What if your money worked for you while you slept? What if every dollar you saved recruited another dollar (or more) to join its ranks over time?

It’s not a fantasy — this is the real-world magic of compound interest. This fundamental principle in finance has transformed modest savings into vast fortunes — and there’s never been a better time to reap the benefits of compound interest than right now.

Want to know how to put compounding interest to work in your portfolio? Keep reading. I’ll walk you through what compound interest is, how it works, and the best ways you can start using it to earn money today.

At-a-Glance: The Best Investments With Compounding Interest

Investment | Suggested Platform |

|---|---|

Dividend stocks | |

Real estate (REITs) | |

Real estate (fractional investing) | |

High-yield savings accounts | |

CDs | |

Money market accounts | US Bank and CIT Bank |

Bonds | |

Micro-investments | |

Self-directed IRA | |

Bonus: best FREE tools for avoiding compound interest on debt |

Note: We earn a commission for this endorsement of Fundrise.

How to Invest in Compounding Interest: The Bottom Line

Investing with compound interest is all about leveraging the power of “earning interest on interest” to make your money multiply faster.

Here’s the crux of how to earn compound interest:

- Understand the Basics: Grasp the difference between compound and simple interest. Remember, compound interest calculates returns on both your principal and the accumulated interest.

- Diverse Investment Channels: From dividend stocks, real estate, and high-yield savings accounts to bonds, CDs, and micro-investments, there are myriad avenues to explore.

- Reinvest Returns: The magic unfolds when you reinvest your earnings. For instance, plow back dividends from stocks or interest from savings accounts to magnify the compounding effect.

- Start Early & Stay Consistent: The earlier you start, the more time compound interest has to work its charm. Regular contributions, no matter how small, can lead to substantial growth over time.

- Use Digital Aids: Take advantage of online calculators, tools, and investment platforms to simplify the math and streamline the investment process.

Of course, there’s much more to the story. Here’s what you need to understand about how to invest in compounding interest before you can get started:

How Does Compound Interest Work?

At its core, compound interest is a process where interest is calculated not just on the principal amount (the initial amount you started with), but also on the accumulated interest from previous periods.

Think of it as “earning interest on interest.”

This mechanism allows your investments to grow at an accelerating rate over time. Picture a snowball rolling down a hill, gathering more snow, and increasing in size as it descends; that’s the power of compounding in action.

(It’s also why Warren Buffett’s biography is titled “The Snowball.”)

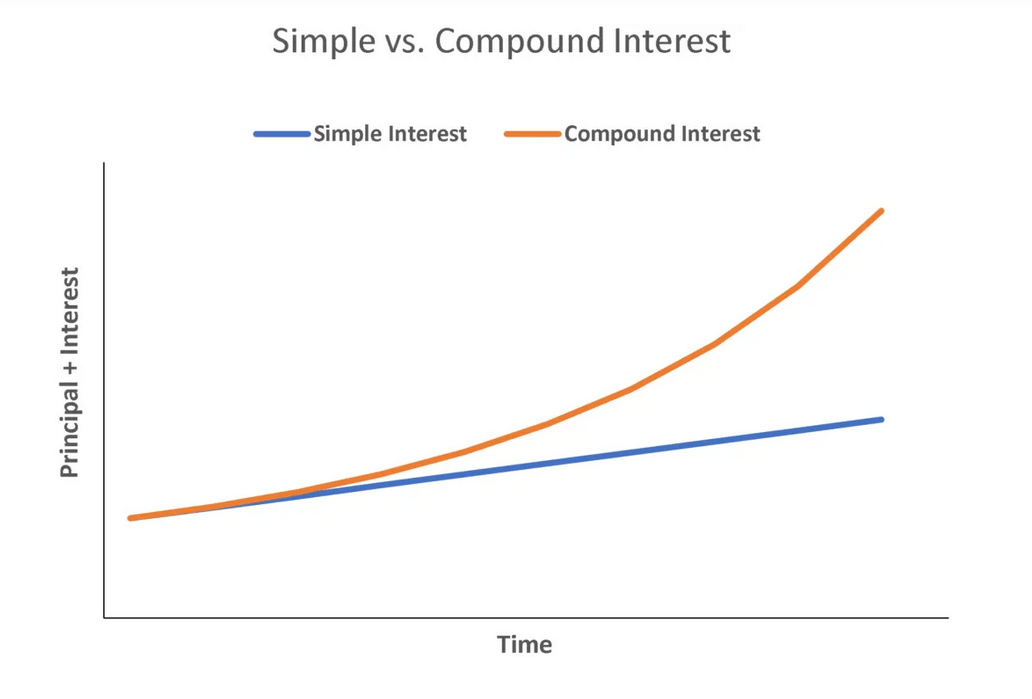

Compound Interest vs. Simple Interest

In addition to compound interest, there’s another kind of interest: simple interest.

