You’re here with a simple question:

What are the best ways to invest in AI?

As you’ll see in this post, some of the best ways to invest in AI are:

- Investing in AI stocks or ETFs — this can include companies directly or indirectly involved with AI

- Investing directly in pre-IPO companies in the AI space

- Alternatively, you could take a different approach and use AI to find stocks, such as with WallStreetZen’s Zen Ratings system, which includes a powerful AI algorithm — the tickers themselves may or may not be involved with AI technology.

That’s the short version — let’s dig into the best ways to invest in AI below.

Before you can invest in AI stocks (or any stocks)…

You need a brokerage account.

One of our top picks is eToro*, which offers stocks, crypto, fractional shares, ETFs, and options trading, in addition to these noteworthy services:

- CopyTrader, a service that lets you copy the moves of eToro’s top investors

- Popular Investor, where Popular Investors can receive up to 1.5% payment based on average AUC (Assets Under Copy).

- A social media newsfeed where users discuss investing

- Virtual Portfolio, a service that lets you practice investing without putting your money at risk

(See important notes below.)

Why Invest in AI?

The global AI market is projected to reach $2.74 trillion by 2032 — a big increase from 2023’s $515.31 billion.

That’s over a trillion reasons to consider investing in this exciting market!

But that doesn’t mean you should just choose any stock or fund that has a connection to AI and invest blindly. You must do your due diligence to find the best AI stocks.

In this post, we’ll help you do your homework with 10 top-notch ideas for how to invest in artificial intelligence. We’ll cover top-performing AI stocks, less-obvious tickers that could benefit from the AI revolution, as well as other investment vehicles like ETFs, diversified funds, and investing directly in pre-IPO AI companies.

This post also includes insights from AI influencer Eric Flaningam.

Let’s go:

1. Look for the Best AI Stocks to Buy

Stocks are probably the easiest way to gain exposure to the fast-growing AI market.

Let’s talk about some of the biggies:

