Whether it has taken years of hard work and savings or you recently came into $100k, this amount of money opens many doors when it comes to investing.

It’s always nice to have options, but you’re probably wondering what’s the best way to invest $100k?

There isn’t a one-size-fits-all answer. The best way to invest $100k might be different for you than for me.

So there’s what we’ll do.

First, I’ll list the 8 best ways to invest $100k for passive income in 2025.

Then, if you keep scrolling, I’ll offer some important questions to ask yourself to better assess which strategies best your individual goals, risk tolerance, and circumstances.

The 8 Best Ways to Invest $100,000 in 2025

1. Private Credit

Let’s start out the list with something a little unexpected: Private credit.

Private credit refers to loans provided to businesses by entities other than banks. Often, private credit borrowers are non-public, middle-market companies. They can’t access public debt like publicly-traded companies, but it can also be a challenge to get financing from banks, largely due to regulations put in place following the 2007-8 financial crisis.

Why invest in private credit? Here’s some food for thought: According to a study by investment giant KKR, the “traditional” 60/40 (stocks/bonds) portfolio allocation may be outdated. The study found that a 40/30/30 portfolio (stocks/bonds/alternative assets) offered both higher returns and lower volatility, particularly during high inflation periods (like today).

But how can you invest in private credit? Until recently, it was an investment class mainly reserved for ultra-wealthy or ultra-connected investors. But thanks to platforms like Percent, that’s changing.

Percent offers countless pre-screened private credit offerings to accredited investors, including a signature “Blended Notes” feature to spread out your portfolio’s risk.

Interested in learning more about Percent’s offerings? Click below.

Not an accredited investor yet?

Non-accredited investors can gain access to private credit funds through Fundrise. Learn more in our Fundrise review.

2. Stocks

When you think of investing, you probably think of the stock market. There’s good reason: There are a lot of different ways to approach stock investing that can suit a variety of different goals and risk tolerances. For instance, if you love risk, you can take a more active role in the market and pursue day trading. If you’re focused on more passive income over the long term, you can focus on blue-chip stocks and dividend stocks or ETFs, or baskets of stocks that allow you to diversify within a single ticker.

If you want to get started investing in stocks, all you have to do is open a brokerage account, pick companies or funds that suit your strategy, and hold as long as your investment thesis holds true.

Of course, you need to remember that no stock is risk-free; even trusted, household-name companies can experience downturns. So always be sure to do your due diligence before investing.

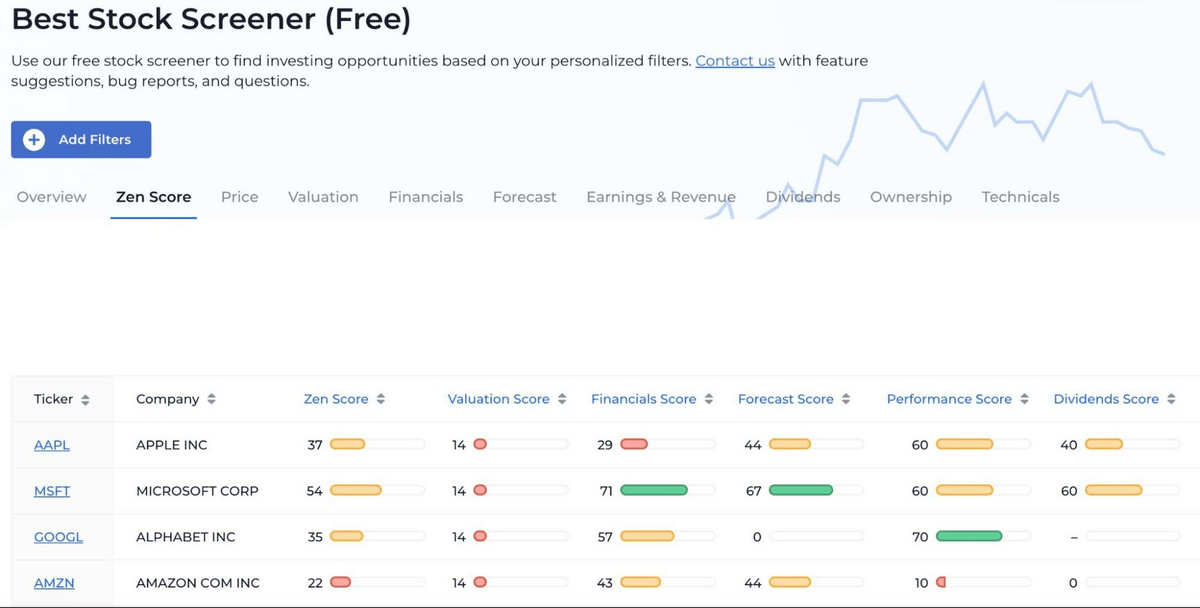

There are a lot of great tools to use for stock research; for instance, WallStreetZen’s Stock Screener is a great starting point to help you find high-potential stocks.

