Can you get rich off stocks? Yes, it’s possible. BUT…

There are no guarantees that you will — many people lose money in the stock market.

If you do want to be one of the few who succeed, and if you really want to know how to get rich investing, you’ll need to consider things like:

- How you want to invest

- Your risk profile

- What type of an investor you are

- What stocks to buy and when to buy them

- What you want to invest in (stocks, bonds or index funds)

- And how quickly you want to make money.

In short, if you want to learn how to invest to become a millionaire, you’ve got to be willing to put in the time and effort. Building wealth can be boring — it’s typically only through consistent, regular investing and time that your work will pay off.

This guide will offer some helpful tips and considerations for those who want to learn how to get rich off stocks.

How to find market-beating stocks before they explode…

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Can You Get Rich Off Stocks?

Yes. It’s possible, but if you want to know how to become a stock market millionaire, you should know a few things.

Namely, there are no guarantees and it can take years of trial and error.

Investing in the stock market is not a get-rich-quick scheme.

Barring outliers, it takes time and patience.

If you give the practice the respect it deserves, can stocks make you rich? Yes. However, most people who do get rich off stocks spend years learning, making bets, and losing a lot of money before they become profitable.

So if you want to know how to become a millionaire with stocks — know that it’s going to be a big, long, uphill battle.

But wait — can you get rich off penny stocks and skip the hard work? Probably not. Penny stocks are extremely speculative. That means it’s possible to win big — but more commonly, people lose big.

Just getting started in the stock market? Check out our guide to how to invest in stocks for beginners with little money.

The Math: How Can Stocks Make You Rich?

According to Investopedia, the average annualized return of the S&P 500 Index from when it started in 1928 to Dec. 31st, 2022 has been 9.82%.

That means, hypothetically, if you put $1000 in right now, at the end of one year you will have $1098.20. This number doesn’t include reinvested dividends either. Utilizing those could boost your return as well.

Going further, if you were to $1000 every year for ten years consistently, at a rate of 9.82% annually, your investment will be worth $18,352. That’s $8000+ more than if you were to just stuff your money in a shoebox on top of the fridge. That’s also $8000+ pretty much out of thin air.

Clearly, investing consistently for the long term has some very attractive benefits.

But here’s the thing. Returns are never guaranteed.

Whether you invest in stocks, bonds, index funds or crypto, there’s no promise that you will make any money. It’s possible you could lose.

Plus, this approach only accounts for passive investors who leverage time to build their wealth.

Active investors (day traders and the ilk) that track daily movements have the potential to make a large amount of money quickly.

However, this requires outsize risk and an advanced understanding of the fluctuations of the market. While it can seem alluring, it’s actually been shown to be the less lucrative style of investing over time.

Looking for the best high-yield investments? Check out our article on how to get a 10% return on investment.

How to Get Rich Off Stocks

I know, I know. You want to know how it all works. You want to know how to get rich in the stock market.

If you want to get rich off stocks, here are the most crucial steps you’ll need to take:

1. Open a Brokerage Account

You can’t invest in stocks if you don’t have a brokerage account — an investment account where you can use the funds to buy stocks, bonds, ETFs, or other assets.

There are the big ones, like E*Trade, Charles Schwab, and Fidelity Investments.

Personally, for ease of use, I’m a big fan of apps like Robinhood.

Apps tend to make investing simple for new investors and for investors who just want simple smart interfaces.

Alternatively, I like apps like Betterment or Plynk, which both offer distinct features depending on how you want to track your portfolio.

The brokerages mentioned above — Robinhood, Betterment, and Plynk — all have their high points. Looking for more ideas? These are the best online brokerages for beginners.

2. Choose an Investment Approach

Do you want to invest passively or actively? What do you want to invest in?

These are all questions that are important to ask yourself as you get started on your road to becoming rich off investing.

If you want to avoid unnecessary risk and stress, you may want to look into passive investing or investing long-term.

In these scenarios, you put your money into assets and consistently contribute over many years.

This has been shown to yield greater returns than investing willy-nilly for the chance of quick profit.

