You’ve got $50,000 to invest.

As a former financial advisor, here’s how I recommend you should invest your $50,000 (and how I invested my first $50,000).

Don’t worry, it’s not as complicated as it seems. For notes about asset allocation, skip to the bottom of the post — but for now, let’s get right to the investments.

The Best Way to Invest $50k

Here’s my list of the 8 best ways how to invest 50k, which are divided into 3 “buckets”:

- Safety ~ 20% ($10,000)

- Growth ~ 70% ($35,000)

- Risk ~ 10% ($5,000)

Each investment below falls into 1 of these 3 buckets.

For example, I list 3 of the best options for “Growth.” It’s up to you to decide how to allocate the $35,000 of “Growth” money between those 3 options (though I’ll make some recommendations on what I feel are the best plaforms).

There is no perfect way to invest or single best allocation, so feel free to tweak my suggestions to best fit your goals and needs as an investor

By the way, if you’re working with a smaller account, we’ve got you covered. Check out the best platforms in our article about how to invest $1,000.

Now, here’s how to invest 50k wisely.

*Disclaimer: Not investment advice. Lincoln Olson and WallStreetZen are not liable for any investment risk you undertake. Invest wisely.

The 9 Best Ways to Invest $50,000 in 2025

1. High-End Artwork (Masterworks)

Bucket: Risk

How much money I would allocate: 0% – 10% ($0 – $5,000)

Like real estate, investing in art can be both lucrative and very capital intensive.

Until now…

Masterworks allows you to diversify your investment strategy by stepping outside of the stock market. You can start investing in high-end art offerings for a fraction of the usual cost.

Masterworks coordinates the purchasing of high-end artwork, registers it as an offering with the SEC, and then allows anyone to invest in shares of that offering. They handle the sourcing and acquisition of paintings (from contemporary icons like Bansky, Picasso and more) as well as storage and sale.

In fact, Masterworks offers a complete art investing service and platform, along with a mobile app.

Masterworks investors have seen +17.6%, +17.8% and +21.5% annualized net returns with representative exits (from paintings held 1+ year, not inclusive of unsold works).

Masterworks aims to hold the art to allow it time to appreciate. When the art is eventually sold, investors in those artwork offerings receive a profit based upon their number of shares.

To date, Masterworks has sold 23 paintings from their collection, distributing back a total of more than $60 million in investor proceeds (including principal).

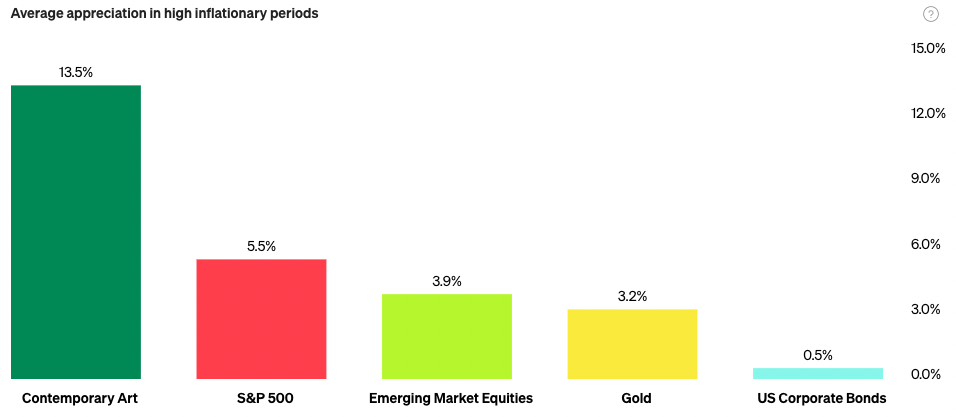

The returns, especially during periods of inflation, are exceptional:

Want to hear the best part? With our exclusive link, you can skip their waitlist with a few easy clicks.

2. Private Credit

Bucket: Growth

How much money I would allocate: 0% – 10% ($0 – $5,000)

Percent is the only platform exclusively dedicated to bringing private credit to accredited investors.

