Real estate vs stocks: is there a winner? Think about it…

- Real estate is scarce, limited in supply, always in high demand, and tends to appreciate in price…

- Stocks are far riskier — demand can fluctuate, and price appreciation is far from guaranteed. But the potential upside is huge…

Then again, why decide? Enter REITs, or real estate investment trusts — an asset class that acts a little like a stock, a little like a bond, and a little like an ETF.

That’s probably intriguing enough on its own. But when you add the fact that REITs are obligated to pay out dividends, it really makes them hard to ignore.

But does that mean you should switch all your holdings to REITs vs stocks? Not so fast. In this article, we’ll take a deep dive into the topic of REITs vs stocks — how they fare in terms of returns, volatility, and more. Prepare to be amazed…

Although REITs receive way less attention than stocks, this isn’t some unorthodox, hard-to-reach asset class. The vast majority of brokerages offer them.

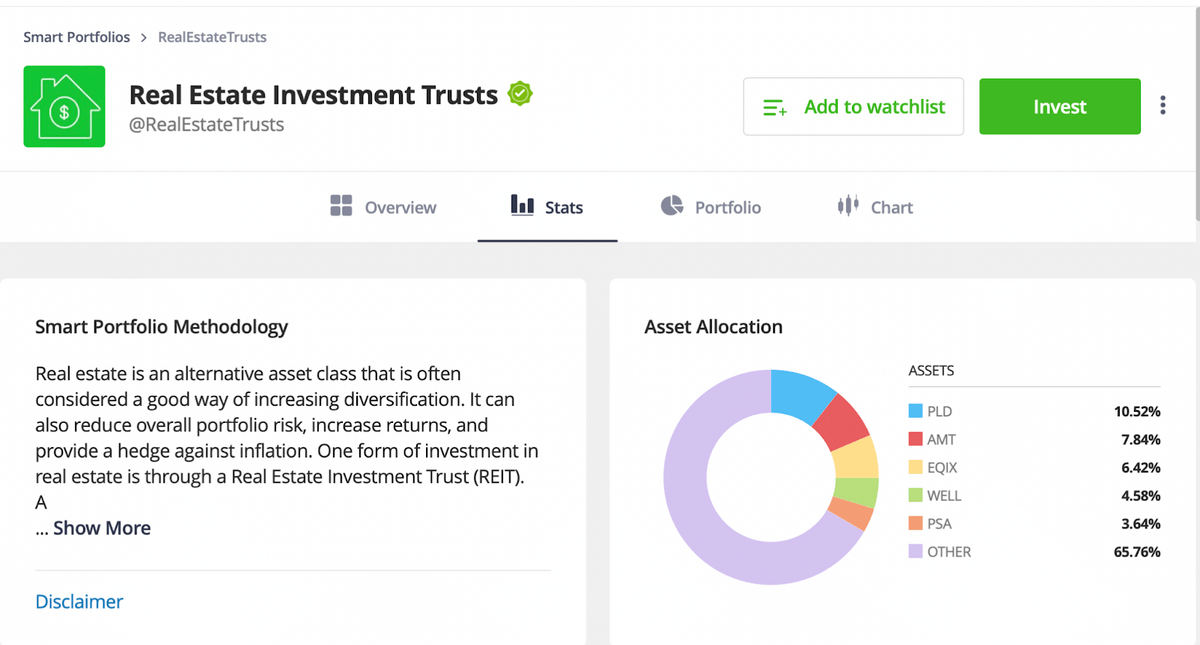

One of our top picks? eToro.

We already love eToro’s extensive offerings for traders — low or no-commission trades, a CopyTrader feature that lets you mirror the trades of pros, and a trading simulator that helps you test out strategies before you put money on the line.

But did you know that eToro also offers access to REITs? You can browse REITs on the platform or check out eToro’s REIT Smart Portfolio.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

What are REITs?

A real estate investment trust (REIT) is a company that makes money by renting out, operating, or financing real estate holdings that generate income.

