The rise of crowdfunded real estate platforms and real estate funds (REITs and ETFs) have given you and I access to an asset class previously available only to the wealthy.

In 2024, anybody can own real estate.

Whether you’re an accredited investor or not, there are several great real estate investing apps to choose from. We’ve reviewed over a dozen platforms to find the top real estate investing apps that provide a great user experience, high-quality investments, experienced teams, and solid returns.

Keep reading to find out which of the best real estate investing apps is the best fit for you…

FEATURED OFFER: Masterworks

Want an investment that won’t collapse like a bank? Try art.

Since 1995, contemporary art has appreciated 14% annually on average. That’s even more than you’d get with the S&P 500 (with less volatility). After all, there’s a reason why many billionaires invest 10-30% of their wealth in art.

Want in? You can invest in shares of million-dollar paintings with Masterworks, the world’s premier art investment platform.

For a limited time, you can skip the waitlist here

*See important disclosures at masterworks.com/cd

The Best Real Estate Crowdfunding Platforms Summary

Rank | Site | Type of investments | Expected returns | Minimum investment | Fees | Accreditation needed? |

|---|---|---|---|---|---|---|

1 | eREITs + more | Varies | $10 | Varies | All Investors | |

2 | Several | 9% | $2,500 | 0.5% – 2.5% | All Investors | |

3 | Private Credit | 15% | $500 | Start at 0% | Accredited Investors | |

4 | Commercial | Varies | $25,000 | Varies | Accredited Investors | |

5 | Farmland | 7% – 9% | $3k – $10k | 0.75% | Accredited Investors | |

6 | ETFs | Varies | $1 | None | All Investors | |

7 | Single Family Homes | Varies | $100 | 1% | All Investors | |

8 | REITs | 8% | $5,000 | 2% | All Investors | |

9 | Commercial | 6.5% – 18% | $5,000 | Varies | Accredited Investors | |

10 | Commercial | 10% – 12% | $25,000 | Varies | Accredited Investors | |

11 | Commercial (direct and funds) | 15% | $5,000 | Varies | Accredited Investors | |

12 | Residential | Varies | Varies | 0.5% – 3% | All Investors |

The 12 Best Real Estate Investing Apps & Crowdfunding Sites in 2024:

1. Fundrise: The Best Real Estate Investing App Overall

Overall rating: ⭐️⭐️⭐️⭐️⭐️

Pros:

- Intuitive platform that’s easy to use

- Access to a wide variety of funds

- $10 minimum

- Well-designed mobile app

Fundrise is the best real estate investing app, giving you access to a wide range of investment opportunities through their proprietary eREITs, funds that allow you to invest in multiple commercial and residential real estate projects within a single investment vehicle, and pay out regular dividends.

Fundrise has several types of investments, from eREIT funds to specialized funds and accredited offerings (reserved for accredited investors). Fundrise even offers a retirement account (IRA), allowing investors to use Fundrise to save for retirement. Plus, they’re transparent about client returns + fees — both can be found on the website.

Note: We earn a commission for this endorsement of Fundrise.

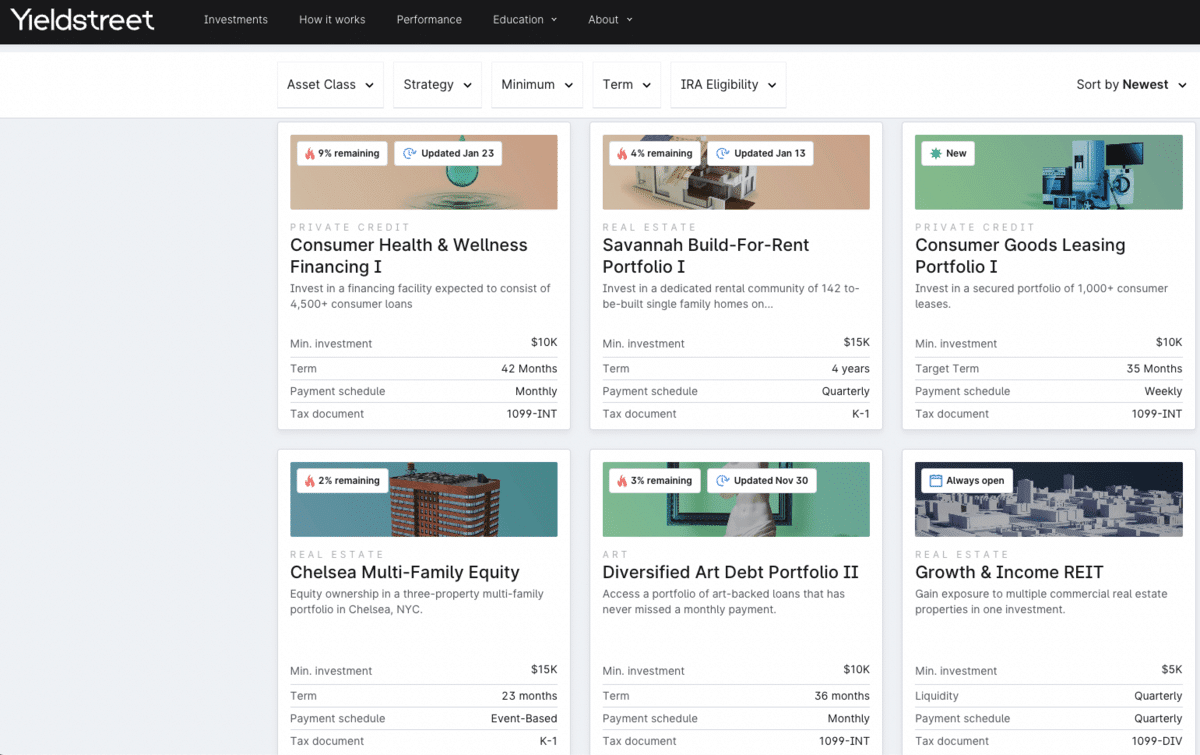

2. Yieldstreet: The Best Real Estate Crowdfunding Platform for Diversified Investing

Overall rating: ⭐️⭐️⭐️⭐️

Pros:

- Multiple types of real estate investments

- Access to alternative investments

- Investment portfolios available

Yieldstreet is an alternative investment platform that offers several types of assets, including real estate, art, crypto, legal, private credit, private equity, short-term notes, transportation, and venture capital. The real estate investments include a mix of REIT funds and private real estate deals, with minimum investments varying per offering.

