Looking to diversify your investment portfolio and explore alternative investment strategies?

You’re in the right place. In this article, we’ll explore the 8 best examples of alternative investment strategies and ideas in 2025.

From fine art investing to cryptocurrencies, we’ll cover a range of options that can potentially generate attractive returns and provide unique investment opportunities.

Let’s get started!

At-a-Glance: Top Alternative Investment Platforms

We’ll dig into each of these categories at greater length below, but here’s a sneak peek at some of our top alternative investment platforms in 2025…

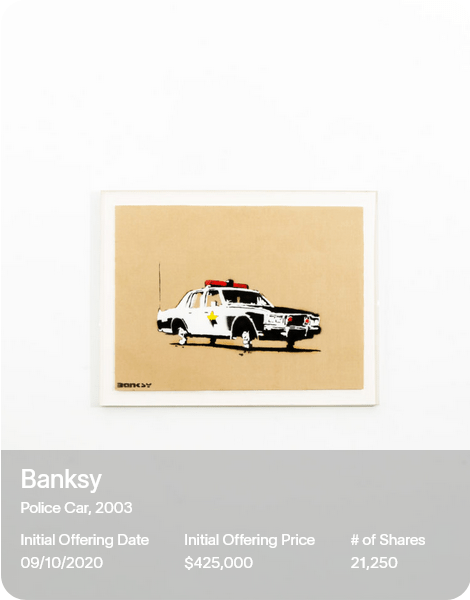

For fine art investing: Masterworks

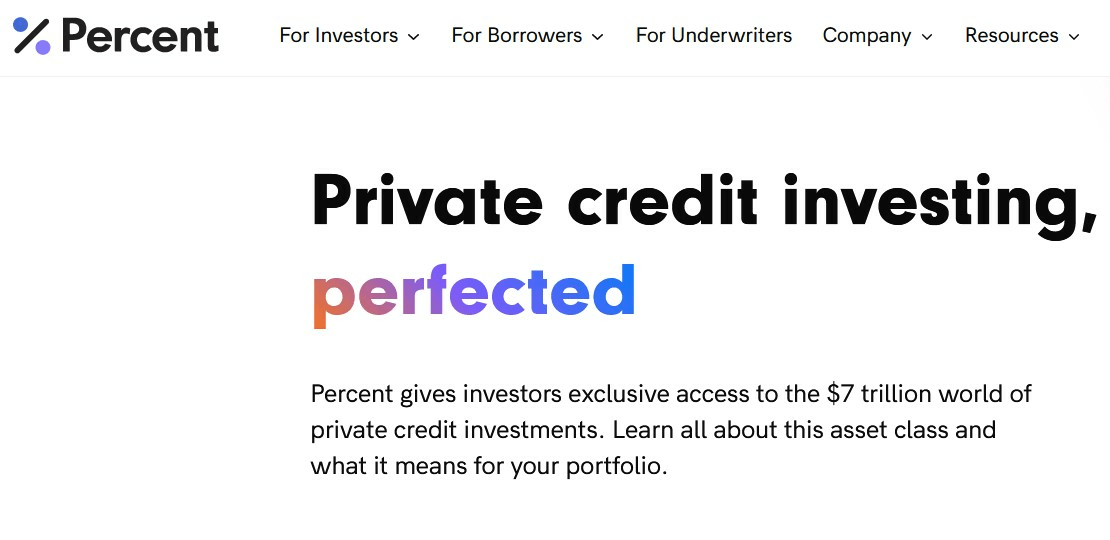

