Sometimes, experience makes all the difference. The Entrust Group isn’t just the leading SDIRA administrator—they’re the originator.

Backed by over 40 years of experience, $5 billion in assets under administration, and 0 hidden fees, it’s clear Entrust has learned from their decades in the industry. They offer cutting-edge tools, support, and flexibility that empowers investors to take complete control of their retirement portfolios.

At Entrust, you can invest in any asset the IRS allows, including real estate, precious metals, private equity, and more. Plus, their client-first approach, award-winning investment portal, and exclusive myDirection Card make for a seamless investment experience.

Learn More About Entrust and download our SDIRA Basics Guide to start learning!

Love the idea of investing in crypto, real estate, or gold, but hate the idea of paying high taxes on your earnings?

A self-directed IRA (SDIRA) account could be a great solution — it lets you invest in alternative assets while enjoying the tax savings of a retirement account.

Most large investment firms don’t carry SDIRA accounts due to their complexity. However, there are a few high-quality platforms that allow you to open an account online and invest while handling all the legal headaches for you.

Looking to find the perfect SDIRA? We’ve reviewed the investment choices, fees, user experience, and customer service options for over a dozen platforms.

Keep reading for the 6 best self-directed IRAs out there, including the best overall pick, the best self-directed IRA for real estate, and more…

The 6 Best Self-Directed IRAs in 2025:

1. The Entrust Group: Best Overall

The Entrust Group is a self-directed IRA provider that has been around for over 40 years and offers access to a large selection of investment options, including private equity, private lending, real estate, precious metals, and more.

The Entrust Group offers “green” and socially conscious investment opportunities in their self-directed IRAs.

Main Features:

- Invest in any asset allowed by the IRS within your IRA

- Supports traditional and Roth IRAs, business IRAs, 401(k) accounts, and even HSA or ESA investing

- Exclusive investment marketplace to find private deals and opportunities

- ESG and “green” investing options

- Create your own LLC and have a checkbook-controlled account

What We Like About The Entrust Group

The Entrust Group is a more sophisticated SDIRA provider, allowing you to invest in whatever you choose (within IRS guidelines).

They offer a well-designed investor portal, and the marketplace offers access to dozens of exclusive private equity investments, including many companies that follow “green” initiatives or have a high ESG rating.

You can open an SDIRA and coordinate with Entrust every time you want to make a major transaction, or you could set up an IRA LLC and gain checkbook control, making all transactions by yourself.Overall, their platform offers great flexibility and class-leading client support.

Fees & Commissions

First, there’s a $50 fee for establishing your self-directed IRA account. Then, recordkeeping fees are charged in one of two ways:

- Under $50,000: An annual fee of $199 (single asset) or $299 (two or more assets) is assessed for account management.

- Over $50,000: In addition to an annual fee of $199 or $299, there is an assets-under-management (AUM) fee of 0.15% of the total asset value over $50,000* (excl. cash) charged.

There are also fees for buying and selling certain assets. The full fee schedule can be found here.

