Does a child really need a bank account? Consider these two data points:

- University of Kentucky research shows people who don’t open savings accounts before turning 18 are less likely to have an account later in life.

- Researchers also discovered that people who didn’t have a savings account before 18 were less likely to have a diverse portfolio by retirement.

In short, the earlier children get involved with banking, the better chances they’ll feel confident about handling their future finances.

So, by now, you’re probably wondering: How old do you have to be to open a bank account?

Keep reading to learn the basics on banking age brackets and legit ways to help kids become superstar savers.

At-a-Glance: Top Bank Accounts Under 18

Today, plenty of investment companies offer custodial accounts. Here’s a list of a few of the best savings and checking accounts for early-bird investors:

Account | Account Type | Minimums + Fees | Best For |

Custodial Account | $5 minimum $3/month personal or $5/month family | Best for those most interested in a fintech-friendly all-in-one account. | |

Custodial Account | $4.95/month $25/minimum investment per month | Best for flexibility and letting friends and family contribute. | |

Fidelity Youth | Joint Account | No minimums and no account fees | Best for 13 -17-year-olds interested in investing, savings, and spending. |

Prepaid Debit Card | No minimums$4.99/month or $9.98/month for four accounts | Best for teaching pre-teens healthy spending habits with a debit card and educational resources. | |

Fidelity | Kids Roth IRA | No minimums and no account fees | Best for a long-term savings fund. |

How Old Do You Have to Be to Open a Bank Account?

The bottom line: People need to be over 18 to open an individual bank account. But it’s possible to open custodial or joint accounts earlier.

Provided an adult signs on as a “custodian” or “joint owner,” anyone under 18 can legally open a bank account.

How Old Do You Have to Have Your Own Bank Account?

You need to be at least 18 to open a bank account on your own.

18 is the “Age of Majority” in the USA, so anyone over 18 is technically an adult and has the right to open a bank account.

However, a few states like Mississippi, Alabama, and Nebraska don’t recognize the “Age of Majority” till 19 or 21. Although many banks follow the federal policy, it doesn’t hurt to ask, “What age can you open a bank account?” if you’re in these states.

But remember — as discussed above, kids younger than 18 can open a bank account with a legal parent or guardian.

Can You Open an Account Without Parents or an Adult?

People under 18 can legally open a bank account without a custodian if they’re “legally emancipated.”

Every state has different requirements for legal emancipation, but most look for the following features:

- Over 14 years old

- Has a source of independent income

- Lives in a residence separate from parents and guardians

- Demonstrates maturity

If a child receives legal emancipation, they can open a bank account independently. But this is an extremely rare situation.

Bank Account Types for Minors

Opening a bank account for minors isn’t super complicated. But picking from the available options can get confusing.

Take the time to research different kid-friendly banking options before deciding what’s suitable for your situation. Here are some common types:

This article does not provide investment advice. If you have specific questions about the accounts listed in this article, contact a professional accountant.

Custodial Account

Custodial accounts are the most popular option for parents who want maximum control over their child’s finances.

Although a child is the owner and beneficiary of a custodial account, the guardian acts as a “custodian.”

What does that mean? Basically, the custodian needs to approve every transfer in and out of this account, but the child has ownership rights over all of the assets.

It’s only after a child reaches 18 that he or she doesn’t have to constantly ask permission to approve transactions.

Since custodians have the final say in these accounts, they’re great for parents who want to closely monitor their child’s spending habits.

There are two versions of custodial accounts for minors:

- Uniform Gifts to Minors Act (UGMA)

- Uniform Transfer to Minors (UTMA)

Both of these custodial accounts transfer funds once a child hits the “Age of Maturity.”

The only significant difference between UGMA and UTMA is that the latter includes “more stuff.”

With a UGMA account, you can only transfer paper financial investments like money and stocks, but UTMA accounts may include physical assets like property and Picasso paintings.

The fintech company Acorns also offers a convenient UGMA/UTMA custodial account called “Acorns Early.” For a subscription fee, Acorns members enjoy an all-in-one savings, checking, and investment platform.