For private credit: Percent

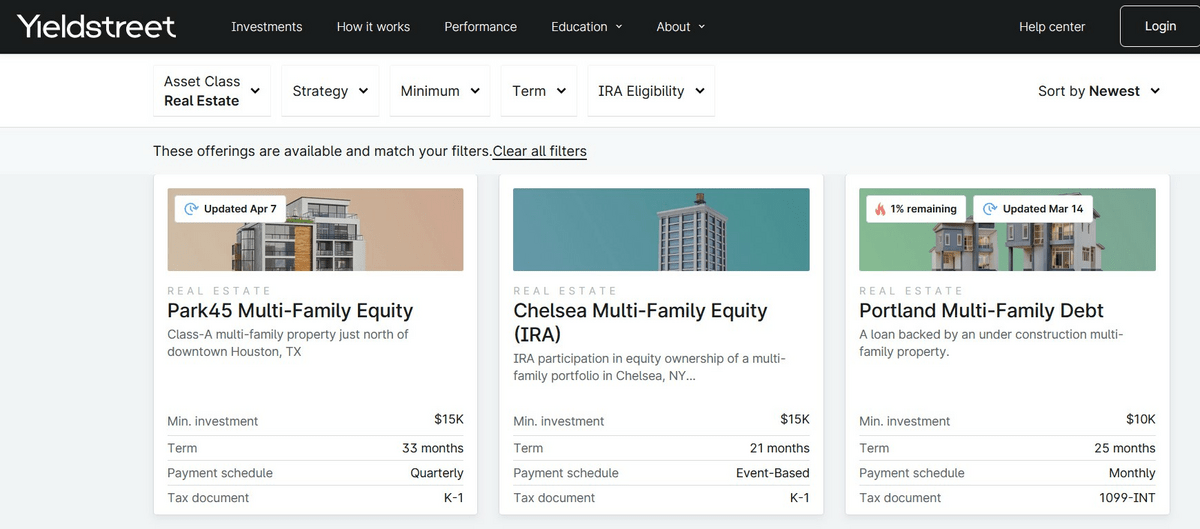

For fractional real estate: Yieldstreet

For investing in businesses: Hiive

For collectibles: Public

For gold: Silver Gold Bull

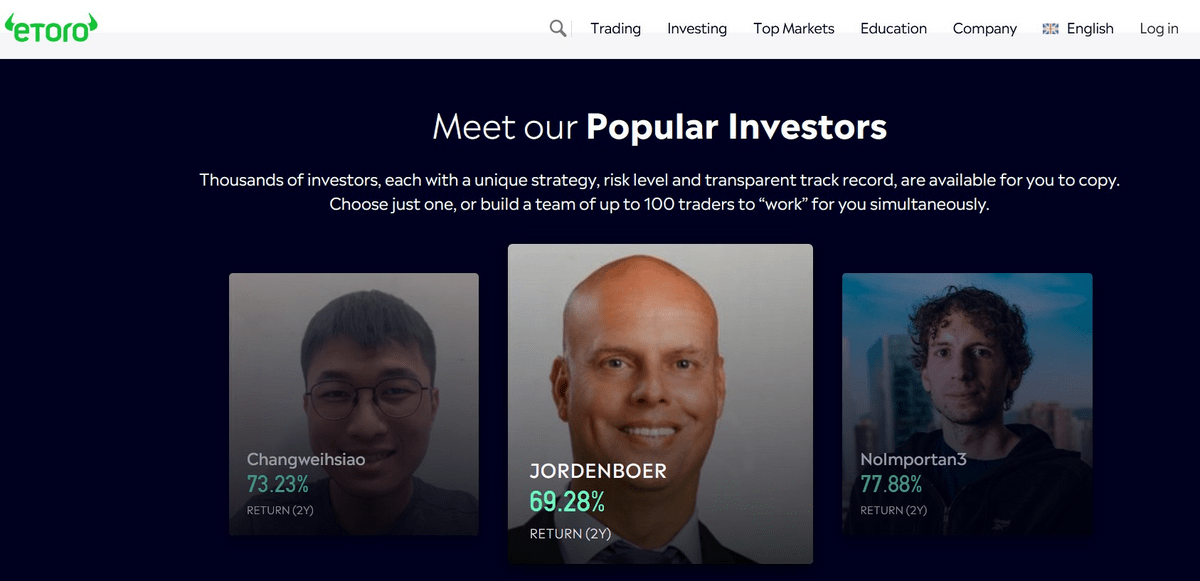

For crypto: eToro

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

8 Best Alternative Investment Strategies in 2025

Ready to diversify? Consider these alternative investments.

1. Fine Art Investing

With fine art investing, you can delve into the captivating world of art and potentially reap financial rewards by investing in masterpieces.

As art prices continue to rise over time, investing in fine art can offer both aesthetic enjoyment and the potential for attractive returns.