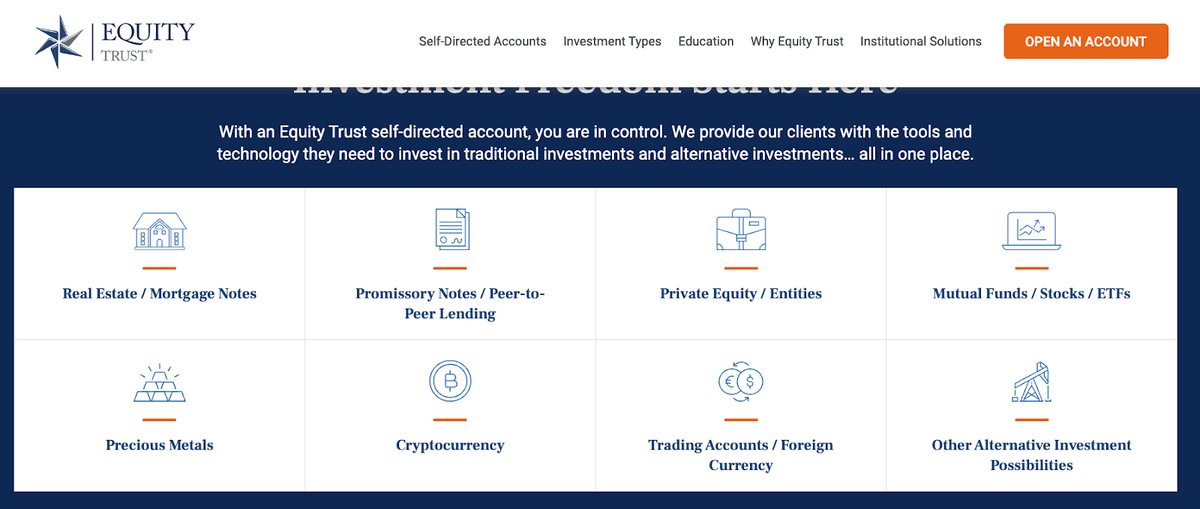

2. Equity Trust: Another Solid Pick

Equity Trust is one of the best self-directed IRAs out there. It’s a long-standing self-directed IRA (SDIRA) company that offers simple account setup and access to a dozen asset classes to invest in.

Equity Trust lets you invest in traditional investment choices, such as stocks, ETFs, bonds, and mutual funds. But you can also invest in:

- Precious metals

- Real estate

- Cryptocurrency

- Private equity deals

- And more

Main Features:

- 12 different asset classes

- IRA, 401(k), or HSA account types

- User education library with live events

- No transaction fees (other fees apply)

- $39 billion in assets under custody; over 200,000 customers

What We Like About Equity Trust

Equity Trust has been around since 1974, and continually evolves to support the latest in alternative investment opportunities.

Its dashboard allows you to view your entire portfolio across all investments, giving you insights into your returns and portfolio allocation.

While Equity Trust does have an annual fee and setup fee, the fact that you can trade within the account with no transaction fees is a huge plus. And Equity Trust has a huge range of account types available, including IRA, 401(k), HSA, and more.

Equity Trust also has stellar customer service, with over 400 account specialists to help you with transactions, investments, and account setup.

Fees & Commissions

Here are the self-directed IRA Equity Trust fees:

One-Time Fees:

- One-time setup fee of $50 for online applications ($75 for paper applications)

- Fees apply for services such as certified checks, expedited processing, and paper bill pay.

Ongoing Fees:

- Annual fee based on account size ($225 per year for accounts up to $14,999; up to $2,250 per year for accounts over $2 million.)

Account Closure Fees:

- $100 per asset termination fee

- Or a $250 full account closure fee.

- To transfer funds after account closure, there is a $100 per asset distribution fee.

2. Alto: Best for Low Fees

Alto is a low-cost self-directed IRA that offers both a traditional self-directed IRA and a crypto IRA with very low fees and access to a wide range of investment options.

Alto IRA launched in 2018 with a focus on streamlining the process of investing in alternative assets easily by partnering with outside investment platforms.

Main Features:

- Access to 15 alternative assets investment partners

- No account setup or funding fees

- Supports multiple types of IRAs

- Partner with other investors to fund an investment

- Both accredited and non-accredited investments available

- Investing in 10 different asset classes

What We Like About Alto

Alto makes it easier to invest in alternative assets by partnering with top investment platforms instead of trying to create everything on their own.

The account setup process is easy, and there are no additional fees to get started. Not only is it one of the best self-directed IRAs, but it’s the best low-cost self-directed IRA around.

Alto also offers several different types of assets to invest in, including art, crypto funds, farmland, infrastructure, venture capital, and more.

Alto’s robust partner network includes:

While some of the partner platforms require accreditation ($200,000 income or $1 million net worth), most allow all investors and have a low minimum investment (under $1,000). Plus, you don’t have to create an account at each partner platform.

Fees & Commissions

Alto is the best self-directed IRA company on our list for low fees. Here’s why:

Starter account fees:

- For $10 per month, you get access to all investment partners with opportunities that have at least 25 other Alto investors involved.

- $10 per investment fee

Pro account fees:

- For $25 per month, you can choose any investment you wish without the 25-person limit.

- $10 per investment fee

- Access to private investments that carry a $75 fee.

