You’ve worked hard to save $10,000, and now you want to make it work for you.

But what’s the best way to invest $10,000?

With so many investment options available, from stocks to real estate to crypto, it can be tough to know where to start.

The good news is that there are plenty of worthwhile investments that can potentially grow your money faster than a typical savings account. In this guide, I’ll walk you through some of the best platforms and strategies for investing $10k. I hope you’ll find some ideas that align with your goals and risk tolerance (remember: there’s no wrong approach, it’s all about figuring out what works for you.)

Let’s get to it:

FEATURED OFFER: Masterworks

Want an investment that won’t collapse like a bank? Try art.

Since 1995, contemporary art has appreciated 14% annually on average. That’s even more than you’d get with the S&P 500 (with less volatility). After all, there’s a reason why many billionaires invest 10-30% of their wealth in art.

Want in? You can invest in shares of million-dollar paintings with Masterworks, the world’s premier art investment platform.

For a limited time, you can skip the waitlist here

*See important disclosures at masterworks.com/cd

The 9 Best Ways to Invest $10k in 2025:

1. Stocks

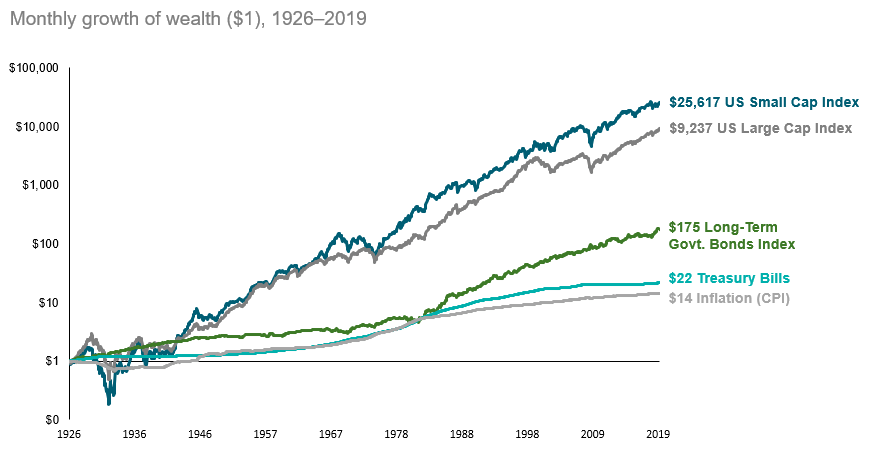

For investors with a long time horizon, stocks are likely the best way to invest 10k. Both large market cap and small market cap stocks historically outperform bonds over long time periods:

But it’s not simply a matter of deciding that stocks are the best investment for 10K and buying random tickers. You’ve got more decisions to make. For instance, individual stocks vs. index funds.

- Individual stocks are shares of ownership in specific companies, like Microsoft (NASDAQ: MSFT), Google (NASDAQ: GOOGL), or Waste Management (NYSE: WM).

- Index funds, on the other hand, track a broad index of companies. The S&P 500, for example, tracks the 500 largest publicly traded companies in the US.

For many investors, and especially those not inclined to do rigorous due diligence, index funds are the best investments with 10k. Here’s why.

Studies have shown that over time index funds outperform the vast majority of actively managed funds. To think that you can outperform the index over long time periods would mean outperforming some of the best active fund managers out there — pros whose full-time focus is stock picking.

Of course, if you are interested in the idea of unearthing winners, there are resources to help you locate high-quality tickers.

A top resource for finding great stocks

One standout stock-picking service? Motley Fool’s Stock Advisor, an investment newsletter that delivers 2 ticker picks to members each month. I’ll tell you why I like Stock Advisor in a sec, but first, take a look at this hubba-hubba chart featuring their returns over time:

With a subscription, you’ll gain access to the service’s recommendations. But you also get a bunch of other valuable resources:

- Best Buys Now – 10 timely buys chosen from more than 300 securities

- Starter Stocks – recommendations for new and experienced investors to add to their portfolios

- All Previous Picks – See the complete list of previous recommendations and their performance data

The Starter Stocks feature is particularly helpful, especially if you’re just getting started. It’s worth mentioning that Stock Advisor aligns best with a buy and hold mentality — the idea is to invest in stocks for at least five years, unless something drastic happens to change the thesis behind an investment. See the Motley Fool investing philosophy below:

Whether you choose to invest $10k in index funds, individual stocks, or both, you’ll need a broker. I recommend eToro.