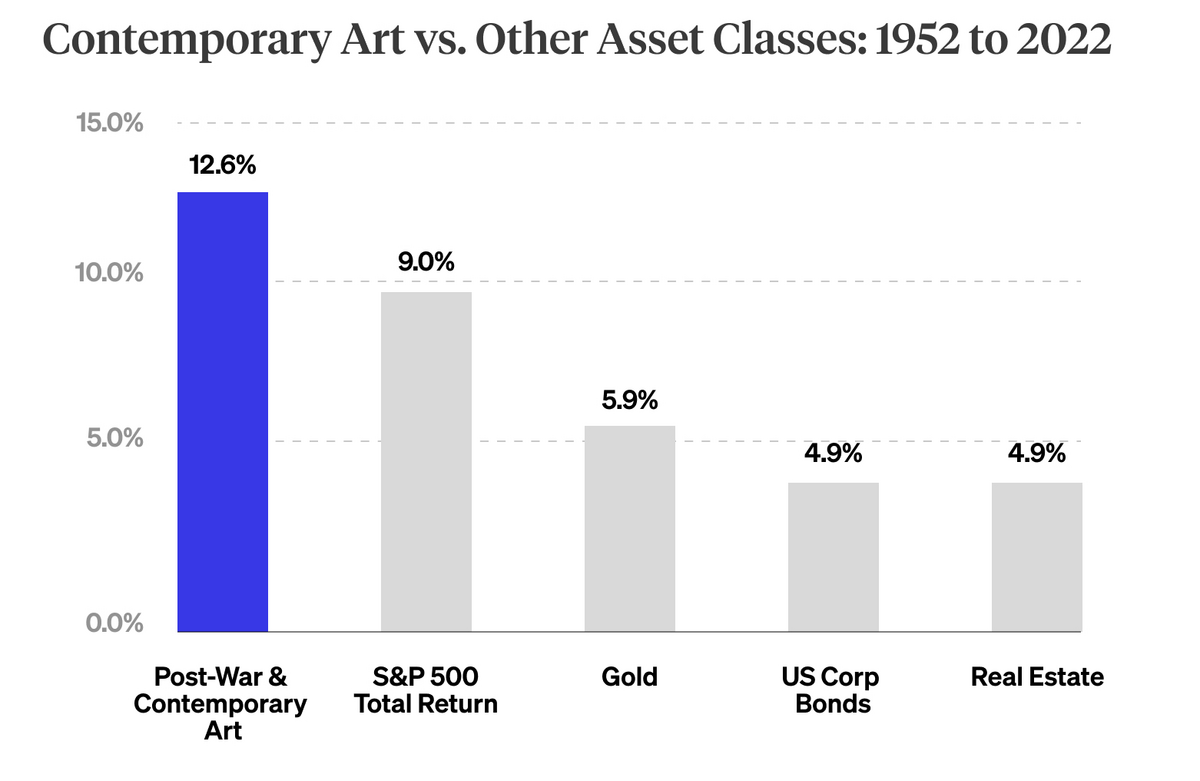

Contemporary art has outperformed the S&P 500 as well as other alternative assets for decades:

The one problem? Not everyone can afford to drop 6 figures on a Bansky.

That’s where Masterworks enters the picture.

With Masterworks, you can gain fractional ownership of renowned paintings and sculptures, allowing you to participate in the art market’s potential appreciation.

While results may vary, their track record is impressive. For example, Masterworks delivered 32% returns to investors after selling a Banksy piece.

(Masterworks has also recently delivered 14%, 17%, and 21% net annualized returns to investors.)

Long story short? If you’re looking for an asset class that has little correlation to the stock market and high-appreciation potential, it’s well worth considering fine art investing.

2. Private Credit

Looking for opportunities to earn higher returns than traditional fixed-income securities? Private credit investments might be the answer.

Private credit involves lending directly to companies or individuals, bypassing traditional banking channels and providing access to unique lending opportunities.

But the main benefit of this alternative investment option is that it can offer attractive yields due to higher interest rates compared to traditional bonds.

Platforms like Percent give accredited investors access to private credit investments, offering the potential to diversify your fixed-income portfolio and potentially achieve higher returns.

