There is a waitlist to join Masterworks.

You can skip the waitlist by using any of our links in this article to sign up.

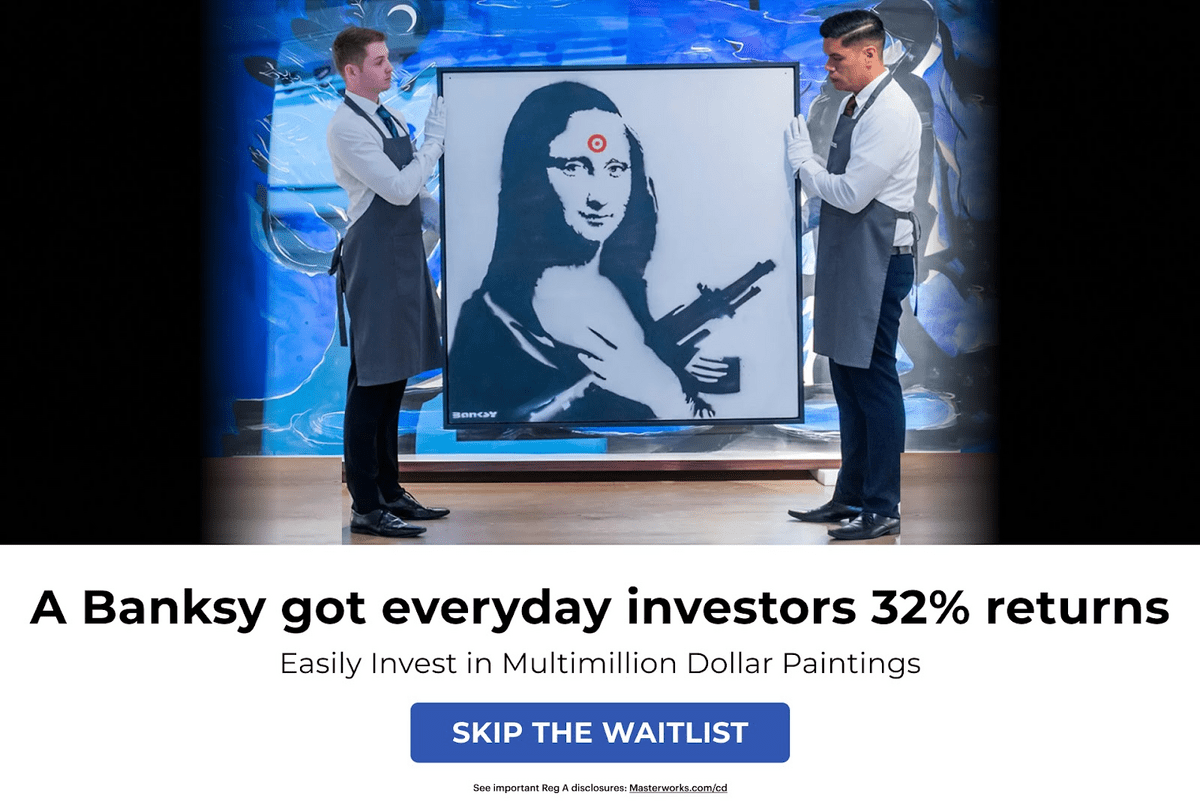

Picasso. Banksy. Basquiat.

If you’ve ever dreamed of investing in works by some of the most famous artists in the world, you’re not alone.

But investing in fine art is a billionaire’s game, isn’t it? There’s no way for investors like you and me to break into the reported $2.1 trillion dollar art and collectibles wealth (2023), right?

Wrong.

Masterworks has developed a way for average investors to invest in high-end art for a fraction of the total cost. Members can invest in shares of famous artwork offerings and see returns if the artwork sells for a profit.

But is this platform too good to be true? Is Masterworks legit?

In this Masterworks art investing review, we dig into the details of the platform, how it all works, how much you need to invest in a piece of art, and review returns that investors have realized so far.Most importantly, we’ll uncover if you should start investing in art with Masterworks.

Masterworks Review: Is Masterworks Legit?

Overall Rating: ⭐️⭐️⭐️⭐️⭐️

The Bottom Line: Masterworks is the premier online platform for investing in high-end contemporary art.

Masterworks is an investing platform that coordinates the purchase of paintings and other art, typically worth $500k to $30M, and then offers investment in shares to their members for investment.