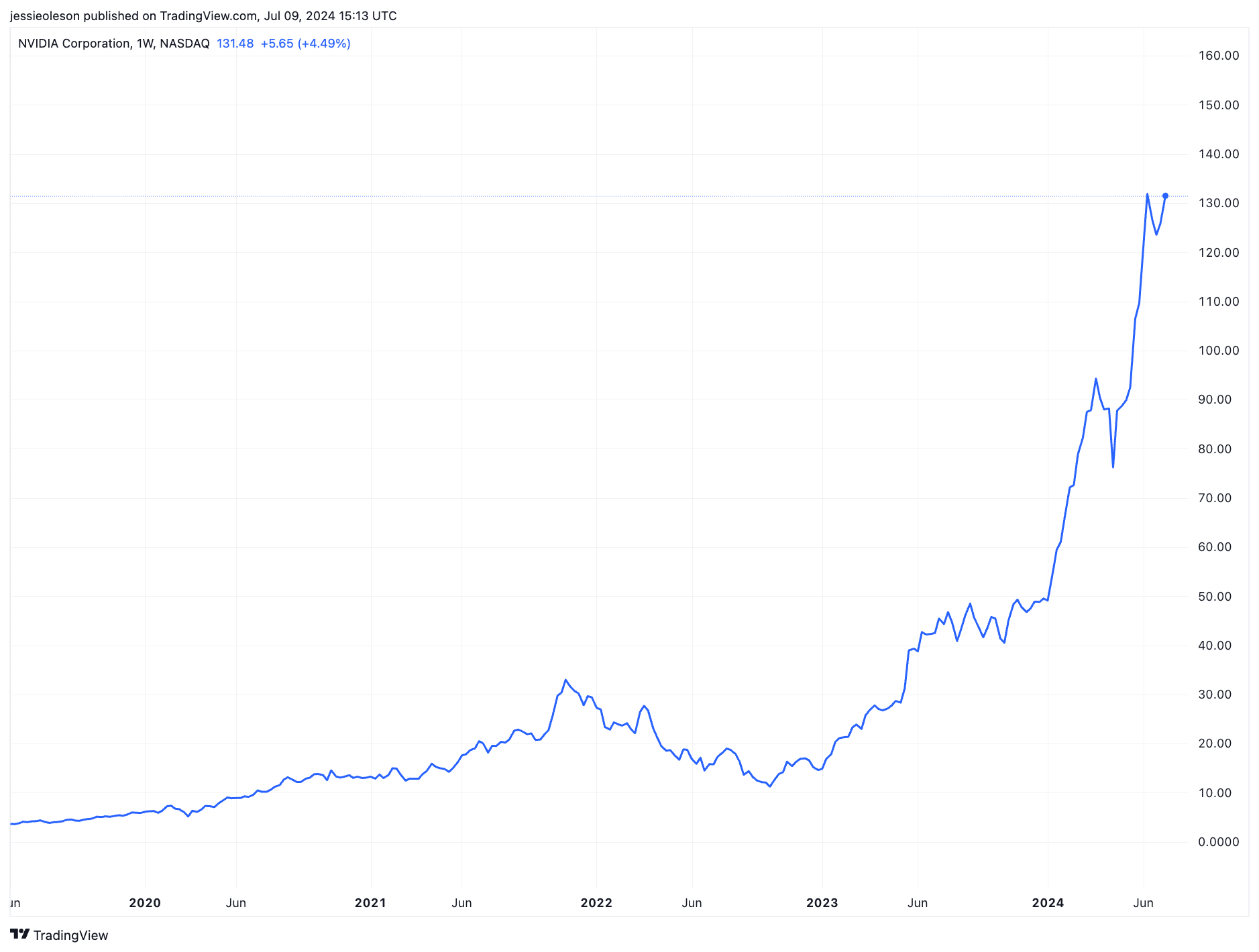

1. Nvidia (NASDAQ: NVDA): For many people, NVDA is the ultimate symbol of the AI boom. Why? Just look at the chart below — that kind of growth doesn’t go unnoticed.

Despite the fact that the stock price is up over 200% just in the past year, analysts still believe there’s room to grow. Among the top analysts we track, 1-year forecasts suggest around 50% potential upside for the stock in the coming year. See NVDA forecasts here.

2. Advanced Micro Devices (NASDAQ: AMD): AMD has been a frequent ticker on the “Strong Buys” section of our WallStreetZen Ideas newsletter due to its consistently upbeat analyst coverage. This semiconductor company is up 57% in the past year as of July 2024, and has 19 Strong Buy ratings from the analysts we follow, including Christopher Rolland, a top 1% analyst, who recently predicted that AMD would capture a small portion of the server market by 2H 2024. See AMD forecasts here.

Related Reading: How to Read Analyst Stock Ratings to Buy/Hold/Sell

3. Amkor Technology (NASDAQ: AMKR): This semiconductor stock was a recent “Stock of the Week” pick from our own resident expert Steve Reitmeister, who manages our Zen Investor stock-picking newsletter.

Among his reasons for the selection? 4 quarters of earnings beats, bullish analyst forecasts, and the fact that AI is driving ever-more demand for chips. Read more here.

4. Qualcomm (NASDAQ: QCOM): Qualcomm develops advanced semiconductor technologies that power AI-driven applications and devices like smartphones and autonomous vehicles. Despite being up 77% in the past year, analysts still like it — in June 2024, Matthew Ramsay of TD Cowen raised their price target after a meeting with management where he was impressed by the company’s strategy for driving Mobile content gains to capitalize on the ongoing AI/automotive momentum. See more analyst takes here.

5. Rambus Inc. (NASDAQ: RMBS): Fun fact: We first featured RMBS, a DDR memory chip provider, in our newsletter as a “Strong Buy” in May of 2022, when it was trading for $24.35 (at writing, it’s trading in the $60s — see most up-to-date price here).

Despite its already impressive earnings growth, which is reflected in the stock price, some analysts still forecast over 30% upside for the stock in the next year — click here to find out more.

6. Synopsys Inc. (NASDAQ: SNPS): Synopsys makes AI features possible. It provides advanced software, IP, and services that allow design and verification of complex semiconductor devices — important stuff for AI infrastructure.

Following the company’s last earnings report, Harlan Sur of JP Morgan (a top 2% analyst) hiked their price target on the stock after seeing the quarter’s “solid results and guidance,” driven by demand for chip design software tools that remains as strong as expected.” See what other top-rated analysts are saying about SNPS now.

7. Taiwan Semiconductor (NYSE: TSM): Taiwan Semiconductor Manufacturing creates advanced AI chips that are crucial to the functioning of AI tech and applications. But that’s not the only reason it’s an AI powerhouse.

Many of the most popular names in AI and chip design rely on TSMC — Qualcomm Inc. (NASDAQ: QCOM), Nvidia Corp. (NASDAQ: NVDA), Apple Inc. (NASDAQ: AAPL), and Advanced Micro Devices Inc. (NASDAQ: AMD) are just some of TSMC’s high-profile customers.

