What’s the best way to invest $1 million in 2025? Whether you came into an exciting windfall or spent years working and saving to build up a nest egg, once you become a millionaire it can be hard to figure out what to do with all that money.

Your investment objectives should be two-fold:

- Maximize returns

- Protecting your capital

So the question is: How do you invest a million dollars to maximize returns while ensuring the money will be there when you need it?

Stocks and Bonds

According to most financial experts, the best way to invest a million dollars is in diversified low-cost index funds with a mix of stock and bond ETFs.

However, the actual mix of stocks vs bonds you should hold depends on your risk tolerance and financial goals.

Stocks have historically generated higher returns but come with increased risk, whereas bonds have lower volatility and lower returns. A classic stock/bond portfolio has stocks to drive returns over the long term while the bonds provide stability and cash flow over the short term.

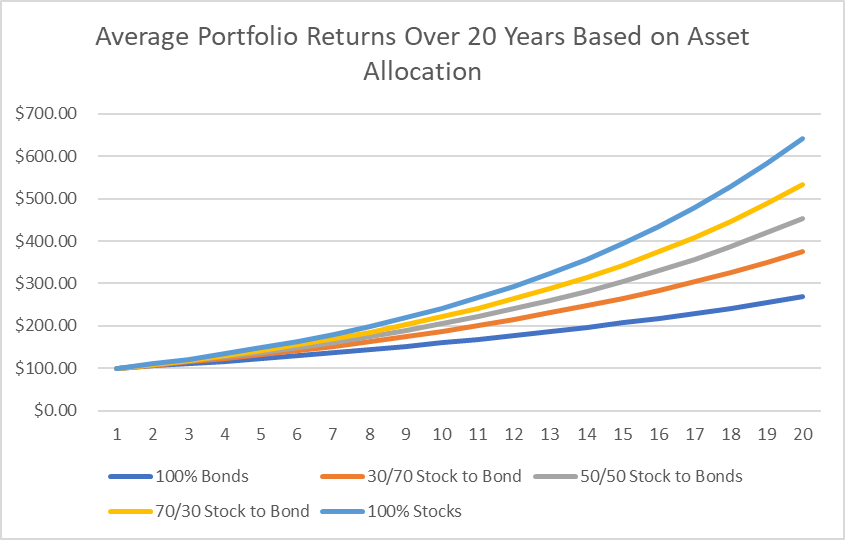

This chart shows the average returns after 20 years, based on asset allocation:

You can see that the 100% stock portfolio generated the highest overall return. However, it was also the most volatile.

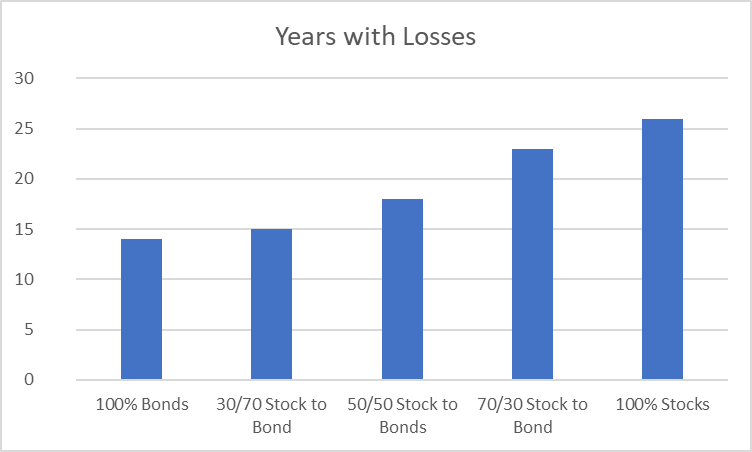

Over the past 94 years, a 100% stock portfolio has seen losses in 26 of them, compared to just 14 years for a 100% bond portfolio.

Additionally, the worst year for stocks saw a loss of 43.13% compared to the worst year for bonds of 8.13%.

Therefore, your risk tolerance and financial goals should drive your approach to asset allocation.

Need help finding high-quality stocks?

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

How to Determine Risk Tolerance

A major factor in determining risk tolerance is your age.

If you’re in your late thirties or early forties, you can weather a few bad years and wait for your 100% stock portfolio to recover over the decades.

