FEATURED OFFER:

If you sign up for the TradingView charting platform using any of the links in this article, you will receive a $15 credit which will be automatically applied to any plan you select.

Plus, test drive any plan risk-free with a free 30-day trial.

TradingView is a technical analysis charting software for day traders and swing traders.

It’s fast, reliable, powerful, and affordable.

If you’ve used the free version of TradingView (or even if you haven’t) and are wondering if the paid versions are worth it, you’ll get my unequivocal answer in a few paragraphs.

I’ve been a regular day trader for the last 6 years and am also a huge fan of finance software (hence my role at WallStreetZen).

I’ve tested nearly every day trading software, trading platform, and charting platform on the market.

While it may have been a waste of time for me, this TradingView review is the culmination of that “research.”

TradingView review spoiler: This is my #1 choice for charting software. And it’s not even a close race.

In this TradingView review, I’m going to cover why it’s the best, what you can do on it, what you can’t do on it, how much it costs, and how to get started with a 30-day free trial.

And as is the case with all my review articles, we start with the conclusion:

Is TradingView Pro Worth It?

The Bottom Line: Yes, TradingView Pro (now called Plus) is worth it (though the Premium Plan is also great — more on that later).

TradingView is the best charting platform in 2025 because of its comprehensive feature set, speed, ease-of-use, coverage, reliability, and extreme affordability. It’s the best solution for new and veteran traders alike.

Accessibility: 5/5

Quality of Research/Analysis: 4/5

Price: 4.5/5

If you sign up to TradingView using any of our links in this TradingView review, you will receive a $15 credit which will be automatically applied to any plan you select.

Plus, test drive any plan risk free with a free 30-day trial.

What is TradingView?

TradingView is a comprehensive charting platform used by more than 60 million traders It’s rated the world’s #1 investing website. (Source)

It allows traders to chart, add indicators, and analyze real-time market data to accurately predict stock price movements and profit from short-term price changes.

TradingView was primarily built for stocks and ETFs, but has recently added coverage for cryptocurrencies. You’ll find financial derivatives like futures and CFDs, too. While you’re at it, be sure to check out the best platform for CFD trading.

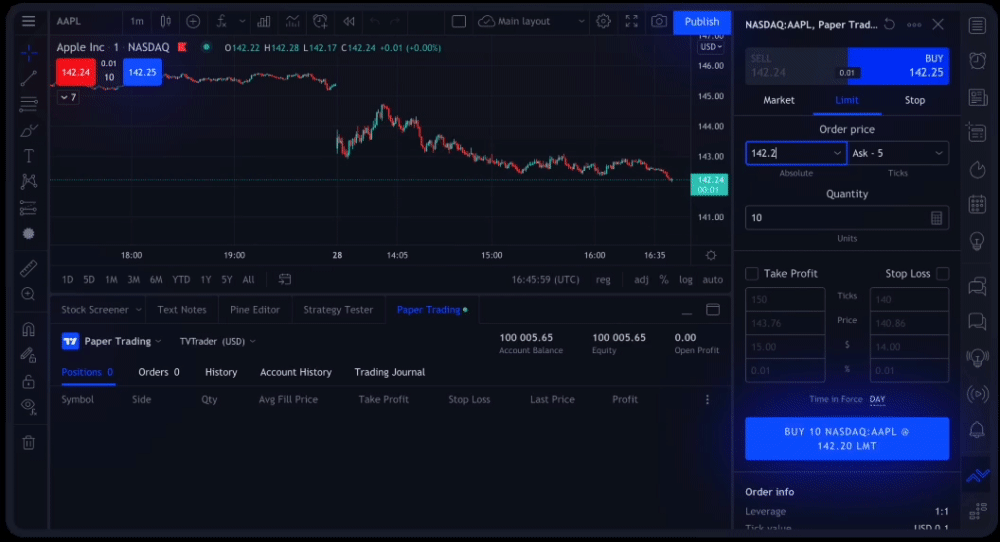

In addition to its key charting features (covered below), TradingView offers additional features like paper trading (virtual trading to hone your skills before risking real money), fundamental data, broker connections with brokers such as Interactive Brokers, and more across its browser-based application, iOS and Android apps, and desktop software.

Who is TradingView For?

TradingView is a platform for active traders to perform technical analysis, primarily on stocks and crypto.

While long-term, fundamental investors may want to do some basic charting for entry/exit points (which they can do with the free version of TradingView), they’re not who TradingView is built for.

Here’s what TradingView does really well: It’s easy-to-use for new traders who are learning about different indicators, trading strategies, and developing their own unique style while being exceptionally powerful for traders with decades of experience and their own custom scripts.

Key Features of TradingView:

If you’re a day trader, the Basic (free) plan will not be enough. You will want to upgrade to a paid plan or use another software. I’ll cover the limitations in each of the categories below.

TradingView is absolutely packed with features while maintaining an exceptionally sleek interface, which is why it’s the perfect solution for both new and veteran traders.

Here are a few of TradingView’s key features – if you’re interested in everything it has to offer, head to their website for more details.

