The Boring Company is not publicly traded, but accredited investors can still buy its stock.

Hiive is a marketplace where accredited investors can buy shares of private companies before they go public.

Sign up with Hiive and get access to The Boring Company stock before its IPO.

The Boring Company, founded in 2016 by Elon Musk, has garnered significant attention for its ambitious mission to revolutionize urban transportation. By creating underground transportation networks, it aims to help alleviate traffic in major cities and improve overall transit efficiency.

Unsurprisingly, this innovative approach has sparked considerable interest among investors looking to capitalize on the potential of this futuristic endeavor.

So, how do you invest in The Boring Company?

The Boring Company: The Basics

While Elon Musk’s projects extend to the cosmos with ventures like SpaceX, The Boring Company stays closer to the Earth’s surface – or rather, below the Earth’s surface.

The Boring Company focuses on solving more terrestrial problems, like urban congestion and inefficient transportation systems.

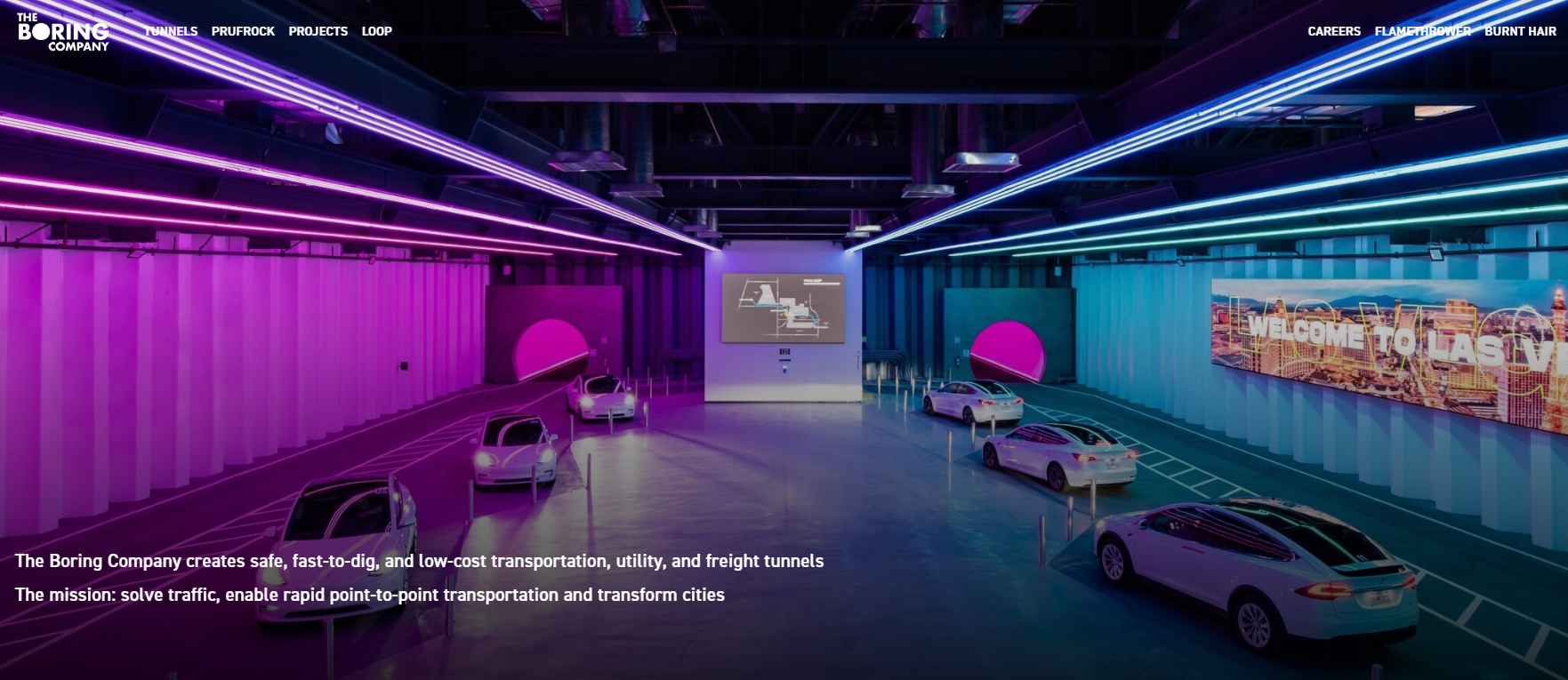

For instance, in Nevada, it successfully constructed the Las Vegas Convention Center Loop, a 1.7-mile underground transportation system designed to efficiently shuttle passengers across the sprawling convention center campus.