But If you’re in your fifties or sixties, you’re probably trying to figure out how to invest a million dollars and live off the interest when you retire in the next few years.

You definitely don’t want to have your portfolio drop 43% in a single year!

Planning out the Best Way to Invest $1,000,000

So how do you figure out the ideal way to balance risk vs reward?

You can use a free retirement calculator to project your portfolio value, based on your age, your risk tolerance, and how much you’re currently saving:

I personally really like Empower’s free retirement planner – its free to use and is helpful for understanding how your investment choices now can impact your investment in 10, 20, 30 or more years. You can try it here and see how your retirement numbers look.

Similar to your risk tolerance, your financial goals play a role in determining the best way to invest a million dollars.

If maximum return is what you want, you’ll need a more aggressive portfolio. If your primary goal is capital preservation, you’ll want to take a safer approach.

Below, we’ll break down the best options for both types of investors.

How to Invest a Million Dollars:

1. High-End Art (Masterworks)

- Risk level: Medium-High

- How much to invest: $50,000

According to experts, high-end art may be one of the best investments in 2025.

Some experts say investors will have a lot on their plates in 2025.

Global turmoil. One of the most concentrated stock markets in recent history. Continuing inflation.

And now, most of the usual investments like the S&P 500 have never been more expensive to buy into.

But recently, a 2024 Bank of America survey revealed something incredible: 83% of HNW respondents 43 and younger say they want to invest in fine art to boost a slice of their portfolios, or already are.

After all, the ultra-wealthy have placed their bets on art for centuries. From the Rockefellers to Bezos and Gates — all actively collect art.

These numbers explain why:

- Contemporary art prices have appreciated 11.4% annually (1995-2024).

- Lowest correlation to public equities of any major asset class, like bonds, housing, and gold.

- Bank of America predicts the value of art and collectibles will make up 11% of ultra-high-net-worth portfolios by 2026.

Thanks to the first and only art investing platform, Masterworks, you can invest in art without needing millions or art expertise.

By securitizing offerings of iconic works by artists like Warhol, Banksy, and Basquiat, everyone can be a bona-fide art investor.

Skip the waitlist with our link below:

2. Max out 401(k) while reducing fees

- Risk level: Varies with asset allocation

- How much to invest: $22,500 maximum per year

If you’re American, one of the best things you can do is max out your 401(k).

A 401(k) is a retirement account offered by employers as an employee benefit. Most countries have similar programs (e.g. RRSPs in Canada, or SSIP in the UK).

Traditional 401(k)s let you invest some of your earnings from each paycheck, deducting the amount you contribute from your income for tax purposes.

This lets you take what you would have paid in taxes, and invest it for your retirement instead.

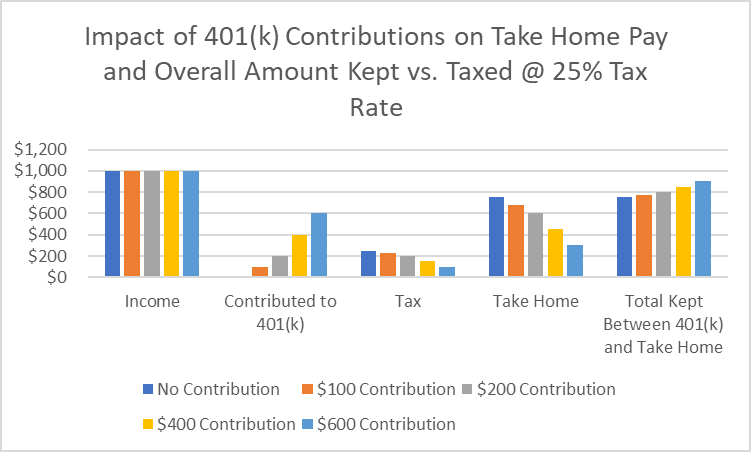

To simplify things, imagine you make $1,000 each paycheck and pay 25% in taxes.

A typical check would see $750 going to you and $250 to the government.

If you decide to put $200 in your 401(k), your paycheck would become $800 and you’d pay $200 in taxes instead. So investing $200 would only cost you $150 in take-home pay.