What’s the difference?

- Compound interest calculates interest on both the principal and accumulated interest

- Simple interest calculates interest solely on the principal amount, or on that portion of the principal amount which remains unpaid

An example might be helpful here.

Suppose you invest $1,000 at an interest rate of 10% per annum.

- With simple interest, every year you’ll earn 10% of the initial $1,000, which is $100.

| After 1 year: $1,000 + $100 = $1,100 |

| After 2 years: $1,100 + $100 = $1,200 |

| After 3 years: $1,200 + $100 = $1,300 |

| So, after 3 years, with simple interest, you will have a total of $1,300. |

- With compound interest, every year, you’ll earn interest on both your principal and the accumulated interest from the previous years.

| After 1 year: $1,000 + 10% of $1,000 = $1,100 |

| After 2 years: $1,100 + 10% of $1,100 = $1,210 |

| After 3 years: $1,210 + 10% of $1,210 = $1,331 |

| So, after 3 years, with compound interest, you will have a total of $1,331. |

With larger sums of money and longer amounts of time, the advantage of compound interest really adds up:

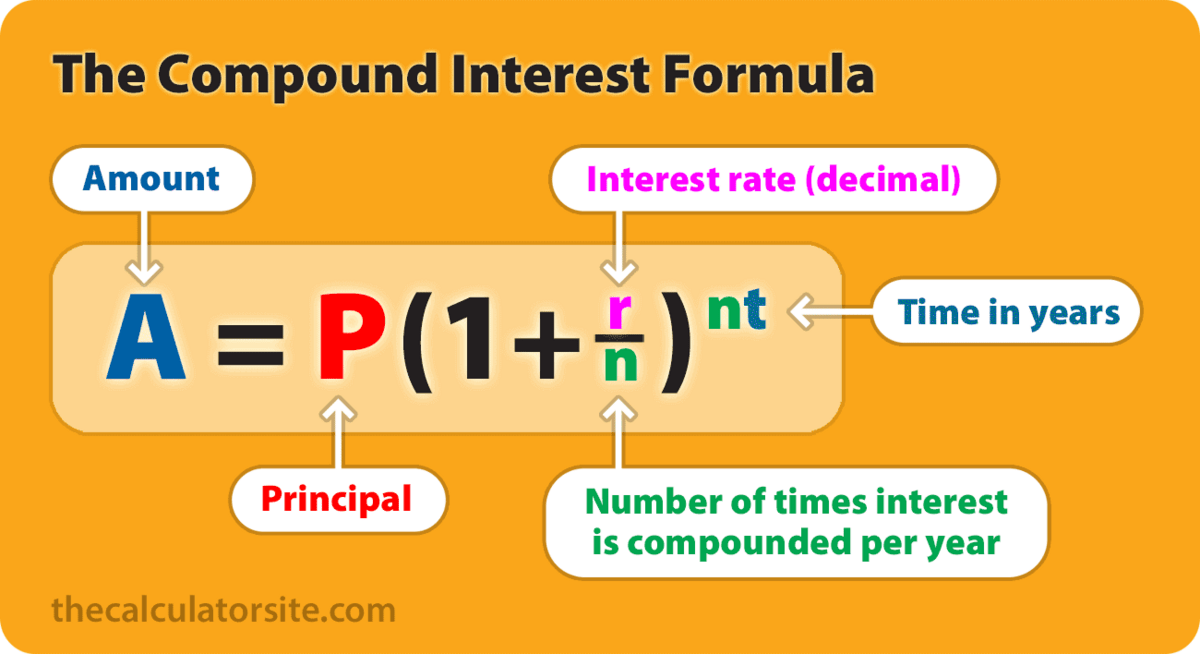

If you’re mathematically inclined, the compound interest formula is as follows:

In the compound interest formula above:

- A is the future value of the investment/loan, including interest.

