As a teen, did you know that you actually have a massive advantage when it comes to your finances?

Even though you most likely don’t have a lot of money or experience yet, you have one crucial advantage over your parents and older siblings.

If you’re a parent, then you probably already know what it is.

Your advantage is time.

You have a lot more time to save your money, invest it, and let it grow.

Due to compound interest, the earlier that you get started investing for your child’s future, the better! It’s crucial to have a good compounding interest account to keep your savings in.

If you’re not familiar with compound interest, don’t worry. We’ll explain in the next section.

With all that in mind, let’s examine some of the top money apps for teens that can help you get your finances on the right track.

The 14 Best Money Apps for Teens

1. Acorns – Best Overall Stock App for Teens

Opening an account on Acorns couldn’t be simpler. It only takes about 3 minutes to get started, and teens can stay with the app from youth all the way through retirement. Right now, you can get a $20 bonus when you set up your first recurring investment — using the links in this post.

Acorns is one of the best stock apps for teens (and adults) because it enables you to jump start your saving and investing without contributing significant funds. Its primary feature is Round Ups which invests spare change into your portfolio every time you spend money.

If you buy a coffee for $2.62, Acorns will round up the amount you spent to $3 and deposit the extra $0.38 into your investment account.

After a month of transactions, you will have saved some money without noticing it’s gone. That’s why it also ranks high on our list of the best money saving apps.

Acorns Early is their custodial account which can be opened for kids below 18.

In addition to your spare change, you can add any lump sums you save from mowing lawns or receive as Christmas gifts.

Acorns is also extremely mobile-friendly.

Price: $3/month (personal) or $5/month (family)

2. Vanguard – The Best Legacy Stock Market Investing App for Teens

By getting started investing in the stock market, teenagers can unleash the power of their greatest asset: Time.

If you’re a teenager, you can invest a small sum now, sit back, and let it grow into a nice nest egg by the time you’re ready to retire. It’s all because of compound interest.

Compound interest is interest that’s calculated on both your initial principal as well as any interest from previous periods. In other words, it’s interest on interest.

For example, let’s say that you invest a lump sum of $10,000 into an account that will generate 8% each year.

- After year 1, you will have $10,800 (an $800 increase).

- After year 2, you will have $11,684 (an $864 increase).

That additional $64 you made in year 2 is compound interest. It’s 8% of the $800 you made in year 1 – your interest on your interest.

