According to Forbes, 87% of teenagers in the US admit to NOT understanding their finances.

Want to make sure your child is on a path to positive money habits? Start with a kids’ savings account. It’s one of the best ways to learn about financial literacy and saving for the future.

What’s the best kids’ savings account? Ultimately, it depends on your goals and needs.

To help narrow down the options, we’ve created a comprehensive overview of our top picks — including options for the best savings account for baby to teen-friendly options.

Learn the pros and cons, fees, and promotions associated with each so you can get your child on the right path to wealth.

Want to teach the kids in your life financial literacy? Look no further than Modak.

Modak is an invaluable (and FREE) tool to help teach children essential money management skills. Designed with a kid-friendly interface, it introduces financial literacy through interactive lessons, games, and real-life budgeting scenarios, making complex concepts like saving, spending, and earning understandable and fun.

Modak encourages responsible financial behavior by allowing kids to set savings goals, earn “allowance” through tasks, and even track their spending with parental guidance. Smarter financial health starts here — create your FREE account today.

The Best Kids Savings Account in 2025

The bottom line:

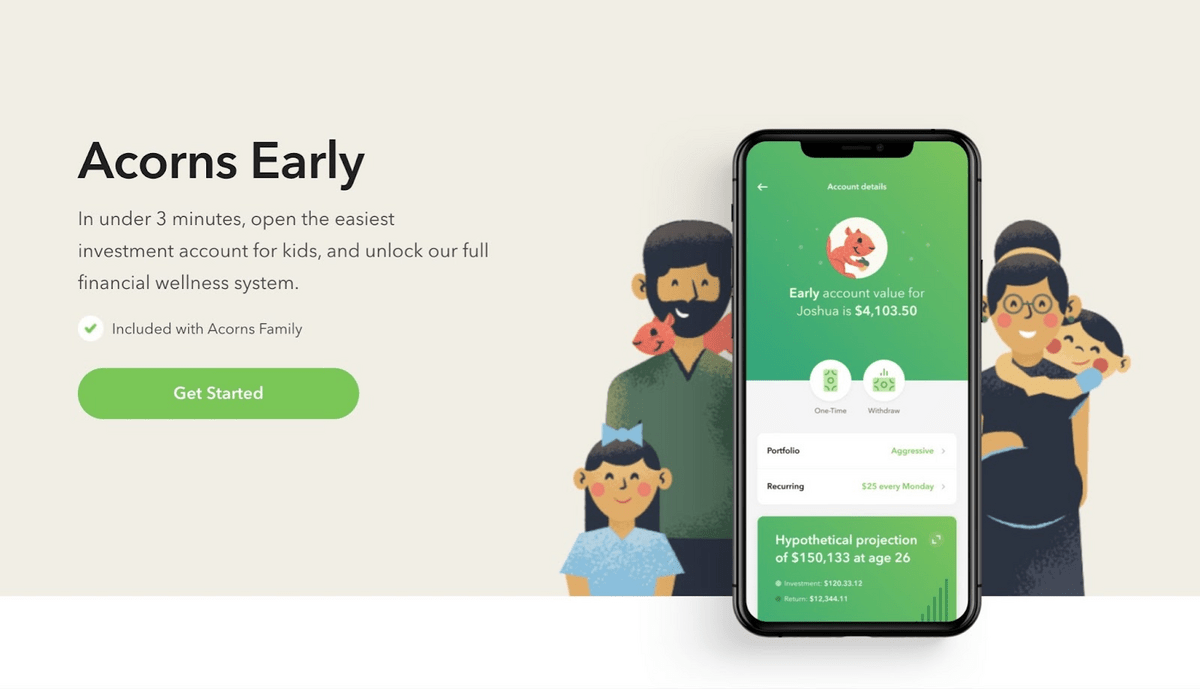

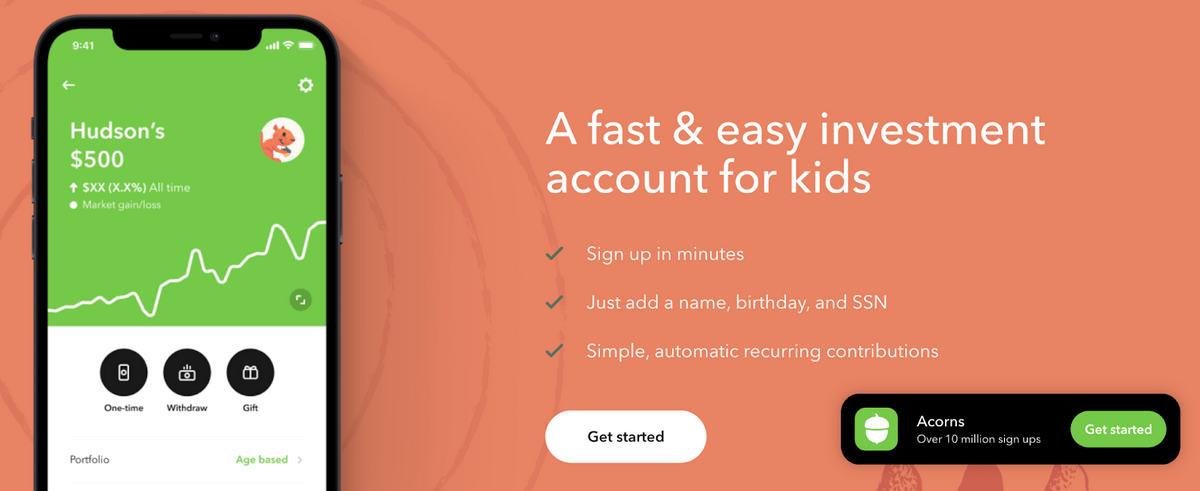

Acorns Early is the overall best kids’ savings account. Here’s why.

- Parents can start investing on their child’s behalf as early as birth — making it the best savings account for baby, too!