Not only does this investment platform offer access to the assets mentioned above, but you can also invest in crypto, try out new investment ideas without putting real money on the line with the eToro Demo Account, and an excellent CopyTrader feature that lets you track — and copy, if you wish — other investors’ moves.

There’s a reason why 30+ million users have signed up with eToro — why not see for yourself?

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

2. Bonds

If you’re an investor wondering how to invest $10,000, bonds are another strong choice. But again, allocation will depend on your risk tolerance.

When it comes to allocation, there are two popular schools of thought for bond investors:

- First, there’s the classic 60/40 portfolio (60% stocks, 40% bonds)

- Second, try this easy equation: take your age and subtract 10 — that’s your bond allocation.

To illustrate the latter, a 30-year-old would have 20% allocated to bonds; a 50-year-old would have 40% allocated to bonds, and so on.

I should note that the bond world can be a bit complicated. There are government bonds, corporate bonds, TIPS, I-Bonds, etc…

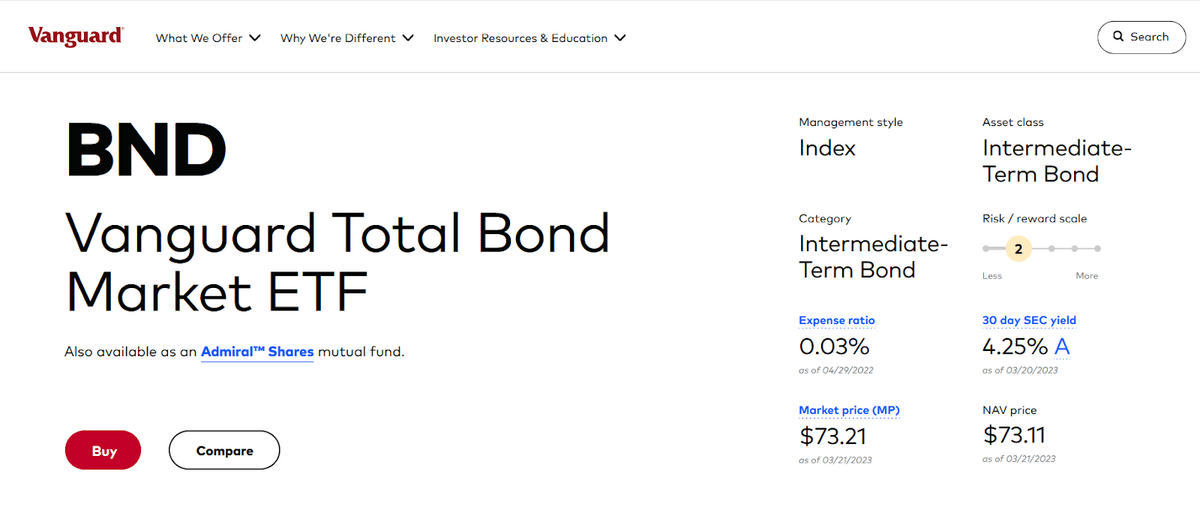

Personally, I like to keep things simple and just own a total US bond index fund. Yes, just like there are stock index funds, the same products exist for bonds. I like Vanguard’s US bond index, ticker BND:

You can buy Vanguard’s $BND ETF within your eToro account.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Another way to get started with bond investing…

Like the idea of bonds, but not sure where to get started? Public’s Bond Account could be the perfect entry point.

Public’s Bond Account has an impressive yield considering the caliber of the bonds — no, it’s not 10%, but a substantial 6.88% as of September 2024. (Rates may change daily.)

The way it works is pretty simple:

- Fund your account — your deposit will go toward a portfolio of 10 investment-grade and high-yield corporate bonds.

- Get paid monthly! Public’s Bond Account generates a monthly yield; when your income reaches $1,000, it’s automatically reinvested.

- If you hold to the maturity date, you’ll receive the highest yield; however, you can withdraw early.

One caveat? While a Bond Account is currently fee-free on Public, it will carry a $3.99 monthly fee starting in 2025 unless you upgrade your account. Take advantage of the high rates now!

3. Real Estate

You can’t have a list of the best 10k investments without mentioning real estate.

But you might be thinking, How can real estate be the best investment for 10k when that amount won’t even buy a parking spot?

Fortunately, there are plenty of ways to get real estate exposure without actually buying or selling commercial or residential structures.