Related reading: How to Buy Groq Stock

8. C3ai Inc (NYSE: AI): AI’s in the name: This company provides both frameworks and solutions for other companies to develop their own AI platforms, as well as a varied suite of “ready to go” solutions that have found diverse applications in healthcare, predictive maintenance, inventory management, and customer relationship management — just to mention a few. But consider yourself warned: While some forecasts suggest as much as 33% upside in the next year, analyst ratings are mixed.

9. Adobe (NASDAQ: ADBE): Think beyond Photoshop! ADBE can be considered an AI stock thanks to its extensive integration of artificial intelligence and machine learning technologies in its products, notably Adobe Sensei.

It has a “Buy” consensus among the analysts we track, and has been praised by analysts like Keith Bachman of BMO Capital for its “optimistic stance on the state of the economy and the growing popularity of AI.” See 1-year price targets for ADBE here.

10. Alphabet (NASDAQ: GOOGL): The Google parent company has been on the edge of innovation for years — in the AI sphere, it leverages machine learning technologies across its many products and services, including Google Search, Google Assistant, and its cloud computing platform, Google Cloud AI.

GOOGL is also unique in that:

- It may offer some exposure to some of the private companies listed later on in the post — for instance, along with Amazon, Google is a notable investor in Anthropic.

- If you’re well-versed enough in AI to be wondering how to invest in quantum AI (and for those not so well versed, quantum AI involves integrating quantum algorithms within machine learning programs), GOOGL could be the gateway. Google recently built a Quantum AI campus to realize their mission of leading the development of large-scale error corrected quantum computers.

18 Analysts Currently Rate GOOGL a Strong Buy. Here’s What They’re Saying.

11. Amazon (NASDAQ: AMZN): Sure, Amazon uses AI extensively in its core operations — product descriptions, enhancing customer recommendations, optimizing logistics and supply chain management. Sure, AI powers its voice-activated assistant, Alexa.

However, AMZN could also present a “picks and shovels” approach to AI investing. Just as miners needed tools during the gold rush, AI development requires significant infrastructure and support. One of the best picks and shovels plays in the AI space is Amazon Web Services (AWS).

AWS is the leading provider of cloud computing services, which are critical for AI development and deployment. AI requires immense computing power and storage, and AWS’s infrastructure is the backbone for these needs.

CEO Andy Jassy said during a recent earnings call that generative AI alone “will ultimately drive tens of billions of dollars of revenue for Amazon over the next several years.” As AI adoption grows, so too will the demand for cloud services, making AWS a key player in the AI revolution.

Plus, Amazon is another big investor in pre-IPO AI companies like Anthropic.

12. Meta (NASDAQ: META): Forget Facebook, forget the Metaverse: META’s into AI now. AI has the ability to enhance its social media platforms, improve ad targeting, and help the company develop virtual and augmented reality experiences — to name a few uses.

Mark Zuckerberg has gotten investors all excited about his plans to go big on AI in recent months — the stock has a Strong Buy consensus on WallStreetZen. We’ll be watching to see what’s next — see analyst commentary and price targets here.

13. Microsoft (NASDAQ: MSFT): This is one of the biggies: MSFT is on the leading edge of AI development, notably through its strategic partnership with OpenAI to integrate and advance technologies like ChatGPT within its Azure cloud platform, Office 365.

While an investment in MSFT offers limited exposure to ChatGPT, it does offer some exposure — that notwithstanding, most forecasts for MSFT are bullish, with some analysts forecasting over 25% potential upside in the next year.

2. Follow AI Influencers

You’ve probably heard of a few of the stocks listed above. What if you want to dive a little deeper?

To go beyond surface-level AI stock selections, I reached out to Eric Flaningam, an investing influencer on Twitter (sorry, X) and author of the popular “Generative Value” newsletter. (Go ahead, give him a follow right now. I’ll wait.)

I asked Eric about AI related stocks most investors might not have considered; here’s what he had to say.

“Not considering price, I think the semiconductor value chain probably provides good exposure with less coverage than the major semiconductor players. I personally admire the semicap companies like $AMAT, $ASML, $KLA, and $LRCX; they have wonderful moats, long-term growth prospects, and relatively reasonable valuations. Additionally, they tend to be heavily cyclical. For long-term investors like myself, cyclical industries can provide strong buying opportunities (assuming I believe the companies will eventually be worth more in the future).”

Here’s that list of Flaningam’s picks again, with a little explanation of each company:

14. Applied Materials Inc. (NASDAQ: AMAT)

Applied Materials supplies equipment, services, and software for manufacturing semiconductor chips; it plays a critical role in producing the hardware that powers artificial intelligence applications. See price targets + forecasts for AMAT.