Yieldstreet also offers several portfolio products, letting you invest in multiple asset classes within a single investment. This gives you instant diversification across investments, and is a great way to hold alternative assets as part of a larger investment plan.

Fees vary by investment, ranging from 0% up to 2.5% annually, depending on the product. These management fees are taken from the equity on the investment, and not out of your earnings.

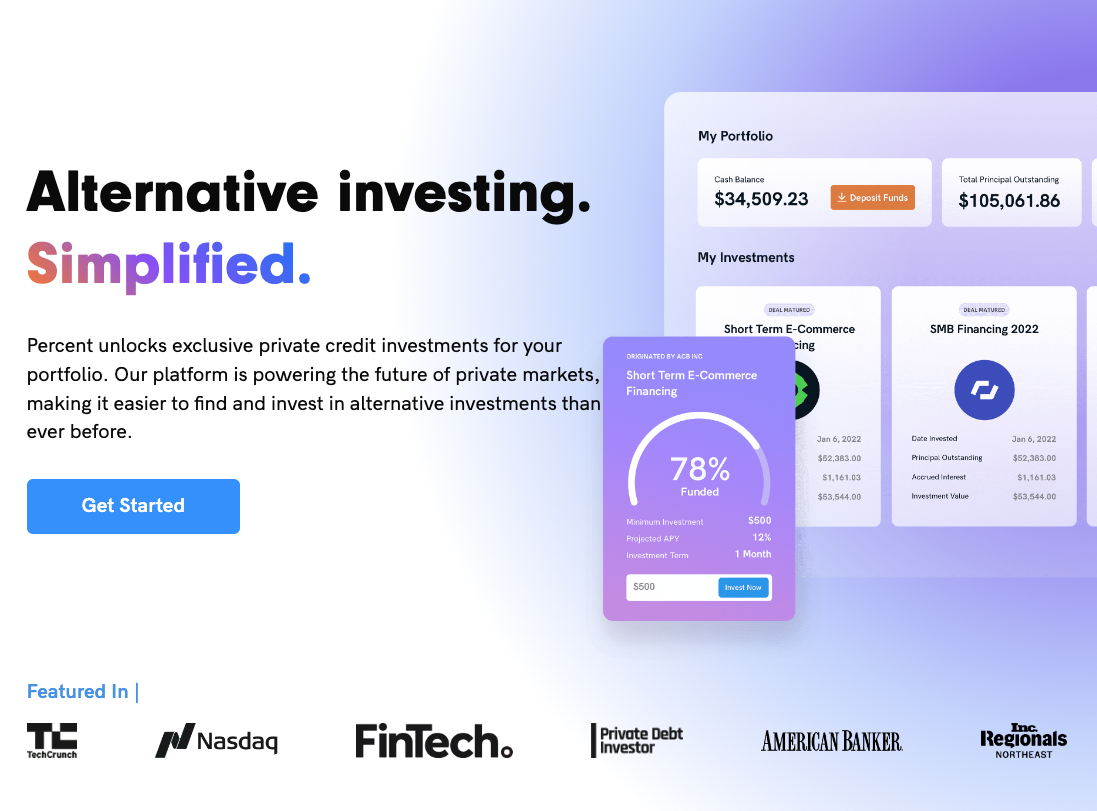

3. Percent: The Best Platform for Structured Note Investing

Overall rating: ⭐️⭐️⭐️⭐️⭐️

Pros:

- Shorter durations

- Predictable, stable income

- Lower volatility than public markets

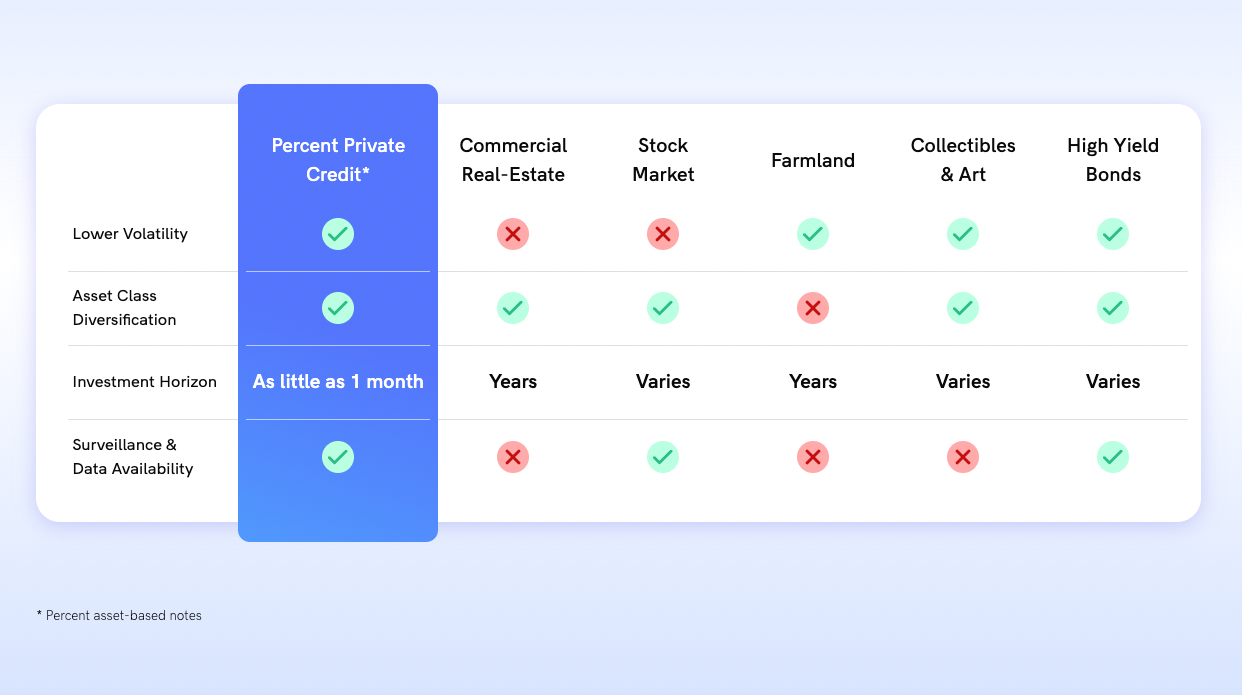

Percent is the only investment platform exclusively dedicated to bringing access to private credit markets to accredited investors.

While it’s not a platform dedicated to real estate investing, Percent has offered its investors exposure to real estate through various structured notes, including single and multifamily residential mortgages and a corporate loan to a multiple listings platform.

Like real estate, private credit (especially deals backed by a portfolio of consumer or business loans) can offer predictable, stable income.

Why invest in private credit?

- Higher yields

- Shorter durations

- Diversification outside of public markets

Businesses without access to public markets turn to private credit to finance their operations and growth, and pay higher rates for the capital. The average duration of investments on Percent is 9 months which makes it easy to restructure your portfolio and ensure you’re receiving the prevailing rates. Plus, private investments don’t experience the same volatility as public markets.

While this asset class used to only be available to non-bank lenders and institutional investors, Percent has opened the door for accredited investors.

As of May 2023, Percent does not charge investors fees on individual deals – the borrowers pay the costs.

You can get started on Percent with a minimum investment of just $500. Plus, if you use the links on this page, you can get a bonus of up to $500 for making your first investment.

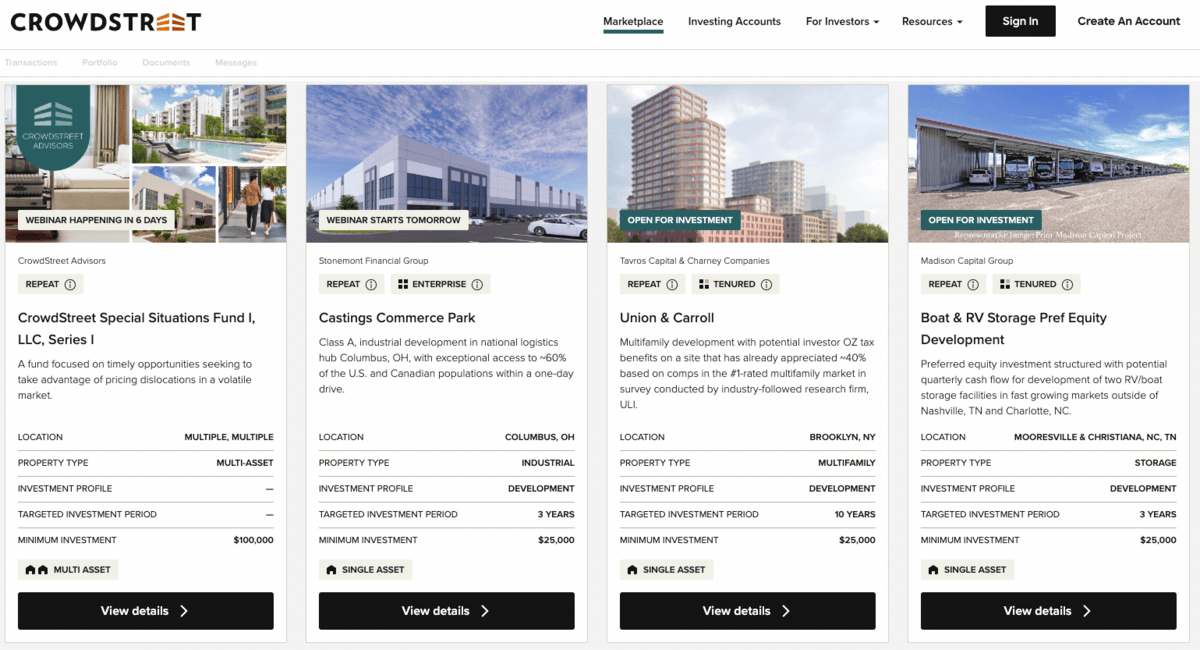

4. CrowdStreet: The Best Crowdfunding Real Estate Site for Commercial Properties

Overall rating: ⭐️⭐️⭐️⭐️

Pros:

- Long-standing company

- High returns on average

- Managed portfolios available

CrowdStreet is the top commercial crowdfunded real estate investing app, giving accredited investors access to some of the best commercial real estate projects around the U.S. CrowdStreet has been around since 2012, and has managed over $4 billion in investments since inception.

Crowdstreet offers multiple types of investments, including individual equity and debt deals, as well as REITs and real estate portfolios. Funds are available to gain access to multiple projects in many different real estate sectors, all within a single shared real estate investment. And high-net-worth clients can gain access to a portfolio manager to help them build a custom investment strategy.

