What’s the best way to invest 2k?

Sure, you could buy a 75” 4K TV. But as you’ll learn in this guide to how to invest $2000-$3000, there are other options out there that can turn into even more money over time — like investing in the stock market, paying off debt, or putting your cash in high-yield savings. Keep reading for a detailed explanation.

At-a-Glance: The Best Platforms for Investing 2K

For investing in the stock market | |

For budgeting + debt management | |

For access to alternative investments | |

For high-yield savings | |

For investing in retirement |

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Note: We earn a commission for this endorsement of Fundrise.

The 7 Best Ways to Invest $2000 in 2025

As mentioned, there are many, many ways to spend or invest that $2000. We’re not going for quantity — we’re going for quality. Here are 7 of the best ways of how to invest $2k, including ideas that suit a variety of financial goals and risk tolerance thresholds.

(Note: Thinking bigger, or thinking ahead? You might be interested in our list of the top platforms to invest 50K.)

1. Invest in Stocks and Exchange Traded Funds (ETFs)

Stocks and funds are a clear way to get into investing, and for many, it’s the best way to invest 2k (and to start investing, period).

Historically, the S&P 500 Index has averaged a return of 11.29%, down to 7-8 percent if you adjust for inflation. If you reinvest any dividends you make (and you probably should), that return is increased further.

$2,000-$3,000 is a perfect amount to get started with. You can choose individual stocks, or diversify quickly by investing in an exchange-traded fund (ETF), or a basket of stocks all rolled into one ticker.

But before you do, you’ll need a brokerage account. And not all investment accounts are created equal.

eToro is a great brokerage account to get started. It has a sleek, intuitive, easy-to-use interface, and plenty of tools and educational resources. It also has a unique CopyTrader program that allows you to automatically copy the trades of top investors. In terms of assets, you’ll gain access to thousands of stocks and ETFs, as well as the ability to invest in crypto if you choose.

As a special gift to WallStreetZen readers, eToro is currently offering a $10 bonus when you open an account with at least $100. Just click here (or below) to get it.

For more information on eToro, check out our piece on the top stock market trading apps.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

WallStreetZen: Your Gateway to Faster + Easier Stock Research

eToro is a great brokerage, but to locate high-potential stocks, you’ll need to do your due diligence on any and every potential investment.

If you’re interested in information related to stocks and are looking for specific stock ideas, look no further than WallStreetZen. Our platform makes finding stocks easy, with easily customizable screeners that can help you find stocks that fit your strategy to a T.

And if you want someone else to do the heavy lifting for you? Our Zen Investor stock-picking newsletter includes a portfolio of high-potential stocks, curated by market veteran Steve Reitmeister.

For everyday ideas, you can subscribe to our no-cost newsletter, WallStreetZen Daily. You’ll gain access to Top Analyst ratings (normally a premium feature on our site) and much more. Subscribe now!

2. Get a High Yield Savings Account

Please, for the love of all that is good in the world, don’t let your money sit around in a “regular” savings account. The average rate of return for a big bank savings account is abysmal, at less than 0.15%. With that rate, you might earn an extra bag of chips at the end of the year with your $2000.

Instead, get yourself a high yield savings account.

With high-yield savings accounts, you can often get an annual return of that’s leaps and bounds better than a “traditional” savings account for absolutely no risk at all (any account worth its salt will be FDIC-insured).

One of the best yields right now is offered by CIT Bank — their Platinum Savings account currently delivers 3.90% APY as of summer 2025. That’s more than 10x the national average. (Though I’d like to note that’s not a fixed interest rate — the APY could change at any time.)

Say you put $2000 in a HYSA with a 3.9% APY today. Provided the rate doesn’t change, in 5 years, your account will have grown to about $2426, factoring in compounding interest. If you deposited $2000 in your HYSA and added $100 per month, you’d have $8980.

Parking your cash in a HYSA may not offer as much earning potential as investing in stocks. But it will make you much more than “typical” savings accounts, and it is reliable — most HYSAs are FDIC-insured.

3. Pay off High-Interest Debt

Do you have a debt to deal with? There’s really no question of where to invest 2000 dollars. Pay down that debt!

Case in point: Say you have some credit card debt. If you pay off a $2000 balance on a 25% APY interest rate credit card or loan, you will save $500 or more (given how interest compounds) per year, depending on when you would have otherwise paid off the card.

Even debt interest rates of 12% will probably beat out what you can get on the market, and I cannot stress the psychological benefits of paying off debt enough.

If you want help to determine what debt to pay off first or assistance in creating a plan, you should check out Empower (formerly Personal Capital). It’s loaded with helpful budgeting tools as part of their free dashboard. The biggest step to take will be the first one, and then it’s a matter of paying off your debt a little every week or month.

