In an investing world where substantial share price gains or losses make the news, dividends — and information about them — often get the short end of the stick. They shouldn’t.

Dividend stocks and, by extension, dividend portfolios, are potentially an excellent way to generate regular income and cash flow.

Plus, dividend portfolios have tax advantages, provide stability and consistency, and typically require less oversight.

Wondering how to build your own dividend portfolio? You’re in the right place. In this article, you’ll learn all the basics about building a dividend portfolio — from how to get started to the best accounts to use and more. I’ll also offer a dividend portfolio example so you can visualize how it all works. Let’s go…

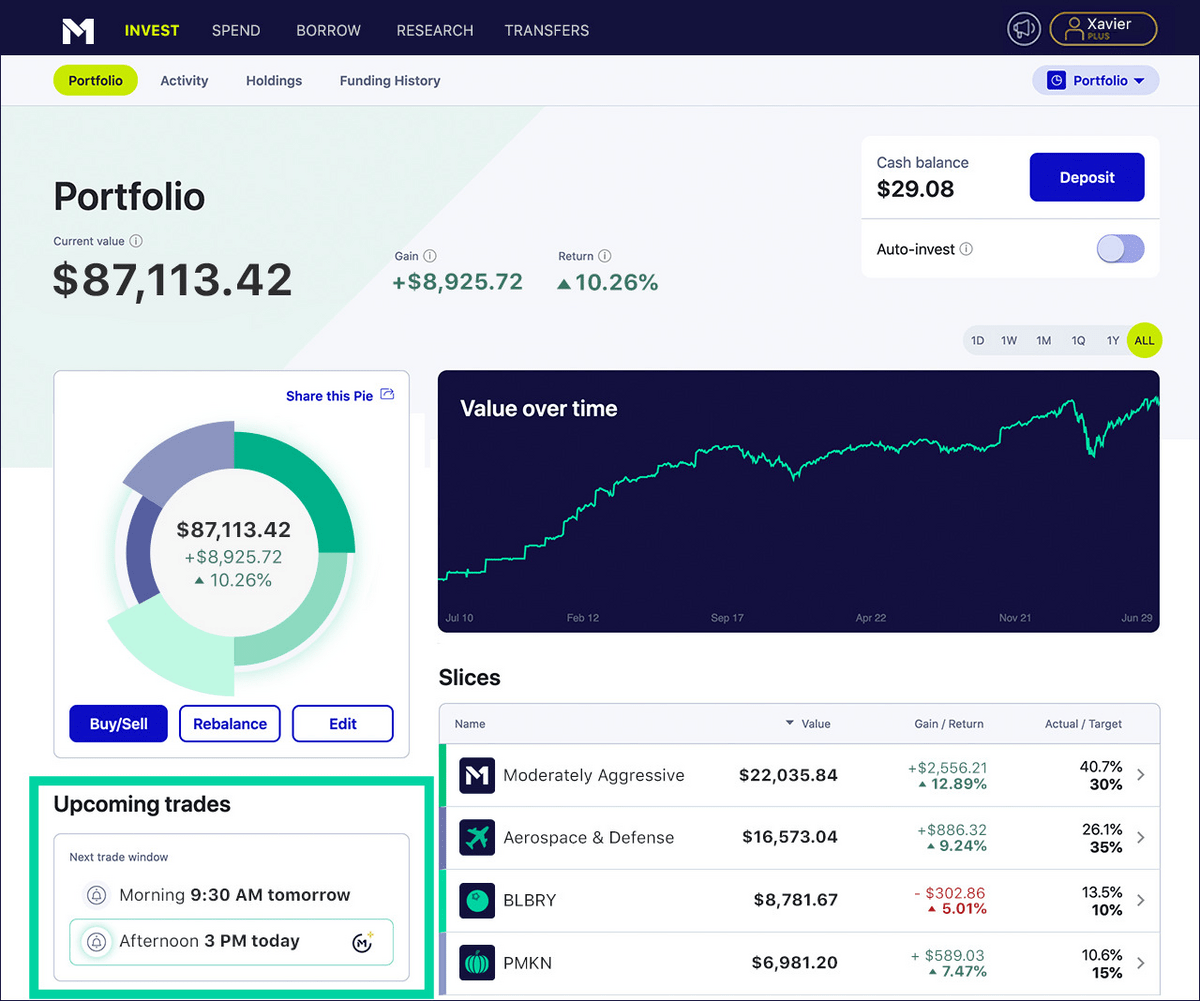

Ready to explore dividend stocks? M1 Finance makes it easy.