15. ASML Holding (NASDAQ: ASML)

ASML evelops, produces, markets, sells, and services advanced semiconductor equipment systems consisting of lithography, metrology, and inspection related systems for memory and logic chipmakers. See price targets + forecasts for ASML.

16. KLA Corporation (NASDAQ: KLA)

KLA specializes in process control and yield management systems for the semiconductor industry; its advanced inspection and metrology tools utilize artificial intelligence to enhance the manufacturing and performance of semiconductor devices. See price targets + forecasts for KLA.

17. Lam Research Corp. (NASDAQ: LRCX)

Lam Research designs and manufactures semiconductor processing equipment — its technology enables the production of advanced semiconductor chips crucial for powering artificial intelligence applications. See price targets + forecasts for LRCX.

Why are these companies worth watching? In a word, potential. Flaningam notes, “These companies don’t have the % exposure to AI that Nvidia does. However, if you believe AI is long-term additive to the semiconductor market, these companies should see tailwinds.”

3. Seek Out “Pick and Shovel” AI Stocks

Now that we’ve gone over some of the companies with a clear AI connection, let’s talk about some sectors and stocks you might not immediately think of when you think about AI.

Insurance Companies: Positioned to Benefit From AI

Insurance companies are uniquely positioned to benefit from AI because the industry relies so heavily on data and statistics. AI works best when it has large volumes of data to digest. By integrating AI, insurers can enhance risk assessment, optimize underwriting, streamline claims processing, and improve customer service. One standout in this sector?

18. Chubb Ltd (NYSE: CB)

Chubb has a “seal of approval” in the form of Warren Buffett’s recent investment in the company. Chubb is actively rolling out AI technologies at scale, leveraging data to enhance underwriting precision and operational efficiency.

On their last earnings call, the CEO stated they’ve been experimenting with deep-learning and math-based AI tools for five years across different business areas, including underwriting, claims, analytics, marketing, and customer service. See why top analysts rate the stock a buy.

Robotics: Real-World AI Systems

Most investors are familiar with AI chatbots and virtual assistants by now. But the next phase of AI may lie in robotics, where AI meets the physical world.

This “embodied AI” or “real world AI” is set to revolutionize industries by performing tasks that require physical presence and manipulation by ai models. For example:

19. Tesla (NASDAQ: TSLA)

Tesla’s Optimus humanoid robot is a prime example of this innovation. Designed to handle a variety of tasks, from manufacturing to household chores, Optimus represents the future of real-world AI. See the wildly varied forecasts for TSLA here.

