Soft landing … or recession on the horizon? There’s a lot of uncertainty in the world, and it can make it hard to know how and where to invest.

That’s why I decided to compile a list of safe investments with high returns. I wanted this list for myself so I would be prepared. Now I’m going to share it with you.

Below, you’ll find my list of the safest investments for 2025 that may still earn good returns.

As a side note — Investing responsibly means you can preserve your capital to diversify with quality platforms like Masterworks:

Here are the 9 Best Safe Investments with High Returns 2025:

By combining several options, you can build portfolios that balance low risk with high returns. In other words, a portfolio of safe investments with high returns.

1. Dividend-Paying, Blue-Chip Stocks

True: investing in stocks carries a greater risk than some of the other options on this list. However, dividend-paying, blue-chip stocks are typically among the more stable stocks out there, and offer much higher potential for long-term returns than the other items on this list, such as high-yield savings accounts or CDs.

Here’s why.

Blue chip stocks are massive, financially-sound companies that have well-established earnings, various products, and proven long-term resilience during downturns and recessions. Their businesses typically grow steadily and have wide business moats, making them exceptionally safe investments with high returns.

Given these companies’ abilities to generate huge amounts of free cash flow, most blue-chip stocks pay dividends, or a cash distribution a public company provides to its shareholders.

While growth stock investors only benefit from price appreciation, dividend investors benefit from appreciation and a steady stream of cash dividends. Many dividend investors have portfolios that average a 2-4% dividend yield.

Here’s a list of popular blue-chip dividend-paying stocks:

-

- Apple Inc. (NASDAQ: AAPL)

- Microsoft Corp. (NASDAQ: MSFT)

- McDonald’s Corp. (NYSE: MCD)

- Costco Wholesale Corp. (NASDAQ: COST)

- Coca-Cola Co. (NYSE: KO)

- Verizon Communications Inc. (NYSE: VZ)

- Caterpillar Inc. (NYSE: CAT)

- Chevron Corp. (NYSE: CVX)

- Johnson & Johnson (NYSE: JNJ)

- Lowe’s Cos. Inc. (NYSE: LOW)

- PepsiCo Inc. (NYSE: PEP)

- Procter & Gamble Co. (NYSE: PG)

- Target Corp. (NYSE: TGT)

- Walmart Inc. (NYSE: WMT)

Of course, don’t just randomly choose a stock just because it pays a dividend. You should always do your DD (due diligence) on a stock before buying. I always use WallStreetZen to scope out potential investments. I can see how the stock scores on a variety of due diligence checks, see what analysts are saying, and more — right from the same dashboard.

For example, a few months ago I was interested in one of the stocks on the above list: McDonald’s (NYSE: MCD). The stock was down a lot, but using WallStreetZen, I discovered that the fundamentals seemed solid and analyst outlook remained strong. This helped me build conviction in the trade, and I bought when MCD was trading in the $240s. Within a few months, the stock was trading for over $290. I felt pretty happy with the returns on what is generally considered a “safer” stock (but let’s be clear — there are no guarantees in the stock market). Plus, I earn dividends on my shares too!

Of course, if you’d like to invest in dividend stocks (or any stocks), you need a brokerage. If you’re in the market for a new one, I recommend moomoo. Despite the funny name, this brokerage has some serious tools to help you on your investing journey. moomoo offers stock, ETF, options, and basic futures trading. The platform is available on both desktop and mobile, and offers a user-friendly dashboard featuring advanced trading features like of charting and access to Level II data.

One other reason to like moomoo? You can get free stocks when you create an account. Sign up for moomoo using any of the links in this article and get up to 30 free stocks, potentially valued up to $2,000 each.

That’s not all. moomoo also helps you make money from your uninvested cash. The platform is currently offering an incredible 8.1% limited-time APY on idle cash. That’s higher than just about any high-yield savings account out there. Terms and conditions apply — click the link below to find out more.

2. ETFs & Index Funds

If you like the idea of stocks but prefer built-in diversity to choosing individual tickers, you might consider investing in a fund — an exchange-traced fund or index fund.

First, let’s talk about the key differences between ETFs and index funds.

An ETF (exchange-traded fund) is a basket of a number of different stocks that trade under a single ticker. You can buy or sell ETF shares on the stock exchange.

