Groq is not publicly traded.

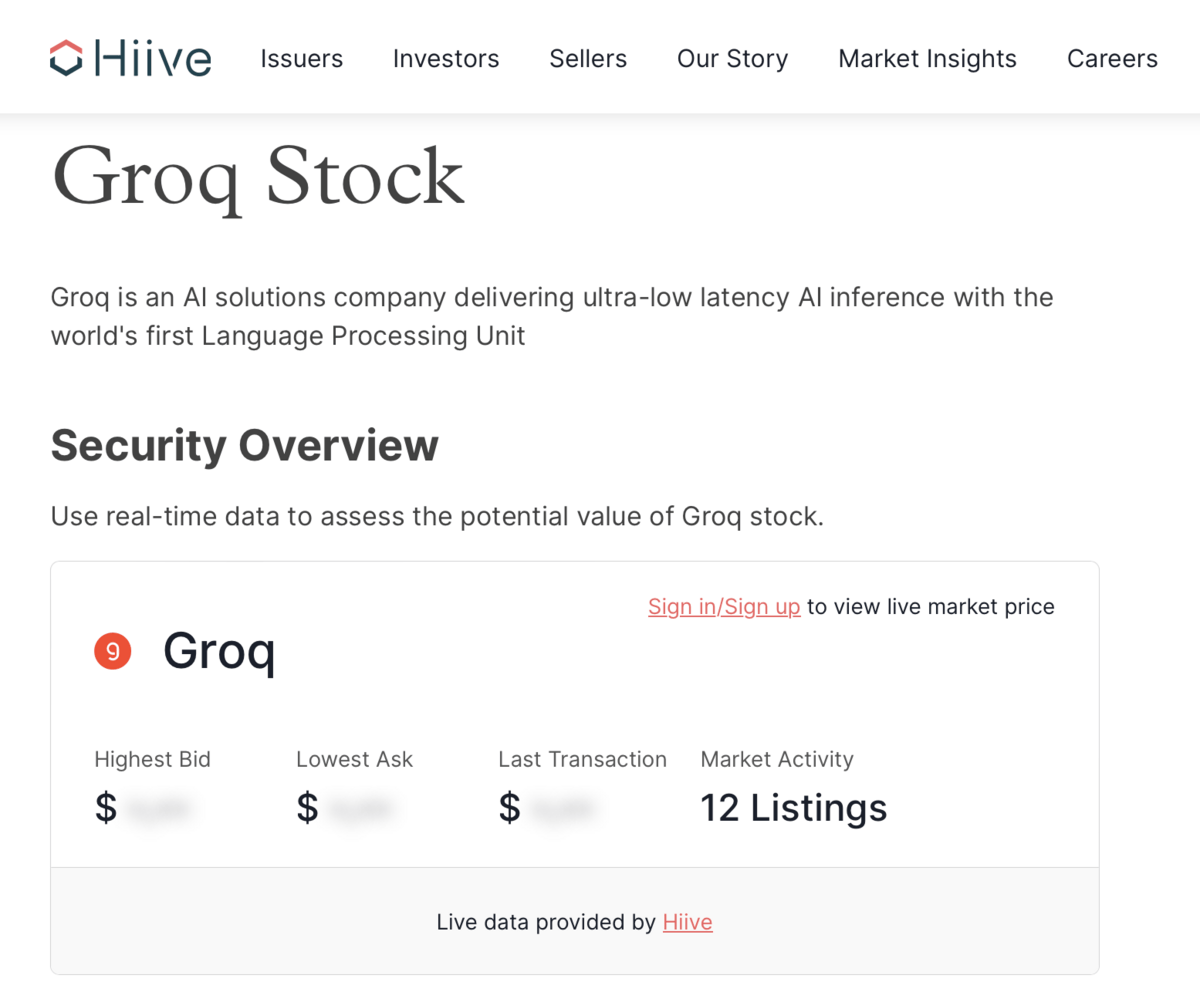

Hiive is a marketplace that connects accredited investors with shareholders of pre-IPO, VC-backed companies like Groq who want to sell their shares.

Sign up with Hiive here and get access to Groq before its IPO.

Investing in AI isn’t a secret stock tip nowadays, but there are still plenty of under-the-radar gems in this red-hot segment.

For instance, the Cali startup company Groq is making quite a squawk with those in the know.