- Parents can take advantage of checking, retirement, and kids’ investing all in one app.

- Over time, kids can graduate from Acorns Early to Acorns Invest and Acorns Later, focusing more on retirement investing.

Our Picks: The Best Accounts For Kids

Keep reading to learn about our top picks for kids’ bank accounts, including all the important details you need to know. But for a quick shorthand:

At-a-Glance: Best Savings Account by Age

Best Savings Account for Baby: Acorns Early

Best Savings Account for Young Kids: Greenlight

Best Savings Account for Teens: Step

1. Acorns Early

What sets Acorns Early from other child savings accounts? Flexibility and control.

For example, the 529 savings plan is designated for your child’s future college and educational expenses. This doesn’t leave the child with much control over allocation.

Early is a custodial UTMA/UGMA account — Uniform Transfer/Uniform Gift to Minors Account.

This means funds are controlled by the adult until the child meets the age of transfer (18-25 depending on the state) and can be used for any expense to benefit the child — travel, school, car, or to start a business.

Rating: | 4.5/5 |

Best for: | Parents who want to easily save and invest for a child — kids investing, checking, and retirement in one app |

Account minimum: | $5 |

Fees: | $5 / month Acorns Family Membership |

Sign-up promotion? | $40 bonus investment |

Pros: | Flexible funds (UTMA/UGMA rules), SIPC-insured, access to financial literacy library, add multiple kids to account at no cost |

Cons: | UTMA/UTGMA accounts may negatively impact child’s college financial aid, monthly fee |

