Binance is not publicly traded.

Hiive is a marketplace that connects accredited investors with shareholders of pre-IPO, VC-backed companies like Binance who want to sell their shares.

Sign up with Hiive here and get access to Binance before its IPO.

Binance’s growth has been rapid, but it’s been a bumpy ride. Right now, the largest crypto exchange in the world is in hot water with the SEC.

I’ll be real with you: Right now might not be the best time to invest in Binance. That said, a company’s fortunes can easily change. Plus, the crypto exchange space is still highly profitable and has the potential to grow.

Caution is key. But as evidenced by Ripple, which recently won a case against the SEC, a lawsuit does not equal a company’s demise. Binance is still the largest dog in the fight — some 8 times larger than its next competitors.

Still interested in how to buy Binance stock? Let’s talk.

Binance: The Basics

We’ll get to how to buy Binance stock in a minute, along with a discussion of some important considerations.

But first, we should go through a couple of key factors illustrating why this company, all troubles included, is still a key player in the crypto space:

- Binance is the largest crypto exchange by trading volume. At writing, it had handled $5,776,697,996 in the past 24 hours.

- The company does business in more than 180 countries.

- Binance’s own cryptocurrency, Binance Coin, currently has a market cap of over $37 billion.

- There are more than 128 million registered users on Binance

- Binance’s annual revenue hit a high of $12 billion in 2022 — experiencing a growth factor of 10 in just two years.

Can You Buy Binance Stock? Is Binance Publicly Traded?

Interested in how to buy Binance stock?

Binance stock isn’t publicly traded — so don’t waste your time looking for a Binance stock symbol. The company hasn’t gone public yet, and its legal problems will likely delay a potential IPO further.

But that doesn’t have to be the end of that. There may still be ways to gain exposure. Let’s talk about it.

How to Buy Binance as an Accredited Investor

Traditionally, accredited investors have invested in private companies through hedge funds, venture capital firms, or angel investing. There’s a slight issue there — all of those methods require large investments (think 6 figures or more).

This is the very issue that Hiive tackles. (Note: Hiive is only available to accredited investors. What does that mean … and what else can accredited investors invest in? Check out our article about the best investments for accredited investors.)