Get this: Groq has already reached a staggering $1.1 billion valuation since its 2016 founding.

With its prized unicorn status, is it any wonder more investors are clamoring over how to buy Groq stock?

While Groq is not currently public, there are still ways to join the Groq flock — if you know where to look. Keep reading to learn how investors are seeking out Groq stock as well as ideas for how to gain exposure to the company indirectly.

What is Groq?

Groq is the brainchild of a couple of brainy AI engineers from Alphabet (NASDAQ: GOOGL), notably Groq’s current CEO Jonathan Ross.

While Groq is innovating in a number of ways, its core product is its Language Processing Unit (LPU), and its focus is on a field known as “inference.”

To put it in simple terms, inference is all about helping AI systems recognize new data as it comes streaming into their circuits. Groq believes its LPU model is the fastest, cheapest, and most energy-efficient offering in its chosen niche, and it has some evidence to support its claim.

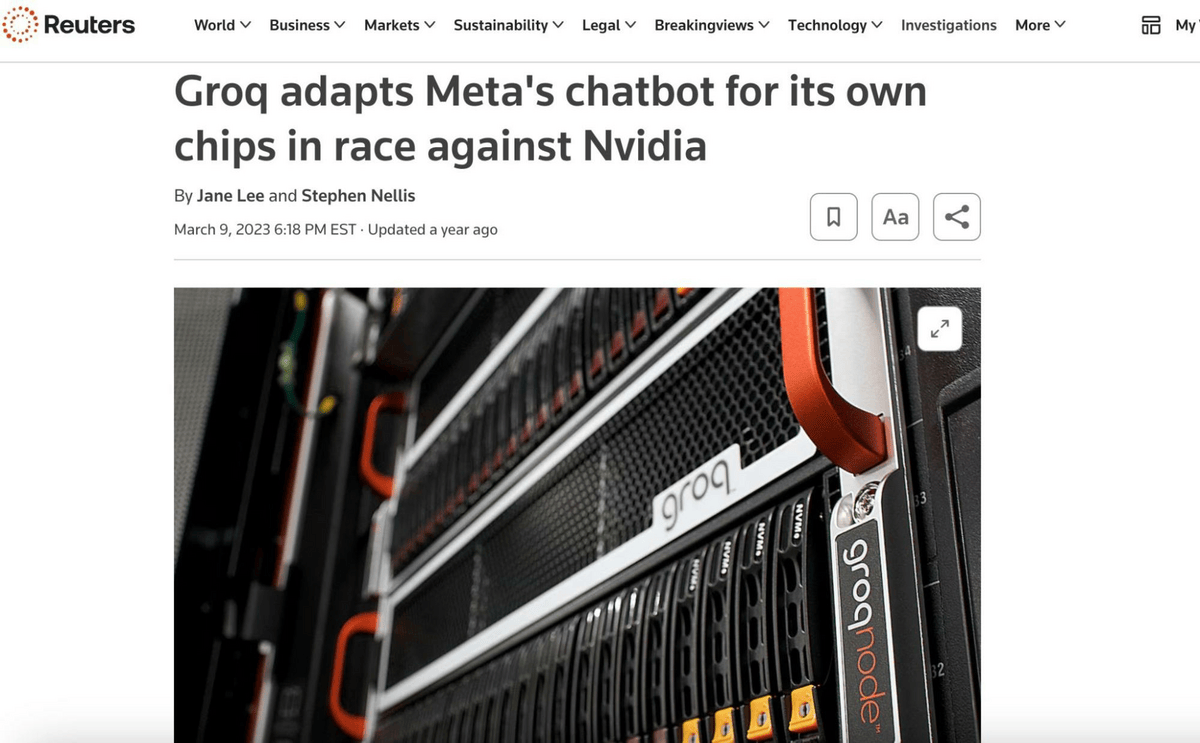

For instance, Groq made headlines in 2024 after successfully repurposing Meta’s open-source LLaMA model for its chips — highlighting Groq as an alternative to the big boy in AI chip manufacturing, Nvidia (NASDAQ: NVDA).

Super investor Chamath Palihapitilya’s Social Capital helped fund Groq in the early days, and it continues to raise millions from multiple VC firms, including Tiger Global Management and XTX Ventures.

Can You Buy Groq Stock? Is Groq Publicly Traded?