Established in the 1960s by the federal government, these corporations were envisioned as a pathway for regular investors like you and me to be able to invest in real estate. Before that, the illiquidity of real estate as an asset class, as well as the large upfront costs, made it non-viable as an investment for most.

Most REITs are publicly traded, like stocks, and can be found on major exchanges worldwide. The thing that sets them apart, however, is the fact that REITs are required by law to pay out 90% of their income on a quarterly basis to investors in the form of dividends.

Types of REITs

There are three types of REITs:

- Equity REITs own, operate, manage, and rent out real estate that produces income. The primary driver of revenues is rent – not reselling.

- Mortgage REITs finance real estate either by providing mortgages or by purchasing mortgage-backed securities

- Hybrid REITs use a mix of both approaches.

You can invest in all of these types of REITs on eToro.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

What are Stocks?

Stocks represent units of ownership in a company. Also called shares or equity, stocks are issued by companies to raise capital. In return, the investor gets a stake in the company’s earnings and assets.

Stocks generate returns for investors in two ways:

- Capital appreciation – if the company continues growing and being profitable, investor interest drives the price of its stock up – allowing investors to sell at a profit

- Dividends – distributions of earnings paid out to shareholders, usually in the form of cash on a quarterly basis

Stocks are the bread and butter of investing. They’re by far the most common and most discussed asset class. They’re incredibly diverse, spanning all industries and sectors of human economic activity.

While stocks, like REITs, can also pay out dividends, this is a much rarer case. When it does happen, the dividend yields are significantly lower. The vast majority of returns from stocks come in the form of capital appreciation or the stock price increasing.

Interested in dividend stocks?

- Read our guide to how to build a dividend portfolio, including specific examples of simulated portfolio mixes.

- Check out WallStreetZen’s dividend stock screener, which lets you filter the top dividend-paying stocks on criteria like dividend payout ratio, yield, and more.

How are REITs and Stocks Similar?

Despite having major differences, REITs and stocks have a variety of things in common.

- Both asset classes are sold and traded in the form of shares on major exchanges.

- Purchasing either of them means owning a small slice of the company’s ownership. Both asset classes can also be privately traded.

- Both can pay dividends, the difference being that REITs are legally obliged to do so, while stocks are not.

- REITs and stocks can experience capital appreciation, an increase in share price, although this is usually more significant for stocks.

- Both investments come with risk, and the price of both is determined by market conditions and investor interest.

What are the Differences Between REITs and Stocks?

Now that the similarities are out of the way, let’s take a look at the differences between REITs vs stocks. I’ll focus on the three most relevant and applicable areas: returns, dividends, and volatility.

1. REITs vs Stocks: Returns

The answer to the question of reit returns vs stock returns might surprise you. Stocks are often touted as the be-all-end-all asset class, and we sort of expect them to have the largest profit potential on account of the risk that is inherent to them.

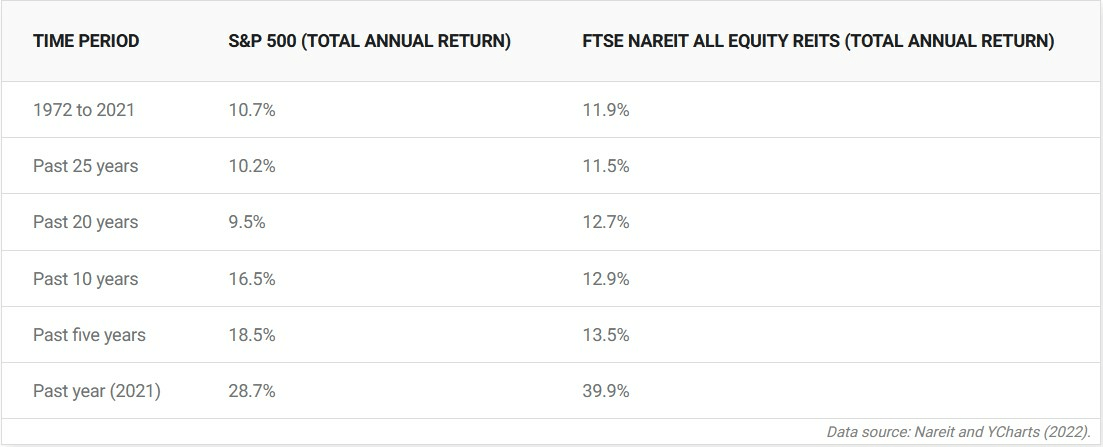

Well…it turns out that the average return on REITs outclasses the average return on stocks by a noticeable margin when looking at certain timeframes. Let’s get into the data.