Percent gives you access to private credit deals. You can see if they’re right for you with transparent profiles and an easy-to-use platform.

3. Real Estate + Real Estate Alternative Investments

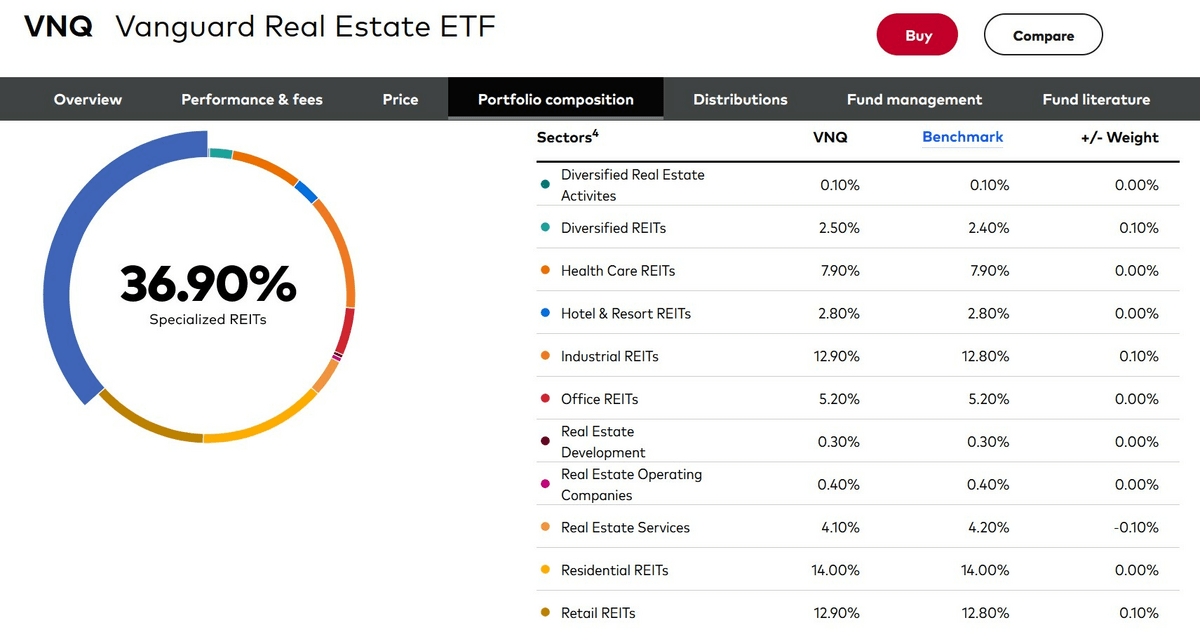

Expand your real estate exposure beyond traditional properties by considering alternative real estate investments. REITs (Real Estate Investment Trusts) are one option, offering the opportunity to invest in a diversified portfolio of real estate assets without the need to directly own or manage properties.

The nice thing about REITs is that they’re “alternative” yet are widely available on major brokerages. For example, the Vanguard ETF VNQ invests in a wide range of REITs across many sectors, including healthcare and industrial REITs:

Of course, another option is to simply buy properties yourself. The only problem? This typically requires a large down payment, or taking out a ton of debt.

Luckily, real estate crowdfunding platforms like Yieldstreet allow investors to participate in real estate projects with lower investment thresholds.

These platforms pool funds from multiple investors to finance various real estate ventures, providing access to a broader range of real estate investment opportunities, including multifamily properties:

Just be aware that in order to take full advantage of Yieldstreet, you’ll have to be an accredited investor.

Are you an accredited investor? Great news — there are all sorts of cool opportunities available to you. Check out our article about the best investments for accredited investors.

However, even non-accredited investors can check out the Yieldstreet Prism Fund. It isn’t a real estate pure play, but rather seeks to generate income by investing across multiple asset classes: Art, Commercial, Consumer, Legal, Real Estate, Corporates, and more. It requires a minimum investment of $10,000.

4. Invest in Businesses

Dream of becoming a venture capitalist or supporting small businesses? Investing in early-stage companies or small businesses can be an exciting and potentially rewarding alternative investment strategy.

