If you have $10,000 in an investment account, contribute $200 per month, and earn an 8% annual percentage yield, you will have $167,072 after 20 years.

At first glance, this compound interest formula might seem impossible. But the math of calculating compound interest works — this is what allows normal investors to become millionaires with a simple commitment to invest consistently.

We’ve researched dozens of investment opportunities and have pulled together the best compound interest accounts available today. But there are several factors to consider, including your financial goals, risk tolerance, current interest rates, and the type of investments available.

Keep reading to find out what the top compound interest accounts are and how benefit from the power of compound interest.

Plus, I’ve broken down the options by level of risk: Low-Risk, Long-Term (medium risk), and Alternative Investments (higher risk).

Best Secure Compound Interest Investments for Long-Term and Short-Term Investments

Think beyond traditional savings accounts and money market accounts! Below, you’ll find a list of our top compound interest-earning investments for all time frames — including a range of investments from real estate investment trusts to private credit and a few assets you may not have considered.

1. Private Credit

Did you know that the private credit market is worth over $7 trillion? Yes, trillion.

How does it work? If a company doesn’t have access to public markets, it may forgo traditional financial institutions and seek out a non-bank lender. That’s where investors come in.

For investors, private credit offer short-term and high-yield investment opportunities — without a strong correlation to public markets.

Up until recently, private credit investing has really only been available to investors with great wealth — or great connections.