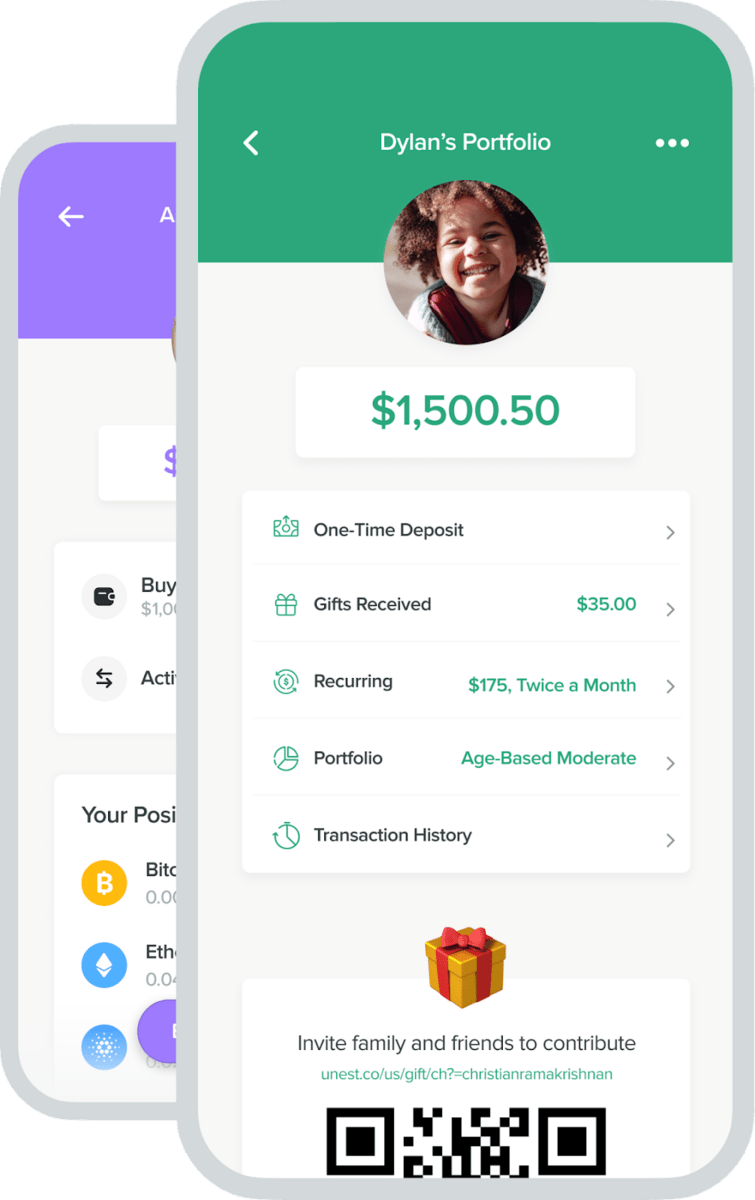

Another top UTMA pick? UNest.

This easy-to-use-app helps you set up and invest in an UTMA account. You can open an account in minutes, and you have the option to allow friends and family members to contribute to the lucky kid’s account.

Joint Account

Joint bank accounts aren’t just for soulmates or business buddies.

Although not as common as custodial accounts, a few banks offer joint accounts with guardians and minors.

For instance, Wells Fargo now offers joint accounts for parents and pre-teens.

In terms of features, joint accounts give parents and children the same access to basic financial services like savings and checking.

The only difference is the control — or lack thereof — that parents have.

Although many joint accounts alert adults whenever there’s a transfer, custodians don’t have to approve every transaction.

Therefore, joint accounts give kids more flexibility with their finances, which may be good depending on your parenting style.

Also, keep in mind not every bank offering joint accounts allows parents to open accounts with minors.

For instance, Chime and Ally offer joint accounts — but only for adults.

Prepaid Debit Card Account

Looking for a great prepaid debit card for kids? One of our top picks is the subscription-based GoHenry, which offers prepaid debit cards tailored for kids.

If you’re more interested in teaching healthy spending habits versus saving, a prepaid debit card might be a good option.

Instead of opening a checking account at a bank, these fintech solutions link with a pre-existing bank account so you can load a kiddo’s debit card for weekly allowance, birthday gifts, or “just because.”

With the GoHenry app, kids can manage funds and spend as they see fit. There are also dozens of gamified education resources which teach healthy money habits.

While prepaid debit cards aren’t as cost-efficient as opening a savings account, they are a convenient option. Not only are apps like GoHenry easy to navigate, it usually takes less time to set up an account versus submitting paperwork at a bank.

Custodial Roth IRA

You may think saving for retirement before 18 is too early, but it’s really not.

Get this: 50% of all Americans between 18 – 34 aren’t saving for retirement.

The sooner you start setting aside a nest egg for your kids, the better odds they’re on the road to glorious golden years.

Custodial Roth IRAs differ from “Traditional IRAs” because account owners don’t pay taxes on withdrawals (but they can’t claim tax benefits for contributions). With a custodial Roth IRA, you and your child can immediately start investing in assets like stocks, bonds, and ETFs.

The rules for custodial Roth IRAs are the same as regular Roth IRAs; however, like a custodial bank account, an adult has to act as the custodian until the minor turns 18.

