If you’re wondering where to invest money to get good returns, you’re human.

I remember when I first started teaching myself the stock market in 2016 or 2017. My priority was chasing hot stocks with high returns, regardless of risk tolerance, diversification, and any other asset class beyond penny stocks.

My only goal was finding where to invest money to get good returns, throwing aside any notion of risk management.

I invested in a cheap oil exploration stock in the Mediterranean. This was an untapped market, and the stock was on a big winning streak.

The first day I owned the stock, it surged +60%. I felt great – investing is easy!

(You probably know where this is going…)

4 days later, my cockiness evaporated into thin air, along with the money I had invested.

Lesson learned.

I’ve come A LONG WAY since then. Between grad school, the workplace, and my personal experiences, I’ve become a much more disciplined and balanced investor.

Almost 7 years and a lot of lessons learned later, I compiled this list so you can skip over all the mistakes I made and set yourself up for a lifetime of successful investing.

Here’s my list of 11 ways to invest money and get high returns.

FEATURED OFFER: Masterworks

Want an investment that won’t collapse like a bank? Try art.

Since 1995, contemporary art has appreciated 14% annually on average. That’s even more than you’d get with the S&P 500 (with less volatility). After all, there’s a reason why many billionaires invest 10-30% of their wealth in art.

Want in? You can invest in shares of million-dollar paintings with Masterworks, the world’s premier art investment platform.

For a limited time, you can skip the waitlist here

*See important disclosures at masterworks.com/cd

Where to Invest Money Now – July 2025

If you’re asking yourself Where should I invest my money, consider these 11 different ways to invest money:

- High-Yield Savings Account

- Index Funds

- Exchange-Traded Funds (ETFs)

- Individual Stocks

- Dividend Stocks

- Real Estate

- Art

- Cryptocurrencies

- Certificates of Deposit (CDs)

- Government Bonds

- Corporate Bonds

*I’ve attempted to assign a 1-5 rating (1 being low, 5 being high) for risk and reward to each of the investments below. Some are high return investments while others are low risk investments. These reflect my own opinion – results may vary. WallStreetZen is not liable for any investment you make.

1. High-Yield Savings Account

Risk: Low

Reward: 1/5

EVERYONE uses banks.

Traditional savings accounts at big banks are some of (if not the) safest places to store your cash. In fact, the federal government insures up to $250,000 in case the bank collapses (known as FDIC insurance).

With safety, however, comes weak returns. Traditional savings accounts pay just 0.05%, meaning every $10,000 you save will earn you $5 in annual interest.

$5.

That’s where a high-yield savings account comes in.

High-yield savings accounts also have FDIC insurance but offer interest rates nearly 20-25x higher than traditional savings accounts.

Most high-yield savings account providers do not have physical locations (one of the most expensive parts of bank operations), and pass those savings along to you in the form of higher interest rates.

My favorite high-yield savings account is M1 Finance. Qualified account holders can get incredible rates — especially considering the average savings account APY in the U.S. is about 0.42%.

Alternatively, check out our Chime bank review — they charge absolutely no fees.

It’s prudent to have savings and I believe everybody should have some cash available in case of emergency, but no one said you had to earn dismal rates in the process!

2. Index Funds

Risk: 3/5

Reward: 3/5

An index fund is an easy way to invest in the stock market without risking too much on any one stock (like I did!).

An index fund is a basket of stocks that follows a benchmark, or “index”. Some of the most common index funds are $SPY and $VOO which follow the S&P 500, an index comprised of the largest companies in the United States.

Instead of investing in all 500 companies individually, I can simply buy an index fund (1 investment) that tracks the S&P.

Warren Buffett, one of the world’s most legendary investors, is a big fan of index funds, especially for non-professionals.

In his view, American businesses always do well long-term. As a result, consistently investing money into a low-cost S&P 500 index fund, regardless of current market conditions, has proven to be an excellent long-term strategy.

Since 1950, the S&P 500 has had an average annualized return on investment of 11.14%. If you invested $100 in the S&P 500 in 1950, that $100 would be worth more than $217,000 in 2022.

Buffett’s favorite index fund is the aforementioned $VOO, Vanguard’s S&P 500 Index Fund ETF.

Want to buy an index fund?

You need a stock brokerage.

Buy stocks, index funds, and ETFs commission-free on Public.com.

Plus, buy fractional shares of art, NFTs, and other collectibles on the best brokerage for alternative investing. Check out Public here.

3. Exchange-Traded Funds (ETFs)

Risk: 3/5

Reward: 3/5

An ETF (exchange-traded fund) is a basket of stocks that focuses on a specific sector, index, theme, or market and are great options for beginner investors to gain exposure to the stock market with easy diversification.

An index fund is a type of ETF.