As of today, it holds over 450+ pieces in its collection, and has enjoyed 23 exits. Masterworks has distributed back a total of over $60 million dollars, including principal, in investor proceeds.

According to Masterworks data, contemporary art has also been largely uncorrelated with public markets, making it historically an unaffected investment during times of economic upturns and downturns.

Masterworks’ offerings are securitized with and qualified by the SEC.

That said, investing in Masterworks carries a higher degree of uncertainty than many other types of investing – it’s less liquid than public markets, and Masterworks has only been around since 2017. If you’re risk-averse and need liquidity, Masterworks probably isn’t for you.

What is Masterworks?

Masterworks is an alternative investment platform that allows anyone to invest in shares of contemporary artwork offerings. The company has offered investors in over 450+ pieces of fine art from postwar and contemporary artists such as Banksy and Picasso.

Masterworks handles all of the acquisition, storage, insurance, and selling of the art pieces, and distributes the profits (net of fees) to investors if the artwork is sold for a profit. It focuses exclusively on post-war and contemporary art pieces, which they believe have the most potential for price appreciation.

It is owned by Scott Lynn, a wealthy online marketer and avid art collector. It has been in business since 2017 and has over 1,000,000 registered users on the platform.

Example Investment on Masterworks

So, exactly how does Masterworks work?

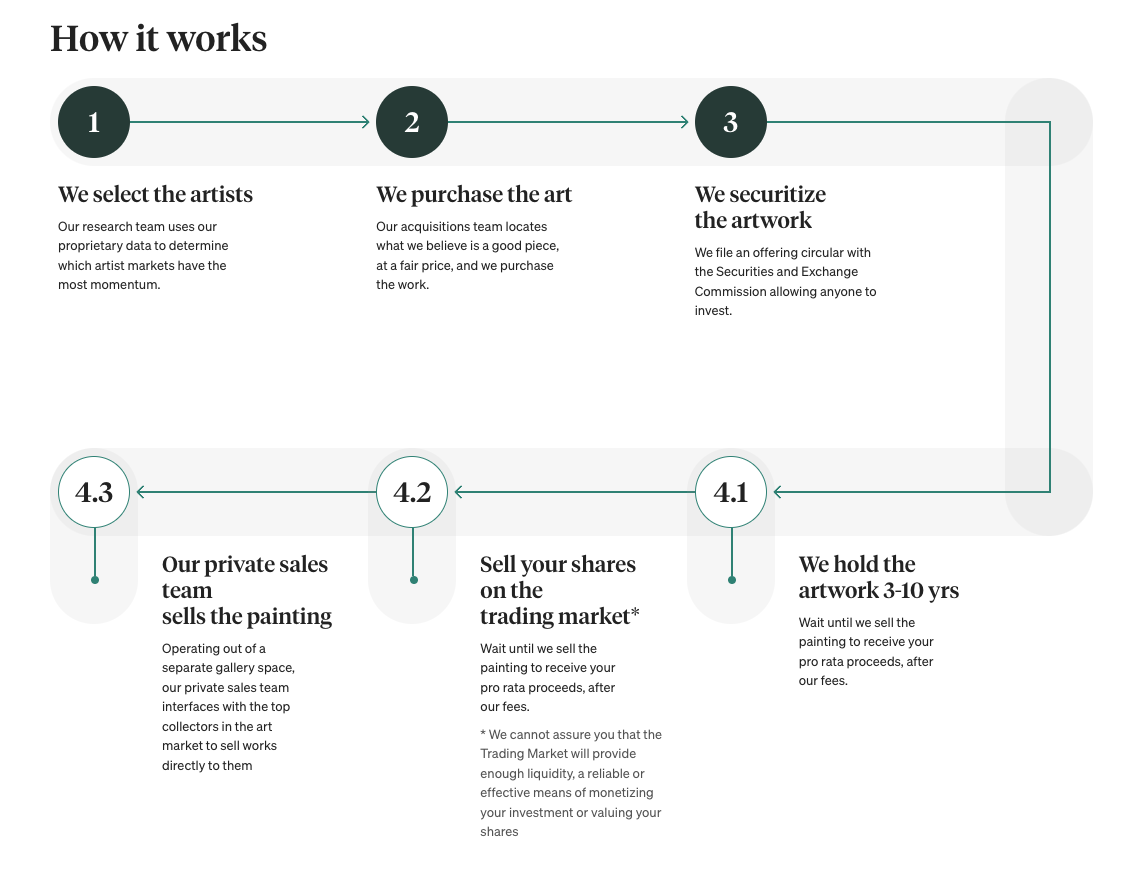

Masterworks has a robust process for purchasing and storing artwork, as well as onboarding investors and eventually selling the pieces for a profit.

