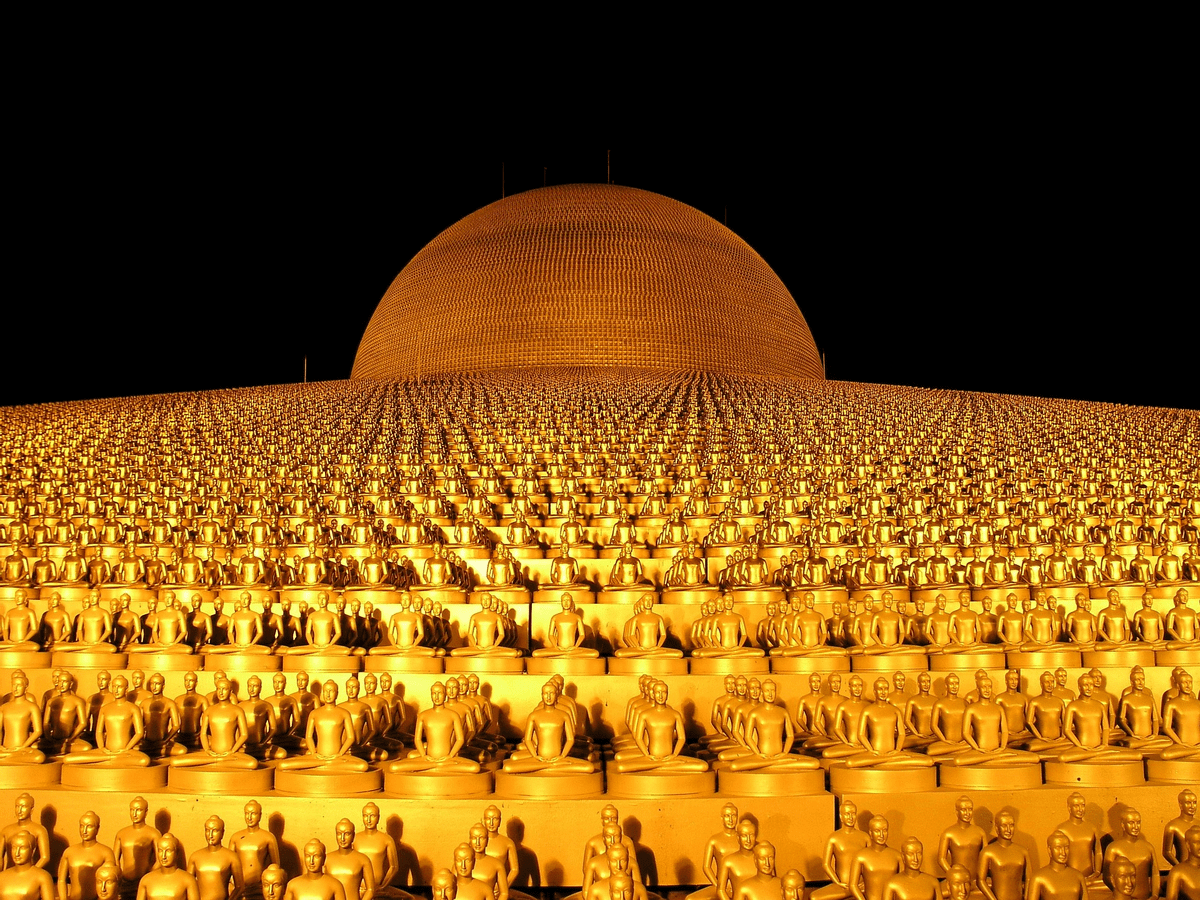

From the era of Pharaohs to the present day, gold remains one of the world’s most reliable assets.

Between 1971 and 2022, gold prices posted respectable annual returns of 7.78%. Plus, as fears of bank failures rise, there’s been a bonanza of gold buying in the precious metals market.

The problem? It’s a pain to store and secure precious metals. If you want access to gold without the hassle of home storage, chances are a Roth gold IRA (or a gold and silver Roth IRA) is the solution.

With a Roth IRA gold investment, you don’t have to store your shiny stash at home. As a bonus, you’ll get access to gold’s “inflation hedge” qualities without paying Uncle Sam extra taxes.

Anyone interested in exchanging money for metals should check out how gold-backed IRAs work and which platforms offer the best experience.