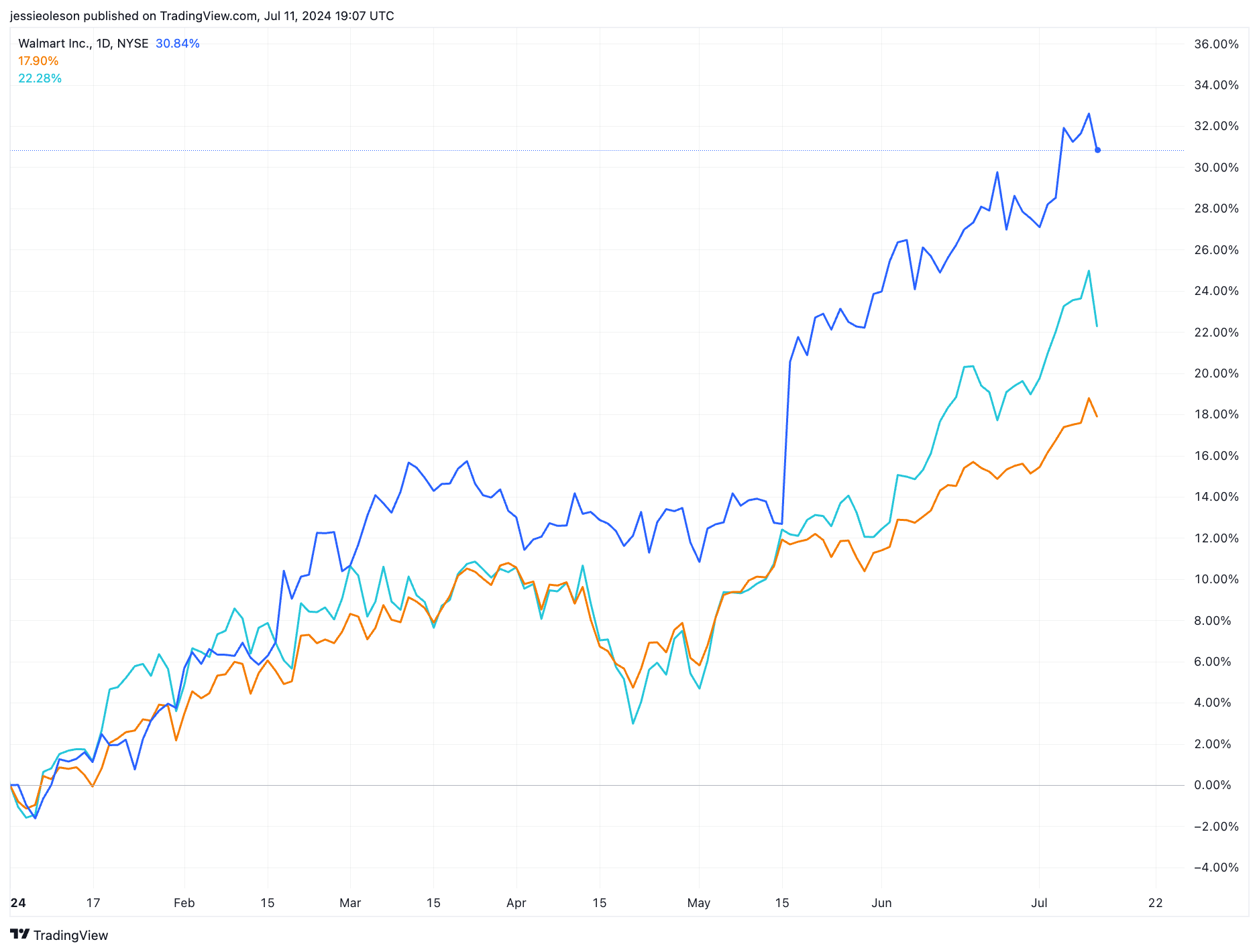

20. Walmart (NYSE: WMT)

On the other end of the spectrum, Walmart doesn’t manufacture robots but is already benefiting from their use, and offers another way to invest. We highlighted Walmart as a strong buy earlier this year, and so far it’s outperformed both the S&P and the NASDAQ YTD:

Energy: AI in Solar and Renewable Energy

Although AI has shown a lot of potential when it comes to optimizing the production of renewable energy, maintaining electrical grids, and improving their reliability, there is another side to the story — AI requires a lot of power.

Although estimates range, the World Economic Forum’s findings suggest that AI’s power consumption is growing at a rate between 26% and 36% annually. Goldman Sachs estimates that data center power demand will increase 160% by 2030, mainly due to AI.

This surge is driving significant growth in the renewable energy sector, particularly in solar power. Here, there are two companies that stand head and shoulders above the competition.

21. First Solar Inc (NASDAQ: FSLR)

First Solar produced more than 12.1GW of solar modules last year and currently has a nameplate capacity of 21 GW. Even so, the company isn’t resting on its laurels — with plans to double manufacturing capacity by 2026 through opening a slew of facilities, primarily in Louisiana and Alabama.

Also quite likable? FSLR’s revenue and earnings estimates outshine both the industry and the wider market — so too does its P/E ratio. Looking at analyst forecasts, the average expectation for the stock’s price a year from now is pretty optimistic — see it here.

22. NextEra Energy Inc (NYSE: NEE)

Although the forecasts and metrics are a bit less stellar than FSLR’s at the moment, the largest producer of wind and solar energy is another ticker to keep an eye on, particularly if the company sees a string of good quarters.

As it stands, a D/E ratio of 2.48 and low earnings and revenue growth forecast make FSLR the clear winner as of right now.

4. Find the Best Artificial Intelligence ETFs

If you’re not keen on picking your own stocks or prefer the built-in diversity of an ETF, there are several strong-performing AI ETFs to consider:

23. iShares Exponential Technologies ETF (XT)

What it is: XT is a fund with a large market capitalization that tracks the Morningstar Exponential Technologies Index. It focuses on international stocks that are driving exponential technological advancements with the potential to significantly disrupt their industries, including artificial intelligence. Information technology stocks dominate the portfolio, comprising nearly 53%, with healthcare and industrials following.

The top ai stocks in XT include:

- SoFi Technologies (NASDAQ: SOFI), a company specializing in online loan refinancing

- Coinbase Global Inc. (NASDAQ: COIN)

- Meta Platforms Inc. (NASDAQ: META)

24. ROBO Global Robotics & Automation Index ETF (ROBO)

What it is: ROBO aims to replicate the performance of the ROBO Global Robotics & Automation Index, which evaluates companies involved in robotics, automation, and AI.