One of the best ways to invest 3k is taking a huge chunk out of that debt to kickstart your financial future.

4. Invest in Artwork

Are you afraid that the market will plunge tomorrow and fearful of how to invest 3,000 dollars? Alternative assets don’t always care about the plunge in the same way a stock like Tesla (NASDAQ: TSLA) might, making it a smart way to diversify.

One of our favorite alternative asset platforms is Masterworks, which allows you to become a fine art investor for a fraction of the price of buying a Van Gogh.

Masterworks makes it easy to invest in fine art for all investors — and you can gain access to big names in the art world, like Banksy, Monet, and Warhol. You can buy shares of ownership in these art pieces and realize the appreciation once it is sold.

Here’s an impressive stat: Every one of Masterworks’ 13 exits has returned a profit to investors, with recent exits delivering net annualized returns of 17.8%, 21.5%, and 27.3%.

Want more alternative investing ideas? You can check out our piece on alternative investments if you want to learn more about your alternative options for how to invest 2k.

5. Invest in Real Estate

Real estate might not be top of mind when you consider how to invest $2-3K. After all, houses cost hundreds of thousands of dollars!

Don’t worry. There are other options. For one, you could invest in real estate investment trusts (REITs), which trade on the stock market. (Want to learn more? Check out our post on REITs vs. stocks.) You can purchase REITs with your brokerage account (we like eToro).

Alternatively, you could gain entry to real estate through a variety of investing apps. Fundrise is our top pick thanks to easy entry, an accessible $10 minimum initial investment deposit, and built-in diversity.

Fundrise is a great way to invest in real estate, with the funding getting crowdsourced among multiple investors. And property management is not your problem. With Fundrise, the minimum investment is an accessible $10, putting it on the table when you consider where to invest 2000 dollars.

Related Reading: Fundrise Review: Can You Really Make Money?

When you create an account on Fundrise, you can select a diversified portfolio that matches your investment goals: Balanced Investing, Supplemental Income, Long-Term Growth, or Venture Capital.

Depending on your risk tolerance, you can invest in real estate deals, real estate-related private credit, or its newest offering, the Innovation Fund, which invests in venture capital.

Fundrise does the investing for you, and makes it easy to track your account value, portfolio breakdown, and returns.