Account closure fees:

- $50 fee to close your account

- $25 for an outbound wire to withdraw your assets

3. IRA Financial: Best Checkbook-Controlled SDIRA

IRA Financial offers complete control of your SDIRA, with a checkbook-controlled option that lets you directly invest your IRA funds into hedge funds, private equity, cryptocurrencies, and more.

IRA Financial is a top alternative assets investment platform that offers self-directed IRAs, Solo 401(k)s, and even Rollover Business Startup Solution investing (ROBS).

There is a wide range of assets available, and you can get a fully-controlled IRA within an LLC that lets you write the checks for individual investments.

Main Features:

- Ability to directly invest in assets from an IRA account

- Access to 9 investment partners

- Can open a traditional, Roth, SEP, or SIMPLE IRA

- Mobile app for managing and monitoring your account

- In-house tax and ERISA professionals available to help

- Partnership with Capital One to avoid banking wire and transfer fees

What We Like About IRA Financial

IRA Financial offers a lot of flexibility, straightforward pricing, and the ability to invest your funds directly.

You also get full support from experts on the IRA Financial team, audit support, annual compliance checks, and they handle all IRS reporting.

IRA Financial’s partnerships include:

A direct retail partnership makes it our pick for best self-directed ira for real estate.

You can choose a custodian-based account that allows IRA Financial to handle all the investments for you, along with lower fees. You can also set up a Solo 401(k) account, or ROBS investment account to roll over your IRA into a startup.

Fees & Commissions

Both types of accounts come with fees:

Setup fees:

- Custodian account: no setup fee.

- Checkbook-controlled account: $799 as a one-time fee.

- You can also set up a multiple-member LLC with multiple IRAs for an additional $1,250.

Annual fees: Both accounts charge a $400 annual fee, no matter the size of your account.

5. Rocket Dollar: Best for Flexible Investment Options

Rocket Dollar launched in 2018 to offer alternative investments inside of a retirement account, and now offers dozens of investment choices.

There is no preset list of investments, but you can choose to work with one of the dozens of partners or bring your own deal to the platform to invest in.

Main Features:

- Access to 50+ partner investment platforms

- Supports multiple IRAs and Solo 401(k) accounts

- Documentation and reporting handled by Rocket Dollar

- No account minimums to get started

- Can bring own investments to the platform

What We Like About Rocket Dollar

Rocket Dollar lets you invest in almost anything. With over 50 partners to choose from and the ability to bring your own deals into the account, it is one of the best alternative investment IRA platforms around.

You can invest in assets like cryptocurrency, farmland, commercial real estate, precious metals, art, vintage wine, and more. Plus, the fees are reasonably low and you get prioritized phone and email support for clients on the Gold plan.

Fees & Commissions

Rocket Dollar charges a setup fee and ongoing account fees. Here are the two levels:

Silver Account fees:

- $360 one-time setup fee; $15 per month after that.

This includes no minimum deposit requirements and no-fee cash transfers from external accounts. But you only get email support at this level.

Gold Account fees:

$600 one-time setup fee; $30 per month after that.

The Gold account offers prioritized support via phone or email, four free wire transfers per year, Roth IRA conversion assistance, and a custom name for your IRA LLC.

6. Strata Trust Company: Best for Debt Investments

Strata Trust Company is a wholly-owned subsidiary of Horizon Bank, and offers access to a wide range of investments, including precious metals, real estate, debt investments, and traditional investments.

The platform is one of the best self-directed IRA custodians, meaning they manage all the legal paperwork for your account and execute trades on your behalf. It’s also the best self-directed ira for gold…

Strata Trust Company offers access to traditional investments (stocks, bonds, ETFs), as well as debt instruments, such as structured notes, private debt, and crowdfunding, all inside a tax-protected IRA account.

Main Features:

- Debt investment options available (lend your money for regular income)

- Traditional, Roth, SEP, and SIMPLE IRAs available

- Custodian-based account

- Reasonable annual fees on accounts

- Backed by Horizon Bank

What We Like About Strata Trust Company

With Strata Trust Company, the cash in your account is backed by Horizon Bank.

It’s a straightforward SDIRA with access to a solid list of alternative assets, and probably the best self-directed ira for gold investing because you can take custody of physical gold inside the account.

If you prefer fixed income, there are several debt investments available, including private debt in both corporate and real-estate-focused assets.