As for what to invest in?

You could buy individual stocks, mutual funds, or exchange-traded funds (ETFs).

Typically, a diverse portfolio featuring investments of different types and within different sectors is seen as a way to protect yourself against individual security fluctuations. In that case, you may want to invest in ETFs, mutual funds, and/or index funds. Learn more about setting up a balanced portfolio in how to invest 100k.

Investing in individual stocks can be risky in that, if you aren’t already very familiar with a company and haven’t done your research and analysis you may lose your money. If you want to invest in individual stocks make sure you’re confident about where you’re putting your money.

Not sure what stocks to invest in?

A premium stock research service can help do the heavy lifting.

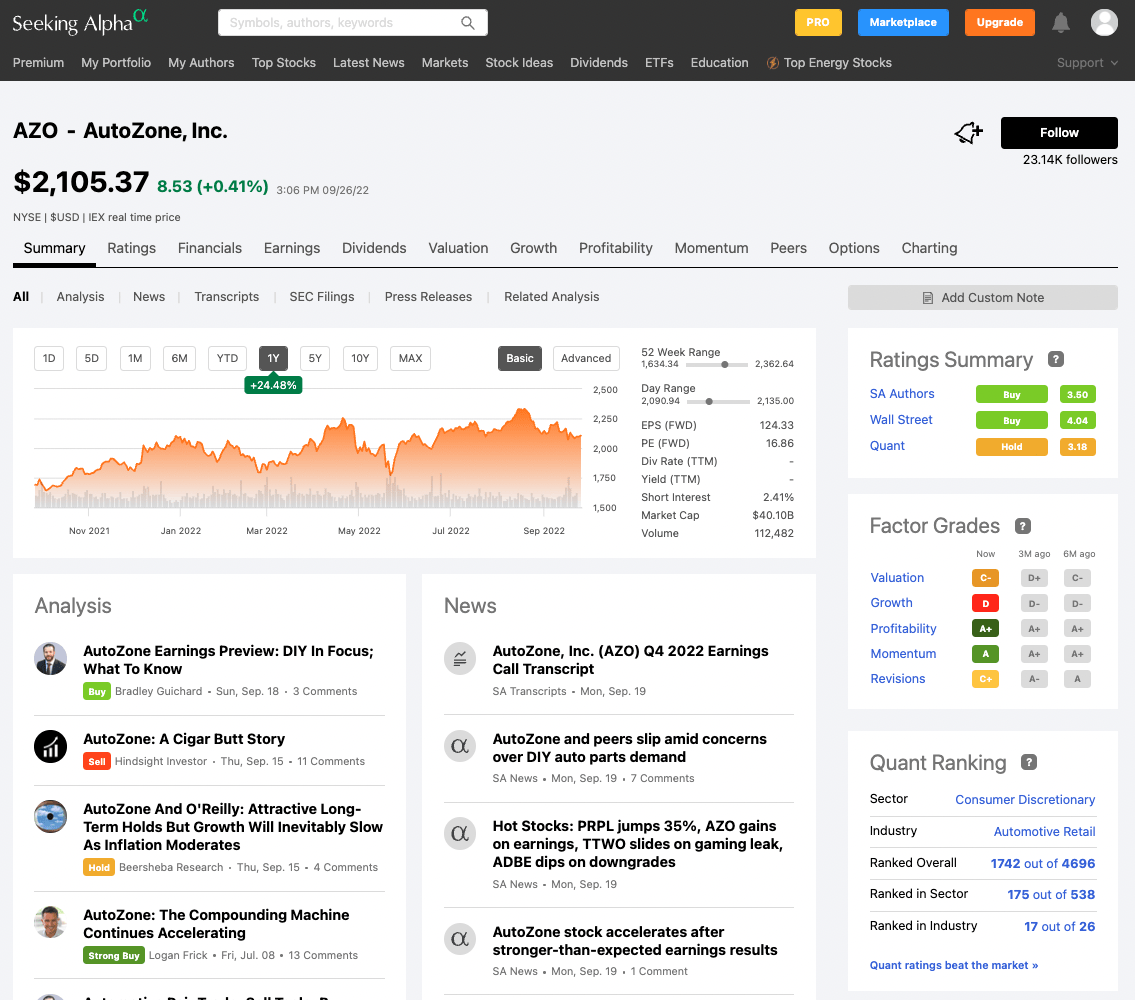

One of our favorites? Seeking Alpha. Since it was founded in 2004, it’s become one of the biggest and most popular stock research websites, with 20 million+ visitors per month. The premium services are even better than the freebies. If you’re looking for research that can help boost your conviction in every trade, this is a great place to start. Use any of the links in this post for $25 off!

3. Contribute Consistently

Here’s a boring secret behind how to get rich off stocks: you’ve got to contribute to your investment account consistently.

Investing small amounts consistently is called dollar-cost averaging and protects you against volatility in the market and you won’t have to worry about whether or not you’re timing the market well.

A good way to invest consistently is to set up your investing on autopilot so a portion of your paycheck is automatically invested every time you get paid.

You probably won’t even miss it, but those small contributions can boost your account. You can also autopilot your money to automatically invest in your chosen stocks so that your portfolio grows without much thought or action at all.

