One of the most crucial components of wealth-building? Diversification of assets.

Here’s the problem. What used to be considered “diversification” — investing in stocks and bonds — is no longer good enough, thanks to an environment of high inflation and high interest rates.

The solution? Consider investments that aren’t directly correlated to the stock market — alternative investments, such as real estate.

In this article, we’ll tackle:

What is an alternative investment?

What are real estate assets and why do they matter?

Why alternative investments — what are the benefits of alternative investments?

By the time you’re done reading, you’ll have a much better idea if real estate alternative investment is the right direction for you — and if it is, how to get started.

At-a-Glance: Top Real Estate Alternative Investment Opportunities

- Best overall: Fundrise

- Best for accredited investors: Yieldstreet

- Best for single-family homes: Arrived Homes

- Best for commercial real estate (accredited investors): CrowdStreet

- Second-best for commercial real estate (accredited investors): EquityMultiple

Note: We earn a commission for this endorsement of Fundrise.

What is an Alternative Investment?

An alternative investment is anything that does NOT fit within the traditional investing box of stocks, bonds, and cash.

The word “traditional” in investing refers to being regulated by the Securities and Exchange Commission and liquidity. Traditional liquidity means an investment can easily be converted into cash — for instance, the speed with which you can sell your shares in a stock.

Why alternative investments? The appeal is that they provide portfolio diversification because their performance is not correlated to the stock market. And of course, the possibility of high returns.

Historically, alternative investments were only available to mega-wealthy accredited investors in the form of private equity or hedge funds. In the last decade, however, these types of investments have become more accessible through mutual funds and online investing platforms.

Although there is a wide array of alternative investment products, here are some key characteristics they share:

- Traditionally NOT correlated to stock market performance

- Higher potential returns compared to stocks and bonds

- Higher minimums: You can buy one share of stock for $10, while other investments might require much higher up-front costs

- Less liquidity: More complex structures mean a longer lock-up period, so your investment can’t be redeemed quickly as with selling a stock.

Below are other common alternative investments to choose from:

- Art and antiques

- Physical real estate

- Real estate crowdfunding

- Online businesses

- Farmland

- Jewelry

- Wine

- Storage units

- Private equity

- Vintage cars

What are the Benefits of Alternative Investments?

There are two critical reasons you may want to consider adding alternative investments to your portfolio.

First, few people can expect to get pensions anymore. Rather than your employer guaranteeing you a future income stream in retirement, that responsibility has shifted to the individual. Alternative investments could provide a passive income stream.

Second, technology allows for a low barrier to entry. Large commercial real estate deals, for example, used to be available only to institutions and accredited investors. Now, alternative investment apps are changing the game.

Online investing platforms make it possible to have equity in a self-storage facility in Texas or an apartment complex in Phoenix with the click of a button for a low minimum.

Personally, I invest in traditional and alternative investments for diversification. However, alternatives may not be suitable for all investors as their individual risk profiles can vary across the alternative spectrum.

Let’s discuss some of the main benefits of alternative investments.

- Indirect correlation to the stock market: The stock market can be unpredictable in a stable economy due to factors including supply and demand, interest rates, and current events. Investors can reduce risk by investing in private alternatives that are not tied to public stock markets.

- Asset class diversification: The stock market primarily represents cash, equity, and fixed-income asset classes. Including additional asset classes like real estate or crypto can help to diversify your portfolio.

- Tax benefits: The main tax benefit from the stock market is playing the long game to avoid short-term capital gains. You can also use any realized losses to offset any gains. Buying rental properties provides the following tax advantages:

- Expense deductions for mortgage interest, operations, repairs

- Depreciate property over time to reduce taxable income

- Opportunities to defer taxes with a 1031 exchange

- Access to new markets and opportunities – These could be investment vehicles that were historically available only to the rich, like art, private equity, storage facilities, private credit or transportation

Real Estate as an Alternative Investment

Rising interests and high inflation have resulted in the traditional 60/40 stock and bond portfolio becoming … not so diversified after all. It has investors looking at real estate alternative investment opportunities.