The project demonstrates the company’s potential to develop innovative solutions for city traffic and sets the stage for more extensive networks in the future.

Can You Buy The Boring Company Stock? Is The Boring Company Publicly Traded?

One of the most pressing questions potential investors ask is whether The Boring Company is publicly traded and if they can buy its stock. Currently, The Boring Company is not publicly traded, meaning its stock is unavailable on major exchanges like the NYSE or NASDAQ.

The fact that The Boring Company remains privately held is not unusual for startups in their development’s early or mid stages. Many high-growth companies remain private to maintain greater control over their operations and strategic direction.

This status allows them to focus on long-term goals without the pressures of quarterly earnings reports and shareholder expectations that publicly traded companies face.

Fortunately, even as a private company, some individuals still have an opportunity to invest.

How to Buy The Boring Company as an Accredited Investor

For accredited investors, platforms are available that facilitate investments in privately held companies like The Boring Company. One of our favorite platforms for such investments is Hiive.

Hiive is an investment platform that connects shareholders of private, VC-backed companies with accredited buyers. There are over 2,000 pre-IPO companies available on Hiive, including Discord, Groq, and The Boring Company:

If you sign up for Hiive, you can get notified if and when offers become available. Each listing is created by a seller who sets their own asking prices and the quantity of shares offered. Sellers are typically current or former employees, but could also be angel investors or venture capital firms.

Buyers can place bids and negotiate directly with the sellers, or accept an asking price as listed.

Register for Hiive and see the complete order book for The Boring Company (including all asking prices, bids, and most recent transactions)

Another avenue for accredited investors is to participate in private equity funds that have invested in The Boring Company. These funds pool resources from multiple investors to invest in private companies, offering a way to gain indirect exposure to The Boring Company’s growth and potential.

Of course, with funds, this often means you’ll be investing in other startups as well, for better or worse. If you want singular and direct exposure to The Boring Company, Hiive might be your best option.

How to Buy The Boring Company as a Retail Investor

Unfortunately, retail investors cannot directly purchase The Boring Company stock at this time.

However, there are alternative ways for retail investors to gain exposure to the innovative transportation sector and companies with similar visionary goals.

Here are a few things to consider before looking for alternative ways to invest in The Boring Company:

Who Owns The Boring Company?

The Boring Company is primarily owned by its founder, Elon Musk, who holds a significant majority stake. Additionally, the company has attracted investments from various venture capital firms and private investors, contributing to its growth and development.

The Boring Company has seen numerous notable investors back the company since its founding, including:

- Vy Capital

- Sequoia Capital

- Valor Equity Partners

- Founders Fund

- 8VC

- Craft Ventures

- DFJ

- Brookfield

- Lennar

- Tishman Speyer

- Dacra

Does Jeff Bezos Own The Boring Company?

No, Jeff Bezos does not own The Boring Company. The company is exclusively owned and operated by Elon Musk and his team.

Jeff Bezos, the founder of Amazon and Blue Origin, is focused on his own ventures, which include space exploration and e-commerce. While both Musk and Bezos share an interest in futuristic technologies, they operate separate companies with distinct missions.

The rivalry between Musk and Bezos, particularly in the space exploration domain with SpaceX and Blue Origin, respectively, adds an interesting dynamic to their respective endeavors.

However, in the context of urban transportation and tunneling, Musk remains the sole high-profile visionary behind The Boring Company.

Of course, if you’re team Bezos, Hiive also offers potential exposure to Blue Origin for qualifying investors.

How to Invest in The Boring Company Stock as a Retail Investor

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

Although retail investors cannot directly invest in The Boring Company stock, they can consider investing in publicly traded companies operating in similar industries or gaining exposure to other businesses managed by the same leadership (e.g., Elon Musk).