Private credit is an alternative asset class of debt financing that can offer:

- Higher yields

- Shorter durations

- Diversification outside of public markets

Private credit borrowers include small businesses and startups without access to public markets. They borrow to finance their operations and growth, and the debt is often collateralized by assets, loan portfolios, or corporate debt.

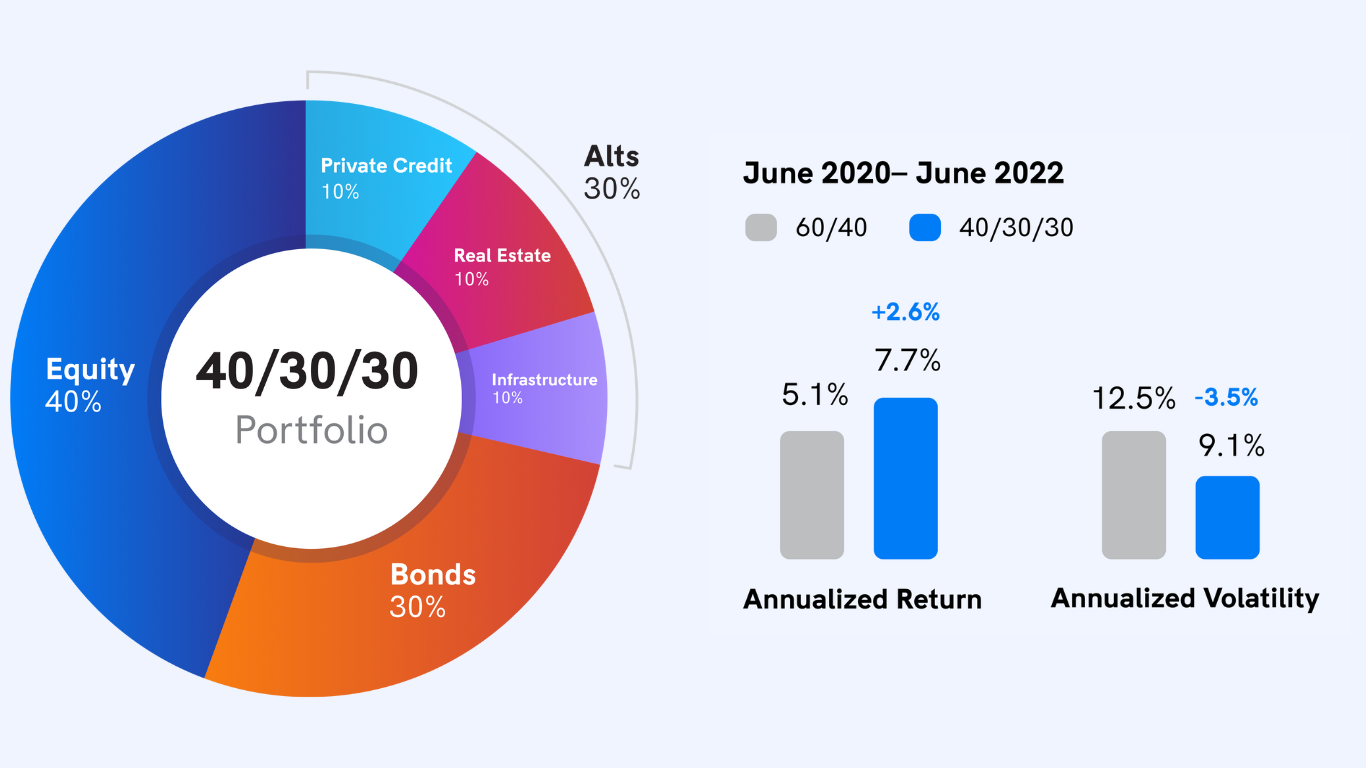

Research from KKR suggests adding alternative investments including private credit could improve risk-adjusted portfolio returns, which is why institutional investors are flocking to this multi-trillion dollar asset class to diversify.