Once you’re ready to invest, it’s time to seek out a brokerage.

Our top pick? eToro. It’s a solid platform for new investors owing to features like excellent option for new investors CopyTrader, which lets you follow (and mirror, if you choose to) the trades of top-ranked traders and investors. It’s a great way to watch and learn from more established investors.

eToro also has tool and features that will appeal to more seasoned investors, including stock research tools, fast execution, alerts, and access to a variety of tradable assets like REITs, options, and crypto.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

3. High Yield Savings Account (HYSA)

If the previous two entries don’t suit your risk tolerance, here’s one of the more stable ideas for how to invest $100,000 right now — high yield savings accounts.

HYSAs are one of the best way to invest $100,000, particularly since rates are still relatively high. Traditional savings accounts at the big banks pay a mere 0.2% on average. You can get 4%+ from the best HYSAs with no difference in risk. Right now, one of my favorite high yield savings accounts, the Platinum Savings account from CIT Bank, offers up to 4.35% APY for accounts of $5K or higher.

HYSAs are low risk, but the return you collect from HYSAs will likely fall short of the potential return you could get by investing your cash in other areas. That’s why it’s great for the short-term. For longer-term investing, you’ll likely want to focus on your 401k.

4. Max Out Your 401k (while limiting fees)

So, what is the best investment for $100k, if you’re planning for the long-term?

To ensure you have the most income available during retirement — it’s best to start investing as early as possible (it’s never too late!) and max out your contributions as often as possible. (In the least, you should be taking full advantage of any employer match).

That means using part of your $100,000 to max out your 401k if you don’t plan to already. For 2025, that’s $22,500 (or $30,000 if you’re 50 or older).

But the best tip for making your 401k contributions go even further is to reduce taxes and fees.

Over the long-term, investment expenses sink your returns. Money that’d be compounding for decades in your 401k is lost to management fees. For example, $500 in 401k fees could have grown to $3,600 if you’d let it compound at 10% a year for 20 years.

That $500 is just for one year of fees — imagine being able to save $500 a year and compound that at 10%.

$500 seems small — just 0.5% of $100,000. But it adds up year-over-year.

