Want to know how to invest $60k? Or maybe how to invest 70k?

First off, good job. You’ve got a significant chunk of change on your hands, so you’re doing something right.

But what now? It’s a lot of money. You don’t want to squander it.

If you’re curious about what is the best investment for 60k (or even where to invest $70k) you’re in the right place. In this article, we’ll look at the most important principles about how to invest 60k wisely, as well as the best places to invest 60k wisely.

Let’s look at the best ways to invest 70k while keeping a rainy day fund and maximizing your long-term growth potential. (Note: Are you slightly under the amounts we’re talking about in this article? Click over if you want to focus on the best way to invest $50K.)

At-a-Glance: How to Invest $60k or $70k

Here’s a quick glance at some of our favorite platforms for investing:

For stocks and ETFs | |

For REITs | |

For fractional real estate | |

For high-yield savings | |

For private credit investing | |

For bonds | U.S. Treasury, or check out Public |

For fine art | |

For robo-investing | |

For paying off debt | |

For investing in private businesses | |

For crypto |

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

What’s the Best Way to Invest $70K (or Even $60K)?

If you want to know how to invest 70K, or how to invest 60K, here are our top suggestions:

1. Invest in Fine Art

Much like investing in real estate, investing in fine art has been the province of the very wealthy for a very long time. In recent years this has changed with the appearance of platforms like Masterworks.

But let’s back up. Why should you care about art? Consider this…

Not so long ago, Sir Elton John sold a Banksy painting for $1.9 million at auction, shattering the “high” expectation of $1.5 million.

You might not have the funds to buy paintings like that and let them appreciate in value, but you can invest in fractional shares of works by paintings like Banksy, Basquiat, and Picasso on Masterworks. Take that, billionaires — art is for everyone now!

Yep: Masterworks is available to all investors — not just accredited investors. As you might imagine, its accessibility and the exciting art assets make it an in-demand platform. There’s currently a waitlist to invest with Masterworks, but you can elbow your wait to the top of the list using the link below.

2. Invest in Stocks and ETFs

Stocks are considered one of the best ways to invest with just a few thousand … One of the best ways to invest $50k … Or 60K, or even higher. They can be very versatile as they come in many shapes and sizes. You can get some if you have basically no risk tolerance by looking for blue-chip companies like Apple (NASDAQ: AAPL) and Coca-Cola (NYSE: KO). There’s a reason why legendary investor Warren Buffett has held both of the aforementioned names for decades.

You could also try and get some staggering growth by following volatile penny stocks.

Not sure what stocks to buy and sell? I strongly recommend Stock Market Guides.

This stock alert service offers four subscription choices for both stock and options investing:

- Premarket alerts for stocks

- Market hours alerts for stocks

- Premarket alerts for options

- Market hours alerts for options

Among these options, you can choose service best suited to your investment or trading style and your schedule. Regardless of which subscription you choose, Stock Market Guides offers something unique: it shows you how a setup has performed in the past. So when you get an alert, you’ll get access to the stock’s past performance in similar situations.

At just $69/month for your chosen alerts service, Stock Market Guides is a fantastic resource to help you locate high-potential investments. Get started here.

Stocks do, however, have some drawbacks. For one, there are no guarantees in the stock market. Active trading can also get quite expensive with taxes, broker fees, and similar annoyances.

Fortunately, these days, there are plenty of low or no-commission brokers that let you buy and sell stocks on the cheap and with ease (sometimes even on apps).

I prefer eToro which charges no commissions on trades and offers a neat sign-up bonus to new US-based users.

eToro also offers another way to invest in stocks — exchange-traded funds (ETFs). ETFs are basically bundles of stocks that attempt to match a certain benchmark. Like stocks, they come in many shapes and sizes and be a fit no matter what your needs are.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

3. Invest in Real Estate

You don’t need to buy a whole house or building to be a real estate investor. Today, one of the best ways to invest $70k (or at least a portion of it) is through less active investments such as REITs or fractional real estate.

REITs

REITs (real estate investment trusts) are one of the ways you can invest $70k in real estate. This is a form of investment where you buy a security in a company that owns various properties and get some of their profits as returns. You can do this with several platforms like eToro.