Percent unlocks the exclusive private credit investments for retail accredited investors, so you can diversify and grow your portfolio with up to 20% APY from inflation- and recession-resilient alternative assets:

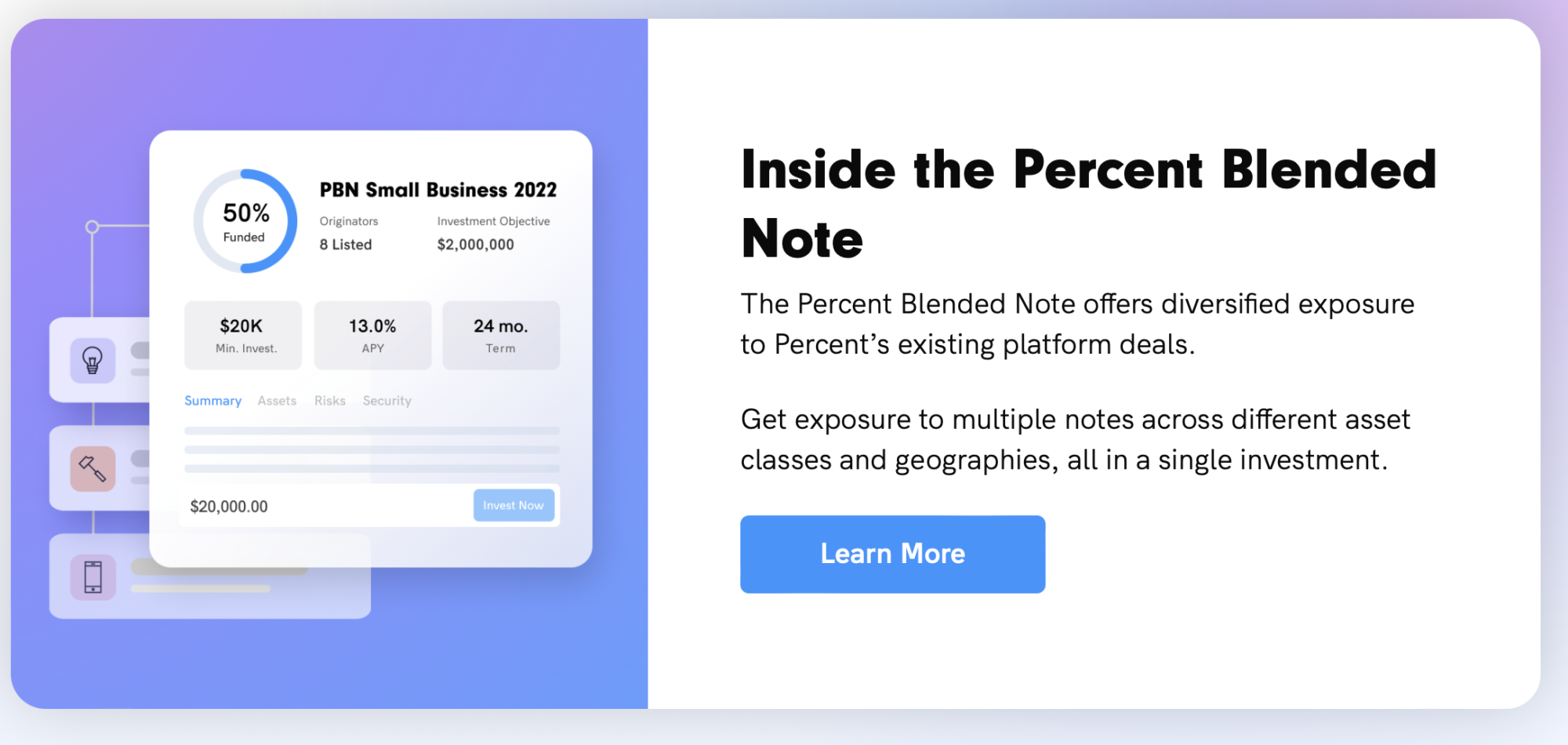

Percent also offers a product that is perfectly suited to less-seasoned private credit investors, or those who want to diversify within a single investment vehicle: the Percent Blended Note. With the Blended Note, within a single investment, you can gain access to a variety of private credit investments across different assets and geographies.

