Lithium is a critical commodity, used in batteries for everything from cell phones to electric vehicles. As the demand for these products surges, lithium demand is expected to do the same.

That begs the question of how to invest in lithium — and perhaps more importantly: what are the best lithium stocks?

I’ve put together a list of my top lithium stocks below — including lithium mining stocks, lithium refining stocks, lithium battery stocks — using fundamentals and current coverage from top analysts.

This post doesn’t just focus on lithium stocks. I’ve also included lithium ETFs to consider, as well as a special resource for accredited investors — how to invest in private lithium companies on pre-IPO investment platform Hiive.

Interested in buying lithium stocks? You need a broker.

One of our top picks? moomoo. There are plenty of reasons why; here are just 3:

1. An amazing welcome promo: You can get up to 30 FREE stocks when you set up and fund your account, plus 8.1% APY on uninvested cash for a limited time. Click the link below to find out more.

2. An intuitive, easy-to-use interface that’s suitable for beginners but loaded with tools like FREE Level 2 data that will please more sophisticated investors.

3. A variety of tradable assets including stocks, ETFs, and options.

1-5: Lithium Stocks to Buy

Before we get started, it’s important to clarify that there are different kinds of lithium stocks.

It’s helpful to break them up into three broad categories:

- Lithium mining stocks: Companies that mine lithium out of the ground.

- Lithium refining stocks: Companies that refine this lithium into battery grade chemicals.

- Lithium battery stocks: Companies that manufacture the actual lithium-ion batteries, including power batteries, storage batteries, and special application batteries

Each of the stocks below falls into one of these categories — I’ll specify which in each entry.

1. The Chemical & Mining Co of Chile (NYSE: SQM)

Sociedad Química y Minera de Chile (or: the Chemical & Mining Co of Chile) (NYSE: SQM) is one of the world’s largest lithium miners.

The company also produces and distributes specialty plant nutrients (fertilizers), iodine and its derivatives, potassium chloride and sulfate, industrial chemicals, and other products and services. The company is headquartered in Santiago, Chile.

2. Albemarle Corporation (NYSE: ALB)

Next on the list is Albemarle Corporation (NYSE: ALB), which manufactures specialty chemicals (lithium, bromine, and catalysts). Offerings based on those chemicals include butyllithium and lithium aluminum hydride, products used in fire safety solutions, fluidized catalytic cracking catalysts and additives, and performance catalyst solutions.

ALB’s customers include companies in the energy storage, petroleum refining, and consumer electronics sectors, among others. The company was founded in 1887 and is headquartered in Charlotte, NC.

Albermarle’s clients are also some of the biggest companies on the globe, such as Corning (NYSE: GLW), Samsung, and Panasonic.

3. Enovix Corporation (NASDAQ: ENVX)

Enovix Corporation (NASDAQ: ENVX) designs, develops, and manufactures silicon-anode lithium-ion batteries. Its products include custom three-dimensional silicon lithium-ion batteries for wearable, mobile computing, and communication device applications. The company was founded in 2007 and is headquartered in Fremont, CA.

Why it’s watchlist-worthy:

Enovix made the list because it’s a pure-play lithium battery designer and manufacturer, which is quite rare, and worth keeping an eye on if that’s your sole area of interest.

The company’s unique 3D cell architecture boosts energy density while ensuring long cycle life. They’re also advancing their 3D cell technology and manufacturing processes for the electric vehicle and energy storage sectors, aiming to enhance the use of renewable energy. So this is potentially a more speculative stock with growth potential in the future.

Like many early stage companies, ENVX is currently unprofitable, so it screens poorly due to valuation metrics. If the company continues to grow and becomes profitable down the line it could be a big battery winner.

4. QuantumScape Corporation (NYSE: QS)

QuantumScape Corporation (NYSE: QS) develops lithium-metal batteries for electic vehicles. QuantumScape was founded in 2010 and is headquartered in San Jose, CA.

Why it’s watchlist-worthy:

I hesitated to include this one, as QuantumScape is years into being publicly traded now and is not even producing revenue, let alone profit, which is typically a red flag.