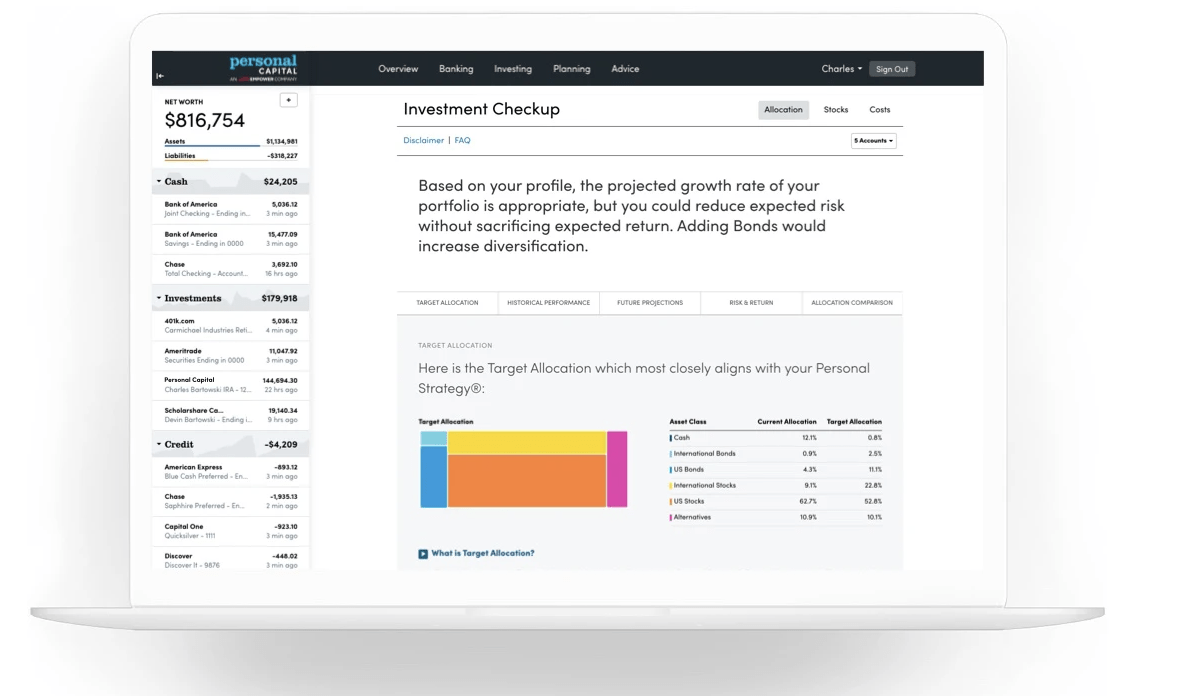

Don’t take my word for it; use a fee calculator and see for yourself. Here’s the one I use — Empower’s fee analyzer. The results can be staggering. If you’re 45 and plan to retire at 67, just the difference of 0.85% in management expenses means you’re losing over half a million dollars in fees.

Ready to break free from high fee funds? Enter: index funds.

5. Index Funds

Index funds are investments that track underlying indexes, which means there’s virtually no management fees.

They are the easiest way to diversify your stock market portfolio — and also the cheapest.

You can find an index fund to invest in almost any area of the stock market. They greatly reduce the riskiness of investing in stocks. That’s why I recommend it as the no. 1 way for beginners to get started investing in stocks. Investing in index funds is also the best way to invest $100k for retirement.

Investing in the stock market is consistently recommended as the best way to generate long-term returns of 10% or more. But what many investors overlook is the money they are losing to fees.

Index funds are the best tool you have to limit the amount of money you’re losing in your 401k. It’s easy to overlook just how much you’re paying in fees. A 2% fee seems small, but over the long-term it can drain your 401k. Roughly 30% of all 401k earnings are wiped out by fees when considering compounding.

You can see exactly how much you’re losing with Empower’s fee analyzer, but it’ll also give you suggestions on which index funds you can pick that track the same indexes, but charge lower fees.

The Ally investing app is one of the best places to start buying index funds with minimal fees.

6. Real Estate

You’re probably not looking to acquire a portfolio of rental properties for $100,000. Most investors would happily avoid the headache of being a landlord. So here’s how to invest $100k in real estate without dealing with broken fixtures and the like.

REITs are publicly-traded investments that own income-generating real estate and pay out at least 90% of their taxable income to investors. You can buy REITs on the stock market using your brokerage account.

REITs are also income investments. When thinking about how to invest 100k for passive income, again, REITs are the answer. For example, some REITs pay dividend yields of 5% or more. Some REITs also pay monthly dividends, such as Realty Income Corp., which would generate a monthly income of between $350 and $400.

Another option? Check out an investment platform like Fundrise, which offers access to real estate and real estate debt funds at an accessible entry point: You can get started with $10.

Fundrise offers various strategies, such as fixed income and growth property portfolios. It also has strategies that take advantage of underutilized properties or those located in growing markets.

7. Pay off high interest debt

If you’re carrying pretty much any credit card debt, the best way to invest $100k is to pay that off. While paying off high interest isn’t technically an investment, it’s a guaranteed return.

Consider this scenario — you have $5,000 in credit cards with an APY of 20%. Would you rather invest $5,000 to maybe get a 10% return over a decade (again, no investment return is guaranteed), or pay off that credit card for an immediate 20% return on your investment?

Paying down debt becomes more important when interest rates are rising. Any debt where interest rates can change, such as credit cards, become an even greater liability. Low fixed-rate debt, such as mortgages or auto loans, are okay.

When thinking about what to do with $100k, paying off debt should be just as high as having an emergency fund. Even if paying off high interest debt takes up a chunk of your $100k, even if it means you’re left with figuring out how to invest $50k.

If you’re looking for a little help with budgeting — not to mention free financial calculators that can help you save smarter — check out Empower’s free dashboard. There’s a reason why we name it the best personal finance software — it offers you comprehensive picture of everything from your current budgeting to your total net worth and even forecast your retirement, education, and savings goals. And let me repeat … It’s FREE!