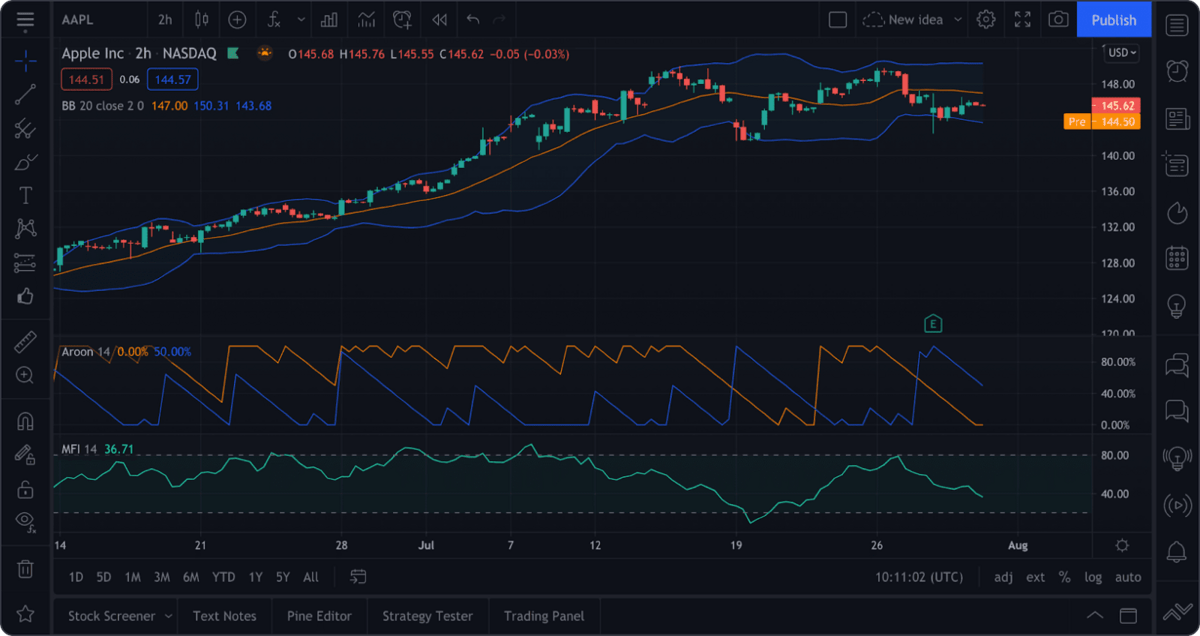

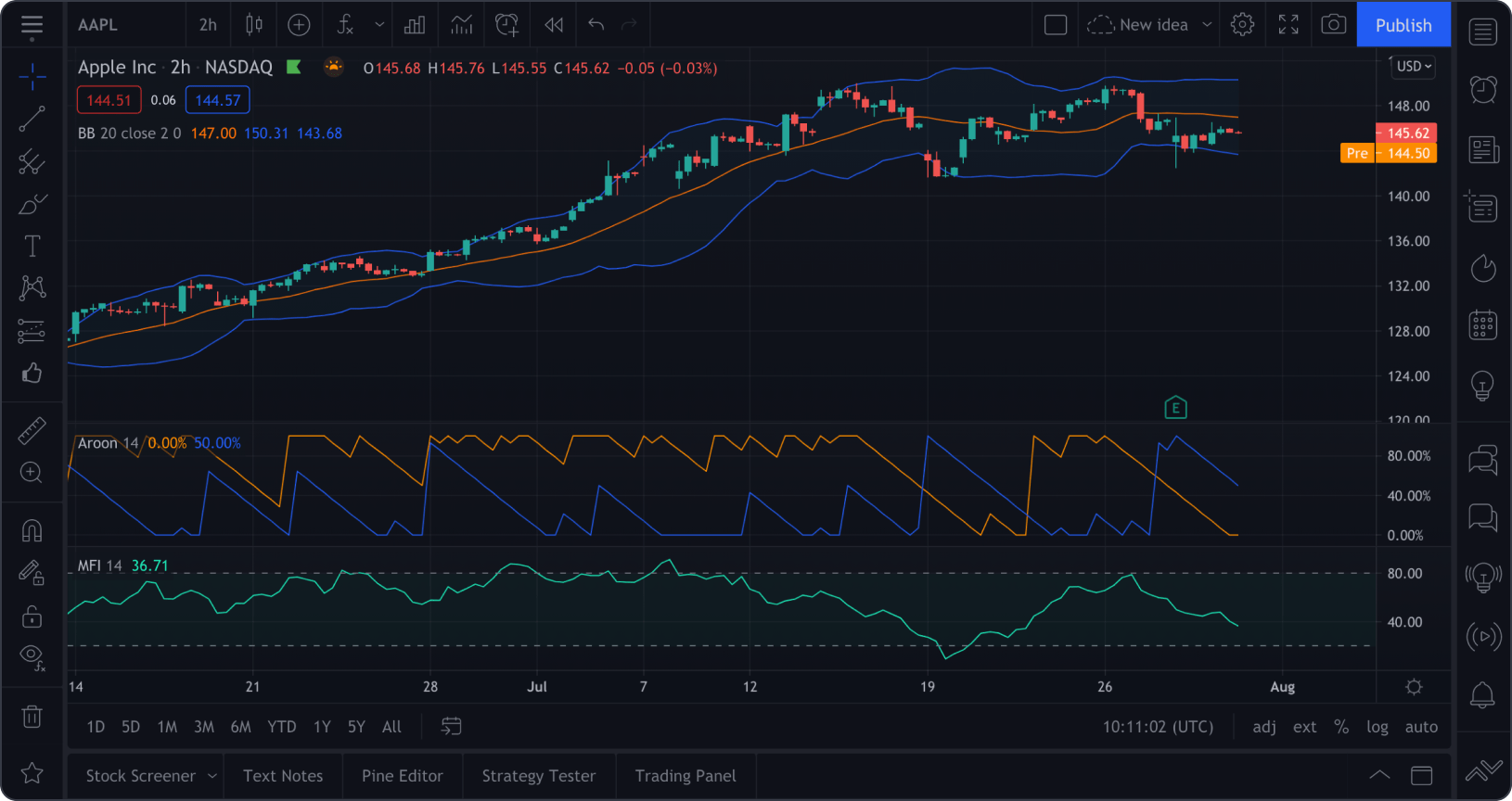

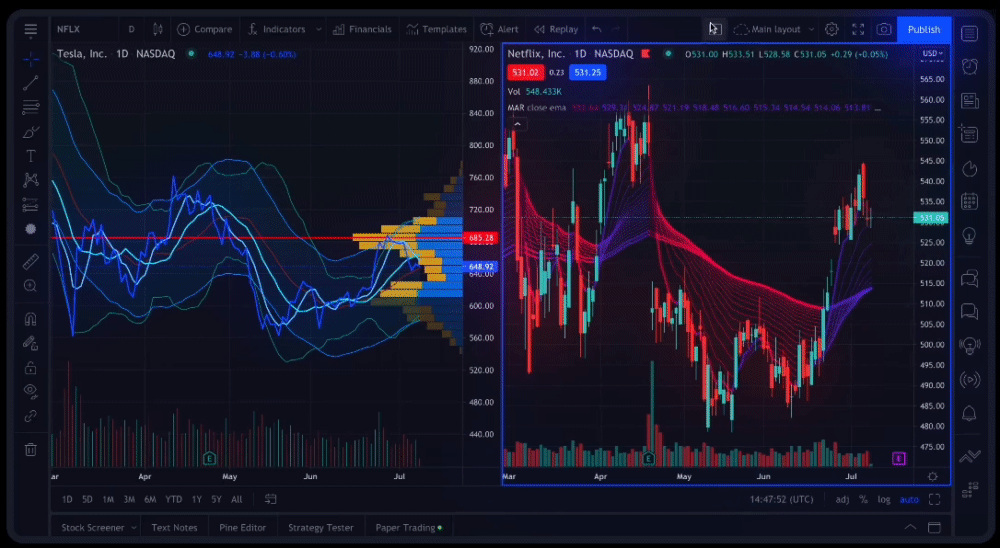

Charts and Technical Analysis

Charting is the reason you’re considering investing in TradingView, and you won’t be disappointed.

There’s A LOT to unpack here, so I’m just going to cover the highlights.

You can choose from:

- 14 Chart types

- 20+ Timeframes

- 90+ Drawing tools

- 100+ Pre-built indicators

- 100,000+ Community-build indicators

- 70+ Exchanges from 50+ countries

I can almost guarantee there’s nothing you’ll be missing – which is why TradingView is used by more than 60 million traders every month.