By investing in businesses at their early stages, you can participate in their growth potential and potentially benefit from substantial returns if they succeed.

Just be aware that this is a high-risk, high-reward strategy. Many venture capitalists take the approach of investing in 10-20 companies, knowing full well that nearly all of them will go broke. However, if one or two companies are a homerun, the gains are massive enough to carry the rest of the portfolio and provide incredible returns.

Previously, this kind of investing was pretty exclusive, requiring you to get involved with private equity or venture capital funds to get started. Today, it’s become much simpler.

Platforms like Hiive provide avenues to invest in promising startups and small businesses.

Through Hiive, accredited investors can gain access to pre-IPO companies — you can find out more in our article about the best investments for accredited investors.

5. Collectibles

Looking to invest in something unique and potentially valuable?

Collectibles can provide a tangible and enjoyable investment experience, combining personal interest and the potential for long-term value appreciation.

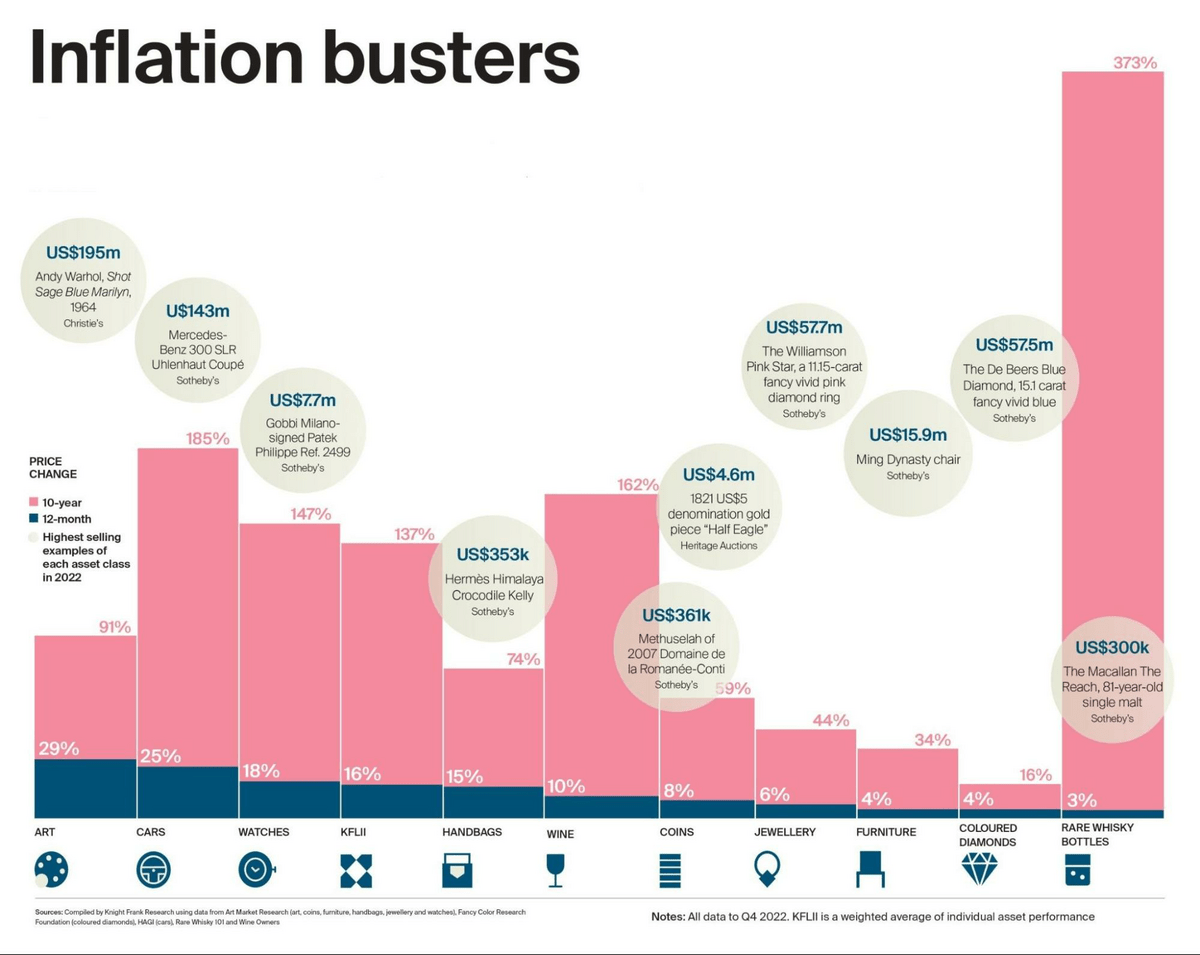

They’ve even been shown to be “inflation busters,” which is another example of alternative investments’ many benefits:

