of leaving the trader with a short position in shares of the stock, so it has a bearish orientation.

Construction:

- Sell an out-of-the-money call option

- Buy another call option that is further out of the money from the contract you sold

Let’s assume you want to collect time value by selling call options. This trade will make money if share prices remain below a given price or go lower. Your only serious risk is if prices run higher rapidly, and naturally want to limit your risk in that situation.

Your trade starts with selling an out-of-the-money call option, let’s say at a strike price of $55 for a credit of $1.50 (or $150 for one contract). To protect from a price spike, you purchase a call option further out of the money, at the $60 strike, for the price of $0.25 (or $25 per contract).

This will give your trade a well defined breakeven price for ABC shares, and max loss and max gain from the option contracts.

- Net credit between call sold and call bought: $1.25

- Breakeven: $56.25

- Max gain: $125 (the total credit)

- Max loss: $375

You figure the maximum loss by using the difference between the two strikes, $60 – $55, amounting to $5.00 or $500 per contract. This is offset by the $125 credit so it nets to $375. Now you have four clear scenarios for how your position can play out:

- ABC closes anywhere below $55 and you keep the max gain.

- ABC closes anywhere between $55 and $56.25. You are making an unrealized gain but are assigned a position of 100 shares short on ABC.

- ABC closes anywhere between $56.25 and $60. You make an unrealized loss and are assigned a position of 100 shares short on ABC stock.

- ABC closes anywhere above $60. You make the max loss.

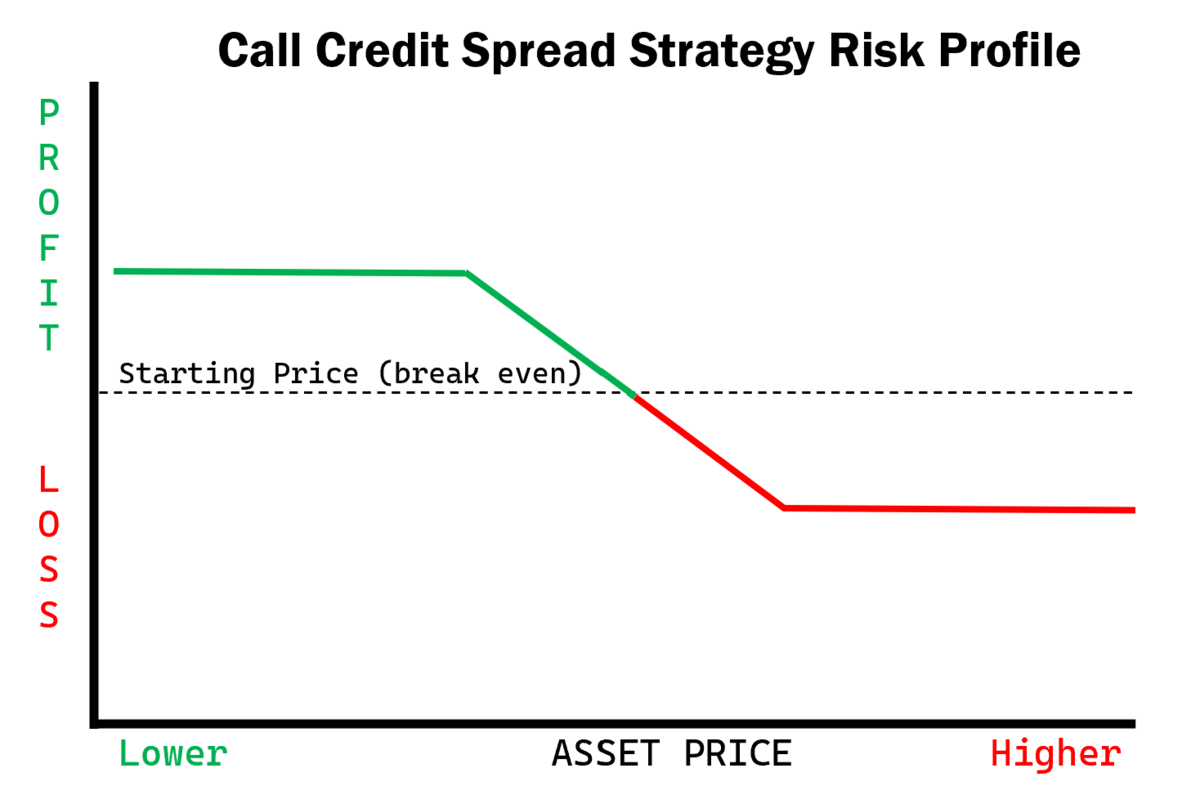

You can graph the risk profile for this trade by showing a fixed amount of gain and risk of loss, but with an orientation for falling prices. That means the strategy has a risk profile that shows risk for higher prices, and gains for lower prices:

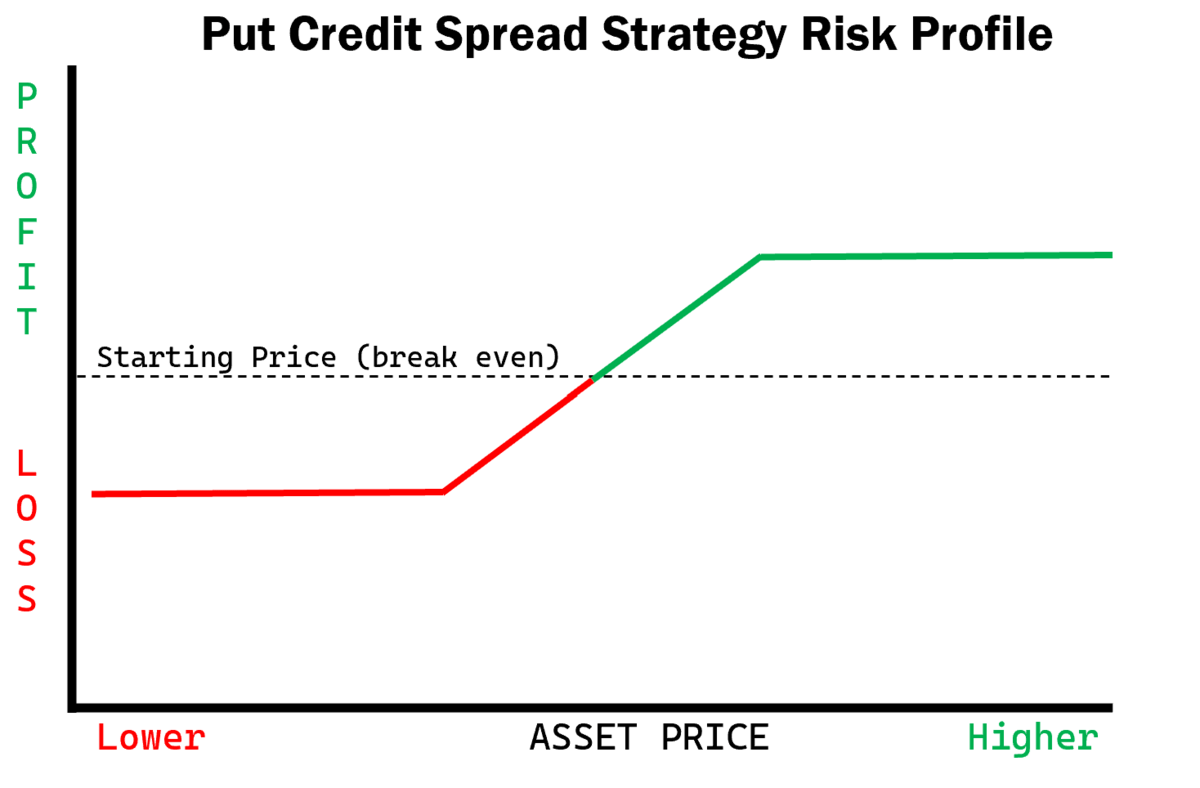

5. Put Credit Spread

This strategy also uses two different options and does not involve holding shares. Like a call credit spread, it’s an excellent way to trade options for income.

The difference is that this strategy uses out-of-the-money put options rather than call options. A put credit spread is capable of leaving the trader holding ABC shares long, so it’s considered a bullish option strategy.

Construction:

- Sell an out-of-the-money put option

- Buy another put option that is further out of the money from the contract you sold

This trade will make money if share prices remain above a given price or go higher. Your only serious risk is if prices drop sharply lower, so you want to limit your risk.

Your trade starts with selling an out-of-the-money put option, for example, at a strike price of $45 for a credit of $1.25 (or $125 for one contract). To protect from panic selling, you purchase a put option further out of the money, at the 40 strike, for the price of $0.25 (or $25 per contract).

This will give your trade a well defined breakeven price for ABC shares, and max loss and max gain from the option contracts.

