If you have $5 million to invest, you have quite a few opportunities to grow your wealth even more. Choosing the right investments can set you up for life.

But while growing your wealth is important, once you have a few million in the bank, managing your risk becomes even more important.

Need help navigating it all? Below, you’ll find a list of great ways to invest $5 million while preserving your wealth and keeping risk management top of mind. Here’s how to invest 5 million dollars:

FEATURED OFFER: Masterworks

Want an investment that’s fueled by the ultra-wealthy? Try art.

Since 1995, contemporary art has appreciated 11.4% annually on average. That’s 43% more than the S&P over the last 30 years (1995-2024). After all, there’s a reason why many HNW individuals can invest almost an entire 10%+ of their wealth in art.

Want in? You can invest in shares of million-dollar painting offerings with Masterworks, the world’s first art investment platform.

For a limited time, you can skip the waitlist here

*See important disclosures at masterworks.com/cd

The 12 Best Ways to Invest $5 Million in 2025

Need some ideas for how to invest $5 million? Consider these:

1. Invest in Stocks and ETFs

If you’ve amassed a large nest egg, you may have already invested in the stock market. Stocks and ETFs can help you maintain and build wealth for the long term, and the stock market has a long track record of solid returns.

In fact, the S&P 500 has averaged nearly 10% returns over the last 100 years.

If you haven’t invested in stocks before, it’s accessible to just about anyone, regardless of account size. Investing small amounts of money allows you to use almost any investing app.

Let’s be real — if you have $5 million, then you have enough to invest in professional money management.

But stock-picking can be rewarding — so you may want to try your hand at DIY investing with a portion of your wealth. (To be clear, I don’t suggest plunking down all of your $5 million on stocks on any platform — maybe just a small portion.)

Whether you’re a new investor or a seasoned pro, eToro is an excellent all-around brokerage. Not only does it have a paper trading feature where you can test out strategies and execute virtual trades with virtual money, but it also has a CopyTrader feature that lets you follow the trades of top-rated traders.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

If you want to choose your own stocks, you need more than a brokerage — you need the right tools for researching potential stocks.

Our Zen Ratings system may be exactly what you’re looking for.

Zen Ratings is our proprietary ratings system that distills 115 factors proven to drive stock growth into a simple, easy-to-read letter grade. All you have to do is enter a ticker in the WallStreetZen homepage and you’ll see the stock’s overall grade. The grades are A-F, with A being the highest (Strong Buy) … just like in school.

The Zen Ratings model also lets you dig deeper through 7 Component Grades that reveal a stock’s specific strengths and weaknesses. For instance, let’s look at a recent addition to our Zen Investor portfolio, Emcor Group (NYSE: EME).

At writing, the stock has an overall A (Strong Buy) rating. Great. But looking at the Component Grades reveals even more:

As you can see, EME rates highly for Financials (a key sign that a company has solid financial footing). It also has an above-average rating for Sentiment, a factor which looks at things like analyst sentiment and insider buying activity to get the “smart money” vibe on a stock. Our proprietary AI component sifts through piles of data to detect subtle patterns that might not be evident to the average human; EME earns an above-average grade there, too.

If you like the idea of stocks that have passed this 115-factor review but don’t feel like filtering through tickers yourself, our Zen Investor portfolio does just that. It’s helmed by Steve Reitmeister, an investor with 40+ years of experience. He considers the Zen Ratings, but also puts each potential stock through a rigorous 4-step review process before adding it to the portfolio.

And at just $79 for your first year, Zen Investor won’t put much of a dent in your $5 mil. In fact, it might even help you add to it.

2. Professional Money Management

Even if you do some of your own stock-picking, $5 million is a lot of money — it’s well worth hiring a professional investment team to assist you with your financial goals.

Investment advisors not only help you with your investments, but also advise on insurance, taxes, estate planning, savings goals, and more.

Most investment advisors will charge a percentage of your investments to manage your finances, with some charging 1.5% or more. This can cost you tens of thousands per year.

Platforms like Empower offer wealth management services for high-net-worth individuals for a lower cost than most advisory services.