However, it’s crucial to research and understand the specific market dynamics and risks associated with each type of collectible investment.

Platforms like Vinovest and Public offer opportunities to explore these alternative investment options:

With Vinovest, you can diversify beyond the stock market and grow your wealth with wine and whiskey. Both of these enjoy a low correlation with traditional assets, making them resilient to the ups and downs of the stock market.

With Public, you can buy fractional ownership of fine art, luxury handbags, collectible sneakers, and other alternatives:

6. Gold

Interested in diversifying your portfolio with tangible assets? Focus on the timeless allure of gold.

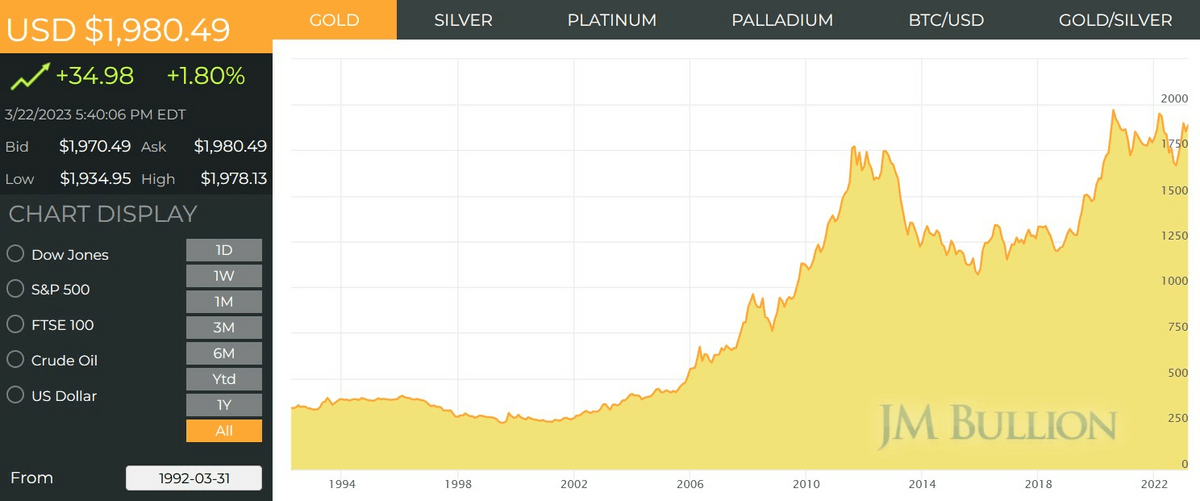

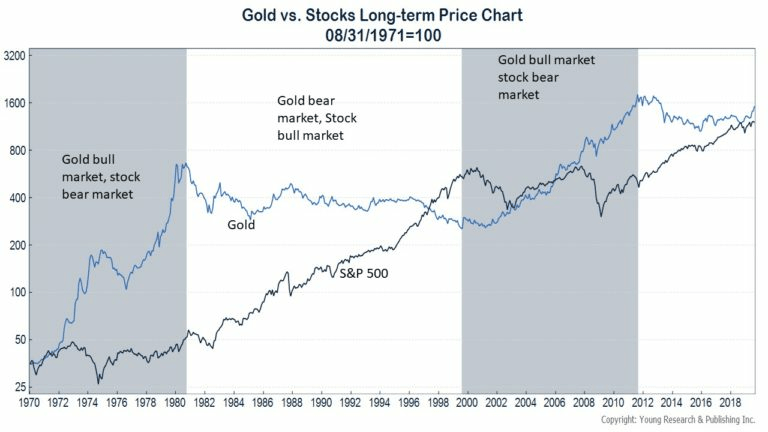

Gold is an example of alternative investments’ ability to hold long-term value and potentially act as a hedge against economic uncertainty. By including gold in your investment portfolio, you can potentially mitigate risk and benefit from its historical track record as a store of value:

Online metal dealers like Silver Gold Bull offer options to invest in physical gold or gold-backed investment products like physical bullion or coins.