8. Invest in Private Businesses

Investing in companies listed on the stock market isn’t your only option. You can invest in private, pre-IPO companies, too.

Important to know: Investing in private companies comes with inherent risks, such as potentially losing your entire investment. That means it’s crucial to research potential investments, and to only invest what you can afford to lose.

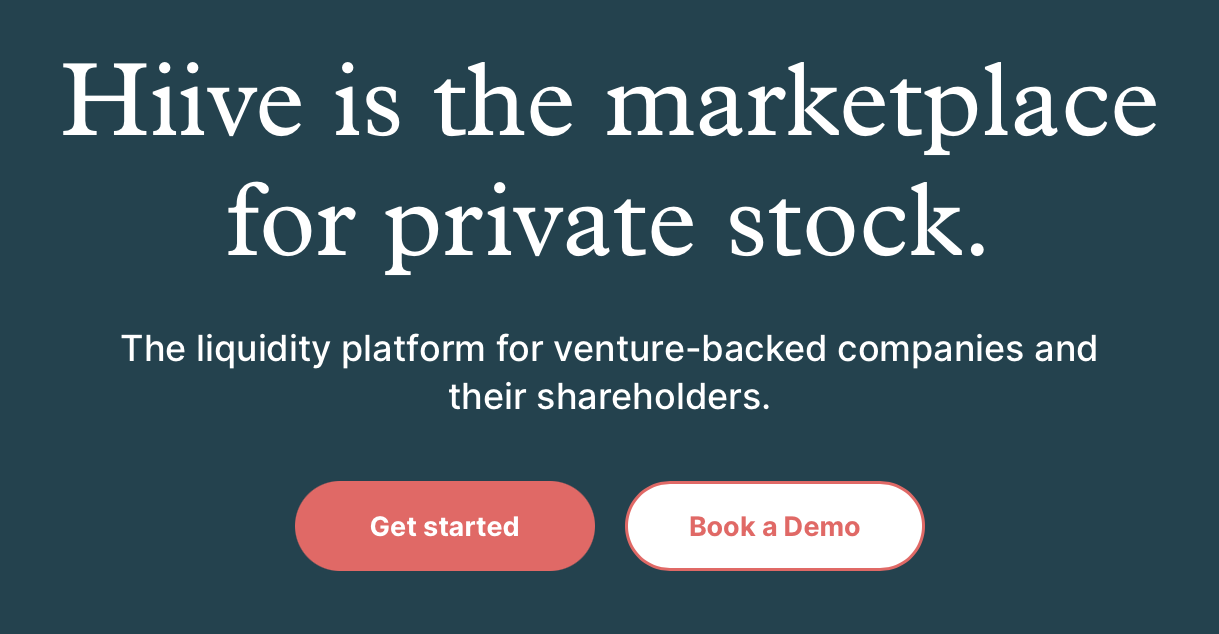

If you’re willing and able to take on that risk, investing in private companies through platforms like Hiive can offer exciting potential rewards.

Hiive connects accredited investors interested in a stake in private and/or pre-IPO companies with employees, venture capital firms, or angel investors who want to sell shares.

Hiive is brimming with neat features — for instance, for those who are admitted onto the platform, there’s a live pricing chart for each company which includes prevailing bids and asks, and you can create watchlists and get notified about price changes or new listings offered.

Additionally, you have flexibility. Buyers can either accept the asking price as listed, place a bid, or negotiate directly with the sellers. As an added perk for investors, for standard transactions, the sellers are the only ones who pay fees.

If this route doesn’t appeal to you, check out Hiive to start investing in startups that haven’t hit the stock market yet, such as Cerebras Systems, Groq, and OpenAI.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

9. Fine Art & Collectibles

If you’re looking for further diversification or are open to something a bit more risky, alternative investments are the place to look. Alternatives tend to be a bit more risky, but they’re one of the 11 ways to invest for high returns. If you want to invest in the highest risk asset class, alternatives is the best way to invest $100k.

Historically, alternative assets included commodities, such as gold. Modern-day alternatives have grown to include angel investing, cryptocurrency, artwork, and collectibles — all of which are more accessible than ever.

Let’s zero in on artwork and collectibles. Our favorite platform? Masterworks.

On masterworks, 64,387 investors have started buying into a market that used to be restricted to the billionaire class: postwar and contemporary art. What do they know that you don’t?