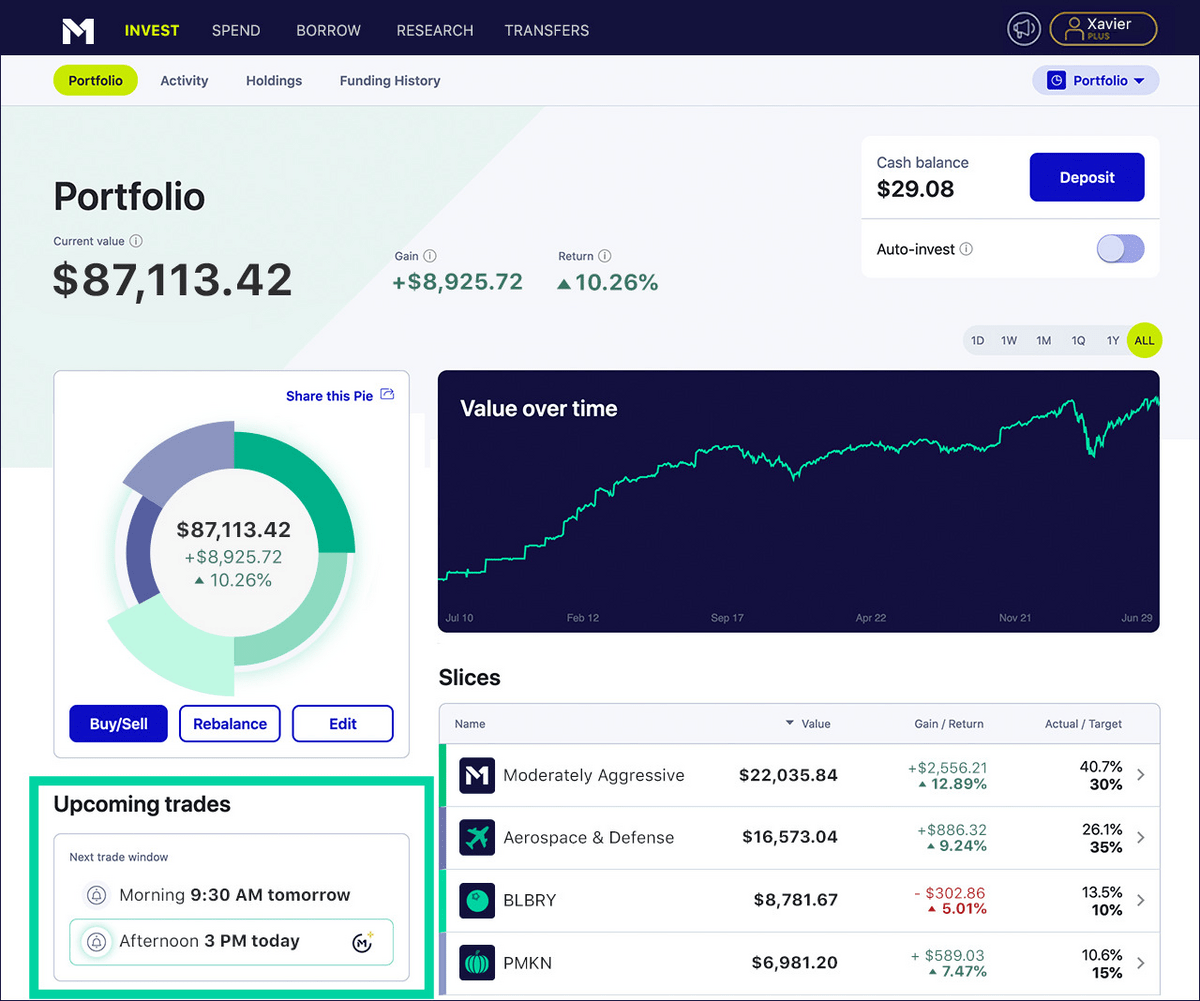

Most investment apps offer an auto-invest option. Using it can set you on your path to financial freedom without you having to worry about your investments.

Looking for a platform that offers auto-investing?

M1 Finance might be the perfect fit. The user-friendly platform is rich in automated investing features, like recurring contributions, auto-investing, and auto-rebalancing.

4. Invest for the Long Haul

Put your money where it can sit and grow consistently over years and decades.

