What if investing was easy?

What if you could open an account, deposit money, and have it automatically invested for you?

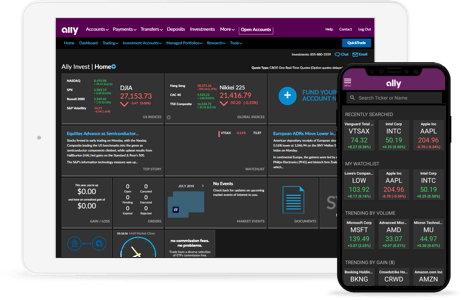

Ally Invest offers hands-off investing and wealth management services for new and experienced investors alike.

It can help you choose your investments, automate your deposits, and build a long-term investment plan tailored to you, all based on an easy-to-answer questionnaire.

While Ally Invest is exceptional for new investors and those who want to take a hands-off approach to their investing, it also caters to confident, self-directed investors who want to choose their own stocks, ETFs, and several other assets.

We’ve reviewed the details of Ally Invest, including its (rock-bottom) fees, investment selection, security, and services to find out who it is best for.

Here’s my Ally investing review:

Spoiler alert: It’s really good.

Ally Invest Review: Is Ally Invest a Good Investing App for ETFs?

The Bottom Line: Ally Invest is a great investment platform that caters to both self-directed and hands-off investors. It offers no-fee trades on stocks and ETFs, as well as robo-advisory services and wealth management solutions.

With access to hundreds of commission-free ETFs from top companies like Vanguard, Schwab, iShares, and Invesco, Ally Invest is one of the best platforms for ETF investing, but it does so much more.

Ally Invest offers both standard brokerage accounts and individual retirement accounts (IRAs), as well as margin accounts for trading with leverage. Ally also offers banking services, credit cards, retirement planning, and several loan options.

Who is Ally Invest Best For?

Ally Invest is best for long-term, passive investors who take a self-directed approach to investing or want managed services for hands-off investing.

If you are new to investing, I highly recommend the robo-advisor service which helps you build an investment portfolio and will automate the investing process with minimal fees.

If you are confident in your investing knowledge, Ally Invest offers self-directed accounts that allows you to choose your own investments, with access to stocks, ETFs, mutual funds, fixed income products, and even foreign exchange (Forex) trading.