As for fees? Percent charges variable fees depending on the investment product.

- For direct deals, 0% management + a % of yield

- For managed products like Percent Blended Notes, 1% management + a % of yield

For example, if a deal paid 15% APY and the fee charged was 10% of interest, your effective APY is 13.5% after fees.

Private credit investments through Percent are shorter term (9-month average) and priced at prevailing rates, making them responsive to current market conditions and the macro credit and interest rate environment. With shorter-term investments, you can regularly re-evaluate and calibrate your investments to meet your portfolio needs.

Plus, you only need $500 to get started investing.

Gain Access to Private Credit Investing Opportunities

If you’re an accredited investor, Percent can give you access to a wide variety of high-yield, short-duration offerings. And the best part is they’ll provide a bonus of up to $500 for making your first investment.

3. High-Yield Savings Account

Bucket: Safety

How much money I would allocate: 10% – 20% ($5,000 – $10,000)

Everybody needs an emergency fund.

Life happens – the car breaks down, there’s a medical emergency, you lose your job. These things happen.

And while we can’t plan for them, we can be prepared for them.

Don’t put all your money in the market.I recommend having 3-12 months of savings in an emergency fund. This way, you can easily cover the costs of any unforeseen emergency without needing to take on debt.

In addition to its practicality, an emergency fund also provides psychological benefits – the reassurance of a safety net removes significant stress.

But traditional savings accounts are horrible savings vehicles. My old bank paid me 0.045% in interest.

That’s $4.50 for every $10,000 I had saved.

Fortunately, there’s a better option.

Online banks are able to offer much higher interest rates because they don’t have to pay to operate physical buildings and pay staff to operate them. By doing this, these banks can pass their savings on to you in the form of higher interest rates.

What’s the Best High-yield Savings Account?

I like CIT Bank for some of the best rates on various banking products like CDs, money market funds, and more. They offer some of the highest interest rates around for high-yield savings accounts.

Other banks can offer similar yields, or offer large cash bonuses when you open a new account and invest funds (which you can later transfer to a higher yielding savings account).

4. Real Estate

Bucket: Growth

How much money I would allocate: Varies

Historically, you’ve needed a lot of money to start real estate investing. But it’s 2025.

Yieldstreet is a crowdfunding platform for people who want to start investing in real estate.

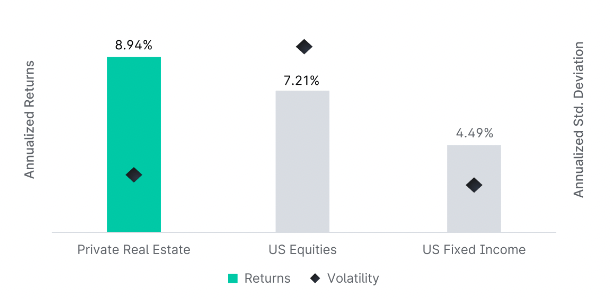

And $15,000 (a lot less than buying a rental property!) is all you need to unlock the potential of private real estate investing, an asset class that has consistently outperformed the stock market for the last 20 years:

Real estate investing taps into 2 types of returns: Investment income (from rent) and price appreciation (from the rise in property value).

Plus, in periods of high inflation, real estate has historically increased in price well above the rate of inflation. It’s also tax efficient and offers diversification outside of public markets (stocks and bonds).

Another reason to invest through a platform like Yieldstreet?? Unlike self-owned real estate, there is no management, maintenance, or deal analysis.

Real estate investing is no longer only for the wealthy.

5. Stocks and ETFs

Bucket: Growth

How much money I would allocate: 0% – 20% ($0 – $10,000)

If you’d like to take more of a hands-on approach to your investing, then you should allocate some of your “Growth” bucket toward individual stocks and ETFs.

If you want to buy stocks and/or ETFs, you need a brokerage account. But what’s the best one for you?

My personal favorite is eToro, which is offering a $10 bonus* for U.S. residents who open and fund a new account (as of July 15, 2025).