- P is the principal investment amount (the initial deposit or investment amount).

- r is the annual interest rate (as a decimal).

- n is the number of times interest is compounded per year.

- t is the time the money is invested or borrowed for, in years.

If you’re not a math wiz, don’t worry. There are many great free compound interest calculators around the internet that will handle the math for you. All you need to do is input your starting amount, interest rate, and a few other variables.

These compounding calculators reveal just how lucrative your returns can be once you understand how to invest in compounding interest.

Love financial calculators? Empower’s FREE dashboard is loaded with them. By signing up for their free dashboard, you’ll gain access to a monthly budget calculator, emergency fund calculator, and more. Sign up today.

Investments With Compound Interest

1. Dividend Stocks

Dividend stocks are one of the best ways to benefit from compound interest. These stocks represent companies that distribute a portion of their earnings to shareholders in the form of dividends.

By opting to reinvest these dividends, you can purchase additional shares. Over time, owning more shares results in receiving even larger dividend payouts. And on and on the cycle goes…

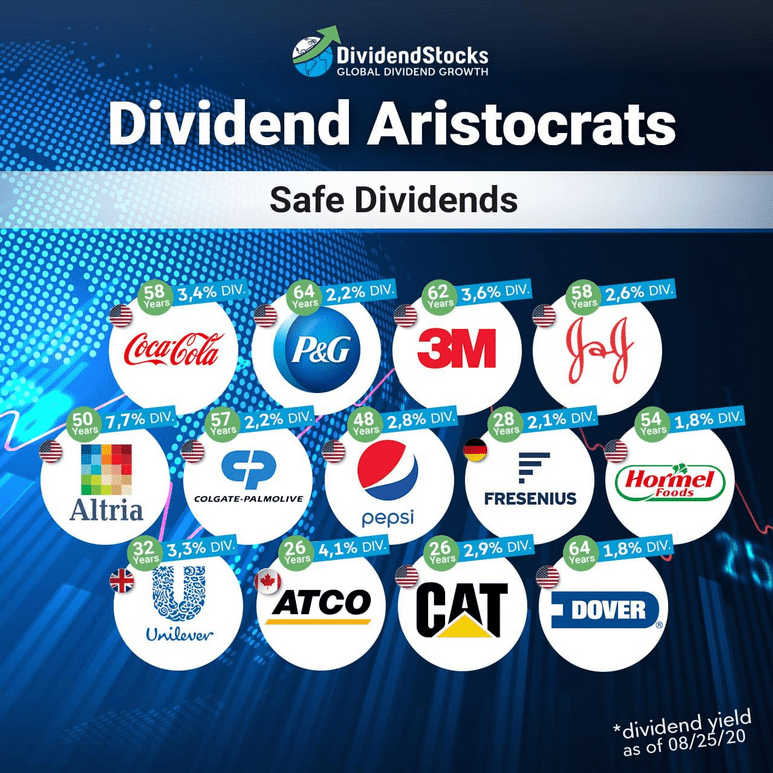

Wondering where to invest in compound interest in the stock market? Some of the top stocks for dividend investors include blue chip companies like:

If you’re not up for picking individual stocks, there are also dividend ETFs like SCHD which will instantly diversify you across many high-quality dividend-paying companies.