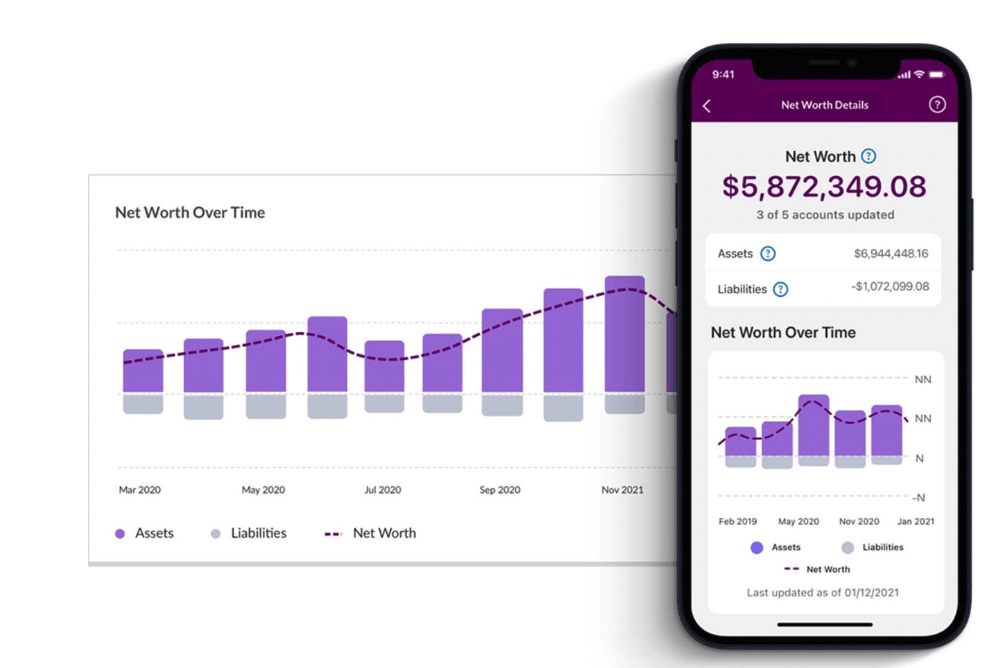

And if you have a larger net worth and want additional help choosing your investments, Ally Invest offers a wealth management service. This includes access to a dedicated financial advisor, a customized financial plan, and access to a digital dashboard for tracking all of your financial accounts (even non-Ally accounts).

Ally Invest offers retirement accounts (IRAs) within each service (self-directed or managed), and there are no additional fees to open one.

Ally Invest Features:

Self-Directed Trading

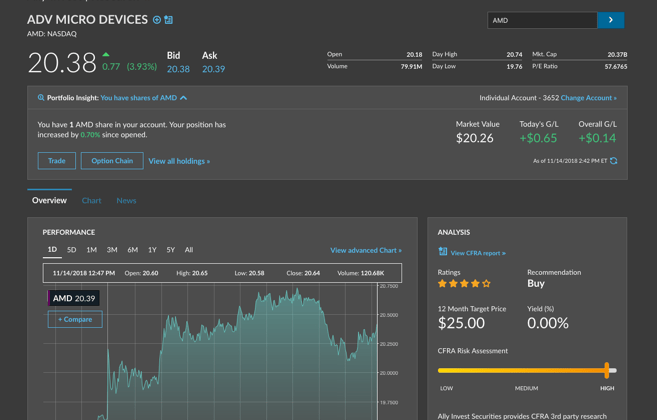

Ally Invest offers a self-directed trading platform that gives you access to thousands of stocks, ETFs, and other assets. This is the best way to build a customized investment portfolio without any additional management fees.

Ally investing fees are quite low across all of its solutions, including its robo-advisory and wealth management services.

Although I like it for its long-term investing solutions, the platform also caters to active traders by offering several trading tools, including charting, customized order types (market, limit, stop-limit, trailing, etc.), and access to margin and options trading. Ally has built-in market research tools to help you stay on top of the latest trends and news, as well as access to analyst commentary and probability tools.

While Ally Invest doesn’t charge commissions on most stocks and ETFs, there are fees for mutual funds, bonds, and stocks valued under $2 (penny stocks). Options trading is also commission-free but will charge a $0.50 per contract fee, standard for the industry.

Robo Portfolios

This is my favorite aspect of Ally Invest.

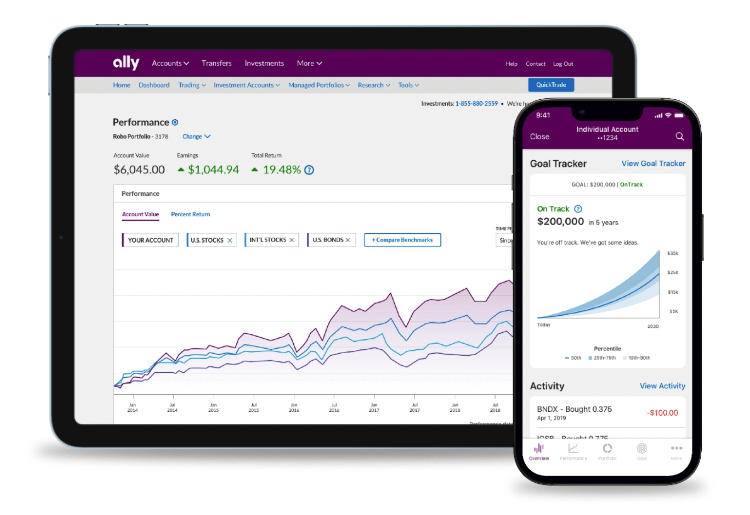

Ally Invest Robo Portfolios offers an automated investing solution for long-term investors. This robo-advisory service helps you choose your investments (typically from Ally ETFs), build a diversified portfolio, and automatically invests your deposited funds according to your chosen plan.

