Once upon a time, I suddenly found myself in possession of $40K. You know what I did with it? Nothing. Or next to nothing — I put it in a savings account earning about 0.40% interest.

The money sat there for years before I realized that I could put it to work for my future.

I sure wish someone had advised me on where to invest 40K sooner. I can’t do that, but I can help other people avoid making the same mistake I did.

I don’t want your money gather moss. At the same time, I don’t advocate taking unnecessary risks. That’s why I’ve put together this “how to invest 40k” list featuring ideas that will enable you to diversify your investment, grow your net worth, and spread your risk across multiple asset classes. Here’s to your future:

Where to Invest $40k in 2025

Let’s get onto it. Want to know how to invest 40k? Start here.

1. Alternative Assets (Fine Art & More)

You thought I was going to start with stocks, didn’t you?

Thing is, you probably already know that investing in stocks is a way to potentially generate income. So we’ll talk about stocks later on, but for a moment, let’s talk about ways to diversify away from traditional investments.

Investing outside of the stock market or real estate can be a great way to balance your holdings with non-correlated assets, or investments that don’t follow the ups and downs of traditional markets.

Historically, it’s been hard for retail investors to break into alternative assets. In the past, you’d need a lot of cash upfront to gain entry in these asset classes. Now, there are quite a few online platforms that let you buy fractional shares of ownership of assets.