For most properties, the Crowdstreet minimum investment is $25,000 — some require even more. And fees can be on the higher side, with some projects requiring up to 7% (or more) in fees.

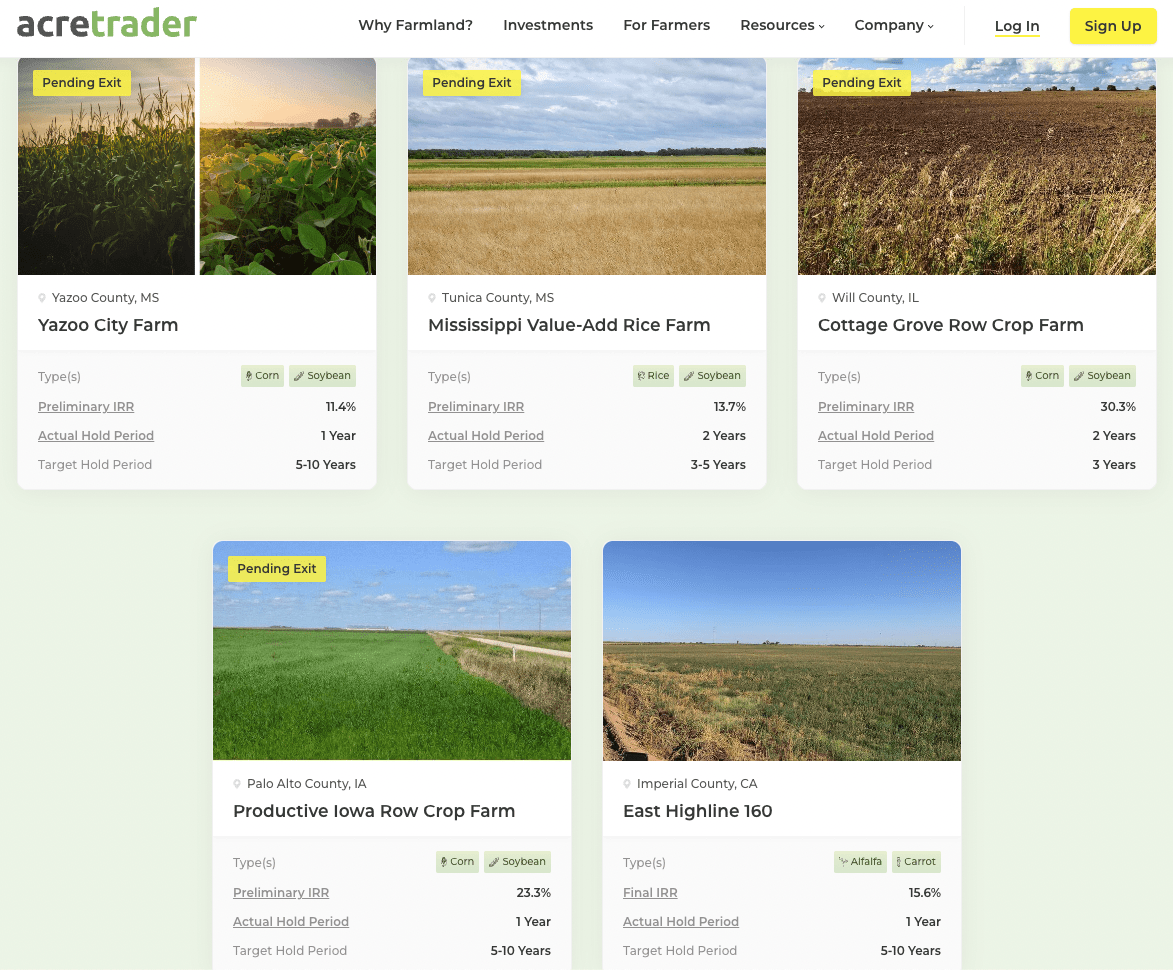

5. AcreTrader: The Best Real Estate Investing App for Investing in Farmland

Overall rating: ⭐️⭐️⭐️⭐️

Pros:

- Access to farmland investing

- Strict vetting process for deals

- Low management fee

Farmland is one of the most unique accredited investor investment opportunities.

AcreTrader allows you to invest in farmland directly, buying shares of equity in land parcels that earn money from rent payments and appreciation. AcreTrader is reserved for accredited investors, and minimum investments start around $3,000, but may be more, depending on the deal.

AcreTrader has a stringent acquisition process, reviewing opportunities and purchasing less than 5% of the deals they come across. This vetting process helps investors earn more, as the land has the most potential cash flow and long-term value.

There is a flat 0.75% management fee assessed, as well as closing fees on each project, which vary. But this is on par with most other real estate investments, and the 0.75% fee is lower than many other crowdfunded real estate platforms.

