With interest rates higher than they’ve been since the 80s, a recession looming, and the country staring down the barrel of an election year, everyone could use a little help figuring out where to invest their money right now. Possibly including you.

If you’re looking for the best places to invest money right now, you’ve come to the right place. I’ve put together this list of my favorite ideas for investing money in the current economic climate — let’s get to it!

What’s the Best Way to Invest Money Right Now? The Bottom Line

The bottom line is that the best places to invest money right now add up to a diversified portfolio of loosely correlated assets. I don’t just mean stocks. Putting your money in a variety of places is essential in uncertain economic environments so that you don’t lose large sums of money when one asset is down.

11 Best Places to Invest Money Right Now

The table below provides a quick birds-eye view of the assets I cover in the following sections.

Asset | Why we like it as an investment | Preferred platform |

|---|---|---|

Fine art | Lots of potential upside | |

Stock market | Stable growth | |

Automated investing | Less work rebalancing | |

High-yield savings | Virtually no risk | |

Bonds | Generates income | |

Index funds | Automatically diversified | |

Collectibles | Completely uncorrelated to other assets | |

Real estate | Inflation hedge | |

Private credit | High-yield fixed-income | |

Private companies | Potentially high returns | |

Gold | Loosely correlated to stocks | |

Crypto | Inflation hedge with a lot of upside |

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

1. Fine Art – Best For Adding Upside

Let’s start with something fun. Investing in fine art isn’t just for people with monocles. In fact, it’s a strong candidate for the best way to invest right now for anyone who wants to add potential upside with little correlation to the stock market to their portfolio.

Masterworks is an online platform that lets anyone invest in fine art — no need to be an accredited investor.

Here’s how it works: You buy shares of fine art pieces. From there, you can either hold and potentially collect a portion of the proceeds when the piece sells, or sell your shares on a secondary market.

Masterworks’ impressive $1 billion collection includes works by the likes of Picasso, Basquiat, and Warhol — and in the past few years, its investors have realized annualized net returns of 17.8%, 21.5%, 35%, and more from these opportunities.

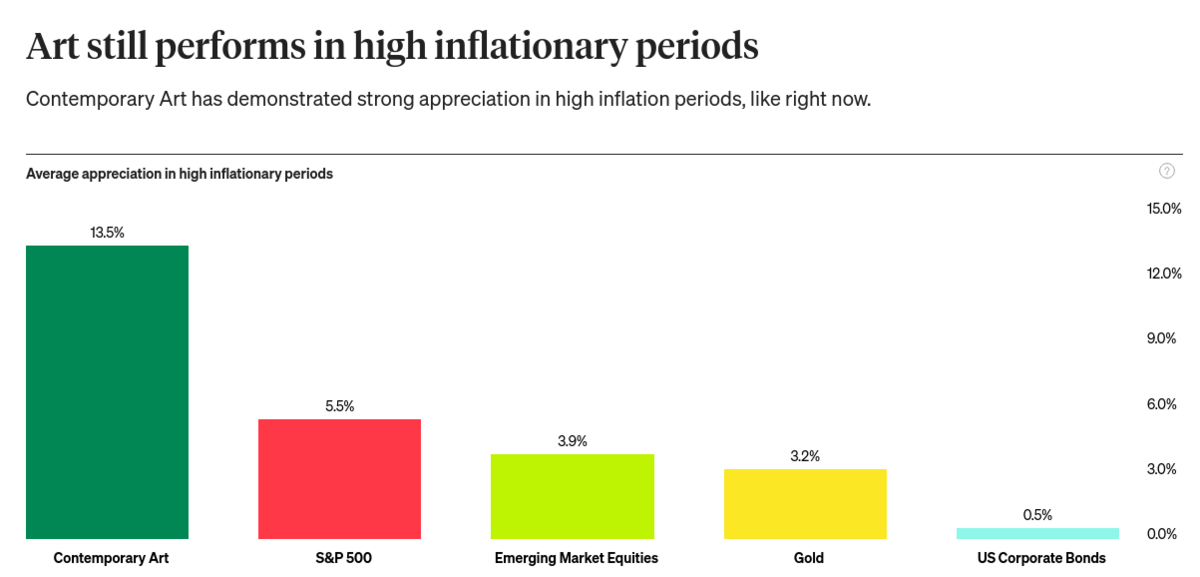

Plus, as you can see in the below image, art has proven to perform well during periods of high inflation:

2. The Stock Market – Best for Long-term Growth

Ah, the stock market. Stocks are one of the best asset classes for growth, historically speaking. Stocks have consistently high risk-adjusted returns and are the core component of almost all growth-oriented portfolios.