Need help finding REITs? WallStreetZen has a number of screeners to help you find great opportunities, including a Best Residential REITs screener, a Best Diversified REITs screener, and more.

To learn more about REITs, check out our comprehensive REIT vs stocks article.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Fractional Real Estate

You can also go for fractional real estate ownership, which lets you invest in a portion of a property or properties.

Platforms like Yieldstreet enable accredited investors to band together and own fractions of real-world property like industrial, office, and storage spaces, as well as various kinds of single and multi-family rental properties.

Find out more: Read our comprehensive Yieldstreet review.

Not accredited yet? You can also access this form of investment if you are not an accredited user with Arrived Homes. Arrived focused on investing in residential and vacation rental properties for as little as $100.

Find out more: Read our comprehensive Arrived Homes review.

4. Invest in a High-Yield Savings Account

While traditional banks tend to offer poor interest rates on your savings accounts that guarantee your money will be eaten by inflation, this is usually due to them having to meet the costs of running physical locations.

Fortunately, it isn’t too difficult to find a high-yield savings account online nowadays. CIT Bank, for example, offers one of the best APYs out there. Currently, their Platinum Savings account offers 4.35% interest — a lot higher than most savings accounts, which offer less than 0.25%.

With an APY higher than most savings accounts, you’ll be better able to keep up with high inflation and have some money readily available in case of an emergency.

5. Invest in Private Credit

Private credit is a great way to diversify your portfolio as it is detached from the broader public market. It has excellent growth potential — plus, private credit APY can be as high as 20%.

This form of investing entails offering a credit line to small businesses and startups. These loans are commonly solidly collateralized in multiple ways.

This is also one of the best ways to invest $60k — or at least part of your money. The loans are generally short-term (averaging 9 months) meaning you can remain agile and adjust your strategy based on current market conditions.

If you are an accredited investor, Percent specializes in giving retail investors the opportunity to invest in private credit.

Here are just 3 reasons why we love Percent (for more, check out our extensive Percent review):

- Percent offers exposure to a variety of debt and blended note portfolios, without fees on individual deals.

- The company partners with quality corporate borrowers, many of whom originate loans to small businesses and consumers, which are then funded by you. You simply sign up, pick a private credit deal you like, and invest.

- As of April 2023, Percent had averaged a 16% APY and the average duration is 9 months. More than $28 million in interest has been paid out since 2019.

6. Invest in Bonds

Bonds come in many varieties both in terms of duration and the issuer so you can pick the ones that best suit your needs.

In today’s climate, the US government’s I-bonds are an interesting option. They are designed to protect investors against inflation and their interest rates have two parts:

- Fixed interest rate

- Interest rate tied to inflation.

Currently, I-bonds pay a 4.28% interest rate.

The variable part of the interest rate is adjusted every six months and you can hold them up to 30 years. There is, however, a small penalty if you redeem them in the first 5 years.

You can buy these bonds directly from the US Treasury as long as you are a US citizen.

But I’ll be honest — the US Treasury site is tough to navigate.

If you’re interested in t-bill investing (treasury bills, or short-term U.S. gov’t debt obligations backed by the Treasury with a maturity of a year or less), investing platform Public makes it easy. You can actually create a treasury account and even create recurring investments to take advantage of the currently-impressive interest rates available.

7. Invest With a Robo-Advisor

While investing in individual stocks, bonds, and ETFs can be very rewarding and fun, let’s be honest, it can also be a big hassle and you can make plenty of costly mistakes.

This is why I like to keep a decent chunk of my investments with a robo advisor. So, what is a robo advisor?

Essentially, it is an automated system that uses an algorithm to offer investment advice based on your preferences. It is like having a personal financial expert at your disposal 24/7 but at a fraction of the cost.