Payments from these investments offer dividends or monthly interest payments and are tax-protected in your IRA account.

Fees & Commissions

$50 setup fee and ongoing account fees (depending on the account chosen):

Precious Metals IRA fees:

- $95 fee for the Precious Metals IRA allows you to invest in gold, silver, and other metals.

- $100 fee for co-mingled storage, or a $150 fee for private storage.

- $40 transaction fee for precious metals purchases, sales, or exchanges

Basic IRA fees: The Basic IRA offers access to traditional public investments such as stocks, bonds, REITs, CDs, and more. There is a $125 annual fee for this account. It also lets you invest in precious metals with the same storage and transaction fees listed above.

Flexible IRA fees: The Flexible IRA lets you invest in everything, from precious metals and traditional investments to real estate, private equity, and more.

- $300 annual fee, as well as the same precious metal storage and transaction fees above.

- $150 fee for real estate investments or sales, and $50 for private equity investments.

There are other various fees based on actions taken within the account. The entire fee schedule can be found here.

What is a Self-Directed IRA?

A self-directed IRA account (SDIRA) is a type of retirement account that allows you to invest in non-traditional assets while still benefiting from the tax savings of an IRA. There are two types of SDIRA accounts:

- Custodian accounts. Platforms that offer custodian SDIRA accounts hold your assets in a trust for you within the IRA structure, handling all of the paperwork and compliance needed by the IRS. These accounts require that you work with an account specialist to buy and sell assets.

- Checkbook-controlled accounts. These SDIRA accounts let you control the investments but require that you set up an LLC and handle the legal paperwork needed to stay compliant. These types of accounts are best for more sophisticated investors or those with an investment team.

Modern-Day Alternative Asset Investing

In the past, investing in alternative assets like art or commercial real estate required connections or a huge amount of capital to be able to access certain deals. But alternative asset investing has been modernized with the advent of crowdfunding and online investment platforms that have low minimum investments.

Who Needs a Self-Directed IRA?

A self-directed IRA is best for investors that want to diversify their retirement holding outside of traditional investments, such as stocks, bonds, mutual funds, and ETFs.

Thanks to these modern platforms, you don’t need hundreds of thousands of dollars but can get started with a small amount and invest in assets like real estate, crypto, and farmland within an IRA.

At-a-Glance: Best Self Directed IRAs

- Best Overall: The Entrust Group

- Second Best Overall: Equity Trust

- Best for Low Fees: Alto

- Best for Checkbook-Control: IRA Financial

- Best for Flexible Investment Options: Rocket Dollar

- Best for Debt Investments: Strata Trust Company

Final Word: Best Self Directed IRAs

Opening a self-directed IRA has never been easier than it is right now — it’s all about finding the one that fits your investing style best.

If you’re looking for an all-around winner, check out Equity Trust. It offers a ton of asset types, can handle most retirement account types, and has a vast education library to get you up to speed on alternative asset investing.

But there are plenty of other options out there — companies like IRA Financial and Rocket Dollar give you a slick mobile app for investing on the go, and platforms like Alto offer very low fees for those wanting to avoid unnecessary charges.

FAQs:

Are self-directed IRAs a good idea?

Opening a self-directed IRA account can be a great idea for sophisticated investors looking to diversify their retirement holdings outside of traditional investments. But if you don’t have any expertise or experience investing in real estate, crypto, or other assets, you may want to learn more before opening an SDIRA.

Is Fidelity good for self-directed IRA?

Fidelity doesn’t offer a self-directed IRA account. In fact, most major brokerage firms don’t have SDIRA accounts, as they require complicated paperwork and management. Often, a dedicated SDIRA platform like Equity Trust is the easiest way to open a self-directed IRA account.

What should I invest in self-directed IRA?

You can invest in dozens of different types of assets within a self-directed IRA, such as crypto, precious metals, real estate, promissory notes, private placements, private equity, farmland, commodities, and more. You should only invest in assets that you have a solid understanding of and have researched beforehand.

Does Charles Schwab self-directed IRA?

No, Charles Schwab does not offer a self-directed IRA account. It currently offers Traditional, Roth, Rollover, Inherited, Custodial, SEP, and SIMPLE IRA accounts.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.