With $5 million invested (or more), your fee is only 0.59% of assets under management, much lower than most advisors. Plus, you can access private equity investments and, and the advisors you work with are licensed fiduciaries.

3. Invest in Private Credit

With $5 million, you should probably diversify a bit.

Here’s some good news — as a millionaire, you’re officially an accredited investor. That means you have access to a variety of great (and potentially lucrative) asset classes. Let’s start with an exciting one: Private credit.

Once you have $5 million, you become the bank. Lending your money to private businesses and individuals can be a great way to potentially earn a high return.

(Want to know more? Check out our post: What is Private Credit Investing?)

Private credit investments include loans and other debt financing to clients who are starting businesses, investing in real estate, or need funding to expand business operations. These investments offer a higher return than normal loans, with a yield of 10% or more in some cases.

Percent is an online platform that allows accredited investors (that includes you, if you’ve got $5 million) to invest in private credit deals, including venture funding, corporate loans, and consumer loans, among other options.

On Percent, you can quickly peruse through deals to find investments you want to fund and build a portfolio of private credit deals with short or long durations.

Alternatively, you can invest in a variety of notes across different asset classes and time horizons within a single investment with the Percent Blended Note, one of their most popular offerings.

Regardless of what approach you take, you can get $500 off your first investment on Percent by using the links in this post.

4. Invest in Fine Art

If you’re looking to diversify your investments outside of traditional markets, investing in fine art might be a good option. Fine art can appreciate over time, especially if you have a rare piece that is kept in pristine condition.

As an alternative asset, art is also not correlated with the stock market and can continue to appreciate, regardless of what the market does.

But while $5 million might be able to buy you some nice pieces, you won’t be able to get a piece of Picasso or Banksy. Platforms like Masterworks now make these pieces accessible, though, allowing you to invest in rare modern art for less.

Instead of buying a $20 million piece of art outright, you can buy shares of ownership through the Masterworks platform and make a profit when the artwork sells.

Masterworks owns hundreds of millions of dollars worth of contemporary art pieces and has realized annualized returns from 4% up to 77%.

For example, investors were able to collect a 77.3% annualized net return in less than a year through an exited work offered by the fractional art investment platform Masterworks. And while it’s not guaranteed for Masterworks to exit so fast in the future, investors have recently secured 14.6%, 16.4%, and 17.6% annualized returns from other offerings.

There’s currently a waitlist to invest with Masterworks — but we’ve negotiated a deal with them so our readers can skip the waitlist with the link below.

5. Invest in Private Companies

Investing in private companies has traditionally been off-limits to individual investors who don’t have insider access. But there are now innovative companies that allow you to invest in a private company directly through employees.