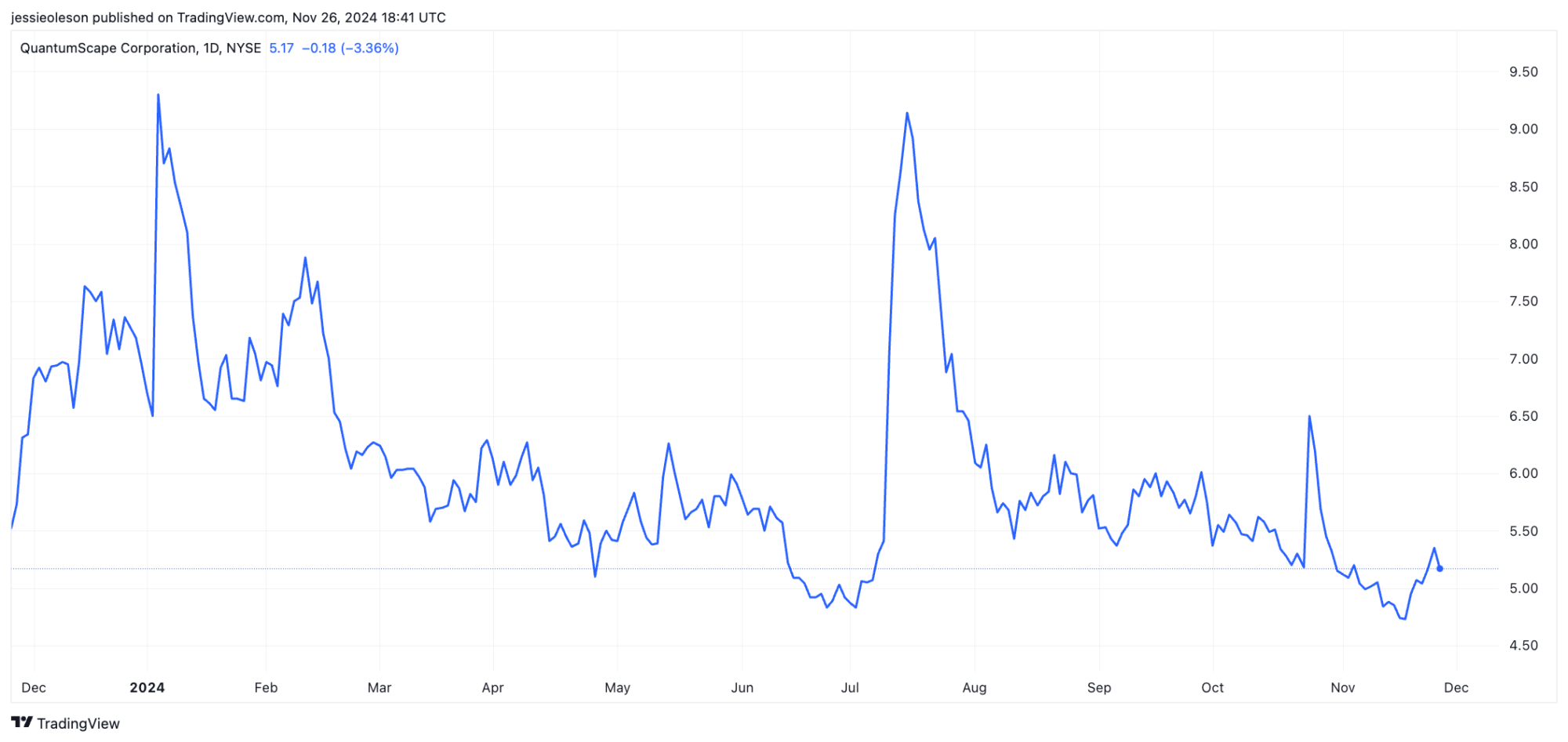

However, the stock had a big surge in July after QuantumScape signed an agreement with Volkswagen’s battery subsidiary, PowerCo.

They’ll be granting PowerCo the license to mass-produce battery cells using QuantumScape’s technology, subject to “technical progress and royalty payments.”

Here’s the 6-month chart (courtesy TradingView) to illustrate:

The surge has clearly cooled off, but it does indicate that there’s some confidence for QS’s battery tech and the fact that Volkswagen was its first official customer. The deal announcement didn’t include any figures, but it’s likely QuantumScape finally starts earning revenue off of this deal.

Needless to say, this is another small, very speculative company.

5. Arcadium Lithium Plc (NYSE: ALTM)

I covered smaller, more speculative battery companies, but some investors might be interested in smaller, more speculative pure-play lithium miners too.

Arcadium Lithium Plc (NYSE: ALTM) operates as a lithium chemicals production company. It engages in lithium production process including hard-rock mining, conventional pond based brine extraction, direct lithium brine extraction (DLE) and lithium chemicals manufacturing.