ROBO offers exposure to firms that develop intelligent systems technology capable of sensing, processing, and acting, as well as those that utilize this technology.

The fund’s top three holdings include:

- Harmonic Drive Systems, a Japanese manufacturer of components for industrial robots and semiconductor equipment

- IPG Photonics Corp. (NASDAQ: IPGP), a producer of fiber lasers

- Zebra Technologies Corp. (NASDAQ: ZBRA), a company specializing in mobile computing software and analytics.

25. Defiance Machine Learning & Quantum Computing ETF (QTUM)

What it is: QTUM is a global multi-cap fund that benchmarks against the BlueStar Quantum Computing and Machine Learning Index. This index comprises companies engaged in the research, development, and commercialization of quantum computing systems and materials.

QTUM’s leading holdings include:

- Cirrus Logic (NASDAQ: CRUS), a supplier of semiconductors

- Baidu Inc. (NASDAQ: BIDU), a Chinese company specializing in internet services and AI

- Alteryx Inc. (AYX), a company focused on data analytics software.

26. The Global X Robotics & Artificial Intelligence ETF (BOTZ)

What it is: A grouping of companies involved in robotics and artificial intelligence. BOTZ has assets under management (AUM) of approximately $2.5 billion.

The fund’s top holdings include:

- NVIDIA Corporation (NASDAQ: NVDA)

- Keyence Corporation, a Japanese manufacturer of automation sensors and vision systems

- Intuitive Surgical, Inc. (NASDAQ: ISRG), a company specializing in robotic surgical systems.

27. The Themes Generative Artificial Intelligence ETF (WISE)

What it is: This ETF focuses on companies leading in the development and application of generative AI technologies. Managed by Themes Investment Management, THAI has an assets under management (AUM) of approximately $1.2 billion.

WISE’s top holdings include:

- OpenAI Inc.

- Alphabet Inc. (NASDAQ: GOOGL)

- Microsoft Corporation (NASDAQ: MSFT)

28. The Global X Artificial Intelligence & Technology ETF (AIQ)

What it is: A grouping of companies involved in the development and utilization of artificial intelligence and technology. Managed by Global X Management Company, AIQ has assets under management (AUM) of approximately $500 million.

The fund’s top holdings include:

- NVIDIA Corporation (NASDAQ: NVDA)

- Alphabet Inc. (NASDAQ: GOOGL)

- Microsoft Corporation (NASDAQ: MSFT)

5. Invest in Pre-IPO Artificial Intelligence Companies

If you’re an accredited investor, you can gain access to select AI startups before they IPO.

Hiive is a marketplace that connects accredited investors with shareholders of pre-IPO, VC-backed companies who want to sell their shares.

Right now, Hiive has a bunch of exciting AI companies among its offerings. Here’s a quick review of each; click the company name links to find out more.

How does one go about buying a share in a privately-held company? You have to be an accredited investor, which means either having a certain level of annual income ($200,000 or $300,000 if filing jointly), a certain level of net worth (over $1 million excluding your primary residence), or a FINRA series 7, 65, or 82 license.

29. OpenAI

OpenAI is ranked as one of the top 3 AI labs worldwide — it has developed game-playing AI software that can beat humans at video games such as Dota 2, but it is best known for its AI text generator ChatGPT (also available on Hiive). Learn more.

30. Anthropic

This company was founded by former OpenAI employees with a mission of ensuring that the technology continues to develop in alignment with human goals and values. Big-name investors include Amazon and Google. Learn more.

31. DataBricks

Databricks is a platform that promises to consolidate a variety of data sources to make machine learning and advanced analytics simple, straightforward, and available to businesses of all stripes. Learn more.

32. Miso Robotics

Founded in 2016, Miso Robotics is revolutionizing the fast food service industry by utilizing Artificial Intelligence (AI) to build robots that assist chefs. Learn more.

33. Groq

Groq is the brainchild of a couple of brainy AI engineers from Alphabet (NASDAQ: GOOGL), notably Groq’s current CEO Jonathan Ross. While Groq is innovating in a number of ways, its core product is its Language Processing Unit (LPU), and its focus is on a field known as “inference.” Read our full article on Groq here.

34. Anduril

Anduril Industries is an American defense company that focuses on high-tech autonomous systems; it was founded by a group led by Palmer Luckey, co-founder of Oculus VR, which was eventually acquired by Meta Platforms (NASDAQ: META) for $2 billion. Learn more.