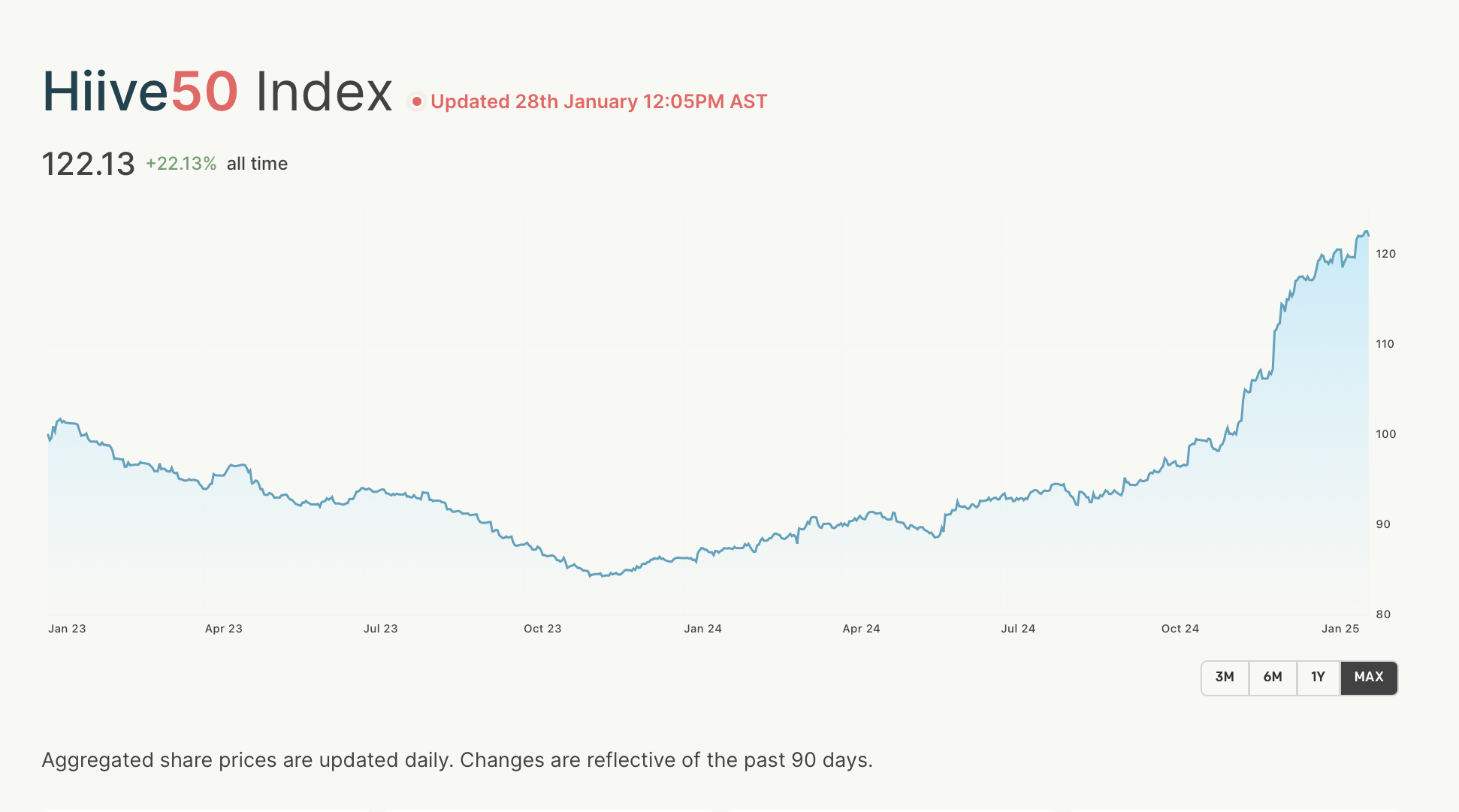

Interested in investing in a company that hasn’t gone public yet? Hiive can give you access. It gives accredited investors the ability to become stakeholders in private, VC-backed companies.

Hiive connects accredited investors who want a stake in private and/or pre-IPO companies and employees, venture capital firms, or angel investors who want to sell shares.

The platform is loaded with neat features. For instance, there’s a live pricing chart for each company which includes prevailing bids and asks, and you can create watchlists and get notified about price changes or new listings offered.

Another interesting tidbit about Hiive: In 2023, 54% of accepted bids on Hiive were approved, 16% meet a buyer from cap table, 30% are blocked altogether (2023 report)

The bottom line? Hiive is one of the best ways to become an investor in private companies like Groq, Anthropic, and OpenAI.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

6. Invest in Real Estate

Buying and holding rental real estate can help you grow your wealth, earn a steady cash flow, and reduce your taxes.

With $5 million at your disposal, you have a lot of different options for investing in real estate. For example, you could buy a property (or multiple properties) and manage them.

But that is time-consuming and can be a hassle.

If you prefer your real estate investments to be a bit more passive, there are several excellent platforms to consider.