“Pie” is the name of the game with this finance app — as in, creating a “pie” of different stocks that make up your portfolio.

On M1 Finance, you can create a customized pie that includes dividend companies and/or ETFs, or you can simply invest in an expert M1 Dividend Pie.

What are Dividends?

A dividend is a distribution of company earnings to shareholders.

Who decides how much? Typically, it’s determined by the board of directors. Dividends might be one-time payouts or regular occurrences (monthly, quarterly, or annually).

Dividends are most closely associated with established companies that maintain steady profits. Profitable companies can afford to distribute them to shareholders. Typically, startups or growth-oriented companies can’t.

For example, at writing, Coca-Cola Co (NYSE: KO) has a quarterly dividend of $0.46 per share.

This means that someone with 10 shares of KO in their dividend portfolio can expect $4.60 quarterly in dividend income and $18.40 annually, assuming the dividend amount doesn’t change.

What is Dividend Yield?

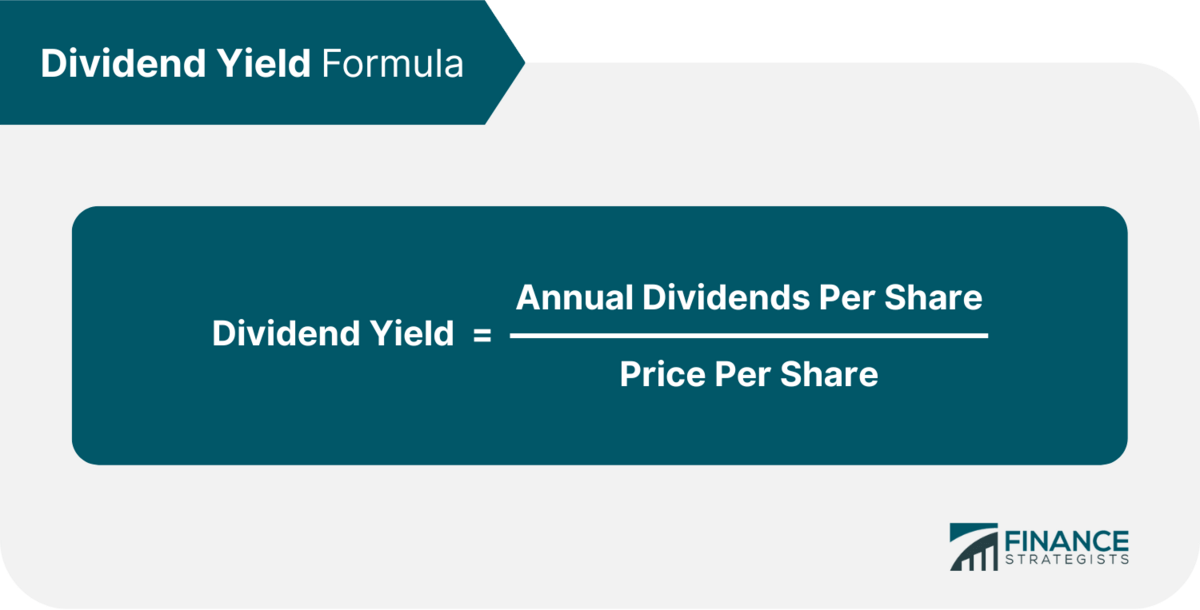

A dividend yield (or dividend-price ratio) measures the dividend per share as a percentage. You might see it expressed as div yield.

It is calculated like so:

Dividend yield = Annual Dividends per Share / Current Share Price.

Let’s take another look at Coca-Cola (NYSE: KO).

The price per share is $63.92, and the annual dividend per share is $1.84.

Plug these numbers into the equation: $1.84 / $63.92 = 0.0287859825. This translates to a 2.88% dividend yield.

Another way to look at it: a share worth $100 that pays $1 in dividends per share each year has a 1% yield.

The dividend yield isn’t everything when looking at a dividend stock, but it is a critical measurement in determining where to find the best ROI among dividend stocks.

