Do you have $1,000 in total cash, or do you have $1,000 ready to invest?

It isn’t the same thing.

Before investing a dime, you should:

- Have an emergency fund of 6-12 months of living expenses in a bank account that offers high interest rates (I like CIT Bank)

- Pay off all high-interest (8%+) consumer debt

- If your employer offers 401k matching, contribute up to the max matching amount

Those are the first 3 rungs you should pass before investing $1,000.

You can start by moving your savings into a high-yield savings account that can earn you higher, risk-free interest.

Assuming you’re past those stages of financial planning and are ready to invest, let’s cover the 7 best ways to invest 1000 in 2025.

How to Invest $1,000 Wisely

Before I cover the different investment options you have, you should know a few investing principles:

-

- Every investment you make has a unique risk/reward profile. Generally speaking, the higher the risk you take on, the higher the potential reward.

- I would invest $1,000 differently than I would invest $50,000 – it’s hard to diversify with just $1,000. As your portfolio grows, your investing style should evolve. (You may be interested in my article on how to invest $50,000.)

- You should know your timeframe before you start investing. If you need the $1,000 in the next 6 months, you should keep the money in a risk-free asset (like a high-yield savings account). If you don’t need the money until you retire in 30+ years, you can invest in assets with higher returns (like stocks).

If you’re a little bit lost, don’t worry, it will all make more sense as I go through the list. I’ll include the Risk, Return, and Timeframe characteristics of each asset.

*Disclaimer: These are approximations, not investment advice. Lincoln Olson and WallStreetZen are not liable for any investment risk you undertake. Invest wisely.

Now, let’s start with the best way to invest $1,000 right now.

The 7 Best Ways to Invest 1000 in July 2025

1. High-Yield Savings Accounts

Risk level: 1/5

Return level: 2/5

Investment Timeframe: Short-, Medium-, and Long-Term

Everyone should have a rainy day fund.

An emergency fund is a bank account with enough cash to cover 6+ months of living expenses in case of an emergency. If the car breaks down, you lose your job, or there’s a medical emergency, you’ll be prepared. It’s the most practical investment you can make (and the best way to invest 1000).

Plus, having a financial safety net removes a significant amount of stress.

But accounts with most financial institutions are horrible “investments”. My old bank paid me 0.045% in interest – that’s $4.50 for every $10,000 of extra money I had saved. (And forget about a checking account, which typically pays no interest.)

Meanwhile, inflation was eroding my savings, costing me $20 per year for every $10,000 I had saved (and that was when inflation was at just 2%!).

Online banks offer much higher interest rates because they don’t have the costs associated with operating physical buildings.

I personally like CIT Bank — their interest rates are currently about 100x what my old bank paid, and there are no account fees.

2. 401(k) Matching

Risk level: 3/5

Return level: 3.5/5

Investment Timeframe: Long-Term

A 401(k) is a tax-advantaged retirement account offered by most employers.

Why should you use a 401(k)?

-

- Your employer may be offering you free money. In many cases, your employer will match your contribution, up to a certain amount (typically 2-4% of your salary). If you contribute $100, your employer will “match” it with a $100 contribution into your account. This is the closest thing to free money in our world.

- Tax benefits. 401(k)s reduce your tax bill. You do not pay taxes on any dollar you contribute to your 401(k). If you make $75,000 per year and contribute $10,000 to your 401(k), you will pay taxes on just $65,000.

A 401(k) is a type of individual retirement account, not an investment.

After contributing to your account, you’ll need to choose an investment. Most plans offer mutual funds, which are baskets of stocks and bonds that can diversify your portfolio with a single investment.

Mutual funds are great investment vehicles, but some of them come with unexpected expenses (think: hidden fees).