$10 bonus for a deposit of $100 or more. Only available to U.S. residents. Additional terms and conditions apply.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Stocks are publicly-traded companies, meaning you can own a small portion (share) of a company. You can buy a tiny slice of companies like Apple, Tesla, Costco, Amazon, and more.

Exchange-Traded Funds (ETFs) are baskets of stocks, bonds, or both which let you invest in many securities with a single investment. For example, Vanguard’s Total Stock Market Index Fund ($VTI) is an index fund ETF which owns every publicly-traded company in the United States.

If you want to start analyzing individual companies, head over to WallStreetZen. You can start by looking into Apple (NASDAQ: AAPL), Tesla (NASDAQ: TSLA), Costco (NASDAQ: COST), and Amazon (NASDAQ: AMZN).

Smarter Stock Market Research

If you’re interested in buying individual stocks but don’t want to perform your own analysis, check out a subscription to Motley Fool Stock Advisor.

This option will require significantly more work, however, than simply using Betterment to automate your investing. You will need to perform research, due diligence, and familiarize yourself with financial jargon and many personal finance topics before you invest (not the case with Betterment).

6. Betterment

Bucket: Growth

How much money I would allocate: 40% – 70% ($20,000 – $35,000)

Betterment is a robo-advisor, an automated financial advisor that provides wealth management services. It’s one of the best options out there for hands-off investing.

It’s like having a personal financial advisor who works 24/7.

Betterment offers algorithm-driven financial planning services which provide you with easy account setup, robust goal planning, portfolio management, tax-efficient investment strategies, diversified asset allocation, and more.

Like I said, personal financial advisor.

I would strongly consider investing your full “Growth” and “Risk” bucket amounts with Betterment. If I wasn’t a total finance nerd, that’s what I would do.

You can get started on Betterment by filling out a short survey covering your age, risk tolerance, current financial situation, and future goals. Your answers are transformed into advice and a custom financial plan tailored to meet your needs into which you can automatically invest.

Recurring Contributions for Your Investing Portfolio

After setting up your account and making your initial deposit, you can turn on auto-deposit and make recurring contributions to your portfolio which Betterment will automatically spread across your optimal investment mix.

Betterment will create a custom portfolio for you filled with ETFs (low-cost, well-diversified investments) that invest in stocks and bonds. The younger and/or more pro-risk you are, the more stocks will be in your portfolio. The older and/or more risk-averse you are, the more bonds will be in your portfolio.

This is the exact approach a financial advisor would take (remember, I would know).

Except there’s one major difference: Betterment is FAR cheaper than a typical financial advisor.

- Betterment charges just 0.25% of the assets you have invested with them ($40,000 invested will cost $100/year in fees).

- Most financial advisors will charge at least 1% for the same service ($400 for the same $40,000 invested).

Betterment is the best solution for the vast majority of people. I can’t tell you how many former prospects I referred to Betterment – it’s that good.

7. Pay off High-Interest Debt

Bucket: n/a

If you have credit card debt or other high-interest consumer debt, forget investing opportunities like crypto (for now). Pay it off immediately.

Although not an investment per-se, one of the best investments you can make is eliminating your high-interest debt. Most credit cards charge APYs above 20%. By paying off those balances, you’re instantly “earning” a 20% ROI – the highest guaranteed rate of return you will find.

While it’s not necessarily earning you money like a traditional investment, the end result is the same: More money in your pocket. It’s one of the best ways to invest in your future.

8. Series I-Bonds

Bucket: Safety

How much money I would allocate: 0% – 5% ($0 – $2,500)

While a high-yield savings account can fulfill all of your “Safety” bucket’s needs, there is a way to turn up your returns, if you’re willing to work a little harder.

The U.S. government sells bonds to its citizens which are inflation-protected. These bonds are known as Series I-Bonds.

Wondering how to invest 50k for cashflow? Consider I-Bonds.

I-Bonds pay interest rates that are made up of 2 parts: A fixed rate and a variable rate. The variable rate is tied to inflation; when inflation is high, these bonds can pay high interest rates.

Right now, I-Bonds have a 4.28% composite rate.

