Let me start by saying if I could give you a guaranteed 10% return on investment I wouldn’t be writing this article. I’d be sitting on a beach somewhere with millions in my bank account.

Anyone who claims anything different is a liar.

Barring U.S. government Treasuries, there’s really no such thing as a guaranteed rate of return. Every investment you make entails a risk/reward trade-off.

The lower the risk, the lower the potential return (U.S. Treasuries). The higher the risk, the higher the potential return (high-growth stocks like Tesla (NASDAQ: TSLA)).

Quick side note while we’re on the topic of risk.

If you’re seeking potential high returns, it’s crucial to diversify.

One asset to consider? Private credit.

Not all lending is done through banks — this alternative asset class includes privately negotiated debt financing and loans and from non-bank lenders. Once only available to connected and/or very wealthy investors, platforms like Percent make private credit investing accessible to accredited investors.

While I can’t guarantee a 10% return on investment, there are several investments that stack the deck heavily in your favor of achieving the coveted 10% return on investment.

Here’s my list of the 10 best investments for a 10% ROI, balancing a high chance of success (low risk) and modest-to-high returns:

How to Get 10% Return on Investment: 10 Proven Ways

1. Invest in the Private Credit Market

Looking for superior returns? It may be time to think beyond the traditional 60/40 portfolio.

Here’s why.

Consider a recent study from investment giant KKR that examined the benefits of adding alternative investments into the mix over almost a century of returns. Here’s what they found…

A 40/30/30 portfolio (including real estate, infrastructure, and private credit assets)…

Offered both higher returns — with lower volatility — during periods of high inflation.

The problem? Until fairly recently, investing in private credit was reserved for an elite population — you had to be super rich or super-connected.

Percent has changed that.

Not familiar? Percent is an alternative investment platform that gives accredited investors access to credit investing for as little as $500.

Is it worth it? I think the returns speak for themselves — as of December 2024, the platform reported an impressive track record — over $1.28 billion funded, a 18.13% weighted average APY, and an extremely low 2.41% default rate (compared to the 2.62% default rate at commercial banks).

Percent gives you exposure to a variety of debt and Percent Blended note portfolios. The company partners with high-quality corporate borrowers, many of which originate loans to small businesses and consumers. Then, those syndicated loans are funded by you, the investor. You simply sign up, pick a private credit deal you like, and invest. With no fees for individual deals, it’s one of the best ways to diversify into private credit investing.

Want to know more about Percent? Check out our comprehensive Percent review.

2. Paying Down High-Interest Loans

While paying down debt doesn’t seem like an “investment”, it will net you one of the highest guaranteed returns you can earn.

If you’re carrying a balance on a credit card with a 20% interest rate, paying down that balance is equivalent to receiving a 20% investment return. That’s the fastest and easiest 20% you’ll ever earn. Once you’ve taken care of your debt, then you can start to think about how to invest 1000 dollars.

However, most people with credit card debt can’t afford to pay down their credit card balances (if they could, they wouldn’t have the debt in the first place). If that’s you, look into loan consolidation and/or opening a 0% APR credit card:

A) Debt Consolidation Loan

A debt consolidation loan allows you to roll multiple debts into a single payment which can save you a lot of money. Instead of paying off 3 credit cards, each with an interest rate of more than 20%, you can apply for a consolidation loan with an interest rate of 10% or less. Use the funds to pay off your credit cards and pay down your single loan.

B) 0% APR Credit Card

A 0% interest, balance-transfer credit card, if you qualify, allows you to transfer all of your debt onto this card and pay down the balance in full without paying a dime in interest before the promotional period ends (typically 1 year). This saves you even more money than a debt consolidation loan, though borrowers with credit scores below 690 typically do not qualify.

Paying down high-interest debt is one of the single best ROI investments you can make. If you need help saving money, head to our article on the best apps to save money.

BONUS: If you want help to determine what debt to pay off first or assistance in creating a plan, check out Empower (formerly Personal Capital). They have helpful budgeting tools as part of their free dashboard that can help you spend smarter and make a dent in your debt.

3. Stock Market Investing via Index Funds

Individual stocks can return well over 10%, but investing can be risky – there’s no guarantee you’ll make money.

Rather than invest in a single stock, index funds offer a convenient way to diversify across a large basket of stocks. By doing so, you can earn more predictable returns.

For example, you can buy Vanguard’s $VOO ETF and own all of the companies in the S&P 500 with one purchase. Since 1950, the S&P 500 has had an average annualized return on investment of 11.45%.