There are two types of robo-advisor strategies:

- Cash-focused. This account holds 30% of your investments in an Ally savings account to earn interest. There is no additional fee for this account.

- Market-focused. This account invests most of your funds, only holding 2% in an Ally savings account to earn interest. This account has a 0.30% annual fee.

Robo Portfolios is an intelligent investing service, meaning it will create an investment portfolio based on your risk tolerance goals, age, and other factors, and keeps your asset allocation in check. As you deposit funds, it will rebalance your account, and also helps you choose tax-efficient funds to hold in each account.

Your investment portfolio is customized based on your answers to Ally Invest’s questionnaire.

While the cash-focused account seems attractive due to no fees, it may end up costing your more in the long run while missing out on additional market returns. To put your money to work, it needs to be invested.

Wealth Management

Ally Invest offers a traditional financial planning service for individuals with $100,000 or more to invest. Wealth management including access to a dedicated financial planner, strategic investment advice, and even a debt payoff and savings plan.

This service is best for clients that have a larger net worth and want more hand-holding with their investments. It is also the only service that will help you manage money outside of the Ally platform, and includes planning for your real estate holdings, insurance considerations, tax considerations, and other financial decisions.

Wealth management is a holistic financial planning service, thus the fees are a bit higher. The fees range from 0.75% – 0.85%, which is much higher than the robo-advisor service, but lower than the 1% to 1.5% that most independent financial planners charge.

Ally Investing Fees & Pricing

- Account Fees: $0 for self-directed accounts and cash-focused robo-advisor accounts, 0.30% for market-focused robo-advisors accounts, 0.85% for wealth management

- Stock/ETF Trading Fees: $0 for most stocks and ETFs, $1 for bonds, $9.95 for mutual funds, and $4.95 (+ $0.01 per share) for penny stocks

- Account Minimum: $0 ($100 for robo-advisor accounts)

- Assets Available: Stocks, ETFs, options, mutual funds, fixed income, forex

Pros and Cons of Ally Invest

Pros | Cons |

|---|---|

Commission-free stocks, ETFs (several Ally ETFs are commission-free), and options | Fees charged on mutual funds, bonds, and penny stocks |

Access to wide range of investment choices | Must have $100,000 for wealth management |

Robo-advisor and wealth management services available | |

Low minimums for most accounts | |

Access to banking services, credit cards, loans, and other financial products and services in a single account | |