This chart below shows how different levels of 401k contributions impact the amount of your paycheck you keep (in take home and invested amounts) vs. pay in taxes.

When you retire, you can withdraw money from the account. You pay taxes on withdrawals, but typically at a lower rate due to your lower income in retirement. Delaying the taxes can have a big impact on compounding returns.

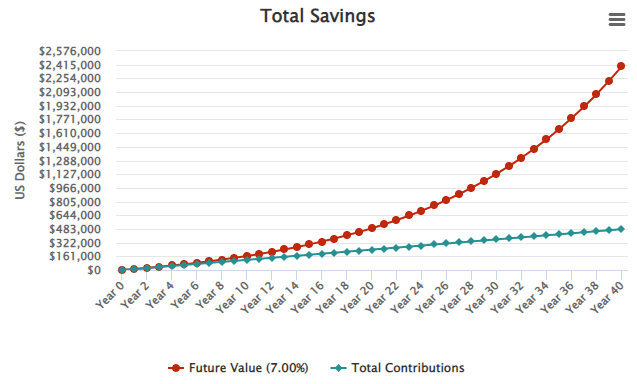

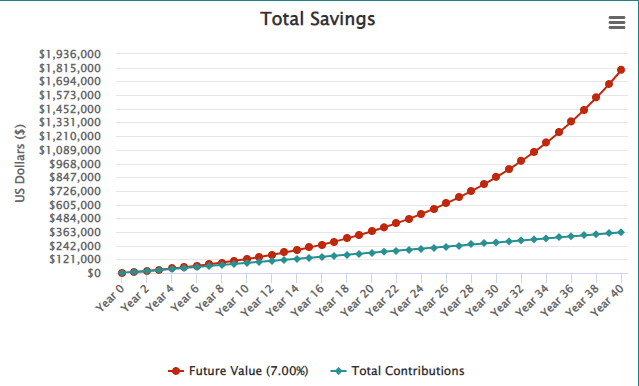

Imagine you have $1,000 to invest each month. You pay 25% in income taxes, so you can invest $1,000 through a 401(k) but only $750 if you decide to invest post-tax.

After 40 years at 7% returns, your 401(k) balance would be $2,395,621.34.

If you invested without the tax benefit, you’d only have $1,796,716.01.

Small Fees Make a Big Difference

Keep in mind that the funds you invest in through your 401(k) charge management fees. Those fees can really eat into your performance, meaning you end up with a lot less money when you retire.

For a simple example, imagine you earn a 10% return on $1 million for 20 years. You’ll have $6,727,499.95 at the end of 20 years. If you pay a 1% annual fee, you’ll only wind up with $5,604,410.77. A 1% fee cost you more than $1 million over 20 years.

So what’s the solution?

You can use Empower’s free 401k fee analyzer to understand how fees are impacting your portfolio. If the app can find a fund with similar investments but lower fees, they’ll let you know so you can swap and save money.

Whether you want to know what to do with a million dollars or how to invest $1,000, maxing out your 401k is the best place to start.

3. Index Funds & Bonds

- Risk level: Varies with asset allocation

- How much to invest: No limit

Index funds aim to let investors track a market index, like the S&P 500, rather than using active management to try to beat the market. This passive management allows index funds to keep fees very low, while retaining strong returns.

For example, the SPDR S&P 500 index fund has returned 9.53% annually (since its inception in 1993).

When investing in index funds, it’s all about matching your asset allocation to your risk tolerance. Stocks are higher risk, but offer higher returns. Bonds are lower risk but have lower returns.

The more risk you’re willing to accept, the more of your portfolio you can allocate to stocks.

A 90/10 stock-to-bond split is aggressive and risky while a 60/40 split is better for someone who is more risk-averse.

How to Allocate between Stocks vs Bonds

A common rule of thumb is to have a bond allocation equal to your age minus 10.

Based on factors like age and risk tolerance, determine your preferred asset allocation, then divide your money appropriately. For example, someone who wants to know how to invest $50,000 at a 70/30 split would put $35,000 in stocks and $15,000 into bonds while someone with $1 million would split their cash $700,000 to $300,000.