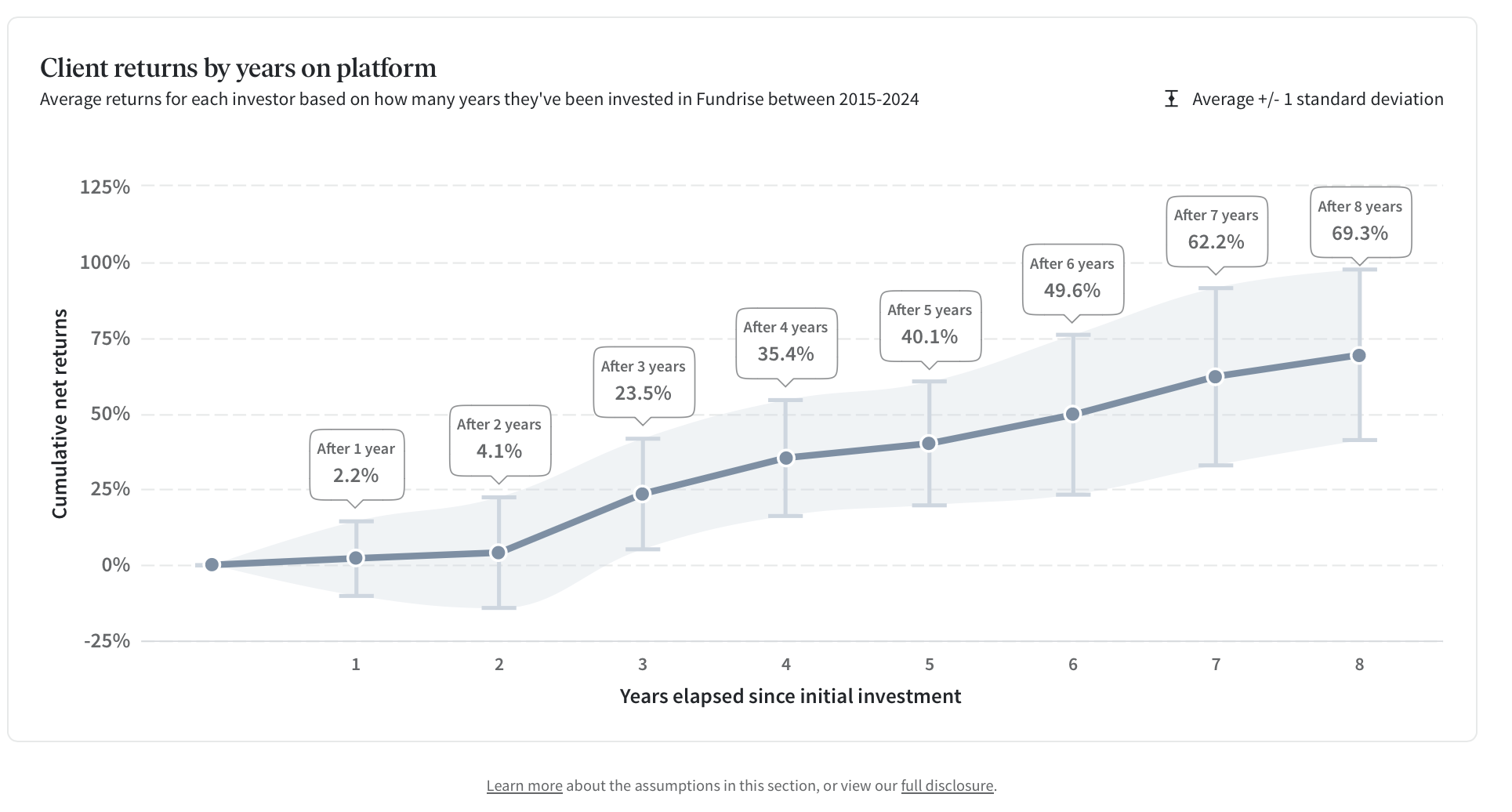

The platform currently reports 2,110,397 users, and boasts impressive average returns:

In short, investing in Fundrise is a fantastic way to diversify with a relatively small investment, and unlike some options (cough, crypto) you’re very unlikely to lose all of your $2,000. The real estate market might expand and contract, but it’s not going to go away completely.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

6. Invest in Retirement

You’ve read the articles about the importance of saving for retirement and how Social Security might not last by the time you retire and how you’ll need to fend for yourself and how no one is saving for their retirement.

Yet ignoring the harbingers of economic doom and gloom for a moment, saving for retirement is a smart idea.

You might be thinking “Why invest in my retirement with only a few thousand dollars? That’s not going to be enough to keep my family afloat for a month!”

Let’s say you have a longer time horizon, such as thirty years till retirement. If you invest $2,500 dollars in your retirement fund, by the time you retire…

- At an entirely safe 5% yearly return (see the high-yield savings accounts from before), you’ll get $10,805 if you put in absolutely no other money.

- If you go by a conservative stock market of about 8%, then the investment will be worth $25,157.

- If you are slightly lucky and willing to take on a bit more risk and get an average of a 10% annual return, then you will be getting $43,624.

And while you might want to consider inflation into that, you’re still making a huge step towards retirement with even a $2,500 investment. Whether your retirement account invests in stocks, bonds, mutual funds, or a combination of the above plus alternative investments, different investment strategies will provide different results.

Play around with an asset calculator and see what even a modest investment can get you by the time you retire if you keep it invested. It’ll surprise you, and saving for retirement might be the best way to invest 2000 dollars after all.

And if you don’t know what to invest in or what platform to use, Acorn can be a great option for easy-to-manage retirement accounts. It will help automate savings for retirement, even in small amounts. And it can be the best way to invest 2k. If you want to be more aggressive, starting with it can be the best way to invest 3k.

As an added perk, you can get a $20 bonus when you set up your first recurring deposit on Acorns using links in this post!

Bonus: 401k Matching

If you have 401k matching available from your employer, there is likely no better option for where to invest $2000. It’s an immediate 100% return on your investment for your retirement, and that’s not counting the gains you get within your account.

You simply will not find a better deal than that when looking for how to invest $2000 or how to invest $3000. If you haven’t already, work on setting things up and getting a contribution plan going today.

6. Invest in Yourself

It might sound like a meme or cliche, but what about investing in yourself? Your skills heavily determine your income, whether hard skills or soft skills. And while I don’t know how to invest $3000 to get another degree, you can get courses, take a class, and try out for certifications with that money.

It doesn’t even need to be related to your career.

Think of this one example. If you decide the best way to invest 2k is on cooking classes and dedicate the time to learning, you’ll be able to do a lot better than you might think by the end of it. Even for $100 per hour of lessons (and that’s fancy), that’s 20 hours of dedicated instruction.

You’ll want to go out to eat less after that, be able to eat happier and healthier, and that benefit will spread to other areas of your life. I’m sure your family will appreciate it, too.