Of course, investing in stocks when inflation is running wild is a bit risky, but a well-diversified basket of stocks — or just a boring old index fund that tracks the market as a whole — is always worth a sizable fraction of your investment money. The stock market is my pick for the best way to invest with $50,000 right now if you’re in it for the long haul.

If you need a brokerage, I can’t recommend eToro highly enough. It has all the tools you need to make smart investments and manage your money from the convenience of your mobile phone.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

3. Automated Investing – Best for Hands-Off Investing

If you like the sound of investing in stocks but don’t want to be bothered managing your investments yourself, you should consider automated investing. M1 Finance has my favorite automated investing tools for automatic rebalancing and dollar cost averaging, which, let’s be honest, covers almost everything retail investors need.

Automated investing is just a better way to invest in stocks, so it’s the best way to invest $50,000 right now if you want to invest in the stock market with the extra peace of mind that your portfolio will rebalance itself.

4. High-Yield Savings – Best for Risk-free Returns

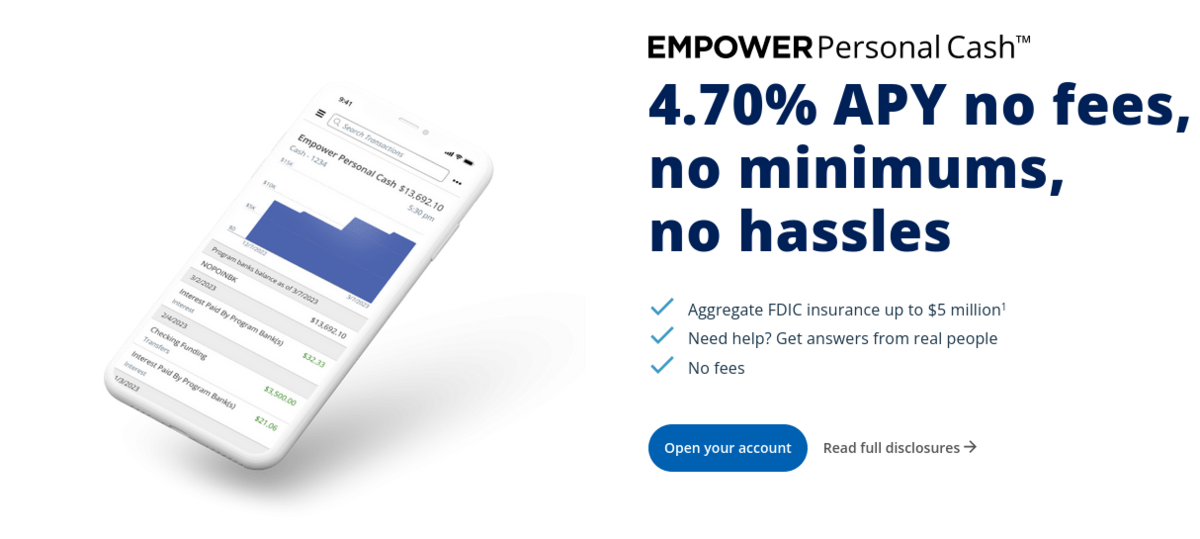

High-yield savings accounts (HYSAs) are great in high-interest rate environments. They provide relatively high returns — typically around 4–5% — for virtually no risk since they’re FDIC-insured up to $250,000.

If you compare 4-5% returns to the average savings account, which gives you back an average of 0.42%, it’s a no-brainer.

Empower has one of the best HYSAs available right now, and I encourage you to check it out if you’re looking for a safe place to park some money for a while.

