Forget the 60/40 portfolio. More and more investors are seeking out a 40/30/30 allocation — featuring stocks, bonds, and alternatives such as real estate, infrastructure, and private credit assets.

Wait. What is private credit?

If you found this blog post, then there’s probably a lot you don’t know about private credit (yet). Let’s get up to speed. Below, I’ll guide you through everything you need to know:

- What is private credit?

- What’s are the pros and cons?

- How do you invest in private credit?

- And more.

I even consulted experts from one of the best private credit investing platforms out there, Percent, to answer some of your most pressing questions. Let’s go:

What is Private Credit?

In essence: Loans provided to businesses by non-banks.

Who seeks out these private loans, and why?

Often, private credit borrowers are non-public, middle-market companies. (What’s a middle-market company? The numbers can range depending on the source, but according to the U.S. Department of Commerce, that includes businesses with pre-taxed earnings anywhere between $5 million and $250 million.)

In terms of securing financing, things can get mushy in the middle market.

These companies need money to finance and grow their businesses. But borrowing can be tricky:

- Unlike public companies, they can’t access public debt.

- Middle market businesses still feel the ripple effects of the 2007-2008 Great Financial Crisis, when a fresh wave of regulations made it challenging for these types of companies to secure financing from banks.

Enter private credit.

For many businesses, private credit can be the gateway to access the funds they need to uplevel their operations. These lenders are not subject to the same restrictions as bank lenders.

They often offer customized loan structures, quicker access to funds, and more flexible terms. (Worth noting: Due to these advantages, some companies prefer private loans to traditional bank loans.)

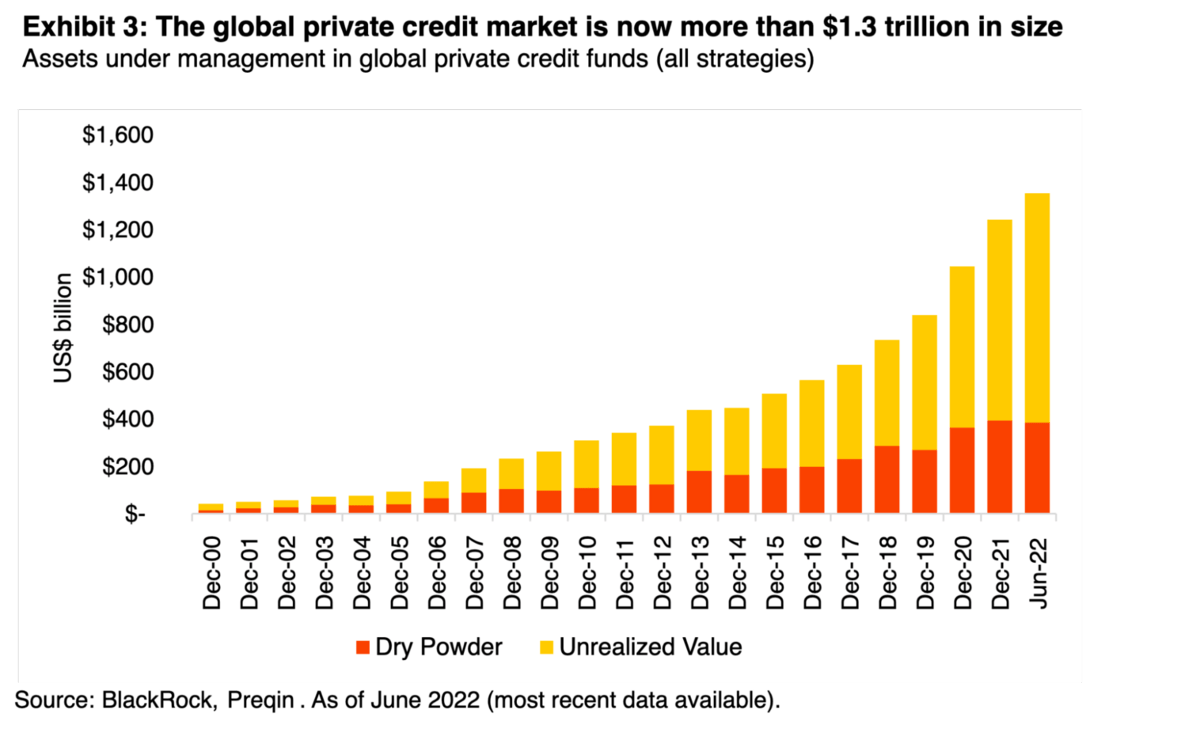

Is Private Credit Investing New?

