What Do These Stocks Have in Common?

These recent winners (plus 60 more stocks gaining over 100%) were unearthed from a little known, but extremely profitable investing approach.

If you have a few minutes now, then please keep reading to discover how easily you can employ this proven method in the weeks and months ahead.

Plus, how to get the next 2 stocks that are about to be released on Wednesday, January 14th.

No doubt you realize that Wall Street is home to most of the world's top investors.

These marble floored firms scour the Ivy League schools looking for the best and brightest. And then shower them with breathtaking comp packages so they can apply their immense brainpower to find winning stocks for their clients.

At the epicenter of this action are greater than 4,500 equity analysts who spend nearly every waking hour devouring everything they can about the market… economy… industry trends… and yes, the upside potential of the stocks they follow.

Aye, But Here's the Rub

At this moment there are a whopping total of 2,771 stocks that have a Buy rating affixed by these analysts.

There is just no way on earth these stocks are equally attractive.

And there are simply not enough hours in a month, let alone a year, to narrow down that mountain of picks to the handful that truly have the greatest upside potential.

That is until now…

4 Step Process to Find the Next Big Winners

This process goes to the very heart of our mission at WallStreetZen.

To help you find a peaceful path to profits

Meaning that investing can be very overwhelming. And the exact opposite of Zen.

Plain and simple, there are far too many:

This leads to the most common complaint we hear from investors. That they suffer from "Information Overload".

To solve that pressing problem, and put you on a smoother path to outperformance we created this 4 step process.

To be clear… we take care of the 4 steps. All you have to do is buy the stocks and enjoy the ample gains that follow.

Step 1: ONLY Top Analysts

As you can imagine… not all analysts are created equal.

That is why we closely monitor the performance of stock analyst recommendations.

Meaning that we only want to pay attention to those analysts making the most profitable picks… and ignore the rest.

Step 2: Maximum Upside Potential

This is where we let the computers do the heavy lifting to narrow down the very best stocks.

We know they are the best stocks because they pass a rigorous 115 factor test that points to consistent outperformance as proven below:

Those 115 factors reviewed daily for each stock are broken down as follows:

From the above you easily appreciate that this is an incredibly well rounded ratings system taking into account the attractiveness of a company from every logical angle.

You will note that we have discussed 115 different factors in the Zen Ratings. Yet if you add up all the ones in the chart above you will discover only 112.

That's because the model has 3 bonus factors for the Size of a stock. That is because over time smaller stocks have generated higher performance. So these 3 factors help skew the model slightly towards small cap stocks.

Let's drill down into the Artificial Intelligence (AI) factor.

What sets our AI factor apart is how it combines multiple factors (such as earnings, cash flow, price movement and industry trends) into a singular, actionable insight.

The Zen Ratings leverages cutting-edge machine learning technology to enhance its rating system, using a Neural Network model trained on over 20 years of historical fundamental and technical data.

This model analyzes patterns and relationships in vast amounts of data that would be impossible for humans to detect, offering a more comprehensive and nuanced view of stock performance.

The AI model incorporates advanced cross-validation techniques, ensuring the system isn't just optimized for past performance but is robust enough to adapt to future market conditions.

Cross-validation helps avoid overfitting, which means the AI isn't just learning how to excel in specific historical periods—it's learning to generalize across different types of market environments.

Best of all, we continue to update the model on the most recent market data. Each time we do that, the AI gets smarter about how to find alpha in today's stock market.

All in all, the Zen Ratings is one of the most complete and consistently profitable stock selection systems available to individual investors today.

This is why it has outperformed the S&P 500 by more than 3 to 1.

We are proud to put these proven ratings at the center of the Zen Investor stock selection process.

Step 3: Due Diligence Score

This is the stringent due diligence process that we perfected at WallStreetZen.

Each stock is put through a gauntlet of 38 tests to appreciate the true fundamental merit of each stock. Important attributes like:

- Profit Growth vs. Industry

- Benjamin Graham Value Formula

- Healthy Debt to Equity Ratio

- Accelerating Revenue Growth

- High Return on Equity

And 33 more due diligence checks covering everything from Valuation to Financials to Dividend to Forecast to Performance.

There are no stocks that clear all 38 of these hurdles. But the more hurdles they clear… the more fundamentally sound the company truly is… and the more likely the stock will outperform in the future.

This comes back to the sound advice from famed investor, Ben Graham (Warren Buffet's mentor and the father of value investing). He stated that in the short term, the market is a voting machine, but in the long term, it is a weighing machine.

In other words, emotion and psychology may cause Mr. Market to overreact or underreact to information in the short term, thus affecting the share price, but that in the long-term, the value of a company is determined by its fundamental strengths and weaknesses as a business.

If you share this philosophy and you believe that identifying fundamentally strong yet undervalued companies is key to long-term investing success, then this third step with the Due Diligence Score can point the way to more winning stocks.

Step 4: Hand Pick the Best of the Best

Most of the previous steps are quantitative in nature.

Meaning where we have trained our computer models on narrowing down from the 2,771 Buy rated stocks from Wall Street to a much smaller and attractive pool of outperforming picks.

But even at this stage there are still too many stocks to place into our portfolio.