ALTM is unique because it’s solely focused on lithium (it’s not a diversified miner/producer of other commodities like ALB or SQM). This is likely why it’s the top holding of BlackRock’s lithium ETF.

ALTM is also trading cheap on a price-to-book metric, at just 0.64x book value. Arcadium’s development and expansion of its low-cost resources should create value as the company is among the lowest-cost producers globally, well below the marginal cost of production.

6-8: Lithium ETFs

Not interested in individual stocks? Lithium ETFs are another option, and many of them include some stocks above as top holdings.

Note: The broker we mentioned above — moomoo — also supports ETF investing.

6. iShares Lithium Miners and Producers ETF (NASDAQ: ILIT)

ILIT is passively managed by BlackRock (NASDAQ: BLK), providing exposure to the lithium industry by investing in stocks of lithium miners and compound manufacturers from all around the world. This was just launched about a year ago, so has just $2.6M under management.

Top holdings:

- Arcadium Lithium – 8.93%

- Sociedad Quimica y Minera – 8.57%

- Pilbara Minerals Ltd – 8.09%

- Albemarle ALB – 7.92%

- Cosmo Advanced Materials & Technology Co – 6.63%

7. Global X Lithium & Battery Tech ETF (NYSEARCA: LIT)

LIT, managed by Global X, tracks a market-cap-weighted index of global lithium miners and battery producers. It currently has $1.28B in assets under management.

Top holdings:

- Albemarle 8.87%

- Tesla 6.40%

- TDK Corp 6.05%

- Mineral Resources 4.97%

- BYD Co Ltd Class 4.92%

8. Sprott Lithium Miners ETF (NASDAQ: LITP)

Sprott is well regarded in the finance space for their commodity and precious metal products. Their fund LITP aims to support the worldwide clean energy transition by tracking an index of global companies in the lithium industry.

Securities are selected based on revenue and weighted by market-cap.

Top holdings:

- Sociedad Quimica y Minera 10.57%

- Arcadium Lithium 10.02%

- IGO LtdIGO 10.00%

- Pilbara Minerals LtdPLS 9.62%

- Albemarle 9.35%

9 & 10: EV Companies

A quick side note: you may have noticed Tesla (NASDAQ: TSLA) and BYD Company (OTCMKTS: BYDDY) listed as top holdings in the Global X Lithium & Battery Tech ETF (NYSEARCA: LIT) above.

These aren’t typically thought of as lithium companies, but maybe they should be.

9. BYD Company (OTCMKTS: BYDDY)

This is the world’s leading producer of rechargeable batteries: NiMH batteries, Lithium-ion batteries and NCM batteries. They own the complete supply chain layout from mineral battery cells to battery packs.

10. Tesla (NASDAQ: TSLA)

Tesla makes their own batteries using proprietary technology. Musk also called lithium refining a “license to print money,” and put his money where his mouth is.

Tesla now owns a lithium refining plant that produces enough lithium hydroxide for more than 1 million EVs per year, making it the largest lithium production facility in North America. So if you’ve wondered how to invest in lithium refining stocks, Tesla is definitely one to consider.

While they weren’t included on the lithium stocks list above, the two companies offer alternative, diversified ways to get exposure to the lithium market.

11-13: Pre-IPO Lithium Companies

If you’re an accredited investor, you can gain access to select lithium companies before they IPO.

Hiive is a marketplace that connects accredited investors with shareholders of pre-IPO, VC-backed companies who want to sell their shares.

Right now, Hiive has a handful of exciting lithium companies among its offerings. Here’s a quick review of each; click the company name links to find out more.

How does one go about buying a share in a privately-held company? You have to be an accredited investor, which means either having a certain level of annual income ($200,000 or $300,000 if filing jointly), a certain level of net worth (over $1 million excluding your primary residence), or a FINRA series 7, 65, or 82 license.

11. Group14 Technologies

Group14 Technologies is at the forefront of advanced silicon battery technology. They’re one of the largest commercial manufacturers and suppliers in the world; according to the company website, they are currently collaborating with customers responsible for 95% of global battery production.

Currently, Group14 is headquartered in Woodinville, WA, and operates a joint venture in South Korea — but it has plans to establish new factories worldwide, and its Battery Active Material (BAM) facilities are designed to meet the growing global demand for silicon battery materials.