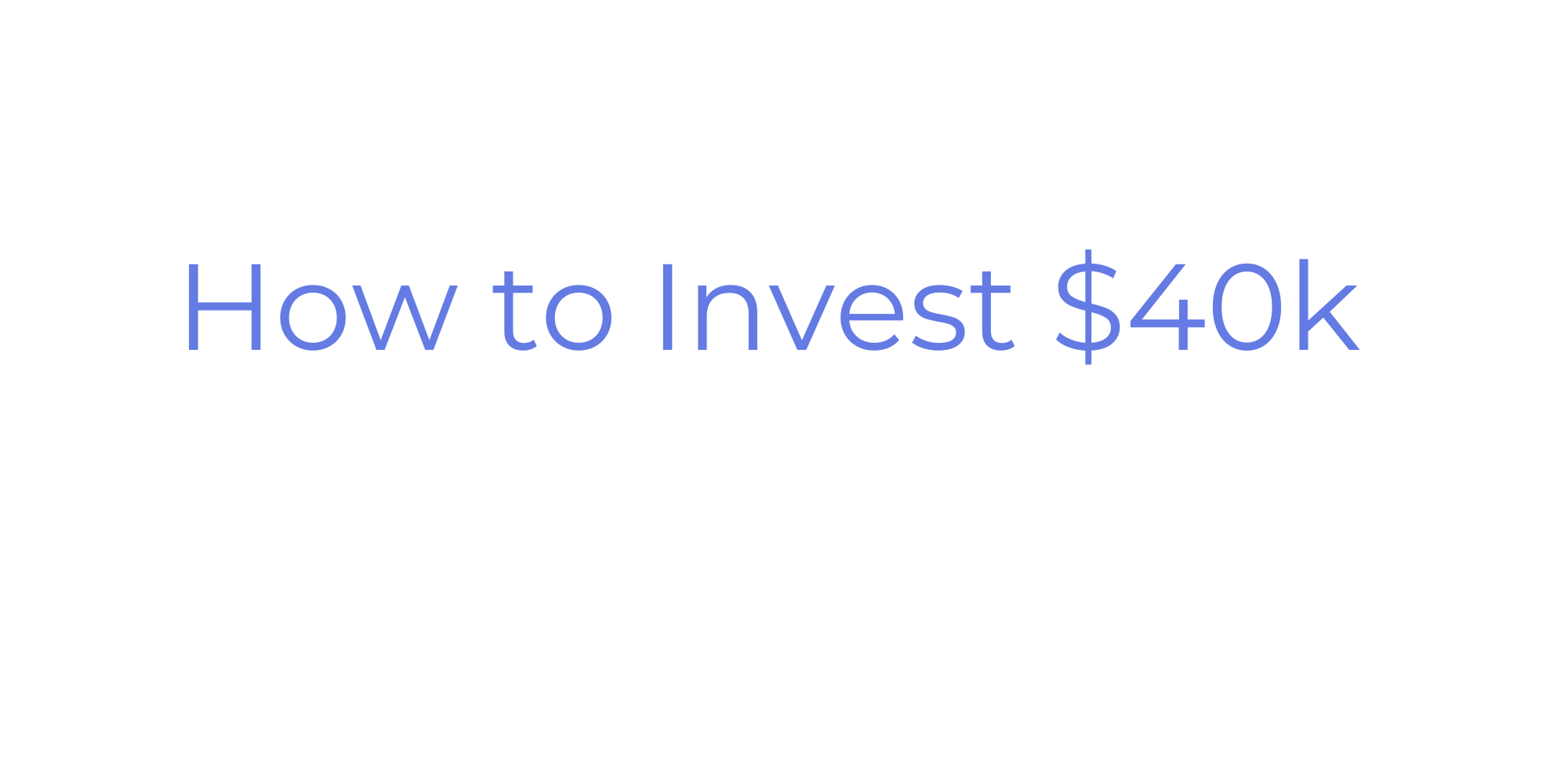

Here’s one I love: Masterworks, a platform that allows you to buy shares of ownership in fine art. As an art school graduate, I’m tickled pink by the prospect of owning artwork by the likes of legends like Andy Warhol.

Instead of bringing $50 million (or more) to the table, you can purchase shares of works by the likes of Warhol, Cecily Brown, and Claude Monet.

Masterworks’ track record is impressive. For instance, in 2020 they delivered 32% returns after selling a Banksy piece.

(Masterworks has also recently delivered 14%, 17%, and 21% net annualized returns to investors.)

Plus, it’s worth noting that art has outpaced the S&P 500 for the past 20+ years. Art has very low correlation to the stock market, which makes it a great way to diversify.

The one catch? There is a waiting list to invest on Masterworks. However, WallStreetZen readers can skip the waitlist using the link below.

Want more? Check out our article about the best alternative investments.

2. Stocks + Exchange Traded Funds (ETFs)

I told you we’d talk about stocks. So let’s get to it.

With thousands of stocks and funds to choose from, the stock market is a great place to potentially invest your savings and grow wealth. But only if you make intelligent investing decisions.

Before you YOLO $40k into a stock like Gamestop (NASDAQ: GME) to try and 10x your money, you need to consider your investment strategy.

Individual Stocks

Picking a few quality individual stocks can be a great growth investing strategy. Choosing the right stocks can prove tricky. There’s a lot of “noise” out there about any given ticker, and it can be hard to know who to trust.

WallStreetZen provides tools for investors who believe that knowledge is power and want to make more intelligent investing decisions. On the site, you can research the companies behind thousands of stocks. Find out how they fare on dozens of due diligence checks like Finances, Performance, and Dividends.

You can also see what analysts are saying about stocks. One of the top features on the site is “Strong Buys From Top Wall Street Analysts” (a paid feature), which details the latest Strong Buy recommendations for analysts. For each listing, you’ll see what catalyzed the Strong Buy rating (whether it’s new, maintained, or reiterated) as well as the 1-year price target for the stock. You’ll also get insight into the analyst — their track record, historical performance, and best and worst trades are clearly displayed. I love this feature — I scan the most recent Strong Buys every day, and I love when I see a Strong Buy rating on a stock I already own, or one I’ve been considering.

And if all that info adds up to overload? We distill all of our findings into a simple, easy-to-read score that acts as our own “grade” for the stock. For instance, here’s the current score for Visa (NYSE: V):

The bottom line? WallStreetZen is a great tool to help you filter through all the “noise” to discover the simple truth about a stock.

For those who want a little more guidance, our Zen Investor stock newsletter features stock picks from 44-year market veteran Steve Reitmeister. He chooses every stock using a simple 4-step process he’s developed over the years — a process with a proven, market-beating track record.