Index funds invest in a specific list of securities to attempt to match the returns of a benchmark index (for example, S&P 500-listed stocks). They may be structured as ETFs or like mutual funds. If the latter, then you can only buy once a day, after the markets close at 4pm ET.

So — an index fund can be an ETF, but not all ETFs are index funds. And not all index funds are ETFs. Got it?

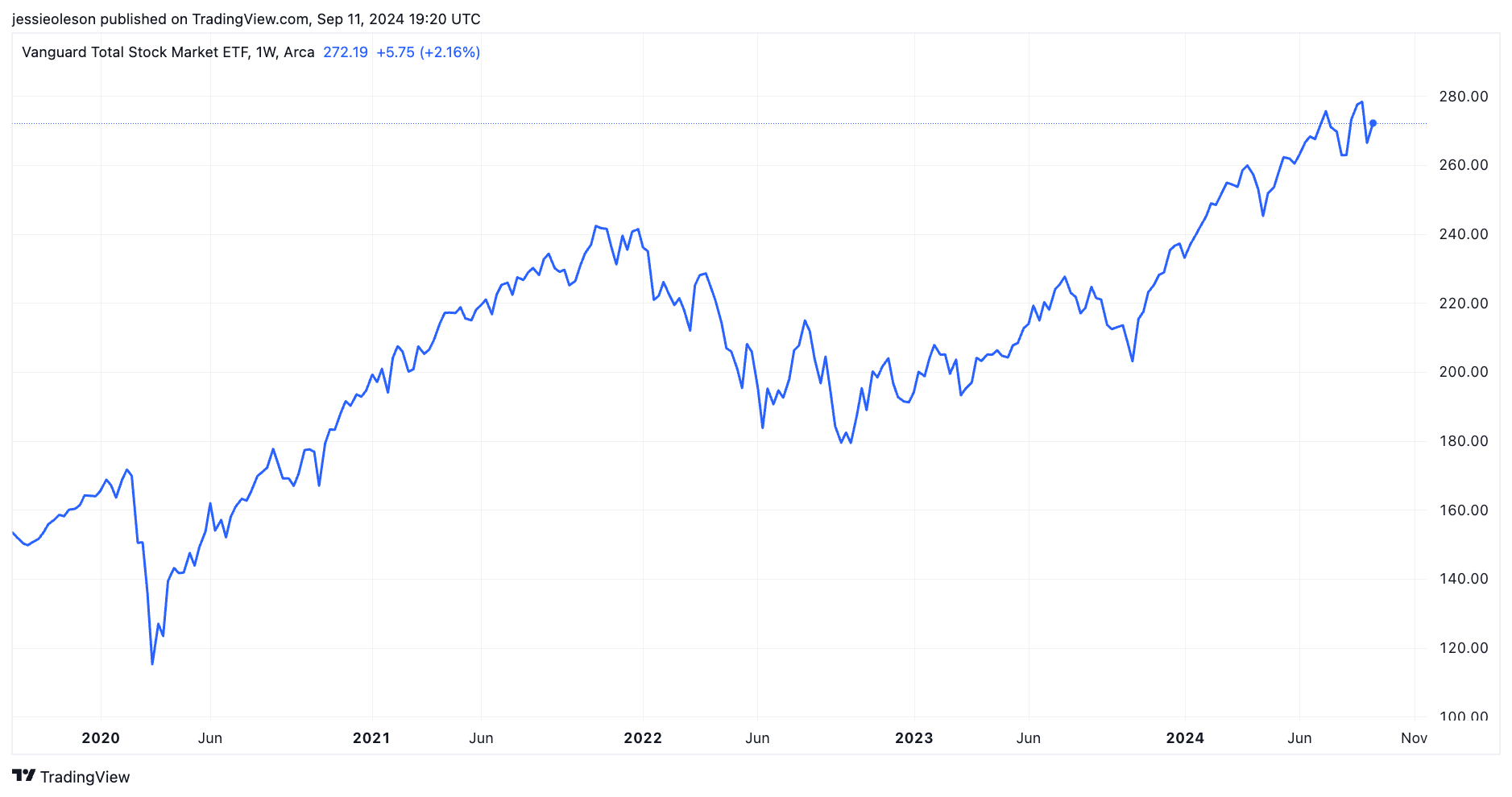

The advantage of ETFs and index funds is that you can invest in a number of different stocks at once within a single security. For instance, if you invest in the Vanguard Total Stock Market ETF (VTI), you gain access to over 3700 stocks. As you can see from the 5-year chart, VTI has performed well over the past few years:

Of course, just because funds offer built-in diversity doesn’t mean you don’t have to do your due diligence. Always research potential investments before you buy — after all, it’s your money on the line. Personally, I’ve found that moomoo is a great resource for ETFs, because you can easily research the ETF’s history, news that could affect it, and more — right from the platform.

3. Real Estate

Real estate is largely considered one of the best safe investments.

There are two key ways to get paid: Rental income and price appreciation. Historically, both rental income and appreciation have at least kept pace with inflation, making it one of the best long-term, safe investments available.

But as a former landlord, I can tell you that buying and renting property can be a hassle. Picture this: You’re rolling along, collecting rent for a few months — then suddenly you get a call from your tenants at 11 pm on the day before Thanksgiving letting you know the water heater broke. That’s what being a landlord is like. If your tenants are good, it’s largely passive income — but every now and again, you really have to jump into action. Personally, I found that the stress wasn’t worth it.

But I do still believe in real estate as an investment. Luckily, people like me (and maybe you?) who want to invest in real estate but don’t want to be landlords or deal with owning property, there are some great real estate investing platforms out there.

If you’re an accredited investor (not sure what that is? Click here), consider Yieldstreet.

Yieldstreet is a crowdfunding platform for real estate investing. It offers an innovative alternative for buying physical real estate assets. Instead of buying and managing properties yourself, you can invest in curated, private-market offerings that have completed a rigorous due diligence process. And you can do this at a fraction of the cost of buying a property outright.

I’ve used this platform myself and can attest to its ease of use and exceptional solution. It’s given me a way to invest in some of the best fractional ownership properties.

The majority of opportunities on Yieldstreet are only available to accredited investors. However, the Yieldstreet Alternative Income Fund (formerly the Yieldstreet Prism Fund), which was launched in 2020, is open to non-accredited investors. It’s a multi-asset class fund that seeks to generate returns through investments in commercial real estate, art, corporate debt, and more. So you can potentially gain access to both real estate and other alternatives with a single investment. (Minimum: $10K)

Since its inception, Yieldstreet clients have had an average IRR of 9.6% as of September 2024:

Yieldstreet gives you access to real estate (and more) and has an impressive track record, making it one of my favorite ways of how to get a 10% return on investment.

Note: Yieldstreet also makes our list of high return investments.

Not an accredited investor (yet)? Fundrise is a worthy alternative that offers all investors (accredited and non-accredited) access to real estate, private credit, and venture capital investments. Check out our Fundrise review to learn more.

Note: We earn a commission for this endorsement of Fundrise.

4. Private Credit Investing

Did you know the private credit market is worth over $7 trillion? Yes, that’s with a T.

Not sure what private credit investing is? In a nutshell, if companies can’t tap public markets for funding (and this is often the case with middle-market companies), they often turn to non-bank lenders. That’s where you — the investor — enter the picture.

As an investor, private credit offers short-term, high-yield opportunities with low correlation to public markets. But until recently, these opportunities were limited to ultra-connected or ultra-rich investors.

Private credit investing platform Percent is changing that. Through its platform, accredited investors can access private credit investments, typically backed by assets, loan portfolios, or corporate debt.

Percent has a proven track record. As of December 31, 2024, Percent’s annual returns averaged 18.13% weighted APY. With performance like that, it’s easy to see why accredited investors are drawn to this alternative asset class.

You can use Percent to browse individual deals and curate your own portfolio …Or, for those new to private credit, or looking for diversification, Percent offers the Percent Blended Note, a private credit fund-like investment. With a single investment, you gain exposure to a diverse mix of notes across multiple asset classes and geographies.

Right now, Percent is offering $500 off your first investment — see for yourself why private credit has attracted so many investors.

5. High-Yield Cash or Savings Accounts

When I have extra cash, I don’t let it sit in a checking account collecting 0.01% interest. I park it in my Public High Yield Cash Account and earn 4.1% interest.