Here’s a complete breakdown of its investment process:

Acquisition and Storage

Masterworks has created a comprehensive pricing database of contemporary artworks which shows the price appreciation of pieces that have been bought and sold at auction over the past few decades, as well as information about trends within artists’ markets.

It uses this data to find artist’s markets they think have the most investment potential long-term, and the acquisition team will negotiate and agree to purchase the markets they think are best for the platform. As of 2025, less than 3% of offered artworks have passed the Masterworks due diligence process.

Once purchased, the art is transferred to a secure storage facility or affiliate gallery, although some paintings have gone on the road as part of museum shows and exhibitions.

Upon acquiring an art piece, Masterworks files an offering with the Securities and Exchange Commission (SEC) under Regulation A, so it can securitize the piece within a Special Purpose Vehicle with individual shares which can be offered to investors on the platform.

This allows both accredited and non-accredited investors to invest in shares in an artwork. It’s important to note that SEC qualification does not mean the SEC passed upon or endorsed the merits of these investments.

Investing with Masterworks

After signing up for a Masterworks account and completing your membership process, you can invest in shares directly on the Masterworks platform.

Masterworks aims to hold each artwork for 3-10 years before selling, making it largely more illiquid than stocks and bonds, but on par with many other alternatives like private equity and venture capital.

When Masterworks determines it is an opportune time, its private sales team will sell the piece and distribute shareholders their portion of any profits (net of fees).Masterworks does offer an unaffiliated trading market where you can sell your shares to other investors before the final sale of the artwork, which recently became available to most international investors as well.

That said, Masterworks makes no promise of liquidity within the marketplace, which means you may need to hold your shares until the art piece is sold.

Masterworks, through their advisory subsidiary Masterworks Advisers, also offers an auto-invest feature, where investors can set a monthly amount to be invested in a bundle of already purchased Masterworks offerings.

Masterworks Investment Example (Masterworks Returns)

Masterworks’ most recent sale was a Basquiat in 2024, which sold for $8 million dollars after 1398 days. After fees, for every $10,000 someone invested in that piece, they took home over $2,600 in profit.

And remember, Masterworks found the painting, negotiated the price, bought and stored it, held it until they found a desirable buyer, sold it, and transferred ownership without any effort from you.

Time frame on returns is always subject to vary, and Masterworks reminds you it is a long-term investment. But this example (along with the 22 others in their exit history) should be enough to show that yes, Masterworks is legit.

Masterworks Track Record

Masterworks has completed 23 exits of their 450+ offerings to date. Check out the full history of the sales and their returns below:

While performance from these exits thus far is exceptional, Masterworks is a relatively young company still building a longer-term track record.

That being said, contemporary art as an asset class has appreciated faster than gold, real estate, and the S&P 500 since 1995, with an 11.2% average annualized appreciation.

Who is Masterworks Best For?

Masterworks is ideal for investors who are looking to diversify a slice of their investment portfolio into alternative assets AND for art investors who don’t want to deal with the up-front cost, required maintenance, and hassle of buying and selling art on their own.

Masterworks does require an up-front investment of $15,000 (subject to waiver) and the investments aren’t guaranteed to have liquidity, so investing is best suited for long-term investors who don’t need access to their funds for quite a while.

As an alternative investment platform, investing with Masterworks carries a higher amount of risk than traditional investments. However, many of their artists show strong market risk-adjusted appreciation (commonly measured as Sharpe Ratio).

That being said, investors need to have a high risk tolerance for the funds invested on the platform, as there are no guaranteed results and it is still a relatively new type of investing.

And finally, Masterworks is a fine art investing platform, and self-serve members will need to choose which pieces to invest in. Although you won’t be on your own in that regard.

If you don’t have at least some knowledge of the industry and marketplace (or the desire to learn more and do research), this investment may not be the best fit.

