There are 5.3 million millionaires living in the United States alone. Do you want to join their ranks?

While there are no guarantees, with the right plan and execution, becoming a millionaire is potentially within the average person’s reach.

Want to know how? I’ve taken the time to study and break down what millionaires have done to reach this prestigious milestone. I put my findings into a comprehensive guide to help you work toward your financial goals.

Let’s peek at what the millionaires do…

At-a-Glance: Tools to Help You Achieve Your Financial Goals Faster

Platform | How to Use It |

|---|---|

Put finances on autopilot + invest spare change you won’t even miss | |

Teach kids financial literacy + increase wealth-building potential from an early age | |

High-yield savings account (Up to 4.7% APY) | |

Investment management + FREE investment calculators + tools | |

Invest in fractional shares of residential rental properties | |

Find high-conviction stock picks and make more informed investing decisions | |

Invest in high-end art and diversify your portfolio |

How to Make a Million Dollars: the Bottom Line

Want to know how to get a million dollars? It most likely won’t happen at your day job. According to a study by the Tax Policy Center, a salary only accounted for 10% of most millionaires’ income.

If you really want to learn how to make millions, it’s all about multiple income streams.

Most millionaires invest in stocks and real estate during their free time. Fortunately, it doesn’t have to take up a ton of your time, especially if you partner with the right tools and support.

Let me explain.

1. Invest Early

The key to how to make a million dollars is to invest early. The earlier you begin, the more time your investments have to grow and compound.

Let’s say two people invest in their retirement accounts.

Person A is 23 years old.

Person B is 33 years old.

They both invest $200 a month into the same type of portfolio with 7.3% yields.

At age 65, Person A would have $601,104.96 to retire on, whereas Person B would only have $280,509.21.

The point of this example was not to shame you if you haven’t started investing, it’s to spur you into action TODAY. Putting this off could cost you big.

Want to know how much you’d make in the scenario described above? Check out the handy (and FREE) retirement calculator on Empower (formerly Personal Capital).

Don’t be discouraged!

If you’re reading this and you’re not a teenager or in your twenties, don’t be discouraged. You can still potentially learn how to make a million dollars.

It’s never too late to start investing and working towards your financial goals. The previous paragraph is simply a nudge to get started as well as an encouragement to start this journey with your children for those who have them.

Tools like Acorns or GoHenry can be really helpful in this regard.

GoHenry

GoHenry is a financial management platform designed specifically for kids and teens. They offer a customizable debit card, a user-friendly app, as well as parental controls.

Acorns

Acorns is great because it can help you build good financial habits on autopilot. With their Real-Time Round-Ups, you can round up your spare change and invest it into the market and can even get paid up to 2 days early. Plus, right now you can get a $20 bonus when you set up your first recurring deposit!

2. Maximize Your Wealth-Building Potential

But how? Hint: Finding the right tools can save you hours of research and work and speed up your learning curve.

Here’s an easy way to get started: with a high-yield savings account.

CIT Bank

CIT Bank offers a high-yield savings account that currently pays an impressive 4.7% APY for accounts over $5K.

If your money is not in an account like this, you’re leaving money on the table. This is hands down one of the simplest ways to earn money with low risk and combat the sting of inflation.

Want to explore other options? Here’s a list of the best high yield savings accounts out there.

3. Invest in Alternative Investments

Diversifying your investment portfolio is crucial to mitigate the risk of having your “eggs in one basket” and increase your potential for a higher return on investment.

One way to diversify is by investing in alternative investments, such as art or real estate, which can be highly lucrative, if a bit more risky than most stocks and bonds.

For a comprehensive list of opportunities, check out our article on the best alternative investments. But for now, here’s one to consider…

Masterworks

Masterworks is a platform that allows you to invest in high-end artwork, providing a unique investment opportunity that has historically produced impressive returns.

4. Invest in Real Estate

Wanna know how to make millions? Real estate is key.

Real estate has been a long-standing pathway to building wealth. Andrew Carnegie famously said that real estate makes 90% of millionaires.

Here are a few of the most common approaches:

Fix and Flip

If you want to know how to make a million dollars, many millionaires recommend you learn how to do a fix and flip.

Since fix and flip investors deal with cash, the closing can be very fast — which can be helpful for homeowners trying to get out of a distressed property quickly.

If you do everything right, you can reasonably expect to earn up to $30,000-$70,000 a flip within a handful of months.

There is also the added benefit of helping a homeowner out of a tough situation, leaving a neighborhood nicer than it was before, and adding back to the community, all while making some money.

There is a lot of expertise needed, so it may not be ideal for beginners.

Want more real estate investing ideas? Check out our roundup of the best real estate investment apps.

Consider Adding Rentals to the Mix

When questioned how to make 1 million dollars, most long-term successful real estate investors admit they will fix and flip until they have enough money to do their next flip, as well as buy a long-term rental property.

Even though a rental property will only earn $200-$2000 a month, this is income generated consistently, even in your sleep, with very little work involved (with the right property manager).