Easy-to-use Ally investing app |

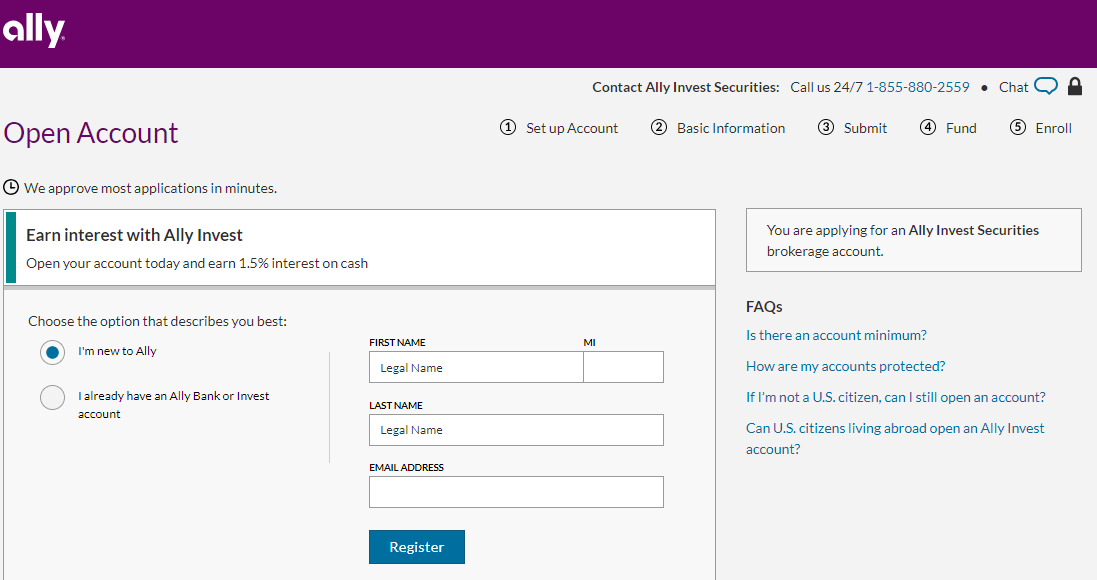

How to Open an Account on Ally Invest

To open an account on Ally Invest, you can apply online or via the Ally Invest mobile app.

You will need to provide some personal information, including:

- Full Name

- Address

- Social Security Number

You will also need to choose how you will fund the account, as well as which type of account you wish to open. You can open a standard brokerage account or an IRA (Roth, Traditional, or Rollover).

Once your application is submitted, you will need to wait for an email from Ally stating that your account has been approved. You will then be able to deposit funds and start investing.

While there’s no harm in opening a self-directed account, I’m a huge fan of Ally Invest’s Robo Portfolios. Its robo-advisory service makes investing and long-term wealth building easy, even for complete beginners.

There are no minimums to open a self-directed account, but there is a $100 minimum for opening a Robo Portfolios account.

If you want to sign up for Wealth Management, you will need to have $100,000 of investable assets available, and you will have to schedule a call with Ally to apply. As this is a more personalized plan, the phone call will help you define your goals and find out if Wealth Management is a good fit.

Final Word: Ally Invest Review

Ally Invest is an excellent, holistic financial management platform that can handle your investing, banking services, credit cards, loans, and more. Its brokerage services are perfect for long-term investors – those with a lot of experience and those completely new to investing.

Self-directed accounts are available for active investors that want access to advanced (but intuitive) trading tools and access to a wide selection of investments. Robo Portfolios and Wealth Management help hands-off investors automate their investing strategy.

Whichever service is right for you, self-directed or hands-off investing, the fees are very low.

And with access to thousands of stocks as well as ETFs from popular firms like Vanguard, Schwab, and iShares, Ally is a great choice for long-term investors.

FAQs:

Is Ally Invest trustworthy?

Yes, Ally Invest is trustworthy.

Ally Invest is a FINRA regulated broker and all accounts are insured. Cash accounts are insured up to $250,000 by the FDIC, and investments accounts are insured up to $500,000 by SIPC.

Is Ally Invest good for beginners?

Ally Invest is a great platform for beginners. With a well-designed mobile app, automated investing, and access to user education, Ally Invest makes it easy for new investors to get started.

Ally Invest also does not have any account minimums for self-directed investing accounts, meaning you can start investing with as little as $1. And since Ally is a larger financial company, you can easily use its banking services, open credit cards, and apply for loans in connection with your Ally Invest account.

Is Ally better than Robinhood?

Yes, Ally is better than Robinhood in almost every way, except a few small details:

- Ally doesn’t let your trade crypto

- Ally charges for trading penny stocks (valued at $2 or less)

Other than that, Ally is a larger financial company with access to more investment choices (mutual funds, fixed income, forex) and wealth management services. And Ally lets you bank with them, as well as offers loans and multiple rewards credit cards.

Is Ally Invest good for day trading?

Ally Invest is not great for day trading.

While it does offer an intuitive trading platform, with advanced charting, several order types, and access to margin, Ally Invest is best for long-term investors. I would choose another brokerage if you’re serious about day trading.

Is Ally Invest safe?

Yes, Ally Invest is safe.

The Ally Invest website utilizes TLS encryption on all online activity, the mobile app has biometric security available, and all accounts are insured. Ally Invest has been around for over a decade and is used by more than 10 million clients around the U.S.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.