So … What are real estate assets?

The foundation of real estate assets is that they are tangible assets. But the overall segment is huge. There are a lot of ways to invest, depending on how active or passive you prefer to be and your risk tolerance.

A real estate alternative investment could be any number of things: a publicly-traded REIT (Real Estate Investment Trust), a private fund that invests only in apartments in the southwest, directly purchasing a duplex in your neighborhood … The list goes on.

How to Invest in Real Estate Alternative Investments:

If you don’t have the cash to buy a rental property you may want to consider some of the real estate alternative investments below:

1. Fundrise – Best Overall

Overall Rating: ⭐⭐⭐⭐⭐

Type of Investor: All investors

Fundrise is a real estate investing platform providing investors access to a wide range of private eREITs (Real Estate Investment Trusts).

Account sizes range from Starter, Basic, Core, Advanced to Premium. Investment minimums start at $10, and the platform is suitable for investors of all experience levels.

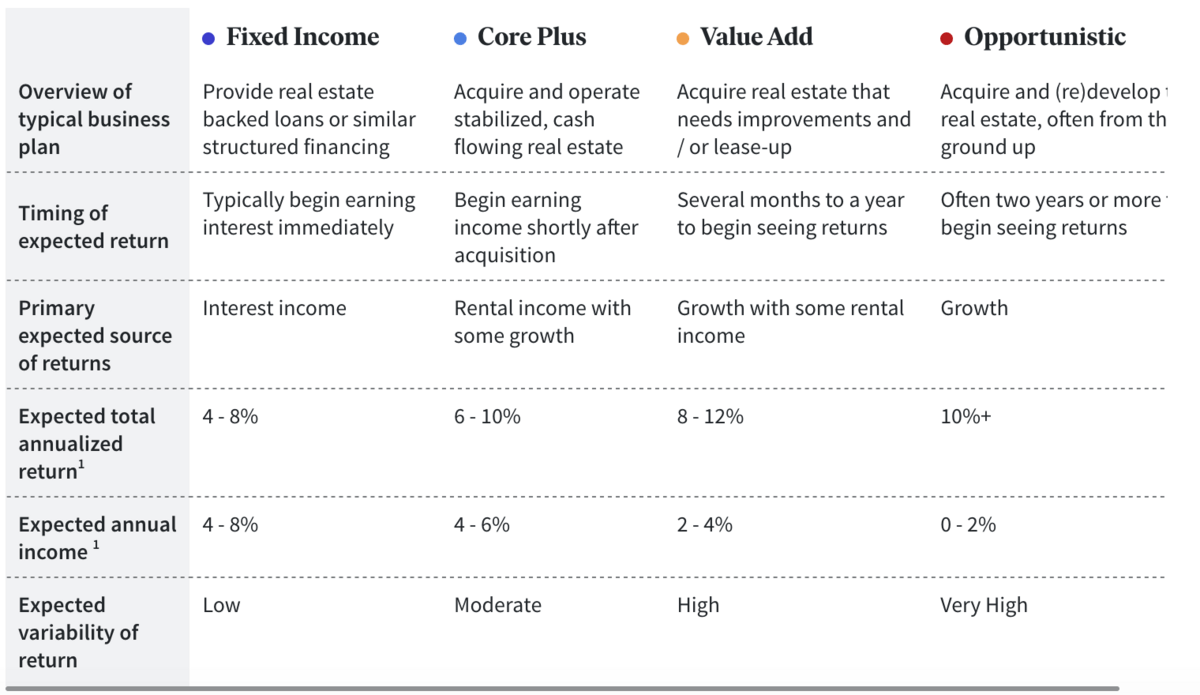

The investment strategy you choose — Fixed Income, Core Plus, Value Add, or Opportunistic — determines the mix of assets in your portfolio.