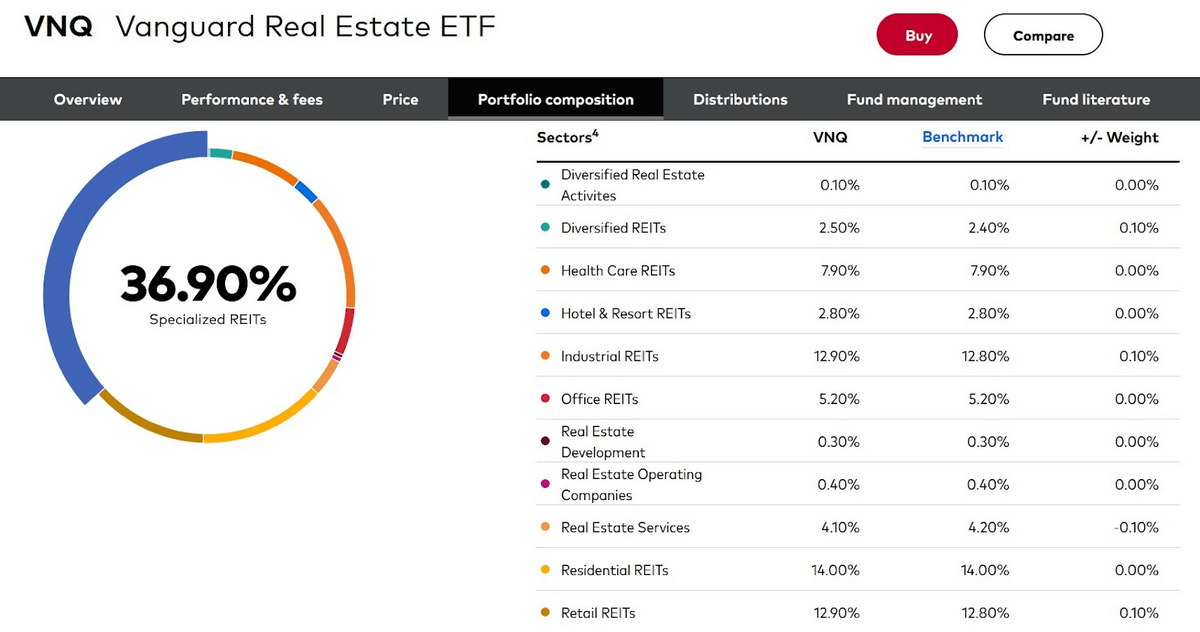

Looking for a simple starting point? Explore Real Estate Investment Trusts or REITs.

REITs are a special kind of stock that invest in real estate. And the cool thing is, there are a lot of benefits to owning REITs versus buying an individual piece of real estate. For example:

- REITs offer instant diversification, as many of them own dozens or hundreds of properties in different geographical areas.

- REITS are also professionally managed (whereas if you buy a property yourself, management is on you).

- REITs are diverse. The REIT universe is vast and includes companies specializing in warehouses, strip malls, farmland, healthcare infrastructure, data centers, cell towers, and everything in between. So if you buy a REIT index fund (my favorite is Vanguard’s VNQ) you are also instantly diversified across these different real estate sectors.

You can buy REITs within your eToro account.

Alternatively, if you’d rather make more specific real estate investments, like rental properties or commercial real estate in a specific area, then you can also consider Fundrise.

Fundrise allows investors to invest in real estate without buying property outright. With an easy-to-use platform and proven returns over time, it’s not hard to see why so many investors prefer it to dealing with all of the hassles that come with property ownership.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Note: We earn a commission for this endorsement of Fundrise.

4. Alternative Assets

Alternative assets include things like:

- Art (I recommend Masterworks)