How Does a Gold IRA Work?

A Roth gold IRA is a tax-advantaged retirement account that allows investors to put their money into physical precious metals.

Similar to standard Roth IRAs, a gold IRA doesn’t charge taxes on withdrawals after you reach retirement age (i.e., 59½). This is in contrast to Traditional IRAs, which let people take tax deductions on their yearly contributions.

The only difference between a Roth gold IRA and a Roth IRA is the former lets people buy IRS-approved precious metals, and the latter lets you invest in IRS-approved assets (e.g., stocks, ETFs, and bonds).

Although gold has been around for centuries, the IRS doesn’t view it as an IRA-approved asset. Therefore, if you want to use retirement funds to purchase precious metals, you must apply for a self-directed individual IRA (SDIRA) focused on gold investing.

Gain a better understanding of precious metals IRA accounts — learn about self-directed individual IRAs! Check out this article.

SDIRAs allow investors to enjoy tax benefits and invest in “alternative assets” like gold bullion, Bitcoin, and even startup companies. For precious metals IRA accounts, you can use your max IRA contributions to add gold, silver, platinum, or palladium in a retirement account.

Want to know more about alternative assets? Check out this article.

You can usually rollover a pre-existing IRA into a self-directed precious metals IRA. Just keep in mind you’ll need to pay different fees to your new gold IRA provider (e.g., startup fees, annual fees, and storage fees).

Also, you can’t store the gold you buy with a Roth gold IRA at your home. According to IRS rules, your IRA provider needs to keep these metals in an approved depository until you reach retirement age.

Once you pass the magical 59½ threshold, you can ask your IRA provider to ship your metals to your door or liquidate your holdings for a cash payment.

Gold Backed IRA Guidelines

Just because self-directed IRAs let you invest in precious metals doesn’t mean you’re free to buy any old coin. Here are a few IRS guidelines to keep in mind when choosing a Roth gold IRA:

- Double-check gold purity scores: IRS-approved metals need to meet a high purity score to ensure their quality. Gold needs to be 99.5%, silver 99.9%, and platinum and palladium 99.95% pure.

- Only contribute the max yearly amount: Similar to Roth IRAs, gold Roth IRAs let people buy a maximum of $6,500 annually (or $7,500 after age 50). Please review the max contribution on the IRS’s website each year.

- Work with IRS-approved depositories: The IRS forces IRA investors to keep their precious metals in a high-quality storage facility before retirement. Review a precious metal depository’s reputation and accreditations before deciding which IRA provider to use.

- Wait till 59½ to withdraw: There are steep penalties if you withdraw precious metals from a Roth gold IRA before 59½. Although you could take money out early if you need it, you’ll pay at least a 10% tax on your holdings.

The Best Roth IRA Gold Providers

Since gold is a popular asset with a track record of near 10% annual appreciation, it’s no wonder more investors want to add it to their accounts.

Luckily for gold bugs, plenty of professional IRA providers work with Roth IRAs. Typically, these providers let you rollover a pre-existing Roth IRA to invest in precious metals on their platform.

When reviewing the best gold IRA companies, research each provider’s longevity in the industry, minimum deposits, and annual fees. After reading all of this data and comparing rates, you should know which provider is perfect for your preferences.

Self-Directed Gold IRAs

There are dozens of high-quality self-directed IRA providers, but here are a few top picks to add to your gold Roth IRA shortlist.

At-a-glance: top gold SDIRAs

- Best reputation: Equity Trust

- Best for alternative investments: Alto

- Best for checkbook control: IRA Financial

1. Equity Trust

Since 1974, thousands of retirees have “trusted” Equity Trust with their savings. In fact, Equity Trust is such a big name in the self-directed IRA space that it earned top marks from leading financial publications.

Equity Trust offers clients a gold and silver Roth IRA with access to coins, bullions, and bars. You can also store your precious metals in highly-rated depositories like A-Mark Global Logistics, Loomis International, Delaware Depository, and Brink’s International.

Besides its longevity, a significant selling point for Equity Trust is its easy-to-understand fee schedule, which ranges from $225.00 to $2,000 per year, depending on your portfolio’s size.

Also, Equity Trust allows account holders to add dozens of other alternative assets to their retirement accounts, including crypto, real estate, and foreign currencies.

2. Alto

Alto is an awesome pick for investors looking for a simple and low-fee self-directed IRA provider.