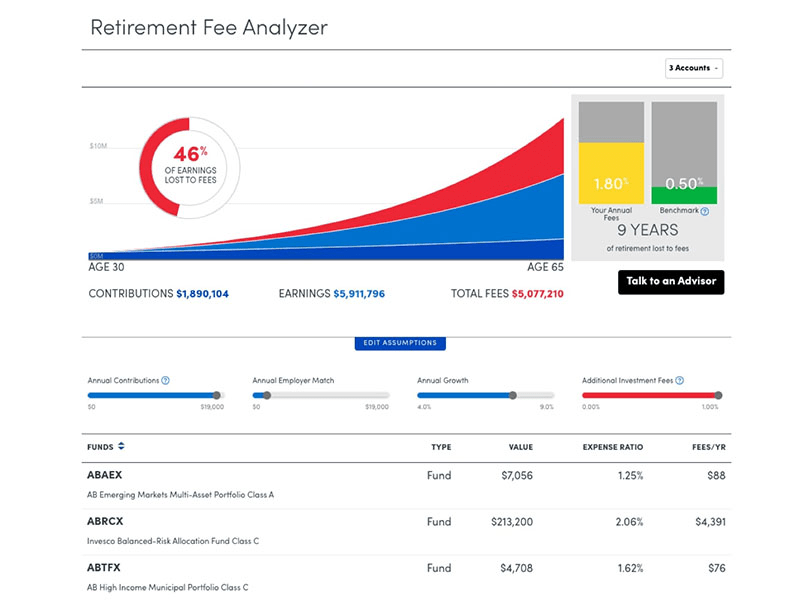

Empower, one of my favorite portfolio trackers, has a free fee analyzer tool so you can easily understand account fees and how they factor into your retirement plan:

Plus, Empower’s 401(k) portfolio tracker will help you pick out the best mutual fund, help plan your contribution schedule, and give you a complete picture of your financial health.

Its money management and financial planning tools are completely free to use. (Empower also offers wealth management and financial advisors … There are fees for these services, but relatively reasonable ones.)

Before you look to invest $1000 somewhere else, see if your employer offers 401(k) matching contributions.

3. Pay off High-Interest Debt

Risk level: 0/5

Return level: 5/5

Investment Timeframe: Short-Term

You might be thinking: Paying off a credit card isn’t an investment!

Or is it?

If you are paying 23% on a $1,000 credit card balance, that’s $230 per year. If you pay off that debt, that’s equivalent to earning 23% per year (double the average stock market returns) and you’re “earning” it risk-free and tax-free.

Paying off your credit card and other consumer debt is the highest guaranteed ROI investment you can make.

Now that I’ve covered the “pre-investment” investments, let’s jump into where to invest $1000 right now.

4. ETFs

Risk level: 3/5

Return level: 3.5/5

Investment Timeframe: Long-Term

Ready to start investing in the stock market? The U.S. stock market has averaged a little more than 10% per year for the last 100 years.

In my opinion, ETFs are one of the best investments if you have $1,000.

An ETF (exchange traded fund) is a basket of stocks, bonds, or other assets that trades on a stock exchange like a regular stock. Adding a few ETFs is a relatively easy way to create a more diverse portfolio.

For example, the $SPY ETF tracks the S&P 500, 500 of the largest companies in the United States. Instead of buying all 500 stocks individually, you can buy the $SPY ETF and have exposure to all of the companies with a single investment. What is SPY offers a complete overview of this particular ETF.

ETFs are a great way to diversify your investment portfolio for an extremely low cost.

There are thousands of ETFs to choose from, but I usually recommend choosing one that tracks a benchmark such as the U.S. stock market. A great option is Vanguard’s Total Stock Market Index ($VTI).

To buy an ETF, you’ll need to open a brokerage account. After opening and funding your account, search for the ETF you’re looking for and hit ‘Buy’.

My favorite brokerage is eToro, which is offering a $10 bonus for U.S. residents who open and fund a new account (as of July 18, 2025).