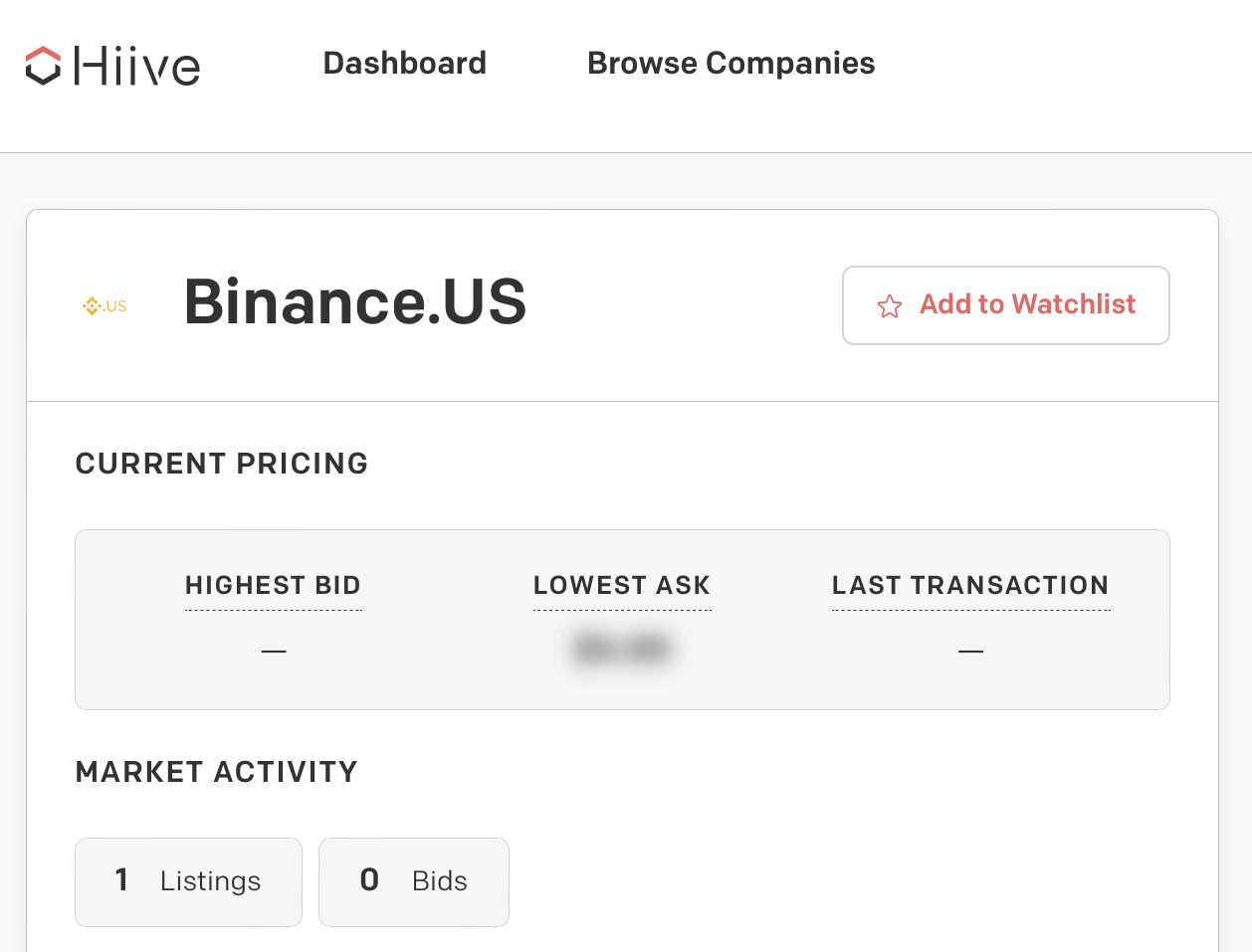

Binance is not publicly traded. But accredited investors can invest in private companies including Binance through Hiive.

Hiive is a marketplace that connects shareholders of private, VC-backed companies who want to sell their pre-IPO shares to accredited investors.

With no buying fees, the ability to negotiate, and a robust marketplace with thousands of companies, Hiive is a great way to invest in companies before they IPO.

Sign up with Hiive, check out Binance, add it to your watchlist, and get notified about any new listings and trades.

On Hiive, each listing is generated by a seller (who might be an employee, a VC firm, or an angel investor), who sets an asking price and the amount of volume offered.

As a buyer, you can curate your watchlist of companies to keep an eye on, and you’ll get notified when there are new listings or a price change. If you see an intriguing offer, you can accept the asking price, negotiate, or place a bid.

Here’s the Hiive listing for Binance:

How to Buy Binance as a Retail Investor

Back to our original topic — how to buy Binance as a retail investor. Long story short, you can’t — at least not directly.

However, there are ways in which you can gain exposure to Binance, recreate its performance, or potentially profit off of the same industry by investing in competitors. But first, a few things you should know:

Who Owns Binance?

The founders of the company — Changpeng Zhao, commonly known as CZ, and He Yi, are most likely the holders of the largest stakes in the company.

Apart from them, ownership of the company is divided among the businesses that funded Binance, including:

- Black Hole Capital

- Sequoia Capital

- Vertex Ventures

- Funcity Capital

- Fundamental Labs

- Iron Key Capital

Does Blackhole Capital Own Binance?

No. Although Blackhole Capital was among the first backers of Binance, and its stake is likely significant, they do not own the company.

Blackhole Capital and Funcity Capital led the first round of VC investment for Binance, but the actual ownership percentages were never publicly disclosed, as is standard practice.

How to Invest in Binance Stock as a Retail Investor

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations. Your investments are solely your decisions.

Today’s question was how to buy Binance stock. The answer is that you can’t do that right now and that there are plenty of reasons why investing directly in Binance is a risky move.

However, if you want to gain some exposure to the company, invest in it indirectly, I’ve got you covered. Let’s look at two possible avenues that you can take.

Binance Coin

Since Binance stock isn’t publicly available, the simplest way to gain exposure to the company is through its crypto token, Binance Coin (BNB). Although it has seen significant price drops due to the lawsuit, as well as general cryptocurrency troubles, the token is currently trading at around $240.

I won’t try to summarize whether or not investing in BNB is a good idea at the moment — I do have to keep these guides short.

I will remind you once again that Binance is in legal trouble, and that crypto investing is riskier than most other forms of traditional investing.