- Net credit between call sold and call bought: $1.00

- Breakeven: $44.00

- Max gain: $100 (the total credit)

- Max loss: $400

The maximum loss comes from the difference between the two strikes in the spread which is $500 per contract, offset by the $100 credit for a net amount of $400. Now review the four scenarios for how your position can play out:

- ABC closes anywhere above $45 and you keep the max gain of $100 credit from the options.

- ABC closes anywhere between $45 and $44. You have 100 shares of ABC put to you at $45 and are making an unrealized gain.

- ABC closes anywhere between $44 and $40. You are holding 100 shares of ABC stock but making an unrealized loss.

- ABC closes anywhere below $40. Both options expire in the money. You do not hold a position of ABC shares and make a max loss.

You can graph the risk profile for this trade by showing a fixed amount of gain and risk of loss, but with an orientation for rising prices. That means the strategy has a risk profile that shows risk for lower prices, and gains for higher prices (see illustration).

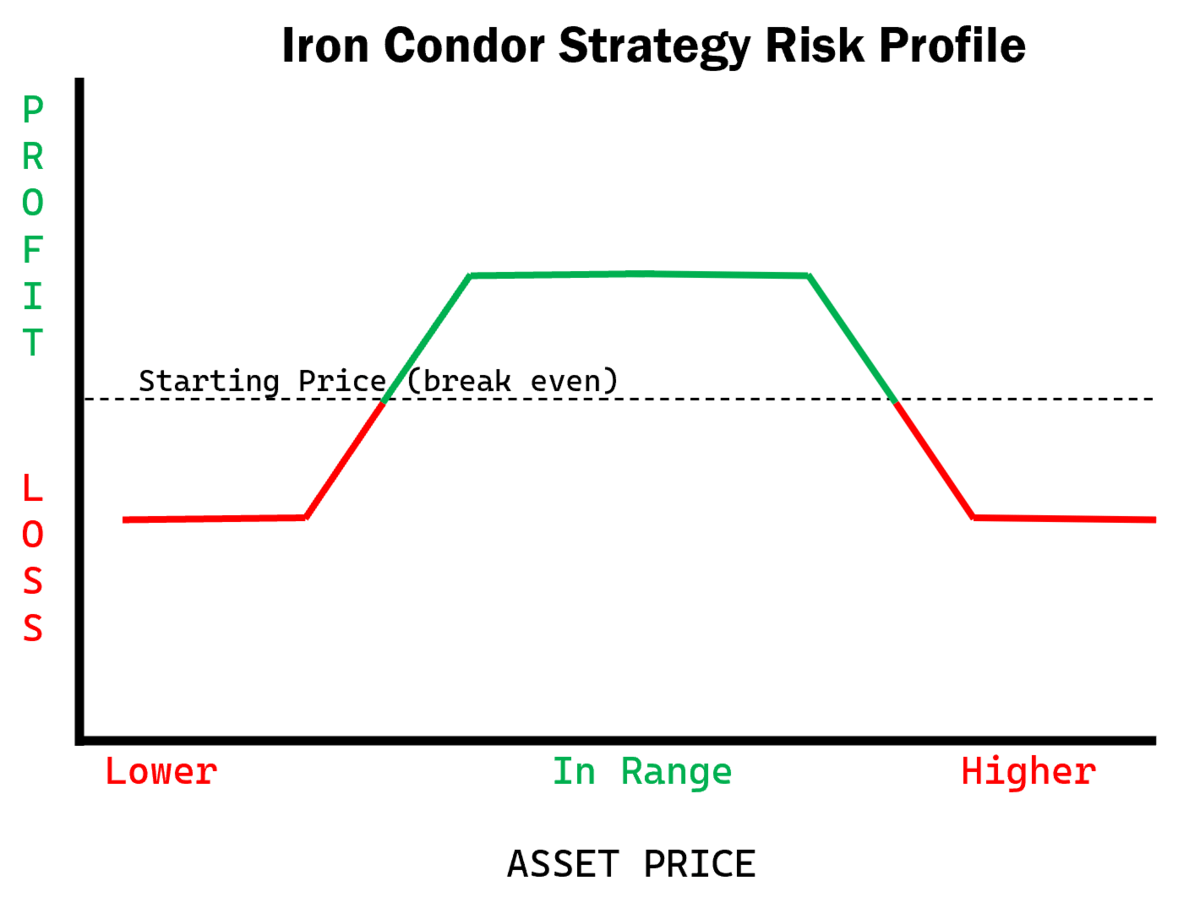

6. Iron Condor

The Iron Condor strategy is actually a combination of both a call credit spread and a put credit spread. The trade is a bit more complex and requires the use of four separate option contracts.