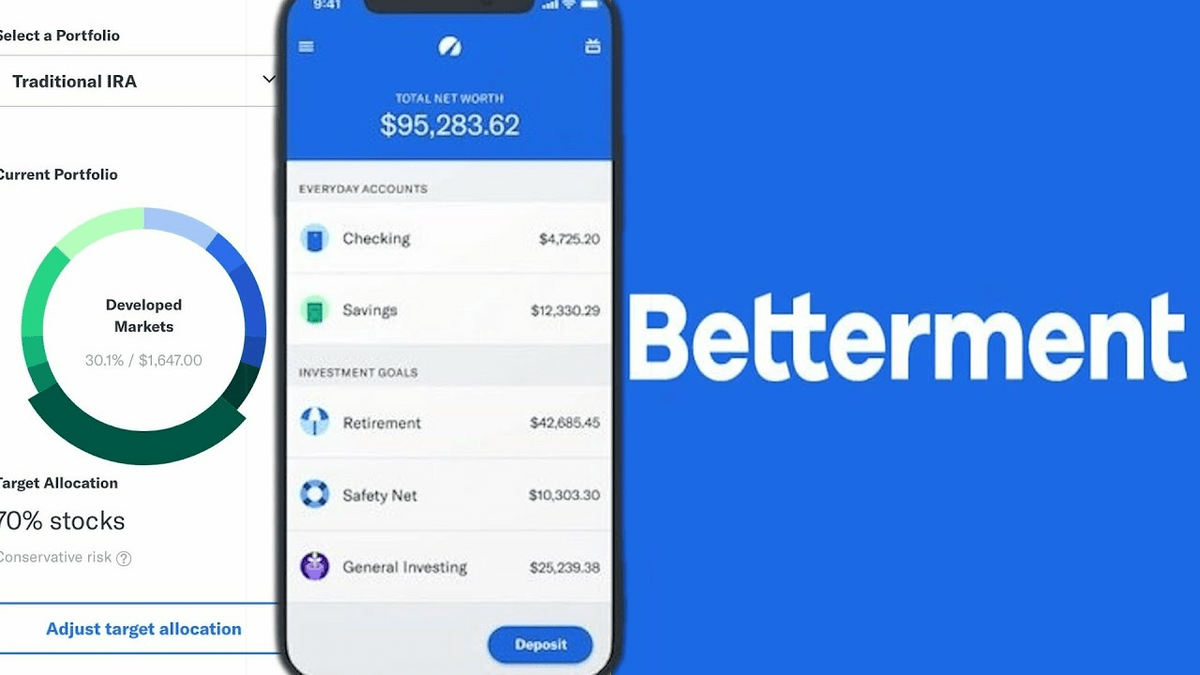

I personally like Betterment due to its great design, the multitude of options, and very low fees. It charges you 0.25% of your investment annually for its services compared to the 1% (or higher) most financial advisors would take.

8. Pay Off Debt

High-interest debt such as credit cards comes with an APY of more than 20%. Just like high broker fees and taxes can stifle your portfolio, debt can cripple your ability to invest in the future.

This makes paying off debt a great way to invest as much of your $70k as you can as, in many ways, money saved is like money invested.

Ultimately, however, the best way to handle bad debt is to avoid it and there are many tools that can assist you with the endeavor.

Empower, for example, offers a free dashboard with lots of cool tools to help budget better which can help reduce debt, such as a FREE budget planner and investment checkup tool.

9. Invest in Businesses

Investing a part of your $60k in a private business is a potentially great way to add some additional diversity into your portfolio. And the rewards of getting in so early that the company isn’t yet on the stock market can be immense.

However, investing in private securities is risky and can result in the loss of your entire investment, so you should be prepared to accept such risks and conduct your own diligence.

If you are an accredited investor, Hiive is potentially a good option for investing in private companies. Hiive is a marketplace where accredited investors can buy shares of private companies before they go public. It features hundreds of businesses, including names you’ll recognize like OpenAI, Discord, and Waymo.

You can even see the most liquid companies on Hiive with the Hiive50 Index.

Note: If this sounds enticing and you are not an accredited investor, fear not! You can also invest in pre-ipo companies on Fundrise through the Fundrise Innovation Fund. Check out our Fundrise review to learn more.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

10. Invest in Crypto

Crypto is a wild card. Its rewards can be immense, but so is the risk.

