Where should you put your money: real estate or stocks?

Great question! I’ve been investing in both for years now, and neither is exclusively better than the other.

That said, the best option for you depends on a bunch of things — your starting capital, the expected length of your investment, and more.

I want to help you figure it out. Keep reading for a comprehensive exploration of stocks vs real estate. By the time you’re done reading, you’ll have a much better idea of which direction is better suited to you and how to get started.

The BEST platforms to invest in real estate

- Best overall: Fundrise

- Best for single-family rental properties: Arrived Homes

- Best for accredited investors: EquityMultiple

Note: We earn a commission for this endorsement of Fundrise.

Real Estate vs. Stocks

First, let’s get clear on what’s what.

Investing in real estate can include a variety of strategies, including purchasing residential or commercial property and renting on a long-, medium-, or short-term basis. There are also real estate investment trusts or REITs to invest in and crowdfunded projects.

Stock investing can also be done in any number of ways. You can buy and hold stocks, day trade, invest with a mutual fund, or explore options trading … to name a few common strategies.

There are upsides and downsides to everything I just mentioned — and there’s no such thing as a universally superior option. So … should you invest in real estate or stocks? Let’s explore.

Advantages of Investing in Real Estate Over Stocks

You’ve probably heard it a million times: real estate is one of the best long-term investments you can make. In a lot of cases, that’s true. Here are some of the advantages of real estate investing:

1. Many Ways to Invest

When you think about investing in real estate, you probably think of buying and renting a property, collecting rent, and acting as a landlord.

That is a popular way to go about real estate investing. But it’s not the only one.

I’ve personally managed long-term rentals and can say from experience that it’s the most hands-on approach. Plus, it can come with a deceptively low return on investment (ROI).

If you don’t feel like dealing with those headaches, there are still plenty of other ways to invest, including:

- Short-term rentals (Airbnb, VRBO, etc.)

- Real estate investment platforms (Fundrise, Arrived, CrowdStreet, etc.)

- Real Estate Investment Trusts (REITs)

- Real Estate Investment Groups (REIGs) — provides the opportunity to go in on investment properties with other private investors

- Renovating and flipping

(I’ll explain REITs and crowdfunded options in more detail in a few minutes … Keep reading!)

2. Hedge Against Volatility

In my opinion, one of the biggest upsides to investing in real estate is that the market isn’t nearly as volatile as the stock market.

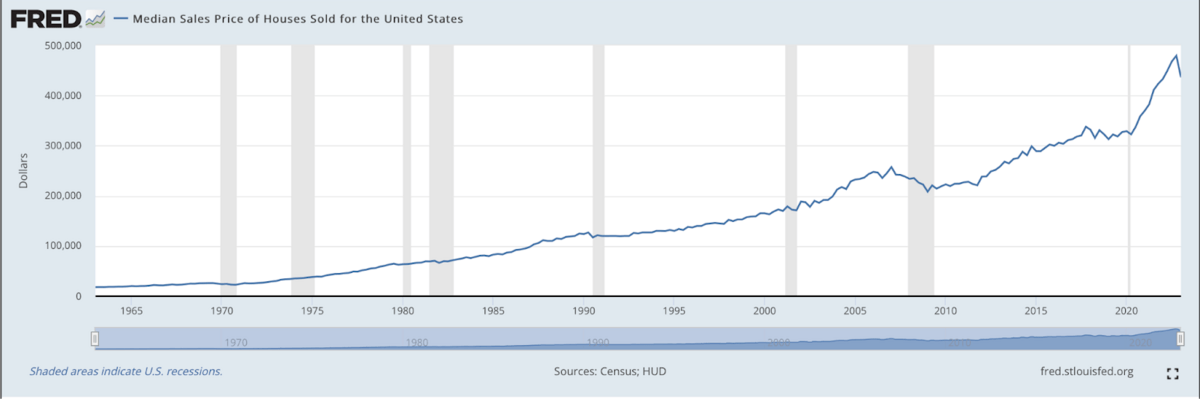

Land has inherent value because everyone needs a place to live. So theoretically, your property will never be worth nothing. Plus, housing prices have historically only increased, provided you look past temporary value dips.

Just take a look at this home value chart from the Federal Reserve Bank of St. Louis and you’ll see that upward trend since 1963:

3. Cash Flow & Price Appreciation

Many real estate investment strategies can lead to a positive cash flow, sometimes within the first year.