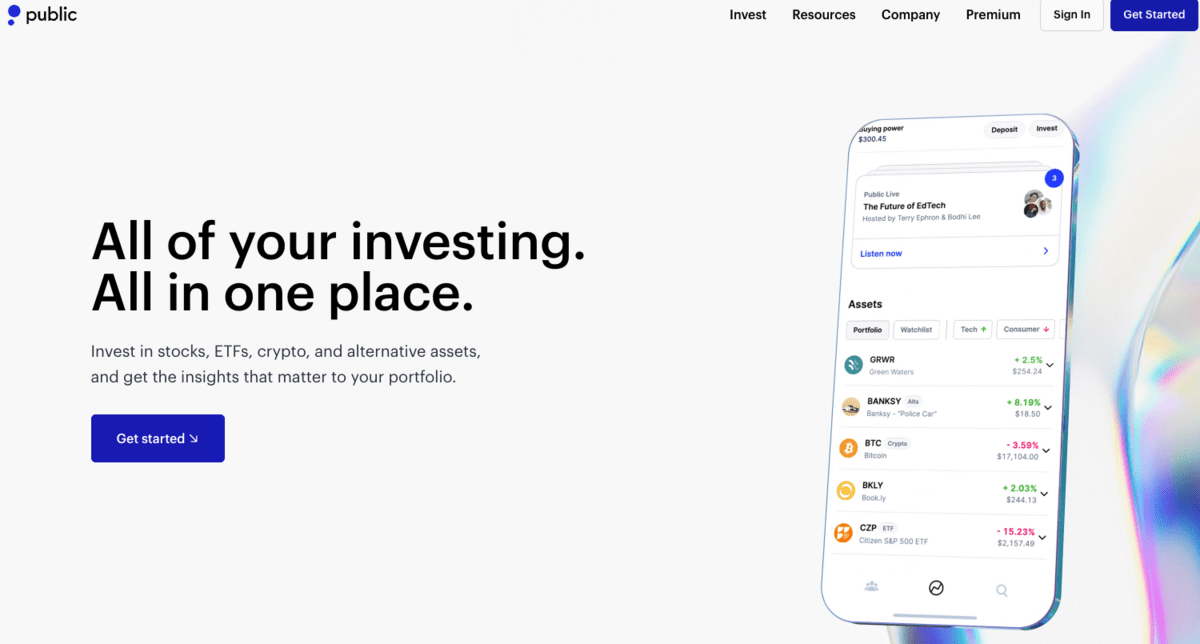

6. Public.com: The Best App for Investing in Real Estate ETFs

Overall rating: ⭐️⭐️⭐️⭐️

Pros:

- Simple-to-use mobile app

- Fee-free stock and ETF trading

- Access to alternative investments

Public.com is a stock trading platform that offers access to commission-free trading for stocks and exchange-traded funds (ETFs), including real-estate focused funds. There are several real estate ETFs to choose from, including Vanguard’s real estate ETF (VNQ) and Invesco Active US Real Estate (PSR) ETF.

Public.com also lets you invest in other alternative assets, such as crypto, fine art, and collectibles. You can buy partial ownership in rare items, with the ability to buy and sell your shares on the Public marketplace.

Public is limited in its real estate investment choices, but the low fees and simple-to-use mobile app make it a great way to add some real estate funds to your investment portfolio.

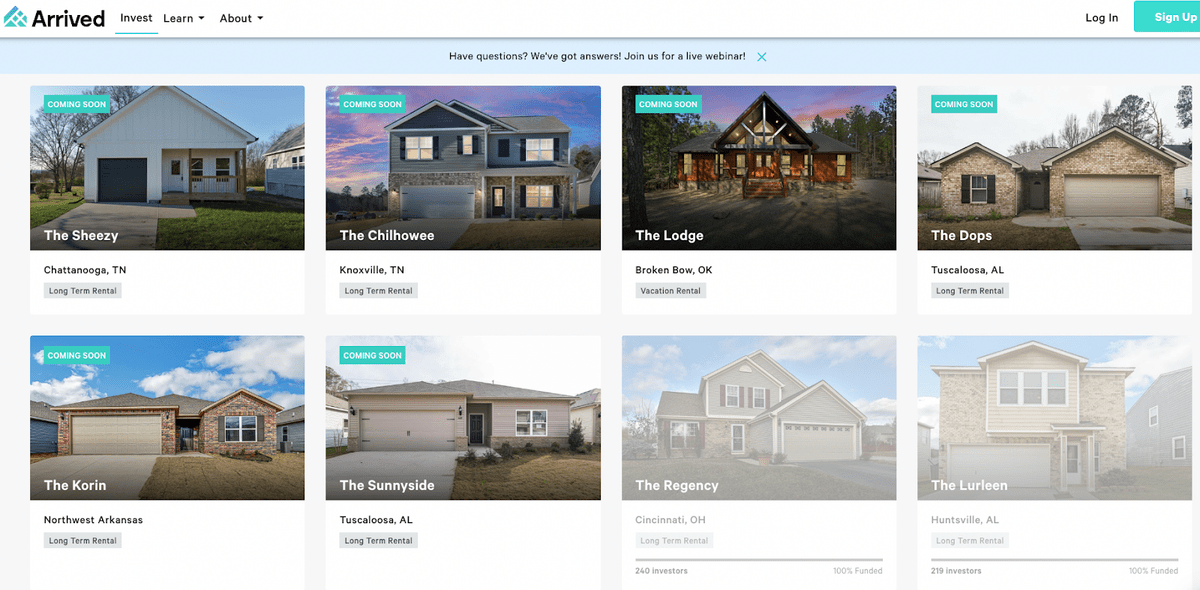

7. Arrived Homes: The Best Crowdfunding Real Estate App for Investing in Single-Family Homes

Overall rating: ⭐️⭐️⭐️

Pros:

- Low minimum ($100)

- Accreditation not required

- Backed by Jeff Bezos

Arrived (formerly “Arrived Homes”) is a crowdfunded real estate platform that allows you to invest in single-family rental homes with as little as $100. As an investor, you don’t have to deal with the purchase, improvements, or maintenance of the home, or deal with tenants, and can buy a small slice of ownership in several properties.

Arrived selects less than 1% of the deals they review, ensuring only high-quality rental properties, and pays out regular dividends to investors. They even have vacation rental properties, allowing investors to take part in short-term rental property profits.

Arrived is open to all investors, and is backed by Jeff Bezos. It is the best platform for investing in single-family homes, period.