It was last valued at $3.21 billion in December 2022.

12. Sunwoda

Sunwoda specializes in the research, development, and manufacturing of lithium-ion batteries, particularly for automobiles.

Headquartered in Shenzhen, China, Sunwoda operates state-of-the-art production facilities and maintains a robust global presence. Sunwoda was last valued at $5 billion in June 2023.

13. ProLogium

ProLogium is a pioneering company in the field of lithium battery technology, founded in 2006 and headquartered in Taipei, Taiwan.

Specializing in the development and manufacturing of next-generation solid-state lithium batteries, ProLogium is dedicated to advancing energy storage solutions for a variety of applications, including electric vehicles, consumer electronics, and grid storage. ProLogium was last valued at $2.5 billion in December 2022.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. WallStreetZen is not a broker dealer or investment adviser. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investment involves risk, including the loss of principal and past performance does not guarantee future results. There is no guarantee that any statements or opinions provided herein will prove to be correct. WallStreetZen may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and member of FINRA / SIPC. Find Hiive on BrokerCheck.

Why Invest in Lithium?

Not sold on lithium as an investment? It’s worth heeding the words of one of the companies mentioned earlier.

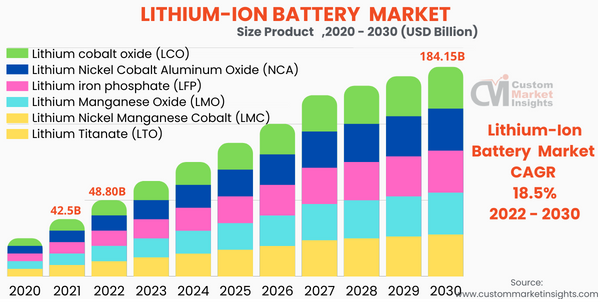

Albemarle management are very optimistic about the long-term demand for lithium. The company expects a significant growth trajectory, with a projected 2.5x growth in lithium demand from 2024 to 2030.

Other sources estimate the lithium-ion battery market itself will grow at impressive double-digit CAGRs (18.5%) into the end of the decade:

Statista is also calling for Global lithium demand to double between 2025 and 2030, and in 2035, lithium demand in forecast to surpass 3.8 million tons.

In short, lithium is a key component for the energy transition and electrification trend, and all the major forecasts bear that out.

Final Word: Lithium Investing

Lithium is a must-have commodity for the EV transition and electrification of the world. There are many ways to invest, from speculative lithium battery stocks to big diversified miners, and even the top EV manufacturers.

Of course, for those of us who don’t pick stocks, ETFs may offer another compelling option.

Either way, there are many ways to get exposure to this exciting long-term investment trend.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate. The experiences of the influencer may not be representative of the experiences of other moomoo users. Any comments or opinions provided are their own and not necessarily the views of MFI, MTI or moomoo. Moomoo and its affiliates do not endorse any strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation of a security or to engage in any investment strategy. Investing involves risk and the potential to lose principal. Investment and financial decisions should be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any images shown are strictly for illustrative purposes. Past performance does not guarantee future results. U.S. residents trading in U.S. securities may trade commission-free using the moomoo app through Moomoo Financial Inc. (MFI). Please see our pricing page for other fees. Level 2 data is free to moomoo users that have an approved MFI brokerage account. Trading during Extended Hours Trading Sessions carries unique risks, such as greater price volatility, lower liquidity, wider bid/ask spreads, and less market visibility, and may not be appropriate for all investors.

FAQs:

Can I buy lithium as an investment?

Yes, you can invest in lithium by purchasing lithium stocks, lithium refining stocks, or lithium mining stocks. To learn more about how to invest in lithium, check out our detailed guide above.

What is the best lithium stock to buy?

One of the best lithium stocks to consider is Sociedad Química y Minera de Chile (NYSE: SQM), known for its strong fundamentals and high growth potential. It's featured prominently on our lithium stocks list for its exceptional value and profitability.

Is lithium still a good investment?

Yes, lithium remains a good investment due to the increasing demand from the electric vehicle and renewable energy sectors. Investing in top lithium stocks can offer significant growth opportunities as global lithium demand continues to rise.

Where does Tesla get its lithium?

Tesla sources its lithium from various suppliers, including its own lithium refining plant, which is the largest in North America. This facility helps Tesla produce enough lithium hydroxide for over 1 million EVs annually, making it a key player in the lithium refining stocks market.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.