Although REITs were established in 1960, NAREIT did not track return data until 1972. Using that as our start date, REITs historical returns have outclassed the S&P 500 by 1.2% in the same period.

Looking at the chart, although there is a noticeable discrepancy between performance in the last 10 years, it is apparent that REITs fared better in the long term.

Several percentage points of difference might not seem like much, but keep in mind that compounding + the fact that REITs pay dividends that are easily reinvested make for a much more appealing end result.

How do they fare in a down market? In 2022, both the S&P 500 and the NAREIT All Equity Reit Index posted losses – with the S&P 500 being down -18.11%, while the average return on REITs was -24.9%. Still, these short-term drops are normal for both stocks and REITs – and can even serve as a good opportunity to purchase them at significant discounts.

2. REITs vs Stocks: Dividends

Dividends are one of the main selling points of REITs and have historically driven around 50% of REITs historical returns, according to NAREIT.

Along with the fact that 90% of REIT income has to be distributed in the form of dividends, it comes as no surprise that, in terms of dividends, the question of REIT vs stocks goes in favor of REITs.

Looking at the S&P 500 index as a whole, the average annual dividend yield was 1.42% in 2023. In contrast, NAREIT’s average dividend yield fluctuated from 3.92% to 4.25% in the same year. (Source)

It’s clear that REITs present a more appealing choice in terms of dividends – but there is one small drawback. Unlike regular dividends, which can be taxed as capital gains in a lot of cases, dividends from REITs always count as regular income, so keep an eye on those tax brackets.

3. REITs vs Stocks: Volatility

Volatility is another factor that can make REITs a more appealing option than stocks.

REITs primarily benefit from a couple of key factors:

- Real estate doesn’t experience rapid price changes.

- Leases and rental agreements usually last for a long time.

All in all, looking at publicly-traded REITs, while there are differences from trust to trust, overall REITs exhibit lower volatility when compared to stocks.

Volatility is measured using beta – a metric that contrasts the volatility of the S&P 500, which is always 1, and a specific security.

Let’s take a look at a couple of examples and their beta values as of August 2024:

- Public Storage (NYSE: PSA) – 0.67

- American Tower Corp (NYSE: AMT) – 0.83

- Healthpeak Properties (NYSE: DOC) – 1.14

- Healthcare Realty Trust (NYSE: HR )- 0.91

- Easterly Government Properties (NYSE: DEA) – 0.72

- W P Carey (NYSE: WPC) – 0.94

- Crown Castle Inc (NYSE: CCI) – 0.85

- AvalonBay Communities (NYSE: AVB) – 0.97

- Realty Income Corp (NYSE: O) – 0.99

- Mid-America Apartment Communities (NYSE: MAA) – 0.88

- Annaly Capital Management (NYSE: NLY) – 1.52

What You Can Expect When Investing in REITs

As investments go, REITs are pretty hands-off.

That is the primary appeal of this asset class — if you do your research, and invest in stable, promising REITs with a history of raising their dividends, your job is done. The only thing left to do is wait for cash to appear in the mail.

When comparing REIT vs stocks, it’s clear that REITs offer both superior dividends as well as capital appreciation that is nothing to scoff at, combined with generally lower volatility.

Another way to invest in real estate (without buying property)…

REITs aren’t the only way to get exposure to the real estate market. One of our top picks for new investors? Arrived Homes.

Arrived Homes is a crowdfunded real estate platform where you can invest in fractional shares of residential rental properties for as little as $100.

While the app is fairly new, it’s got some serious cred — Jeff Bezos of Amazon fame was an early investor.

