What are the best investment firms? Depends on what you need.

For example, the best investment companies for beginners may not be suitable for a professional trader. The best investment firms for index funds might not offer access to crypto, precious metals, or other alternatives.

All of the big names have strengths and weaknesses. Different platforms are appropriate for different styles of investing and levels of experience.

That’s why I’ve compiled this one-stop resource revealing all the pros and cons of the top 10 investment companies so you can figure out which one(s) are right for you. Keep reading to get the full scoop, including what each platform is known for and the fine print on their fees.

At-a-Glance: Top Investment Companies in Jul 2025

Company | Biggest strength | Minimum investment |

Empower (Formerly Personal Capital) | Many free, robust investing tools | Varies depending on the service |

Advanced trading tools and resources | None | |

Vanguard | The best for low-fee index funds | Funds typically have a minimum investment requirement of $1,000 to $3,000 |

The best for robo-advisory investing | $10 | |

Fidelity | Long track record and many accounts to choose from, including IRAs and HSAs | None |

Social trading and easily cloning top-performing traders and portfolios | $200 | |

The best of both worlds – combining robo-advisor investing with self-directed investing | None | |

The best user interface, easy to get started for beginners | None | |

Schwab | All-in-one capabilities make it a great fit for self-directed investors or those who want personal wealth management | None |

Best for alternatives like crypto and precious metals | $1000 |

Best Investment Companies: The Bottom Line

What is the best investment company? There’s no one-size-fits-all answer.

Ultimately, the best investment companies for you depend on what you’re looking for.

- For active pro traders, TradeStation may be the best fit.

- If you’re a long-term, low cost index fund investor, Vanguard is your best bet.

- If you’re a long-term investor looking to combine robo-advising and self-directed investing, consider M1 Finance.

Keep in mind that there’s nothing stopping you from using multiple of these top investment companies. For example, you could trade crypto on eToro and have an HSA full of index funds at Fidelity. You may want to use multiple platforms to capitalize on their unique strengths.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

10 Best Investment Companies in July 2025

Let’s take a look at the biggest strengths of the best investment firms…

1. Empower (formerly Personal Capital) – Best Free Tools and Resources

- Minimum investment: No minimum investment limits for tools. Wealth management and financial planning require $100,000.

- Pricing/fees: Many tools are free. For investors, empower’s pricing structure is based on a percentage of assets under management (AUM), which ranges from 0.49% to 0.89%.

Empower (formerly Personal Capital) is a leading investment company that offers a comprehensive suite of financial tools and personalized advice. It’s best if you value a holistic approach to managing your finances, with features like budgeting, retirement planning, and investment tracking.

Pro tip: Many of Empower’s financial tools, including retirement planning calculators and budgeting features, are free and can be enjoyed even if you invest elsewhere.

The company also offers personalized advice from certified financial planners. However, only those with a minimum of $100,000 qualify for Empower wealth management or financial planning services.

Pros | Cons |

Offers IRAs | Investment fees may be higher than some competitors |

Many free tools | |

Many no-minimum options |

2. TradeStation – Best for Advanced Traders

- Minimum investment: No minimum deposit.

- Pricing/fees: TradeStation offers different pricing plans, including per-trade commissions and a flat-rate plan.

With its powerful trading platform and extensive range of investment options, TradeStation is ideal for individuals who want to take a hands-on approach to their investments using advanced trading tools and technology.

Not only does the platform offer a comprehensive suite of advanced trading tools and research resources, but it supports various asset classes, including stocks, options, futures, and cryptocurrencies.

Pros | Cons |

Wide range of trading tools and resources | Best for experienced traders, beginners may find it overwhelming. |

Multiple pricing plans to choose from | |

Offers crypto |

3. Vanguard – Best for Low-cost Index Investing

- Minimum investment: Varies depending on the investment product. Vanguard’s funds typically have a minimum investment requirement of $1,000 to $3,000.