For example, that means that a 30-year-old would have 20% of their money in bonds and 80% in stocks. A 60-year-old’s portfolio would have a far less risky 50/50 split.

Empower offers a tool to analyze your risk tolerance and help you choose the right portfolio.

Keep in mind that you can invest in index funds through a 401(k).

Max out your retirement account before investing outside of a tax-advantaged account to ensure you make the most of your limited tax benefits. And don’t forget to analyze your 401k for hidden fees.

If you’re reading this for aspirational purposes (i.e. you don’t have a million dollars yet), index funds are a great way to invest in the stock market with a little money. starting out with index fund investing could put you on the path toward being a millionaire.

4. High-Yield Savings account

- Risk level: Very low

- How much to invest: $250,000 maximum per account

A high-yield savings account is the safest place to keep your hard-earned money. But that safety means lower returns.

The reason savings accounts are so safe is that they come with FDIC insurance. If the bank can’t return your money, the government will step in to reimburse you. However, this coverage has a limit of $250,000 per account type, per depositor, per covered bank.

Given current rates and inflation, money in a savings account will lose purchasing power. If your bank pays 3% interest and inflation is 5%, you’re losing 2% of your purchasing power ($20,000 if you put $1 million in the account) each year.

That’s because while your balance would grow from $1 million to $1,030,000 at 3% interest, inflation being 5% would cause things that cost $1 million to rise in price to $1,050,000.

If you do choose to put cash in a savings account, choose the one with the highest yield. I recommend M1 Finance.

Many people choose big banks with lower rates, which means they’re missing out on huge amounts of interest. The Wall Street Journal found that this amounts to billions of dollars in lost interest each year.

5. Real Estate

- Risk level: High

- How much to invest: No limit

If you want to know what to do with a million dollars and don’t mind taking on some risk and putting in some legwork, real estate has 3 major advantages vs investing in stocks.

- The two asset classes offered similar overall returns between 1870 and 2015. However, real estate was less volatile than stocks.

- Real estate can be a cash flow positive asset, assuming the rents you collect can cover the mortgage and maintenance costs.

- Real estate lets you use leverage. You can borrow money to buy real estate, letting you gain control over more valuable assets, then use those assets to pay off the loans you used to buy them.

That is something that you typically can’t do with stocks.

For example, if you decide you want to make a 20% down payments on any property you buy, having $1 million available to invest means you could buy real estate worth as much as $5 million.

A real estate portfolio worth $5 million could produce much greater returns than $1 million stock or bond portfolios.

If you want a hands-off way to invest in real estate, without the option to use leverage, you could consider investing through DLP Capital, a platform specifically designed for larger accounts.

If you have a large account and you’re interested in becoming a real estate investor but don’t necessarily want to buy property outright, DLP Capital might be a great fit.

Yes, the $200K minimum is high, but the company’s legit. Founded in 2006, DLP has a proven track record, with thousands of investors, an inventory of 18,000 housing units, and over $5.25 billion in assets under management.

