Natron Energy is not publicly traded.

Hiive is a marketplace that connects accredited investors with shareholders of pre-IPO, VC-backed companies like Natron Energy who want to sell their shares.

Sign up with Hiive here and get access to Natron Energy before its IPO.

Lithium is the life force of eco-friendly energy, right?

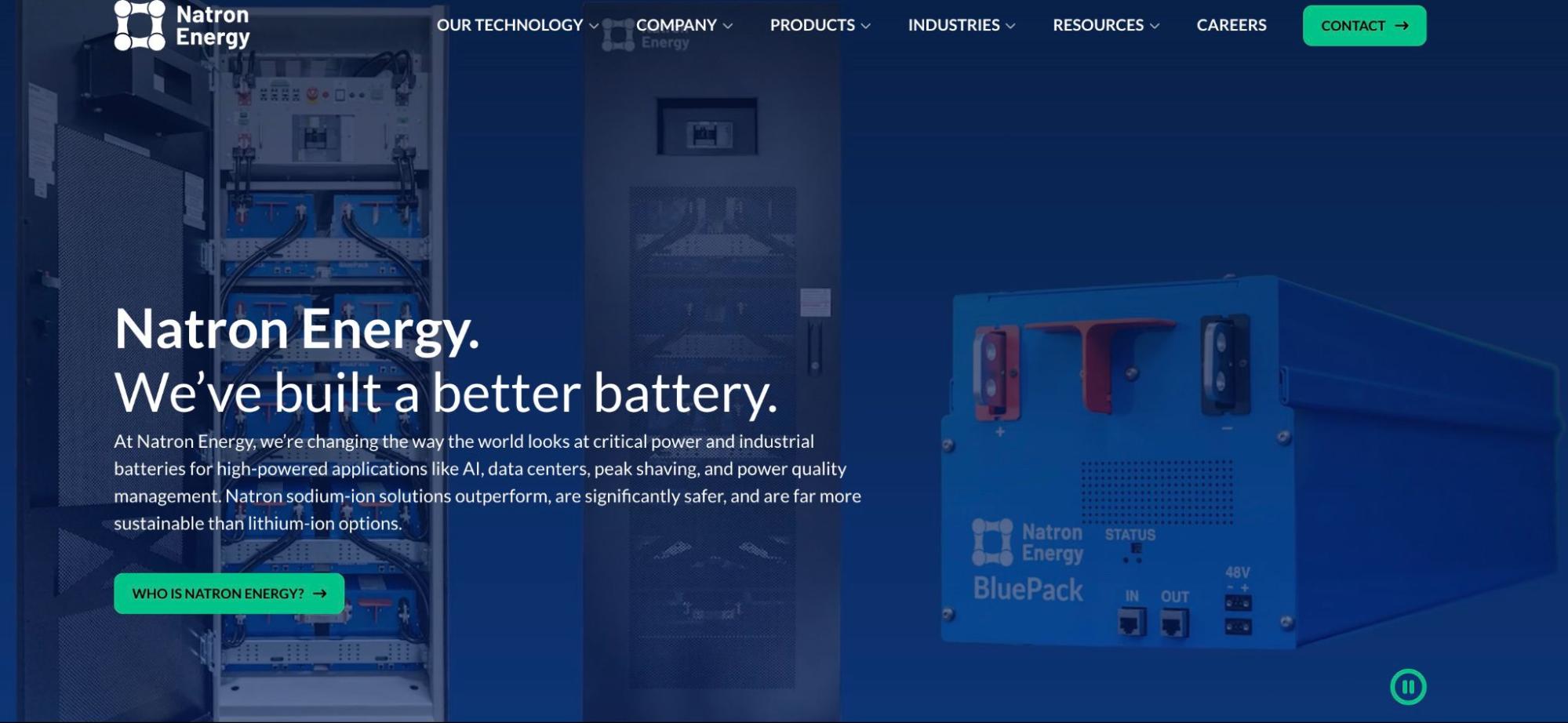

While there’s no denying the surging appetite for lithium-ion batteries, some companies believe they’ve found a better way to energize the globe.

For example, the company Natron Energy stakes its reputation on swapping lithium for sodium — and some pretty big investors are already thirsty for exposure.

Learn the full scoop on this sodium-ion superstar and how to invest in Natron Energy.