- Pricing/fees: Vanguard is known for its low expense ratios (as low as 0.03%)

Vanguard is renowned for its low-cost investment options and long-term investment strategies. As a leading provider of index funds and exchange-traded funds (ETFs), Vanguard is an excellent choice if you prioritize low fees and a diversified portfolio:

Vanguard offers a wide range of low-cost index funds and ETFs, allowing investors to build a diversified portfolio. The company also provides excellent customer service and educational resources.

Pros | Cons |

Great customer service | Lacks advanced trading features offered by other investment companies |

Long track record | Large minimum investment |

Low fees |

4. Betterment – Best Robo-advisor

- Minimum investment: 10$ minimum deposit

- Pricing/fees: Betterment charges an annual fee based on a percentage of AUM, ranging from 0.25% to 0.40%.

Betterment is a leading robo-advisor that combines sophisticated algorithms with personalized advice to help you achieve your financial goals. It’s one of the best investment firms if you prefer a hands-off approach to investing.

Betterment provides automated portfolio management, tax-loss harvesting, and personalized financial advice. The user-friendly platform offers a seamless user experience and a wide selection of investment options.

Pros | Cons |

A fully automated solution | Little control over your investments |

Beginner-friendly | Fees can be high-ish compared to self-directed index fund investing |

Cheaper than financial advisors, and will likely achieve similar results |

5. Fidelity – Best for HSAs and a Wide Range of Account Types

- Minimum investment: No minimum investment

- Pricing/fees: No fees or commissions on trades. ETF expense ratios, mutual fund fees, and advisory fees can vary.

Fidelity is a well-established investment company that caters to a wide range of investors. With its comprehensive suite of investment options, including mutual funds, ETFs, and brokerage services, Fidelity is suitable whether you’re a beginner or an experienced investor.

Fidelity provides a vast selection of investment options, including low-cost index funds and commission-free ETFs. The company also offers excellent research tools, educational resources, and a user-friendly platform. It’s also one of the only investment companies where you can invest within an HSA. This makes Fidelity one of the best retirement investment companies.

Pros | Cons |

Suitable for beginners or pros | Advanced trading features may be limited |

Wide range of accounts – including IRAs and HSAs | |

Long track record |

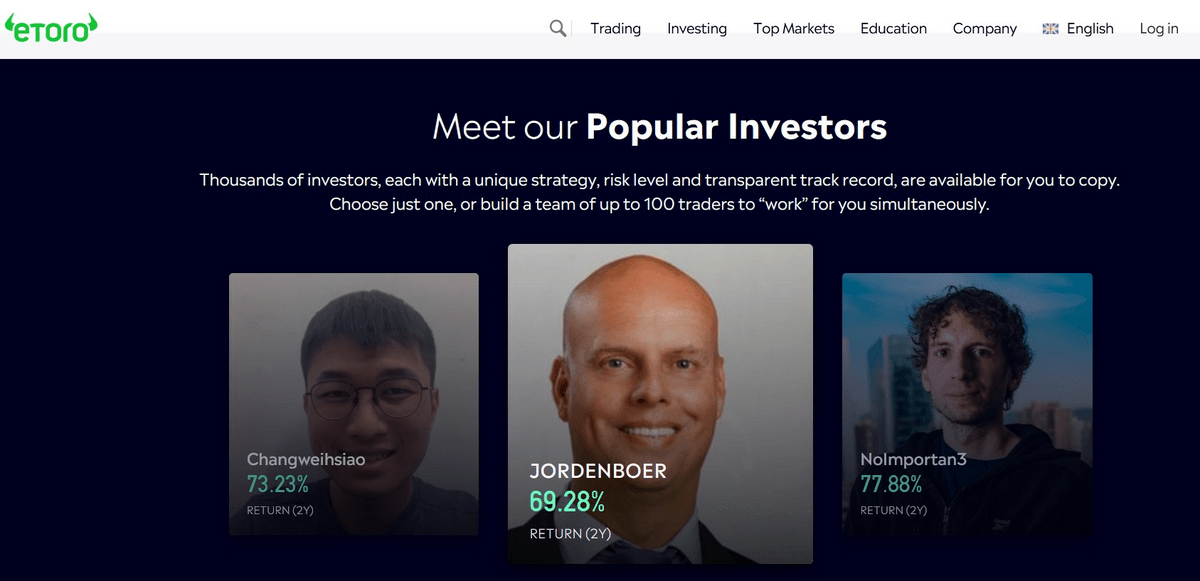

6. eToro – Best for Social Trading

- Minimum investment: $200 minimum deposit.