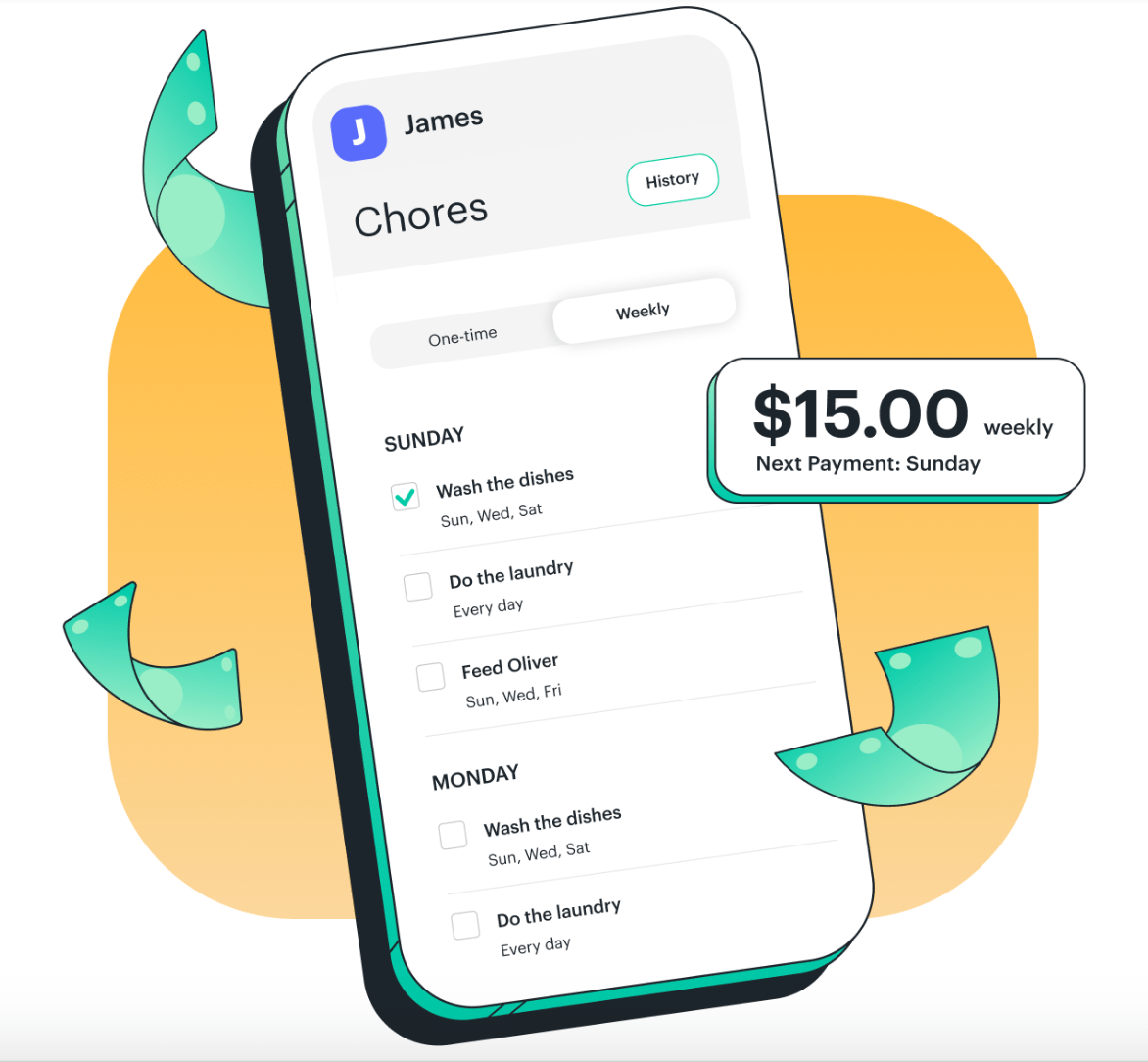

2. Greenlight

Greenlight is a debit card and educational app for kids and teens to earn, save and spend. Plans start at $4.99/mo and include debit cards for up to 5 kids.

The card works like a checking account. The savings component of the card pays 1-5% interest each month based on the average daily savings balance. Parents can send funds from their app and set controls while kids learn how to manage their own money.

There are no ATM or overdraft fees, and kids can only spend what has been loaded into their account. So they can make financial mistakes and learn without getting burned.

One of my favorite parts about Greenlight? Parents can automate an allowance to pay out weekly, bi-weekly, or monthly and set up recurring or one-time chores.

In terms of parental peace of mind, Greenlight debit cards are FDIC-insured up to $250,000. Parents can also receive spending notifications in real time and cards can be turned on or off from the app.

Overall, Greenlight is a solid option for families who want to teach kids about money management and investing. If you’re not planning on using the investing functionality or other features, a cheaper or free account may be a better alternative.