Construction:

- Buy an out-of-the-money call option (well out of the money, 3 strikes or more).

- Sell an out-of-the-money call option (a lower strike than the one you bought).

- Sell an out-of-the-money put option (at least two strikes out of the money).

- Buy an out-of-the-money put option (well out of the money, 3 strikes or more).

The strategy works when the price of the underlying stock remains between the lowest call option strike and the highest put option strike. As long as the trader selects option strikes that are sufficiently far out of the money, the trade will reliably generate income from the trader. The trader’s expectations are for range-bound price action to occur on the stock.

If you’re expecting a stock to made a sudden move, rather than remain range-bound, the reverse iron condor is the the way to go.

For example, with ABC trading at $50 per share, suppose you sold a $57 strike call for $1.05 and bought a $60 strike call for $25. For the put options you sold a $43 strike put for $0.75 and bought a $40 put option for $0.15.

The net credit from the call spread is $0.80, or $80 for one contract, and the net credit from the put spread is $0.60 or $60 per contract, making the total credit of the spread $140. The distance between both sides of the trade is $3.00 per share (or $300 per contract). Here are the characteristics of the trade.

- Net credit including call and put sold: $1.40

- Breakeven prices: $58.40 or $41.60

- Max gain: $140 (the total credit)

- Max loss: $160

The maximum loss comes from the difference between the two strikes in each half of the spread which is $300 per contract, offset by the $140 credit for a net amount of $160. The trade has two break even prices and as long as ABC stays between those you make money. Now review the four scenarios for how this trade can play out:

- ABC closes anywhere between $58.40 and 41.60 you make some or all of the $140 credit.

- ABC closes anywhere above $60 or below $40 and you lose $160.

- ABC closes between $41.60 and $40. Your $43 option expires in the money and is exercised so you are making an unrealized loss holding 100 shares of ABC stock.

- ABC closes between $58.40 and $60. Your $57 option expires in the money and is exercised, so you end up being assigned a short position of 100 shares of ABC and you are making an unrealized loss.

To graph the risk of an Iron Condor trade you need to show a fixed amount of gain inside a range and risk of loss outside the range. Since the loss is also fixed at some point, the red lines will flatten out (see illustration).