- Pricing/fees: eToro charges spreads and fees on trades, as well as withdrawal and inactivity fees.

eToro is a social trading platform that allows users to trade a wide range of financial instruments, including stocks, cryptocurrencies, and commodities. It’s best if you’re interested in social trading and want to interact with other traders.

eToro’s claim to fame is its unique social trading experience, including a CopyTrader feature that allows you to follow the trades of successful traders. The platform also provides a wide range of financial instruments and a user-friendly interface.

Pros | Cons |

Unique social trading experience | Fees can be high and may not be worth it unless you’re an active trader |

Easily clone other investors and portfolios | Availability of certain assets may vary by location |

Offers crypto |

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

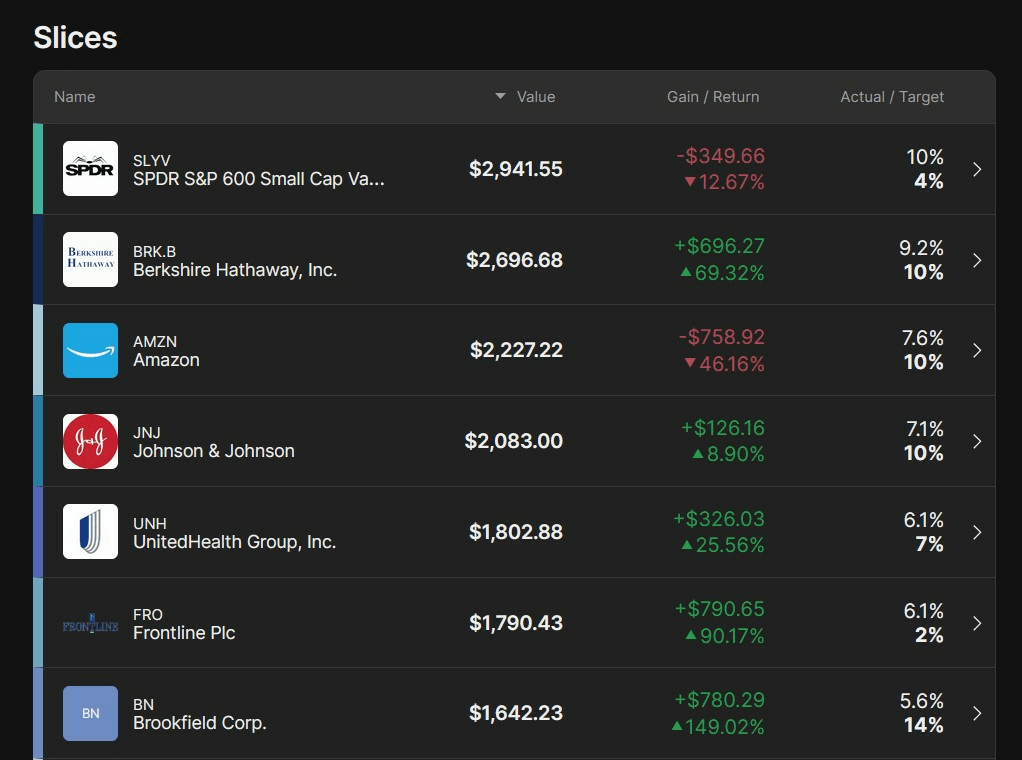

7. M1 Finance – Best for a Combo of Automated and Self-Directed Investing

- Minimum investment: No minimum investment.

- Pricing/fees: M1 Finance offers a free basic platform with optional subscription plans for additional features.

M1 Finance is a self-directed platform that offers a combination of automated investing and individual stock picking. It’s an excellent choice for investors who want the flexibility to create and manage their portfolios while benefiting from automated features.