Savings accounts are one of (if not the) safest places to store your cash. Almost all savings accounts are FDIC-insured, meaning up to $250,000 is completely protected in case of bank failure.

With that safety, however, comes dismal interest rates. The average interest rate on savings accounts is currently 0.05% – for every $10,000 you have invested, you’ll earn a whopping $5 in annual interest.

Enter: High-yield savings accounts.

High-yield savings accounts offer interest rates 20-25x higher than traditional savings accounts while still being government-insured.

While FDIC insurance prevents any risk of capital, inflation can erode your cash’s purchasing power.

Rates have come down somewhat since the 5%+ heyday of 2022-2023, but Public’s High Yield Cash Account is still one of the better options out there, currently offering 4.1% APY.

But rates could keep going down. So while finding the highest APY savings account is great for safety (and beating traditional savings accounts by a wide margin), you’ll need to make an investment with higher risk to keep pace with and exceed inflation.

6. Certificates of Deposit (CDs)

In exchange for committing to not touch your funds for a short period of time, most banks will offer you a higher interest rate. These are known as certificates of deposit.

Certificates of deposit are considered one of the safest investments and are a popular place for investors to stash money they don’t need in the immediate future. You can start a CD at a physical or online bank if you want to put aside some cash and get a higher yield than a typical savings account.

Almost all CDs are FDIC-insured and offer a guaranteed return.

The holding period is the critical component of CDs, and why the interest rate is higher than savings accounts and MMFs (which allow you to withdraw your funds at any time). You can’t touch the cash in a CD within the first few months without penalty. Even after that first few months, you can get penalized if you withdraw funds from a CD early. You may lose some of the accrued interest you earned, and some banks may even take part of your principal.

I’m a big fan of CIT Bank for CDs because of the many options they offer. For one, they offer a no-penalty 11-month CD, so you don’t have to worry about a big fee if you need to access funds before maturity (though there is a week-long lockup period when you first create the CD). They also offer term CDs for a variety of different time horizons, from 6 months to 5 years. While their rates are currently not as high as their HYSA, they’re still a lot higher than the average savings account. Plus, CIT Bank has stellar customer service.

7. Bonds

Let’s discuss 2 types:

U.S. Government I-Bonds

A Series I Savings Bond is a debt security issued by the U.S. Government that adjusts for inflation.

I-Bonds are currently paying 4.28% interest. And since I-Bonds are backed by the U.S. Government, they are essentially risk-free. The U.S. Government is regarded as the most creditworthy lender in the world (since they can always print more money to pay back what they owe, something I wish I could do too).

You can buy a Series I bond from TreasuryDirect.gov with a minimum of $50.

Before investing, note the required holding periods (minimum 12 months).

Corporate Bonds

Corporate bonds are bonds issued by public or private companies.

Since these borrowers have a higher risk of default than the federal government, they pay a higher yield.

In other words, corporate bonds are safe investments with high returns.

You have to be more cautious, however, when researching corporate bonds.The safest bonds are rated AAA and considered reliable sources of income. The lower-rated bonds, or “junk bonds,” may provide higher yields but are higher risk, especially during recessions.

Most corporate bonds pay out semiannual interest payments and are issued with maturities ranging from 1 to 30 years. Most bonds have $1,000 face values, the minimum amount that can be purchased. You can buy these bonds directly from a company, but it’s easier to do it with a brokerage account.

Public (the same broker I mentioned for T-bills in the previous entry) has a great high-yield bond account right now. Actually, I’ve started moving some of the funds from my matured Treasury Bills into my Bond Account, since the bond yields are currently higher (6.89% as of January 2025).

The way it works is pretty simple:

- Fund your account — your deposit will go toward a portfolio of 10 investment-grade and high-yield corporate bonds.

- Get paid monthly! Public’s Bond Account generates a monthly yield; when your income reaches $1,000, it’s automatically reinvested.

- If you hold to the maturity date, you’ll receive the highest yield; however, you can withdraw early.

One caveat? A Bond Account does carry a $3.99 monthly fee on Public unless you upgrade your account.

8. U.S. Government Treasury Bills

U.S. Government Treasury Bills, or T-Bills, are short-term bonds with maturity dates of less than 1 year.