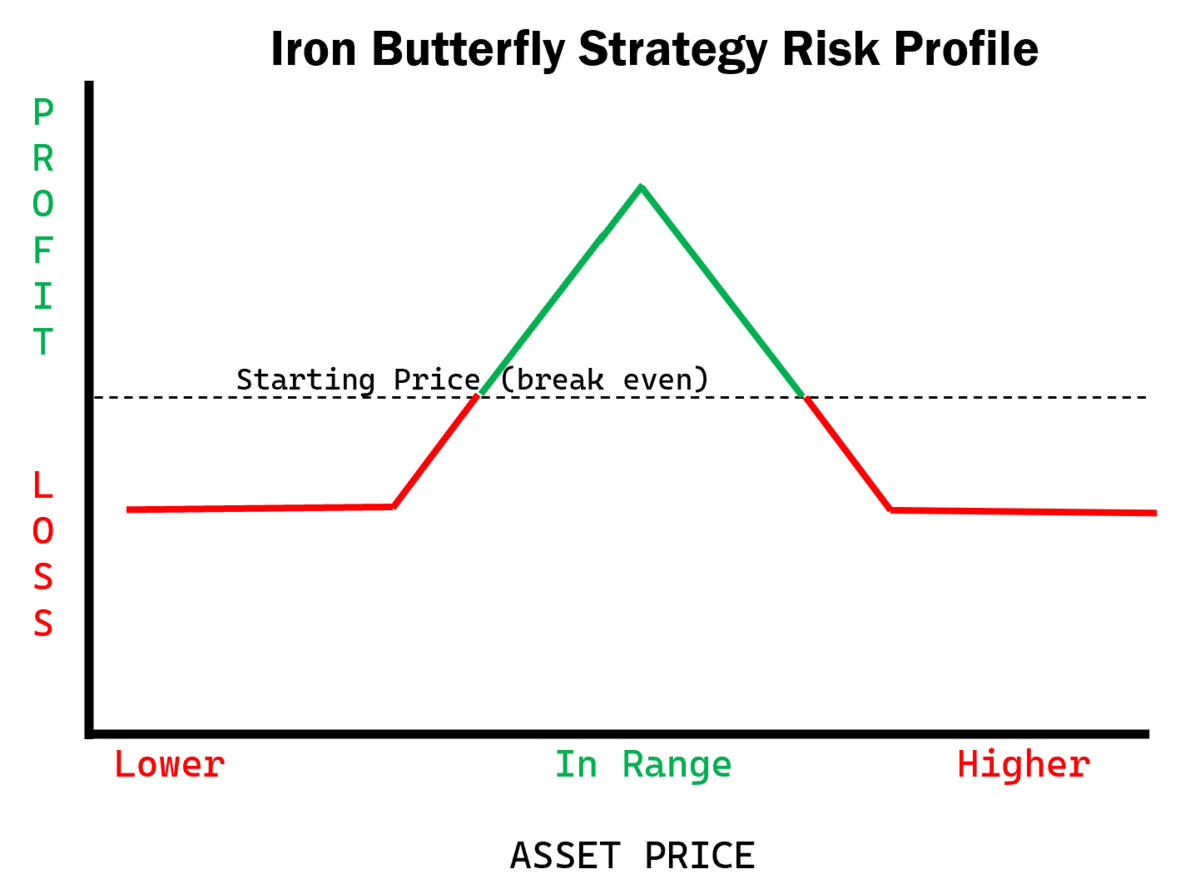

7. Iron Butterfly

The Iron Butterfly strategy is also a combination of both a call credit spread and a put credit spread. The trade requires the use of four separate option contracts, but the two middle contracts will share the same strike price. This creates a trade that can offer more profit for some scenarios than the Iron Condor would pay out.

Construction:

- Buy an out-of-the-money call option (well out of the money, 3 strikes or more).

- Sell an at-the-money call option.

- Sell an at-the-money put option.

- Buy an out-of-the-money put option (well out of the money, 3 strikes or more).

The strategy works when the price of the underlying stock remains between the two breakeven prices that the trade generates. As long as you select option strikes that are sufficiently far out of the money, the trade will reliably generate income from the trader. The trader’s expectations are for range-bound price action to occur on the stock.

For example, with ABC trading at $50 per share, suppose you sold both a call and a put option at the 50 strike. Imagine you sold the call for a $3.05 credit and sold the put for a $2.95 credit. Next imagine you bought a call at the $57 strike for $1.05 debit and bought a put at the $43 strike for a $0.95 debit.

The net credit from the trade is found by totalling up the credits and subtracting the debits. That gives you a net of a $4.00 credit (or $400 per contract). The distance between both sides of the trade is seven dollars per share, generating two different breakeven prices, just like the Iron Condor. Here are the characteristics of the trade.

- Net credit from all four contracts: $4.00

- Breakeven prices: $54.00 or 46.00

- Max gain: $400 (the total credit)

- Max loss: $300 (the spread minus the total credit).

Since your trade has two break even prices it will not lose money so long as ABC stays between those prices. Let’s look at the five scenarios for how this trade can play out:

- ABC closes exactly at $50.00. You make the maximum profit of $400.

- ABC closes anywhere between the breakeven prices. You make partial profit.

- ABC closes between $57 and $61. You make a partial (unrealized) loss and end up with a short position of 100 shares.

- ABC closes between $43 and $39. You make a partial (unrealized) loss and end up holding 100 shares.

- ABC closes above $61 or below $39. You hold no positions and make the maximum loss.

To graph the risk of an Iron Butterfly trade you need to show a fixed amount of loss, two breaking points and a sloping degree of loss or gain ranging from max loss to max gain. You make the max gain only at the middle strike price (see illustration).

Final Word: Options Strategies for Income

Each of these income strategy options requires that you do a small amount of study to understand it. You should also expect to put in a fair amount of practice to master it. For a more hands-off approach, consider an options alert service.