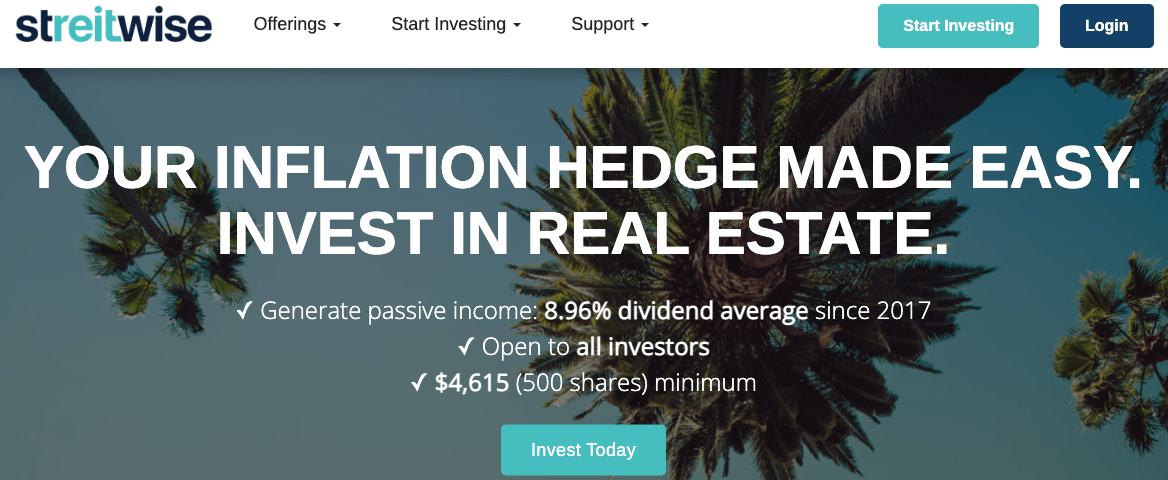

8. Streitwise: The Best Real Estate Investing App for Commercial REITs (The Best Real Estate Investment App for Beginners)

Overall rating: ⭐️⭐️⭐️

Pros:

- High returns on average

- REIT available without accreditation

- Access to individual commercial real estate deals

Streitwise offers one of the best commercial REITs of any platform, with a track record of paying out an average of over 8% every year in dividends since 2017. The fund is invested in two massive commercial properties with dozens of companies that pay rent on a regular basis (think: retail shops and corporations). The rents are paid out to the REIT, and dividends are distributed quarterly to investors.

The minimum investment is around $5,000, and the fee is a flat 2%. The dividend average of around 8% is after fees, so even when paying 2%, you are still earning a solid return.

Streitwise also offers access to individual commercial real estate deals for accredited investors through their sponsor, Tryperion Holdings. These deals include multi-family homes, office buildings, and other commercial properties. The minimum investment on these can be $50,000 or more.

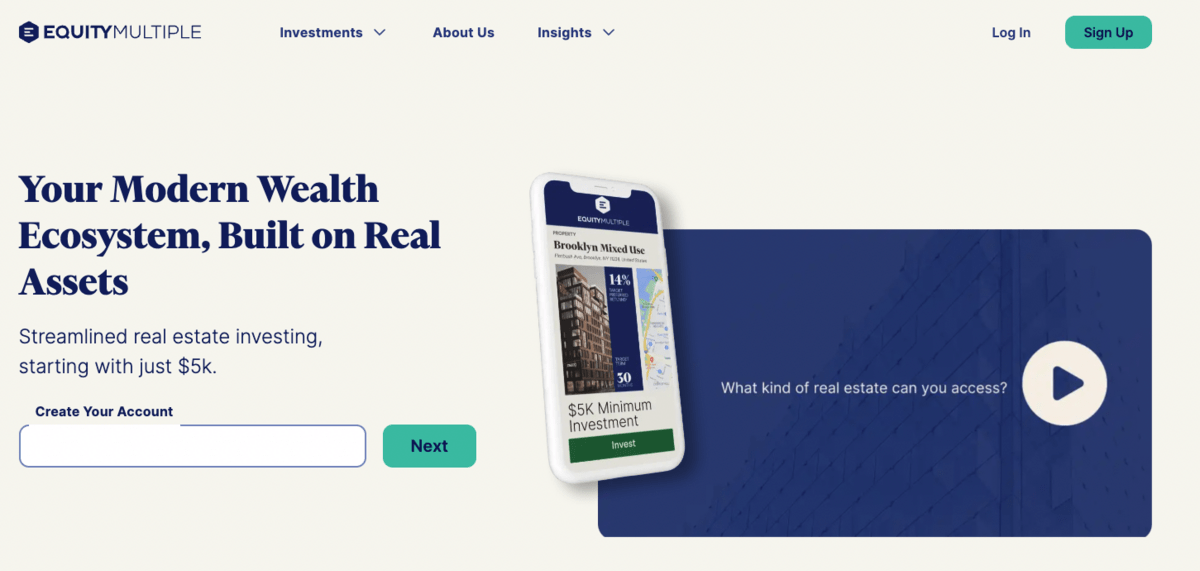

9. EquityMultiple: The Best Real Estate Crowdfunding Platform for Debt Investments

Overall rating: ⭐️⭐️⭐️

Pros:

- Multiple types of real estate investments available

- No fees on short-term notes

- High returns on growth deals

EquityMultiple is a crowdfunded real estate platform that offers access to direct investment into commercial real estate deals, as well as debt investments, such as short-term notes. These investments let you become the bank, lending your funds to real estate investors, with a high yield return that is usually paid back within one year (or less).

EquityMultiple also offers direct investment into commercial real estate deals, with a focus on cash flow or growth. These investments can return up to 18% per year (on average), which outpaces most other asset classes.

EquityMultiple charges various fees, depending on the investment, but the short-term notes don’t have any fees associated. Equity investments can charge from 0.5% up to 1.5%, but this is in line with most other crowdfunded real estate platforms.

EquityMultiple is available to accredited investors only.