If you’re saving money for a downpayment or just looking to preserve your cash while you figure out what to do with it, a HYSA from Empower is the perfect place to put it.

Plus, Empower has a ton of other FREE tools on its impressive dashboard, ranging from a budgeting tool to an investment checkup tool to retirement planning tools.

5. Bonds – Best for Generating Income

There’s a reason why bonds are a staple of fixed-income portfolios. Bonds generate steady income, which is what you need when you’re done chasing gains in the stock market and are ready for some stability. With interest rates as high as they are, bonds are one of the best investments for 2023.

Bonds come in two broad categories: government bonds and corporate bonds.

Government

Government bonds are a hot investment right now since basically, all terms have excellent rates at the moment. They’re also among the safer investments since the only way you don’t get paid is if the U.S. government can’t pay its debts, and if that happens, you probably have bigger problems to deal with. U.S. Treasury bonds are my pick for the best way to invest $2,000 right now for people looking for a safe investment.

Corporate

Corporate bonds are similar to government bonds, but instead of buying the government’s debt, you’re buying a company’s debt. Corporate bonds are riskier than government bonds

Interactive Brokers is one of the best online brokers for buying and selling bonds. Its Bond Marketplace gives you access to more than one million different bonds from around the world, all of which are easily searchable using the built-in Bond Search tool. I highly recommend it, especially if you’re new to bonds.

6. Index Funds – Best for Dollar-Cost Averaging

Index funds are designed to make investing easier. They work by automatically tracking the major indexes, like the S&P 500, the Nasdaq, and the Dow Jones Industrial Average. That means that they’re automatically diversified, so there’s no rebalancing required on your end, as the companies that make up the index gain and lose value.

Index funds are becoming more popular every year, and they’re the best way to invest $50,000 right now, in my opinion.

I should mention that mutual funds are not the same thing as index funds.

Mutual funds are private funds designed by investment teams at banks and other financial institutions, while index funds only track indexes. Mutual funds also have more fees and higher expense ratios since you’re essentially paying for active management when you purchase a mutual fund.

My brokerage of choice for index funds is eToro, which has access to all the index funds you could possibly want.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