EquityMultiple: For Accredited Investors Who Want Access to Commercial Real Estate

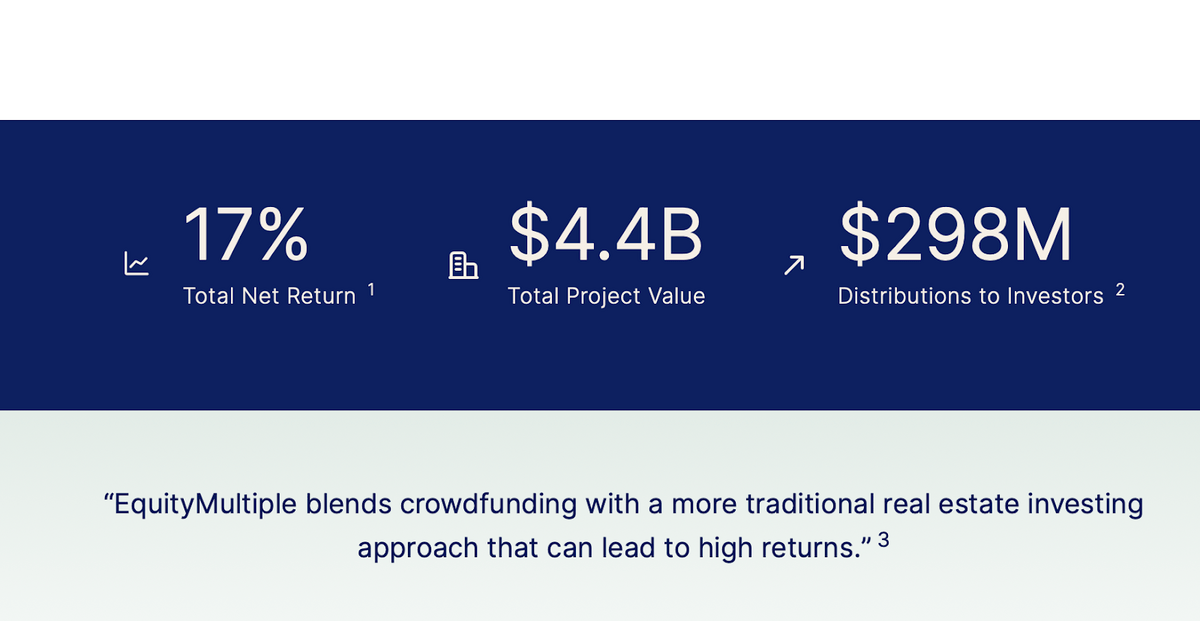

First up? EquityMultiple, a crowdfunded real estate investment platform that gives accredited investors access to professionally-managed properties.

On EquityMultiple, you can gain access to a variety of investing opportunities, including a mix of different property types and price points. You can also invest directly in commercial real estate deals. Minimums range by the investment, with many projects in the $5,000 to $30,000 range.

As you can see from the below image, EquityMultiple’s stats are impressive — at writing, the platform reports $4.4 billion in project value, and the average historical returns are 17% — to put that in perspective, the historical average return of the S&P is just around 10%.

DLP Capital: For HNWIs Who Want to Increase Their Real Estate Exposure

IIf you’re a high-net-worth individual (HNWI) looking to invest seriously in real estate — without the hassle of owning property outright — DLP Capital is another top-tier platform to consider.

With a $200K minimum investment, your first question is probably: Is DLP legit? The answer is yes. Founded in 2006, DLP Capital is not a flashy newcomer but a well-established firm with a proven track record. It manages over $5.25 billion in assets and 18,000 housing units, serving thousands of investors.

DLP Capital caters to affluent investors, providing access to multiple real estate funds designed for different strategies and objectives:

- DLP Housing Fund – Invests in build-to-rent and multifamily communities.

- DLP Building Communities Fund – Focuses on equity and preferred equity investments, as well as senior mortgage and mezzanine loans for new rental community developments.

- DLP Lending Fund – Provides debt investments for the construction, acquisition, and repositioning of attainable rental housing.

- DLP Preferred Credit Fund – Invests in debt (senior mortgage and mezzanine loans) and preferred equity in RV and luxury vacation parks, manufactured housing, and rental properties.

But fund variety isn’t the only thing that sets DLP apart. Here’s what makes it unique:

- Impact-Driven Investing – DLP prioritizes investments that generate strong returns while benefiting society—a rare approach among elite investment platforms.

- Transparent Fee Structure – It charges a 2.0% management fee, with potential rebates for higher balances.