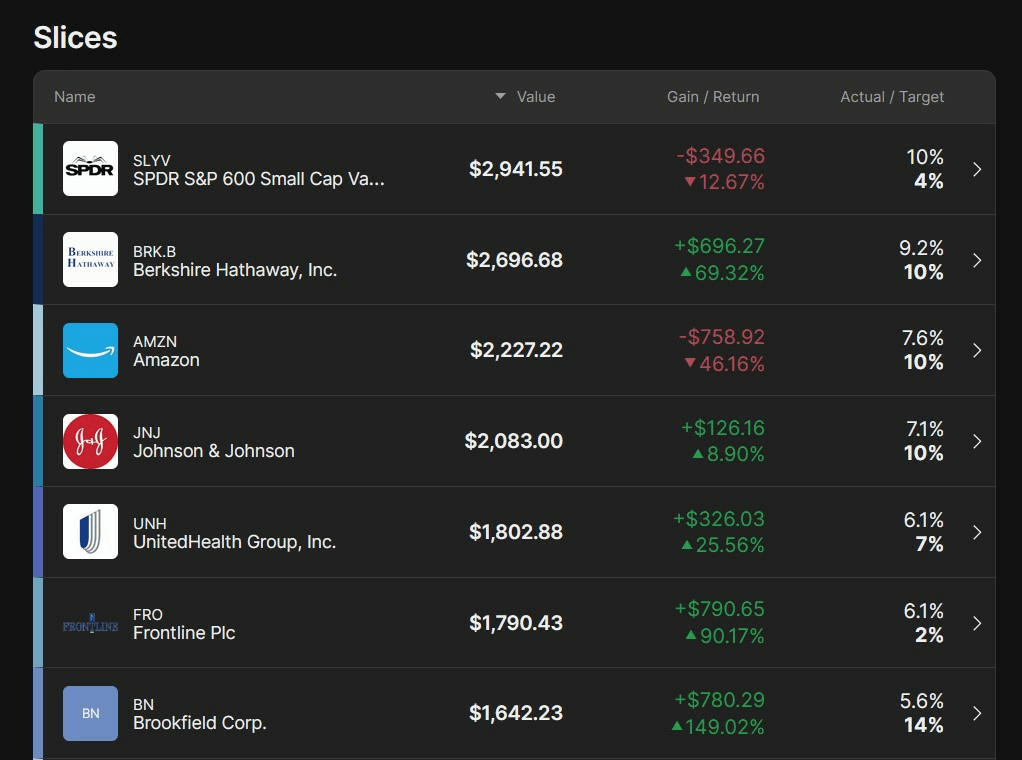

Whether you opt for ETFs or individual stocks, platforms like M1 Finance make dividend investing more accessible than ever. The platform boasts a user-friendly interface and a diverse set of dividend-paying stocks and ETFs, making it a top choice for beginners and experienced investors alike.

With M1 pies, you can also set target percentages and fund your portfolio passively, and M1 will take care of allocating to your desired positions for you with their auto-invest feature:

Want more great stock ideas? Subscribe to our new (and FREE) newsletter, WallStreetZen Daily. You’ll gain access to Top Analyst ratings (normally a premium feature on our site) and much more. Subscribe now.

2. Real Estate

Real estate isn’t always the first thing to come to mind when thinking of compound interest. However, according to Quicken Loans, the national average appreciation rate for real estate is 3% – 5%. That’s the annual rate that your property could compound over long periods of time.

Owning a rental property and progressively raising the rate is another way to derive compounding interest from your real estate investment.

But these days, you don’t even need to own physical real estate yourself to get in on the compounding. REITs (Real Estate Investment Trusts) allow you to invest in real estate without buying physical property.

Like the dividend stocks above, many REITs pay heft dividends of between 4-5% and higher, including:

- Realty Income (NYSE: O)

- Simon Property Group (NYSE: SPG)

- VICI Properties (NYSE: VICI)

moomoo features all of the REITs above, so it’s a great platform to enjoy a mix of traditional stock trading and real estate exposure. Plus, you can get free stocks for signing up — currently, new users are eligible to get up to 30 FREE stocks, plus a limited-time 8.1% APY on uninvested cash. Terms and conditions apply — click here to learn more.