- Transportation

- Legal finance

- Private equity and credit

- And much more

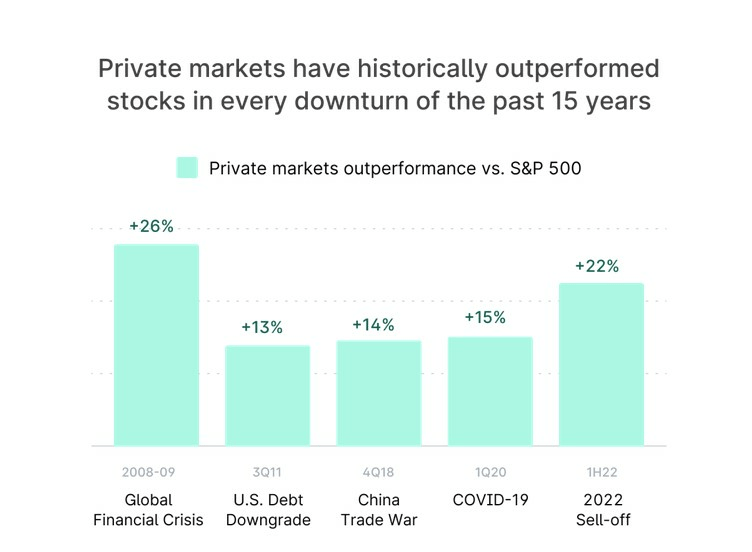

The advantage of private alternatives is that their performance is often uncorrelated with broader market performance, as you can see in the chart below:

So why is Masterworks my favorite platform? Let me illustrate with a story.

Imagine paying $6.2 million dollars for a banana and a roll of tape. That’s how much Maurizio Cattelan’s conceptual artwork The Comedian – essentially a banana taped to a wall – fetched at a Sotheby’s auction in late 2024. But that amount pales in comparison to other blue-chip art sales that very same week, like Magritte’s “L’Empire des Lumières” ($121 million, a new artist record), Ruscha’s “Burning Gas Station” ($68 million, a new artist record), and Monet’s “Nymphéas” ($65 million). The lesson: art is a hot commodity.

True: The banana is a special case, with a viral history, and you might not have the funds to buy paintings with millions that previously hung in the homes of the world’s ultra-wealthy (I don’t either.) However, shares in offerings are far more accessible. Masterworks gives you access to paintings like Banksy, Basquiat, and Picasso on Masterworks.

Art is now for everyday investors. Masterworks is available to all investors — not just accredited investors. But gaining access to this asset class is mighty appealing. There’s currently a waitlist to invest with Masterworks, but you can skip it by using the link below.

5. High Yield Savings

It may surprise you to see high-yield savings accounts listed as an investment. But as your portfolio grows in size, cash will have an important role to play in your personal finances.

Cash minimizes drawdowns in your portfolio and allows you to take advantage of market downturns. It can also act as an emergency fund.