Exchange Traded Funds (ETFs)

But overall, stock picking is a bit riskier than diversifying your money with an index fund. While individual stocks let you invest in a single company, ETF index funds allow you to buy hundreds (or thousands) of stocks within a single investment.

Not interested in researching individual stocks? A safer play is to invest a majority of your cash into ETFs across several market sectors while picking a few individual stocks to put a much smaller amount into. This lets you spread your risk so that a poor-performing stock doesn’t sink your whole portfolio.

Personally, I prefer ETFs to mutual funds, which tend to have higher fees (but are also more actively managed than ETFs — which again underlines the importance of researching the investments you choose).

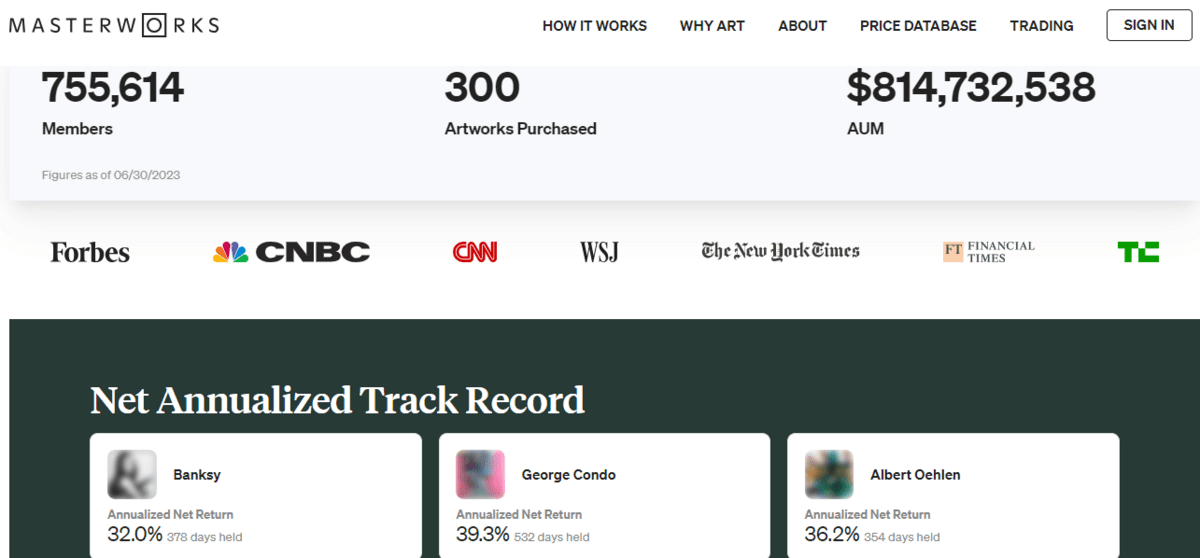

Investing in ETFs is pretty straightforward these days. You can find a quality online broker (such as eToro and invest in stocks and ETFs right from your mobile device.

eToro is easy-to-use, powerful, and modern, which is why it’s our #1-ranked broker — for the purposes of this article, the fact that ETF investing is one of its best features doesn’t hurt. It has virtually everything you could possibly want for ETF investing: You can research, set alerts, add to watchlists, and invest in 221 different ETFs, all with commission-free trading.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

3. Real Estate

If you’re thinking of how to invest $40,000, you might consider investing in real estate. But the down payment alone might take all of your spare cash, and you’ll need money for improvements, maintenance, repairs, and the ongoing costs of owning a rental property. Not to mention the headache of being a landlord. No worries. Real estate investing is still considered a great investment at $40K or a top strategy for the best way to invest $50K. You just have to get creative.

REITs (Real Estate Investment Trusts)

One approach to investing in real estate without buying property is choosing an REIT to invest in. A Real Estate Investment Trust is a company that buys rental properties and issues shares of ownership to investors. As an investor, you don’t have to perform any maintenance or handle tenants, but you earn income from monthly rents collected.