Here are some notable alternatives:

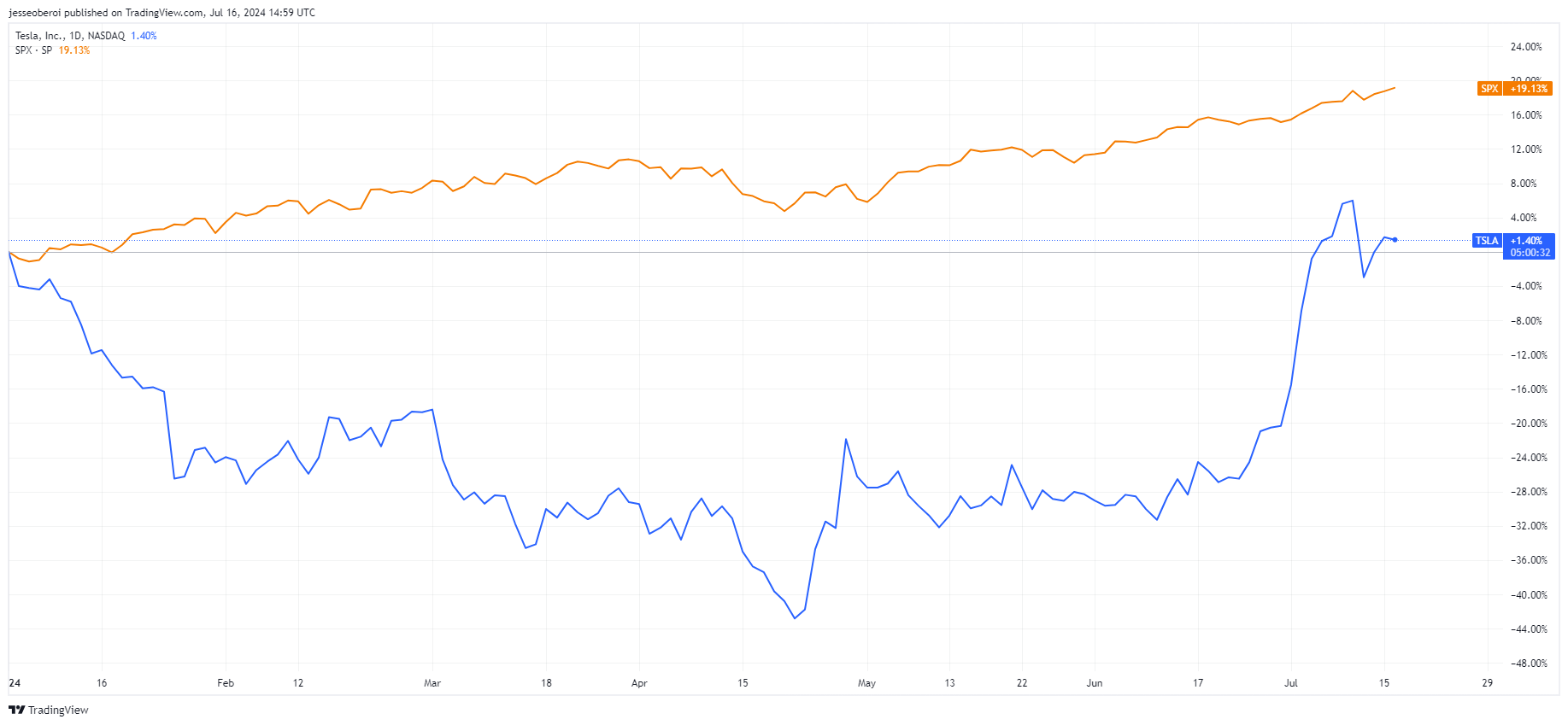

Tesla, Inc. (NASDAQ: TSLA): Some people are less interested in The Boring Company specifically and just want exposure to Elon Musk more generally. As a result, purchasing Tesla shares can expose you to Musk’s ambitious brain without needing accreditation.

Moreover, Tesla focuses on electric vehicles and renewable energy solutions, aligning with The Boring Company’s vision of sustainable transportation.