*$10 bonus for a deposit of $100 or more. Only available to U.S. residents. Additional terms and conditions apply.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Another excellent platform that offers a unique, hands-off approach to ETFs is Ally. Check out our Ally Invest review to learn more.

5. Individual Stocks

Risk level: 3.5/5

Return level: 4/5

Investment Timeframe: Medium- to Long-Term

If you want to take a more active approach to your stock market investing, you may want to invest in individual stocks.

Instead of buying a basket of stocks with an ETF, you can buy shares of your favorite companies through your brokerage account (like Apple, Tesla, and Meta). Like with ETFs, you’ll need a brokerage account (my fave: eToro). This approach, however, will require more skill and analysis than buying an index fund ETF.

While the stock market as a whole has always gone up over the long term, many individual companies have become worthless. You should perform proper due diligence and research before investing your money in individual stocks.

WallStreetZen helps investors analyze individual stocks via fundamental analysis. To learn more about fundamental analysis, check out this article on how to know what stocks to buy.

If you want to invest in individual stocks but want a team of professionals to do the research for you, check out this Motley Fool review.

Ever wish you had a smart investor buddy who could help you pick out awesome stocks? If so, you might be interested in our new stock-picking newsletter, Zen Investor. As a member, you receive stock picks, commentary, portfolio updates, and webinars from stock market veteran Steve Reitmeister, who hand-selects stocks through a proprietary 4-step process using WallStreetZen tools.

The result? You get additional focus in your investing and more free time. Check out Zen Investor today.

6. Real Estate

Risk level: 4/5

Return level: 4/5

Investment Timeframe: Medium- to Long-Term

How on earth are you going to buy real estate with $1,000?

Fractional real estate.

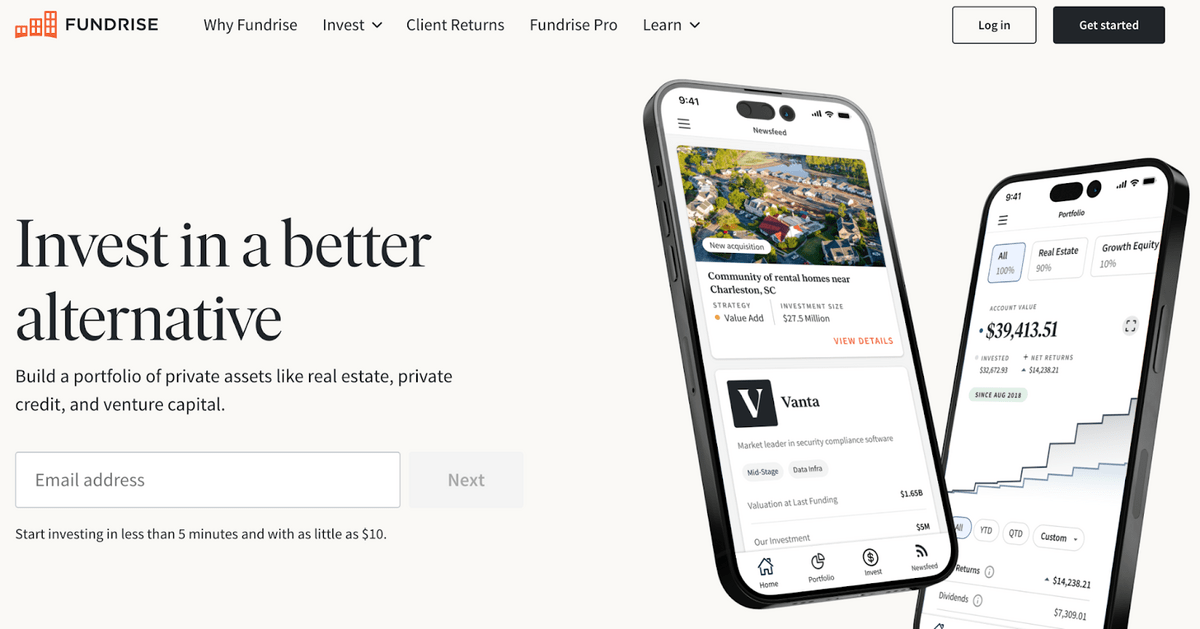

The biggest barrier to entry to real estate investing is lack of capital. Fractional real estate platforms like Arrived Homes and proprietary funds from Fundrise help solve that problem.