They do, however, have a team of affiliated financial advisers that can help guide you to appropriate investments for your risk tolerance.

Is Masterworks Legit?

Masterworks securitizes all its offerings with the SEC. Any investment advice provided through the platform is given by investment advisor representatives of Masterworks Advisers, an SEC-registered Investment Advisor.

Masterworks has over 1,000,000 registered users and owns over 450+ high-end pieces that you can invest in. The platform has been around since 2017 and has sold 23 artworks and counting. They also have over $1 billion dollars and counting in invested capital from their investor base.

Yes, it’s legit.

Is Masterworks a Scam?

No, Masterworks is not a scam. It’s one of the only ways to invest in high-end art without a ton of up-front capital.

Investing in alternatives is (unfortunately) fraught with many scammers, especially around art, collectibles, and digital assets like crypto and NFTs. But Masterworks aims to be very transparent with its members and investors, and files all its offerings with the SEC, also linking to those filings directly on each offering page on their site.

Each piece is contained within its own special-purpose limited liability corporation (LLC) and “securitized” to allow investors to invest in shares of the LLC, whose sole asset is the artwork. This is similar to how other alternative investing platforms work.

Masterworks Key Figures

- Masterworks returns: Demonstrative returns include 17.6%, 17.8% and 21.5% net annualized gains (works held 1+ year, not inclusive of unsold).

- Masterworks fees: 10% initial “true-up” in form of equity, 1.5% annual management fee, 20% commission on profit from sale of artwork.

- Number of users: 1,000,000+

- Number of investors: 65,000+

Pros and Cons of Masterworks

Pros | Cons |

|---|---|

Invest in high-end art pieces | Highly illiquid investment |

Strong historical returns | Hold time of 3 to 10 years |

Detailed market research available | High fees compared to traditional investments |

Can sell shares on Trading Market | No dividends (only make money when art is sold) and no promise of liquidity |

Robust acquisition and storage process | Requires a phone interview to get started |

How to Open an Account on Masterworks

To open an account with Masterworks, you need to sign up for an online account and request an invitation. Masterworks requires a phone interview to review the account requirements and make sure it is a good fit for your investment needs.

You will need to submit your name, email address, and phone number, plus create a password for your account.

Once you have submitted an application, you will set up a phone interview with Masterworks Advisers. During this phone interview, they will review your personal information,verify your identity, and determine if art investing is a fit for you.

Then, they will work with you to determine an appropriate investment strategy. And finally, they will help you find suitable art pieces for you to invest in, and help you complete your first investment.

Once you have completed your first investment, you can continue your investment process with them online. You can pick and choose pieces to invest in to build your own investment portfolio or buy and sell shares on the unaffiliated secondary marketplace.

The process probably takes about 20-30 minutes in total, but once you’re in further investments take just a few clicks, or just by setting up the auto-invest feature.

Final Word: Masterworks.com Review

Masterworks is a premier place to invest in shares of high-end contemporary art pieces…period.

The entire buying and selling process is handled for you, Masterworks purchases some of the most well-known artworks in the contemporary art space, and the returns, so far, have been strong for its investors.

Investing in fine art is risky and should not make up the bulk of your investment portfolio. But if you are looking for an alternative investment platform to add more diversification to your portfolio and are interested in art, Masterworks could be a good option.

FAQs:

Is Masterworks a good investment?

Masterworks has provided strong returns so far for investors since it sold its first painting in 2019. Masterworks has sold 23 artworks as of March 2025, each for a positive return.

But, just because returns have generally been high in the past, does not guarantee that the results will be the same going forward. Investing in Masterworks can be a great way to add some alternative assets to a slice of your portfolio, but it all depends on your investment goals, timeline, risk tolerance, and the amount of money you have to invest.

Has anyone made money with Masterworks?

Masterworks has paid out over $61 million dollars in proceeds distributed back (including principal) to investors since their first painting sold. Every single one of their 23 exits so far each delivered positive returns for investors.

How much money can you make on Masterworks?

Masterworks shares their historical data of the postwar and contemporary art industry on their website, and shows that the average annual price appreciation has been about 11.2% annually over the past 30 year period (1995 - 2024).

How much money do you need for Masterworks?

The Masterworks minimum investment requirement is $15,000 for first time investors. This minimum can be waived, though, at their discretion when you speak to them on the phone interview.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.