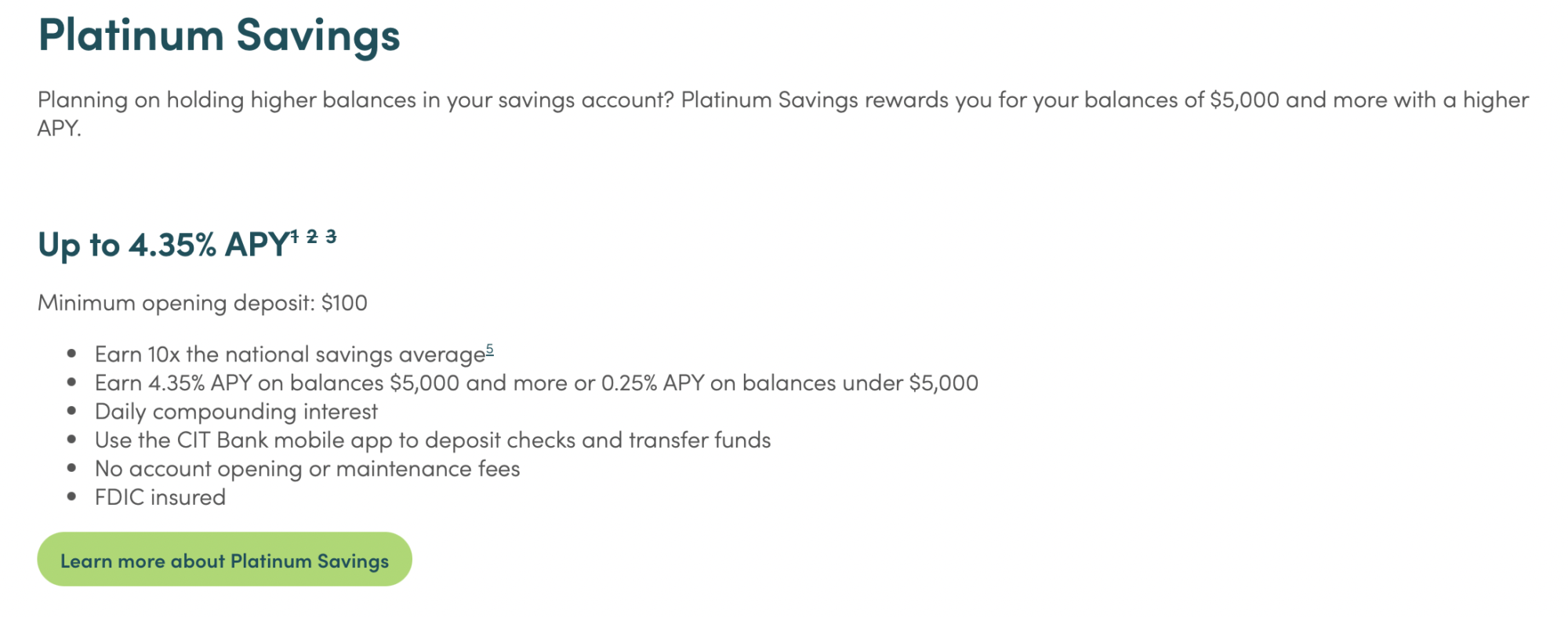

Unfortunately, a recent Wall Street Journal article found that investors are still leaving billions on the table by neglecting high-yield savings accounts. Some of these high accounts are paying up to 4.35%, notably CIT Bank’s Platinum Savings account:

True, you only get that killer rate on balances of $5k or higher, but even their Savings Connect Account (minimum $100) earns an impressive 4.00% APY.

With rates going down, more important than ever that investors earn at least a nominal yield on their cash savings. That’s why investors searching for the best way to invest $10K would do well to allocate at least some of their cash position to a high-yield savings account.

6. Gold

As an investment, gold usually pops up on people’s radars during times of fear and uncertainty.

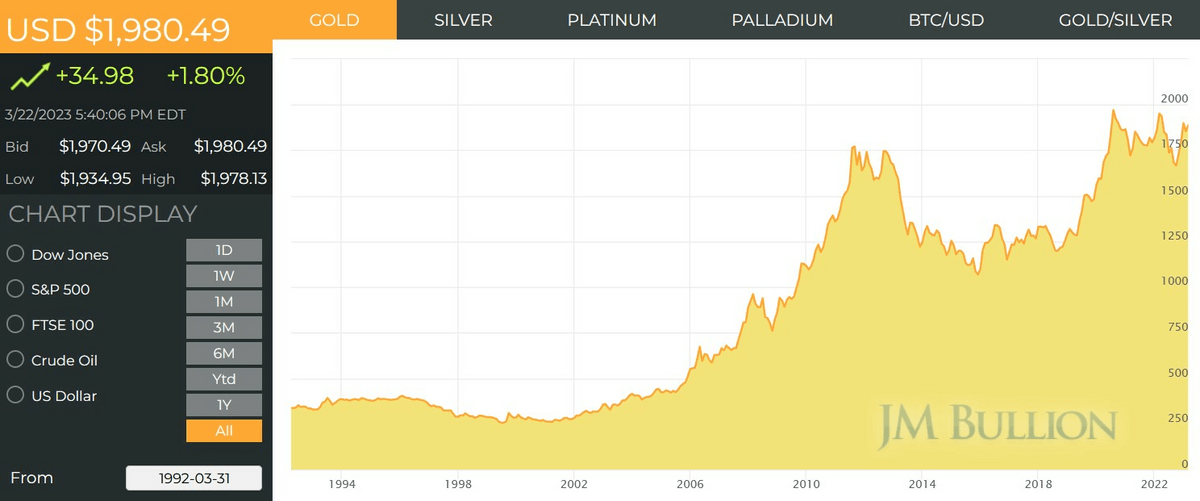

But rather than betting big on gold as a short-term fear trade, it’s wiser to think about it as a small portion of the portfolio that plays a specific role as a long-term hedge and a non-correlated asset.

I think of gold as a hedge against debt-laden governments and potential currency problems. We’ve got plenty of both right now!

Gold tends to go through long (think decades) periods of consolidation, and then has meteoric rises when no one is expecting it:

This pattern frustrates many traders. It’s also why I prefer to simply hold a small gold position long term. You can set a desired portfolio allocation (say, 5%) and “add on dips and sell on rips” whenever it rises or falls sharply beyond your allocation.