7. Collectibles – Best for Speculators

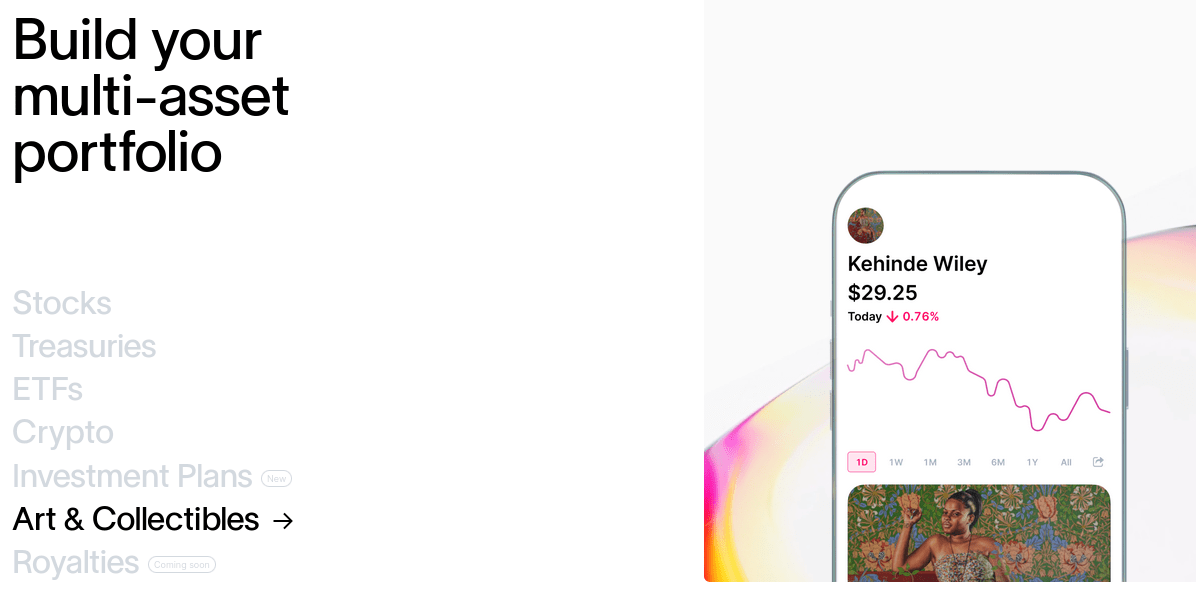

Ok, now that I covered a bunch of serious investments, it’s time for another fun one. Who doesn’t love collectibles? Lots of people have old toys, comic books, coins, and other relics from their past lying around, but not many people realize that some collectibles make for excellent investments. Even fewer people realize that you can invest in collectibles even if you don’t have any physical items through the online platform, Public.

Public lets you invest in shares of collectibles. It’s a great way to expose your portfolio to potentially big gains, although it is a bit riskier than more traditional investments. I don’t recommend putting all of your cash into collectibles, but it’s the best way to invest $1,000 right now for people who want to spice up their otherwise boring portfolio.

(Note: There’s more to Public than just collectibles. You can also invest in stocks, crypto, and treasuries.)

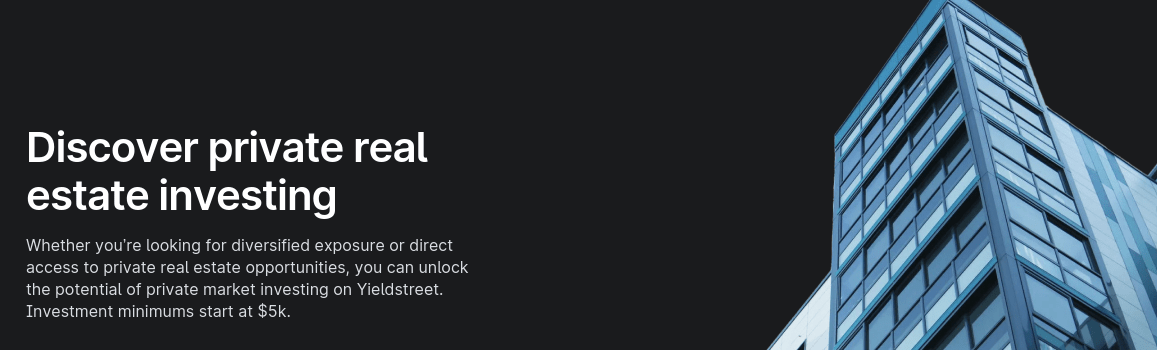

8. Real Estate – Best for Hedging Against Inflation

Real estate is one of the best ways to generate wealth, but buying a property to rent requires a lot of capital. Thankfully, platforms like Yieldstreet make real estate investing more accessible through fractional real estate investing.

Now is a great time to get into real estate investing because real estate tends to hold value or even appreciate through inflationary periods.

Rental Property

The classic way to invest in real estate is to purchase a rental property. While there’s a lot of upside to be had with rental properties, there’s also a lot of work involved. You have to maintain the property, deal with tenants, and pay property taxes, all of which make traditional real estate investing more of a headache than most people are willing to endure.

Want to increase your real estate know-how? Check out SkillShare’s course “Excel In Real Estate Investing.”

Fractional Real Estate Investing

Enter fractional real estate investing. Instead of purchasing a property yourself, fractional real estate investing through companies like Yieldstreet lets you buy shares in an income-generating property, earning some of the money generated each month without the hassle of buying and maintaining your own property.

The real estate market is on fire right now, and Yieldstreet is the best way to get involved if you don’t have enough time or money to buy a rental property right now.