You can research the best REITs using WallStreetZen Stock Screener and locate the ones that offer the highest potential returns. Once you’re ready to actually invest, it’s easy to do through brokers like eToro. Just make sure to research the fees before picking an REIT to invest in.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Real Estate Investing Sites (Fractional Sites & More)

Another way to invest in real estate (that doesn’t require getting an investment property loan) is through real estate investing sites like Fundrise or Arrived Homes.

On real estate investment sites, you can choose residential or commercial real estate projects to invest in.

Fundrise offers a low initial investment and access to a wide range of commercial real estate investments. It also offers access to other asset classes that non-accredited investors typically are not permitted to invest in, like private credit and venture capital. Want to hear more? I have personally invested in Fundrise for over a year — see my review (and returns!) here.

Arrived Homes allows you to reap some of the benefits of being a landlord without … You know, being an actual landlord. This real estate crowdfunding site focuses specifically on single-family homes, letting you invest as little as $100 for ownership in a rental home. You know, if you want that rental property portfolio lifestyle without buying or taking care of the property. The company is fairly new, but it’s backed by Jeff Bezos of Amazon fame — and as of earlier this year, Arrived Homes has funded 266 properties, surpassing $97 million in property value, and is now operating in more than 49 markets across the United States. Not bad! To learn more, check out our Arrived Homes review.

4. High-Yield Savings

It’s nice to keep some cash available as an emergency fund. But just because you have an emergency fund doesn’t mean you can’t earn interest.

Earlier, I mentioned that I had about $40K that I did nothing with for years. If I could turn back time, I would at the very least put the money in a high-yield savings account.

HYSAs really exploded in 2022-2023, when rates were frequently higher than 5%. Now, rates have fallen a bit, but you can still pretty easily find an account that offers over 4% interest.

I personally use CIT Bank’s Platinum Savings account, which currently offers up to 4.35% APY on balances of $5K or more. I’ve had the account for over a year, and I’ve been very happy with not only the great interest rates but the ease of use of the online platform and the responsive customer service.

Looking for other options?

Empower also offers a high rate in their HYSA, paying out as much as 4.70% without the need for any membership.

5. Pay off High-Interest Debt

I know, boring, right? But here’s the thing.

Investing $40K might be fun. But you might actually earn a better “return” by paying off high-interest debt. For example, if you have debt with an interest rate of 10% or higher, you can essentially earn a 10% return by paying it down.

Credit card debt, auto loans, personal loans, or any other debt with a high rate can cost you hundreds of dollars per month in interest alone. That loss compounds over time, keeping you in debt and preventing you from growing your net worth.

Putting together a debt payoff plan is the best way to become debt free. Getting on a strict budget and putting all extra funds toward your debt principal can help you quickly become debt free. Whether you pay off the smallest-balance debt first, or the one with the highest interest rate, the key is to focus on one debt at a time.

I mentioned Empower earlier as a resource for high-yield savings. What I didn’t mention is their free dashboard, which is loaded with tools that can help you keep track of your money with ease. Thanks to free offerings like their Investment Check Up tool and Budget Planner, you can help keep your budget and investments in line — and start working toward specific financial goals.

6. Embrace Automated Investing

If you don’t feel comfortable investing it yourself, you might consider hiring a financial advisor. The problem is that many advisors charge high annual fees, and some even collect commissions on investments they sell you, which can hurt your investment performance.

An alternative to hiring a qualified financial advisor is using a robo-advisor service. These companies automate the investing process, helping diversify your investments across low-fee funds, and charging a fraction of the costs of a traditional financial advisor.

I personally embrace this high-tech approach in two ways.

First, I have an account with Acorns. In case you’re not familiar, it’s an investment platform with a catchy claim to fame: Its Round-Ups feature allows you to round up purchases to the next dollar, and then deposit those tiny amounts into your brokerage account. When you open an account, you fill out a survey to determine your goals and risk tolerance, and your money is invested to align with a strategy that suits you.