There are a few rules and regulations to consider:

- Series I-Bonds are only available to U.S. citizens

- The minimum purchase amount is $25

- You can buy up to $10,000 annually

- They are a long-term investment that can be held for anywhere between 1-30 years but there is a penalty for redeeming them before 5 years (forfeiture of the previous 3 months’ interest).

- The variable interest rate adjusts every 6 months based on the latest inflation data.

This list is not exhaustive – be sure to research these in more depth before investing.

You can learn more about and invest in Series I-Bonds at TreasuryDirect.gov.

A simple way to get started with bond investing…

Like the idea of bonds, but not sure where to get started? Public’s Bond Account could be the perfect entry point.

Public’s Bond Account has an impressive yield considering the caliber of the bonds — no, it’s not 10%, but a substantial 6.88% as of September 2024.

The way it works is pretty simple:

- Fund your account — your deposit will go toward a portfolio of 10 investment-grade and high-yield corporate bonds.

- Get paid monthly! Public’s Bond Account generates a monthly yield; when your income reaches $1,000, it’s automatically reinvested.

- If you hold to the maturity date, you’ll receive the highest yield; however, you can withdraw early.

One caveat? While a Bond Account is currently fee-free on Public, it will carry a $3.99 monthly fee starting in 2025 unless you upgrade your account. Take advantage of the high rates now!

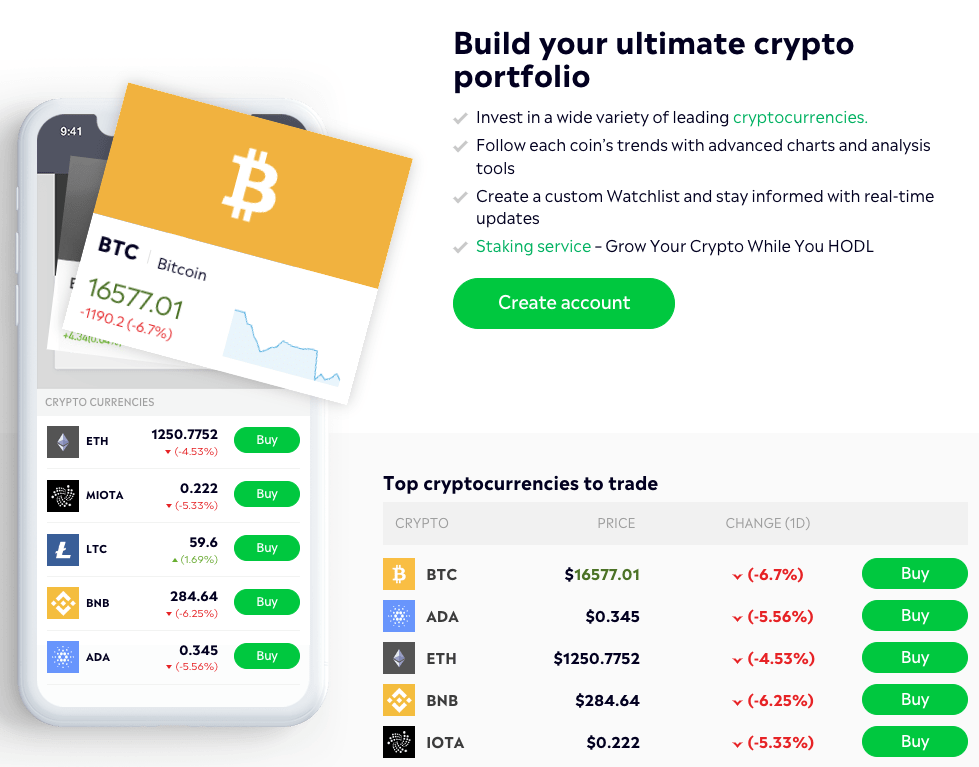

9. Cryptocurrency

Bucket: Risk

How much money I would allocate: 0% – 5% ($0 – $2,500)

Like art investing, investing in cryptocurrencies is a bit of a black box.

You can buy cryptocurrencies like Bitcoin and Ethereum on eToro.