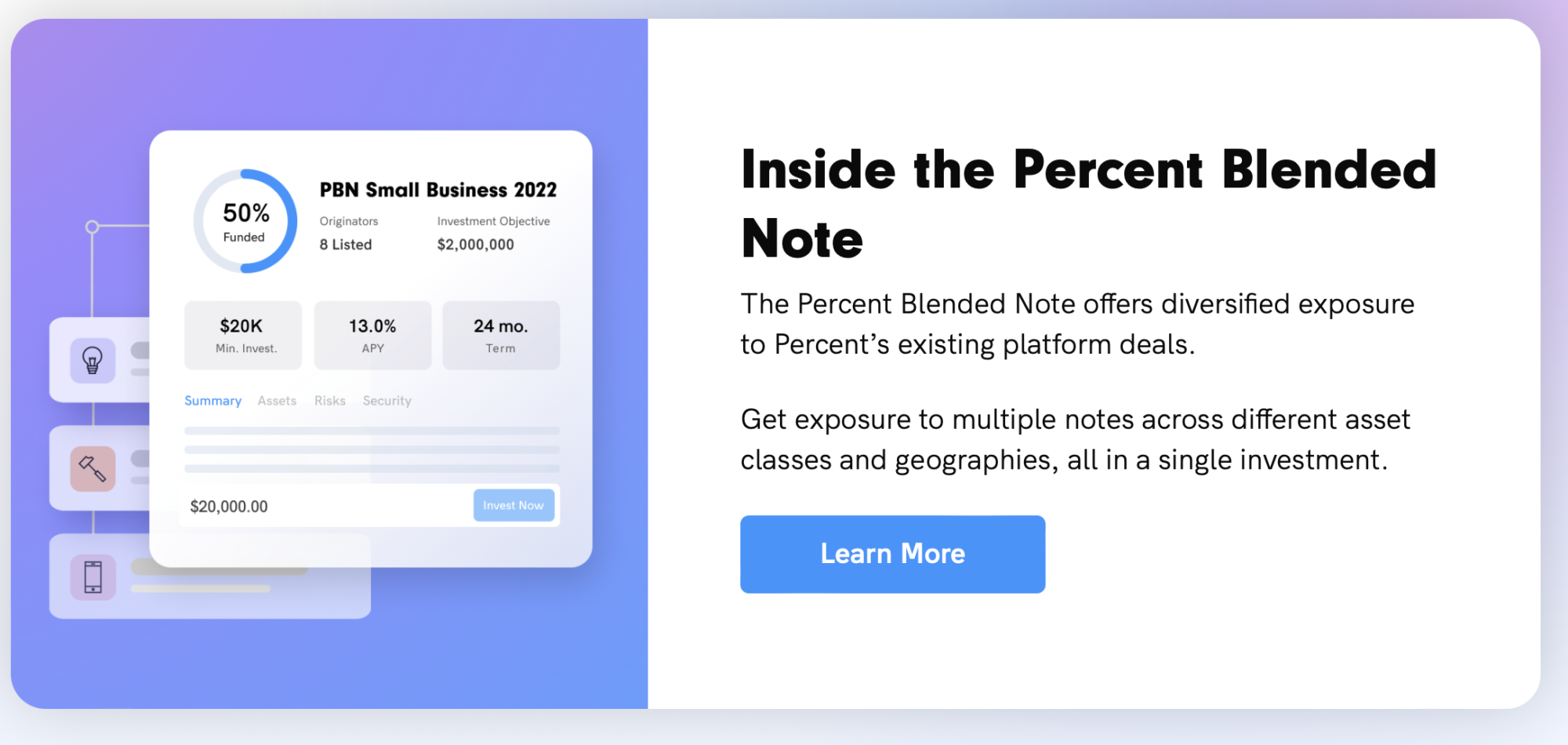

Percent is changing the landscape of private credit investing. Through the platform, accredited investors can access private credit opportunities that are largely secured by assets, loan portfolios, or corporate debt.

That’s all well and good, but how about the cold, hard numbers? As of December 31, 2024, Percent’s annual returns averaged 18.13% weighted annual percentage yield (APY). With historical results like that, it’s not hard to see why accredited investors are so attracted to this little-known alternative asset class.

As a benefit for newer private credit investors (or those looking for diversity), Percent offers the Percent Blended Note, which is sort of like a private credit fund you can invest in. Within a single investment, you gain access to a diverse mix of notes across different asset classes and geographies.

- Risk: Medium-to-high (7 out of 10)

- Returns: Varies

- Best for: Accredited investors interested in diversifying their investments

2. Real Estate (Commercial / Residential)

Owning real estate has been one of the best investments over the last 100 years. And with both home prices and rents on the rise, owning real estate can be a great hedge against inflation.

However, the upfront capital required to purchase real estate keeps many would-be investors on the sidelines. Especially right now, with interest rates so high.

For some investors, real estate investment trusts (REITs) may be a stepping stone. You can invest in them on the stock market — find out more here.

Another option?

Crowdfunded real estate platforms allow you to start investing in real estate directly for much less than buying property outright. Platforms like Yieldstreet make it easy to invest in real estate portfolios, and earn regular income from rents paid and equity built over time.

- Risk: High (8 out of 10)

- Returns: 8% – 20%

- Best for: Long-term investors looking to diversify their holdings into real estate

Our favorite Real Estate Investment: Yieldstreet

Diversification station! Yieldstreet gives accredited investors the opportunity to diversify their portfolios with real estate — as well as hard-to-find assets like art, private equity, and shipping vessels.

While many of the individual deals on Yieldstreet are only available to accredited investors, non-accredited investors are welcome to invest in the Alternative Income Fund. With a minimum investment of $10k, this fund gives you access to an impressive array of alternative assets within a single vehicle — real estate, private and structured credit, legal finance investments, and more.

Non-accredited investors may also be interested in Fundrise, a highly-rated real estate investing platform specializing in funds related to real estate and private credit within the real estate sphere.

Note: We earn a commission for this endorsement of Fundrise.

3. Real Estate (Farmland)

Investing in farmland is one of the hottest investment opportunities right now, having outpaced the S&P 500 over the past 30 years.

In fact, Bill Gates himself is heavily invested in this sector, with over 270,000 acres in his investment portfolio.

Don’t worry, you don’t need to buy a farm and start planting crops to get in on the action. Platforms like AcreTrader offer a way for accredited investors to buy a parcel of farmland, and earn passive income through rents and other income-producing activities.

- Risk: High (7 out of 10)

- Returns: 6% – 8%

- Best for: Long-term investments and diversification

Our favorite Real Estate Farmland Platform: AcreTrader offers direct investments into high-quality farmland, with a minimum of around $10,000, and steady returns of 6% (or more). Check out our AcreTrader Review.

4. Dividend Stocks

Dividend stocks are an investment in companies that pay stockholders a portion of the profits earned by the company. Dividends are a great way to earn passive income, but can be compounded by “reinvesting” your dividends back into the company stock.

Dividends are paid by popular companies like Coca-Cola, Microsoft, and Chevron, and are usually indicative of an established company with great financials. But the risk of loss is also much higher than something like an ETF or mutual fund, as you are concentrating your investment on a single company that can lose value in a hurry.