Check out Arrived and potentially earn extra cash on the side from your phone with this passive real estate investing app!

What You Can Expect When Investing in Stocks

Stocks, on the other hand, are a bit more demanding.

You have to play well on both sides of the court — buying at the right time is important, sure, but if you don’t sell the stock and lock in the gains before the price drops again, you’ve accomplished nothing.

The primary appeal of stocks is that they offer something for everyone.

Whether you prefer to invest for the long term, trade in shorter time frames, take a hands-on approach or simply fire and forget, stocks can accommodate an incredibly diverse set of styles, strategies, and goals.

Stocks are incredibly diverse — with the asset class allowing you to invest in any sector or industry imaginable.

However, they do require a lot more attention. Keeping an eye on returns, important news events, macroeconomic factors, and occasionally taking another look at a stock’s fundamentals are par for the course when investing in equities for the long term.

Along with this, the inherent volatility of stocks, while it does drive returns, can also lead to big losses. When you invest in a stock, a large portion of your investment — or even the entire investment — can go to zero. On the other hand, total losses and bankruptcies are extremely rare in the REIT sphere.

Want smarter, higher-conviction stock picks for long-term holds?

Seeking Alpha’s new service, Alpha Picks, is an alert service that endeavors to give you a market edge based on extensive market research that results in high-conviction stock picks.

As a subscriber, you get timely and trending financial news so you can understand the “why” behind market and stock movements, as well as key data and analyst ratings to help you make higher-conviction investments. For added peace of mind, Alpha Picks offers proprietary dividend safety scores and forecasts so you’re not caught by surprise when they change.

Want to know more? Check out our extensive Alpha Picks review.

REITs On the Dividend Aristocrat list

The S&P 500 dividend aristocrat list contains businesses that have consistently paid out their dividends for at least 25 years, while also raising their dividends every single one of those years.

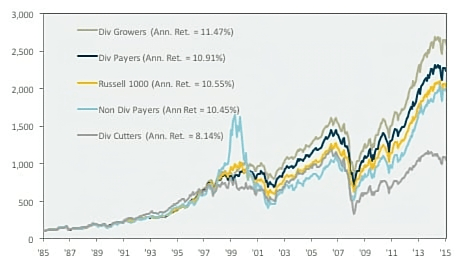

This isn’t only a shorthand for finding good REITs. Historically, companies that have consistently paid out and raised their dividends have outperformed the wider market by a fair margin.

There are currently 3 REITs on the dividend aristocrat list:

- Federal Realty Investment Trust (NYSE: FRT)

- Essex Property Trust (NYSE: ESS)

- Realty Income (NYSE: O)

As an added note, Realty Income stands out even among this distinguished list, as this REIT pays out dividends on a monthly basis. If you’re considering investing in REITs, these three companies offer a fantastic place to start building a portfolio.

REIT Subgroup Performance

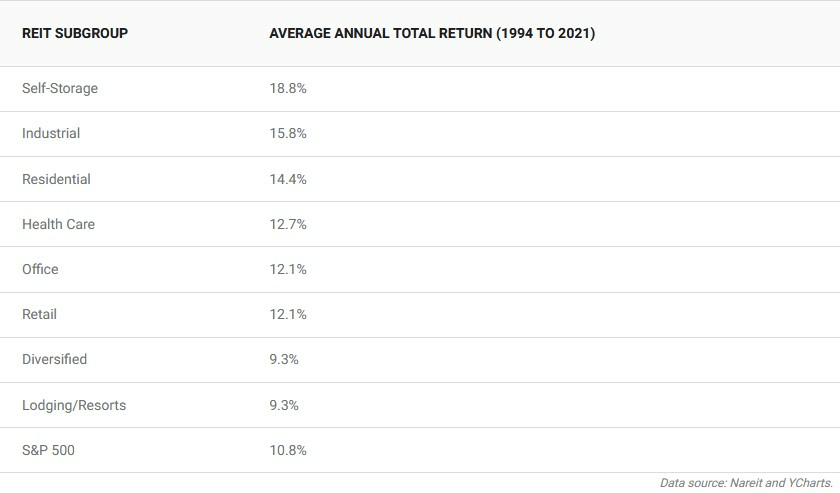

First, let’s lay out all the different subtypes of REITs. NAREIT categorizes REITs into 12 subgroups – 8 of which have been tracked since 1994, and 4 of which have been tracked since the 2010s. First, let’s deal with the ones that have more data available.