Nope, private credit investing isn’t new. It’s been around for decades, and the market has been growing exponentially. Case in point: Check out the chart below (courtesy BlackRock), detailing the global private credit market’s ascent since 2000:

That chart ends in 2022. According to Morgan Stanley, the market had exceeded $1.5 trillion by early 2024 and is estimated to grow to $2.8 trillion by 2028.

But as a retail investor, you might feel like private credit and private credit funds just popped on the scene overnight. There’s a reason why — until recently, it was primarily an investment vehicle reserved for large, institutional investors.

To understand this progression, I consulted one of the most popular private credit investing platforms out there, Percent, for guidance.

Why has private credit been so hard for retail investors to access?

According to Percent’s Investor Relations team, “While private credit has been growing with institutional investors, it’s been hard for retail investors to access.

That’s because these opportunities are typically privately negotiated with substantial investment minimums, long periods of illiquidity, and are managed by large funds and asset managers that don’t allow smaller individual investors.

Additionally, even when retail investors did get access to invest in private credit opportunities, they also encountered difficulties assessing quality of transactions, performing proper due diligence, and lack of transparency and standardization across deals, making it harder for them to finally invest.”

Wider adoption is starting to happen, largely thanks to pioneering platforms like Percent. But even as private credit gains a larger audience, there are still some common misconceptions about private credit investing — so let’s clear those up now.

Common Misconceptions About Private Credit

As Percent’s team shares, there are two primary misconceptions about private credit: First, that you need a lot of cash, and second, that it’s only for professionals. Let’s do a little myth-busting:

Misconception 1: You Need a Lot of Cash to Invest

According to the Percent team, “One common misconception is that you need a lot of cash to invest in private credit. While that may have been true for this opaque asset class in the past, Percent makes it possible with deals with lower minimums for accredited retail investors.

The lowest minimum deal we have on our platform requires only $500 to invest. This makes it realistic for everyday investors to build a private credit portfolio of their own.”

Misconception 2: You Need to Be a Pro

Not necessarily. As the Percent Team shares, “Another misconception is that the average investor can’t benefit from private credit and that it’s designed more for large institutional investors.

However, because private credit is significantly less correlated to public markets, it can be a useful hedge in a portfolio against market downturns and volatility.

Compared to a portfolio of just stocks and bonds, reallocating 10% of a traditional equity and fixed income portfolio to private credit would have reduced volatility and increased returns historically (T. Rowe Price).”

With these misconceptions out of the way, you might be wondering: Is a 40/30/30 portfolio featuring private credit right for you? First, a little context…

Is a 40/30/30 Portfolio (Including Private Credit) Right For You?

[The 40/30/30 portfolio] model can provide higher returns and lower volatility, especially during periods of inflation or general market uncertainty. It is particularly suited for investors seeking to diversify their portfolios beyond public equities and bonds, looking for uncorrelated returns and enhanced yield.

– Percent Investor Relations Team

According to a recent study by investment giant KKR, the classic 60/40 (stocks/bonds) allocation could leave potential returns on the table. They found that a 40/30/30 portfolio (stocks/bonds/alternative assets) … Offered both higher returns and lower volatility during periods of high inflation.

Once again, I consulted Percent for their thoughts on the 40/30/30 allocation. Here’s what they had to say:

What’s so great about a 40/30/30 portfolio including private credit investments?

According to Percent’s Investor Relations team, “The 40/30/30 portfolio model, which includes allocations to real estate, infrastructure, and private credit assets, offers a compelling alternative to the traditional 60/40 portfolio.

This model can provide higher returns and lower volatility, especially during periods of inflation or general market uncertainty. It is particularly suited for investors seeking to diversify their portfolios beyond public equities and bonds, looking for uncorrelated returns and enhanced yield.

Given the evolving economic landscape, where traditional asset classes face challenges, incorporating alternatives like private credit can be a strategic move to achieve better risk-adjusted returns through the ups and downs of the market.

We believe this model represents the direction of the future, as more investors recognize the benefits of a diversified and balanced approach that includes private market assets.”