If you’re looking for a simple, cheap, and effective option that has stood the test of time, there are always books. Having a nice read on a Sunday will cost $10 or so ($12 with some nice tea). If you read a book to improve yourself weekly (and that’s a lot), that $2000 will last more than three years (tea included).

Alternatively, have you considered a new bed and mattress? How much better would you be able to do at work and at life if you got a great night’s sleep every night? What about just a better pillow? The possibilities are endless.

One platform you should consider to improve yourself is Skillshare, which has courses on practically everything under the sun (and a few specifically about the sun, I’m sure). Want to build a skill for your career? There’ll be something to help on Skillshare.

Here are just a few top-rated courses on Skillshare that might be of interest:

Best of all, you probably don’t need to spend $2,000-$3,000 on Skillshare. (But if you did, you’d learn a lot.)

Bonus: Crypto

We discussed alternative investments before, and cryptocurrency can be considered part of that category. Yet considering its press and how everyone is talking about it, we wanted to give it special consideration.

Crypto often gets a bad reputation among some investors and the general public as an investment vehicle. It’s hard to understand, it’s extremely volatile, and no one really knows what it’ll look like in 10 years.

These things are generally true. However, it’s a great opportunity if you’re willing to take on the risk and already have a balanced portfolio to rely on. The return of Bitcoin (BTC) over the last five years has been nearly 8,000%. This is with many twists and turns, and requires good timing, but it can be a fantastic option for a bit of your portfolio.

What do you need to invest in cryptocurrency? You need a trading platform, a wallet (sometimes that comes with the platform), and knowledge to know what to do with $2000. Here are our top picks:

- For trading, check out eToro, an easy-to-use platform with many cryptocurrencies available.

- For your wallet, check out secuX. It is a hardware wallet that is secure, easy to use, and supports more cryptocurrencies than you can count.

- If you’re looking for knowledge, I recommend looking at courses on Skillshare — their “Demystifying Crypto” course is incredible.

There are plenty on everything to do with cryptocurrency, giving you the knowledge to make it the best way to invest 3k.

Important note: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

A Note About Allocation…

When asking yourself how to invest 2000 dollars or how to invest 3000 dollars (or any number in-between), know that you don’t have to invest all of the $2,000-$3,000 into the same thing. You can split up your investments to create a more diverse portfolio, so long as you meet the minimums for each investment account or platform. If dividing even $2,000-$3,000 amongst different asset classes will make you feel more secure in your investments, go for it.

Certain assets or investment avenues might be blocked off with this amount of money, especially if you spread your money widely. A portion of $2,000 might not buy many shares of Alphabet (NASDAQ: GOOGL) or Amazon (NASDAQ: AMZN). A fair number of mutual funds might not be available, as the share price will be higher than $3,000. And you might not always get the best signup bonuses and perks from platforms.

Final Word: Best Ways to Invest $2K to $3K

The best way to invest 2000 dollars to 3000 dollars will vary depending on your situation, financial goals, how much you have invested already, and what rate of return you’re looking for. There are few perfect answers, though there may be a perfect answer for you.

Whether you are investing for the first time or are a lifelong investor with a windfall who wants to try something new, I hope you have a better idea of what to do.

If you haven’t already subscribed to our newsletter, please do so. It will have tips on what to do with $2000, how to invest 3k, and more. You may also want to check out our blog, whether you want to consider what apps and platforms might be a good fit for you, what to do if you have more (or less) money to invest, and how to stay on top of a turbulent financial world.

FAQs:

How to turn $2,000 into $10,000 in 6 months?

You can turn $2,000 into $10,000 in six months through a lot of luck and a willingness to completely lose your $2,000 through extreme risk. Unfortunately, given the volatility of such investments, there is absolutely no guarantee your money will get a 500 percent return in six months.

How Can I Invest $2,000 to Make More Money?

There are many ways to invest $2,000 to make more money. You can use stocks, ETFs, index funds or other more “standard” investments to get a decent return, or try out alternative investments or investing in a small business. Your best choice depends on the risk you’re willing to take on, your hopes for returns, and the time you want to start investing.

For more detailed information, I recommend reviewing all the options listed in the article above.

How Do You Invest $2000 Dollars and Double It?

To invest $2000 and double it, you will likely need a very aggressive investment or a lot of luck. There just isn’t anything that can guarantee such a return.

Alternatively, if you have a 401k with employer matching available, that is the safest, easiest, and clearest choice to double your money. There is no better retirement option when you consider the risk of other options.

How to Invest $2,000 for Beginners?

The best way to invest $2,000 as a beginner is to invest in bonds, stocks, or create passive income streams.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.