Sure, I earn quarterly dividends from a handful of my stock picks, but one of my investment properties in upstate New York — which is listed as a short-term rental — presented a cash-on-cash return of over 25% in year one. You’ll rarely see that from stock dividends!

And based on that handy chart above, it’s likely that your investment will be worth more if and when you go to sell it. That’s not just my opinion — it’s based on historical trends.

4. Leverage

As a stock market investor, unless you’re using leverage (such as in options trading), you’re probably using your own money. That means your potential upside is limited by what you have to invest.

With real estate, it’s common practice to finance investments, which means you use other people’s money (OPM) and can leverage your actual investment amount many times over.

5. Tax Advantages

The last time I filed my taxes, I was tempted to drive to my upstate short-term rental and kiss the dirt. After using accelerated depreciation, that single property saved me over $20,000 in taxes that would otherwise have been due to the IRS.

Tax advantages for real estate are plentiful, so as long as you have an accountant who specializes in real estate investment, the tax breaks can be one of the most significant advantages over investing in stocks.

Alternatives to Traditional Real Estate Investing

Investing in real estate frequently demands quite a lot of capital. This means the barrier to entry is high. For example, the short-term rental I mentioned earlier involved an initial investment of over $80,000. That’s just not in the cards for a lot of people.

If you don’t have the money to buy a piece of property the traditional way — or the time to manage it — I recommend you look into the more accessible options below.

1. REITs

When you invest in a Real Estate Investment Trust (REIT), you’re actually investing in a company that purchases and manages real estate investments.

So rather than paying $80,000 for a down payment, you can buy shares of the REIT parent company, usually for less than $100 per share. Plus, you can buy REIT shares on the stock market.

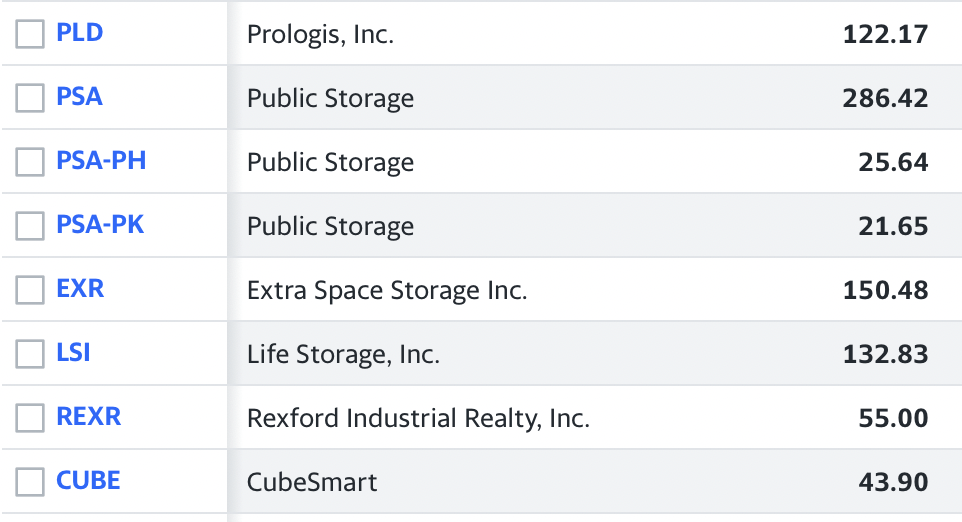

Here’s a look at some of the most expensive REITs on Yahoo Finance to illustrate just how affordable they are:

REITs also provide a passive investment opportunity and don’t require the time or energy you’d need to put into a traditional real estate purchase. REIT returns vs stock returns tend to be less volatile over a long timeframe.

In short, REITs are an easy way to get into real estate or diversify an existing portfolio.

2. Crowdfunded Real Estate

Crowdfunded real estate deals are funded by a variety of investors who pool their money and pay small management fees to a management company.

One of the biggest benefits? It’s almost totally passive: there’s no maintenance or work to do on your part after you invest.

And with companies like Fundrise setting low minimum investment amounts of $10, crowdfunding remains accessible to virtually everyone.

Crowdfunding is a bit more of a direct approach to real estate investing than REITs because you invest in a specific property or project rather than a parent company.

How to Invest in Crowdfunded Real Estate:

Fundrise | Arrived | EquityMultiple | |

Overall Rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

Minimum Investment | $10 | $100 | $5,000 |

Fees | 3.5-5% of purchase price, plus 0.125%-0.15% quarterly (0.5%-0.6% per year) | 0.5%-1.5% annually; additional annual fees also apply to some investment opportunities | |

Important note: While Fundrise and Arrived Homes are available to all investors, EquityMultiple is only available to accredited investors. Want to learn more about accredited investor investments? Check out this article.