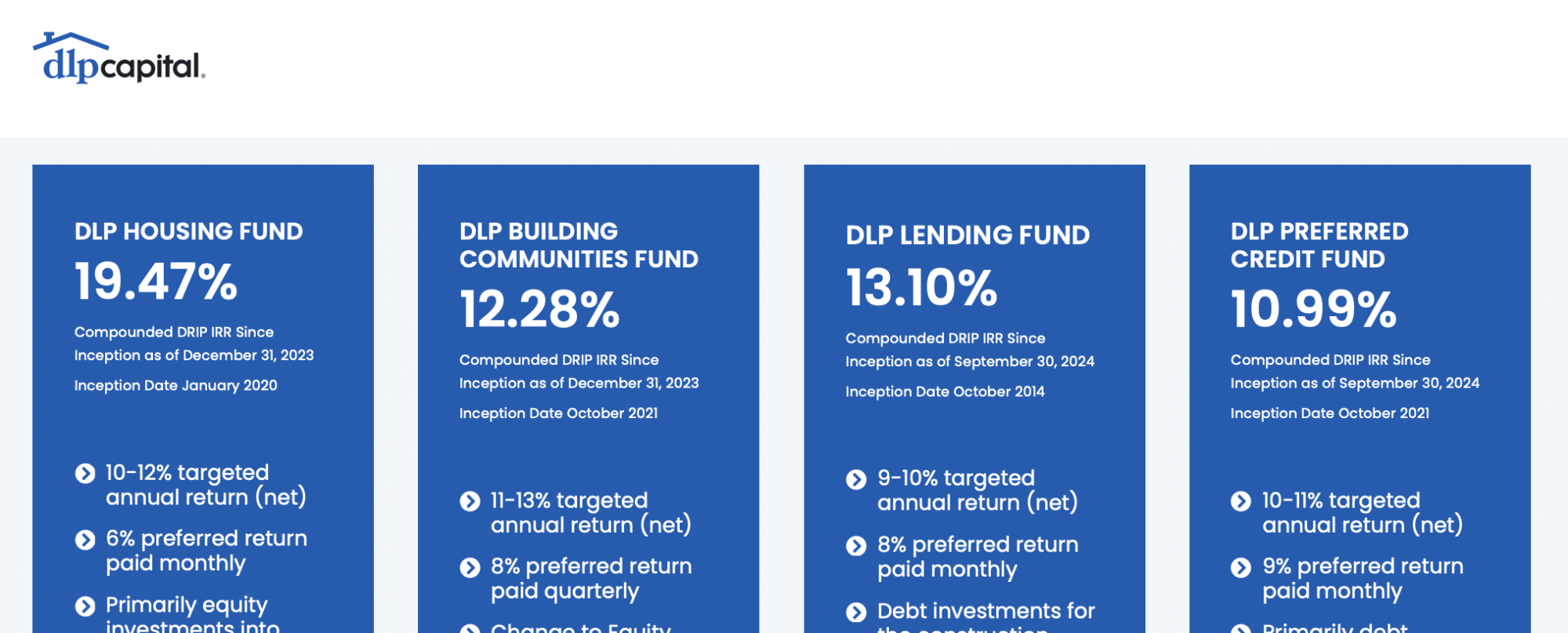

DLP Capital primarily serves wealthy investors, offering access to a variety of real estate funds to align with different investment strategies and objectives:

- The DLP Housing Fund offers access to build-to-rent and multifamily communities

- The DLP Building Communities Fund offers access o equity and preferred equity investments in entities or senior mortgage loans or mezzanine loans for developing new rental communities

- The DLP Lending Fund offers access to debt investments for the construction, acquisition, and repositioning of attainable rental housing

- The DLP Preferred Credit Fund offers access to debt investments (senior mortgage loans and/or mezzanine loans) and preferred equity in RV and vacation luxury parks, manufactured housing, and rental housing properties.

Not only do you have plenty of options and the ability to choose a fund that aligns best with your goals, but DLP also has a number of other unique selling points:

- DLP primarily focuses on impact-based investment strategies, attempting to profit while also benefiting society for the greater good. I’ll be real with you: This is not common with elite investment platforms.

- Additionally, DLP’s fee structure is refreshingly transparent. It offers a 2.0% management fee, with potential rebates for higher account balances.

- Its historical returns are impressive. Looking at the DLP Housing Fund to illustrate, the fund currently lists a 19.47% compounded DRIP IRR Since Inception (2020) as of December 31, 2023, and currently targets a 10-12% annual net return. Other funds report 12.28%, 13.10%, and 10.99% DRIP IRR since Inception.

Not ready to invest $200k of your million dollars in real estate quite yet? If you’re interested in getting started with a smaller budget, consider Fundrise.

This service offers real estate crowdfunding, letting you get involved in higher-cost investments like major office buildings.

Note: We earn a commission for this endorsement of Fundrise.

6. Pay off high-interest debt

- Risk level: None

- How much to invest: Up to your total amount of debt

If you’ve built up a nest egg of $1 million, you probably don’t have all that much debt. However, if you do, paying it off is one of the easiest ways to generate a good return.

A good way to think about paying off debt is that each payment you make generates a return equal to the debt’s interest rate. If you have a credit card balance at 20% interest, you’d have to earn more than 20% return on an investment for the investment to come out ahead.

Paying off the credit card balance is much easier and generates a guaranteed 20% return.