Some goldbugs swear by the need to hold physical bullion. Others prefer to hold low-fee ETFs backed by physical bullion, like GLDM, or to invest in gold stocks, like Barrick Gold (NYSE: GOLD). Take a look at the 1-year chart and it’s not hard to see why:

If you want physical ownership of gold (without needing to store it and maintain it yourself), consider using a gold IRA. Gold IRAs store and maintain your gold within a tax-efficient vehicle. Since you’re using it as a long-term hedge anyways, there’s no reason not to use an IRA. One of our top picks? Silver Gold Bull. With over 355,000 customers, 365K verified 5-star reviews, and an extremely well-rated customer service department, it’s one of the most trusted platforms for diversifying and protecting your IRA with precious metals.

7. Yourself

I know you probably landed on this article looking for more conventional finance investments for where to invest 10k. But as Warren Buffett says, “investing in yourself is the best thing you can do.”

Do you have a skill, business, educational program, career, or side hustle? Consider investing in it as a means to improve yourself and your career.

True, $10K may seem like a lot of money to bet on yourself.

But think about it this way: what if the $10K you invest in yourself could take your income from $40K/yr to $60K a year?

Theoretically, such an investment is a no-brainer. You’d get a 100% return in a year. But really, the returns are potentially infinite. Investing in yourself could increase your active income for many years to come.

Maybe that investment involves growing your own knowledge as an investor. You could invest in classic books like “The Intelligent Investor” or “Berkshire Hathaway Letters to Shareholders,” a collection of Buffett’s shareholder letters…

…Or you could sign up for courses to improve your knowledge in specific areas of investing or trading.

Ready to Uplevel Your Trading Expertise?

- For trading, Investors Underground has the best ecourses and community.

- For options, Benzinga Options offers alerts & educational commentary — the best of both worlds!

Bonus: Crypto

Investors wondering how to invest 10k could also consider allocating a small amount to cryptocurrency.

Cryptos like Bitcoin have been called “digital gold” and may offer some of the same benefits as precious metals, mainly the ability to offset inflation due to the scarcity of the asset.

Just keep in mind that Bitcoin and other cryptos haven’t been around long enough to know how they’ll perform during an extended downturn, so most people recommend limiting crypto to a small portion of your portfolio.

Also, you should put a lot of thought into where you hold your crypto, as several firms have blown up recently (Celsius, BlockFi, FTX, etc). I like eToro because it provides a comprehensive crypto trading experience, on a powerful yet user-friendly platform:

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

The Importance of Stocks & Bonds

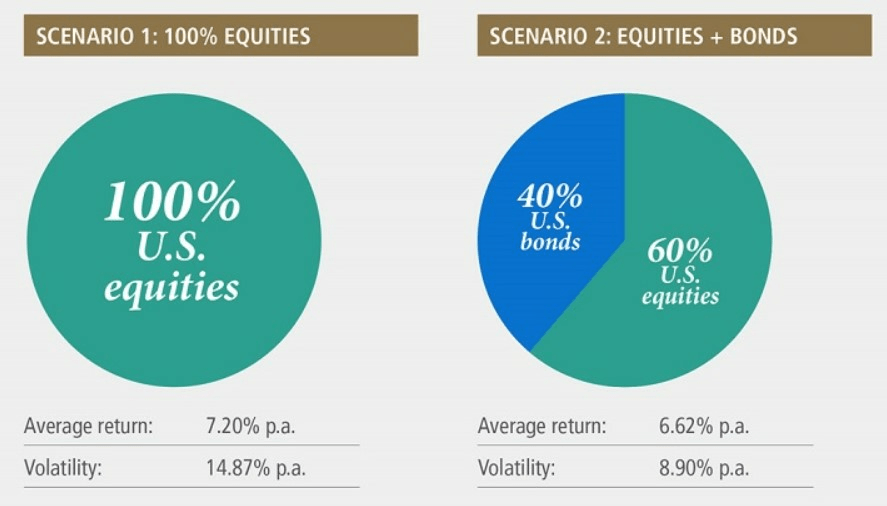

Why do most experts say you should own both stocks and bonds?

Over the long term, stocks deliver the lion’s share of returns in the portfolio. But they’re also subject to huge drawdowns.

Bonds deliver more modest returns, but also experience much lower volatility and less severe drawdowns. Together, stocks and bonds help stabilize your portfolio:

But the 60/40 portfolio may not be the be-all, end-all. According to recent research by KKR, a 40/30/30 portfolio (including real estate, infrastructure, and private credit assets) offers both higher returns — with lower volatility — even during periods of high inflation. That’s exactly why I’ve included other assets, including real estate and fine art, on this list!