Arrived Homes is one of the most exciting new additions to the world of crowdfunded real estate. It’s available to all investors, and it offers something a little different: access to single-family rental properties.

The minimum investment is just $100, and it offers a lot of the benefits of owning property — but without the hassle of being a landlord.

(Want to learn more? Check out our Arrived Homes review.)

Advantages of Investing in Stocks Over Real Estate

Despite everything I said, there are some reasons why stocks are better than real estate in certain cases. Let’s explore:

1. Diversification

First off, the stock market is a great place to diversify your portfolio. There are thousands of stocks to choose from on the major U.S. stock markets, which means you can invest in multiple sectors or industries through a single broker or online brokerage.

Since stocks have a low barrier to entry in most cases — unless you’re looking to buy Berkshire Hathaway…

Plus, stocks make it easy to “fill in the gaps” in your portfolio with varying risk levels and investment amounts.

2. Liquidity

Buying real estate is often a long-term investment, and even crowdfunding platforms often only allow for quarterly liquidity. That’s no good if you need access to your money in a pinch.

One of the biggest upsides to stock investing is that your money remains far more liquid. You can sell most stocks in just a few seconds and “cash out” at a moment’s notice if you ever need to. Liquidity is one major reason why stocks are better than real estate for some people.

3. Easier to Get Started

Finally, the barrier to entry into stock investing is much lower. I was only comfortable investing in real estate because I worked alongside an investor for five years and saw how he operated.

With easy-to-use stock brokerages like Public, it’s not only straightforward to get started, but the low trading fees mean it remains accessible to most people.

Should You Invest in Real Estate or Stocks?

Ultimately, whether or not you should invest in stocks vs real estate comes down to your investment goals, how long you want your money to be tied up, your risk tolerance, and more. The answer will be different for everyone.

- Investing in stocks might be ideal if you’re willing to take on more risk for a greater potential return. Stock investing also helps you maintain liquidity, has a lower barrier to entry, and is always a passive form of investment.

- Real estate, on the other hand, can be passive and require small amounts of capital if you find good REITs to invest in or invest through platforms like Fundrise. If you’re looking to buy a piece of property yourself, though, be prepared for lots of research, a more hands-on approach—or management fees—and minimal access to your investment, sometimes for years.

- Investing in both is also an option that can diversify your portfolio, help you reduce your exposure to risk, and maximize your upside … all of which should be music to your ears as an investor.

Final Word: Stocks vs Real Estate

Rental property vs stocks: Which one wins?

Both stock and real estate investing offer outstanding opportunities to fight inflation and even to turn a profit on your capital.

Granted, I’m a real estate investor. But in my personal opinion, I’d go with a rental property vs stocks if you’re looking for less overall risk or if you want the opportunity for cash flow, appreciation, and tax breaks.

But that’s me. If you need an investment to be liquid, or if getting into real estate investment seems too intimidating for now, consider investing in stocks and getting exposure to real estate through REITs or crowdfunded real estate platforms.

Once again, there are benefits to both styles of investing — so why not explore both? Even if you have a small account, the discount brokerages and platforms I’ve discussed in this article make it easy to diversify by investing in both real estate and stocks.

FAQs:

What makes more millionaires stocks or real estate?

Historically, real estate makes more millionaires than stocks. Land has inherent value, and property prices have historically only gone up since data became available in the early 1960s. Additionally, real estate investment provides tax breaks that help you keep the profits you earn.

Is real estate better than stocks?

In some ways, yes. Real estate has inherent value, whereas a company’s value on the stock exchange is just the perceived value. Real estate investment can also provide positive cash flow and appreciation.

Stocks do provide a lower barrier to entry and more diversification, though, so which option is better depends on your investing goals, your risk tolerance, and more.

Is it better to invest in stocks or houses?

Generally speaking, it’s better to invest in real estate than in stocks. Real estate values have, over time, always gone up, which cannot be said for stocks. This is one critical area where stocks vs real estate investing differ greatly.

What is the 2% rule in real estate?

The “2% rule” is a very broad and general rule of thumb for assessing a property’s cash-flow-to-value ratio. It suggests that the monthly rent for a property should be no less than 2% of what you paid for the piece of real estate. Some investors use a 1% rule, which works the same way but requires half the rent per month.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.