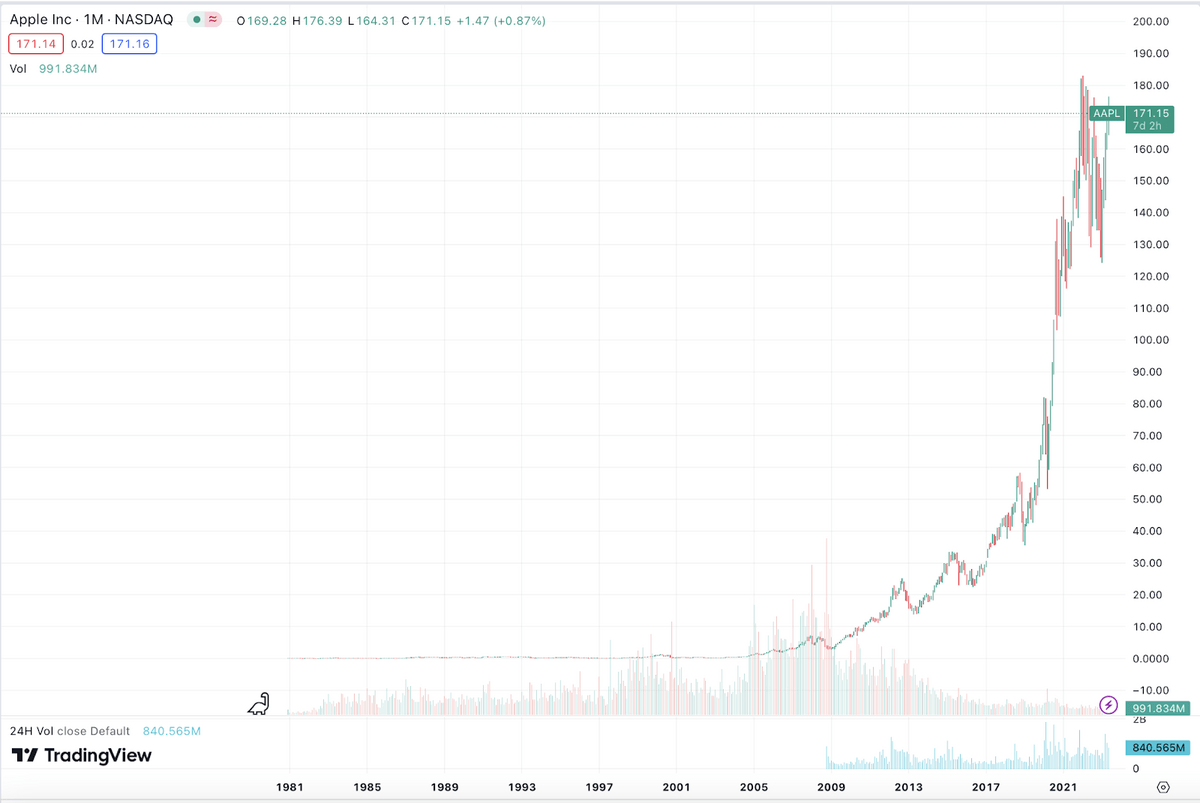

Think about if you had invested in Apple (NASDAQ: AAPL) in 1980 when shares were $22 each.

- By 2018 Apple shares were $227 per share.

- That means if you invested $1000 in 1980 you would’ve had 45.5 shares…

- Over time, the stock split 56 times meaning today you would have 2548 shares worth $227 each. In total that would be $578,396, a profit of over $577,000.

This shows the value of patience and time.

If you pick good companies, or good funds and practice patience for however many years it takes, you can easily become not only a millionaire but a multi-millionaire just by sitting on your investments.

In addition, it’s an incredibly low-stress, low risk way of making money, all you have to do is wait. You don’t have to worry about market fluctuations because history has shown that the market continually appreciates year over year. That’s how Warren Buffet made his billions, simply by choosing good stocks and waiting.