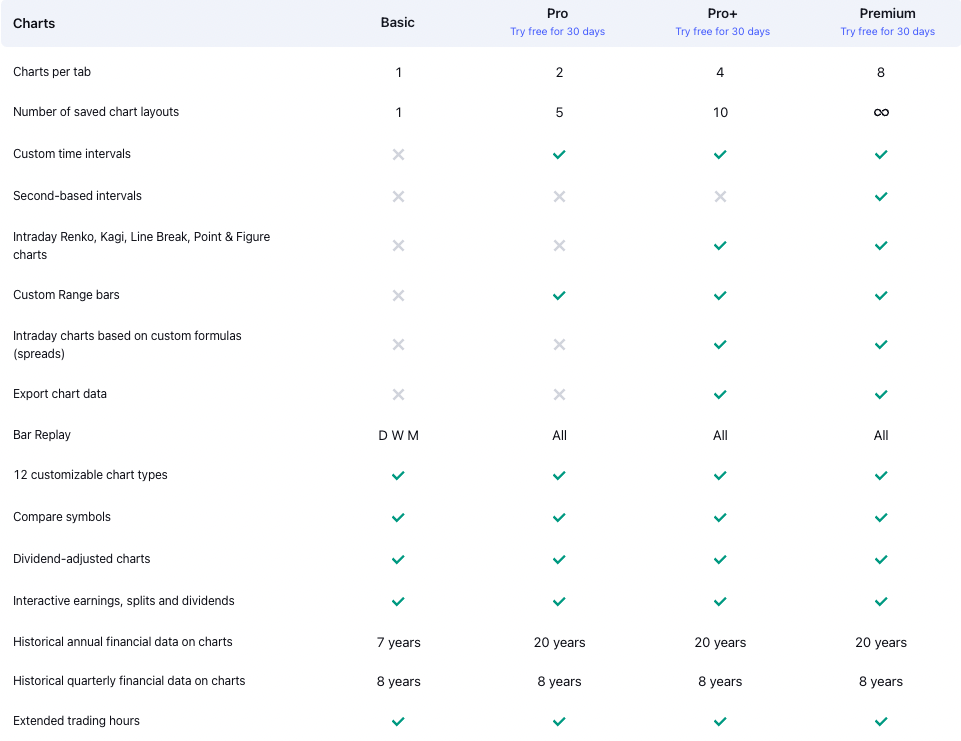

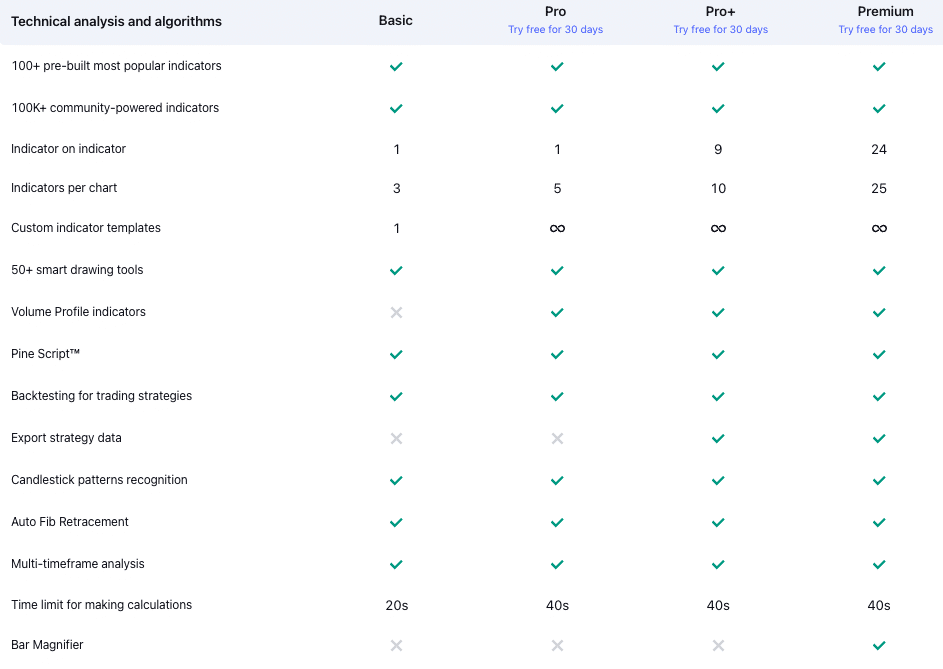

However, when it comes to actually using these features (especially in combination), you’ll be severely limited by a Basic plan.

First off, here are the chart limitations:

And here are the technical analysis limitations:

There’s really no question: If you’re serious about your trading, you need to upgrade.

Fortunately, you can experience TradingView’s full capabilities risk-free with a 30-day free trial.

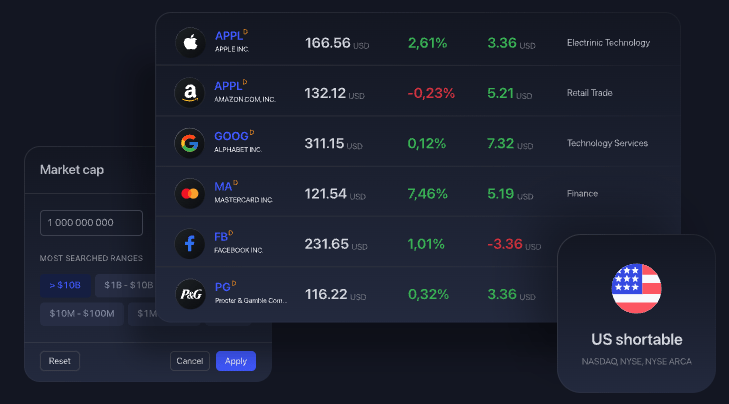

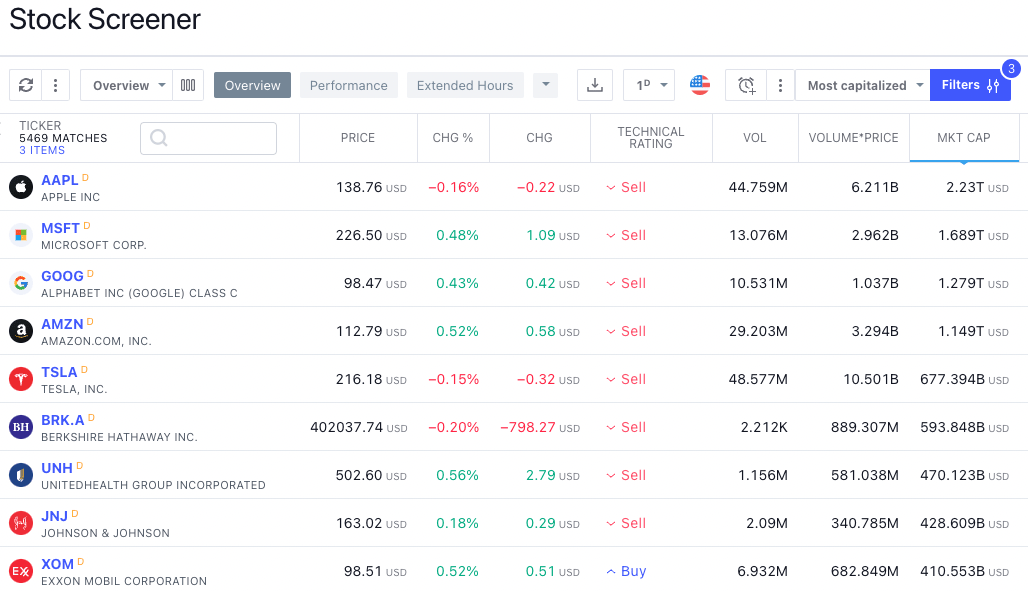

Screeners

Beyond your few favorite assets you like to trade, you need a way to quickly sift through thousands of securities for potential trades.