Pros + Cons of Investing in Private Credit

Still on the fence? Let’s dig into the specific advantages and disadvantages of private credit investing:

1. Potentially Higher Yields

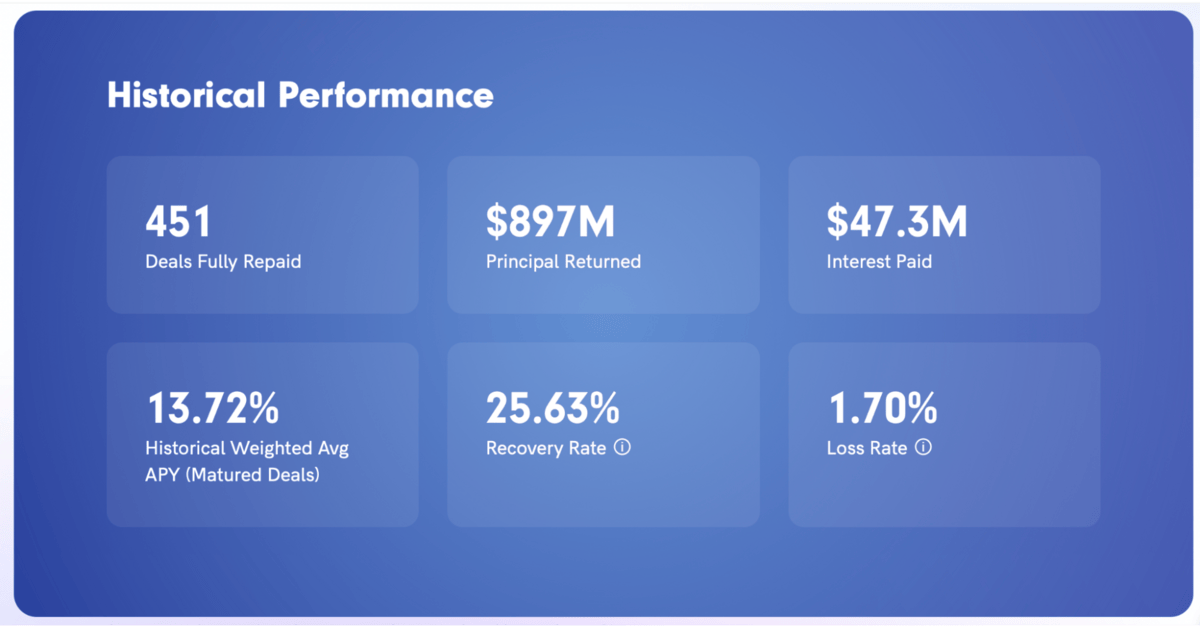

What types of returns might you be looking at with private credit investments? I took a look at Percent‘s historical track record to get an idea.

As of May 31, 2024, Percent reports a current weighted average APY of 18.27% and a historical weighted average APY is 13.72% (based on matured deals). (Click here for the most up-to-date info on Percent’s performance.)

That sounds impressive, but how about a point of comparison? Let’s look at how junk bonds, or high-yield / higher risk bonds with a rating of BBB or lower, are doing:

- The SPDR Portfolio High Yield Bond ETF (SPHY) is currently yielding 7.75%.

- iShares Inflation Hedged High Yield Bond ETF (HYGI) currently pays 6.22%.

2. Favorable Market Conditions

As you may have noticed, the Fed was on an interest-raising frenzy in 2023, and the “will they or won’t they” conversation about rate cuts is ongoing. This shift in policy had a destabilizing effect on the market and increased strain system-wide.

However, this created a very attractive setting for private credit investments. During times like these, when businesses borrow money — particularly in the short term — they are forced to do so at high rates, which is a good thing for investors, since high interest rates often mean borrowers are borrowing at lower leverage, which can reduce risk. Speaking of reducing risk…

3. Lower Correlation With Public Markets

Private credit investments tend to have lower volatility than public markets (like stocks and bonds).

One reason why? The direct lending market tends to focus on resilient industries that are not as susceptible to economic volatility — for example, business services, healthcare, and IT. All of these industries tend to have more cash flow stability and have less sensitivity to shifts in the larger U.S. economy.

Additionally, with a platform like Percent, many of the loans are backed by assets, corporate debt, or loan portfolios.

4. Potentially Low Default Rates

You know that past performance is no guarantee of future performance. That said, a good track record speaks volumes.

Since 2018, Percent’s loss rate (losses based on defaults) is 1.35%. Compare that to the high-yield market, which experiences default rates in the 3.6% range. (Source)

Once again, this could be thanks to the magic of middle-market companies. The companies typically securing private credit aren’t newbies: they’ve established themselves to the point when they want to scale and grow — a good indication that they’re doing something right.

5. Short to Medium-Term Investments

One of the nice things about private credit investment is that it doesn’t have to lock you in for years and years. For example, in 2023, Percent’s average term length of an investment was 9 months; deals are typically 6 to 36 months.