To put this into perspective, $1000 invested in the S&P 500 in 1950 would be worth more than $266K in 2025. That’s a pretty good rate of return.

Want to buy an index fund?

You need a stock brokerage.

You can buy stocks, index funds, and ETFs on moomoo.

moomoo is easy-to-use, powerful, and modern, and ETF investing is one of its top features.

On the platform, you can research, set alerts, add to watchlists, and invest in hundreds of ETFs, commission-free.

But that’s not all. For a limited time, you can get up to 30 free stocks when you sign up for moomoo using the links in this post. Terms and conditions apply — see moomoo’s website for more info.

While index funds are considered a relatively safe investment over a long time horizon, short-term volatility can negatively impact the value of your investment.

For this reason, a good rule of thumb is to not invest any money in stock market index funds that you’ll need within the next five years.

Index funds are one of the fastest and easiest ways to diversify your stock portfolio.

4. Stock Picking

While buying index funds makes diversification simple and lowers your risk, it also caps your upside.

The best-performing stocks drive the vast majority of an index fund’s returns.

From 1926 to 2009, stocks returned 9.6% per year. If you excluded the top 25% of stocks, annual returns would have been slightly negative.

Here’s what that means: The bottom 75% of stocks were a massive drag on the top performers.

Over that 83-year period, the top 25% performing stocks averaged a staggering 50% annual return.

Stock picking is all about finding which stocks are most likely to outperform the market, buying those, and ignoring the rest. One of WallStreetZen‘s offerings, Zen Investor, helps you uncover the stocks with the greatest potential to be long-term winners. Zen Investor is a stock picking newsletter led by stock market veteran Steve Reitmeister. As a subscriber, you receive stock picks, commentary, portfolio updates, and webinars from Steve, who hand-selects stocks through a proprietary 4-step process using WallStreetZen tools, including the market-beating proprietary Zen Ratings system.

Another option if you prefer a ‘done-for-you’ approach to your stock picking? The Motley Fool is a service that has vastly outperformed the S&P 500 since its inception:

Prefer a DIY approach? WallStreetZen Premium is a suite of stock research and analysis tools for DIY investors. As a member, you gain full access to due diligence checks, stock screeners, forecasts and recommendations from top-performing analysts, one-sentence explanations of why a stock moved, important email updates for stocks on your watchlist, and more. It’s everything you need to find, research and select your own stocks.

(Side note: You may be wondering, how much money can you make with stocks? Click the link to find out.)

5. Junk Bonds

When investors are looking for a safe investment, they typically turn to bonds. However, investment-grade bonds offer low returns (around 3-5% in the last decade).

While junk bonds don’t offer the same level of security as investment-grade bonds, they make up for it with higher average returns.

Rating agencies like Moody’s and Standard and Poor’s grade businesses on their creditworthiness. The lower the quality of the company, the higher the interest it will pay on the bonds it issues.

Similar to investment-grade bonds, your online brokerage should allow you to invest in junk and lower-grade bonds.

If you’re wondering how to get a 10% investment return, junk bonds could be the solution you’re looking for. Be sure to do your homework before investing, though.

A simple way to get started with bond investing…

Like the idea of bonds, but not sure where to get started? Public’s Bond Account could be the perfect entry point.

Public’s Bond Account has an impressive yield considering the caliber of the bonds — no, it’s not 10%, but about 6.6% as of February 2025.

The way it works is pretty simple:

- Fund your account — your deposit will go toward a portfolio of 10 investment-grade and high-yield corporate bonds.

- Get paid monthly! Public’s Bond Account generates a monthly yield; when your income reaches $1,000, it’s automatically reinvested.

- If you hold to the maturity date, you’ll receive the highest yield; however, you can withdraw early.

Get started with a Bond Account on Public.

6. Fine Art + Collectibles

I know what you’re thinking: “I can’t afford fine art. I’m not a gazillionaire.” You don’t need to be. In today’s ultra-online society, of course there are apps for fractional art investing. The best one? Masterworks.

How has art investing platform Masterworks been able to realize a profit for investors with each of its 21 exits to date?

Here’s an example: An exited Banksy was offered to investors at $1.03 million after acquisition. As Banksy’s market took off, Masterworks received an offer of $1.5 million from a private collector. It resulted in 32% net annualized gain for investors in the offering.

Every artwork performs differently but overall, their exits have delivered median returns of 17.6%, 17.8%, and 21.5%.