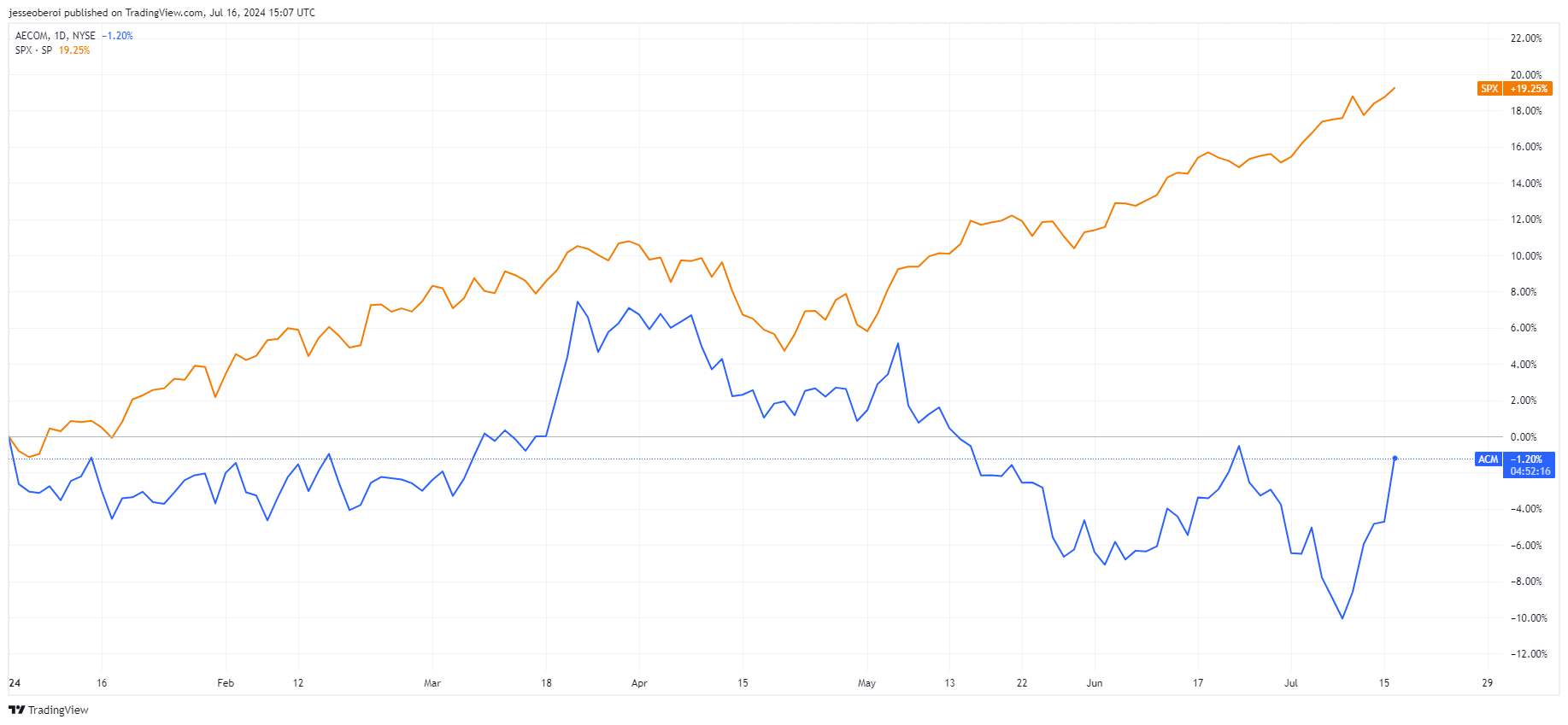

AECOM (NYSE: ACM): Are you looking for something more explicitly similar to The Boring Company? While you might not find an exact replacement, AECOM could be a reasonable alternative.

AECOM is a global infrastructure firm providing design, consulting, construction, and management services to various industries, including transportation and infrastructure projects.

Fluor Corporation (NYSE: FLR): A multinational engineering and construction firm that provides services in infrastructure development, including large-scale tunneling and transportation projects.