- Until now, prices haven’t declined for 2 years in a row in nearly 30 years

- Trends can change, but when prices last “dipped” in 2009 they shot up 132% over the next 5 years

- Postwar and Contemporary art prices have outpaced the S&P by 64% (1995-2023)

Now, anyone can easily invest in blue-chip art with Masterworks. Masterworks’ team scours the art market for the best deals, buys them at a discount, and offers shares to members.

Want to get in before the art market comes roaring back? As a trusted partner, WallStreetZen readers can use this exclusive link to skip the waitlist:

10. US Government I-Bonds

Bonds are great for low-risk, stable passive income. And it doesn’t get much better than Series I-Bonds, which are backed by the US government. The risk of losing money is as close to 0% as it gets.

What’s special about I-Bonds is that they also protect you against inflation. The return on I-bonds rises with inflation. You can buy up to $10,000 a year directly from the Treasury’s website.

It’s a no-brainer place to invest $10,000 in a high-inflation environment. The rates being paid on today’s I-Bonds are 4.28%* — and you can buy as little as $25. But you must hold them for at least a year. And if you redeem before holding for five years, you lose 3 months of interest.

*As of August 2024

Before You Invest $100k…

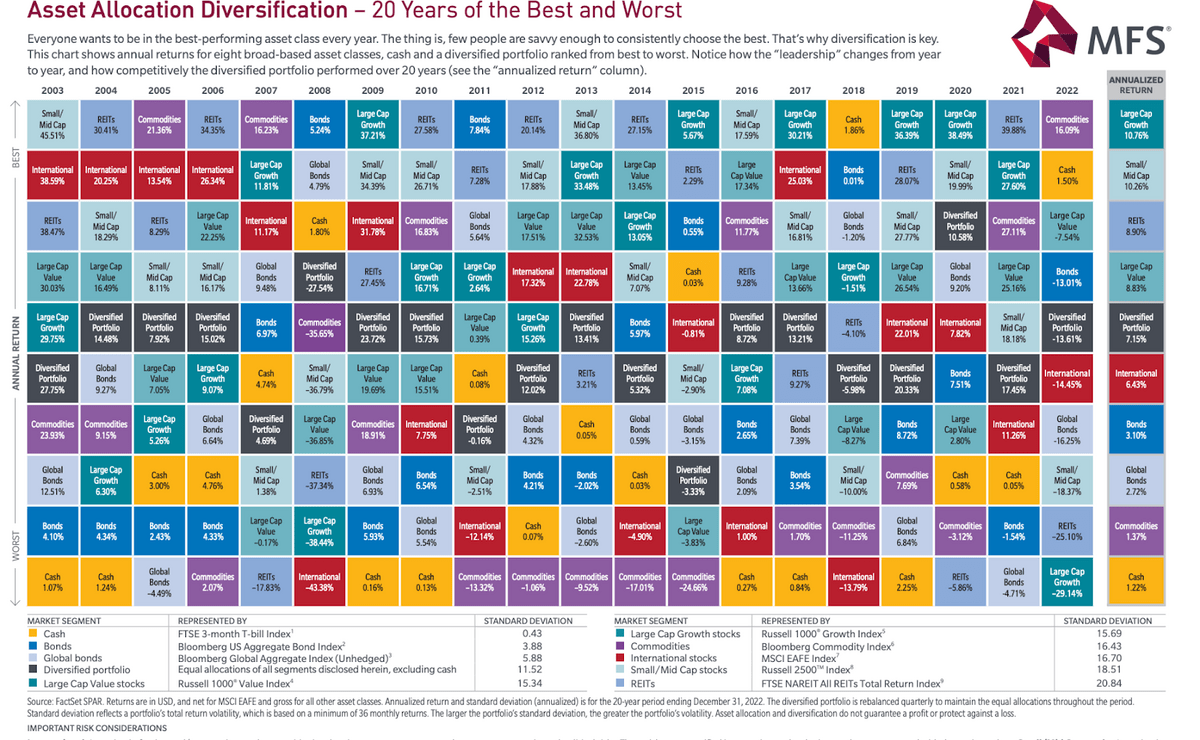

Proper diversification is the best way to lower the probability that you’ll lose money.

With $100,000 to invest, your list of investment options gets a bit longer than when investing $1,000.

But there are still major “gotchas” to watch out for.

One thing you shouldn’t do is invest all $100,000 into a single asset. This is where a good asset allocation strategy comes into play.

It’s well-touted by every financial expert. You’ve been told 1,000 times how important diversification is.