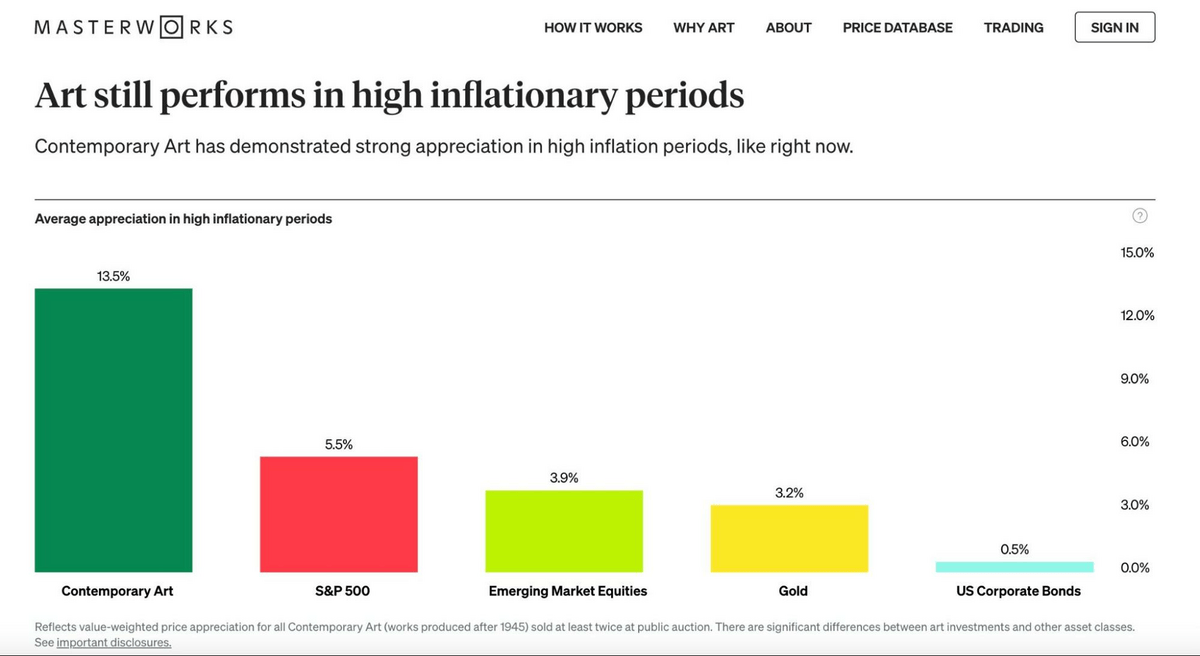

It’s not just because the platform is great (though it is). It’s because art is uncorrelated to the stock market, and therefore has the potential to perform well even when stocks aren’t. In particular, art has a track record of performing well in high-inflation periods (like right now). In the chart below, you can see that has appreciated at a higher rate than many of the “standard” investment vehicles like indexes, gold, and bonds.

Oh, I should also mention — Masterworks takes care of all the heavy lifting from buying the paintings, to storing them, to selling them opportunistically for you – no art experience required.

While there’s currently a waitlist to invest on Masterworks, we’ve got the hook-up. Use the link below to unlock VIP access.

7. Buy an Existing Business

Buying existing businesses is, in my opinion, one of the most overlooked investments.

Consider this: There are dozens of small businesses in your town generating hundreds of thousands of dollars each year in revenue.

Many of these owners are willing to sell for 3x-5x profit, while the public companies we are buying on the stock market are selling for 20x earnings. Plus, many of these businesses have opportunities to instantly increase their revenue and/or profitability, making them instantly more valuable.

There is, however, much more work that is needed to run a business (as opposed to buying a stock) and there’s more idiosyncratic risk (one business will cost you hundreds of thousands of dollars instead of spreading that out across 500 businesses in an index fund).

But you’re buying a business with existing customers and positive cash flow which could generate you hundreds of thousands of dollars in profit every year.

Remember, investing = Balancing risk/reward

You can look for local businesses to buy on sites like LoopNet and Craigslist or by asking owners directly if they’re interested in selling or know of anyone who is.

If you’d rather invest in someone else’s startup, consider Hiive — this unique investing platform allows accredited investors to invest in pre-IPO companies.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

8. Peer-to-Peer Lending

Peer-to-peer lending consists of regular people loaning money to people in need of a loan. Individuals who either do not want or are unable to qualify for a traditional bank loan may turn to peer-to-peer lending.

The risks and returns of peer-to-peer lending are similar to those of junk bonds.

Because of the risks involved in peer-to-peer lending, returns can average in excess of 14%. One lender, My Constant, offers an APR of up to 18%.