- Risk: High (7 out of 10)

- Returns: 5% – 10%

- Best for: Long-term investing and income for retirees

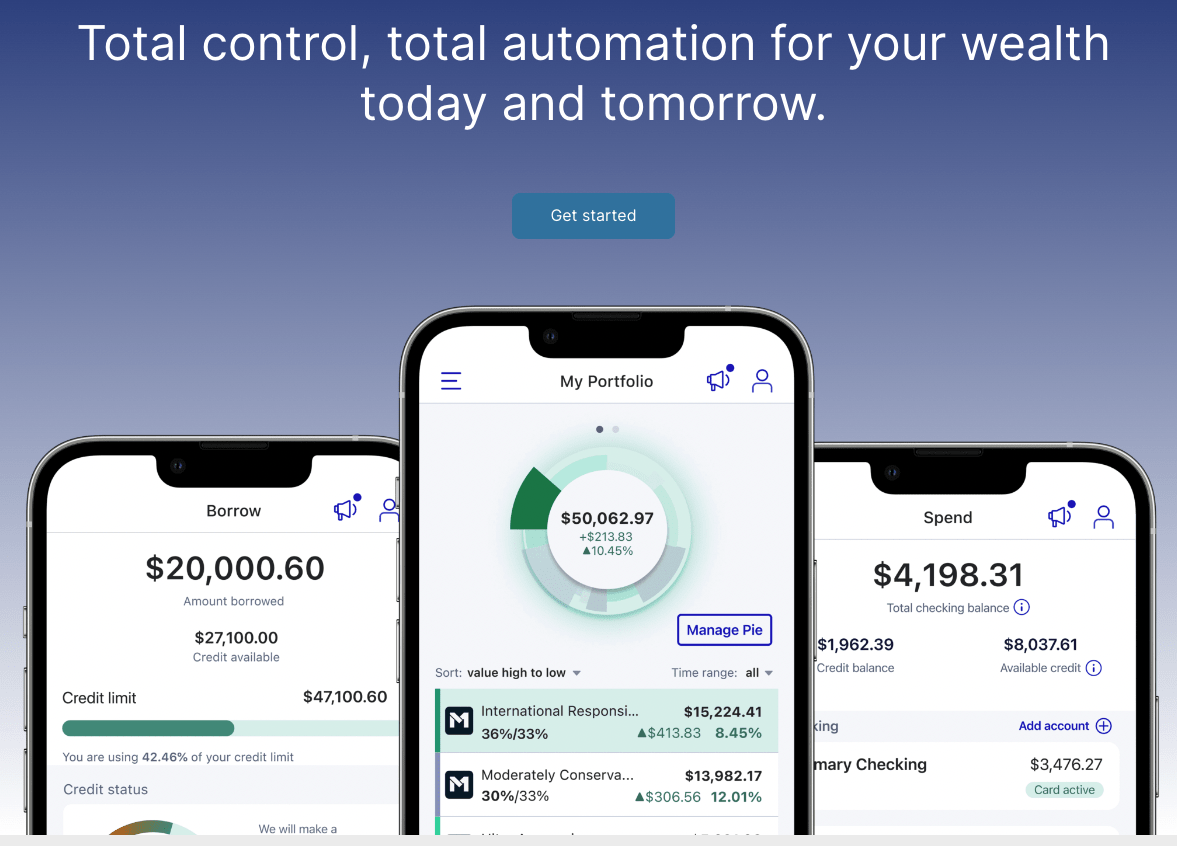

Our favorite investing app for dividend stocks: M1 Finance has hundreds of dividend stocks and expert-built dividend portfolios (called “Pies”) you can use.

5. ETFs

Exchange Traded Funds (ETFs) are funds composed of a basket of securities (such as stocks, bonds, and other assets) in a single investment. These funds carry low fees and offer a way to own hundreds (or thousands) of assets within a single investment.

If you want to own the entire U.S. stock market, you can invest in an ETF like $VTI. While ETFs are an excellent way to easily diversify your portfolio, you’re still investing in individual companies and your investment will fluctuate with the stock market.

- Risk: Moderate (6 out of 10)

- Returns: 5% – 10%

- Best for: Long-term investments including retirement and brokerage accounts

Our favorite investing app for ETFs: M1 Finance carries thousands of ETFs with no trading fees and low expense ratios. Check out our M1 Finance Review.