How to Build a Dividend Portfolio in 2025:

You know the basics about dividends, but you came to this article for more than that. Here are your general steps and strategies for building a stock dividend portfolio:

Before You Build a Dividend Portfolio: Choose a Strategy

Just as not all dividend stocks are the same, not all dividend portfolios are the same. They can range from very conservative to aggressive.

Why? For example, people nearing retirement will likely want a more stable income portfolio that is less subject to fluctuations in the market.

On the other hand, younger people or people with more assets may be more focused on growth and risk since they have the time. But these are not hard and fast rules.

Consider a general strategy or mix of methods for your own dividend portfolio. The main options include:

- An income portfolio focuses on screening top dividend stocks that will typically provide 2-4% yields. It is best for conservative investors for the stability and long-term prospects of the investments.

- A growth portfolio focuses on steady gains, seeking to balance dividends and price appreciation. Valuation is the key factor here, with dividend yields being less than 2%. You will want to reinvest most earnings to get the most out of growth opportunities. It is best for investors looking for more growth than income.

- Payout Ratio: >100%

- Earnings Growth Estimates: 2% to 20%

- Valuation (P/E): <15

- Example stocks include BRUNSWICK CORP (NYSE: BC) (Dividends Score 80) and ENCORE WIRE CORP (NASDAQ: WIRE) (Dividends Score 40)

- An aggressive dividend portfolio will have stocks with dividend yields greater than 4%. It is less concerned with stock price appreciation and more about stocks where yields may be high due to falling stock prices.

- Payout Ratio: Any

- Earnings Growth Estimates: >30%

- Valuation (P/E): >30

- Example stocks include BASSETT FURNITURE INDUSTRIES INC (NASDAQ: BSET) (Dividends Score 80) and EUROSEAS LTD (NASDAQ: ESEA) (Dividends Score 60)

Step 1: Choose an Account Type

So you know you want to set up a dividend portfolio. That’s great! You need an account, though.

Not sure where to get started? There’s some excellent information on our “How to Buy Stocks Online” page.

Most investors will do well with an M1 Finance account. They focus on long-term wealth, charge no fees for trading, and have an easy-to-use interface on both mobile and desktop.

You must also consider whether you’re setting up a traditional investment account, Roth IRA, or IRA. M1 has account options for all of them.

If you don’t have one, an IRA or Roth IRA should likely be your top priority. Which one you get will depend on your income, age, and retirement plans.

If you already are maxing out your IRA or do not want your account to be retirement-focused, go with a traditional investment account, though the taxes will be higher.

Step 2: Choose Your Assets

The assets you pick will be determined by your strategy as decided in the first step. Consider the yields, share price, risk factors, recommendations, and other information.