TradingView has 3 screeners:

- Stocks

- Forex

- Cryptocurrencies

Regardless of what trading strategies you favor, there are endless filtering options for each screener based on whatever criteria and quantitative data you find most important. Notably, you can filter by technical indicators.

For example, you can filter by stocks with an overbought RSI if you want to look for potential short opportunities.

The screeners also include TradingView’s Technical Rating which ranges from Strong Sell to Strong Buy. These ratings are calculated based on measuring the interplay between a number of technical indicators.

When you’re finished, hit the export button to download the data into a CSV for further analysis.

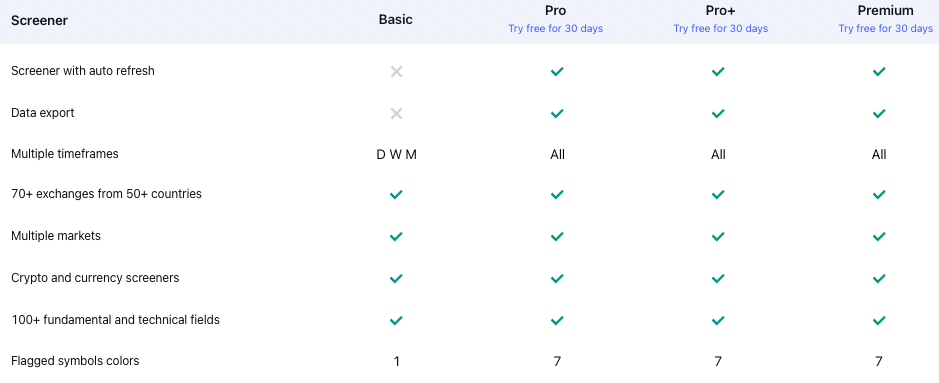

Here’s the feature comparison across plans:

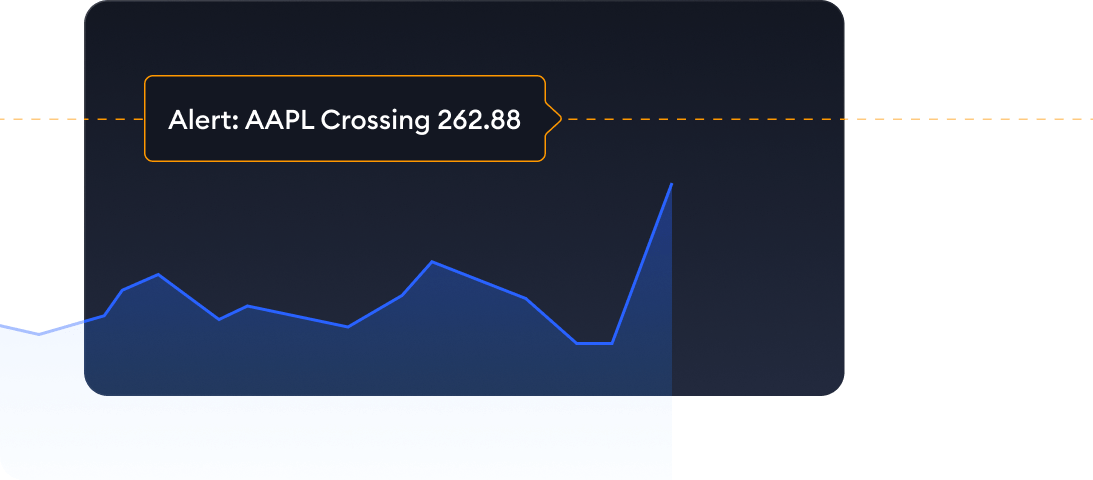

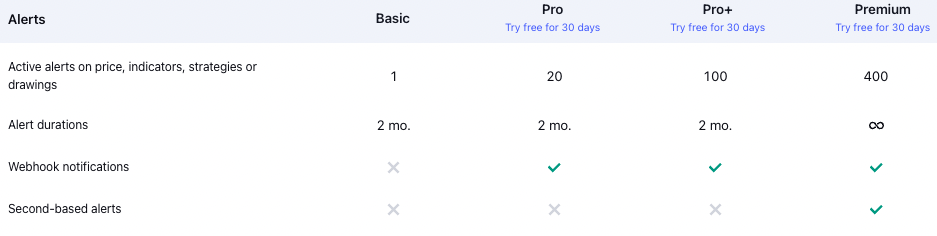

Alerts

Most traders follow many stocks at once – you need to in order to find the best setups to trade.

But it also gets overwhelming, and constantly switching between different assets can be a large mental drain.

TradingView solves this problem by offering server-side alerts. These alerts allow you to set price alerts on the assets you’re following around key support/resistance levels so you can be notified when a stock is approaching or leaving a major price.