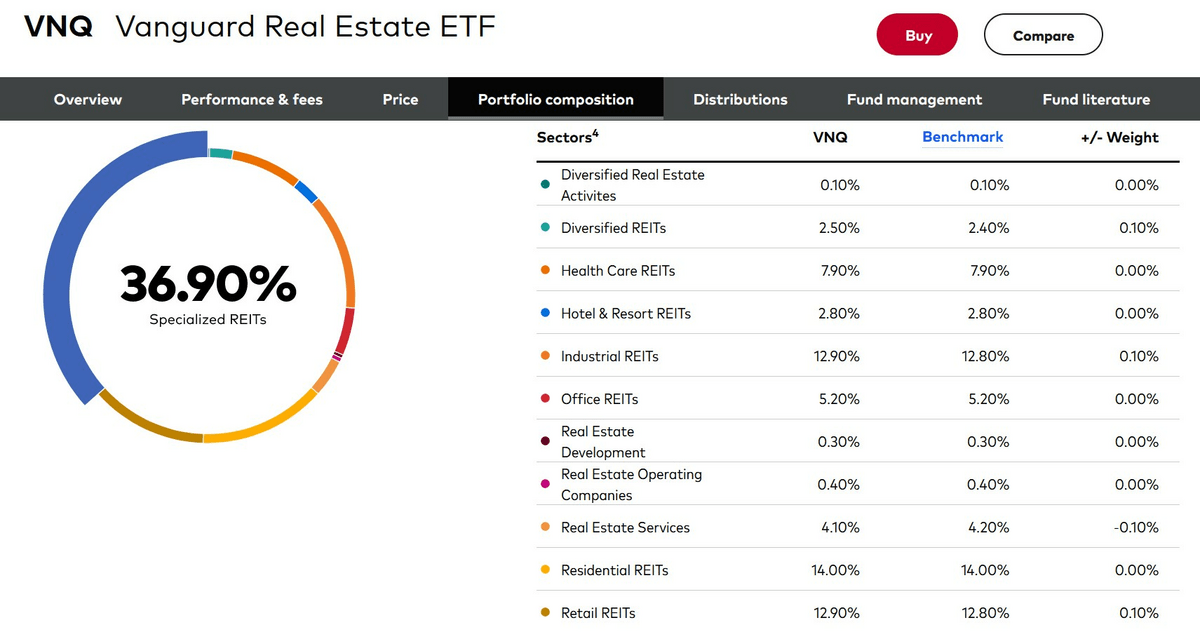

REIT ETFs

Once again, if you prefer not to invest in individual companies, ETFs are available. Vanguard’s VNQ diversifies you across many different REITs:

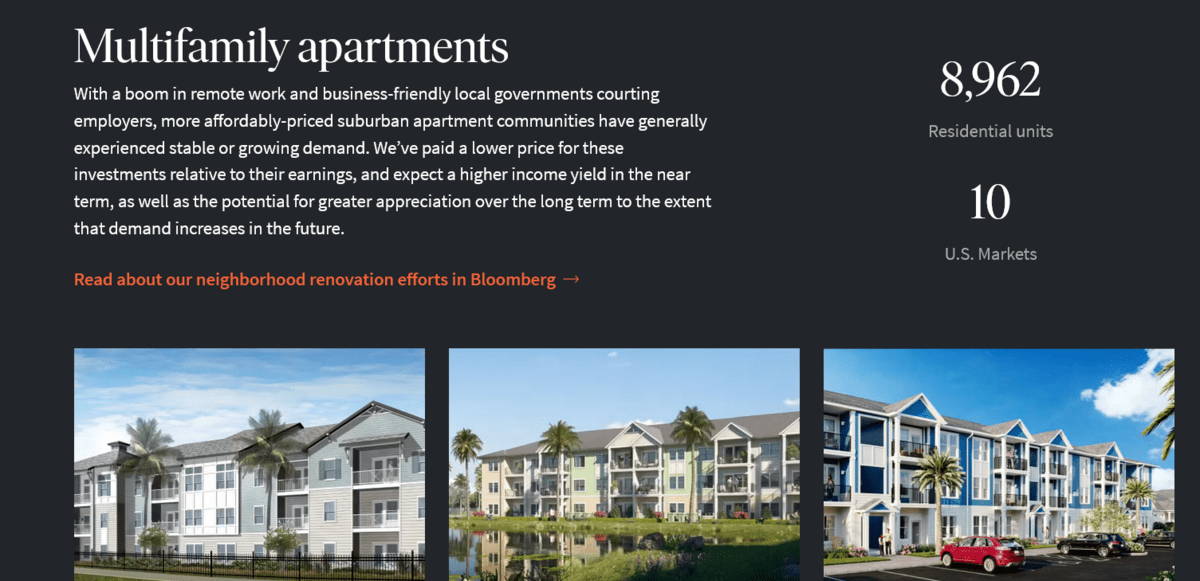

Alternatively, platforms like Fundrise have revolutionized the real estate investment landscape by providing diverse opportunities previously reserved for institutional or high-net-worth investors.

One particularly exciting option on Fundrise is multifamily apartments. By pooling funds from multiple investors, crowdfunding allows individuals to partake in the ownership and profits of large-scale residential complexes. These multifamily units can offer steady rental incomes and potential for appreciation, all while diversifying an investor’s portfolio beyond traditional stocks and bonds.

3. High-Yield Savings Accounts

Want to know how to invest in compounding interest, while minimizing your downside risk? High-Yield Savings Accounts might just fit the bill.