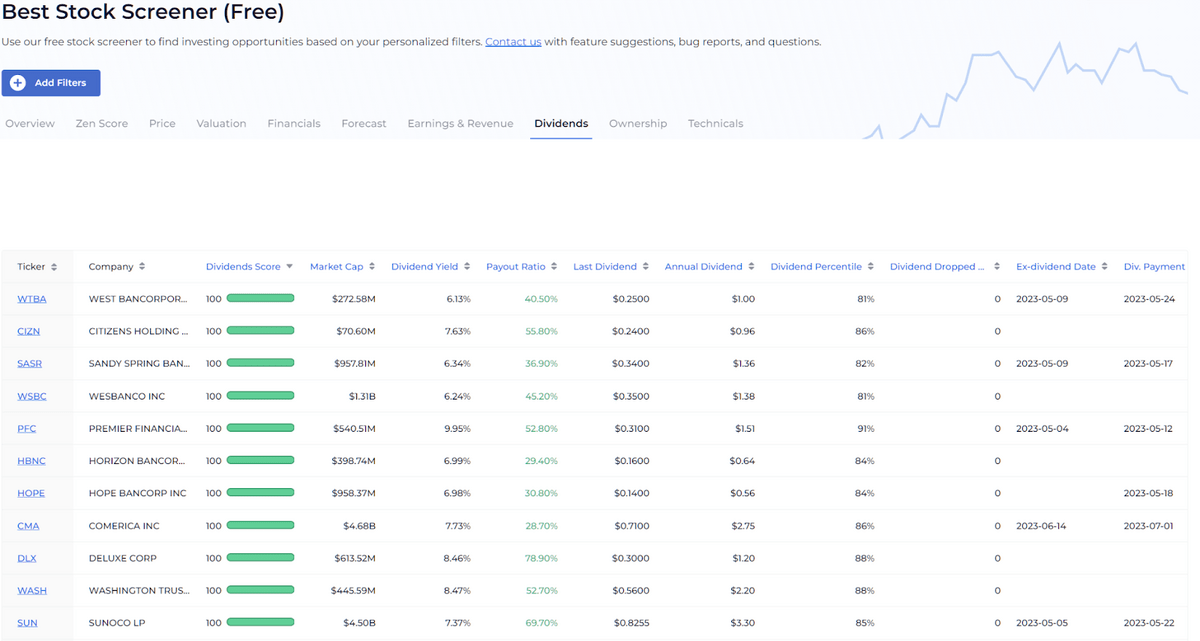

You can use WallStreetZen’s stock screener to help locate stocks that meet your dividend criteria.

You can filter by several different metrics, including:

- Dividend Yield

- Payout Ratio

- Annual Dividend

- Earnings Growth Estimates

- Valuation (P/E)

- Share Price

When you find a stock that seems interesting, you can click over to its individual page and review how it fares on Zen Ratings, our proprietary system of distilling a detailed review of 115 factors that drive growth into an easy to read letter score for each stock. For instance, I set up a custom scan for stocks that offer top 75% dividends that have demonstrated dividend stability over the past 10 years.

That list had about 400 stocks, but quickly scanning through a few of them, I was able to locate Qualcomm, (NASDAQ: QCOM) which not only demonstrates dividend strength but also boasts a Buy Zen Rating, with exceptional scores in value and financials; our AI screen also gave it a B rating.

Do not just pick assets one at a time and throw them into a portfolio. Do your due diligence first!

Step 3: Diversify

As with any portfolio, the diversity of your assets is key. Some investors may focus deeply on a few stocks or industries. Yet these investors also spend all their time watching over their dividend portfolio, hoping they can react to whatever happens. You probably have other things to do.

When diversifying, consider diversity in terms of risk and industry. If the oil industry suffers devastating news that will affect yields and stock prices, you don’t want your whole dividend portfolio to suffer.

Still, if picking individual stocks, do as Warren Buffet does and stay inside your areas of competence.

You may be wondering — How many dividend stocks should I own?

As a general rule, diversify with more than 20 and less than 60 stocks. The more you diversify, the less risk you take on, but you’re less likely to beat the market average.

How you diversify your dividend portfolio will be up to you, your knowledge base, and your risk tolerance.

Step 4: Create Automatic Contributions

The best way to ensure that your portfolio is growing and that you’re putting more into it is by ensuring that you’re contributing to it without thinking about it.