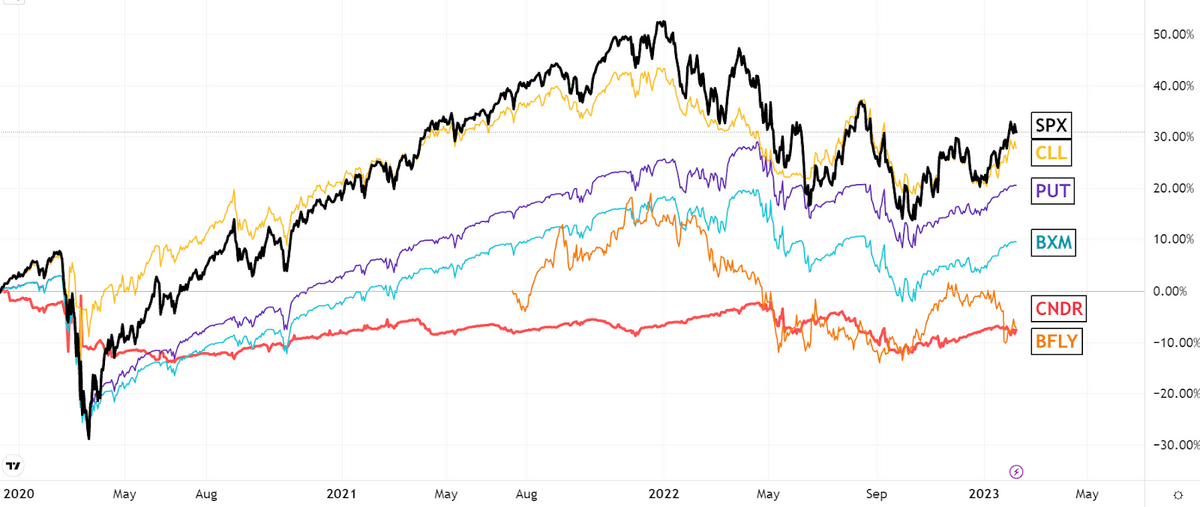

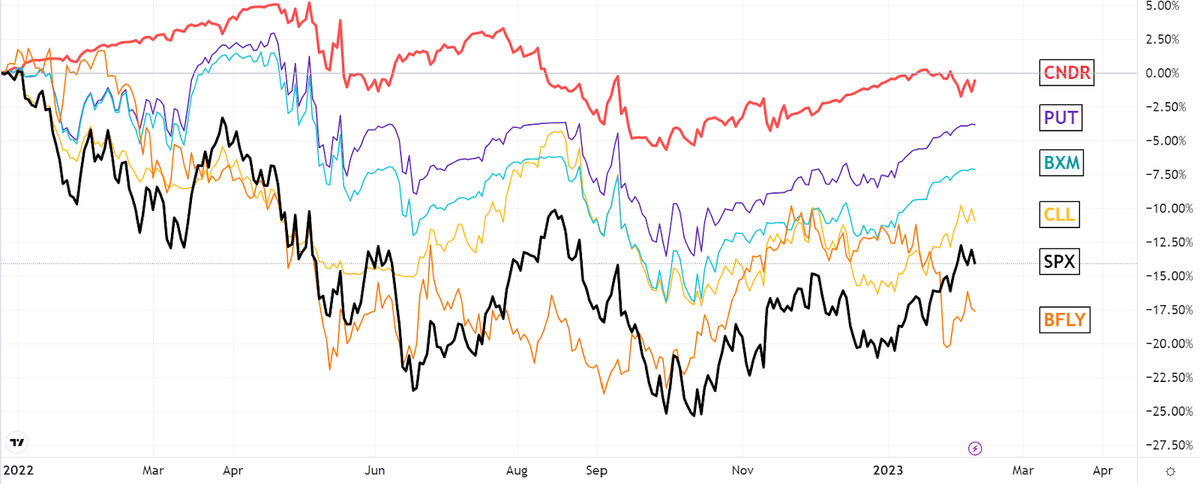

Although implementations can vary, the Chicago Board of Options Exchange (Cboe) generates indexes designed to track how these kinds of strategies might perform.

If you compare the indexes (see below) you see that protective collars have performed the best during the past three years.

This performance can vary greatly from year to year. During the past three years, the collar strategy index (CLL) showed very similar performance to the S&P 500 (SPX), Both of these two outperformed the cash-covered put strategy index (PUT), the covered-call strategy index (BXM), the Iron Condor strategy index (CNDR) and the Iron Butterfly strategy index (BFLY).

However, in the year 2022 the relative performance was quite different, with CNDR outperforming the other indexes. This demonstrates how much of a difference market conditions can make when you trade these strategies.

Want Lincoln’s FREE covered call and cash-secured put selling checklists?

Want to learn more about these 2 strategies?

Check out his Selling Options for Income ecourse and start selling options the right way.

And don’t forget to grab Lincoln’s free options selling checklists.

And if you want to start making money today from selling covered calls and cash-secured puts, check out his course and start selling options the right way:

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our June report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.