High-yield savings accounts are a type of deposit account that offers higher interest rates than traditional savings accounts. These are excellent if you’re looking to earn compound interest on your savings without the risks associated with investments like stocks.

A 4-5% “risk-free” return is pretty compelling when the stock market returns 8-10% per year on average (but with much more risk).

CIT Bank is a great resource for high-yield savings accounts. Right now, their Platinum Savings Account offers up to 4.35% APY if your account is over $5,000.

4. CDs

Another compounding interest savings vehicle to think about are CDs, or Certificates of Deposit. Think of these as “timed deposits.” You tuck your money away for a set period, and in return, you’re promised a fixed interest. Safe and predictable, right? Yes, but you give up some flexibility when by locking your cash away for some time.

Some investors bypass this hurdle by leveraging CD ladders. This is when you distribute your investment across various CDs with different maturity dates. The result? You get the best of both worlds: enticing returns and the ability to access cash without waiting too long. So, every time a CD matures, you can reinvest or use the cash. Meanwhile, you have some cash stored away earning interest in other CDs that haven’t matured yet. Smart move!

Most banks will offer some form of CD. Just make sure the interest rate is compelling enough to give up access to your cash. A modern solution we’re intrigued by is SoFi’s “vaults”. It’s a fresh, innovative take that seems to combine the benefits of high-yield savings accounts and CDs. Think of them as flexible pockets to stash and grow your cash, tailored for today’s fast-paced world.

In addition to SoFi, we’re also impressed by CIT Bank’s extensive CD offerings.

CIT Bank is also a great resource for CDs. Right now, they’re offering some of the best rates around for both short and long-term CDs over $1,000.

5. Bonds

When you hear the word ‘bonds’, think of it as loaning your money to a corporation or government. In return, they say, “Hey, thanks! Here’s a little interest for your trust,” and periodically send you interest payments. And the best part? Once the bond matures, it gives you back your original investment. It’s like a predictable, long-term friend that pays you for hanging out.

If you’re pondering where to dip your toes, bond funds can be an excellent starting point. They offer instant diversification, even if you’re not investing a fortune. This diversification can shield you from the potential default of any single bond. Think of it as not putting all your eggs in one basket, but instead, a bit in many baskets.