Looking for how to buy Groq stock on your brokerage platform? If so, you’ll quickly discover there’s no Groq stock price or Groq stock price chart.

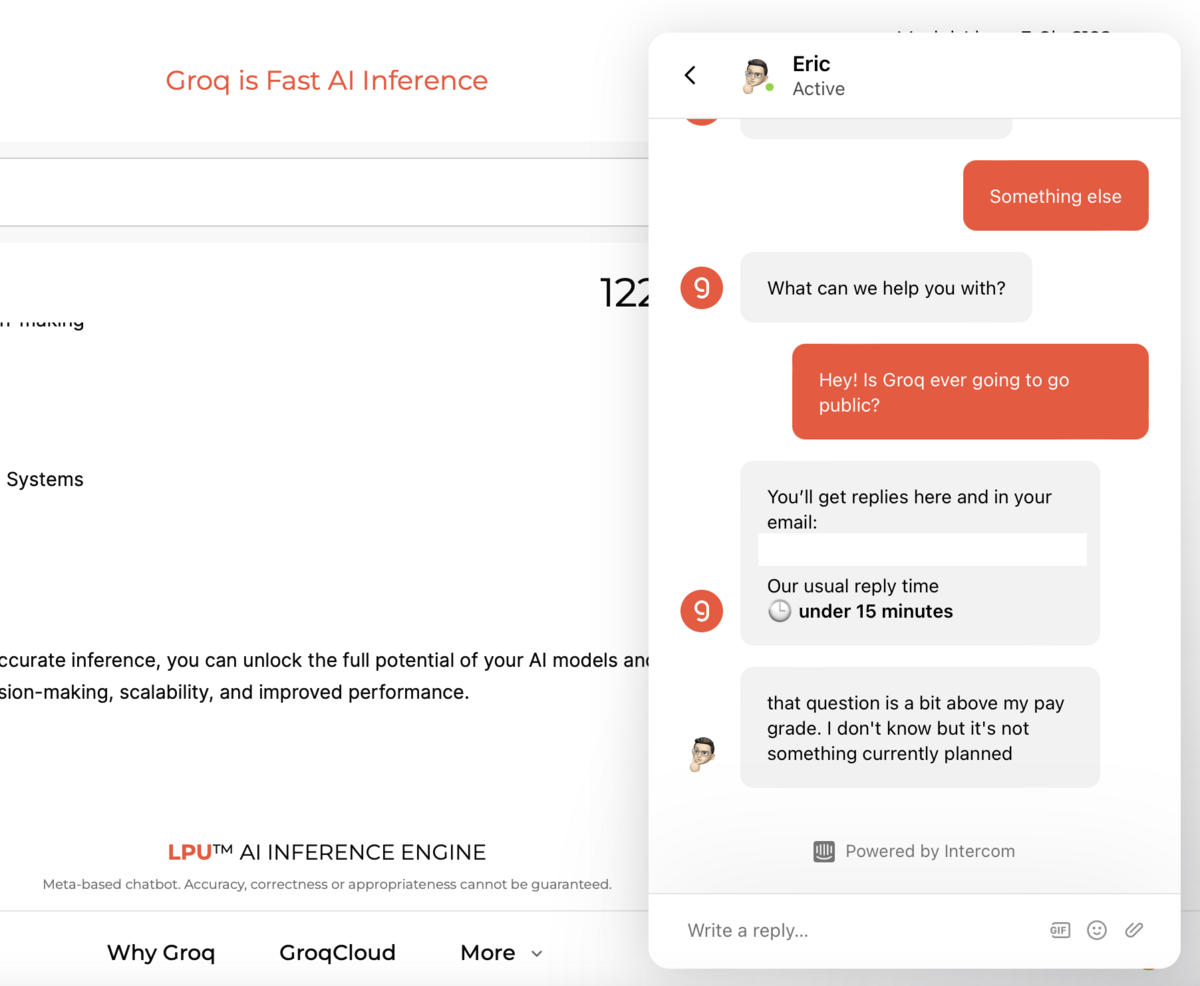

Will there be a Groq AI stock? Not anytime soon. We reached out to Groq directly to ask, and here’s what they said:

That’s right: According to a company source, Groq is not currently planning to go public.

However, if you’re an accredited investor, keep reading to get the full details on how to buy Groq stock.