M1 Finance provides a unique “pie” investment approach, allowing investors to create customized portfolios. The platform offers automated rebalancing, fractional share investing, and a wide range of investment options.

With its long-term orientation and so much versatility, M1 is easily among the top investment companies.

Pros | Cons |

Best of both worlds: automated robo-advisor, or go the self-directed route | Research and educational resources may be limited compared to some other investment companies. |

Pies make your investments easy to visualize | “Trading window” restricts your trades to specific times of day |

Offers crypto |

8. Robinhood – Best for Beginners

- Minimum investment: Robinhood has no minimum investment requirement.

- Pricing/fees: Robinhood offers commission-free trading, but it generates revenue through payment for order flow and premium subscription plans.

Robinhood is a popular investment platform known for its commission-free trading and user-friendly interface. It’s best if you want to start investing with small amounts of money and prefer a mobile-first platform.

Despite the bad press they received during the Gamestop fiasco, Robinhood is still one of the best investment companies for beginners due to their ease of use and the intuitive nature of their platform.

Pros | Cons |

Commission-free trading on stocks, ETFs, options, and cryptocurrencies | Platform may lack advanced research and analysis tools offered by traditional brokerage firms |

Simple and intuitive interface makes it easy for beginners to get started | |

Offers crypto |

9. Schwab – Best for Professional Advice and Wealth Management

- Minimum investment: No minimum investment.

- Pricing/fees: No commission fees for online stock, ETF, and options trades.

Schwab is a well-established investment company with a wide range of investment products and services. It’s best if you’re looking for a full-service brokerage that combines a robust trading platform with access to professional advice.

Schwab provides a comprehensive suite of investment options, including mutual funds, ETFs, and fixed-income securities. This makes Schwab one of the best retirement investment companies. The company also offers excellent customer service, educational resources, and a powerful trading platform.

Pros | Cons |

Long track record | Fees for certain services, such as its advisory programs, may be high |

Great customer service | |

No fees for trading | |

Wide range of products | |

IRA accounts | |

10. iTrustCapital – Best for Alternatives

- Minimum investment: $1000 minimum deposit.

- Pricing/fees: 1% Transaction Fee for the buying and/or selling of cryptocurrencies · $50 over spot, per ounce for Gold

iTrustCapital is an investment company that specializes in self-directed individual retirement accounts (IRAs) for alternative assets like cryptocurrencies and precious metals.

The platform offers secure storage for your precious metals, and its $50 over spot fee for gold is reasonable, making it one of the best gold investment companies. However, iTrustCapital’s focus on alternative assets may not be suitable for all investors. If you’re most interested in stocks and bonds, you can skip this one.

Pros | Cons |

Exposure to crypto | Mostly focused around alternatives |

Exposure to precious metals | |

Offers IRA accounts |

Types of Investment Companies

Self-Directed

Self-directed investment companies provide you with the freedom to make your own investment decisions. They offer a wide range of investment options, such as stocks, bonds, mutual funds, and more. As a self-directed investor, you’d have full control over your portfolio and can actively manage your investments. This is the best option if you’re a hands-on, or active investor.

Robo-Advisor

Robo-advisors are automated investment platforms that use algorithms to manage portfolios based on your financial goals and risk tolerance. They provide a hands-off approach to investing, with automated portfolio rebalancing and tax optimization. Robo-advisors are suitable if you prefer a more passive investment strategy.

Financial Advisor

Financial advisory firms offer personalized investment advice and portfolio management services. They work closely with you to develop customized investment plans based on your financial goals, risk tolerance, and time horizon. Financial advisors provide expertise and guidance to help you navigate the complexities of investing. In return for this personal touch, though, they tend to charge the highest fees of all these options.