I like investing in ETFs focused on sectors in which I’m underweight or have less knowledge. For example, I own the Fidelity MSCI Utilities Index ETF $FUTY to get diversified exposure to utility stocks, a segment of companies I’m not familiar with.

I’m also bullish on Southeast Asia, so I own ETFs like the iShares MSCI Indonesia ETF $EIDO and the Global X MSCI Vietnam ETF $VNAM.

Read more: Best Brokerage for ETFs

4. Individual Stocks

Risk: 4/5

Reward: 4/5

Index funds and ETFs add diversification to reduce risk, but they can also cap your upside.

Instead of buying an ETF, you can buy individual stocks. You won’t be diversified, but if you’re confident in your research skills and believe a specific company is set to outperform the market, buying that one stock could produce outsized returns.

For example, while the S&P 500 is up 47.09% in the last 5 years, Tesla (NASDAQ: TSLA) is up 179% over that same period, more than tripling the performance of the index.

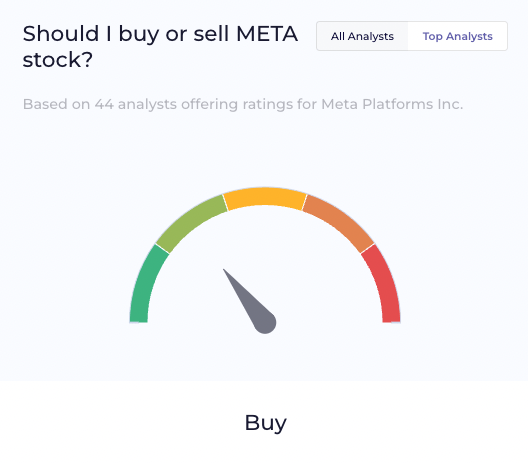

However, stock picking can also go the other way. If you bought Meta (NASDAQ: META), you’d be down nearly 50% in the last 5 years.

Picking out individual stocks is about finding ones you believe will beat the market.

How do you find such stocks?

Fundamental analysis.

Fundamental analysis is the process of determining companies’ fair values then buying the ones you believe are undervalued. At WallStreetZen, our automated analysis makes this process faster and easier to help you uncover high-quality stocks poised to outperform.

5. Dividend Stocks

Risk: 3/5

Reward: 3/5

There are 2 ways for investors to earn a return when investing in stocks: Price appreciation and dividends.

Price appreciation is what we typically think of when investing in the stock market: I bought Tesla for $150 and sold it for $250, netting a $100 gain per share.

But a company may also issue dividends, a portion of the profits paid out (typically quarterly) by a company to its shareholders.

Not all companies issue dividends – they’re typically only paid by stable, well-established companies with a lot of earnings and predictable cash flow.

While some investors are chasing the hottest stocks (and hoping for price appreciation), some conservative investors choose to focus on dividend-paying stocks for their stability and steady income streams.

Most dividend investors want companies that pay a dividend yield of 2% or more. A dividend yield is the percentage of a company’s share price it pays out in annual dividends.

If you invested $100,000 with Procter & Gamble (NYSE: PG), the company’s 2.68% dividend yield would net you $2,680 per year.

“Dividend Aristocrats,” or companies increasing dividends for over 25 consecutive years, are especially popular among dividend investors. This type of stock is one of the best compound interest investments.

If you’re interested in dividend stocks you may also want to consider Real Estate Investment Trusts (REITs), real estate holding companies that typically pay dividends around 5%.

6. Real Estate

Risk: 2/5

Reward: 4/5

Amid inflation and recession risks, you may be wondering where to invest money now.

Real estate offers consistent income streams from rental income and long-term appreciation and has historically kept pace with inflation. But there’s a problem.

If you’re like me, you may be working hard just to own your own house, let alone saving enough to afford a down payment on a rental property.

The problem with real estate is it’s extraordinarily capital-intensive and inaccessible for many investors. It’s also very difficult to sell, should the need arise.

But it’s the 21st century – there’s a solution available.

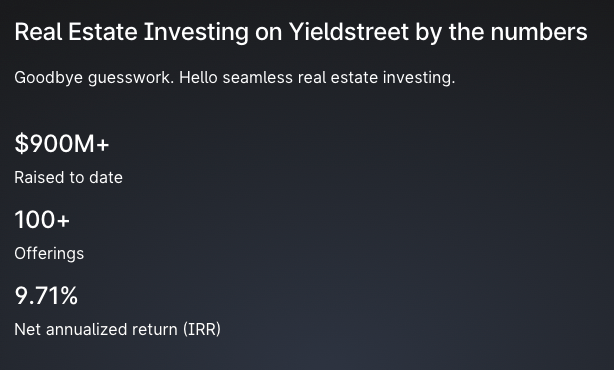

Yieldstreet is a platform that allows me to invest in physical real estate. It’s a crowdfunding outlet that democratizes real estate investing and makes it accessible to many investors.