I use price alerts all the time so I don’t drive myself crazy switching back and forth between every stock in my watchlist.

The total number of alerts is the key limitation by not upgrading. If more alerts are one of the important features you look for, you’ll definitely want to consider one of the paid plans:

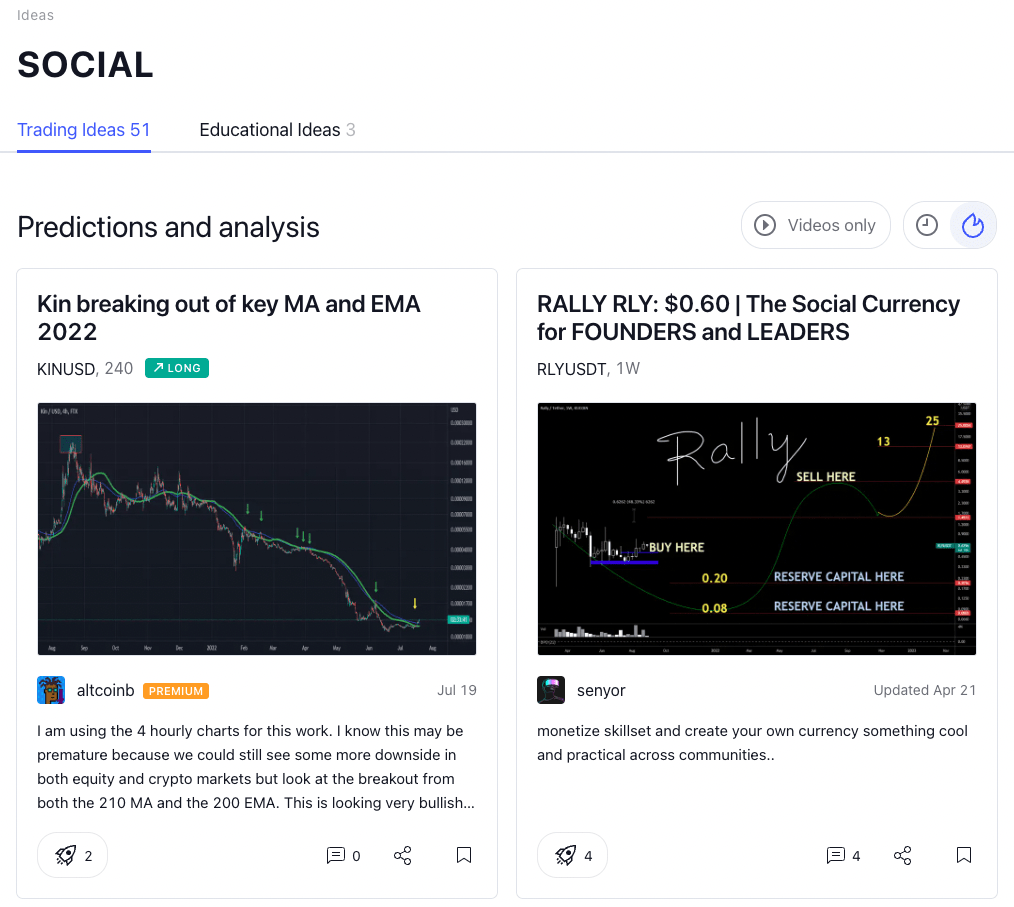

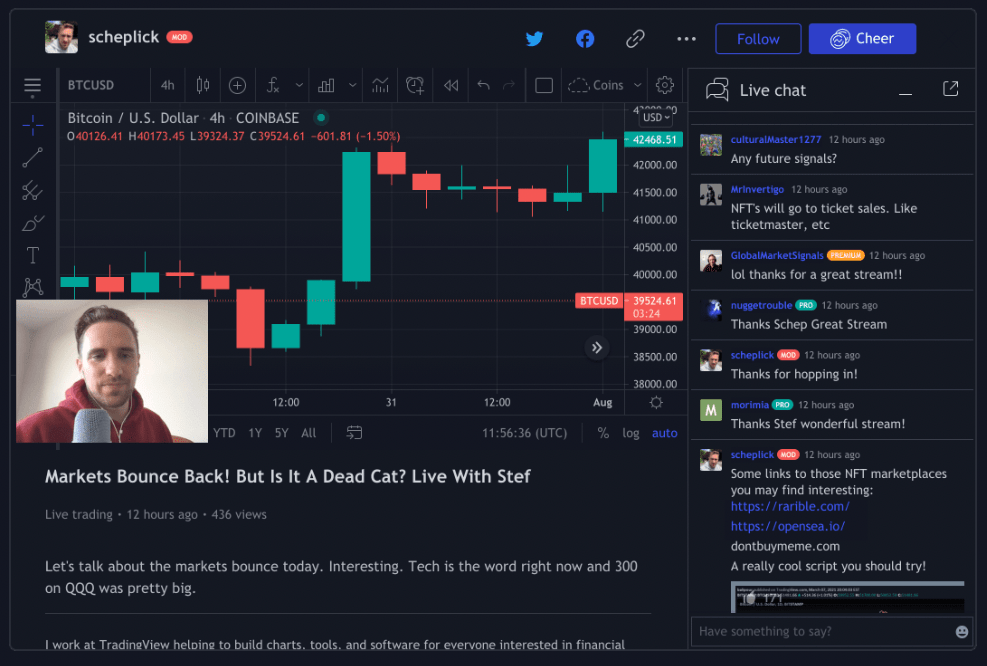

Community

Trading is really hard (even for experienced traders). Plus, it can get lonely. So it’s nice when platforms have a social aspect.