Don’t forget to grab your $10 bonus*. The bonus is available to all U.S. residents who open and fund a new account (as of July 15, 2025).

$10 bonus for a deposit of $100 or more. Only available to U.S. residents. Additional terms and conditions apply.

Cryptocurrency is highly volatile – prices fluctuate wildly. Today, Bitcoin is down nearly 7%, which would be a massive one-day swing in the stock market but it’s far more common in crypto.

If you’re bullish on the future of cryptocurrencies then don’t hesitate to make an investment. Make sure to check out the best crypto IRAs if you’re a long-term investor. My only other recommendation/best practice for crypto investing is to keep it a relatively small part of your investment portfolio.

BONUS: Gold IRAs

If you’re like me, you’ve read a lot about the benefits of investing a percentage of the money in your portfolio into gold:

- It’s a natural inflation hedge

- Risk-reducing characteristics, especially in volatile markets

- Stable, long-term returns of around 7%

In my opinion, the biggest benefit to investing in gold is as a portfolio stabilizer. That’s why Ray Dalio, founder of the world’s largest hedge fund, has gold make up 7.5% of his All Weather Portfolio.

Despite knowing it’s a good idea, most investors don’t ever use gold in their investment mix. Don’t let that be you. Investing in gold is a smart strategy that can diversify your portfolio beyond stock market securities.

Best of all? You can now invest in gold in tax-efficient IRAs. The opportunities are seemingly endless, but our top gold IRA providers are:

In 2025, now may be the perfect time to allocation a portion of your portfolio to one of history’s most reliable assets.

What is Asset Allocation?

There’s an important concept you need to understand: Asset allocation.

Asset allocation is how you divide your money between different asset classes, such as stocks, bonds, cash, and more – it’s how you diversify your investment portfolio.

Instead of investing all $50,000 into a single asset, you should spread it amongst multiple assets to diversify so you’re not overexposed to any one area.

Therefore, the question isn’t “What is the best investment for 50k?” (which implies there’s a single investment you should make). The question is “How to invest $50,000?”

In my opinion, this is the best way to invest $50,000.

Investment | Bucket | Potential Allocation | Preferred Platform |

|---|---|---|---|

High-End Artwork | Risk | 0-10% | |

Private Credit | Growth | 5% | |

High-Yield Savings | Safety | 10% | |

Real Estate | Growth | 15% | |

Stocks and ETFs | Growth | 20% | |

Robo-Advisors | Growth | 30%+ | |

Paying Off Debt | Safety | Variable | N/A |

Series I-Bonds | Safety | 10% | |

Cryptocurrency | Risk | 5% |

Final Word: How to Invest $50k

Based on my allocations above, here’s what my portfolio looks like:

- Betterment – 80% ($40,000)

- Emergency fund (CIT Bank) – 20% ($10,000)

2 accounts – that’s all I need.

Anyone who tells you that how to invest 50k is more complicated than that is lying to you.

But that’s just my opinion. Ultimately, it’s your money and your investing strategy needs to suit your needs.

Feel free to mix in some higher-risk assets like art (Masterworks) and cryptocurrency (eToro). You may also want to add some real estate to your portfolio (Yieldstreet) that has a lower correlation to the stock market.

And if the Betterment route is too hands-off for you, open your eToro account and start investing in individual stocks and ETFs, after doing your homework.

FAQs:

What should I invest in right now with 50K?

If you’re looking for a long-term investing solution, you should invest your 50k on Betterment.

Betterment is a robo-advisor that creates custom portfolios based on your personal profile, financial situation, and investment objectives.

What can you do with 50K to make money?

You can invest in stocks, bonds, real estate, cryptocurrency, artwork, and other asset classes to generate a return on investment.

I would recommend investing it on Betterment and allowing it to create a portfolio tailored to your financial goals.

Where can I invest $50000 in the short-term?

You should invest $50000 in a high-yield savings account or a CD at an online bank.

My favorite high-yield savings account is CIT, which is currently offering some of the best interest rates out there of up to 4.35%.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.