Note: We earn a commission for this endorsement of Fundrise.

2. Yieldstreet – Best for Accredited Investors

Overall Rating: ⭐⭐⭐⭐⭐

Type of Investor: Primarily accredited investors

Yieldstreet provides accredited investors with a range of highly vetted alternative investments for a balanced portfolio.

Opportunities include real estate and more — other Investments include art, transportation, private credit, crypto, and private equity. Most minimums start at $15,000, and the majority of investments are available to accredited investors only.

However, non-accredited investors can access The Prism Fund. The fund minimum starts at $10,000 and provides access to over five asset classes, including art, real estate, transportation, cash, private credit, and legal finance.

3. Arrived Homes – Best for Single-Family Homes

Overall Rating: ⭐⭐⭐⭐⭐

Type of Investor: All investors

Arrived Homes gives investors the opportunity to invest in rentals without the operational headaches. Minimums range from $100-$20,000 and you can earn income and appreciation while Arrived manages the properties.

Buy shares, diversify across multiple homes, and start receiving rental income quarterly. The first company to offer shares of rental homes to the general public, Arrived is on a mission to provide more investors access to the residential rental asset class.

4. CrowdStreet – Best for Commercial Real Estate

Overall Rating: ⭐⭐⭐⭐⭐

Type of Investor: Accredited investors

Crowdstreet is well-known for its wide range of private commercial offerings. With investment minimums starting at $25,000, you can access institutional-grade commercial deals by investing in REITs, custom portfolios, or individual deals.

Crowdstreet property types include but are not limited to, hospitality, industrial, land, office, multifamily, residential, retail, storage, senior housing, parking, and data centers. Their rigorous three-step deal review process ensures only the highest quality commercial assets will be available for investment.

5. EquityMultiple – Second Best for Commercial Real Estate

Overall Rating: ⭐⭐⭐⭐

Type of Investor: Accredited investors

EquityMultiple is another solid commercial real estate crowdfunding platform. Accredited investors can take advantage of lower minimums starting at $5,000.

EquityMultiple is one of the few commercial crowdfunding platforms offering equity, preferred equity, and senior debt investments, allowing investors to select assets aligned with their goals. Their assets are focused on mid-market commercial space with multi-tenant properties.

Other Types of Alternative Investments:

Interested in branching out beyond real estate assets? Here are some other types of alternative investments:

At-a-glance: other alternative investment platforms to explore

- Fine art: Masterworks

- Collectibles: Public

- Wine: Vinovest

- Farmland: AcreTrader (accredited only)

- Cryptocurrency: eToro*

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

1. Fine Art

What if you could buy a share of art like you can buy a piece of a real estate deal? Welcome to the complete platform for investing in art — Masterworks. Pool your funds with other investors to buy shares of famous artwork for as little as $20 (available for non-accredited investors).

Masterworks is structured like other crowdfunding platforms. They select the artists, purchase the art, then securitize it through the SEC, allowing the assets to be bought and sold.

2. Collectibles

What do Air Jordans, The Incredible Hulk, and Pokemon all have in common? They are all considered collectibles.

(Plus, did you know you can own a fractional share of the iconic “Shattered Backboard” Air Jordans signed by MJ himself?)

Public is a one-stop-shop for all your investing needs, offering stocks, ETFs, treasuries, crypto and alternative assets. Open to all investors, their unique collectible offering allows you to buy and sell fractional shares of memorabilia, trading cards, comics, video games, and more.

3. Wine

It would be nice if your investment portfolio could ‘age like fine wine.’ It can, literally, by investing in wine as an alternative investment.

Fine wine is emerging as one of the best-kept secrets in investing. Vinovest, your investment sommelier, offers direct ownership of world-class wine with no minimums required (open to non-accredited investors).

Master sommeliers combine with quantitative investment models to carefully select wines primed for maximized returns. Factors like brand equity, scarcity, aging, and critic score all contribute to the value.