Some cryptos can explode very quickly and turn less than a hundred bucks into millions. Others can (and this is far more common) plummet to nearly $0 and just stay there forever even if they appear large and stable at the moment.

Despite this, as long as you don’t venture anything you aren’t willing to lose, I do recommend putting a little bit into crypto as it can be very rewarding – and who knows, maybe Michael Saylor is right and Bitcoin is the complete future of money.

Still, as the SEC and the CFTC are only now looking to seriously police crypto, you need a trustworthy platform to trade it, and I’d, frankly, again recommend eToro for it.

The watchdogs have been stamping down on many crypto exchanges with ongoing disputes with major firms like Binance and Coinbase.

Online brokers that offer cryptos have, however, so far been mostly spared and eToro has up to this point made an effort to be proactive with regard to staying compliant making it a rather good pick.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

How to Invest $60K to $70K: Important Things to Consider

Goals

One of the first things you need to decide when figuring out where to invest $60K? Your goals. They could be anything, from ensuring a steady supply of high-quality dog food for your pup to getting a fancy new house to early retirement.

Don’t be afraid to dream — but keep your feet rooted to the ground by considering some pragmatic stuff:

Allocation

A big part of finding the best way to invest $60 or $70K is finding out where to invest it – and no, not everything has to go in the same place. One of the key parts of investing is asset allocation.

Perhaps the best-known example of this is the old 60/40 portfolio – 60% of your money goes into stocks and 40% into bonds.

Obviously, stocks and bonds aren’t the only assets available, and 60/40 is not the only way to divvy up your money but some mix of allocating to risky, safe assets, and a savings account is probably what you are gunning for.

Time Horizon

The time you are working with will have a major impact on where to invest $60 or $70k. If you have decades ahead to build your portfolio, you can afford to take on more risk.

While stocks don’t always offer the smoothest sailing, the stock market has been on a significant uptrend since it was first opened.

On the other hand, if you are very close to retirement, you might prefer playing it safe with bonds or real estate.

Investing Style

Are you a level-headed finance nerd? Doing some fast-paced day trading might be the right way to invest your $70k.

For example, if you have limited time and prefer not to think too much about what your money is doing, check out automated investing on M1 Finance, or build a dividend portfolio where you reinvest what you earn.

Risk Tolerance

Basically, this boils down to how okay you are with potentially losing money.

If you feel the jitters every time the market makes a sudden move and can’t resist impulsive buying or selling, penny stocks or crypto might not be for you. You might want to stick with REITs or growth stocks on a platform like eToro.

Where to Invest $70K (or $60K): The Bottom Line

While $60-70K is a lot of money, it traditionally hasn’t been able to get you far in assets like real estate, fine art, or private equity. But this is the 21st century, and there’s an app for all of that.

As you’ll see in this article, the best way to invest 60K isn’t FOMO-ing your funds into a single stock — it’s about diversifying with fractional investments that go beyond the stock market.

The truly important part is knowing your options (I hope I got you covered right here) and your goals (and that is up to you).

Ultimately, focus on these key principles:

1. Diversify

2. Keep things relatively simple

3. Invest in what feels right to you and is aligned with your risk tolerance and goals

4. Always do your due diligence

Armed with the high-quality options we’ve discussed in this post, you’re well on your way to smarter investing.

FAQs:

How much interest will $60,000 earn in a year?

$60K can earn anywhere between about $60 with a regular savings account in a bank and $6000+ if you manage to match or beat major indices like the S&P 500. As a rule of thumb, the more risk you take on, the higher your possible APY.

How to flip 60K to 100K?

The best way to flip $60k into $100k is by investing your money. There are many ways to invest and the best choice for you will depend on how risk-tolerant you are and how long you have to double your money.

How much money do I need to invest to make $3000 a month?

You’d need about $360,000 to make $3,000 a month if you manage to consistently match the average return rate of about 10% of major market indices like the S&P 500.

What to do to invest $50K?

To invest $50k you only need to find a broker of your choice and open an account. A good jack of all trades for stocks, ETFs, and crypto is eToro while Betterment is one of the best robo advisors out there and probably the best choice for the majority of investors.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.