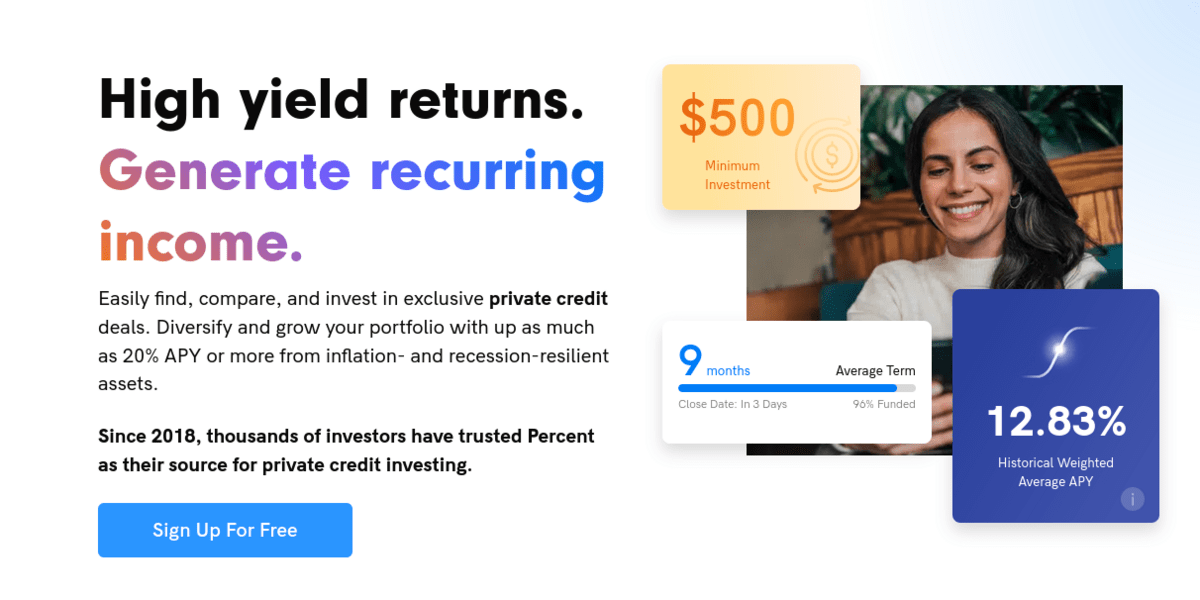

9. Private Credit – Best for High-Yield Fixed Incomes

If you’re looking for a high-risk, high-reward, fixed-income investment, private credit is what you want. Most fixed-income investments — like government bonds and HYSA — offer relatively low returns, typically in the 1%–5% range.

Private credit has the potential for much higher returns. For instance, the highly-rated platform Percent boasts a historical weighted average APY of 12.83%.

Percent is by far the best online platform for investing in private credit for accredited investors. The company makes private credit investing as easy as buying stocks from your broker.

Are you an accredited investor? Great news — there are all sorts of cool opportunities available to you. Check out our article about the best investments for accredited investors.

It’s free to sign up, and Percent’s easy-to-use platform is simple to understand, even for people who haven’t invested in private credit before.

10. Private Companies – Best for Accessing Up and Coming Companies

Interested in investing in a company that hasn’t gone public yet? Hiive can give you access. This pioneering platform gives accredited investors the ability to become stakeholders in private, VC-backed companies.

Hiive acts as a matchmaker between accredited investors who want a stake in private and/or pre-IPO companies and employees, venture capital firms, or angel investors who want to sell shares.

Hiive has a lot of cool features — for instance, there’s a live pricing chart for each company which includes prevailing bids and asks, and you can create watchlists and get notified about price changes or new listings offered.

Additionally, you have flexibility. Buyers can either accept the asking price as listed, place a bid, or negotiate directly with the sellers. As an added perk for investors, for standard transactions, the sellers are the only ones who pay fees.

Another interesting tidbit about Hiive: In 2023, 54% of accepted bids on Hiive were approved, 16% meet a buyer from cap table, 30% are blocked altogether (2023 report)

The bottom line? Hiive is one of the best ways to become an investor in private companies like Groq, Anthropic, and OpenAI. (Note: Want to see what’s trending on Hiive? On the Hiive website, you can check out the Hiive50 Index, an equal-weight price index of the 50 most liquid securities on the platform, generated directly from user orders and transactions on the Hiive platform.)

11. Gold – Best for Diversification

Gold is one of the best investments you can make in uncertain times like these. It is the classic inflation hedge — although it’s not quite as good at that as it used to be — and it’s only loosely correlated to stocks, which helps smooth out your returns.