The shorter investment term also diminishes interest rate risk. Here’s why. Interest rate risk involves the decline in the value of longer-term bonds when interest rates rise. As new bonds are issued with higher yields, the prices of existing bonds decrease. Bonds with shorter maturity dates are less susceptible to this risk.

Cons of Investing in Private Credit

While the benefits of private credit investing are many, there are some potential disadvantages you should be aware of:

Lack of liquidity: While the terms for private credit investments are typically short, your money is often locked up for the duration of the investment. There isn’t an established secondary market for private credit, so if you invest, you’re in it for the duration of the loan or investment period.

Opaque market: Remember when I said earlier that private credit isn’t subject to some of the same regulations as public lending? This means there might not be a lot of publicly available information on the companies you’re lending to. This makes it all the more important to invest through a trustworthy platform that will do some due diligence on your behalf.

Complicated loan structures: Private credit loans can be customized to the business, but this means that they can be hard to understand because every loan will have its own set of rules. Either you’ll need to read the fine print or trust that your private credit investing platform is doing it for you.

Potentially high minimums: As noted earlier, the barrier to entry historically has been that private credit offerings are typically offered in large sums, to institutional investors. Platforms like Percent are changing and simplifying this by allowing you to invest with just $500.

As you’ve probably gathered by now, I’m a fan of Percent because it simplifies some of these disadvantages for you. With that in mind, let’s get to what you really want to know about now:

How Can I Invest in Private Credit?

As you may have inferred, WallStreetZen recommends Percent for private credit investing. If you’ve considered the pros and cons and decided to add private credit to your portfolio, follow these steps:

- Learn about private credit and private credit funds. You’re reading this blog post, so you’re already on top of this.

- Think about how much you want to invest: Revisiting that KKR study, the suggestion is that high-net-worth individuals invest up to 30% in alternative assets, 10% of which is private credit. But remember, that’s just one benchmark — your allocation is your decision.

- Choose an investment platform: I strongly suggest signing up with a platform like Percent for private credit investing. I’ll share why below — you can also check out our Percent review for more details.

- Research potential investments: Once you’ve chosen a platform, browse the available deals and look for one that aligns with your goals.

- Invest!

Why We Like Percent for Private Credit Investing

Percent is considered a pioneer in the world of private credit investing — and one of the best platforms out there for this type of investing. Here’s why:

- Private credit focused: Unlike other platforms, private credit isn’t one of a basket of assets for Percent. It’s the main event.

- Strong track record: As of May 31, 2024, Percent reports a current weighted average APY of 18.27%. Its historical weighted average APY is 13.72% (based on matured deals).

- Find investments that suit you: On the platform, you can specify your desired yield and minimum investment amount during syndication. Only invest if your parameters are met.

- Transparency: As noted above, private credit can be an opaque world. Percent does a great job of making things transparent. You can see and compare available deals up front. You can access comprehensive borrower, deal and market data.

- Tracking abilities: On Percent, you can track performance and use surveillance reports to keep informed at every step.

Plus, Percent isn’t done pioneering — there are some exciting things on the horizon. When I asked about their hopes for the future of private credit investing, they stated a commitment to continued innovation and making private credit investing even more accessible to more investors:

“We envision a future where private credit investing becomes more democratized and accessible to a broader range of investors.

By leveraging technology and innovative financial products, like our Percent Blended Notes (PBNs), we aim to simplify the investment process, provide greater transparency, and offer diversified, high-yield opportunities.

Our goal is to continue bridging the gap between public and private debt markets, enabling more investors to benefit from the attractive returns and diversification that private credit can offer.“

What is Accredited Investor Status?

As noted earlier, Percent is only available to accredited investors. They hope to open up the platform to non-accredited investors soon, but for now that’s the way it is.

In case you’re unfamiliar, these are the standards to qualify as an accredited investor

- You have an annual income of $200,000 individually or $300,000 jointly.

- Your net worth exceeds $1 million, excluding your primary residence.

- You meet certain professional standards. (For more information, check out our post on how to become an accredited investor.)

If you do qualify, you can get started with Percent today. (You can also invest in a lot of other cool stuff, too — check out our guide to the best accredited investor investments.) But don’t worry — even if you’re not accredited, there are options for gaining private credit exposure. Let’s look at a few.

Non-Accredited Investors: Ways to Invest

If you’re not an accredited investor but want to invest in private credit funds, here are two to consider:

Yieldstreet’s Alternative Income Fund

Yieldstreet also offers private credit investing for accredited investors, but we’re focusing on non-accredited investors here, so we’ll zero in on the Alternative Income Fund, which doesn’t require accreditation.