Rating: | 4/5 |

Best for: | Parents who want to monitor and teach their kids multiple aspects about money management – spending, investing, and saving |

Account minimum: | $1 – $20 |

Fees: | $4.99/mo – $14.98/mo |

Sign-up promotion? | One month free trial |

Pros: | Parental monitoring, educational tools, family money management, up to 5% cash back to savings, digital wallet access, FDIC-insured |

Cons: | $5000 monthly load cap, monthly fee |

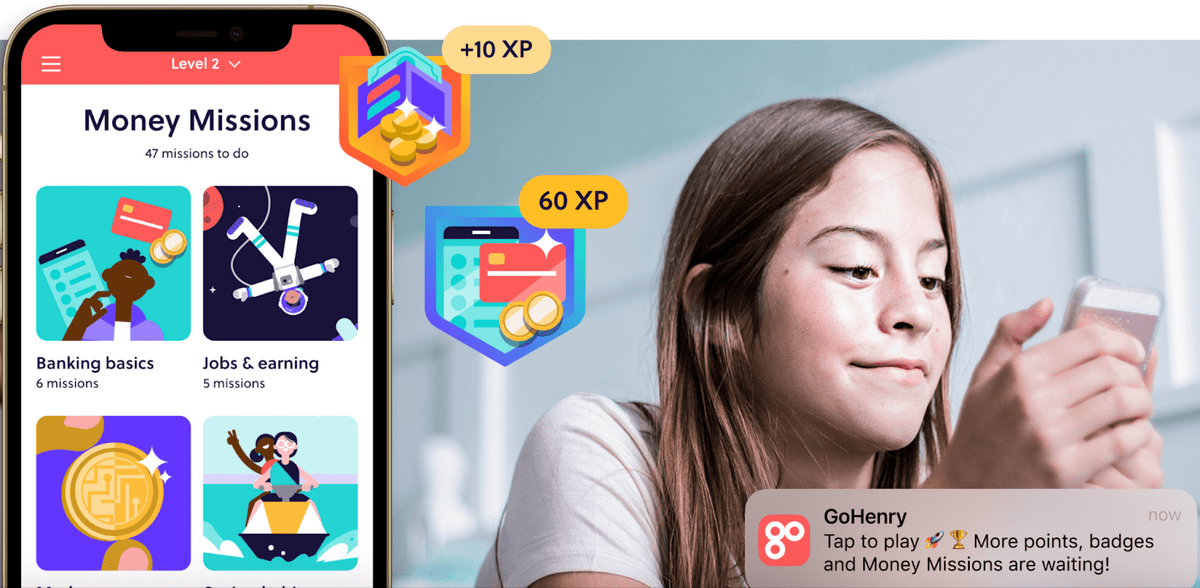

3. GoHenry

GoHenry = debit card + app + money lessons

GoHenry is an app that helps parents manage their child’s finances while also teaching them about money. It is a prepaid debit card so kids are limited to spending only what is in the account.

Parents can see transactions in real-time, adjust spending limits and instantly block cards if they are lost or stolen. In addition, accounts are FDIC-insured and Mastercard provides Zero Liability Protection. With the merchant control feature, parents can also block transactions for merchants selling age-restricted items.

GoHenry makes it easy for parents to set up chores and tasks. This is a great way to teach time management and the development of routines.

The app’s two differentiating features?

- Parent-paid interest savings

- Money Missions

To incentivize kids, parents can use the in-app interest calculator to set an interest rate so kids can see the power of interest over time. GoHenry is not a traditional savings account. However, it has a savings component where parents fund the interest so savings can become a habit.

Money Missions is an interactive, gamified way for kids to learn financial literacy. Kids earn points and badges with videos and quizzes, learning topics including credit, investing, saving, budgeting, and more. Money Missions was developed by financial education experts and follows the K-12 Personal Financial Education National Standards.

Overall, GoHenry is a great way to teach kids financial independence while offering parental peace of mind. The main downside? The monthly cost. However, the features outweigh the cost as kids learn the priceless skill of financial literacy.

Rating: | 4/5 |

Best for: | Parents who want simple features to teach kids about saving, spending and money management |

Account minimum: | $1+ |

Fees: | $4.99/mo per child, add up to 4 child accounts for $9.98/mo |

Sign-up promotion? | One month free trial |

Pros: | Offered in US and UK, parental monitoring, Money Mission education tool, FDIC-insured |

Cons: | No investment capability, no direct deposit, no digital wallet access, monthly fee |

4. Fidelity Youth Account

Teens don’t have to wait to start investing in stocks, ETFs, and mutual funds. The Fidelity Youth Account is a teen-owned brokerage account that comes with a debit card. This is unlike a custodial account (UTMA/UGMA) where the custodian, usually the parent, makes investment decisions on the minor’s behalf.