On TradingView, you can easily share your ideas with other traders and see what strategies are working for profitable veterans.

Sure, reading books on technical analysis and practicing with paper trading is beneficial, but one of the best ways to improve your trading is by learning from others and having them test your assumptions and strategies. This is one of the fastest ways to pick up on the nuances of trading, which is often the difference between profits and losses.

In TradingView’s Trade Ideas section, millions of traders are posting their trades and setups they’re looking to enter. This is one of the fastest ways to level up your trading skills and discover new technical analysis techniques

Beyond improving your technical trading skills (pardon the pun), you’ll also learn about risk management, trading styles, market interpretation, trading plans, and so on. Though these “soft skills” are less talked about, experienced traders know the vital role they play in consistent profitability.

TradingView’s Community features give you direct exposure to learn every facet of effective trading from some of the world’s best traders.

Other Features

Moving past community features, here are a few other notable features TradingView offers…

- Assets: Stocks, futures, commodities, forex, CFDs, cryptocurrencies

- Markets: Most major indices and 50+ exchanges

- Broker connections

- Web-based platform and desktop and mobile apps

- Bar replays

- Paper trading

- Enhanced watchlists

- Fundamental stock data

- Backtesting

- Trade ideas

- Chart exports

- Heatmaps

- Real-time, global news

- Earnings calendars

These features are available (at least to a degree) on all plans.

TradingView Platform Performance and Reliability

We’ve talked about the platform. We’ve shared a cool feature or two. I’ve already shared some of the reasons I enjoy TradingView. Now, let’s fast forward to the good stuff: how reliable is the platform, and what do actual users have to say?

I want to give you the full picture, so I hit up everyone I knew (and some people I don’t) to ask about their experience with TradingView. From conversations with friends to scouring chat rooms and reviews, here’s what I’ve found:

What People Are Saying About TradingView Alerts

Are TradingView alerts any good?

According to one user, “In my experience, the alerts work reliably overall.” They go on to note that if indicator-based alerts aren’t working well, it could be a problem with the indicator, and that they find the most reliability with alerts that depend only on the price level.

Not all users agree. Another TradingView user I spoke to found that the platform wasn’t up to snuff for fast-past scalping, since alerts were frequently triggered 20-30 seconds after the ticker alert on the screener. While that might not sound like a long time, it can render fast-paced trades (for day traders and scalpers) totally useless.

What People Are Saying About TradingView Broker Integration

Among the friends, coworkers, and chat room members I spoke to, Interactive Brokers was the most popular broker to integrate with the TradingView charting platform. But the platform does have its weak spots: As one user shared, while Interactive Brokers makes it easy to see your positions and drag “take profit/stop loss” directly onto the chart, they found the lack of trailing stops to be a flaw.

Another TradingView user who has used the platform in tandem with TradeStation and Alpaca echoes the lack of trailing stops. They also report delays with the orders you place showing up on screen — something that might not matter for swing traders, but could make a big difference for scalpers. However, as they summed it up, “All that said I still use it over the alternatives.”

Worth noting: At this time, TradeStation doesn’t support a lot of big brokers like Schwab, Fidelity, etc. However, they do have brokers in a variety of categories, including stocks, crypto, Forex, and more. See the full list here.

What People Are Saying About TradingView Plans

Which is the fairest plan of them all? People have strong opinions — here are a few highlights:

According to one user who used TradingView Basic for a year before upgrading to a paid plan, upleveling was a game-changer: “It’s definitely worth the upgrade.”

I also hit up Reddit to see what people were saying (it’s a good place for brutal honesty). Here are two reviews I found interesting:

“To me it’s hands down best charting software. I have it open all day and hemmed and hawed about going for premium package I was able to utilize all of the layouts in one window today and really liked it. Honestly, worth it for that alone.”

On the difference between an Essential and Premium plan: “I´d say this is probably like the difference between driving a Fiat or a BMW. Especially when you are a skilled driver, both drive well and you will easily reach your destination. But with the BMW you drive more comfortably. Most probably wont become better traders even with premium. It just brings better ride comfort.”

TradingView Pricing: How Much is TradingView?

It wouldn’t be much of a TradingView review if we didn’t look at the Tradingview cost and price tiers. Since they have a lot of plans, it might seem a bit confusing. Let’s simplify it.

You can use various features for free within the Basic plan. But more serious traders who want to use more than one chart per tab or gain access to ample alerts will likely want to upgrade from the TradingView free option to a paid plan: Essential, Plus, or Premium.

The platform even offers professional plans:

These paid plans will give you access to more indicators, multiple charts, custom time intervals, advanced chart types, and more – all the bells and whistles. Let’s compare TradingView plans below.

If you sign up to TradingView using any of our links in this article, you will receive a $15 credit which will be automatically applied to any plan you select.

Plus, test drive any plan risk free with a free 30-day trial.

TradingView also ranks #1 as my best platform for swing trading.