Managing rental properties is tough. The right software can help keep you organized. I have gathered a list of the best property management software which may help make things easier for you.

Don’t Have Enough Cash to Buy Real Estate?

Not everyone has the seed money to start fixing and flipping or buying rental properties. That doesn’t mean you cannot go the real estate route. Consider rental arbitrage or crowdfunding.

Rental Arbitrage

If you’re considering how to make 1 million dollars with limited seed funds, rental arbitrage might be an attractive option. This is when you rent a property from a landlord and turn around and list it on a site like Airbnb or VRBO.

Study the market and make sure you read the fine print before renting an apartment as some apartments restrict rental arbitrage.

Crowdfunding

Crowdfunding may not be how to get a million dollars the fast way, but it’s relatively safe to get started.

If you find the right platform, experts will study the market and vet a pick for you. Then, you can buy shares of a property, significantly reducing the time cost, and risk involved in investing in this opportunity.

Here are a few platforms to consider:

Arrived Homes

Arrived Homes is a platform backed by angel investor Jeff Bezos that allows non-accredited investors to invest in single-family rental homes through crowdfunding.

You can buy shares of a vetted real estate investment opportunity with as little as $100 and start earning dividends, without any expertise or additional work involved.

Crowdstreet

If you’re a bit more established and you have an accredited investor status, Crowdstreet could be a great crowdfunding platform for you.

Crowdstreet helps you invest in shares of commercial real estate investment opportunities, something that is significantly less accessible to beginners as it requires quite a lot of expertise.

Each opportunity presented to you is heavily vetted and comes with potential returns upwards of 20%.

EquityMultiple

EquityMultiple is another platform for accredited investors that offers access to commercial real estate investments, allowing you to invest in a variety of property types.

Are you an accredited investor? Great news — there are all sorts of cool opportunities available to you. Check out our article about the best investments for accredited investors.

You can invest as little as $5,000 into a real estate investment opportunity that is vetted and bought, renovated, and leased by a team of experts for you.

They offer flexible investment options allowing you to diversify across markets and property types.

5. Invest in Stocks – How to Make 1 Million Dollars Investing in the Stock Market

Investing in stocks is another way to potentially earn a high return on investment. By researching and selecting promising stocks, you can potentially earn significant returns. Warren Buffet recommends investing in high-quality stocks and holding them long-term.

This has the added benefit of significantly reducing your capital gains tax on your profits.

Here’s an example.

2020 was a terrible year for many stocks. The upside was that you could buy very low.

Let’s say you bought 100 Shares of (NYSE: MGM) in March 2020 at 11.80/share. You would have invested $1180. If you sold it on June 7, 2023, at 41.31 you could have seen a profit of $2951.

That’s a 40% profit margin.

Hopefully, we won’t see another 2020 for a while, but there are other ways to pick stocks that can help you increase your earnings.

WallStreetZen is one of the best top stock-picking services out there.

We don’t just pick stocks at random. WallStreetZen’s Top Analysts page aggregates top picks from the pros.

This service aggregates the research and recommendations from nearly 4,000 Wall Street analysts — then backtests their performance over multiple years.

Based on this research, analysts are ranked based on average return, frequency of ratings, and win rate — so you can rest assured you’re only following top performers.

Investing in Stocks: Considerations

If you want to learn how to get rich off stocks, know that it’s not a game of luck — though sometimes it can feel that way.

If you really want to know how to make millions of dollars, consider learning the basics of investing before you begin.

Again, there are no guarantees, but learning the basics (and beyond) can save a significant amount of time and headaches in the long run.

Udemy and Investors Underground both have great courses covering some basics by competent instructors with more than a decade of experience trading.

Investors Underground

Investors Underground is run by Nathan Michaud, a trader with dozens of years of experience as well as a team of successful experts.

As a member, you get access to 1000+ videos, pre-market broadcasts, trade recaps, and IU’s Live Trading Floor. IU also has a Trading Encyclopedia to teach new traders the basics of trading.

Udemy

Udemy is run by Hari Swaminathan, long-time successful investor and founder of an options mentoring company OptionTiger. The “Complete Foundation of Stock Trading” course is essential viewing if you want to invest in the stock market.