The Importance of Tax-Advantaged Accounts

Whether you’re looking for the best way to invest $10K, the best way to invest $50K, or beyond, it’s important you know that not all investment accounts are created equal.

As Nobel Prize laureate and economist Harry Markowitz is reported to have said, the only free lunch in investing is diversification. But I’d argue there’s another one: tax-advantaged accounts.

Traditional IRA, Roth IRA, HSA, and other tax-advantaged accounts allow you to take profits and receive dividends on your investments, tax-free.

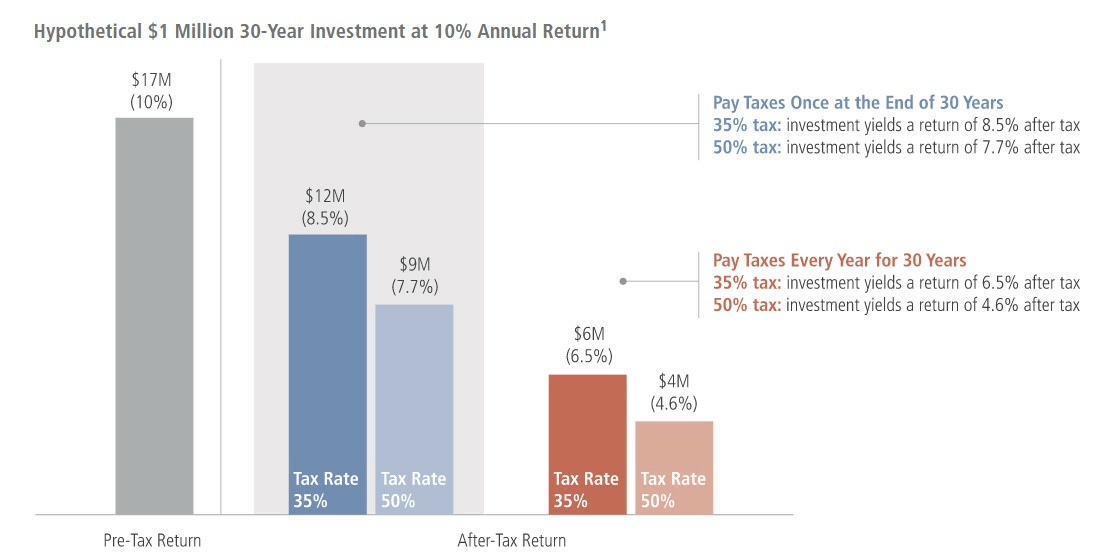

To see how taxes eat into returns, take a hypothetical investment of $1 million. After 30 years of 10% annual returns, that $1M would be worth $17M … before taxes. After paying taxes, that $17M could drop to as low as $4-12M depending on the tax treatment:

I don’t want to bog down this article with the details of each account, but suffice it to say that most investors would benefit from maxing out a tax-advantaged account before opening a taxable brokerage account.

Final Word: How to Invest 10k

Deciding how to invest 10k will depend on you, your goals, and your risk tolerance. With stocks, bonds, real estate, gold, alternatives, crypto, cash, and more, you have no shortage of options.

But for most people, the best way to invest 10k would be to:

- Max out your tax-advantaged accounts by investing in a diversified portfolio of index funds.

- Put three to six months of expenses away in cash as your emergency fund.

- Limit other investments (crypto, gold, individual stocks, etc) to a small percentage of your portfolio.

Above all, when deciding how to invest $10k, remember to diversify, minimize taxes and fees, and think critically about your personal taste for risk and reward. Before you know it, you’ll be learning the best way to invest $100k.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs:

What should I invest $10,000 in right now?

Where to invest $10,000 right now depends on your individual circumstances and preferences. Stocks, mutual funds, ETFs, and real estate investment trusts (REITs) all have the potential for high returns.

How can I make money with 10k?

To make money with 10k, consider investing in stocks, bonds, or real estate to generate long-term returns and passive income.

Is 10k good to start investing?

Yes, $10,000 can be a great starting point for investing. There are a number of different investment options available, including stocks, bonds, real estate, gold, and other assets.

How to invest $10k for passive income?

Dividend-paying stocks, bonds, and rental properties can help you create a portfolio that generates a passive income stream.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.