With bond-like volatility, inflation and recession resistance, and lack of stock market correlation, it’s tough to deny fine wine as a solid alternative investment.

4. Farmland

What alternative investment comes to mind that is a hard asset with equity build-up, low volatility, and on average, double-digit annual returns?

Not stocks, bonds, gold, or CDs … but farmland.

Overlooked due to its simplicity, demand for food combined with a rapidly growing population makes farmland a diversified alternative investment with attractive returns.

With platforms like AcreTrader, accredited investors can own shares of a variety of farmland types and earn money in two different ways — through land appreciation and annual rent payments from farmers. Investment structures mirror real estate platforms, ranging from core to opportunistic.

5. Gold

Commodities like gold are a great inflation hedge and have a low correlation to the stock market and other assets. One of the most historically known stores of value, gold is tangible, liquid, and can help diversify your portfolio.

There are several ways to add gold to your portfolio. In addition to purchasing physical bars or coins, you can also invest in gold ETFs or gold mining stocks. In a high-inflation environment, gold becomes more appealing as it tends to hold its purchasing power as the value of the dollar decreases.

Interested in gold investing? Check out this article, plus our top gold IRAs below:

6. Cryptocurrency

The crypto craze has resulted in new online trading platforms in the last decade — social trading.

Investing is social. With platforms like eToro, investors of all levels can see what others are buying and selling, make connections, and get questions answered by successful investors.

eToro offers a large range of trading tools and available currencies and focuses on the social connection aspect of investing.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

8. Hedge Funds & Private Equity

Two main categories that come up in the alternative investment conversation are hedge funds and private equity. They have their differences but both strategies invest capital in companies and serve as a hedge against the stock market.

- Private equity firms look to take a controlling interest in companies with a more long-term strategy

- Hedge funds do not buy companies outright and look to make a profit for investors as quickly as possible.

Both funds attract high-net-worth investors, including accredited investors and institutions. Compared to newer crowdfunding investing platforms, the barrier remains high to get involved.

Final Word: Real Estate Alternative Investment

The traditional path to retirement has changed and the responsibility is in the hands of the individual. As a result, you need to look for other ways to build equity, create cash flow and gain tax advantages to maximize wealth.

The number of alternative investments can be overwhelming to choose from if you’re looking outside the stock market. The subcategories of alternatives seem to get longer by the day.

To cut through the noise it’s crucial to define the problem solved by looking at alternatives, especially real estate as an alternative investment.

Real estate offers diversification, plus there are plenty of ways to get involved that suit a variety of investors, from ETFs to crowdfunding to buying individual hard assets and beyond.

FAQs:

What are the 4 main categories of alternative investments?

Alternative investments are assets outside of traditional investments like stocks and bonds. Four main categories include hedge funds, private equity, real estate, and commodities.

What are real estate assets?

Real estate assets are “real property.” This includes land and any permanent improvements made to the land. The most common real estate assets are residential, commercial, industrial, and land.

What are the 4 different types of real estate investment?

Real estate investments can take the form of public equity, public debt, private equity, and private debt. Within any of these categories, the most common real estate assets are residential, commercial, industrial, and land.

How to invest in real estate with $1 K?

Two common methods to invest your first $1,000 in real estate are through a REIT (Real Estate Investment Trust), or an online real estate crowdfunding platform. Both methods allow investors to get started with low minimums by owning a portion of a real estate portfolio.

What is the most popular alternative investment?

The most popular alternative investment asset class is real estate. There are multiple ways to invest in real estate depending on risk tolerance, capital, and your overall investment goals. In addition, it checks more boxes than most alternatives — appreciation, tax benefits, depreciation, and cash flow.

The growth of online crowdfunding platforms over the past decade has given investors the opportunity to gain ownership in real estate with minimums as low as $10. In addition to real estate, other popular alternatives include crypto, farmland, art, transportation, and collectibles.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our June report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.