Or, consider reaping the tax advantages of investing in one of these best gold IRA companies.

7. Crypto

Ready to explore the exciting world of cryptocurrencies? Cryptocurrencies like Bitcoin and Ethereum have gained significant attention and can offer opportunities for growth and diversification.

Investing in cryptocurrencies comes with its unique risks and volatility, but it can also provide opportunities for substantial returns and participation in the innovation of blockchain technology.

Platforms like eToro provide access to trading these digital assets. Plus you can even let top traders do the hard work for you. With eToro’s Copy Trader, you can follow the top-performing crypto traders on the platform. It’s a great way to gain insight and understanding of how top traders operate so you can develop your own winning strategy.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

8. Hedge Funds

For sophisticated investors seeking diversification and potentially higher returns, hedge funds can be another potentially attractive alternative investment strategy.

Hedge funds employ various investment strategies, aiming to generate positive returns regardless of market conditions. For example, the term “hedge fund” actually originates from the practice of “hedging” or mitigating risks through various investment techniques like shorting.

Short exposure allows hedge funds to profit from declining prices or market downturns by selling borrowed securities and buying them back at a lower price, thus capturing the difference as a profit. This can serve as a valuable risk management tool, as it allows hedge funds to potentially generate returns even in bearish market conditions.

Shorting was famously depicted in the movie The Big Short:

That said, it’s important to note that hedge funds often require higher investment minimums and may be limited to accredited investors and high-net-worth individuals due to regulatory restrictions.

List of Alternative Investments: Key Types

Still not sure — what are alternative investments?

- Commodities: Commodities allow you to invest in tangible assets such as gold, silver, oil, or agricultural products.

- Hedge Funds: These are professionally managed investment funds that employ various strategies to generate returns.

- Private Equity: With private equity, you can invest in privately held companies or funds that invest in non-publicly traded companies.

- Real Assets: Another example of alternative investments, these are physical assets such as real estate, infrastructure, or natural resources.

How Much Should I Allocate to Non-Traditional Investments?

Determining your allocation to non-traditional investments is a crucial step in constructing a well-rounded investment portfolio.

Ultimately, the amount you allocate to these alternative investment strategies depends on several factors, including:

- Risk tolerance

- Investment goals

- Overall portfolio diversification

To see what I mean, let’s look at a few different examples of potential portfolio allocation to non-traditional investments based on risk tolerance:

- Conservative Investors: If you have a conservative investment approach, a lower allocation to non-traditional investments may be suitable. A conservative investor might allocate around 5-10% of their portfolio to alternative investments, such as real estate or commodities, to add diversification while still maintaining a predominantly traditional investment portfolio.

- Balanced Investors: As a balanced investor, you’re aiming to strike a balance between risk and return. In this case, you might consider allocating around 15-20% of their portfolio to non-traditional investments, incorporating strategies like private credit or collectibles. This allocation can enhance potential returns while maintaining a diversified portfolio.

- Aggressive Investors: If you’re an aggressive investor, you’re willing to take on higher levels of risk in pursuit of potentially higher returns. In this case, allocating a larger portion of the portfolio, around 25-30% or more, to non-traditional investments like hedge funds or cryptocurrency can provide exposure to potentially lucrative opportunities. However, it’s crucial to note that higher allocation to non-traditional investments also increases risk, and careful consideration is necessary.

Obviously, these are just examples, and individual preferences and circumstances may vary.

Consulting with a financial advisor who understands your financial goals, risk tolerance, and time horizon can help determine a more personalized allocation strategy. They can evaluate your overall financial picture and recommend an appropriate allocation to non-traditional investments that align with your specific needs and objectives.

Alternative Investments Portfolio Example

To illustrate how alternative investments can fit into a portfolio, let’s consider a hypothetical portfolio consisting of a mix of traditional and alternative assets.