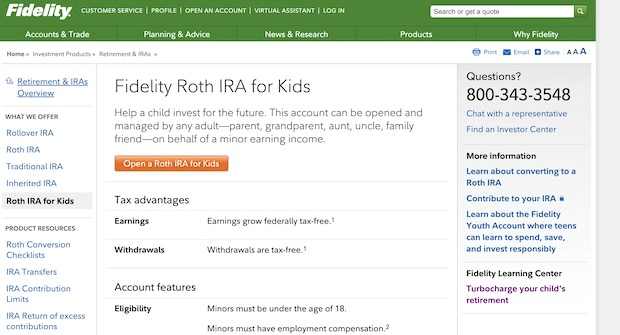

Fidelity is one asset manager currently offering this financial service through its Kids Roth IRA.

Educational Savings Accounts

If you’re paranoid about educational expenses, it may be worth setting aside some funds in either a 529 college savings plan or the federally-backed Coverdell Education Savings Account (ESA).

These plans are similar to a Roth IRA in terms of structure and tax benefits, but they’re focused on education rather than retirement.

You can contribute a max yearly amount in either a 529 or ESA into stocks, bonds, or ETFs, and take withdrawals without paying taxes.

The biggest difference between these plans has to do with contribution limits. Typically, Coverdell ESAs have lower yearly contributions of $2,000. Depending on the state, 529s may have total contribution limits of between $235,000 – $529,000.

Those interested in 529s or Coverdell ESAs can work with many financial institutions or brokers, including Fidelity Investments and E-Trade.

Under 18: How to Open a Bank Account

Once you’ve figured out the proper account for your needs, signing up isn’t too difficult.

Just be sure to ask, “How old do you have to be to open a bank account?” at different institutions to ensure your kiddo is eligible.

Although every bank has different requirements, you’ll probably need the following info:

- Social security numbers

- Government-issued IDs

- Proof of residence (e.g., a copy of a utility bill)

Depending on your financial institution, you might need to visit a branch in-person to set up an account. Otherwise, you may be able to sign up over the phone or online.

As you set up an account, you have to supply the ID information the bank asks for, such as the parent and child’s full names, SSNs, and proof of residence.

If you have any issues during an online set-up process, feel free to contact your bank’s official customer service rep via phone or live chat.

Once you’ve completed your application, processing your request may take a few business days. You’ll then need to fund the new bank account via another bank account or with a credit or debit card.

What to Look For in a Bank Account for Minors

When investigating bank accounts for minors, there are a few unique features to pay careful attention to before choosing which institution to work with:

- Minimum age: Not all bank accounts have the same minimum age limits, so always ask, “What age can you open a bank account?” when working with a new bank.

- Type of account: Figure out your primary financial goals and the level of control parents have with different accounts to see what’s most suitable for your situation.

- Monthly fees: A few child-friendly accounts—especially prepaid cards—have monthly payments you’ll need to factor into your expenses.

- Educational resources: Many parents sign kids up for bank accounts to learn about finances, so it’s helpful to have high-quality info on topics like spending, saving, and investing.

- Insurance protections: Please never assume a bank offers federal insurance protections. While most financial institutions are FDIC, verifying these safety features beforehand is crucial.

Looking specifically for investment accounts for kids? Check out our article about stocks for kids, which covers the best brokerage accounts for kids and some of the best stocks for kids.

Bank Accounts Under 18: Tax Considerations

Do You Owe Taxes on Interest Accounts Under 18?

It’s possible that people under 18 need to pay taxes on their interest, but they need to earn over $2,300 per year, according to the IRS.

Not sure if your kid needs to pay taxes? Check the latest guidelines from the IRS each tax year to see if this threshold changes.

Also, if you have specific tax-related questions about the accounts listed above, it’s suggested that you contact a professional accountant.

Final Word: Minimum Age to Open Bank Account

So, when your kids ask, “How old do you have to be to have your own bank account?” now you know the answer:

In most cases, 18 is the magic age when anyone can walk into a bank and open an account.

However, people under 18 have plenty of custodial options to get involved with saving, checking, and investing.

With a trusted adult guardian, anyone under 18 can gain invaluable early experience with money management.

By the way, check out our comprehensive “Investing for Teens” article for more helpful savings tips.

FAQs:

What is the minimum age to open a bank account?

How old do you have to be to open a bank account? The minimum age to open a bank account is 18 in most states. If people want to open bank accounts before 18, they must sign with a parent or legal guardian.

Can you have a debit card under 18?

People under 18 can apply for a debit card with a parent or guardian.

Can I open a bank account at 16 or 17 by myself?

The only way to open a bank account under 18 without a parent or guardian is if you're "legally emancipated."

Can I open a bank account for my 14 year old?

If you're the legal adult guardian of a 14-year-old child, you can open a joint or custodial bank account for them.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.