Instead of saving up hundreds of thousands of dollars of your own money, Yieldstreet allows you to start investing in real estate with as little as $5,000. If you’re not ready to put up 5K, check out our Fundrise review — you can start with $10.

Since its inception, Yieldstreet clients have had an average IRR of 9.71%:

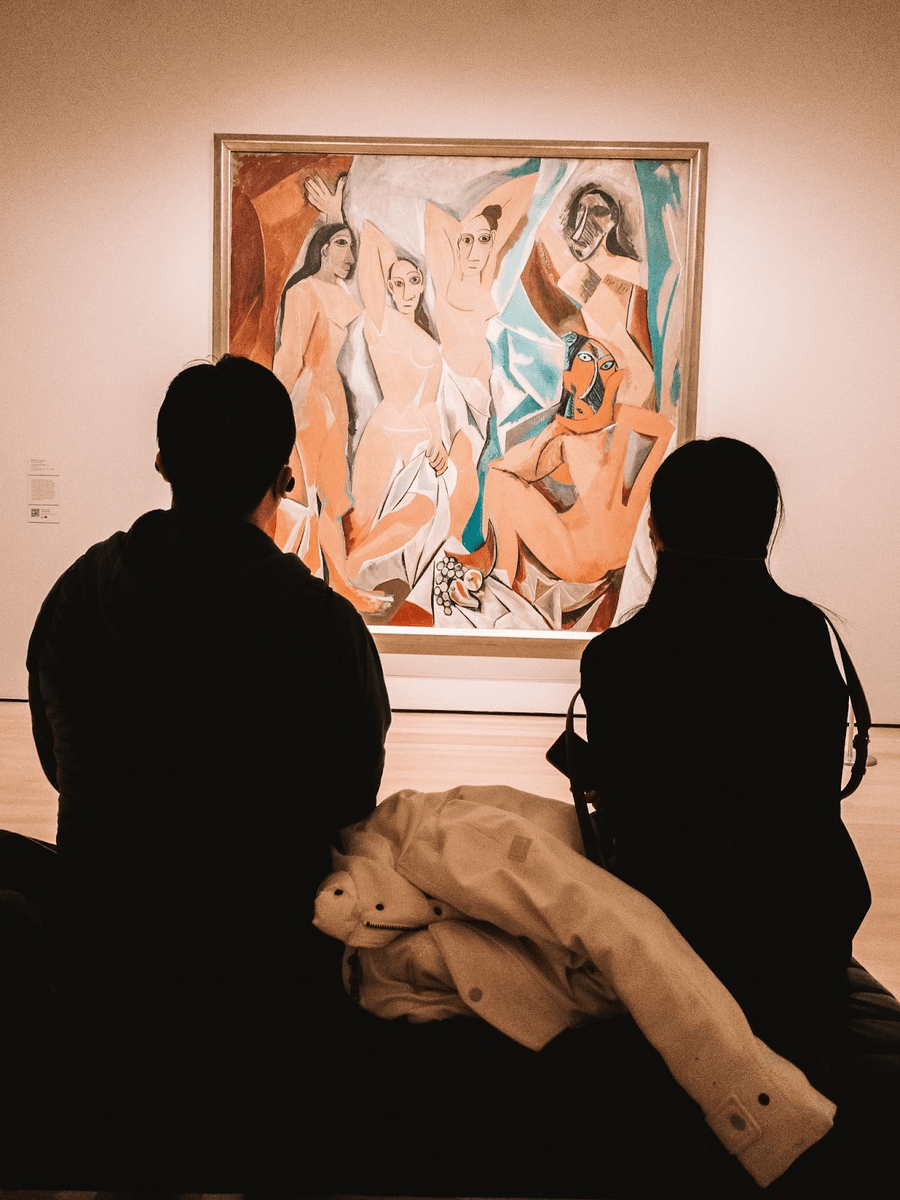

7. Art

Risk: 4/5

Reward: 4/5

Many high-net-worth investors buy art.

Besides its inherent beauty and status symbol, there’s another reason for buying.

Since 2000, art investment returns have outperformed the S&P 500 by 250%.

But if you think real estate investing is expensive, I’m guessing a multi-million dollar painting is a bit out of reach.

Masterworks is the solution.

Like Yieldstreet for real estate investing, Masterworks allows individual investors to invest in fractional shares of works by artists like Basquiat, Picasso, Banksy, and more.

And if you’re still wondering where to invest money to get good returns, Masterworks’ net annualized realized returns of 29.03% are some of the highest on this list.

That said, crowdfunding art investing is still a new asset class – it’s hard to predict where the market will go from here.

If art isn’t your thing, there are plenty of alternative assets to look into. For example, you can learn all about investing in wine from our Vinovest review.