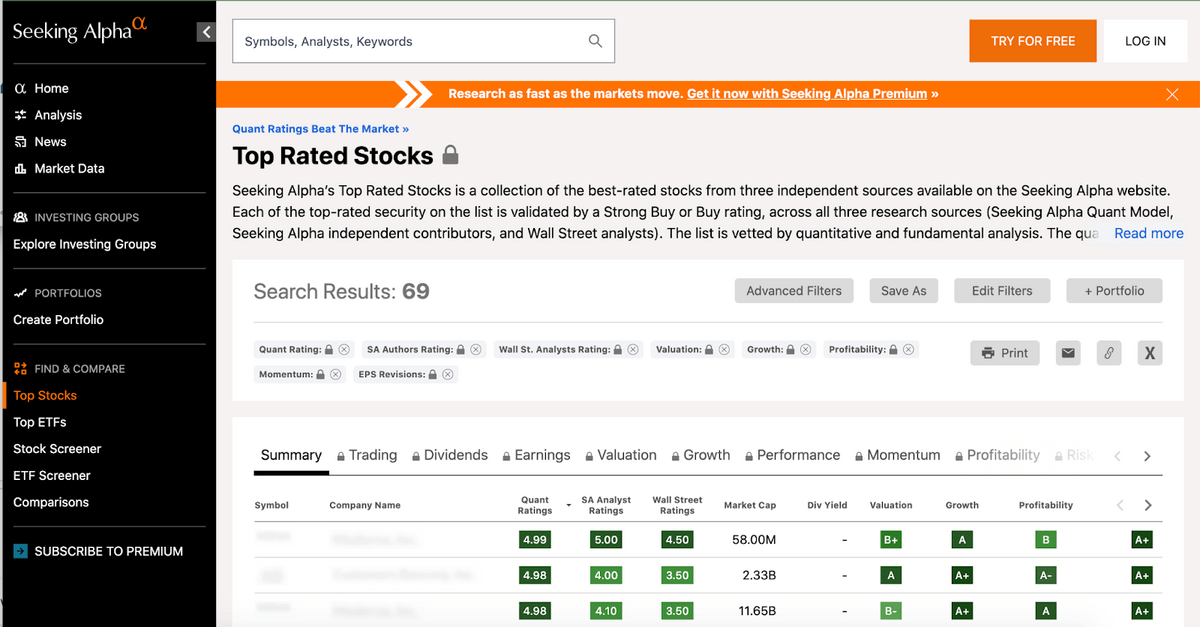

Upgrade Your Stock Market Performance With Seeking Alpha

A service like Seeking Alpha can help your portfolio grow exponentially faster.

It is a platform that provides stock market insights, analysis, and recommendations to help you make informed investment decisions and potentially boost your stock market performance.

Teams of stock experts extensively study the market and provide Strong Buy recommendations, highlight hidden gems, announce rising stars, track your portfolio of stocks, and more, saving you a ton of time.

6. Max Out Your 401(k)

We touched on building your retirement earlier. The bottom line is, the earlier you prioritize this, the longer your money will work for you.

If your employer will match, then not contributing to the matched amount is literally throwing money away.

Learn more about the best retirement investment strategies to maximize your earning potential.

7. Banish the High-Interest Debt

High-interest debt, such as credit card debt, is the single biggest barrier to building wealth.

It can affect your credit score, which will affect what interest rates you get. This can cause you to spend more money on interest that you could otherwise invest.

Treat high-interest debt like it’s the plague. Do everything you can to banish it and keep it out of your life.

8. Get — and Keep — Your Credit Score in Check

This will be especially helpful when it comes to real estate. A good credit score can save you thousands of dollars in interest payments over time, making it easier to invest in assets that can help you reach your million-dollar goal.

Monitor your credit score regularly and take steps to improve it. You can do that by:

- Paying your bills on time

- Reducing your credit utilization

- Addressing any errors on your credit report

9. Work On Building Passive Income

It’s entirely possible to learn how to make a million dollars in 5 years, but if you want year 6 to be smooth, you really should build passive income along the way.

What is the point of learning all the ways to make a million dollars if you have no time to spend enjoying your wealth?

We mentioned earning rental income earlier, but there are several other passive income avenues. Passive Income apps, apps that help you generate passive income easily can be particularly handy.

Generated some income? Discover how to invest 100K as recommended by experts.

Final Word:

Thankfully, there are a lot of ways to make a million dollars.

It’s not an overnight feat, but with the right strategy, persistence, and smart financial decisions, it’s entirely possible to learn how to make a million dollars in 5 years or even 1 year.

From $0 to Millionaire — Swipe this Million Dollar Strategy

Obviously, there are many ways to potentially make a million dollars. Here’s just one example of a possible approach:

- Start with opening a high-yield account.

- Link your account to Acorns, and set your investing to autopilot.

- Learn stock market basics.

- Research investment opportunities.

- Start investing.

- Use your investments to branch into real estate.

- Open an LLC and get insurance.

- Learn how to fix and flip or partner with a trusted expert.

- Invest income from your flips into both your investment portfolio, your fix and flip business, and rental properties.

- Keep investing and growing your portfolio.

- Diversify as you go and explore the best alternative investments.

FAQs:

How to realistically make a million dollars?

To realistically make a million dollars, I recommend a combination of investing in stocks, real estate, and alternative investments, maximizing contributions to retirement accounts, and building passive income streams.

Is it possible to make a million dollars?

Yes, it is possible to make a million dollars through a combination of disciplined saving, smart investing, and generating passive income.

How hard is it to make a million dollars?

It does not have to be hard to make a million dollars. Smart budgeting, a diversified approach to investing, and a long-term mindset can help you work toward a million-dollar goal.

How to turn $1 million into $2 million?

To turn $1 million into $2 million, you'll need to continue investing in assets that generate high returns, such as stocks, real estate, and alternative investments.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.