Here’s how a hypothetical investor interested in alternatives might split things up:

- Stocks: 50%

- This portion of the portfolio consists of a diversified mix of domestic and international stocks. It can include individual company stocks or exchange-traded funds (ETFs) that track broad market indices.

- Bonds: 30%

- This allocation focuses on fixed-income securities, such as government bonds or corporate bonds, which provide income and stability to the portfolio.

- Real Estate: 10%

- Real estate investments can be made through Real Estate Investment Trusts (REITs) or real estate crowdfunding platforms. This allocation provides exposure to the real estate market and potential rental income.

- Other Alternative Investments: 10%

- This portion of the portfolio is dedicated to alternative investments, which offer diversification and potential returns outside of traditional asset classes.

What are alternative investments? Well, within that final alternative basket, you might include a combination of the following:

a) Private Credit: 4%

- Investing in private debt instruments through platforms like Percent, which provide access to higher-yielding opportunities.

b) Fine Art Investing: 3%

- Fractional ownership of valuable artworks through platforms like Masterworks, which allows investors to participate in the art market’s potential appreciation.

c) Commodities: 2%

- Investing in gold through platforms like Silver Gold Bull, which offer options to invest in physical gold or gold-backed investment products.

d) Crypto: 1%

- Exposure to cryptocurrencies like Bitcoin or Ethereum through platforms like eToro, which allow for trading and storing digital assets.

Benefits of Alternative Investments

Let’s quickly explore the benefits of alternative investments in a bit more detail:

- Diversification: Alternative investments provide an opportunity to diversify your portfolio beyond traditional asset classes like stocks and bonds. Diversification helps reduce risk by spreading investments across different types of assets that have a low correlation with one another.

- Risk Mitigation: Alternative investments can act as a hedge against market volatility and economic downturns. For instance, hedge funds employ various strategies, including short-selling, to profit from declining markets. Investors can benefit from their unique function of short exposure without having to place shorts themselves.

- Lower Sensitivity to Traditional Market Factors: Alternative investments, such as commodities, can be less influenced by traditional market factors like interest rates and economic indicators. For instance, gold, a popular commodity, has shown an inverse relationship with the stock market. During times of economic uncertainty, investors often turn to gold as a safe haven, driving its price up:

Bottom line? By incorporating alternative investments into a well-diversified portfolio, investors have the potential to enhance returns, reduce risk, and explore unique investment avenues.

Final Word:

Diversifying your investment portfolio with alternative investments can provide several benefits, including potential higher returns, diversification, and access to unique opportunities.

But it’s still important to approach alternative investments with caution. Conduct thorough research and understand the associated risks and considerations.

To take action and incorporate alternative investments into your portfolio, consider the following steps:

- Define your investment goals and risk tolerance: Determine your financial objectives, time horizon, and comfort level with risk. This will help guide your allocation to alternative investments.

- Conduct thorough research: Explore different types of alternative investments and understand their historical performance, risk factors, and liquidity. Consider factors such as market trends, regulatory considerations, and the expertise required to invest in each option.

- Diversify your portfolio: Incorporate a mix of traditional and alternative assets to achieve diversification. Determine the optimal allocation based on your risk tolerance and investment objectives. Remember that diversification does not guarantee profits or protect against losses, but it can help manage risk.

- Stay informed: Stay updated on market trends, economic conditions, and regulatory changes that may impact alternative investments. Regularly review your portfolio and make adjustments as needed to align with your investment goals.

Remember, it’s crucial to thoroughly understand the risks and potential rewards before committing capital. By approaching alternative investments strategically, you can potentially enhance your portfolio’s performance and explore new avenues of investing.

FAQs:

What are the 4 types of investments?

The four types of investments include stocks, bonds, cash equivalents, and alternative investments.

Are alternative investments a good idea?

Alternative investments can be a good idea for investors looking to diversify their portfolios and potentially achieve higher returns.

What are the three types of alternative assets?

Three types of alternative assets commonly include private equity, hedge funds, and real estate.

Is a REIT an alternative investment?

Yes, a REIT (Real Estate Investment Trust) can be considered an alternative investment as it offers exposure to real estate without direct ownership of properties.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.