I use Acorn’s Round-Ups service and deposit about $50 per week in my account, which is automatically invested on my behalf. In a few short years, these small investments have grown to over $5,000 — and it’s all felt pretty passive. So yeah, you could say I’m a fan of automated investing with Acorns.

As a special bonus to WallStreetZen readers, Acorns is currently offering a $20 bonus when you set up your first recurring investment. But don’t delay — this offer won’t last forever!

Second, I use the robo-advisor service offered by my retirement brokerage account. Many brokerage accounts offer some sort of automated service — it’s all about finding what works for you.

If you want a platform that gives you a sort of middle ground — some automation, but the freedom to choose your own investments — M1 Finance offers the best of both worlds. (Check out my full M1 Finance review here.)

7. Bonds

Bonds are used by the government and corporations to raise money, and when you invest in a bond, you are essentially loaning money. Bonds are seen as a safer investment than stocks and real estate, and pay out regular coupon payments to bondholders.

You can invest in individual bonds or in a wide range of bonds through a bond fund. Some bond funds even hold thousands of different types of bonds inside them, diversifying your bond holdings and spreading your risk.

Investing in bonds isn’t exciting, but it can help stabilize your overall investment portfolio.

If you ask me, the simplest way to get started with bond investing is on Public.

Public’s Bond Account has an impressive yield — currently over 6% in October 2024. Once you create and fund an account, your hard work is over. Your deposit will go toward a portfolio of 10 investment-grade and high-yield corporate bonds, and you’ll be paid monthly. Then, when your income reaches $1K, it’s automatically reinvested.

You’ll get the highest yield if you hold on to the maturity date, but you are permitted to withdraw early.

One small consideration? While a Bond Account is currently fee-free on Public, it will carry a $3.99 monthly fee starting in 2025 unless you upgrade your account. Take advantage of the high rates now!

8. Save for Retirement

If you have $40k in the bank, you might be better off investing some of that money in a retirement account. Not only does it give your money more time to grow for retirement, but you can save on taxes at the same time.

Investing in your 401k account at work is a great place to start. Some companies offer matching contributions as well, allowing you to earn even more. Next, you can open an individual retirement account (IRA).

IRAs allow you to pick the broker and investments you want to choose. You can invest in a traditional IRA to save on taxes one, or a Roth IRA to save on taxes in retirement.

(We like Betterment and M1 Finance for Roth IRAs.) No matter what account you choose, saving for retirement now can help you retire sooner.

More resources for smarter retirement saving:

- Our top selections: best brokerage for a Roth IRA

- Our article on the best retirement strategies.

9. Invest in Yourself

One of the best investments you can make is in yourself. Taking online courses, building a business, or finishing your degree can have a major return on investment. And the more skills you learn, the more valuable you can become in the marketplace.

There are now online platforms that make investing in yourself simple (and cost-effective). Instead of paying tens of thousands for college classes, you can sign up for a platform like Skillshare and take online courses to learn specific skills.

Want to learn the basics before you start investing? Skillshare’s Personal Finance Masterclass is a must-watch if you’re new to investing and want to learn the ropes; if you like learning with a side of sass, check out How Not To Suck At Investing.

When you want to hone in on an investing strategy, you can find more specific classes on niche topics, like Excel In Real Estate Investing or Option Trading For Beginners — or even Learn To Swing Trade Using Charts.

But don’t stop at finance! If you want to learn how to shoot the perfect YouTube video, how to become a better graphic designer, or how to build a personal brand, you can sign up for a Skillshare membership and take all the classes you want. And most of these classes can be finished within a few hours, saving you time as well.

10. Gold

If you’ve got a large pile of cash waiting to be invested, you might want to consider setting some aside to invest in gold. Gold has historically been a store of value, keeping up with inflation and maintaining your purchasing power. This is especially important during times when inflation is rising (like right now).

While you can invest in Gold ETFs and other precious metal funds, you might want to own it directly. Owning physical gold allows you to take custody of your investment, and you don’t have to pay additional fees each year to hold it.