Teens ages 13-17 can invest in the stock market and learn good money habits at the same time.

Unlike other youth accounts, there are no subscription fees. In addition, there are no account fees or trading commissions. The debit card can be used for any purpose with parental oversight.

Teens can learn about financial literacy through the Youth Learning Center on the app, then apply their skills in the real-world stock market. The Fidelity Youth Account is a great option for kids looking to get a jumpstart in the investing world. When the teen turns 18, the account converts into a standard Fidelity brokerage account.

Rating: | 4/5 |

Best for: | Parents looking to get their teens started with money management and investing on their own |

Account minimum: | No investment account minimum – invest as little as $1 with fractional shares |

Fees: | No monthly account fee or trading commissions |

Sign-up promotion? | $50 reward after downloading Fidelity App and activating the Youth Account |

Pros: | No monthly fee, Youth Learning Center, parental controls, investment focused |

Cons: | Parent must be Fidelity customer, no chore/allowance feature |

5. Fidelity Roth IRA for Kids

Starting a Roth IRA for your child is considered advanced in terms of the child savings spectrum. Many options for kids include prepaid debit cards that instill good spending habits, financial discipline, and the value of a dollar by getting paid for chores and other tasks.

Shifting from saving to investing is the next step of the journey. This can help kids understand not only the day-to-day money management habits but simultaneously how to save for retirement. The Fidelity Roth IRA is a type of investment account that is designed for long-term retirement savings.

The parent will maintain control of the account as long as the child is a minor (age depends on state). Here are the eligibility requirements:

- 18 years of age or younger

- Must have employment compensation – This could be income from a job or from employment tasks like mowing lawns or shoveling snow.

Kids get the opportunity to invest in stocks, bonds, ETFs, and mutual funds. Roth IRA accounts are most appealing for their tax advantages. Contributions AND earnings can grow tax-free. This means at retirement they can take withdrawals without being taxed on the back end. In terms of long-term financial impact, overall a Roth IRA is the best account for kids.

Rating: | 4.5/5 |

Best for: | Parents who want to get a head start on tax advantage retirement saving for their child |

Account minimum: | None |

Fees: | No monthly fees or trading commissions |

Sign-up promotion? | None |

Pros: | Funds can be used for college and first home, qualified withdrawals are 100% tax-free, Youth Learning Center |

Cons: | Annual contribution limit, no chore/allowance feature |

6. Chase First

Chase First is a debit card for kids and teens, managed by parents. As long as parents are existing Chase customers, there are no monthly service fees.

Chase First focuses on simple money management for parents and children through the lenses of spending, saving, and earning. The account functions like a checking account with buckets to save, spend and earn.

Parents can choose where their kids shop, assign chores and track savings goals. Kids can learn how to manage their money in the real world and experience the freedom of having their own debit card.

Chase First is basic in its features compared to other child savings accounts. The account focus is helping kids learn the foundation first with parental oversight. Kids can ‘graduate’ to the Chase High School Checking account and add features like Zelle, direct deposit and check writing.

Outside of adding an educational curriculum component, the Chase First account is a great option for parents looking for a free account to teach their child the basics of money management.

Rating: | 4/5 |

Best for: | Teaching a child how to use a debit card and learn smart money habits |

Account minimum: | None |

Fees: | No monthly service fee |

Sign up promotion? | None |

Pros: | Parental controls, allowance/chore feature, no monthly fee, easy to use, FDIC-insured |

Cons: | Parent must be Chase customer, no investment feature, no education component |

7. Capital One Kids Savings

Capital One Kids Savings makes your child’s weekly allowance go further with a high-yield savings component. While most competitor account age minimums are around 6 years, you can open a Capital One account when they are a baby. It’s never too early!

Kids can make mobile deposits and parents can link their account to theirs to facilitate transfers. Once the child turns 18 the account can be converted into a Capital One 360 Savings Account.

Overall, the Capital One Kids Savings account is a safe and simple account to help kids learn about savings. The account functions like a traditional savings, offering 0.30% APY to help their money grow.