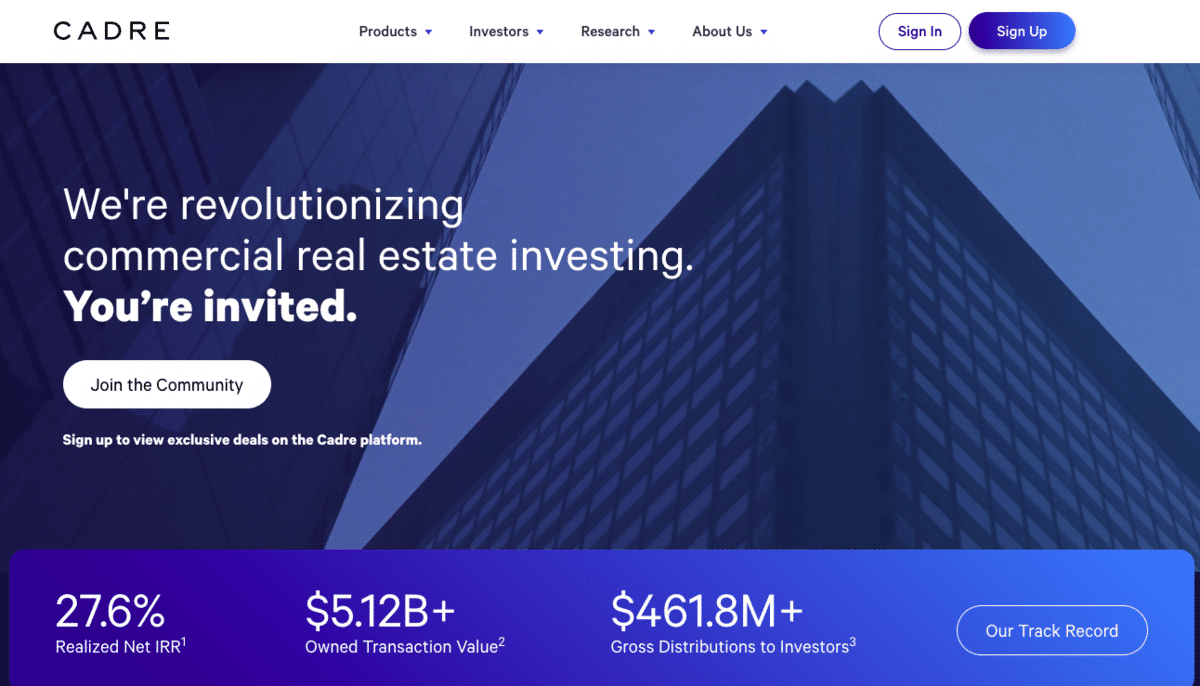

10. Cadre: The Best Digital Real Estate Investing Platform for Institutional-Quality Real Estate

Overall rating: ⭐️⭐️⭐️

Pros:

- Cadre co-invests on each project

- Fund available for instant diversification

- High returns on individual deals

Cadre is a crowdfunded real estate platform that offers access to commercial real estate deals that allow you to invest alongside qualified institutions. And Cadre themselves co-invest in every deal, giving them some skin in the game to maximize returns.

There are two main ways to invest with Cadre; The Cadre Direct Access Fund, and “Deal by Deal.” The fund offers a diversified mix of multiple properties, spreading your investment across multiple deals in a single investment. The “deal by Deal” opportunities allows you to pick and choose which properties to invest in, and build your own real estate investment portfolio.

Cadre has closed 15 deals since 2015, and has exceeded their projections on each so far, with an average net internal rate or return of 26%. Cadre is only available to accredited investors, and the minimum investment is $25,000.

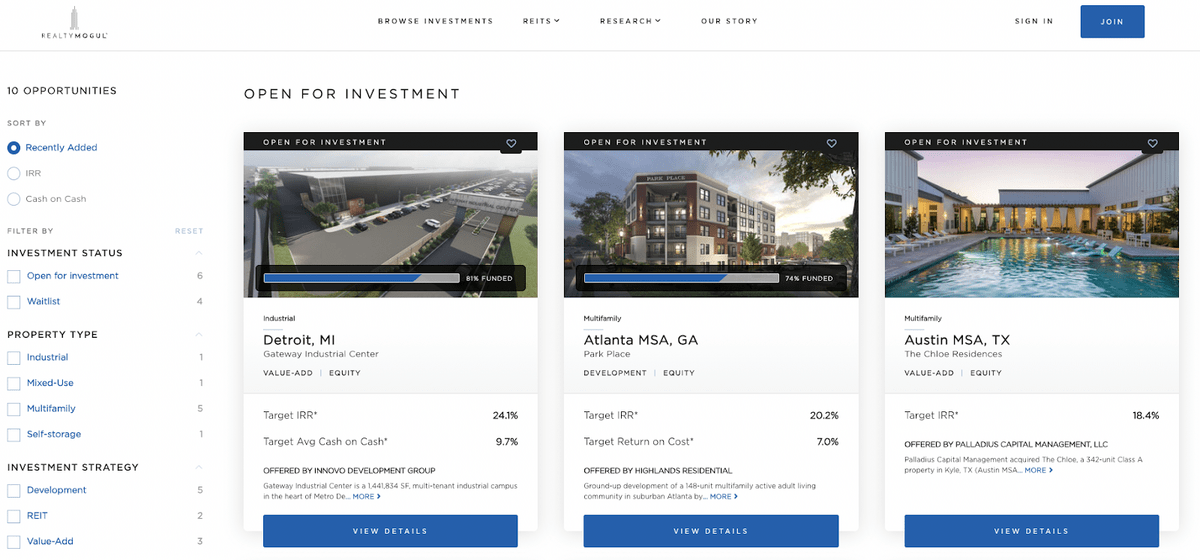

11. RealtyMogul: The Best App for Real Estate Investing in Non-Traded REITs

Overall rating: ⭐️⭐️⭐️

Pros:

- High cash-flow REITs

- Buyback program available

- Access to individual deals

RealtyMogul is a high-end platform for investing in commercial real estate through non-traded REITs and commercial real estate. Non-traded REITs (as their name suggests) can’t be traded, but you must hold them for several years before they can be sold, and they can only be re-purchased by RealtyMogul themselves.