Love the charts in this post? Check out TradingView, a platform with both free and paid premium tiers. Its advanced charting tools and user-friendly interface make it our favorite charting software, hands down.

Other Important Considerations:

If you want to become rich in the stock market there are other important considerations to take into account as well.

These include a general if not intermediate knowledge of how stocks perform in the market over time.

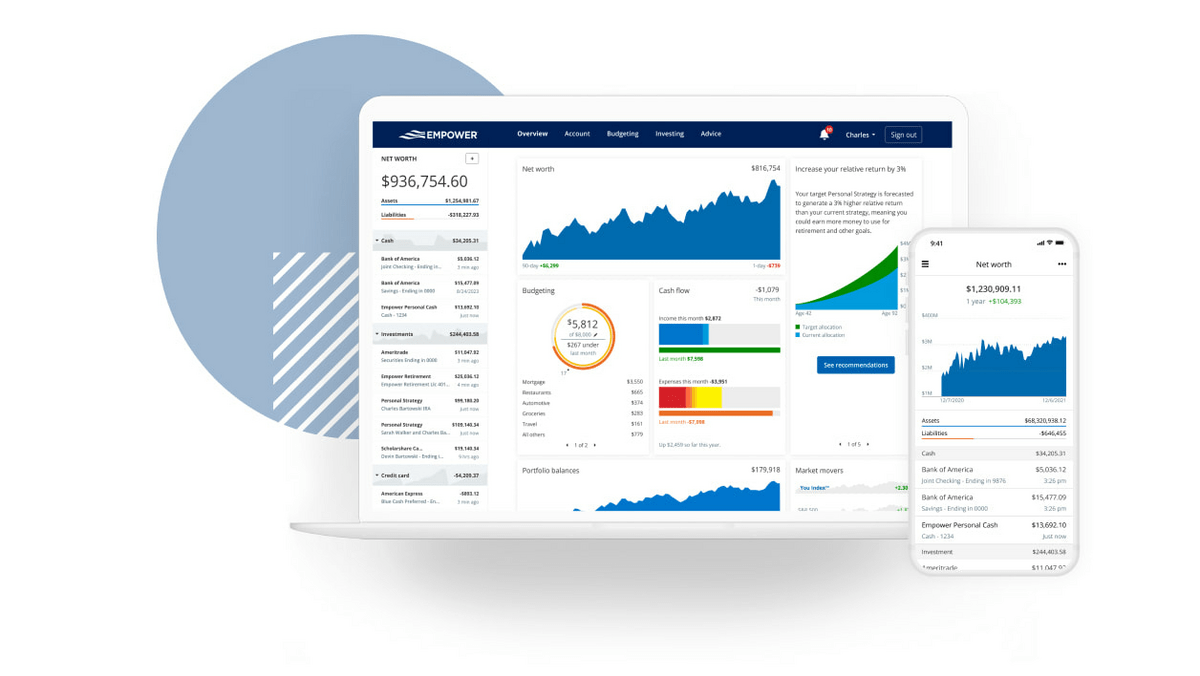

Making money requires analysis of companies and funds you want to invest in to make sure they are healthy and good choices for a growth-centered portfolio. Personal Capital vs Mint breaks down two of our favourite tools for managing your investments and your cash.