6. Corporate Bonds

Corporate bonds are a way to invest in corporate debt, allowing companies to borrow funds, while paying out a monthly or quarterly dividend. Corporate bonds can be purchased directly through most brokers, and offer a more stable way to secure fixed income in retirement.

Corporate bonds are seen as more risky than government bonds, as corporations can go out of business, and returns are not guaranteed. But the payouts are higher, allowing you to compound your returns at a higher rate.

- Risk: Moderate (5 out of 10)

- Returns: 5% – 7%

- Best for: Long-term investors and passive income

Our favorite investing app for bonds? Public’s Bond Account is one of the easiest ways to gain entry to the corporate bond market.

It has an impressive annual percentage yield considering the caliber of the bonds — 7.3% as of April 2025.

The way it works is pretty simple:

- Fund your account — your deposit will go toward a portfolio of 10 investment-grade and high-yield corporate bonds.

- Get paid monthly! Public’s Bond Account generates a monthly yield; when your income reaches $1,000, it’s automatically reinvested.

- If you hold to the maturity date, you’ll receive the highest yield; however, you can withdraw early.

Note: You can also buy individual bonds on Public.

7. Treasury Bills (T Bills)

Treasury Bills (T Bills) are a short-term government debt obligation backed by the U.S. government.

T Bills are purchased at a discount, and then are redeemed at maturity for the face value, giving you a return. There are several maturity lengths, including 4, 8, 13, 17, 26, and 52 weeks.

T Bills are currently paying out over 4.5% APR in interest, with higher interest rates available on shorter-term bills. They are very secure investments, but do require a bit of legwork to purchase and sell.

- Risk: Low (3 out of 10)

- Returns: 4% – 5%

- Best for: Short-term investment returns

How to Buy T Bills: You can buy Treasury Bills via a secure compound interest account directly from the U.S. government using the TreasuryDirect.gov website, but I personally find navigating that dinosaur of a website to be frustrating.

That’s why I have a monthly recurring Treasury Account buy on Public.com, where you can invest in T-bills in increments of $100 and they’ll automatically roll over at maturity until you decide to cash in your investments.

8. I Bonds

I Bonds are government-backed savings bonds that provide a return that is based on the current inflation rate.

With today’s sky-high inflation, these provide a great return, currently offering 6.89% for the next six months. But be aware, as inflation comes down, so will the returns on I Bonds.

I Bonds have a minimum holding period of five years (max 30 years), but you can sell them after 12 months if you need the cash. Just be aware that if you sell prior to five years, you will forfeit three months’ worth of interest.

- Risk: Low (2 out of 10)

- Returns: 6.89%

- Best for: Medium-term savings and investments (rental home down payment, fixed-income, etc.)

How to Buy I Bonds: You can buy an I Bonds directly from the U.S. government using the TreasuryDirect.gov website. Simply sign up for a Treasury Direct account, verify your identity, and purchase up to $10,000 in I Bonds each year. You can also use your tax refund to purchase I Bonds directly.

9. Certificates of Deposit

Certificates of Deposit (CDs) are deposit accounts that offer a fixed interest rate in return for locking up your money for a set period of time.

CDs pay out a lump sum of interest at maturity, and typically penalize you for withdrawing funds early. CDs pay out higher interest rates than a traditional saving account, but usually require a higher minimum deposit.

- Risk: Low (2 out of 10)

- Returns: 3% – 5%

- Best for: Short-term savings and investments (down payments, etc.)

Our favorite CD: CIT Bank is offering 3.50% annual percentage yield (APY) on select term CDs right now with a minimum deposit of $1,000.

10. High Yield Savings Accounts (HYSAs)

High Yield Savings Accounts (HYSAs) are one of the most accessible types of compound interest accounts. It’s a type of high interest savings account that offer better rates than a traditional savings account, and still give you access to your funds. They are a great alternative to CDs, which lock up your funds.

HYSA accounts offered through financial institutions are also FDIC insured up to $250,000, keeping your funds safe while deposited. HYSAs used to cap the amount of transfers per month, but now they function similar to a regular savings account, with no limits on deposits and withdrawals.