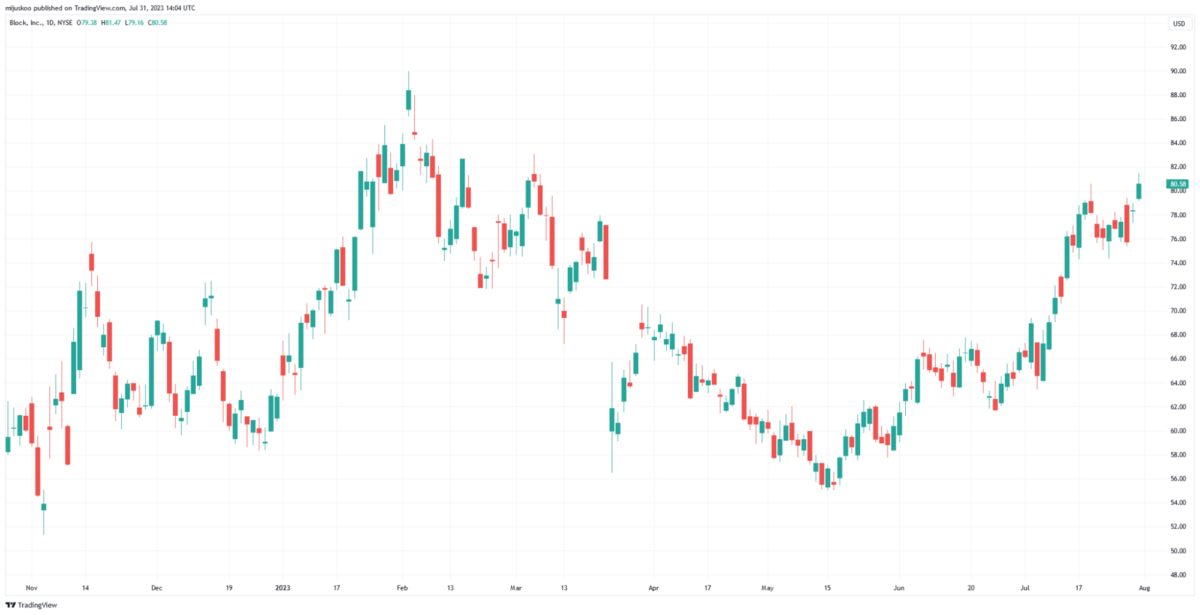

With that said, I’ll leave a price chart below (courtesy of TradingView) and leave the in-depth research in your capable hands.

Interested in trading crypto? One of our favorite exchanges is eToro.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Competitors and Publicly-traded Crypto Companies

Binance has competitors, and some of them are publicly traded.

The first item on our list is Coinbase (NASDAQ: COIN). Coinbase is significantly smaller than Binance, and is currently rated Buy by the top analysts featured on our website.

However, the average forecast for the coming year is -16% — so I would steer clear unless you’re intent on a long-term, buy-and-hold approach. Still, Coinbase deserves a spot in one of your watchlists.

Block Inc, formerly known as Square (NYSE: SQ), although not a crypto exchange, is a payment platform — and apart from just accepting Bitcoin, the company is also a part of plenty of exciting crypto projects.

Last but not least, Riot Platforms (NASDAQ: RIOT) and Microstrategy Inc (NASDAQ: MSTR) are companies with large exposure and correlation to cryptocurrencies.

Out of all these options, Block currently looks like the best choice — rated a strong buy by our featured analysts, with an average forecast of +16.64% looking at the next year. Chart below courtesy of TradingView.

How to Buy the Binance IPO

Here are the steps on how to buy Binance stock if and when it becomes available:

- Create or login to your brokerage account (if you don’t have one, we recommend eToro)

- Search for Binance

- Select how many shares you want to buy

- Place your order

- Monitor your trade

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Binance Stock Price Chart

Because the company hasn’t gone public yet, I can’t give you a legitimate Binance stock price chart. There’s no Binance stock symbol and no way to measure Binance stock price.

That being said, I can give you other charts that will provide you with some useful information. Let’s start with the bad news.