One of my favorite ways to invest in gold is through the Birch Gold Group, a company that specializes in precious metal investments in retirement accounts.

If you’re interested in adding inflation protection to your IRA and are thinking about buying some gold, I highly recommend you check out Birch Gold Group. Gold is the best place to invest money right now, with inflation being as high as it is.

Want to find out more? Read our roundup of Birch Gold Group reviews.

Check out more of our favorite gold IRA companies:

Bonus: Crypto – Best for Risk Takers

No list of the best places to invest money is complete without cryptocurrencies these days. Crypto is still a wildcard investment, but it’s becoming more mainstream with every passing year.

Luckily, eToro now offers crypto trading, so you can stack your satoshis right next to your traditional stock investments.

I have to mention that crypto’s potential for outsized gains comes with an equally large potential for big losses. Even “safe” cryptocurrencies like Bitcoin and Ethereum are way more volatile than even the wildest stocks.

Want to learn more about crypto? Check out SkillShare’s excellent class “Demystifying Cryptocurrency.”

If you’re going to include crypto in your portfolio, I recommend playing it safe and only allocating a small amount relative to other asset classes.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Questions to Ask Before You Invest

Here are some things to ask yourself before you make any decisions about where to put your money.

What’s My Risk Tolerance?

The best investments for someone saving money to buy a house are very different from the best investments for someone with money to burn.

What Are My Goals?

Are you looking for growth or stability? Are you chasing big gains or looking for steady income? These are essential questions to ask that will color your entire investment strategy.

Stocks are great for growth and chasing big gains, but they’re less suitable for risk-averse investors looking to preserve capital. Bonds, on the other hand, are useful for keeping your money safe and generating small amounts of income, but they’re not going to help you grow your portfolio much.

What is My Account Size?

The best way to invest $1 million right now is not the same as the best way to invest $1,000 or $2,000 right now. If you have a lot of money to play with, you can consider purchasing your own rental property, while people with less capital will have to stick to smaller investments.

I always recommend getting into stock investing early in your investing career since it’s a great way to learn about risk and reward, and online brokers like eToro make it easy to jump in and get your feet wet.

How Can I Diversify?

There are a lot of ways to diversify an investment portfolio. The easiest way is to buy shares of a broad market index fund. These funds are automatically diversified, so you don’t have to worry about picking individual stocks or spreading your money around in different sectors.

You should also consider including some less common asset classes like fine art and private credit in your portfolio for further diversification.

Final Word: Best Way to Invest Money Right Now

There you have it! The eleven best ways to invest your money right now, in my opinion. I hope you found this article helpful and are now ready to make some money with a well-diversified collection of assets. Keep in mind that there is no one best place to invest money right now for everyone since everyone’s goals are different.

FAQs:

Where should I invest $1,000 right now?

The best way to invest $1,000 right now is either in fine art through Masterworks or in collectibles through Public, assuming you already have your traditional investments sorted out. While $1,000 isn’t much money to invest in the grand scheme of things, investing it in a high-risk, high-reward asset like artwork or collectibles could yield big returns.

Where to invest $5,000 today?

The best way to invest $5,000 right now, in my opinion, is to put it in a HYSA like the one offered by Empower. HYSAs have rates between 4% and 5% right now, making it a great way to generate cash that’s essentially risk-free.

Where can I get 10% interest on my money?

Getting 10% interest on your money requires taking a little risk. Investing in stocks is one option, but it’s inherently uncertain and risky. The S&P 500 is up 17% YTD, but it could just as easily be down 10% or more in any given year. Private credit is another good option, but again, it’s risky. It’s not uncommon to see private credit investments that return 10%. I recommend checking out Percent if you’re interested in private credit investing opportunities.

How much money do I need to invest to make $1000 a month?

It depends on what assets you’re invested in. The S&P 500 typically returns 7% annually on average, which means you’d need to invest almost $175,000 in it to return an average of $1,000 per month. If you’re looking for something safer, such as a HYSA, you’ll need to invest $240,000, assuming a rate of 5%.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.