- Risk: Low (1 out of 10)

- Returns: 3% – 5%

- Best for: Emergency funds and other liquid savings goals

Our favorite HYSA: Right now, Public offers a High-Yield Cash account that offers an impressive 4.10% annual percentage yield (APY). In contrast, the interest rate on an average savings account from most financial institutions clocks in at about 0.01%.

To put that in context, $10,000 in a HYSA with 4.10% interest — not even factoring in compounding — would earn you about $400 in a year. An account offering 0.01% interest would make you about $1.00.

Technically, Public’s is not a HYSA but a High-Yield Cash account. These high interest accounts are swept to partner banks to help you harness the power of compound interest — but they’re still FDIC-insured.

For more ideas on how to maximize compound interest with high-yield savings, check out this list of the best high-yield savings accounts.

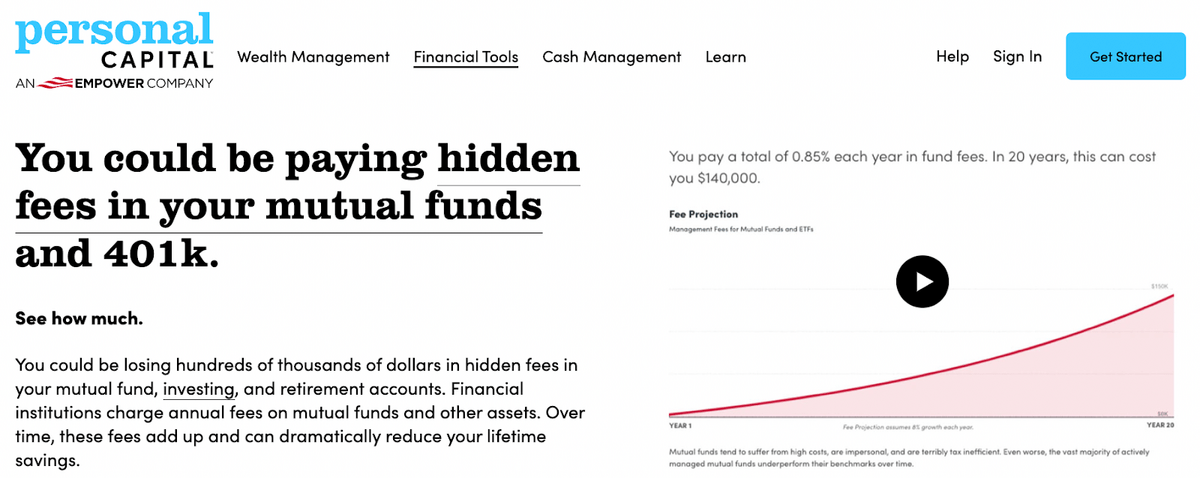

11. Max out your 401k and Reduce Fees

Investing in your retirement account is always a good plan, but did you know that many plans charge high fees? In fact, 401k accounts are notorious for administrative and fund fees that eat into your retirement savings. But it doesn’t mean you should stop investing. Many 401k accounts offer matching funds, which is one of the best ways to build wealth.

You can save on fees within your 401k or IRA, but you need to know where the fees are coming from. Luckily, there are free tools that can help you with this. Empower is a free online investment tracker that has a built-in fee-analyzer to help you review your retirement accounts, and will show you all the fees you are paying. This can help you avoid high-fee fund and ultimately save tens of thousands in retirement fees along the way.

- Risk: Varies

- Returns: 3% – 12%

- Best for: Long-term investments for retirement

How to Reduce Fees: You can review all the fees in your 401k and other retirement accounts with the free Empower Fee Analyzer. Just connect your investment accounts and review the fees within the Empower Fee Analyzer Dashboard.

12. Crypto IRAs

Investing in crypto is a great way to diversify your investment portfolio, but it’s not for everyone. Crypto comes with an exceptionally high level of risk.

But, Bitcoin is the best-performing asset of the past and continues to grow as a legitimate alternative investment. And to save on taxes, there are now crypto IRA platforms that allow you to invest in Bitcoin (and other cryptocurrencies) within a retirement account.

If you’re a long-term believer in crypto assets, crypto IRAs are a great way to invest.

- Risk: Very High (10 out of 10)

- Returns: 100%+

- Best for: Long-term investors and those looking for alternative asset exposure.