8. Cryptocurrencies

Risk: 5/5

Reward: 4.5/5

Cryptocurrencies are some of the most boom or bust investments in the market today – they’re extremely volatile but have the potential to be very high return investments.

Interest in Bitcoin, Ethereum, Litecoin, XRP, Dogecoin, and other cryptos has exploded over the last 5+ years.

As decentralized finance becomes more widespread, crypto still has the chance to completely revolutionize the global financial system.

For investors, this means upside potential higher than many other asset classes. However, it also may be the riskiest asset class on this list, so tread carefully.

It’s incredibly easy to get started — head over to our Public investing app review to learn how to invest in crypto, NFTs, and other alternative assets.

Cryptocurrency prices are highly volatile. For some investors, this is a good thing. For others, it’s intimidating. A cryptocurrency can see its price rise or fall 20% in hours or minutes.

Another appeal of trading crypto is 24/7 trading. There are no market hours or weekends and holidays for trading crypto. You can buy and sell and transfer at will, whenever you want.

You can buy cryptocurrencies in your Public account.

9. Certificates of Deposit (CDs)

Risk: 1/5

Reward: 1/5

Certificates of deposit are considered one of the best safe investments you can put your money in. They are a popular place for investors to park money and receive higher interest rates than a traditional savings account.

Physical and online banks offer CDs with high-interest rates in exchange for you agreeing to not withdraw your funds for a defined period. CDs are a great option for high net worth individuals who want a hands-off investment. If you’re not sure what to do with a million dollars, CDs are worth looking into.

Almost all CDs are also FDIC-insured and offer a guaranteed return.

10. Government Bonds

Risk: 1/5

Reward: 1.5/5

When you buy a government bond, you’re lending money to the federal government in exchange for an interest payment.

Government bonds have maturity rates ranging from under 1 year to 30 years and various interest amounts. You can buy government bonds on TreasuryDirect.gov or in some brokerage accounts (like Fidelity, TD Ameritrade, and Charles Schwab).

Bonds issued by the U.S. government are considered some of the safest, risk-free investments because, if needed, the government can print more money to repay its debt.

One type of government bond garnering a considerable amount of attention is the Series I Savings Bond. I-Bonds have a fixed interest rate plus an adjustable rate tied to inflation. When inflation rises, the bond’s interest rate increases, and when inflation falls, the bond’s payment falls.

I-Bonds currently pay a 9.62% interest rate. They’ve become so popular that potential buyers recently crashed TreasuryDirect.gov.

11. Corporate Bonds

Risk: 2/5

Reward: 2/5

Public and private companies issue bonds the same way that governments do. These are called corporate bonds.

No matter how big and stable they are, corporations have a higher risk of default than the federal government. However, corporate bonds are still considered safe and high-return investments.

The safest corporate bonds are considered reliable sources of income and have AAA ratings. Lower-rated bonds, or “junk bonds,” may provide higher yields but are riskier, especially during recessions.

Most corporate bonds pay out semiannual interest payments and have maturities ranging from 1 to 30 years. The easiest place to buy corporate bonds is in your brokerage account, though you can buy bonds directly from a company.

Final Word: Where to invest money to get good returns

I hope you have a better understanding of the different ways to invest money in July 2025. Remember to take a balanced, diversified approach to your investing and consider your long-term investment goals.

Stay patient and keep your portfolio well-rounded, spreading your money across a number of vehicles that you know and understand each investment’s risk/reward matrix.

If I can do it, anyone can.

FAQs:

Where should I invest my money?

Deciding where to invest your money depends on a few things: time horizon, risk tolerance, and investment goals. The amount of money you have to start with can factor in as well, as some investments have minimum requirements.

Suppose you’re looking for more safety and security. In that case, investments like a high-yield savings account, government or corporate bond, and CD may be a better fit.

If you want a little more risk for the potential of higher rewards, an index fund or ETF is a great choice. Especially if you're just starting out or want diversification while mitigating risk.

Individual stocks are riskier but have a higher ceiling. Dividend-paying stocks especially offer long-term growth potential through consistent income streams.

Real estate and high-end artworks are tangible assets and great places to invest money. Especially now that platforms like Yieldstreet and Masterworks make it more accessible.

Of course, crypto’s volatility and enormous boom potential may appeal if you're an adventurous investor.

Which investments have the best returns?

If you’re going off pure returns, crypto has the biggest short-term boom or bust potential.

On this list, individual stocks also offer a better potential to beat the market than index funds and ETFs do.

Consider also that high-end art returns since 2000 have outgained the S&P 500 by a whopping 250%, while Masterworks’ net annualized realized returns of 29.03% are outstanding.

While government bonds traditionally offer muted returns, I-Bonds currently pay a guaranteed 9.62% interest rate.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.