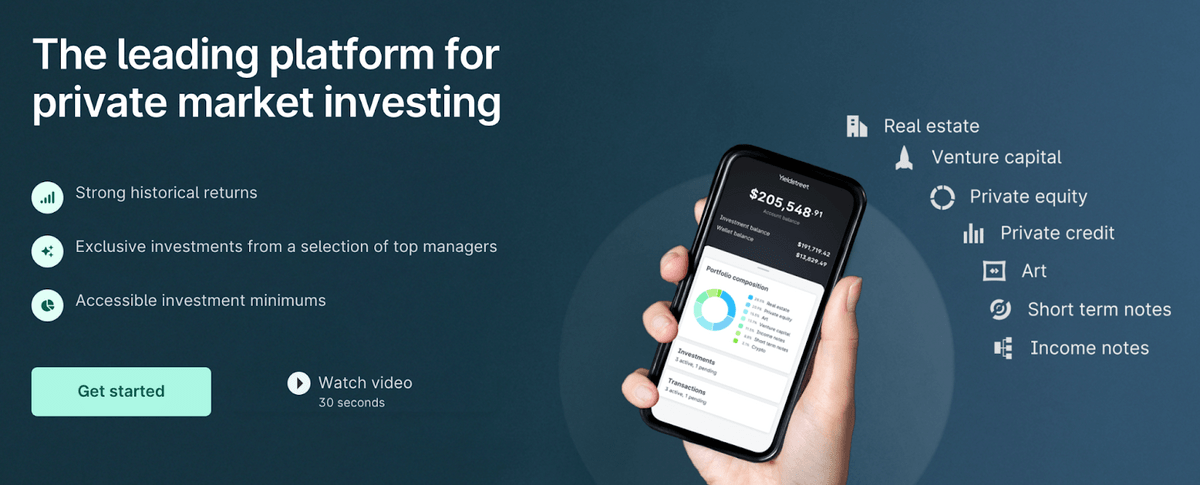

Yieldstreet is an online platform that provides individual investors access to various alternative investments including real estate, art, private credit, and other non-traditional assets. That in and of itself is fairly revolutionary — for decades, private alternative investments like these have been limited to institutions and ultra-wealthy investors.

Now you can diversify with the aforementioned offerings and more with ease.

But … Is Yieldstreet any good? Is it a good fit for you? In this Yieldstreet review, I’ll dive deep into how it works, pros and cons, management fees, minimum investment, and more to help you make the best decision.

Is Yieldstreet Legit?

The Bottom Line: Yes, Yieldstreet is legit.

With Yieldstreet, you’re investing in curated private market offerings that have passed a four-step due diligence process. Out of the billions of dollars of opportunities submitted to Yieldstreet, only 9% of offerings make it to investors. Since inception in 2015, over $3.9 billion has been invested on the platform, and $2.4 billion has been returned to investors.

Yieldstreet provides everyday investors access to a wide selection of alternative investments. Most offerings are debt investments backed by physical assets like real estate and art.

Investment Opportunities: 4.5/5

Accessibility: 4.5/5

Price: 3.5/5

What is Yieldstreet?

Yieldstreet is an alternative investment platform that provides retail investors access to alternative investments including private credit, art, real estate and crypto. The private aspect of Yieldstreet investing means their offerings are less correlated with stock market volatility than traditional public markets.

Important note: Many Yieldstreet investments are open to accredited investors only – individuals with an earned income of $200,000 annually or a net worth over $1 million. (Related reading: How to Become an Accredited Investor)

The Yieldstreet Alternative Income Fund (Formerly the Yieldstreet Prism Fund) was launched in 2020 and is open to non-accredited investors. The multi-asset class fund seeks to generate income by investing across alternative assets like art, commercial real estate, corporate debt, and more.

According to the Yieldstreet website, the Fund targets paying a quarterly distribution — and to date, all targeted payments have been made.

The minimum investment of the Yieldstreet Alternative Income Fund is $10,000. Currently, the AUM is $152 million and the net annualized yield is listed as 8.3%.

Yieldstreet’s Key Numbers

- Annual Management Fee: Yieldstreet fees range from 0%-2.5% annually. Additional fees may apply depending on the fund. The Yieldstreet Prism Fund has a total annual fee of 1.0% and charges no load or redemption fees.