ACM and FLR can provide exposure to the broader trends that The Boring Company aims to influence, such as reducing urban congestion and promoting sustainable transit solutions. Alternatively, shares of TSLA can deliver exposure to the same minds behind The Boring Company.

How to Buy The Boring Company IPO

Here are the steps on how to buy The Boring Company stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for The Boring Company

- Select how many shares you want to buy

- Place your order

- Monitor your trade

The Boring Company Stock Price Chart

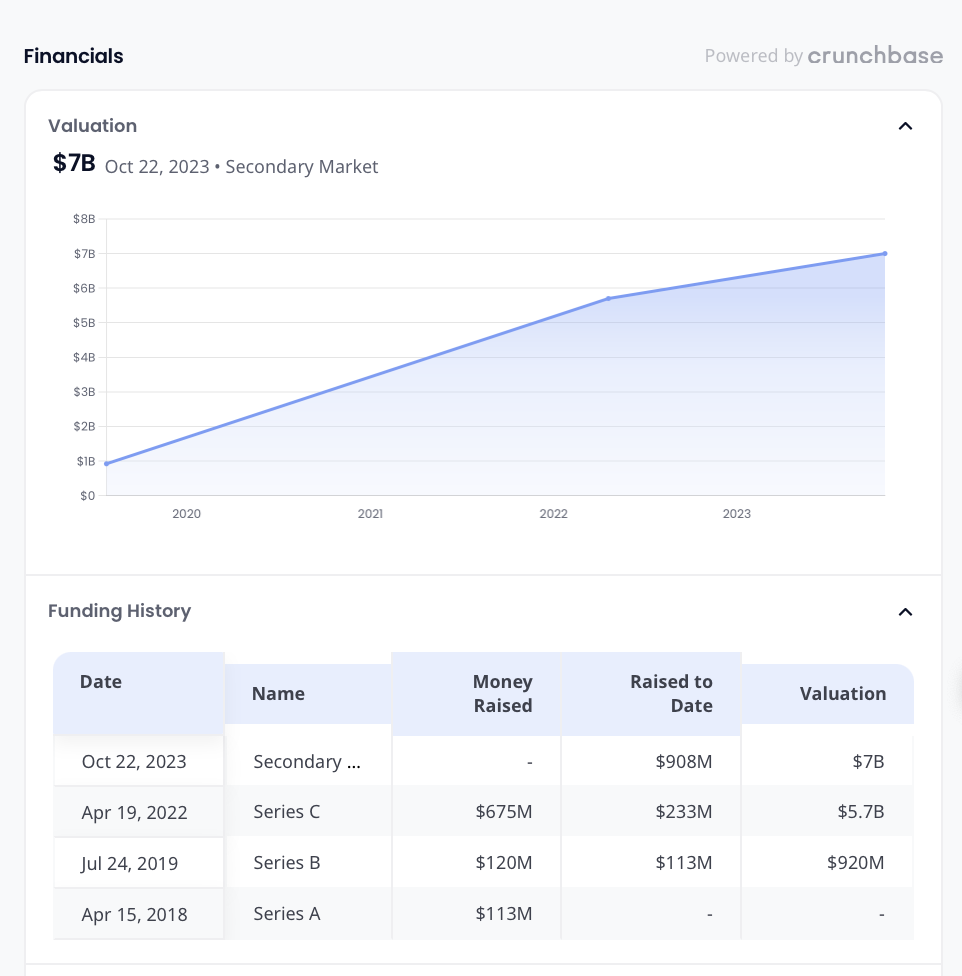

While there is no publicly available stock chart for The Boring Company, you can see its current aggregate pricing information on Hiive:

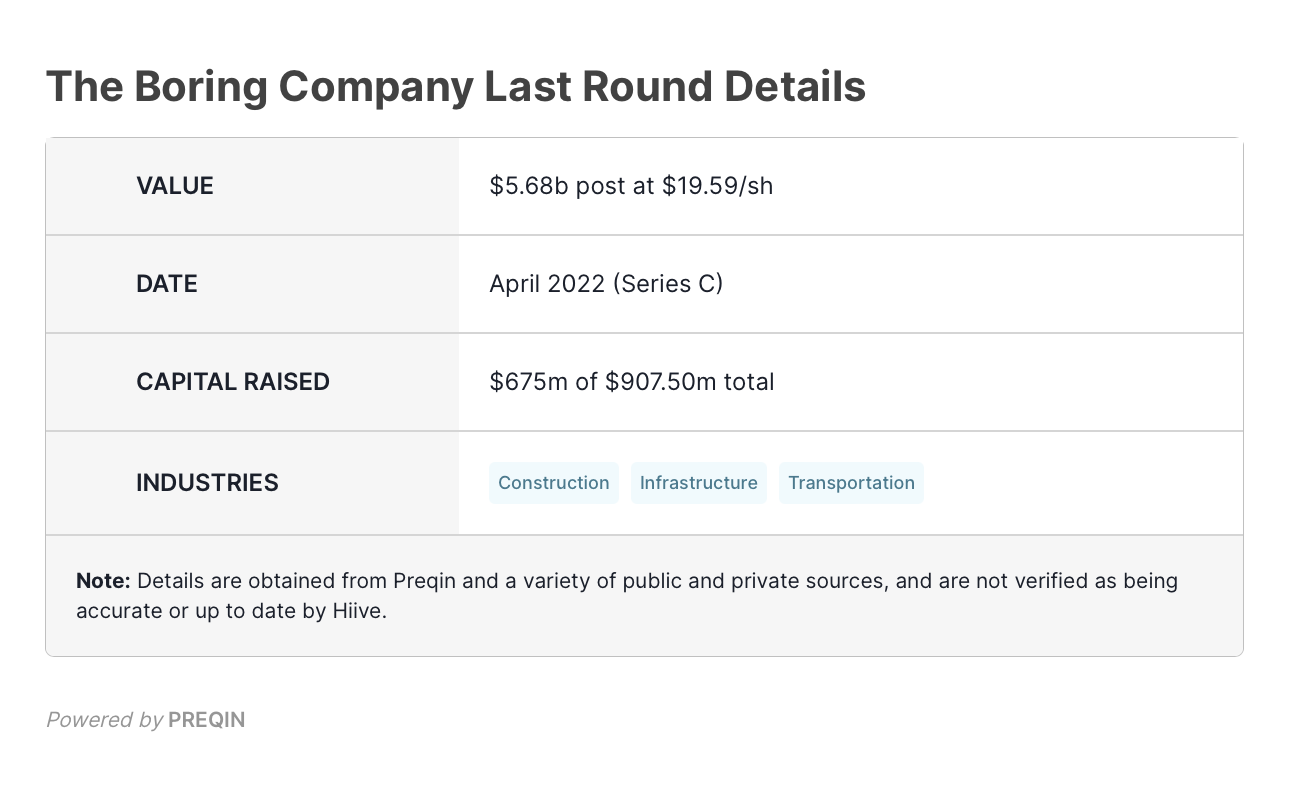

That’s not the only way you can get an idea of its growth. You can also check out data from its last funding round:

Conclusion

The Boring Company represents a bold vision for the future of urban transportation, driven by the innovative mindset of Elon Musk. While the company is not yet publicly traded, accredited investors have unique opportunities to gain early access through platforms like Hiive.

For retail investors, alternative avenues, such as investing in publicly traded companies with similar missions or strong ties to Musk’s other ventures, like Tesla, provide other potential opportunities.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How to buy The Boring Company stock?

Currently, The Boring Company stock is not available for purchase by retail investors as it is not publicly traded. Accredited investors can explore platforms like Hiive to invest in The Boring Company stock.

How much is The Boring Company stock?

Since The Boring Company is not publicly traded, there is no publicly available stock price. The company's valuation is determined by private funding rounds and investments from venture capital firms.

What is The Boring Company stock symbol?

As The Boring Company is not publicly traded, it does not have a stock symbol. Investors interested in the company's stock should monitor it for any announcements regarding a potential IPO in the future.

Who owns The Boring Company stock?

The Boring Company is primarily owned by Elon Musk, with additional investments from venture capital firms and private investors.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.