Tools To Help Maximize Your Portfolio

Need help managing your investments? Consider these tools:

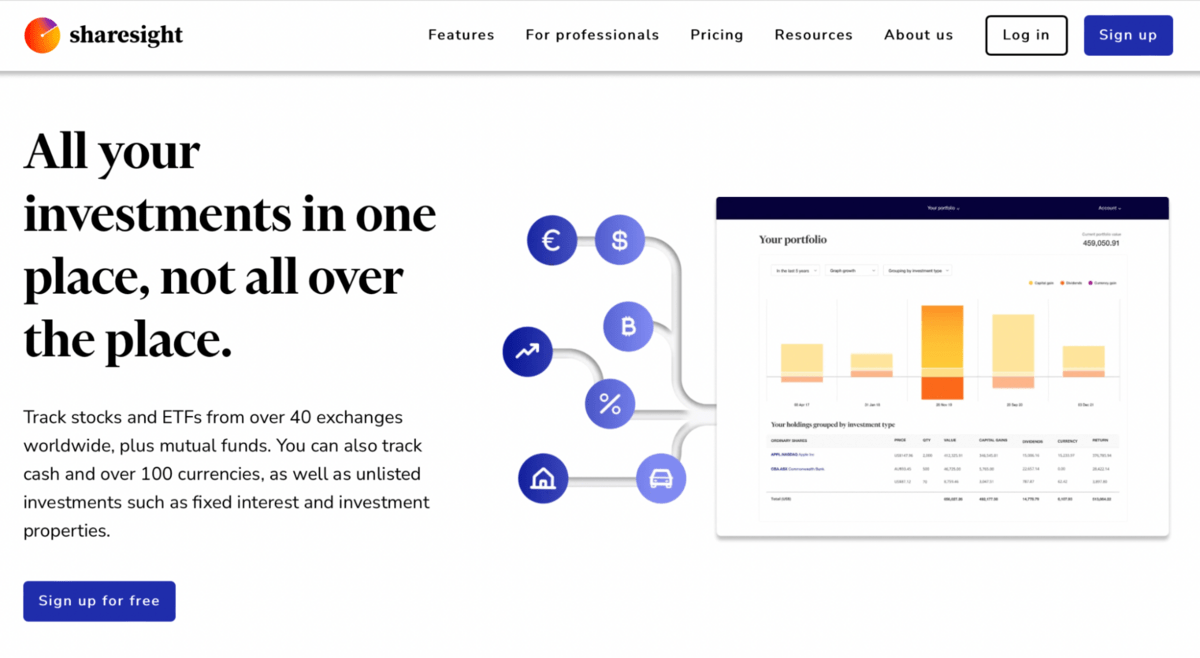

Sharesight

What it is: Sharesight is a portfolio tracking and performance reporting tool that helps investors monitor and analyze their investments. It provides detailed insights into portfolio performance, dividend tracking, and tax reporting.

Why it’s worth it: With Sharesight, investors can make data-driven decisions, track their gains, dividends, and taxes, and stay on top of their investment activities.