- Minimum Investment: The minimum investment for different opportunities range between $15,000-$50,000 (accredited investors). The Yieldstreet Alternative Income Fund starts at $10K (non-accredited investors).

- Projected Returns: Targeted annual net returns range from 8%-20% and are stated on the fund offering page. Actual results may vary.

- Investment Time Length: Terms range from 6 months to 5 years.

- Alternative Asset Classes: Art, crypto, legal, multi-asset, private credit, private equity, real estate, short-term notes, transportation, venture capital (Note: Yieldstreet offers a broad mix, and asset types can evolve, so reviewing the current categories on their platform is advisable.)

- Investor Requirements: Most offerings are available to accredited investors – individuals with an earned income of $200,000 annually or a net worth over $1 million. The Yieldstreet Alternative Income Fund is open to non-accredited investors.

Pros (Benefits) of Yieldstreet

Yieldstreet provides accredited and non-accedited investors access to a wide array of private alternative investments.

I’d go so far as to say Yieldstreet offers more asset classes than most platforms out there, including real estate, crypto, transportation, venture capital, short term notes, art, private equity, structured notes, private credit, and diversified funds.

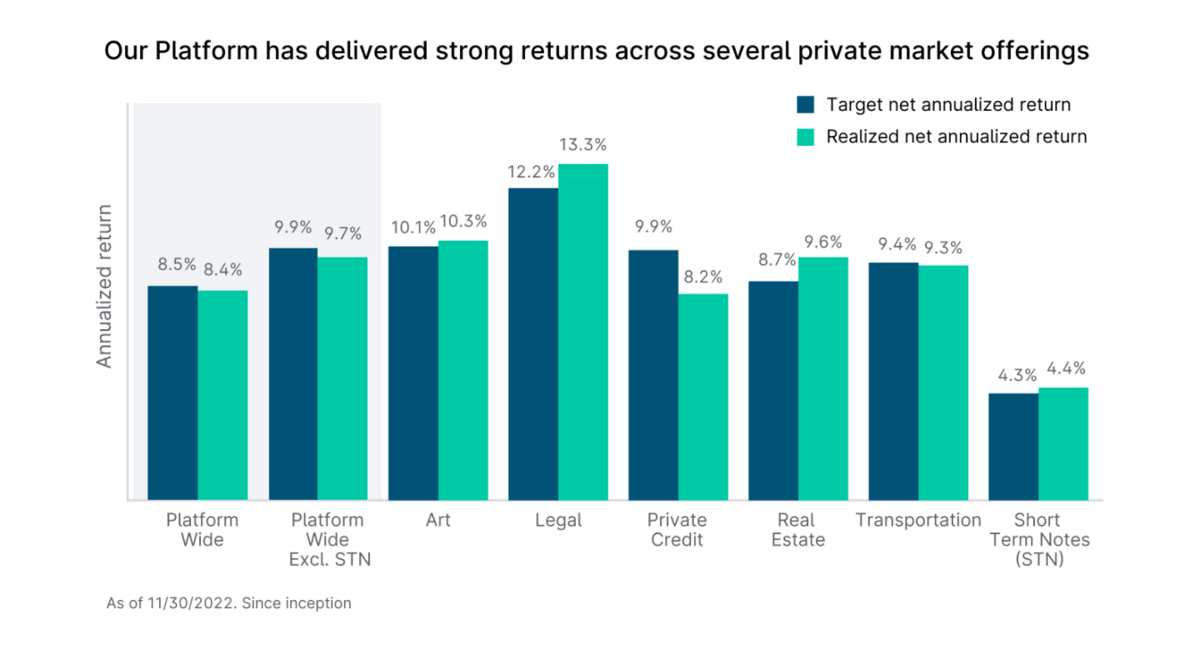

Can you make money with Yieldstreet? This is another reason I like the platform. Private market investments offer potentially higher returns given their limited availability. Targeted annual net returns range from 8%-20%, making it one of the highest paying passive income apps.

Yieldstreet’s IRAs give investors access to the unique opportunity to hold private investments within a tax-efficient retirement account. Most large traditional brokerage firms do not allow privately held investments.

Yieldstreet also prides itself on its transparency. You can view historical performance since inception for each asset class. Out of the billions of dollars in opportunities submitted to Yieldstreet, only 9% make it to investors. Their 30+ person investment team has a four-step vetting process to approve offerings.