You can’t buy Groq stock on the public market.

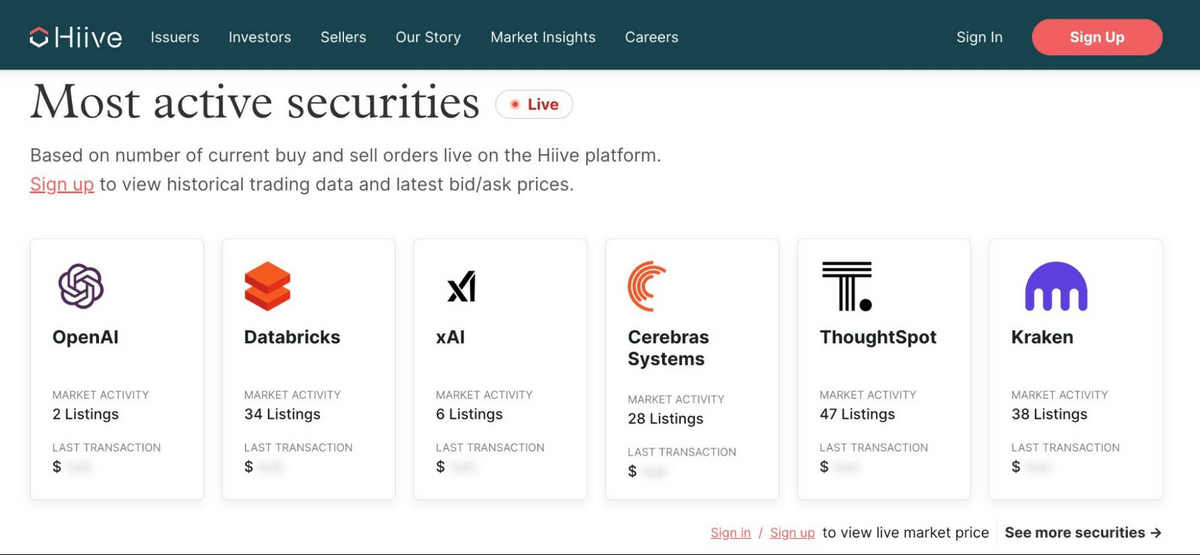

However, if you’re an accredited investor, you can invest in Groq through Hiive, a secondary marketplace where users can buy and sell shares of over 2,000 private, pre-ipo companies — including Groq.

As long as you’re an accredited investor, you can complete a Hiive profile and connect with insiders who already own shares of Groq and want to make a deal. At writing, there are 12 listings for Groq on Hiive.

Beyond Groq stock, Hiive’s intuitive interface offers access to other hot VC-backed private companies, such as Binance, Juul, and OpenAI.

Serious about adding Groq stock to your portfolio? Sign up for Hiive using this link.

What securities are most active on Hiive? It’s easy to find out with Hiive’s innovative Hiive50 Index, an equal-weight price index of the 50 most liquid securities on the platform, generated directly from user orders and transactions on the Hiive platform.

Not only does it give you an idea of what’s trending on Hiive, but it also acts as a barometer for the direction and momentum of the late stage pre-IPO market. Check out Hiive today.

Who Owns Groq?

Hardware engineer Jonathan Ross is the founder and CEO of Groq, so it’s most likely he holds the most stake in the company.

Before working at Groq, Ross was best known for developing Google’s Tensor Processing Unit (TPU), which is critical to Alphabet’s machine learning ambitions.

Since Groq is a private company, there are no public records on shareholder ownership, but there’s no question Mr. Ross is the boss (so he probably owns a big chunk of the company!).

Does Samsung Own Groq?

Groq has a public partnership with Samsung; in August 2023, it announced partnering with the Seoul-based electronics company to make its next-generation chips.

According to a 2023 announcement, Groq uses Samsung’s distinct “4-nanometer process node” to make its LPU chips in a Texas facility.

Although this partnership is a big deal for Groq, it doesn’t mean Groq is now a subsidiary of Samsung.

While there are no details over how much — if any — Groq stock Samsung controls, the two companies are still separate entities.

How to Invest in Groq Stock as a Retail Investor

If you’re a non-accredited investor researching how to buy Groq stock, you can’t acquire this AI startup yet.

However, there are a few indirect ways to gain exposure.