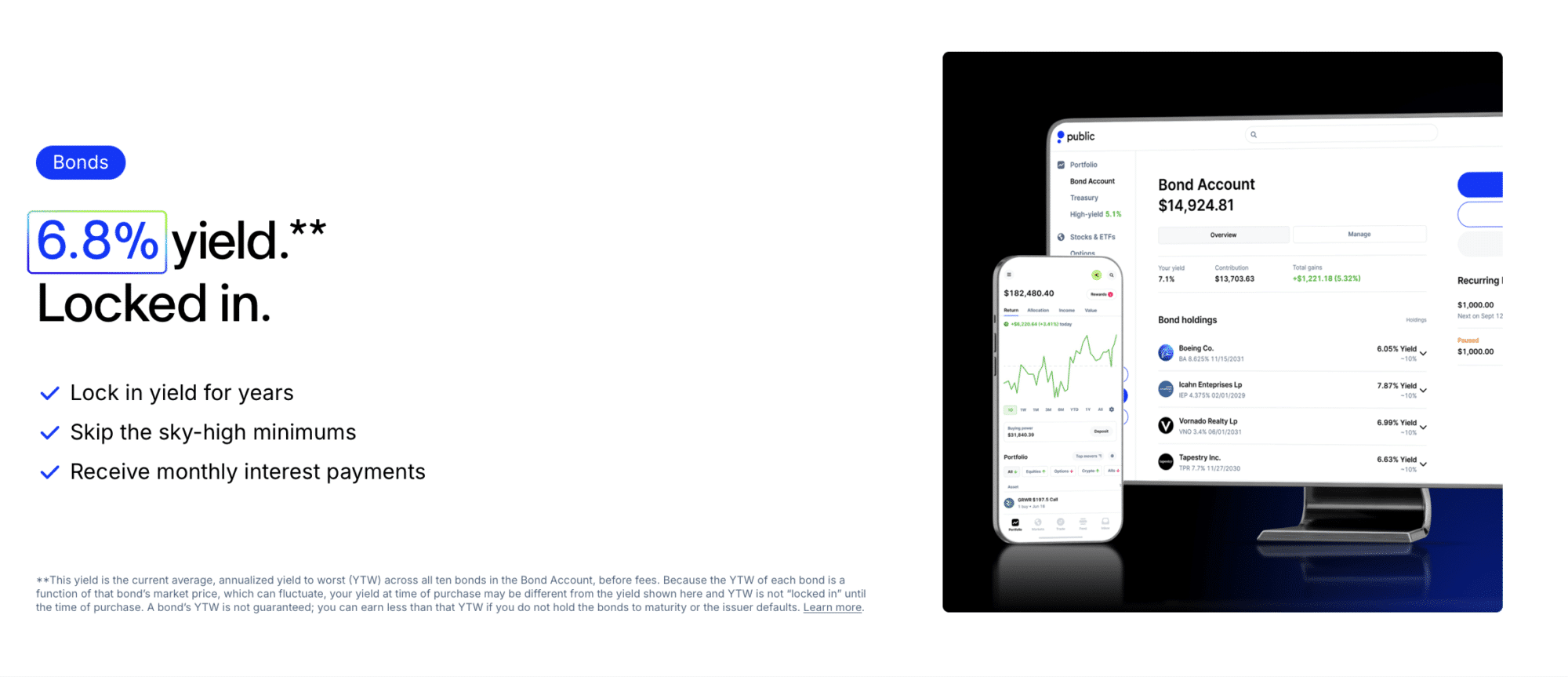

Personally, I think Public’s Bond Account is the easiest way to get started with bonds, with yields that are typically over 6%.

With Public, all you have to do is fund your Bond Account, and it will automatically go toward a portfolio of 10 investment-grade and high-yield corporate bonds. You’ll receive a monthly yield; when your income reaches $1K, it’s automatically reinvested. While it’s OK to withdraw early, you’ll get the highest yield if you hold on to maturity.

The Bond Account is currently fee-free on Public, but it will carry a $3.99 monthly fee starting in 2025 unless you upgrade your account. Take advantage of the high rates now!

6. Money Market Accounts

Wondering where to invest in compound interest without needing to tie your money up, as many CDs require? Enter Money Market Accounts (MMAs). Compared to traditional savings accounts, these often come with beefed-up interest rates, giving you a bit more bang for your buck.

The beauty of MMAs lies in their duality. On one hand, they’re savings-focused, protecting your principal. On the other, they offer better returns, dancing on the edge of the investing world. And let’s not forget the perks: Some MMAs come with check-writing abilities and debit cards, blending in a touch of checking account convenience. They’re certainly more flexible than CDs.

But, as always, there’s a catch. MMAs often demand higher minimum balances to start or maintain those attractive rates. It’s a bit of a balancing act, weighing the benefits against the commitments. For example, US Bank’s Elite Money Market Account offers up to 4.5% APY but requires $25,000.

If you’re working with a smaller account, we really like CIT Bank’s offerings.

With a smaller balance in your MMA, your APY will be a lot lower than most HYSAs and CDs. But if you’re interested in diversifying and already have an account with CIT Bank, it’s easy to open a money market account with an APY that is still a lot higher than the average savings account and that offers more flexibility than CDs.

Overall, for those with a decent chunk of change looking for a safe harbor with a sprinkle of growth, MMAs are a tempting proposition.

7. Micro-Investments

Remember when we used to collect spare change in those adorable little piggy banks? Well, micro-investing is like the grown-up, tech-savvy version of that.

Every time you make a purchase, platforms like Acorns round up the amount and invest the extra pennies on your behalf. It’s the digital equivalent of throwing your loose change into a jar, but with a twist—this jar grows with the magic of the stock market!

As an added perk, right now you can get a $20 bonus from Acorns when you set up your first recurring deposit. Just use any of the links in the post to get the promo!

The best part is that you’re investing without even feeling it. A coffee here, a grocery trip there, and your spare change accumulates into a diversified portfolio. It’s effortless, consistent, and taps into one of the golden rules of investing: starting early.

Rounding up small change might seem minuscule, but think of it as many tiny streams feeding into a growing river. Over time, these tiny investments, combined with the power of compounding, can swell into a sizable sum.

For those who’ve always been daunted by the thought of investing, fearing they lack the capital or expertise, micro-investing offers an ideal, gentle entry point. It’s democratizing finance, making investing accessible to everyone, one cent at a time.

What’s the Best Way to Earn Compound Interest?