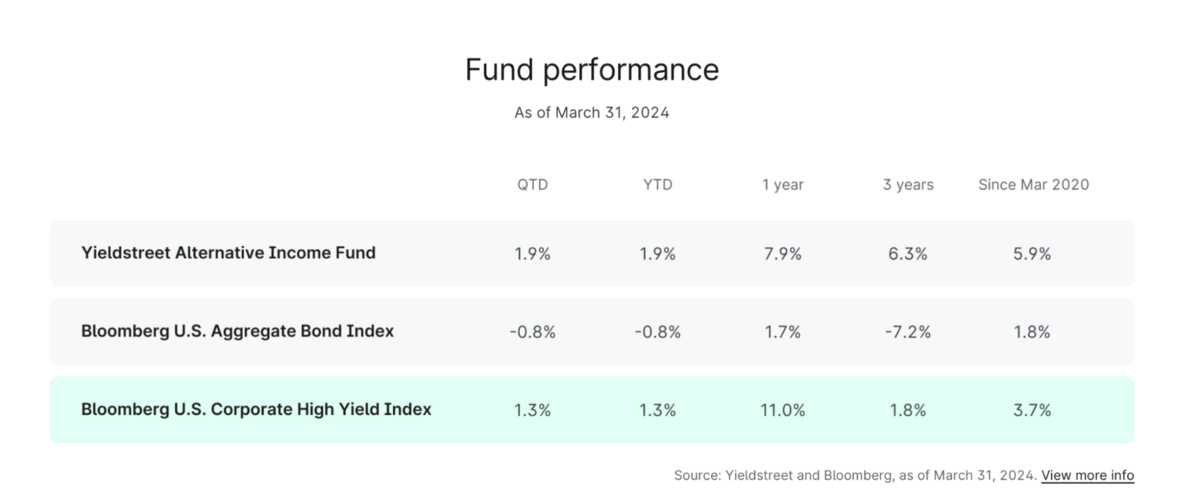

Formerly known as the Yieldstreet Prism Fund, this isn’t a pure private credit investment. Rather, it’s a fund that invests in a variety of private market investments, including private credit, that delivers quarterly income. Here’s a peek at the fund’s performance:

The site reports a net annualized yield of 8.1% and AUM of $145 million as of 3/31/2024.

If you’re interested in gaining some exposure to private credit and like the idea of diversifying into other private markets, it might be appealing.