What qualifies as high-interest debt depends on your risk tolerance and expected investment returns. Keep in mind that the S&P 500 has returned an average of about 10% over the past decade, so anything approaching that level could be considered high interest.

7. Individual Stocks

- Risk: High

- How much to invest: As much as you feel comfortable losing

With an online brokerage account, it’s easy to start buying stocks online with your computer or phone.

Buying individual stocks lets you design a portfolio with a highly specific strategy. For example, with a value investing approach, you would buy shares in businesses you have identified as undervalued.

If you want income from your portfolio, you could focus on dividend-paying stocks instead.

Keep in mind that putting all your money into one company is risky. If that company runs into financial trouble, you can lose a lot of your investment.

If you have $1 million, you can afford to take some risks this way, but you should only invest a very small portion of your portfolio in individual stocks.

Remember, buying individual stocks is not remotely necessary to do if you’re just looking for an easy, effective answer to how to invest $1 million.

If you need a brokerage account, check out Public. In addition to stocks, ETFs, and bonds, you can also buy cryptocurrencies within your Public account.

8. Crypto

- Risk: High

- How much to invest: As much as you feel comfortable losing. No more than a few percent of your portfolio.

Crypto is still a relatively young asset class that is filled with controversy and highly volatile. However, if you don’t mind a high-risk, high-reward investment, believe in the technology, or think that crypto is the future, adding it to your portfolio is an option.

Think of cryptocurrency as a venture capital-style investment. Most venture capital firms invest in businesses understanding that there’s a good chance they’ll fail. However, for every 50 startups that fail, one succeeds, turning into the next behemoth.

If a venture capital company makes 50 $100,000 investments that fail and one $100,000 investment that turns into a $100 million profit, they come out ahead despite losing $5 million on the failed investments.

If you put something like 5% of your portfolio into crypto, it won’t hurt too badly if you lose it all. However, if the currency goes up in value by 30x like Bitcoin did between April and June of 2011, that would be an overall gain of 50% of your portfolio’s value. That’s before thinking about the returns generated by the rest of your portfolio.

9. I-Bonds

- Risk: Almost none

- How much to invest: Up to $10,000 per year

I-Bonds are US government bonds that are designed to protect investors from inflation. To that end, their interest rates are composed of a sum of two factors.

- An inflation-based rate that is recalculated every six months.

- A base rate determined when the bond is issued.

Currently, I-Bonds pay a fixed rate of 0.40% and an inflation-based rate of 6.49%. Combined, that leads to a composite rate of 6.89%.

The bonds are backed by the U.S. government, which is considered one of the safest borrowers in the world, making them very low-risk. However, you’ll only beat inflation by 0.4%, meaning the overall returns will be very low.

You can buy up to $10,000 in I-Bonds each year at TreasuryDirect.gov, so if you want to keep your nest egg safe, you might consider allocating a portion of your $1 million nest egg to these bonds.

Final Word: How to Invest $1 Million

If you’ve saved $1 million, you’ve likely done so through years or decades of hard work.

You want to keep your nest egg growing while making sure you don’t put it at risk. For most people, the best way to invest $1,000,000 will be to:

- Pay off high-interest debt.

- Max out your retirement accounts.

- Put at least 6 months’ worth of living expenses in a high-yield savings account to serve as an emergency fund.

- Invest the rest in a portfolio of index funds with an asset allocation that matches your risk tolerance.

While there are other options, each with pros and cons, this strategy will work for the vast majority of investors and help you grow your savings over time.

FAQs:

Where should I invest $1,000,000 right now?

The single best place to invest $1 million is in a diversified portfolio of index funds with a stock and bond split that matches your risk tolerance.

A popular rule of thumb to help decide your stock vs bond allocation split is to take your age, subtract ten, and allocate that percentage of your money to bonds.

What is the safest investment for 1 million dollars?

The safest way to invest $1 million is to split the money between savings accounts to keep the money fully FDIC insured or to buy U.S. Government bonds. Each account has a limit of $250,000, so you’ll need four accounts.

How much can you make if you invest $1 million?

It depends on how you invest it. Based on historical returns over the past century, putting the money in the S&P 500 could generate $100,000 in a year on average, though volatility means you could lose as much as $431,000 or make as much as $542,000 in a single year.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.