It’s clear that harnessing compound interest can significantly amplify your wealth.

But the looming question is, how do you best capitalize on it?

Let’s delve in.

Self-Directed IRA with a Diversified Portfolio

For those with a hands-on approach to their finances, a Self-directed IRA offers a splendid route.

By diversifying your portfolio with a mix of ETFs, dividend stocks, REITs, and bonds, you’re not just banking on one performer. You’re casting a wider net, ensuring that even if one sector or stock fumbles, others can potentially offset the dip.

These investments with compound interest do require a keen understanding of the market, but the payoff? A portfolio that’s well-poised to tap into the beauty of compound interest.

If you want to go this route, M1 Finance takes the cake. You can be as hands-on as you like, picking individual stocks and REITs. Or go the passive route, and set target allocations to diversified dividend ETFs and bond funds. Either way, you’re in full control.

Leaning Towards a Set-and-Forget Strategy? Enter Wealth Management

If you truly want to go fully passive and aren’t interested at all in a DIY approach, you may want to consider professional wealth management services. After all, for many, a more hands-off approach is not just preferable, but practical. And that’s where wealth management shines.

Enter Empower. With its suite of financial services, Empower is setting itself apart in the world of wealth management. They offer various tiers tailored to different investment needs and the cherry on top? Their fee structure is generally more attractive than many traditional brokers or money managers.

Empower (formerly Personal Capital) offers wealth management services at significantly lower fees than most legacy brokers. Here’s why Empower might be a better option for some investors:

Fees start at 0.89% for up to the first million dollars invested, but go down to as low as 0.49% depending on account size. That’s significantly less than most legacy brokers, which might charge a 1.25% fee or more. Say your account is $1 million. With Empower, you could save as much as $36,000 over ten years in fees alone.

By entrusting your funds with experts, you’re essentially ensuring your money’s working for you, even when you’re not actively thinking about it.

It’s the best way to earn compound interest without needing to manage anything yourself.

Compound Interest on Debt

Einstein famously mused that compound interest was the eighth wonder of the world. But he also said, “He who understands it, earns it… he who doesn’t, pays it.”

Credit card debt is a prime example. When you don’t pay off your balance in full, interest compounds on both the principal amount and previous interest accrued. This can quickly balloon your debt, making it increasingly challenging to claw your way out. Loans can have a similar effect.

It’s crucial to understand that the longer you take to pay off these debts, the more you’ll end up paying. It’s not just about the principal anymore; it’s about the ever-accumulating interest on that principal.

Luckily, tools and resources exist to help you navigate the treacherous waters of debt. Empower’s free dashboard is one such tool. This platform offers insights into your spending, helping you craft a sensible budget.

With clearer financial visibility, you’re better equipped to tackle your debts head-on. By keeping your finances in order, you can transition from ‘paying’ compound interest to ‘earning’ it.

Final Word:

Whether you’re an avid stock market enthusiast, a real estate aficionado, or someone simply looking to stash away savings wisely, leveraging the power of compound interest is key.

Here are the main takeaways of how to earn compound interest:

- Start Early & Stay Consistent: The earlier you begin, the more time compound interest has to work its magic. Even if it’s just micro-investing, every little bit can make a difference over time.

- Diversify: As the options listed demonstrate, there’s no one-size-fits-all approach. Consider a mix of dividend stocks, REITs, CDs, and more to optimize returns while managing risk.

- Reinvest: Whether it’s dividends from stocks or interest from savings, reinvesting the returns further fuels the compounding effect.

Remember, it’s not just about how much you invest, but how wisely you let that investment grow. No matter what the best way to earn compound interest is for you, make sure to embrace the snowball effect and let your financial future flourish!

FAQs:

Which investment is best for compound interest?

The best investment for compound interest is typically dividend stocks, as they allow reinvesting dividends to acquire more shares, magnifying returns over time.

How do I start compounding investing?

To start compounding investing, begin by choosing a high-yield savings account, dividend stocks, or bonds, depending on your risk tolerance, and consistently reinvest the returns to maximize growth.

Is it good to invest in compound interest?

Yes, investing in compound interest is beneficial as it amplifies returns, allowing your earnings to grow exponentially over time.

How do you invest in stocks with compound interest?

To invest in stocks with compound interest, you can purchase dividend-paying stocks and reinvest the dividends to accumulate more shares, harnessing the power of compounded returns.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.