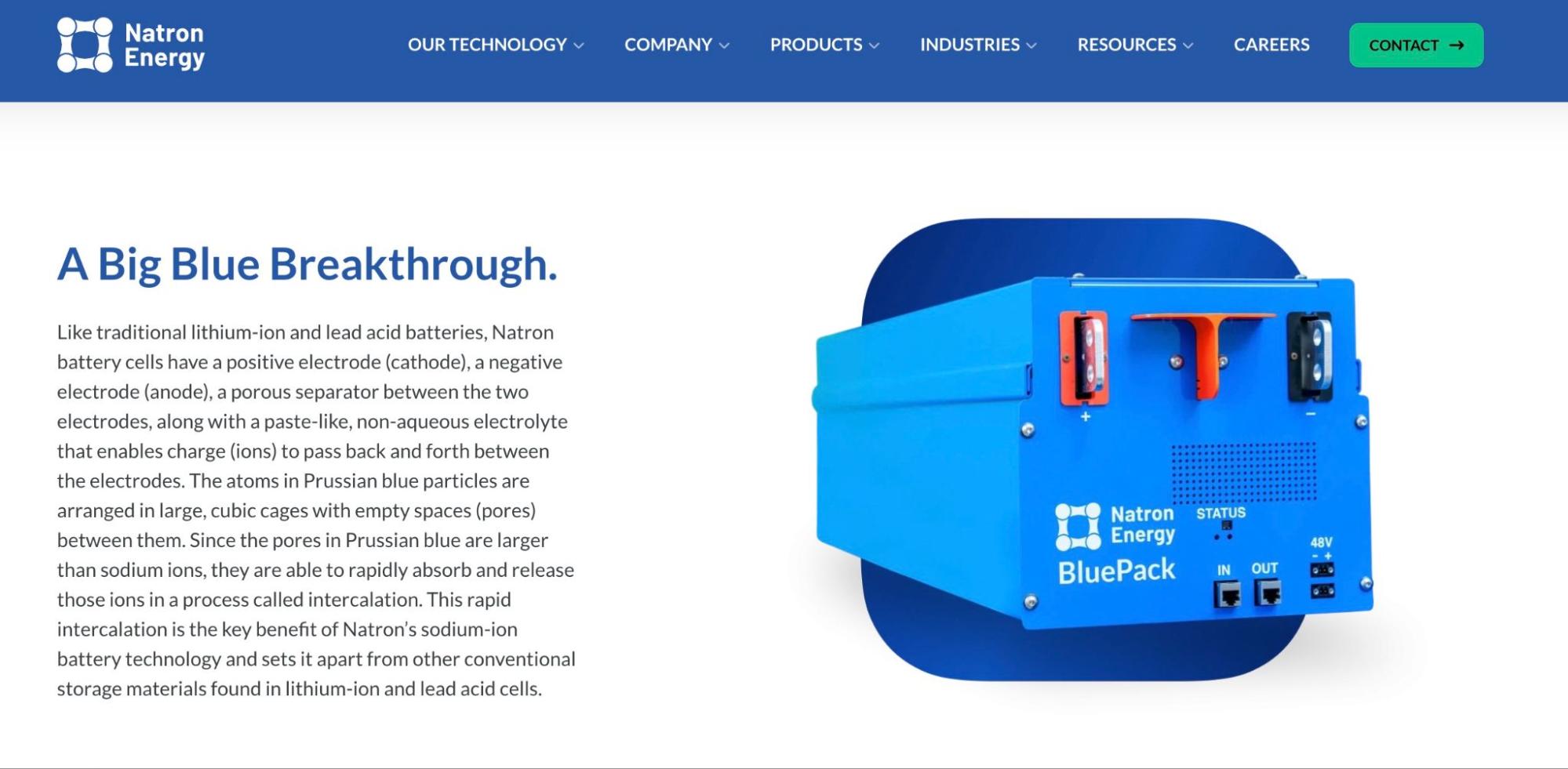

What is Natron Energy?

As with many stories of scrappy California startups, Natron Energy began in a garage.

Stanford grad Colin Wessells perfected his sodium-ion battery solution in a Palo Alto private residence before pushing forward with mass production.

From Natron Energy’s humble beginnings in 2012, sodium-ion batteries have only become a more attractive option for many applications (e.g., data centers, forklifts, and EV charging stations) thanks to their eco-friendly status.

Not only is sodium more abundant than lithium, but sodium-ion batteries appear to offer fast charging capabilities and a solid safety profile.

Natron Energy now boasts a large sodium-ion manufacturing plant in Holland, Michigan, and it has UL 1973 status to sell their batteries to a wide range of clients.

The specifics of Natron Energy’s valuation are under wraps, but some reports suggest it could be worth between $750 million to $1.1 billion.

Can You Buy Natron Energy Stock? Is Natron Energy Publicly Traded?

Natron Energy remains a private company, so there’s no way for retail investors to buy Natron Energy stock.

However, some investors can nibble on Natron Energy shares.

If you have accredited investor status, you can seize a slice of this sodium-ion stock.

How to Buy Natron Energy as an Accredited Investor

Natron Energy is not publicly traded, but accredited investors can invest in private companies like Natron Energy through the pre-IPO platform Hiive.