- Strong Historical Returns – For example, the DLP Housing Fund has delivered a 19.47% compounded DRIP IRR since its inception in 2020 (as of Dec. 31, 2023) and currently targets a 10-12% annual net return. Other funds report IRRs of 12.28%, 13.10%, and 10.99% since inception. Remember what I said about the S&P averaging 10% per year? These results are at least on par, if not superior.

The bottom line? If you’re seeking a real estate investment platform with a strong track record, impact-driven focus, and transparent fees, DLP Capital is worth a closer look.

7. Invest in Farmland

Farmland is becoming one of the most popular real estate investments as it generates a solid return with long-term renters (farmers). But don’t worry — you don’t have to buy the whole farm to potentially reap the rewards of this investment.

As an accredited investor, you can invest in fractional ownership with AcreTrader, a crowdfunded real estate site that allows you to invest in parcels of farmland, earning a return through rents collected and price appreciation. Some recent investments have earned over a 15% IRR!

The minimum investment is around $15,000, and holding periods are usually 5 to 10 years in length. If you want to take a portion of your $5 million and diversify into a solid asset class that continues to grow (pun intended), farmland is a great bet.

8. Invest in Master Limited Partnerships (MLPs)

When you have a net worth of $5 million and you’re somewhat risk averse, you may want to focus on investing for income instead of just growth. Master Limited Partnerships (MLPs) are a popular investment option that allows you to invest as a limited partner in companies that focus on commodities, such as oil, gas, coal, or timber. They typically have high yields and some tax advantages.

MLPs are traded on public exchanges, similar to a stock or ETF. This makes them more liquid than joining a private investment as a limited partner.

And since MLPs deal in commodities, they are somewhat uncorrelated to the stock market, making them a great option for diversifying your investments.

If you want to invest in MLPs for yield, you can do this on most exchanges. One exchange that really stands out is eToro — the platform features a great variety of MLPs as well as a robust knowledge base of articles so you can familiarize yourself with what MLPs are and how they work.

Plus, with its “social trading” features, you can see what other eToro members are saying about MLPs you’re interested in, which can help bolster your trading plan.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

9. Set Up a High-Yield Savings Account (or a few)

You’ve got a lot of money. But it’s smart to keep some of it liquid. A high-yield savings account, or high-yield cash account, can help you keep a portion of your cash liquid while also collecting interest.

While savings accounts have been a dismal place to earn a return over the last decade, a recent increase in interest rates has made them an attractive option for solid returns.

High-yield savings accounts (HYSAs) are now offering over 4% APY on deposits, with some platforms offering even more.

Empower offers a high-yield cash account that is currently paying out 4.7% APY, while CIT Bank currently offers 4.35% for its Platinum Savings account.

If you are planning to park millions into HYSAs, just make sure to open multiple accounts, as FDIC insurance only covers up to $250,000 per account, per depositor.

10. Invest in Retirement

If you have a high net worth, you might be thinking about retirement. And while you might already have funds in a workplace retirement account or IRA, it’s good to maximize your retirement savings to save on taxes and grow your wealth further.

You can max out workplace retirement accounts (such as a 401k) with up to $22,500 per year, or up to $30,000 per year if you’re age 50 or older. IRA accounts let you invest up to $6,500 per year, or $7,500 per year if age 50 or older.

But if you’re a business owner, you may be able to invest even more. SEP IRAs allow you to invest up to 25% of your income, up to $66,000 per year. And a Solo 401k account also lets you invest up to $66,000, plus an extra $7,500 if age 50 or older.

Empower offers an impressive retirement planner tool that helps you figure out which of its accounts work best for you.

Plus, Empower’s Premier IRAs are a great option if you want one of Empower’s retirement experts to manage your account, but the platform also offers an ordinary self-run brokerage IRA if you’re a bit more experienced.

11. Invest in Gold

If you’re looking for a way to fight inflation and keep your purchasing power over time, gold has been a longtime standard of wealth preservation.

Investing in gold is an alternative way to protect your hard-earned money, and has earned a solid return for hundreds of years.

You can invest in physical gold, or in gold stocks and ETFs. If you want to hold the real thing in your hands, using a platform like Silver Gold Bull lets you buy 1 oz gold coins and larger bars at fair market prices.