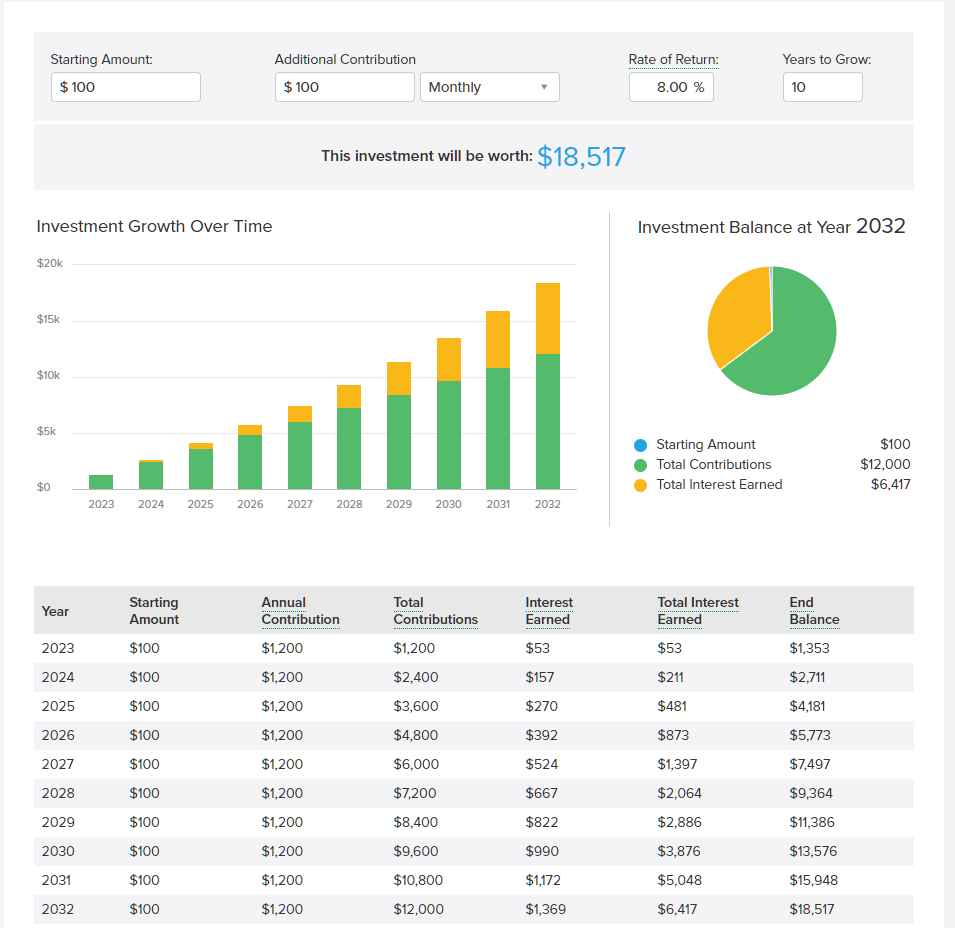

If you automatically invest $100 monthly into your dividend portfolio, which provides an 8% return yearly, that will build over time to $18,517 in 10 years.

Unless you’re in such dire straights that creating a dividend portfolio is the last thing on your mind, I promise you won’t miss that $100 if you make the deposit automatically.

Just be sure to periodically invest your automatic contributions into stocks that will do something instead of just letting cash sit in the account. Do it whenever you reinvest your dividends.

Step 5: Have Patience

Dividend stocks are not stocks you watch like a day trader. They’re stocks you watch over months, years, and decades.

Buy and forget dividend stocks until it is time for your regular portfolio check. Barring extreme events, this is the way to the best returns and the greatest sense of emotional peace.

Dividend portfolios are relatively stable investments. They are there to provide steadier income and stability.

If you want to seek out short-term gains or riskier options with potentially greater rewards, consider looking at our best stocks to buy on the dip or penny stocks page.

Dividend Portfolio Example

There are nigh-infinite potential dividend portfolios, and everyone has their own opinion (which can, should, and will change).

However, we should look at a dividend stock portfolio and what a top investor considers a good pick. Let’s go with the dividend stocks Warren Buffet has as of May 2023 as the starter basis for a portfolio, sorted by dividend yield:

Ticker | Name | Industry | Dividend Yield |

|---|---|---|---|

USB | U.S. Bancorp | Diversified Banks | 5.60% |

ALLY | Ally Financial | Consumer Finance | 4.55% |

C | Citigroup | Diversified Banks | 4.33% |

PARA | Paramount | Broadcasting | 4.11% |

KHC | Kraft Heinz | Packaged Foods and Meats | 4.07% |

JEF | Jefferies Financial | Investment Banking and Brokerage | 3.75% |

UPS | United Parcel Service | Air Freight and Logistics | 3.60% |

CVX | Chevron | Integrated Oil and Gas | 3.58% |

HPQ | HP | Technology Hardware, Storage, and Peripherals | 3.53% |

BK | Bank of New York Mellon | Asset Management and Custody Banks | 3.47% |

BAC | Bank of America | Diversified Banks | 3.01% |

JNJ | Johnson & Johnson | Pharmaceuticals | 2.91% |

KO | Coca-Cola | Soft Drinks and Non-alcoholic Beverages | 2.87% |

CE | Celanese | Specialty Chemicals | 2.64% |

PG | Procter & Gamble | Household Products | 2.41% |

KR | Kroger | Food Retail | 2.14% |

MDLZ | Mondelez | Packaged Foods and Meats | 2.01% |

TSM | Taiwan Semiconductor Manufacturing Company Limited | Semiconductors | 1.67% |