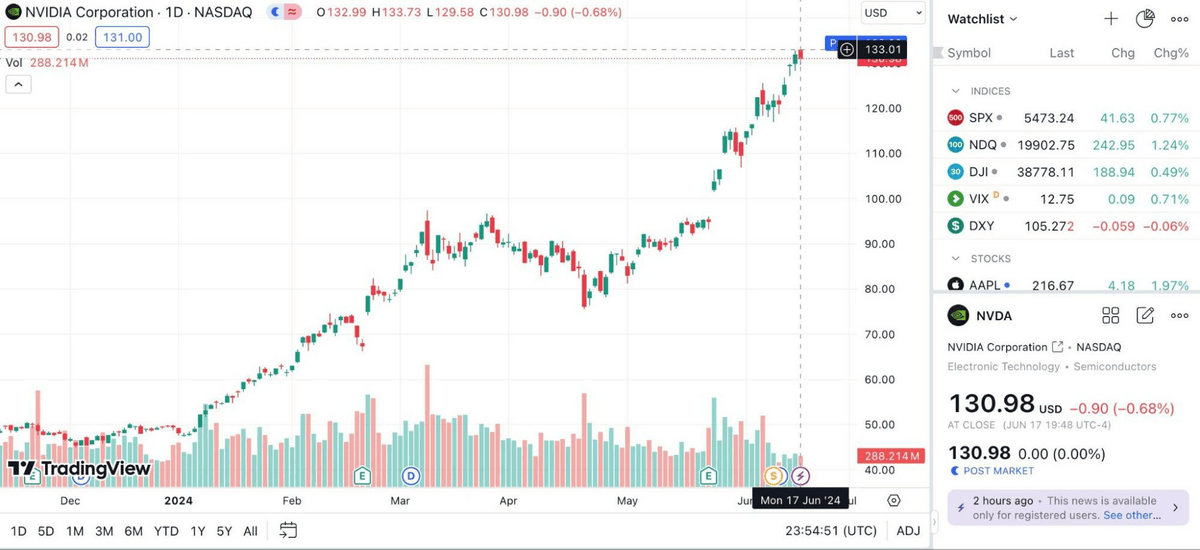

The kingpin in the AI chip space remains Nvidia (NASDAQ: NVDA), but there are plenty of other competitors worth considering.

For instance, since Groq has close ties to Alphabet (NASDAQ: GOOGL) employees, the Google parent company may be worth watching.

Other chip manufacturers, such as Advanced Micro Devices (NASDAQ: AMD), Intel (NASDAQ: INTC), and Taiwan Semiconductor (NYSE: TSM), are also popular tickers that you may consider adding to your watchlist to follow AI chip trade.

Lastly, although Samsung offers more direct exposure to Groq due to its partnership, it’s tricky to get Samsung shares outside of South Korea. Foreigners who want to buy into Samsung often have to work with OTC markets or buy a South Korean-focused ETF like Ishares Msci South Korea ETF (EWY).

Aside from that, investing in Samsung for Groq exposure could be a drop in the bucket. Samsung has a market cap of $370 billion or so, so the Groq partnership is a pretty small slice of what they do.

How to Buy the Groq IPO

Here are the steps on how to buy Groq stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Groq

- Select how many shares you want to buy

- Place your order

- Monitor your trade

Groq Stock Price Chart

There’s no Groq stock price chart yet because Groq isn’t a publicly-traded company.

However, you can monitor big semiconductor companies or ETFs in this field.

For example, SPDR S&P Semiconductor ETF gives a good sense of the overall price action in the chip manufacturing space.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How to buy Groq stock?

Accredited investors can buy Groq stock on the pre-IPO trading platform Hiive, but retail investors have to wait till Groq's team decides to issue public equity.

How much is Groq stock?

We won't know Groq's stock price until it goes IPO on a market like the NASDAQ. Until then, people who buy Groq stock do so on pre-IPO platforms like Hiive.

What is the Groq stock symbol?

No Groq stock symbol exists because it isn't on any public exchange. The company will only reveal the official Groq stock symbol if it goes IPO.

Who owns Groq stock?

Jonathan Ross is the CEO and founder of Groq, so he probably owns a large number of the company's shares. However, a few investment firms, like Tiger Global Management and Social Capital, also have significant stakes in the company.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.