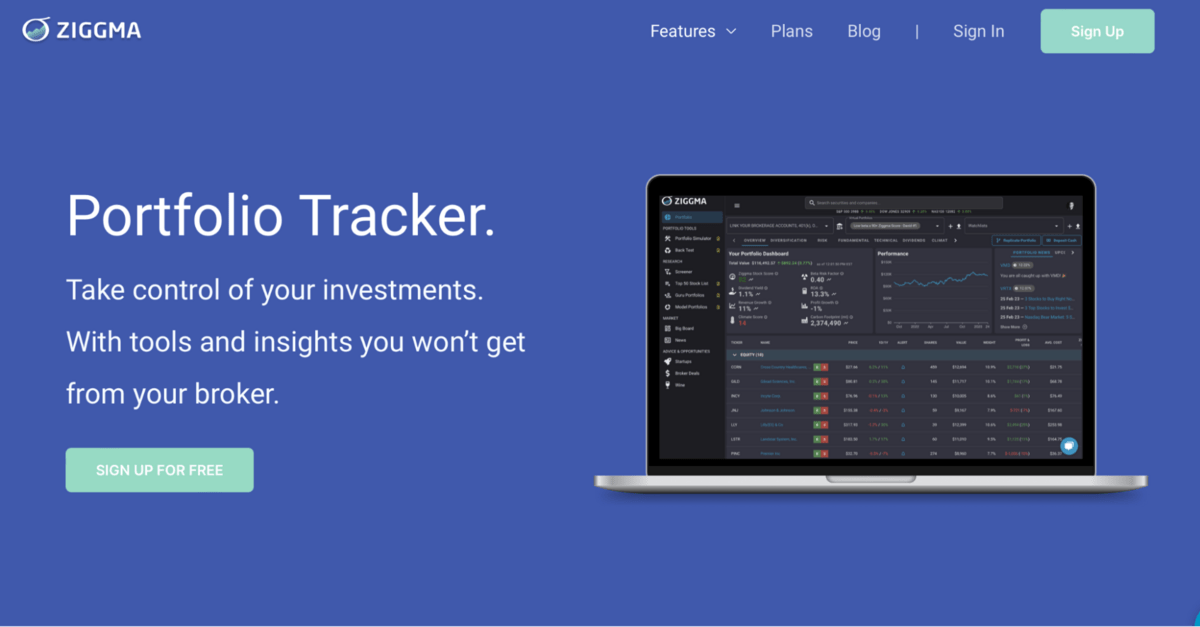

Ziggma

What it is: Ziggma is an investment analysis platform that offers portfolio optimization, risk management, and research tools. It helps investors construct and manage well-diversified portfolios while providing real-time market data and investment recommendations.

Why it’s worth it: With Ziggma, investors can gain a deeper understanding of their investments and get notified about important investing updates. For example, you can set a limit for maximum stock or sector exposure and get notified when the event occurs. Or set a price or PE ratio alert.

What are REALLY the Best Investments?

Finding the best investments can be a tricky task. For most people, a simple blend of stocks and bonds, with small exposure to some alternatives often works best.

Consider the below to figure out what might work best for you:

Your Goals

What are your financial goals? How much risk are you comfortable with? Are you looking to grow your wealth over the long term, generate regular income, or make quick gains? Understanding your objectives and risk tolerance will help you choose investments that align with your needs.

Diversification

Instead of putting all your eggs in one basket, spread your investments across different types of assets. This could include stocks, bonds, real estate, or commodities. By diversifying, you can minimize the impact of market fluctuations and potentially achieve more consistent returns.

Research and Due Diligence

Take the time to study the investments you’re interested in. Look at the financial health of the companies, their historical performance, and their future prospects. Stay informed about market trends, economic indicators, and any external factors that could affect your investments.

Focus on the Long-term

It’s easy to get caught up in short-term market movements, but focusing on the long-term growth potential of your investments can lead to better outcomes. Keep in mind the power of compounding, which can significantly boost your returns over time.

Final Word: Best Investment Companies in July 2025

What is the best investment company? Ultimately, the right firm for you depends on your specific needs.

But here are a few standouts from the top 10 investment companies:

- For active pro traders, TradeStation is my top pick.

- If you’re a long-term, low-cost index fund investor, I suggest Vanguard.

- If you’re looking for a combination of robo-advising and self-directed investing, consider M1 Finance.

- Looking for gold and alternative investments? Check out iTrustCapital.

Ultimately, by understanding what you’re looking to achieve, spreading your investments across different assets, doing your due diligence, and focusing on long-term growth, you can increase your chances of success.

So take the time to assess your needs, explore the options available to you, and choose the investment company or combination of companies that align with your goals.

FAQs:

Who is the best company to invest your money with?

The best company to invest your money with depends on your specific needs and goals. Some of the best investment companies include Schwab, Vanguard, M1 Finance and Betterment.

What are the top 5 investment agencies?

Many consider the top 5 investment agencies, based on various factors, to be Schwab, Vanguard, Fidelity, TD Ameritrade, and Merrill.

Is Vanguard or Fidelity better?

Whether Vanguard or Fidelity is better for you depends on your individual preferences and investment strategy. Vanguard is a leader in low-cost index funds, but Fidelity offers more investment options.

What is the #1 safest investment?

The #1 safest investment depends on your risk tolerance, but among financial assets options like government bonds and FDIC-insured savings accounts are generally considered safe.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.