For those wondering how to get a 10% return on investment, peer-to-peer lending offers a creative solution for both investors and those in need of loans.

For access to larger-scale loans that are offered by non-banks, read about Percent in entry #2.

9. Real Estate Investment Trusts (REITs)

REITs are a way to get exposure to the real estate market without going through the trouble of actually buying and managing property. Plus, you can buy REITs on the stock market with a broker like moomoo.

A REIT is a company that owns income-producing real estate and pays out shareholders at least 90% of its annual taxable income.

Since REITs are public companies, you can purchase REITs in your brokerage account like you would stocks. Alternatively, check out Fundrise for an easy way to get into non-public REITs and other types of real estate investment funds. (Check out our Fundrise review here.)

On average, REITs offer a good rate of return, outperforming the broader stock market during periods of high inflation by a 3.6% margin. Stocks (blue) do, however, tend to outperform REITs (yellow) over the long haul:

REITs are also highly sensitive to interest rate changes and can overexpose you to specific real estate subsets (like apartments, offices, or medical facilities).

10. Real Estate

Instead of buying a REIT, you can skip the intermediary and invest directly in real estate yourself.

Direct real estate investments offer more tax breaks (deductions, 1031 exchanges, write-offs, etc.) and give you more control over your investment than REIT investments. Additionally, owning real estate usually results in a greater ROI.

You can buy single-family homes, multi-families, office spaces, or land and earn income from rent and appreciation. Given the number of millionaires in real estate, it may have the largest “margin for error” of any asset class available – there’s more than one way to get rich.

Real estate can potentially deliver great returns. But breaking into real estate investing and managing properties can be intimidating. Here are some highly recommended resources:

- To learn the ropes: Skillshare’s course “Sophisticated Real Estate Investing: The Core Strategies, Tools & Mindset“

- For screening potential tenants: RentPrep

- For managing long-term rental properties: TurboTenant

- For handling your taxes: H&R Block Tax Software

The biggest barrier to real estate investing is lack of capital – it’s expensive to get started.

Like art investing, however, this too has changed in recent years with companies like Yieldstreet.

Consider Yieldstreet your gateway to investing in real estate — and beyond. It offers investors a chance to diversify into all sorts of nifty alternative assets including real estate — but also art, private equity, and more.