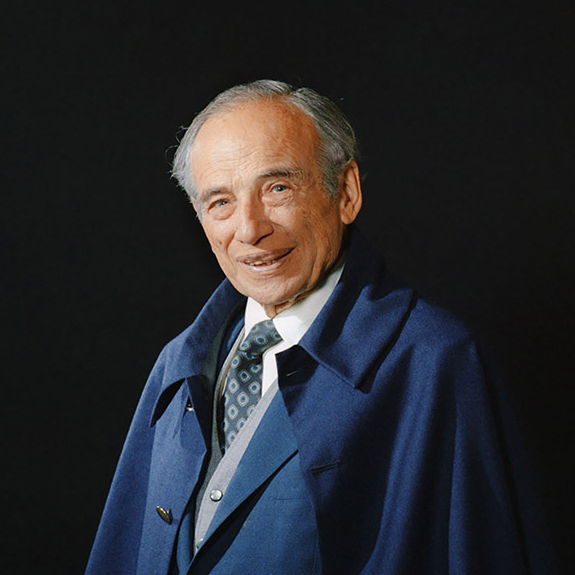

Over those 44 years Steve (aka Reity) has seen every kind of market condition. Sure it's easy to brag about the ample gains generated during the bullish years where everyone saw their portfolio swell.

Rather it is the difficult times that provide the best lessons learned. To see them coming at the earliest possible stages to weather the storm.

And over the last 4 decades Steve has not just seen your run of the mill recessions that beget bear markets.

But has also endured the popping tech bubble in 2000 that led to a three year bear market. (And how he took advantage of those times with 2 extraordinary stock picks… more about that in a moment)

Or the tremendous lessons learned from the Financial Crisis and Great Recession periods of 2008 and 2009.

Then you have the shocking developments of the Covid crisis in 2020… with an equally surprising bounce for stocks that unfolded just 3 weeks later.

The point is that no matter what Mr. Market throws our way… Reity will know how to respond.

Likely you know Steve from his nearly 20 years as Executive Vice President, leading the charge for Zacks.com… one of the largest and most respected investment websites covering the US market.

The specialty of Zacks was following the lead of Wall Street analysts to uncover the most profitable stock picks.

Thus, it was great timing for Steve to join Zacks in 1999 just as the tech bubble was bursting. This led him on a buying spree to sweep up the best of these stellar growth companies at extremely discounted prices in 2001 like:

Amazon bought @ 43 cents (split adjusted). Gladly still own the shares today at $227.35 pointing to a lifetime return of 52,772%.

Same goes for Priceline (now Booking Holdings) bought @ $14.62 and now at $5,393.74 for a welcome 36,793% gain.

Of course, we are not pretending this will be the result from all the picks.

There will be losers sprinkled in over time. That is where the 44 years of experience comes into play helping to spot the weaklings as early as possible to cull them from the herd.

Beyond Steve's hand selected stocks, he will also provide the all important WHY behind their selection.

First, his commentary will clearly help you appreciate the current state of the market. Bull… bear… or anything between.

Next providing a decisive trading plan of what sectors are hot… and which are not. Leading to an overweighting of the groups that are most attractive.

This leads to a portfolio of 20-30 of the most attractive long term stocks with that right combination of:

- Top 25% of Wall Street Analyst recommendations

- Zen Ratings analysis with a track record of +32.52% annual gains

- 38-point Due Diligence check

- Best long term upside potential

- Hand selected by Steve Reitmeister, with 44 years of proven investment success

Then Steve will spell out specifically WHY these are the best stocks to buy with complete analysis of the companies' growth prospects and exciting upside potential.

If this appeals to you… and it should… then please read on below how you can become a charter member of our brand new Zen Investor newsletter to start filling your portfolio with the best stocks for the long haul.

The Zen Investor portfolio is currently loaded with stocks showing tremendous upside.

Plus Steve Reitmeister will be adding 2 more winners on Wednesday, January 14th.

Steve will not just say when to buy… but when to hold… and when to sell to maximize gains!

And then you will have Steve's in-depth monthly commentary to keep you fully apprised of market conditions and any changes to our trading strategy.

Even better is that every month Steve will host a Members Only webinar to go into even greater detail about the investment landscape… trading strategy… and top picks.

This is where the Zen Investor becomes a 2-way street.

Because the heart of these monthly webinars is the robust Q&A sessions where Steve tackles any and all customer questions.

Rarely do investors get such complete access to one of the industries most respected experts.

Yet this all comes back to our mission to help you enjoy more Zen with your investing.

Are You Ready to Get Started?

Everyone who signs up now will be considered a charter member to the Zen Investor.

This entitles you to get the best price.

Note that we created Zen Investor to have broad appeal. That is why we are keeping it attractively priced at just $99 per year.

However, for charter members you can get started now for only $79.

Your membership is fully backed by 2 industry-leading money-back guarantees.

Plain and simple, if Zen Investor can't help you beat the market… then we don't deserve your money.

Full details on these Iron Clad 100% money back guarantees are available on the next page.

Plus the ability to save an additional 50% on your subscription.

All you need to do to get started now is just enter your email address below and press submit.