Bonus: Crypto

While no one would suggest putting your entire nest egg in crypto. That said, it is a brand-new asset class with exciting possibilities.

If you’re looking to branch out with some of your investment funds, investing in Bitcoin and other cryptocurrencies may be something to consider.

Bitcoin has grown in value over the last 10 years and has been the best-performing asset of the decade. And other cryptocurrencies, such as Ethereum, offer an exciting new technology landscape that is changing rapidly.

You can invest in crypto through crypto exchanges and through platforms like eToro. With access to dozens of the top cryptocurrencies and low trading fees, eToro is a simple-to-use platform for crypto investing.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Summary: Suggested Platforms

For stock + ETF investing | |

For MLPs | |

For professional money managements | |

For private credit investing | |

For fine art investing | |

For investing in private companies | |

For real estate investing | |

For farmland investing | |

For high-yield savings | |

For retirement investing | |

For gold investing | |

Bonus: crypto investing |

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

How Important Are Tax-Advantaged Accounts?

If you have millions of dollars that you are trying to protect, tax-advantaged accounts can save you tens of thousands of dollars (or more) on an annual basis.

Most high-net-worth individuals with high-earning jobs are in America’s top tax bracket, paying out up to 37% of their earnings in income taxes. If you can shelter your income in tax-advantaged accounts, this can be a massive tax savings.

An Important Note About Allocation

Diversification is much more than just a buzzword, it’s a way to split your investments up in a way that protects you from losing it all on one bad bet.

You can invest in safer, income-based investments to preserve your capital, and then choose a smaller amount toward growth investing, such as stocks and ETFs or even crypto. But the old saying rings true; “Don’t put all your eggs in one basket.”

How to Invest $5 Million and Live Off the Interest

If you want a simple strategy for living off your $5 million investments, you can choose to invest in safe assets that offer annual interest payments or regular dividends.

Dividend stocks are a great example, with some offering 3% to 5% yields. This would earn you from $150,000 to $250,000 in passive income without doing anything.

Another option is certificates of deposit (CDs). Right now, yields are impressive for both short and long-term CDs — one of our favorite places to find “jumbo” CDs for larger accounts is CIT Bank.

Whatever you choose to invest in, if you simply want to live off passive income, make sure it’s a safe investment that is FDIC-insured.

Final Word: Best Ways to Invest $5 Million Dollars

Making $5 million is hard. However, investing $5 million can be easy if you choose your investments wisely. Yes, there are a lot of choices when investing a large sum of money, but it all comes down to your financial and lifestyle goals.

If you want to preserve your wealth, stick with safe investments like bonds, U.S. Treasuries, and high-yield savings accounts. If you want to grow your wealth, investing in real estate, stocks and ETFs, and alternative investments is the way to go.

Bottom line: If you don’t feel comfortable investing $5 million, you should hire a licensed financial advisor who can help create a lifetime financial plan for you.

FAQs:

How much interest does 5 million dollars earn per year?

If you deposit $5 million into a high-yield savings account at 4.5% currently, you can generate $225,000 per year, risk free. And if you buy U.S. Treasuries, you can earn even more, with over 5% available, or $250,000 in passive income.

How much income will 5 million generate?

$5 million can generate anywhere between $150,000 to $250,000 in passive income in relatively safe investments. If you are investing for growth, the rule of thumb suggests you can withdraw up to 4% of your portfolio for a 30-year retirement and never run out of money. This would equate to $200,000 per year.

Can I live off 5 million dollars?

If you spend less than $150,000 per year, you can easily live on $5 million, which earns anywhere from $150,000 to $250,000 in risk-free income right now. This means your monthly budget is $12,500 in spending (or less). If you spend more, you’ll need to be more aggressive with your investment strategy.

What should I invest in if I have 5 million?

There are hundreds of choices for investing $5 million, but it all comes down to your financial goals and lifestyle needs. If you want to play it safe, investing in U.S. Treasuries or CDs is a good place to start. If you want to double your net worth, investing in stocks or real estate is a great option. Make sure you assess your risk tolerance and potentially meet with a fee-only financial planner before choosing where to put $5 million.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.