TradingView Free Vs. Paid Plans

Should you go for a totally free plan or ante up for a paid plan? Depends on your trading style and needs. Let’s take a look.

Personally, I think that TradingView Pro or Pro+ are the best options — I’ll share why below.

As for the free plan, I think that considering the price (free) you get a lot of bang for your buck, but there are some things that might annoy you / prompt you to upgrade:

- The basic (free) plan is ad-supported; pop-ups can get annoying after a while.

- Features are limited. For instance, you can only access three indicators per chart.

- You can get a free 30-day trial on any of the plans — why not give one of them a test drive?

Now, to give a quick little roundup of the free vs. paid plans and what you get:

My Opinion: TradingView Basic Vs. Essential Vs. Plus Vs. Premium

In my opinion, TradingView Plus is the best plan for most traders.

With Plus, you can use TradingView across multiple devices, run multiple charts, save more chart layouts, use more indicators per chart, increase the number of alerts you can set, and more.

For my own trading, I use the following indicators:

- Volume

- Volume Profile

- RSI

- MACD

- 2 EMAs

- and a MA

Here’s an article of, in my opinion, the best volume indicators.

That’s 7 indicators in total, which means the Essential plan’s 5 indicator maximum doesn’t cut it. Most traders will use at least this many indicators.

I also like to keep my eye on SPY, QQQ, and the VIX while trading, so having 4 charts in one layout is a must – also a Pro+ only feature.

Beyond those key must-haves, the rest of the features from upgrading are “nice-to-haves” (I like to set a lot of alerts).

How much does TradingView cost? How do the features stack up? Here are all of the differences between Plus and Premium:

TradingView Basic (Free) | TradingView Essential | TradingView Plus | TradingView Premium |

|---|---|---|---|

Free | $12.95/mo (billed annually) | $24.95 (billed annually) | $49.95 (billed annually) |

1 chart per tab | 2 charts per tab | 4 charts per tab | charts per tab |

2 indicators per chart | 5 indicators per chart | 10 indicators per chart | 25 indicators per chart |

1 saved chart layout | 5 saved chart layouts | 10 saved chart layouts | Unlimited saved chart layouts |

5 price alerts | 20 price alerts | 100 price alerts | 400 price alerts |

Export chart data? NO ❌ | Export chart data? NO ❌ | Export chart data? YES ✅ | Export chart data? YES ✅ |

Ads? YES ✅ | Ads? NO ❌ | Ads? NO ❌ | Ads? NO ❌ |

The Premium plan unlocks even more functionality and additional features, but ultra professional plans like this are total overkill in my opinion (unless you’re running a trading firm or some other business using TradingView’s software).

For just $24.95/month (when billed annually), TradingView Plus is the best charting subscription in 2025.

If you use fewer indicators and trading tools than I do and don’t need as many charts in one window, TradingView Essential is an excellent price at $12.95/month (billed annually).

TradingView Pros and Cons

To round up some of the pros and cons of TradingView:

Pros | Cons |

|---|---|

Different options for every type of trader & budget, from a basic plan to professional plans | The many plans can be confusing to newbies |

Broker integration | The free plan has ads |

Built in indicators and customization features make it easy to transform TradingView it into the best tool for your style of investing, from long term investors to swing traders | Access to trade execution can be limited — the platform’s main focus is on analysis |

Social network features allow you to connect with other traders | The best features are found in paid plans |

Try any plan free for 30 days | |

Final Word: TradingView Review

TradingView is an absolute necessity for my trading.

I don’t need an alert service or a bunch of trade ideas. I want a place to chart that’s fast, reliable, and affordable – TradingView is a home run.

It has every indicator and analysis tool I need (and much more) and its minimalist design makes trading simple and effective. Plus, it’s extremely affordable.

And it’s a great solution for just about every other trader too, from total newbies to professional traders.

If you’re still wondering, “Is TradingView good for day trading?”, here’s your answer:

Yes it is. It’s trusted by more than 30 million traders because no one can find anything they don’t like about TradingView.

The trading view is good from here: Use the link below for your 30-day free trial and experience the difference TradingView makes:

Want more? See my full list of tools for traders. Need trade ideas? Check out our new stock picking newsletter, Zen Investor.

FAQs:

Is TradingView free to use?

Yes, you can use TradingView for free.

However, the free version of TradingView comes with a number of limitations (only 1 chart per tab, only 3 indicators per chart, no custom time intervals, etc.) and is not ad-free. If you’re a trader (and not an investor looking for basic entry/exit points), I would highly recommend the 30-day free trial of Pro+.

What is better than TradingView?

In my opinion, nothing is better than TradingView for active day and swing traders who want a fast, reliable, and intuitive charting platform.

My favorite alternative is TD Ameritrade’s thinkorswim platform, but only because it’s completely free (for people with Ameritrade brokerage accounts).

How much does TradingView cost?

TradingView has a free plan and 3 paid plans: Pro is $10.50/month, Pro+ is $17.95/month (my recommendation), and Premium is $30/month.

*All prices above are when billed annually.

You can try any of their paid plans for free for 30 days.

Can you actually trade on TradingView?

Yes, TradingView has broker integration which allows you to trade from directly within the TradingView platform.

TradingView currently supports 15 brokers, including TradeStation, Interactive Brokers, and Ally Invest.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.