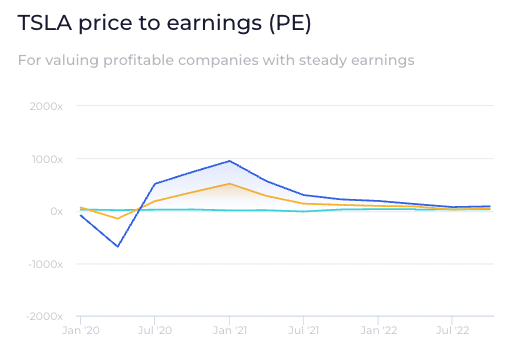

Historical data and things like P/E ratio, debt, and cash flow can help you determine if a company is performing well and is primed for future growth.

Keep learning — check out our article “What is a Good P/E Ratio?”

Understand the Stock Market

It’s important to understand that the stock market is subject to numerous conditions that can positively or negatively impact the price of your chosen stocks.

Frighteningly it can be subject to the whims of scared bankers and conditions like inflation, war, news events, and even seemingly innocuous occurrences that can spook investors.

Maintaining consistent contributions and riding out market fluctuations is still the safest way to go though, given the stock market’s history of growing.

Want to learn more about the stock market, investing, and trading?

Here are some of our favorite ecourses:

- Best day trading course: Investors Underground

- Best free course: TD Ameritrade

- Best investing courses for beginners: Udemy

Budget for Investing

Making investing a priority can have a tremendous positive impact on your investments as well, setting aside money every month to invest as part of your monthly budget is a good consistent way to grow your wealth and boost your investing journey.

This ensures that your money will be less subject to volatility and that your growth will remain steadfast throughout the years.

Need help budgeting?

Empower (formerly Personal Capital) is chock-full of incredible portfolio management and budgeting tools, ranging from personal budgeting to a retirement calculator and more. Best of all? It’s FREE to get started.

The Fastest Way to Get Rich Investing

Getting rich overnight in the stock market may not be a reality for most investors but consistently supplementing your accounts and investing in good, strong, well-performing stocks and index funds is generally considered the fastest, easiest, and lowest-risk way to get rich investing.

Need help finding stocks?

We mentioned Seeking Alpha before — it’s worth mentioning again.

The platform was founded with the goal of helping individuals gain financial freedom. How? Through extensive resesarch that helps its users build smarter and better trades. Seeking Alpha is not a brokerage, but it can help you make the most of your investment capital for a relatively small fee.

Final Word: How to Get Rich Investing

The best way to get rich investing? Be diligent, patient, and consistent. (Boring, I know!)

Consistency with your investments and patience often delivers the greatest yield. It could take years but sitting on strong investments has shown to be, historically, the best way to achieve your financial goals.

FAQs:

Can stocks make you a millionaire?

It is possible, but there are no guarantees. Making money requires putting in the time and research to make good investments, and allowing time for your investments to grow. Educating yourself on how the stock market works and doing research on every potential investment can help improve your results in the stock market.

How can I get rich fast in stocks?

Getting rich fast is not a very wise approach to playing the stock market. It’s possible to win big but the odds are low, and it will take time and consistent investing for your investments to pay off.

Can you get rich off $100 in stocks?

It is possible but not guaranteed. Investing in knowledge and the right tools may help.

How to become a millionaire off of stocks?

Consistent contributions to your investing portfolio and sitting on your investments for the long term can go a long way toward making you a millionaire in the stock market. Again though, there are never any guarantees when it comes to investing.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.