Thanks to Alto’s dozens of partnerships with alternative investment platforms (e.g., Masterworks and Vint), you’ll enjoy a huge variety of asset categories with competitive monthly rates. As a bonus, setting up an Alto IRA is a simple and streamlined process.

With an Alto Starter IRA, you can access dozens of partner investment platforms with assets like precious metals for a monthly fee of just $10 and partner investment fees of $10. Alto also allows investors to add assets outside its advertised offerings with a Pro plan for $25 per month plus the $10 partner investment fee.

3. IRA Financial

Based in sunny Miami Beach, IRA Financial is another top-rated self-directed IRA provider with access to precious metals. With a flat annual fee of $400, investors can buy gold, silver, platinum, or palladium from Crown Bullion using IRA Financial’s sleek online portal or mobile app.

IRA Financial also works with popular partner providers like Vint, Grayscale, and RealtyMogul to offer other alternative assets like wine, crypto, and real estate.

What sets IRA Financial apart from the competition is its option to give IRA holders complete checkbook control thanks to its “IRA LLC” offering. For an extra one-time fee of $999, you enjoy the speed, control, and lower costs of operating your IRA as an LLC.

While this LLC option is most popular with real estate investors, it’s worth considering if you want to maximize control over your portfolio.

Roth Gold IRA vs Other Account Types

The critical difference between Roth gold IRAs and other self-directed gold IRAs is their taxation policies.

With a Roth gold IRA, you don’t pay taxes on withdrawals after reaching 59½. However, you can’t claim tax deductions when you contribute to your gold Roth IRA as you would with a Traditional IRA account.

Simply put: Roth gold IRAs are the smarter pick for people who don’t mind paying upfront to enjoy tax-free “golden” years.

Pros and Cons of Gold Backed IRAs:

Pros | Cons |

Precious metals have a long track record of retaining their value through uncertain economic times. | Metals like gold aren’t usually as volatile as other assets, so it may offer limited upside potential. |

Helps diversify your portfolio from paper assets like stocks and bonds. | Self-directed gold IRAs have special fees which will cut into your profits. |

Roth gold IRA holders don’t pay taxes when they withdraw at retirement age. | You have to trust the IRA provider will secure your precious metals and ship them to you once you reach retirement age. |

Withdrawing from a Gold IRA

Every gold IRA provider has different withdrawal policies when you reach 59½, but most give you one of two options:

- Direct shipment of precious metals

- Buyback

If you want your physical metals, call your IRA provider and ask them to ship them to your doorstep. Just know this option may have extra insurance or shipping fees.

For those who’d prefer cash rather than coins, call your IRA provider to liquidate some of the precious metals. Depending on your IRA company’s policies, you may get a check in the mail or a bank transfer.

Please review whether your IRA provider offers a buyback program before depositing funds in your account so there are no surprises down the line.

Should You Invest Retirement Funds in Gold?

Roth gold IRAs are popular with investors who want to play it safe with their long-term funds.

Although precious metals don’t offer the same volatility as other asset classes, they’ve been around since the dawn of civilization, and they’re unlikely to plummet anytime soon.

Plus, since you own the tangible metals with a Roth gold IRA, you’ll diversify your portfolio away from paper assets.

If you’re bullish on precious metals and place a high value on security, a precious metals IRA account may fit your investment goals.

Final Word: Roth IRA Gold

Roth gold IRAs are a legit way to use a tax-advantaged plan to diversify your retirement account.

If you like the long-term trajectory and impressive history of metals like gold, a Roth gold IRA should provide extra peace of mind.

Even if you don’t invest all your retirement funds into precious metals, a gold Roth IRA may offer stability to your long-term savings.

For more ideas on investing in precious metals, check out WallStreetZen’s top picks for the Best Gold IRA Companies.

FAQs:

Can I buy gold in a Roth IRA?

You can purchase gold with a self-directed Roth IRA. Most precious metal IRA providers let users rollover a pre-existing Roth IRA or open a new account to add physical gold to their retirement savings.

Is it safe to hold gold in an IRA?

Holding gold in an IRA is safe if you're working with an IRS-approved self-directed IRA provider. Roth gold IRA platforms must meet strict requirements for storage and metal purity to offer products to customers, so you can rest assured your metals are in good hands.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.