Hiive is a marketplace that connects shareholders of private, VC-backed companies who want to sell their pre-IPO shares to accredited investors.

With no buying fees, the ability to negotiate, and a robust marketplace with thousands of companies, Hiive is a great way to invest in companies before they IPO.

Sign up with Hiive, check out Natron Energy, add it to your watchlist, and get notified about any new listings and trades.

How to Buy Natron Energy as a Retail Investor

Don’t bother searching for the Natron Energy stock price because it doesn’t exist yet.

Unless the company’s leadership decides to go IPO, Natron Energy stock isn’t available for retail investors. However, there may still be ways to gain exposure. But to understand the approaches we discuss below, it’s important to know a few things first…

Who owns Natron Energy?

While we don’t know the exact breakdown of share ownership at Natron Energy, founder and CEO Colin Wessells likely has the majority stake.

Natron Energy also lists some of the most prominent investors in its brand, each of whom likely has a lot of Natron Energy stock.

Just a few companies and firms invested in Natron Energy include:

Does Chevron Own Natron Energy?

It may seem odd for one of the biggest names in Big Oil to partner with a supposed “rival” energy brand.

Despite Chevron’s (NYSE: CVX) fame in fossil fuels, it has been making an effort to diversify its energy portfolio and prepare for a “greener” future.

This pivot to eco-friendly energy sources is the main reason Chevron formed a partnership with Natron Energy.

Specifically, Chevron wants to incorporate Natron Energy’s sodium-ion batteries into electric vehicle charging stations.

Although this partnership is a big deal for Natron Energy, it doesn’t make this brand a subsidiary of Chevron.

Instead, it’s most likely Chevron has a fair stake in Natron Energy stock.

Alternatives to Natron Energy for Retail Investors

Looking for how to invest in Natron Energy? Unfortunately, there’s no way for retail investors to get a piece of this sodium-ion battery maker.

But don’t get too “salty!” There are a few alternative ways to get indirect exposure to Natron Energy stock.

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

Investing in strategic partners is one possible way to get close to Natron Energy’s business.

Although the Natron Energy stake won’t move the needle for companies like United Airlines (NASDAQ: UAL) and Chevron (NYSE: CVX), they are some of the biggest backers of this sodium-ion battery maker.

If you want more general exposure to Natron Energy’s business sector, look for companies that benefit from its sodium-ion technology.

For example, the EV manufacturer Tesla (NASDAQ: TSLA) might be interested in Natron Energy’s offerings both for its EV charging ports and energy storage facilities.

Other EV rivals, such as Rivian (NASDAQ: RIVN) and Nio (NASDAQ: NIO) might be worth a look for similar reasons.

Other companies involved in alternative energy, grid storage, or competing lithium batteries, such as Enphase Energy (NASDAQ: ENPH) or Albemarle (NYSE: ALB), are also potential ways to enter Natron Energy’s business segment.

How to Buy the Natron Energy IPO

Here are the steps on how to buy Natron Energy stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Natron Energy

- Select how many shares you want to buy

- Place your order

- Monitor your trade

Natron Energy Stock Price Chart

There’s no Natron Energy stock price chart or Natron Energy stock symbol because this company is private.

The only way to get a sense of Natron Energy’s current value is to follow news on the latest funding rounds and examine activity on the pre-IPO platform Hiive.

Retail traders could also monitor stocks and ETFs in industries like alternative energy, lithium-ion batteries, and EVs to get an overview of how Natron Energy’s business segment is doing.

Conclusion

Retail investors excited about Natron Energy’s prospects can’t invest in this company just yet.

At the time of writing, only accredited investors can put their money into this company via Hiive.

Otherwise, there are publicly-traded companies that hold Natron Energy stock, as well as competing companies or broad ETFs in Natron Energy’s target sector.

Until Natron Energy goes IPO, retail investors must find other ways to get involved in the sodium-ion battery business.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How can I buy Natron Energy stock?

Only accredited investors could buy Natron Energy stock on the pre-IPO platform Hiive. For retail investors looking into how to buy Natron Energy stock, they'll need to focus on publicly-traded companies similar to this business.

How much is Natron Energy stock?

We don't know the Natron Energy stock price because it's not publicly traded.

What is the Natron Energy stock symbol?

A Natron Energy stock symbol doesn't exist because this company isn't on the public market. We'll only see a Natron Energy stock price chart if the company lists IPO.

Who owns Natron Energy stock?

Natron Energy's founder and CEO, Colin Wessells, probably owns a lot of stock, but other companies and investment firms have stakes in this brand. A few big names tied to Natron Energy's success include United Airlines, Chevron, and Nabors Industries.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.