35. Cerebras Systems

Cerebras Systems is a technology company known for developing the world’s largest and most powerful AI accelerator, the Cerebras Wafer-Scale Engine, which makes it an AI pioneer by significantly advancing the computational capabilities and efficiency of artificial intelligence workloads.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

6. Invest In a Private AI Investment Fund

If you got bummed out reading the above section because you’re not an accredited investor (yet), there is a way to potentially harness the pre-IPO growth companies: The Fundrise Innovation Fund.

36. The Fundrise Innovation Fund

If you’re a regular reader of this blog, then you already know that Fundrise is a solid service that allows you to invest in private, diversified real estate and private credit funds. Now, they’ve expanded into innovative technology.

The Fundrise Innovation Fund is an investment vehicle focused on backing high-growth, technology-driven companies poised to drive future innovation.

This fund aims to provide investors with exposure to emerging sectors such as artificial intelligence, biotechnology, and advanced manufacturing, leveraging the expertise of Fundrise in identifying and supporting transformative ventures.

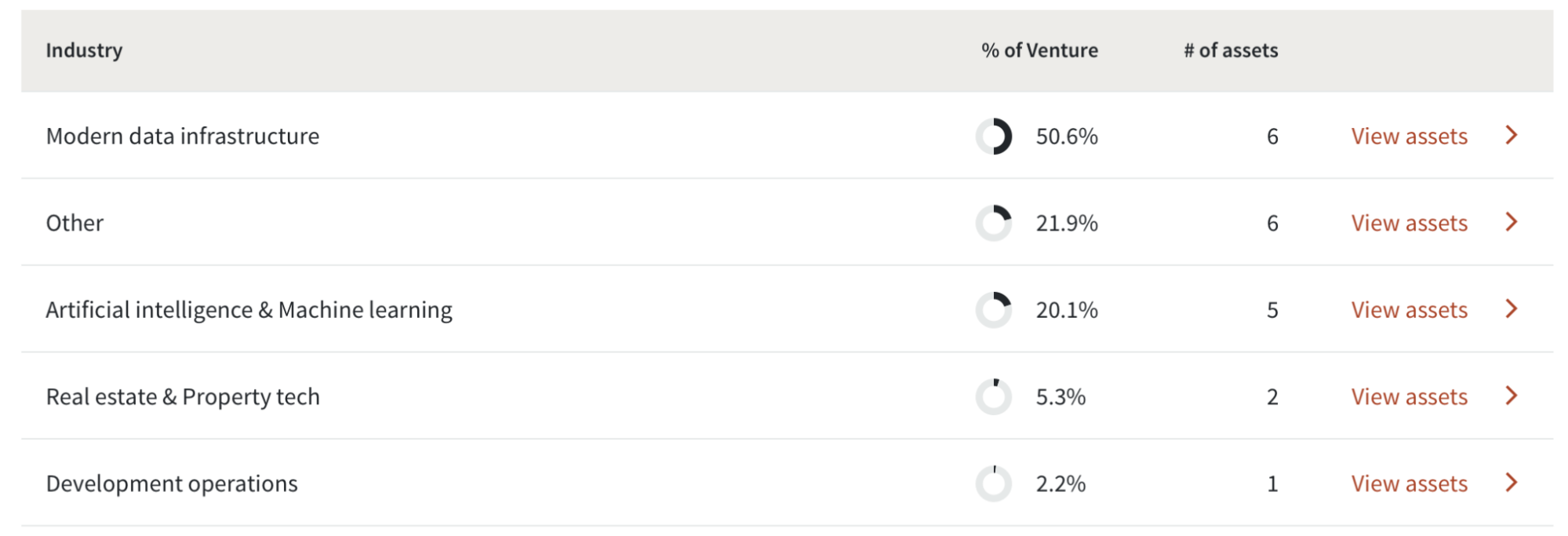

I have a Fundrise account, and after listening to a great interview with Fundrise’s CEO about the motivation behind the fund on the Financial Samurai Podcast, I decided to invest a small amount in the Innovation fund. Here’s the breakdown of assets in the fund by industry:

So as you can see, it’s not pure AI, but it does have a significant chunk of AI exposure, both through the designated AI industry and probably a bit through the other industries too. It’s too soon to share the results, but I’ll update this post once I have progress to report.

Note: We earn a commission for this endorsement of Fundrise.

What Makes a Security an “AI Stock”?

Obviously, companies that have strong AI offerings, or that make AI hardware. But according to AI investment influencer Eric Flanagam, who we quoted above, there’s more to it than that.