LPX | Louisiana-Pacific Corporation | Forest Products | 1.61% |

AXP | American Express | Consumer Finance | 1.49% |

MMC | Marsh & McLennan Companies | Insurance Brokers | 1.31% |

OXY | Occidental Petroleum | Integrated Oil and Gas | 1.17% |

GM | General Motors | Automobile Manufacturers | 1.09% |

MCO | Moody’s | Financial Exchanges and Data | 0.98% |

GL | Globe Life | Life and Health Insurance | 0.83% |

COST | Costco | Consumer Staples Merchandise Retail | 0.81% |

V | Visa | Transaction and Payment Processing Services | 0.77% |

AON | Aon | Insurance Brokers | 0.76% |

MA | Mastercard | Transaction and Payment Processing Services | 0.60% |

MCK | McKesson | Health Care Distributors | 0.59% |

AAPL | Apple | Technology Hardware, Storage and Peripherals | 0.54% |

ATVI | Activision Blizzard | Interactive Home Entertainment | 0.00% |

These are mostly more stable options and larger companies, with a mixture of higher and lower dividend yields.

You may want to use something other than this dividend portfolio example as a complete basis for your choices. Nonetheless, consider why these examples are held.

Tips for Building a Dividend Portfolio

1. Reinvest the Dividends

After you’ve built your dividend portfolio, what do you do with the income?

Depending on the portfolio size, some people will supplement their income with dividends or even live off them. Doing so is fine if it is your plan all along.

However, if you don’t reinvest your dividends, you could lose a major portion of potential returns in the long run.

Assuming dividend yields don’t change, someone with 100 shares of Citigroup just collecting dividends without reinvesting them would receive a total dividend payment of $1,990.87. Meanwhile, someone who reinvests their dividends would get $2,488.35.

With many brokerage accounts, including M1 Finance, you can automatically reinvest your dividends for individual stocks or your entire portfolio.

2. Beware the Dividend Yield Trap

A yield trap is a stock that represents a company that could be troubled but is attractive to some investors because of a very high dividend. It might also be called a dividend value trap.

Signs of a yield trap include

- An excessive amount of debt

- An oddly high yield

- Little cash flow

- General business operation problems

- Dividends greater than earnings

These are all indicators that the dividend isn’t sustainable or subject to failure. The investment could sour as a result.

3. Remember Taxes and Fees.

Dividends are taxable income. However, dividend stocks tend to pay out “qualified” dividends, which have a tax rate of 0-20%, depending on your household income. Otherwise, dividends can be taxed as income up to 37%.

If you aren’t careful, brokerage fees can easily affect your portfolio’s returns. With some brokerages charging as much as $20 per trade, a portfolio can cost you hundreds of dollars or more in fees yearly.

Pro tip: Some brokers and apps charge steep fees. M1 does not charge any portfolio management or trading fees.

Final Word: Dividend Stock Portfolio

Now that I’ve answered all of your dividend stock portfolio-related questions, the ball’s in your court.

If you don’t feel ready to pick your stocks quite yet, check out WallStreetZen’s screeners and stock ideas for carefully considered picks.

If you’re looking for a platform to create and manage your dividend stock portfolio, I suggest M1 Finance. It’s easy to sign up, there are numerous options for how to create your portfolio, and it’s easy to set up regular contributions.

A dividend portfolio is a long-term endeavor. But it can be one of your most stable and regularly profitable accounts if you take the time to set it up carefully and intentionally.

FAQs:

How much do you need for $1000 a month in dividends?

It depends significantly on the risk you are willing to accept in your portfolio. The main factor will be the portfolio’s dividend yield.

For example, assuming an average 4% dividend yield for your portfolio, you’d need to invest $300,000.

Is a dividend portfolio a good idea?

For most investors, a dividend portfolio is a good idea, and it is an excellent idea for investors looking for a stable source of cash flow.

A dividend portfolio can provide steady income, mitigate risk in your more extensive financial holdings, and requires less effort to manage.

How do I make $500 a month in dividends?

To make $500 a month in dividends, you will need a stock portfolio with dividend stocks that provide dividends equal to $500 monthly ($6000 annually).

How to make $1,000 a month with dividends stock?

To make $1,000 a month with your dividend portfolio containing dividend stock, you must buy enough stock so that your average monthly income from dividends reaches $1000.

To determine how much stock you need, you will need to consider the dividend yield for the assets you want to add to your portfolio. For example, a 5% dividend yield portfolio would need $240,000 invested to provide an average income of $1000 per month.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.