Online marketplaces like Silver Gold Bull offer gold bullion coins and bars with minimal markup, and they securely ship it to you directly. You can also invest in other precious metals, such as platinum, palladium, and silver.

Why Tax-Advantaged Accounts are Crucial

If you want to maximize the growth of your investments, putting some money away into tax-advantaged accounts can help. Accounts like IRAs, 401ks, and HSAs offer tax savings when you invest.

You can choose a Roth 401k or IRA to save on taxes when you retire, or stick with traditional accounts to save on taxes now. When you invest in a traditional tax-advantaged account, the amount you invest is deducted from your taxable income. This allows you to pay less in taxes and put more toward investing each year.

Best Way to Invest $40K: What About Allocation?

If you’re investing a big chunk of the $40k that you’ve saved up, you’ll want to consider how to allocate your funds proportionally. Asset allocation is the practice of splitting up your investments between different types of assets, including stocks, bonds, real estate, and other investments.

When you’re younger and have a longer time until you retire, financial planners typically recommend investing more aggressively. This means allocating more toward growth assets like stocks, real estate, or alternative investments. As you get closer to retirement, the allocation typically becomes more conservative, adding in more bonds and stable income investments.

BONUS: A note on allocation…

Evidence shows that the classic 60/40 portfolio allocation could could leave opportunities (and potential returns) on the table.

Case in point: A recent study from investment giant KKR examined the benefits of adding alternative investments into the mix over almost a century of returns.

They discovered that a 40/30/30 portfolio (including real estate, infrastructure, and private credit assets) offered both higher returns — with lower volatility — during periods of high inflation.

$40K to invest may not put you in the category of accredited investor. However, if you are an accredited investor, we highly recommend checking out Percent, a pioneering platform that offers accredited investors access to this previously exclusive market. To learn more, read our comprehensive Percent review.

Final Word: How to invest $40k

The best way to invest $40k will vary from person to person.

Your age, goals, timelines, risk tolerance, and other factors will come into play when choosing the best investment for your lifestyle. Whether you choose to invest in the stock market, alternative investments like Masterworks, or safer assets like bonds or a high-yield savings account, it’s important to put your money to work. After all, financial security and financial freedom is up to you, and you won’t get there leaving cash in your checking account.

Recap: Best Platforms to Invest 40k in 2025

Best for… | Platform(s) |

|---|---|

For alternative asset investing | |

For investing in stocks + ETFs | |

For real estate investors | |

For high-yield savings | |

To pay off high-interest debt | |

For robo-advisor investing | |

For investing in bonds | |

For investing in REITs | |

For retirement saving | |

For investing in yourself | |

For gold investing |

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Note: We earn a commission for this endorsement of Fundrise.

FAQs:

What should you do with $40,000?

Handling a large sum of money like $40k should be part of a larger financial plan. Experts recommend having money set aside for emergencies, so putting aside three months’ worth of expenses is a good starting point. After that, it’s up to you whether to invest the money, park it in a high-yield savings account, or pay off debt.

How to invest $50,000 and make money?

There are several ways to invest $50k and make extra money. Investing in dividend stocks can bring in regular income through quarterly dividends. Investing in real estate through platforms like Arrived allows you to collect monthly rental income. And high-yield savings accounts pay out monthly (or even daily) interest to safely grow your $50k.

How to get rich with 40k?

If you’re wondering how to invest $40k to turn it into millions of dollars, the best investment you can make is in skills. Taking online courses, learning valuable skills, and then putting them into practice can significantly increase your income. You can earn far more than $40k by choosing some well-designed educational courses (such as Skillshare) to bolster your skills.

How can I legally double my money?

If you are looking to double your money in a short amount of time, you probably need to start a business and invest your funds in growing it quickly. This will take time, patience, and a lot of effort. If you simply want to invest $40k and turn it into $80k, to safely do this, you probably need to invest in the stock market or real estate. It will take time (7 -10 years), but it can be done.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.