“Don’t put all your eggs in one basket. If you do, and that basket breaks, there goes all your eggs.”

“Don’t invest all your 401k in one stock. If you do, and that stock goes to $0, there goes all your retirement.”

So, how do you actually balance risk and reward in a $100,000 portfolio?

It depends on so many factors, including:

- Your current asset allocation

- What your target asset allocation is (or should be)

- The costs (fees & expenses) for the assets you own

- Availability of the same assets with lower volatility

That’s where Empower’s free allocation analyzer comes in. A free portfolio analyzer tool like this will ensure you don’t have too much of your portfolio in a single asset class. It can also help you find similar investments with lower fees and volatility.

This means more consistent returns year-over-year and less risk to your net worth.

If you prefer a more hands-off approach, these passive money making apps can also offer impressive returns.

Answer these questions before investing $100k

1. Do you have an emergency fund?

An emergency fund is a savings account with enough cash to cover 6-12 months of living expenses in case of a job loss, a medical emergency, car maintenance, or any other unforeseen expense.

Without an emergency fund, you’ll be forced to liquidate assets or use credit cards to meet financial crises. Plus, an emergency fund provides you with a safety net that can give you significant peace of mind.

A high-yield savings account is the best place to house an emergency fund and any other cash you’ll need within the next year. The highest-yielding HYSAs currently pay an APY of over 4%, including my favorite — CIT Bank.

2. Do you have high-interest debt?

If you have credit card or other high-interest, consumer debt, do not start investing until you pay it off.

Most credit cards have interest rates near 20%, much higher than you can reasonably expect to earn from any investment listed below. By paying off this debt, you’re essentially guaranteeing a 20% ROI.

While it’s not technically an investment, paying off debt with an APR of 8% is one of the best ways to accelerate your wealth accumulation.

3. What are your financial goals?

What are you trying to fund? Do you want to buy a vacation home, pay for someone’s college tuition, or donate to your favorite charity? Your financial goals should drive your investment plan.

How passive or active do you want to be with the investment? Some investments require more work, such as managing rentals. Others, like ETFs, are more hands-off. They’re still one of the best compound interest investments.

How much of that money are you willing to lose? $1,000? $10,000? All of it? If the thought of losing even $1,000 scares you to death, then you’ll want to avoid anything too risky.

When will you need to access the money? Need to use your $100k soon? You should keep your funds highly-liquid vehicles, such as bank accounts or short-term CDs.

The general rule of thumb is the longer the timeframe before you need to start accessing the money, the more risky the investment can be. The idea is that you’ll have plenty of time for the asset to rebound if it falls in the short-term.

Now, if you have 10 or more years until retirement — or if you’re comfortable taking on more risk for higher potential returns — I’ll share 3 tactics further down that can shorten your time to retirement by 5+ years.

Speaking of retirement, if you’re unsure whether you’re on track for retirement or want to see how long you have until retirement — here’s a wonderful retirement calculator that I use for clients.

Financial tools, like those offered by Empower, make it easier than ever to get to retirement on your own. Meaning, you don’t need a pricey money manager.

Final Word: How to Invest $100k

Trying to figure out what to do with $100K can feel daunting.

It isn’t.

The 8 options above are the best ways to invest $100k.

But don’t forget to set your priorities and be a relentless “risk manager.”

Employ HYSAs to keep — and grow — your emergency fund. Paying down high-interest debt is the epitome of guaranteed ROI. Use your 401k wisely — take full advantage of any employer match and cut your fees with index funds.

Consider other investments to further diversify your finances, such as I-Bonds, REITs, and alternatives.

That’s how to invest $100,000! Next stop: how to invest 1 million dollars.

FAQs:

Where should I invest $100k right now?

A HYSA and then index funds.

Start by investing your emergency fund into a HYSA. Then use index funds to max out your 401k. And retire a couple years early by minimizing your 401k fees — use a fee analyzer to rework your portfolio.

How much interest can I earn on $100k?

The amount of interest you can earn on $100k will vary depending on the investment. For example, you can potentially earn 5% interest or more with a high-yield savings account.

How to turn $100,000 into $1,000,000?

Play the long game.

Turning $100k into $1 million is a long-term play. Exactly how long it’ll take you to 10x your money will depend on your risk tolerance and how you invest your assets.

Want to understand your timeline? You can figure out how long it’ll take you to hit $1 million with Empower’s retirement calculator.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.