Of the 8 original REIT sub-sectors, only 2 failed to outperform the S&P 500 from 1994 to 2021 – although lodging and diversified REITs also experienced solid growth in that timeframe.

The best-performing sector, self-storage, is a curious case – although it has seen the most growth, it is also considered a defensive REIT sector and tends to fare quite well in times of recession.

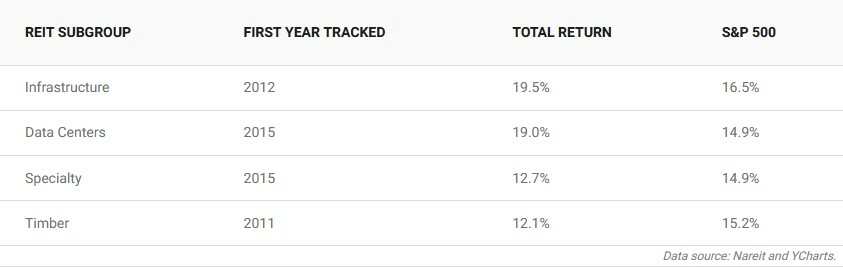

Now, on to the new additions.

Infrastructure and data centers remain profitable fields, particularly as infrastructure has become a hot topic on Capitol Hill, while the demand for data centers is likely to continue to grow at a pace of 5.4% CAGR according to McKinsey.

Should You Invest in REITs or Stocks?

REITs vs stocks … Why not both?

Investing in both asset classes can help you build a healthy, diverse portfolio. That said…

If you would benefit from some passive income, prioritize REITs.

Likewise, if your current portfolio has a beta of over 1, investing in REITs is a good way to stay on track with regard to returns while lowering overall volatility.

A typical balanced portfolio consists of 60% stocks and 40% bonds – if you’re looking to invest in REITs, however, the targeted approach should be 50% stocks, 10% REITs, 40% bonds.

On the other hand, while REITs offer access to various types of real estate, at the end of the day, it’s still real estate. Real estate prices change slowly, and that is reflected in REITs.

This leads to another point – although on average, REITs match or outclass stocks when looking at returns, REITs don’t have any significant outliers.

What I mean by this is that the success stories of quadruple-digit returns that do happen with stocks generally don’t happen with real estate investment trusts. If your portfolio is sluggish in terms of returns, although it is risky, stocks are likely the better choice to help you make up the difference.

Final Word: REITs vs Stocks

The question of REIT vs stock is multifaceted, and let’s face it, slightly confusing. Hopefully, I’ve demystified it for you here.

The biggest takeaway I’d like you to walk away with? REIT vs stocks need not be an either/or decision.

The most potential benefits can come from investing in both — understanding the difference between the two allows you to make the optimal play at the right time.

FAQs:

Is REIT better than stocks?

REITs have a variety of benefits over stocks, including performance and passive income, but better is too strong a word. Both asset classes have pros and cons — and a healthy portfolio should look to include both of them.

Are REITs as risky as stocks?

In general, no. Although investing in REITs does carry risk, data suggests that REITs are less risky than stocks both in the short term and in the long term. As always, past performance does not guarantee future performance, but the data we have on hand is still quite promising for would-be REIT investors.

What is a disadvantage of a REIT?

The primary disadvantage of a REIT is that capital appreciation usually takes more time than it would with stocks, and is usually lower than that of stocks.

Why not invest in REITs?

There are a few reasons why you might not invest in REITs. Although REITs have many benefits, there are also a couple of drawbacks: REITs are highly sensitive to interest rate changes, can offer variable income, and the income they give in the form of dividends is taxed as ordinary income.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.