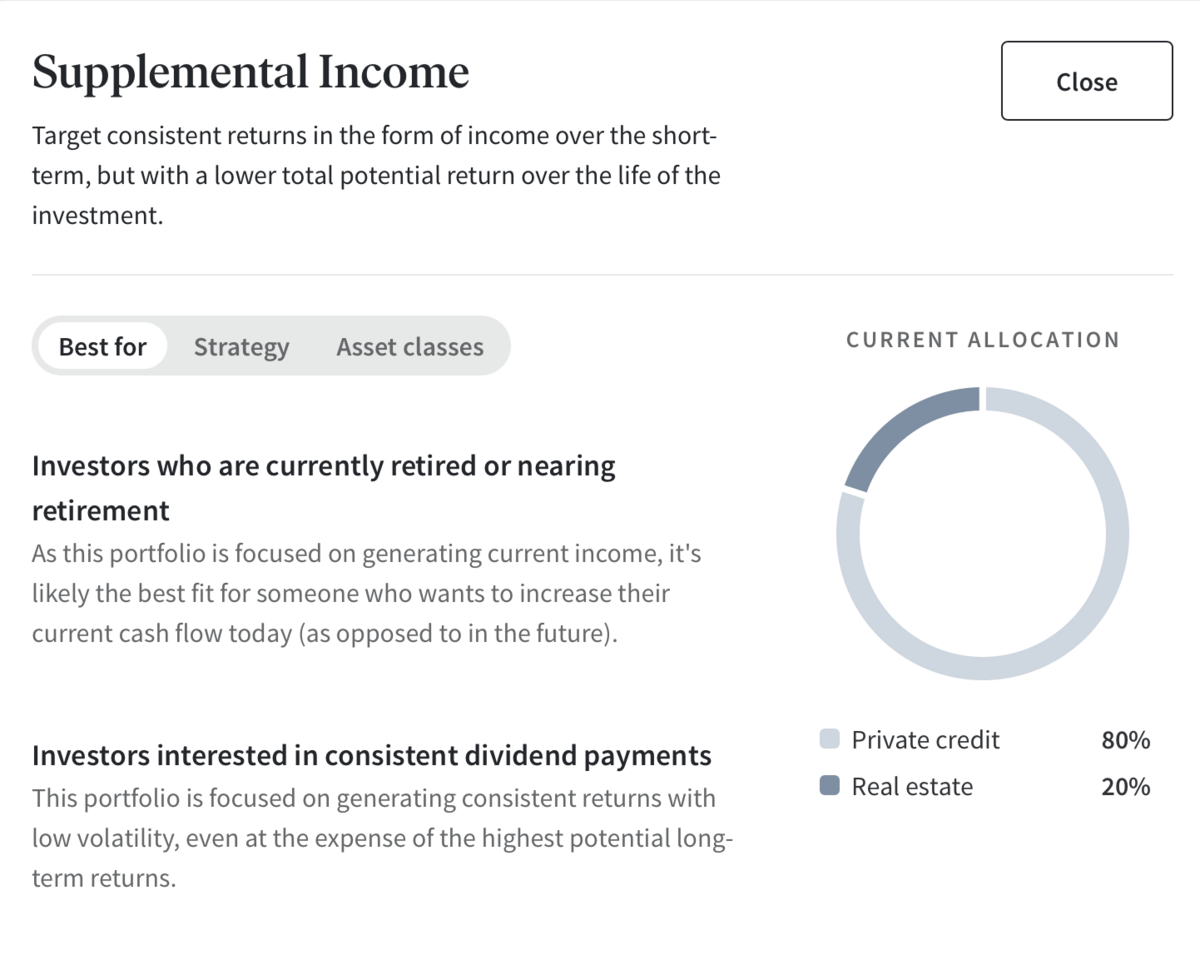

Fundrise

Investment platform Fundrise offers several investment plans that you can choose based on your personal objectives as an investor. The catch? At this time, there is not a plan that allows you to invest solely in private credit — their “Supplemental” Plan is mostly a private credit fund, but includes some real estate too.

The goal of Fundrise’s “Supplemental” plan is to “capitalize on the changed economic environment, offering some of the most attractive potential risk-adjusted returns of the past decade” by providing rescue capital to high-quality borrowers.

While you have less selection and control than you would with a platform like Percent, if you feel comfortable with the platform doing the decision-making for you, it’s a great way to enter the world of private credit investing for an accessible starting point.

Note: We earn a commission for this endorsement of Fundrise.

The Bottom Line

So, should you invest in private credit?

That’s a personal decision. Personally, I believe in private credit investing and I am a private credit investor myself. Here’s why:

- I see the potential in the middle market, which represents a massive chunk of the U.S. economy, and I respect the fact that these are established companies that are less likely than startups to default on loans.

- Platforms like Percent for accredited investors, and Fundrise for non-accredited investors, make private credit accessible to a wider audience of individual investors while also adding a layer of legitimacy so you don’t have to seek out the deals yourself.

- The market has been growing exponentially; it’s gone from the millions to trillions in the past 2 decades or so.

- The short time horizons on platforms like Percent allow exposure without locking up money for years and years.

Those are the reasons I like private credit. But your investment decisions are your own.

That said, if you do decide to invest in private credit, I strongly recommend going with a well-reviewed, trustworthy platform with a proven track record. I’ve mentioned Percent, Yieldstreet, and Fundrise today — all platforms with great reviews, a ton of happy users, and proven track records.

But remember: Alternative investments are speculative and possess a high level of risk. No assurance can be given that investors will receive a return of their capital. Those investors who cannot afford to lose their entire investment should not invest. Investments in private placements are highly illiquid and those investors who cannot hold an investment for an indefinite term should not invest.

Private credit investments may be complex investments and they are subject to default risk.

FAQs:

What is the difference between private credit and public credit?

The main difference between private credit and public credit is who is borrowing and who is funding. Private credit primarily serves middle-market, non-public companies. Public credit borrowers are typically public companies or government entities.

In general, the public market is more accessible, has more liquidity, more regulation (and therefore more transparency) and a larger pool of investors.

What is a private credit fund?

A private credit fund pools money from multiple investors to invest in private credit deals. These funds are managed by professional investors who handle the sourcing, analysis, and management of all investments on behalf of their investors. Every investment fund has unique objectives, so make sure they're aligned with your goals before investing.

Are private credit and private debt the same thing?

Yes. Private credit and private debt are the same thing.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.