Given the U.S. Government’s creditworthiness, T-Bills are typically considered the highest return investments of any “risk-free asset.”

Although shorter maturity dates typically mean a smaller interest payment, they are the safest, lowest-risk, and most secure types of bonds to buy. Currently, the 1-year Treasury Rate is roughly 4%.

You can buy T-bills directly online at TreasuryDirect.gov, but I personally find navigating that dinosaur of a website to be frustrating.

That’s why I have a monthly recurring Treasury Account buy on Public.com, where you can invest in T-bills in increments of $100 and they’ll automatically roll over at maturity until you decide to cash in your investments.

9. Fixed Annuities

An annuity is a contract you can make with an insurance company to exchange a lump-sum payment today for a stream of income.

Annuities are an excellent option for retirees who want guaranteed income.

Most annuities are set up to pay their holders a monthly amount over a fixed period, usually 20 years or until the death of the client. To fund the annuity, you can make a lump sum contribution or pay into it over time.

Since fixed annuities are safe investments that can provide protection and guaranteed income for life, theys are popular among individuals nearing retirement age and those who want to set aside additional funds for retirement, even if they’ve maxed out their 401(k)s or IRAs.

Interest rates vary widely based on the duration of the annuity, total amount contributed, and the structure of the contract. Most fixed annuity rates are around 3.50%-5.25%.

Yet, like anything, there are some drawbacks to consider.

First, like many other low-risk investments, the low yields of fixed annuities may be unable to keep up with inflation – annuities should not be expected to grow your wealth.

Furthermore, annuities are complex contracts. You should read the fine print (there’s a lot of it) and work with a reputable annuity provider.

Annuities are also illiquid and hard to get out. It’s nearly impossible to withdraw money from an annuity without a hefty penalty.

RECAP: The 9 safest high-yield investments:

- Dividend-Paying, Blue-Chip Stocks (moomoo)

- ETFs (moomoo)

- Real Estate (YieldStreet)

- High-Yield Cash Account (Public)

- U.S. Government I-Bonds

- Short-term Certificates of Deposit (CDs) (CIT Bank)

- U.S. Government Treasury Bills (Public)

- Corporate Bonds (Public)

- Fixed Annuities

Risk and Reward

Every investment you make has its own risk/reward profile.

Generally speaking, the higher the risk, the higher the potential reward (like growth stocks). The lower the risk, the lower the potential reward (like U.S. Treasuries).

Each of the 9 investments on my list has varying amounts of risk and reward, and has different priorities. Some investments are for capital preservation. Others are riskier, but offer higher potential for returns.

Final Word: Safe Investments with High Returns 2025

That is my list of the 9 Best Safe Investments with High Returns in 2025.

At a bare minimum, I would strongly suggest you check out a high-yield savings account from an online-only bank like CIT.

From there, you might consider branching out into alternative investment strategies like real estate through platforms like YieldStreet or Fundrise.

Remember, to diversify across various assets and build a portfolio that mixes higher risk/higher reward investments with safer alternatives.

We’re all experiencing the pain caused by the stock market and inflation, but we do have options to protect our capital.

Get started today.

Read more: How to Invest 50k

FAQs:

What are the safest investments?

The safest investments are considered FDIC-insured high-yield savings accounts and CDs or government-issued bonds like I-Bonds and T bills.

Investments with some risk include corporate bonds, annuities, dividend stocks, and real estate.

The goal of no risk investments is to keep the initial money you invest, otherwise known as your principal. On the other hand, investments with some risk are bought with the expectation of higher returns.

What are the safest high yield investments?

The safest high yield investments are dividend-paying, blue-chip stocks.

Although dividend-paying stocks are the riskiest investments on our list, they easily offer the highest potential for long-term yields.

These massive, financially-sound companies consistently perform well over the long term. In a downturn, they also trade at attractive discounts.

They expose investors to well-established earnings, various products, and proven long-term resilience. Their businesses typically grow steadily and have wide business moats, making them exceptionally safe investments with high returns.

Moreover, their dividends provide risk-averse investors with consistent income streams. You don't have to chase the same risks of non-dividend-paying growth stocks.

If you’re willing to buy and hold these stocks for at least 5 years, historically speaking, returns have been excellent and consistent.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.