Cons (Drawbacks) of Yieldstreet

The primary drawbacks of Yieldstreet are accessibility and liquidity.

Most of what Yieldstreet offers is primarily available to accredited investors. That said, the Yieldstreet Alternative Income Fund was launched for non-accredited investors and charges a 1.0% annual fee. The fund has a $10,000 minimum and invests across multiple of Yieldstreet’s most popular asset classes.

If you’re looking for liquidity, Yieldstreet may not be right for you. The accredited investor offerings range from 6 month to 5 year terms. Again, the Yieldstreet Prism Fund allows investors the opportunity to liquidate at least a portion of their shares on a quarterly basis.

Another main drawback is the limited amount of offerings. Not only are most available to accredited investors, but they are only open for a limited time. You could be ready to invest and find out the fund you’re interested in is already closed.

Example Investment on Yieldstreet

Yieldstreet provided an $11.6 million mezzanine to the borrower constructing a 124-unit multifamily development in Portland, OR. This is a real estate debt investment where Yieldstreet investors can expect monthly payments.

Here are a few details:

- Investing in a mezzanine loan – a hybrid of debt & equity financing

- Expected return: 10.3%

- Available to accredited investors

- Market demand: Project is near major employers in the Slabtown neighborhood, including Nike, Intel, Amazon, Adidas and Lululemon. CoStar expects a 4% vacancy decrease combined with 4.9% rent growth over the next 3 years.

Yieldstreet vs Fundrise

There are other alternative investment platforms out there. One is Fundrise, which also offers access to a variety of alternative assets.

Both platforms provide everyday investors the opportunity to generate passive income through real estate investing and private structured credit deals, but they go about it in different ways.

Here’s a breakdown of the 2 services:

Yieldstreet | Fundrise | |

|---|---|---|

Overall Rating | 4.5/5 | 4/5 |

Minimums | $10,000 Alternative Income Fund $15,000 Accredited Offerings | $10 for Starter account |

Projected Returns | 8-20% annually | 4-10% annually |

Alternative Assets Available | Real Estate, Legal, Art, Transportation, Private Credit, Cryptocurrency | Real Estate, Private Credit, Pre-IPO Tech Companies, Retirement |

Fees | 0 – 2.5% | 0.15% advisory fee; 0.85% management fee for real estate, 1.85% management fee for the Fundrise Innovation Fund |

Retirement Accounts | ✅ | ✅ |

Mobile App | ✅ | ✅ |

# of Investors | 404,000+ | 400,000+ |

Amount Invested | $3.9+ billion | $7+ billion |

Yieldstreet is best for accredited & non-accredited, experienced investors who want access to many private offerings in multiple asset classes like real estate, venture capital, private equity, private credit, crypto, short-term notes, structured notes, diversified funds, transportation, and fine art.

Fundrise is best for accredited & non-accredited investors who are only looking to get started in real estate investing.

Read our full Fundrise Review.

Note: We earn a commission for this endorsement of Fundrise.

Final Word: Yieldstreet Review

Most professional investment managers recommend supplementing your portfolio of stocks and bonds with private market alternatives. Yieldstreet offers more alternative asset classes than any other platform.

On Yieldstreet, you’re investing in:

- A track record of strong returns

- Investments from managers with $500 billion in assets under management

- Deals analyzed by 30+ investment professionals

It may be slightly more expensive than a few other platforms (Yieldstreet fees are slightly higher than Fundrise’s), but, at least in this instance, you get what you pay for.

FAQs:

What is the average return on Yieldstreet?

The average return on Yieldstreet is 9.8%, excluding the short term notes program.

Is Yieldstreet FDIC insured?

Yes, Yieldstreet is FDIC insured. Funds are held in the Yieldstreet Wallet - an account held at Evolve Bank & Trust, which is an FDIC-insured bank.

Which is better Fundrise or Yieldstreet?

They are both great real estate crowdfunding platforms. Fundrise is better suited for the beginner real estate investor looking to get started with low minimums. Yieldstreet is geared toward experienced investors who want access to the broadest base of alternative investments.

Can anyone invest on Yieldstreet?

Yes, anyone can invest on Yieldstreet.

Although most offerings are available to accredited investors only, the Yieldstreet Alternative Income Fund is available to non-accredited investors.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our June report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.