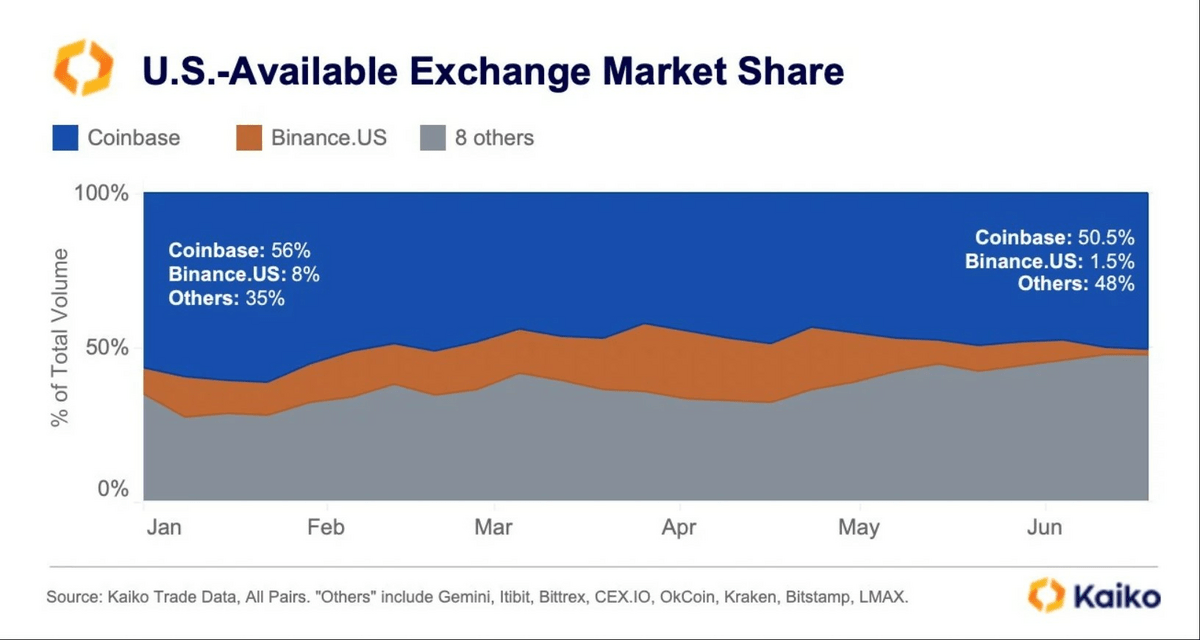

The chart above, dated June 2023, shows the rapid drop in market share that Binance US experienced as a result of the SEC lawsuits. Since then, market share has dropped even further, plummeting below 1%.

On the bright side, while the troubles that Binance and other crypto exchanges have run into with regulatory bodies have certainly thrown a spanner in the works, things aren’t actually all that bleak.

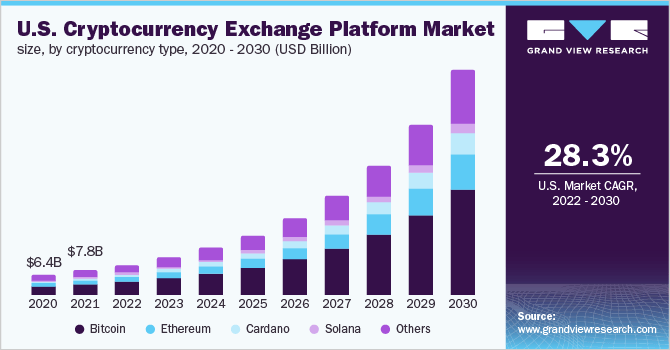

In the chart above, you can see Grand View Research’s estimates on the growth of the crypto exchange market. At the forecasted 28.3% CAGR, the market should be worth $264.3 billion in 2030.

The legal and regulatory issues facing cryptocurrency are far from a done deal, as Ripple’s recent court victory against the SEC has shown.

While there may be some more bumps further down the road, they won’t be able to stop the inevitable growth and further adoption of crypto worldwide.

The bottom line? You can’t buy Binance stock yet. However, if you’re an accredited investor, you can check it out on Hiive; if you’re a retail investor, there are plenty of other crypto stocks to explore.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How to buy Binance stock?

You can’t buy Binance stock — at least not at the moment. The company is still privately-held, so its shares are not publicly traded.

How much is Binance stock?

There currently isn’t a way to accurately measure how much Binance stock is worth, or for how much it would trade.

What is Binance stock symbol?

There is no stock symbol associated with Binance as of mid-2023 since the company isn’t listed on any of the world’s stock exchanges.

Who owns Binance stock?

Apart from the two founders, Changpeng Zhao and He Yi, various VC and private equity companies own Binance stock — including Black Hole Capital, Sequoia Capital, Vertex Ventures, Funcity Capital, Fundamental Labs, and Iron Key Capital.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.