Fundrise lets you invest in real estate funds. If you want to diversify further, it also offers access to private credit funds and the new Innovation Fund, which focuses on high-tech companies).

Arrived Homes lets you invest in residential rental properties. In both cases, the account minimums are perfect for beginners:

Fundrise account minimum: $10

Arrived Homes account minimum: $100

With well under $1,000, you can invest in residential or commercial real estate and benefit from rental income and price appreciation with 0 headaches.

Note: We earn a commission for this endorsement of Fundrise.

7. Artwork

Risk level: 4.5/5

Return level: 4.5/5

Investment Timeframe: Medium- to Long-Term

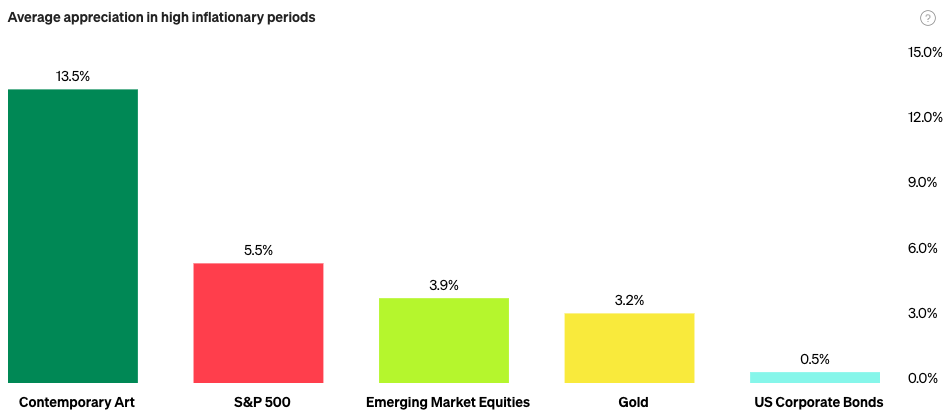

Another asset class that was once limited to professional investors and the very rich is art.

Masterworks has made high-end art investing available to individual investors.

Here’s how it works:

- Its research team analyzes and locates good pieces at fair prices and purchases the pieces

- It files an offering circular with the SEC which allows anyone to invest

- It holds the artwork for 3-10 years, then either:

- sells the painting and returns the proceeds to the investors, or

- allows you to sell your shares on its secondary market

This is a relatively new field – invest with caution.

Final Word: How to Invest 1000 Dollars

Now you have several investment choices to consider, ranging from exchange traded funds to high yield savings accounts and beyond. The investment strategies you choose are up to you, but I believe these are all solid picks.

Remember to complete the pre investment goals detailed at the top of the post before looking to invest money beyond that (if you have any savings that aren’t earning you interest – start by moving them into a high interest savings account.

Take advantage of a high-yield savings account and your employer’s 401(k) matching, and be sure to track your financial picture with Empower’s free tools.

That’s how to invest 1000 dollars — here’s to your financial future!

FAQs:

Where to invest $1000 right now?

Your first $1,000 should go into a high-yield savings account to start your emergency fund.

If you already have an emergency fund, are maximizing your 401(k) matching, and have no consumer debt, I would invest in ETFs.

How to invest 1000 dollars?

To invest $1,000 wisely, you should invest based on your risk tolerance, financial goals, and time horizon and take into account each investment's risk/return profile.

If you have a long-time horizon and are comfortable investing in the stock market, the easiest way to start investing is by buying an ETF.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.