Our favorite Crypto IRA: iTrustCapital offers access to 30 different cryptocurrencies (plus gold and silver), with low trading fees and no extra setup fees to open an account. Check out my iTrustCapital Review.

What is Compound Interest?

Compound interest is the “interest on interest” – it’s the process of investing your money to earn interest, and then that interest earning interest on itself in the next period.

For example, a $100 investment that earns 10% each year will give you $110 after the first year, or interest of $10. In year 2, you will earn $11 in interest. That additional $1 you earned in year 2 is compound interest – that extra interest you earned on year 1’s $10 in interest.

As Benjamin Franklin stated, compound interest is when your “money makes money. And the money that money makes, makes more money.”

The longer you invest, the more time you give compound interest to work its magic.

For example, a $1,000 deposit earning 5% per year will be worth:

- $1,276 in 5 years

- $1,629 in 10 years

- $2,653 in 20 years

- $11,467 in 10 years

The bottom line: Invest consistently and give compound interest plenty of time to work its magic.

Best Compound Interest Investments

There are many different types of investments that allow you to compound your money. Here are a few of the best investments available today (along with the risks involved in each):

- U.S. Treasury Bills (low risk, paying almost 5% APY)

- U.S. Stocks (moderate risk, average 10% APY over past 100 years)

- U.S. Bonds (lower risk, paying over 4% yield right now)

- Real Estate (high risk, returns can exceed 15% APY)

Remember, when investing, the higher the risk the higher the potential returns and vice versa. Most investors choose to invest in multiple assets to spread the risk across different types of investments. When building an investment portfolio, it’s important to understand how much risk you are willing to take, and then choose the appropriate investment mix for you.

Summary: Investments for Compound Interest

Account | Average returns | Risk Level (1 – 10) | Link |

|---|---|---|---|

Private Credit Investing | 12-16% | 7 | |

Crypto IRA | 20%+ | 10 | |

Real Estate | 8% – 20% | 8 | |

Real Estate (Farmland) | 6-8% | 7 | |

Dividends Stocks | 5% – 10% | 7 | |

ETFs | 5% – 10% | 6 | |

Corporate Bonds | 5% – 7% | 5 | |

Certificate of Deposit (CD) | 3-5% | 2 | |

T Bills | 4-5% | 2 | |

I Bonds | 4.28% | 2 | TreasuryDirect |

Money Market | 3-5% | 1 | |

High-Yield Cash Account | 5.05% | 1 |

The Final Word on Compound Interest

We’ve covered low-risk, stable investments, like those offered by CIT Bank, all the way up to more aggressive, potentially higher-returning assets like stocks (M1 Finance) and crypto (iTrustCapital).

In my opinion, every investor should be using a combination of the investments for compound interest listed above. This isn’t an either/or situation – find the best combination for you.

Remember, the best way to compound interest is to put time on your side. Whatever investment mix you believe in and can stick to over the long term is the best portfolio for you.

Be consistent, and put the magic of compound interest on your side.

FAQs:

Where can I get 5% interest on my money?

There are several places offering 4% to 5% return, with a lower risk profile, but for a true 5% or more, you will need to invest in bonds or stock market funds (including ETFs). This higher the return expected, the higher the risk you need to be willing to take.

Can you lose money with a compound interest account?

Yes. While there are several “safe” places to invest in compounding accounts, many accounts involve a certain level of risk. This may include the risk of total loss, which can happen when investing in individual stocks, real estate, and cryptocurrency.

But to offset risk, it’s important to diversify your investments among several asset classes and investments. This allows you to invest in assets that have a higher risk with the protection of other assets to keep our accounts stable.

How do I start compounding investing?

Compound investing requires that you re-invest any income you earn from your accounts. Savings accounts do this automatically, but investment accounts require you to choose to reinvest dividends and other income back into the original investment. And investing in fixed-income products (like bonds or T Bills) also requires a re-investment of the interest earned.

The magic happens when you pour the income from your investments back into another investment, allowing your earnings to earn more income over time.

Where can I put my money to earn the most interest?

There are several places to earn interest, and the higher the returns typically means a higher risk to earn those returns. Short-term investments such as T Bills and CDs offer a high return for very low risk.

But to get the best returns, investing in stocks, real estate, or cryptocurrency with a long-term time horizon produces the best returns. Just don't expect to pull your money out for 10 years or more.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.