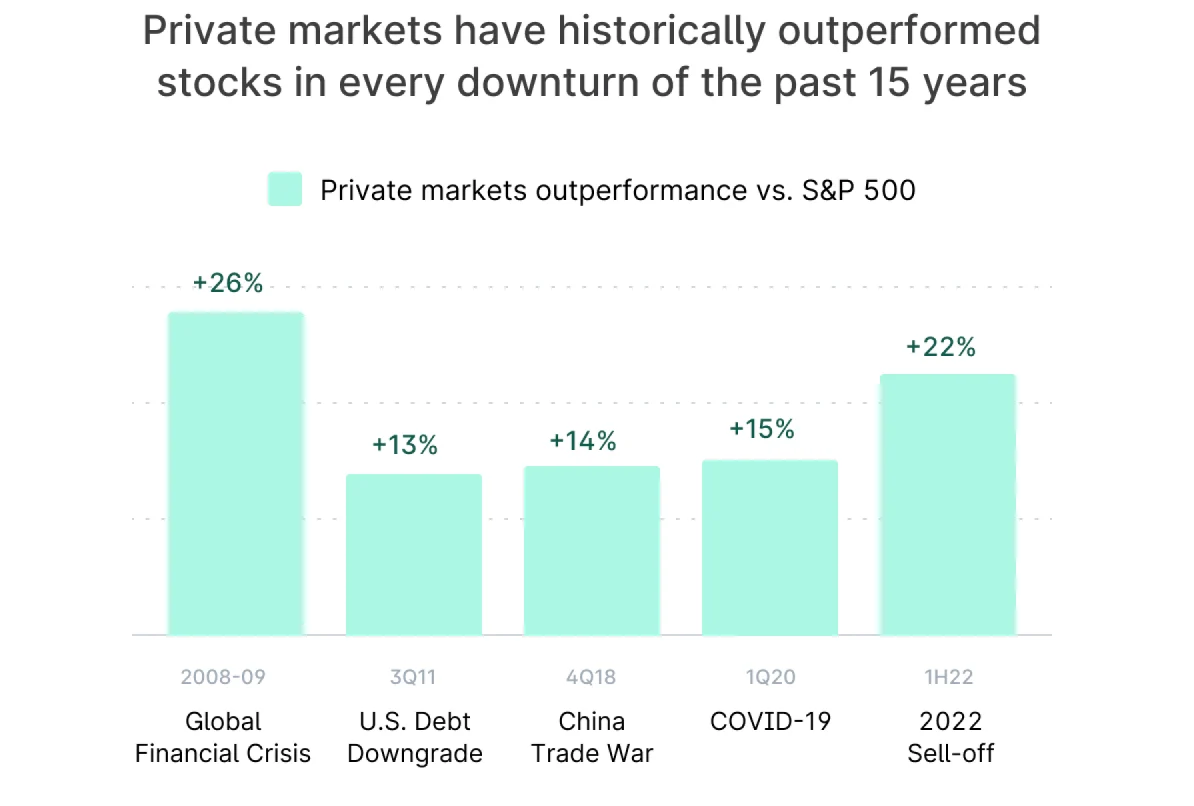

One of the best things about investing in alternative assets on a platform like Yieldstreet? It’s a hedge against market downturns:

In the below chart, you can see that Yieldstreet has delivered over 9% net annualized returns for real estate alone.

But you can diversify further (and take potentially benefit from some of those other juicy-looking assets) by investing in a fund like the Yieldstreet Alternative Income Fund (formerly the Prism Fund), which launched in 2020, and which happens to be one of the few investments available to both accredited and non-accredited investors on the platform.

The assets include art, commercial real estate, and more. The minimum investment of the Yieldstreet Alternative Income Fund is $10,000. Currently, the AUM is $152 million and the net annualized yield is listed as 8.3%.

BONUS: Gold IRAs

Over the last 20 years, gold has returned 9.6% per year. Although this falls just short of our 10% threshold, it’s worth an honorable mention on this list.

Gold is an asset many investors know should be in their portfolio, but one that isn’t often included. Most people know its history of being a store of value and generating consistent returns. Plus, it’s a finite physical commodity, making it a natural inflation hedge (especially important in 2025).

Investors who buy gold do so for a long-term inflation hedge and a place to safely park money. Given the long-term nature of the investment, most investors choose to purchase gold via an IRA.

Here’s one to consider: Noble Gold.

While it’s a relative newcomer, there’s a lot to like about Noble Gold:

- No setup fee, and relatively low annual fees ($80 service fee; $150 annual storage fee) and minimum investment requirements.

- In addition to gold, platinum and palladium are available.

- Plus, it’s secure. Noble Gold uses Equity International as its custodian and International Depository Services (IDS) for storage. The IDS facility has two locations in the U.S. and one in Canada, and storage comes with a Lloyd’s of London insurance policy.

One hitch? You can’t complete registration 100% online. You’ll have to finalize your details over the phone, which can be annoying. But considering Noble Gold’s many benefits, that’s a relatively small complaint.

Want more options? Here are a few more to consider; additionally, be sure to check out our article on the best gold IRA companies.

Moreover, gold is an asset that has given investors stable, inflation-hedged returns for a long time. A gold IRA is well worth considering as a potentially high-ROI investment.

Final Word: How to Get a 10% Return on Investment

Remember: Investing is always about balancing risk and reward.

For the best ROI investments, buying an existing business or individual stocks can sometimes offer unbeatable upside, though you’re signing up for more due diligence and the potential for losses.

Pay off your high-interest loans before you invest in anything else. This will net you the best return on money.

Personally, I’m biased toward long-term stock market investing in both individual stocks and index funds. For me, it’s the perfect balance of risk and reward.

Hopefully I’ve offered you some viable options and answered your question about how to get 10% return on investment.

Read more: How to Invest 50k

Wondering where to invest now?

FAQs:

What investment can give me 10% return?

Stock market index funds can give you a 10% return.

Buying an index fund like Vanguard’s $VOO will give you exposure to the entire S&P 500 in a single investment and has averaged annual returns of 11.14%.

Is a 10% annual return realistic?

Yes, a 10% annual return is realistic.

There are several investment vehicles that have historically generated 10% annual returns: stocks, REITs, real estate, peer-to-peer lending, and more.

How do you make a 100% ROI?

The best way to make a 100% ROI is to invest in individual stocks.

Some stocks vastly outperform the market every year. The key is to identify these companies early and invest in them before their explosive growth. To find these companies, try using WallStreetZen or The Motley Fool.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.

![10 Investments That Earn A High Return [10% ROI or more]](https://www.wallstreetzen.com/blog/wp-content/uploads/2022/10/10-Investments-That-Earn-A-High-Return-10-ROI-or-more-scaled-e1666197396945.jpg)