He made a nifty chart which you can see below detailing the many layers of AI investing.

Sharing how I think about the AI investing ecosystem:

— Eric (@EricFlaningam) December 14, 2023

1. The Application Layer

Integration of AI models into applications like chatbots and assistants.

VCs have interesting opportunities to invest, but little opportunity for public investors.

2. The Model Layer

Three primary… pic.twitter.com/Gz1Lnjm23q

Is Now a Good Time to Invest in AI Stocks?

Many investors believe that the AI revolution is just getting started. However, plenty of big AI stocks have already made big gains. Does that mean it’s over?

As Flaningram notes, “The clear early winners from AI are the hardware providers (mostly NVDA) and the cloud providers to a lesser extent. The important variable that will define the next 5 years is demand for AI applications.”

So what does that mean for you as a forward-looking investor?

Flaningram continues, “It may be counterintuitive, but I think now is a good time to be patient when investing in AI. Demand for AI applications is still unclear in the short-term. If the demand for applications doesn’t meet the assumptions that have driven the infrastructure build-out, we’ll have some short-term pains in the market. In that situation, we’ll see a much stronger risk-reward profile than we see today.”

New to Investing? How to Invest in AI Stocks

Some of you will already know this part. Once you’re ready, here’s how to invest in AI stocks:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for the stock ticker you’d like to invest in

- Select how many shares you want to buy

- Place your order for your chosen AI stocks

- Monitor your trade

Pros and Cons of Investing in AI

Let’s break it down:

Pros | Cons |

High growth potential / transformational technology | High volatility |

Diverse applications: AI is being integrated into healthcare, finance, automotive, and retail applications — and that’s just the beginning. | Regulatory risk: The AI sector faces regulatory scrutiny and potential legal challenges related to data privacy, security, and ethical concerns. |

Efficiency gains: Companies using AI can improve efficiency, which could potentially lead to higher profits. | Technological Uncertainty: Rapid technological changes mean that not all AI investments will be successful; some companies may fail to achieve commercial viability. |

Companies that successfully implement AI can gain a competitive edge over peers, potentially leading to better market positioning and higher returns. | High Valuations: Many AI companies are valued at premium levels, which can pose a risk if growth expectations are not met. |

Investing in AI supports cutting-edge innovations that can revolutionize industries and create new market opportunities. | Ethical Concerns: Investing in AI raises ethical considerations related to job displacement, privacy, and the potential misuse of AI technologies, which can affect public perception and regulatory landscape. |

What is the Best Way to Invest in AI?

Asset | Advantages | Disadvantages | Suggested platform for investing |

Publicly-traded stocks | Accessible to most investors | You may not have access to the most disruptive companies; AI stocks can be volatile | Brokerage account (our favorite broker is eToro) |

ETFs | Accessible to most investors; built-in diversity | Potentially less upside | Brokerage account (we suggest eToro) |

Pre-IPO Companies | Offers access to cutting-edge companies on the forefront of AI technology | Companies may be more volatile than publicly-listed companies. | Hiive |

Private Funds | Access to companies that are not on the stock market | Invests in more than just AI technology |

Note: We earn a commission for this endorsement of Fundrise.

Final Word:

I’ve spent years writing and editing stocks and investing content, and have experienced firsthand how artificial intelligence (AI) transforms the way people work.

As an investment nerd, I’ve seen the powerful effect that AI has had on all sectors of the market, driving huge gains for AI stocks, ETFs, and even private AI investments.

But like with any emerging technology, don’t take it for granted that this growth will last forever. Always do your due diligence before investing and evaluate the risks before you put your hard-earned money on the line.

FAQs:

How to Invest in quantum AI?

Right now, one of the most effective ways for retail investors to invest in quantum AI is through Alphabet (NASDAQ: GOOGL), which is invested in developing quantum AI through its quantum AI lab.

What are the benefits of AI investing?

Reasons to consider AI investing include potentially benefiting from the high growth potential of transformational technology, efficiency gains which could potentially lead to higher profits for companies, companies that successfully implement AI can gain a competitive edge over peers, potentially leading to better market positioning and higher returns, and the fact that investing in AI supports cutting-edge innovations that can revolutionize industries and create new market opportunities.

What are the best AI stocks to buy?

AI investments should be aligned with each investor’s individual goals. However, experts agree that some of the best AI stocks to buy include AI hardware companies that make equipment like semiconductors, and AI providers. These include Nvidia (NVDA), Microsoft (MSFT), Advanced Micro Devices (AMD), and C3ai Inc. (AI).

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.