Think of it as a “buy and hold” type of investment that pays out monthly or quarterly dividends.

RealtyMogul has two different types of REITs; Income-focused funds and growth-focused funds. The income REITs pay out 6% – 8% annually in monthly or quarterly dividends, while the growth funds aim for a higher return through improvements and capital appreciation.

RealtyMogul also offers direct investments in individual properties, but this requires a much higher initial investment.

12. Roofstock: The Best Crowdfunding Real Estate Site for Investing in Rental Properties

Overall rating: ⭐️⭐️⭐️

Pros:

- Marketplace shows annual returns for each property

- Can buy or sell a rental property (tenant or no tenant)

- Transparent fee structure

- Can “return” your home within 30 days of purchase

Roofstock is a rental property marketplace that allows investors to find and purchase rental real estate properties, or list their own rental property for sale. You can browse through a list of properties for sale, and purchase one for just 20% down. Roofstock allows you to make offers directly through their platform, and will even connect you with a lender if you don’t have one.

Roofstock can also connect you with a local property management company to handle the day-to-day operations of managing the property. And Roofstock offers “Roofstock One,” an investment platform for accredited investors to purchase equity in a rental property portfolio for as little as $5,000.

Roofstock charges a 0.5% fee on purchases (or $500, whichever is lower), and a 3% fee on sales (or $2,500, whichever is lower). The fees for Roofstock One will vary by investment.

And (Roofstock says) you can “return” your home within 30 days of purchase if you don’t like it. What this actually means is they will list it for free and sell it for you, then return your funds.

Final Word: The Best Real Estate Investing Apps in 2024

Investing in real estate has never been easier.

If you’re like me, you may decide to become an investor on multiple platforms listed above to round out your portfolio. Don’t hesitate to try multiple apps and decide which one or which combination is right for you.

Fundrise is the top app for non-accredited investors, with access to a wide range of real estate investments and a very low minimum of $10. And Arrived also lets any investors join for just $100, giving access to single-family home investing at an affordable price.

Accredited investors can benefit from the high-quality deals available on platforms like CrowdStreet and EquityMultiple, with historical returns exceeding 12% in some cases. And AcreTrader gives them access to farmland investing, which is a hot commodity right now.

You can start investing in real estate in 2024.

FAQs:

What app can I use to invest in real estate?

There are dozens of real estate investing apps on the market, both for accredited and non-accredited investors. Fundrise is the most popular for non-accredited investors, and Crowdstreet is the most popular for accredited investors.

Many of the best apps are crowdfunded real estate platforms, but some are alternative investment platforms, like Public.com and Yieldstreet.

What is the most profitable real estate investment?

Commercial real estate seems to be the most profitable real estate investment, regularly returning above 10% returns between cash flow and capital appreciation. But it also comes with outsized risk, and usually requires a much higher minimum investment.

Can you invest $1000 real estate?

Yes, there are digital real estate platforms that offer low minimum investments. Fundrise ($10), Arrived ($100) allow you to invest with very little, and Public.com allows you to buy real estate ETFs with just $1.

How can I invest my $5,000 in real estate?

If you have $5,000 to invest, there are several ways to invest in real estate. Apps like Fundrise and Streitwise let you invest in REITs, which are a diversified fund of real estate properties. Public.com and other investing apps let you access ETFs that hold real estate investments. Or you can directly buy shares of a property with crowdfunded real estate.

Many commercial real estate platforms require a higher minimum, but there are several with a $5,000 minimum you can join.

What is better than Fundrise?

If you are an accredited investor, Crowdstreet is probably the best real estate investing app available. It gives you access to high-quality commercial real estate deals, vetted through their proven process, and with very high returns.

Is real estate crowdfunding a good investment?

It can be. Real estate crowdfunding can produce great returns and cash flow.

But as with any investment, there is always a risk. And when investing in real estate crowdfunding, there is a risk of total loss of capital (which has happened to a few crowdfunded platforms).

Where can I crowdfund real estate?

There are several popular crowdfunding platforms for real estate investing, including Fundrise, Crowdstreet, Cadre, RealtyMogul, and Arrived. Each offers a unique mix of real estate investment opportunities, which may include REITs, single family homes, commercial properties, or debt instruments.

Which real estate platform is best?

Each real estate platform offers unique investments, but Fundrise is probably the most popular. For commercial real estate, Crowdstreet is the longest-running platform for accredited investors.

Can you make money crowdfunding real estate?

Yes. Crowdfunded real estate allows you to earn regular dividends (cash flow), as well as earnings from capital appreciation of the property when it is sold.

Has anyone made money from Fundrise?

Yes. Fundrise has averaged over 5% returns on an annual basis since 2017.

How can I invest $1000 in real estate?

Start small by investing with apps like Arrived ($100 minimum) or Fundrise. You can also invest in ETFs that hold real estate investments, like Vanguard’s VNQ fund.

Is DiversyFund or Fundrise better?

DiversyFund is a crowdfunded real estate platform that has one offering currently, and is only available to accredited investors. They also charge high fees and have a minimum investment of $50,000 for their current offering.

Fundrise has a quality track record of REIT and direct real estate investments that produce actual returns. So Fundrise is by far the better platform.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our April report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.