The top-rated app and no monthly account fees make this an attractive option for parents looking to start teaching their children the basics of banking and saving.

Rating: | 4/5 |

Best for: | Parents looking for a top-rated app with parental oversight to teach kids about savings accounts |

Account minimum: | None |

Fees: | No monthly service fees |

Sign-up promotion? | None |

Pros: | Set automatic savings, no monthly fees, link to parent account, FDIC-insured |

Cons: | Basic features, no educational component, no investing feature, lower APY compared to other child savings accounts |

8. BECU Early Saver

The BECU Early Saver account offers one of the best savings accounts for kids in terms of interest rates – 6.17% APY on the first $500. The account lacks the ‘bells and whistles’ other youth accounts offer, but is great for parents looking to get their child started with a competitive interest rate.

BECU is a credit union, not a bank. Credit unions are different from banks mainly because they are non-profit cooperatives. So, ‘profits’ are returned to members in the form of better rates, fewer fees, and more financial services.

While the BECU Early Saver account is basic in its features, kids can access more credit union benefits as they progress into their teen and adult years. These benefits include loan and mortgage services, financial planning, investment accounts, estate planning and more.

Rating: | 4/5 |

Best for: | Parents looking for a basic child savings account with a competitive interest rate |

Account minimum: | None |

Fees: | No monthly service fees |

Sign-up promotion? | None |

Pros: | 6.17% APY on first $500, no monthly fees, free online and mobile banking, FDIC-insured |

Cons: | Basic features, no educational component, no investing features |

9. Step

We live in a world where the majority of our financial decisions are based on credit — auto insurance, school loans, cell phone plans, and more. The problem for teens and young adults is finding opportunities to build credit.

Look no further than the Step Visa Card, a secured credit card for teens. Purchases can be made up to the balance in their Step Spending Account and the Smart Pay feature ensures balances are paid in full each month.

Step is on a mission to improve the financial future of the next generation. Through the app teens can save, spend, invest, and build credit – all before turning 18 years old! With Money 101, a financial literacy curriculum, you can take the first step in the right direction and learn about topics including banking, budgeting, investing, credit, and loans.

Rating: | 4.5/5 |

Best for: | Parents looking for a comprehensive financial platform for their teen to learn about saving, spending, investing, credit and more |

Account minimum: | None |

Fees: | No monthly service fees |

Sign-up promotion? | None |

Pros: | All-in-one modern banking app, teens can build credit and invest in stocks, no monthly fees, no credit card interest, FDIC-insured |

Cons: | Must have own phone number to get started, not ideal for children 12 and under |

Best Account for Kids: Must-Know Tips

It’s never too early to start planning for your child’s future. The type of account you choose will depend on the long-term goals you want them to achieve through financial literacy. Here are a few things to look for in the process:

- Fee types – Look out for monthly service fees or other account fees. There are solid paid and free options for child accounts.

- Financial education – Parents and kids should be able to boost their financial literacy together. GoHenry features ‘Money Missions’ while Fidelity offers the ‘Youth Learning Center.’

- Documents needed – Depending on age, you may need to provide a birth certificate, driver’s license, social security card, or passport.

- Parental controls – Are you able to track your child’s spending and see not only how much, but where they are spending?

- Investing features – After your child has learned about building savings they can graduate to investing that money in securities like stocks, ETFs, and mutual funds.

Final Word: Best Kids Savings Account

As parents, it is our responsibility to take action in not only getting children started in saving and investing but also teaching them about financial literacy.

You could argue your biggest motivation is to ensure they don’t end up living with you … forever … due to their lack of personal finance skills.

There are plenty of account types to choose from depending on your goal with your child — save for a short-term goal, learn about banking, learn about money management, or learn the value of a dollar with routine chores.

FAQs:

What’s the best kids savings account?

Our top pick for the best kids savings account is Acorns early. Not only can parents start investing on their child’s behalf as early as birth, but they can take advantage of checking, retirement, and kids’ investing all in one app.

What’s the best savings account for baby?

Our top pick for the best savings account for baby is Acorns early. Parents can start investing from birth while also managing their own checking, retirement, and kids’ investing all in one app.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.