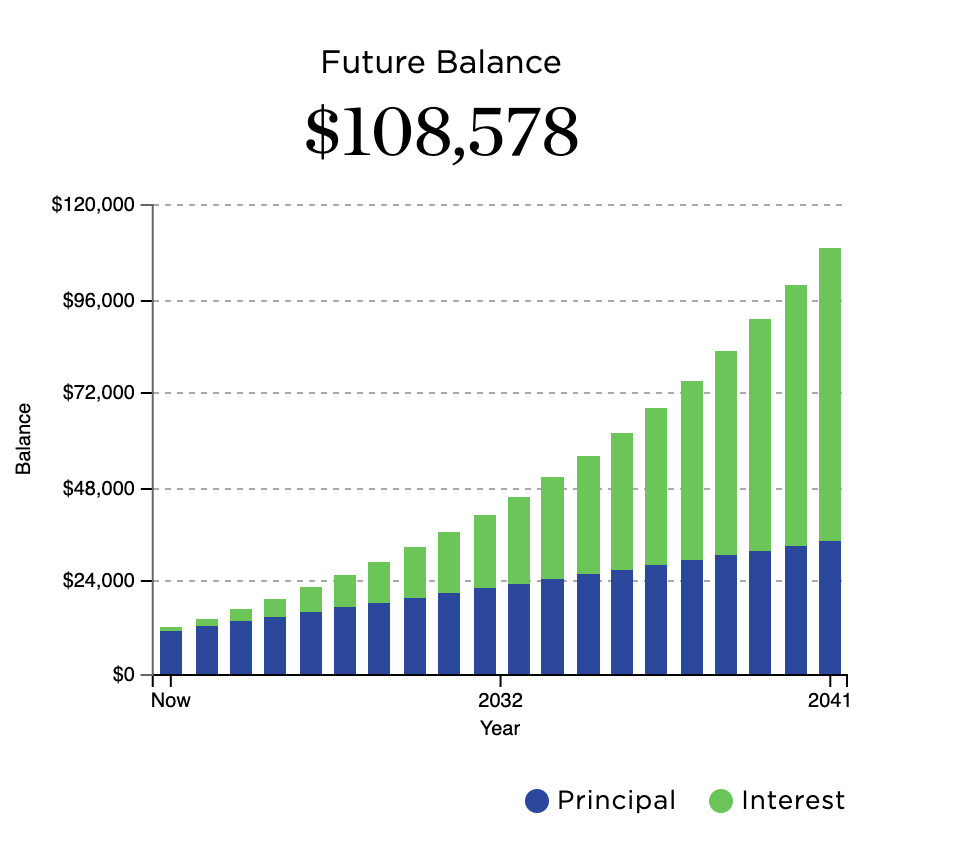

To take this a step further, let’s say you invest an additional $100 each month. If you make this investment at 16 years old and let it grow for 20 years, your portfolio value at 36 will be:

As you can see, your interest grows exponentially even though your savings are linear.

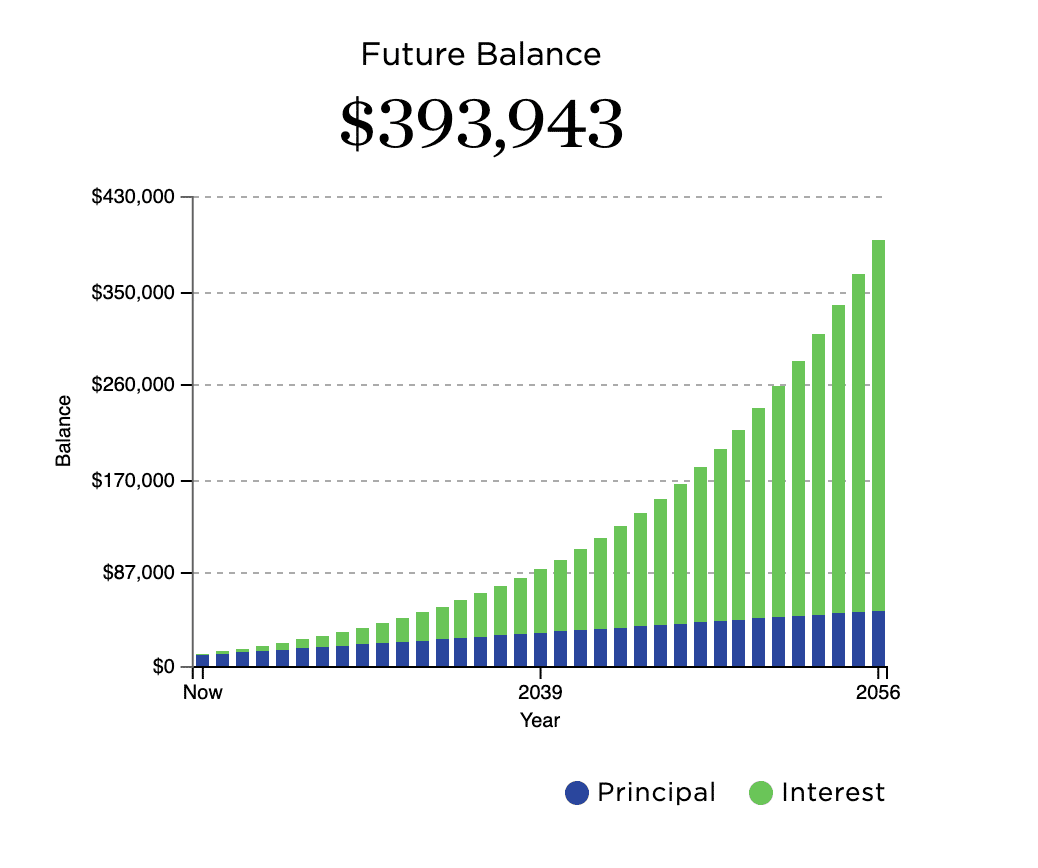

If you continue investing $100 each month for another 15 years, your portfolio value at 51 will be:

That’s an additional $284,965 in your pocket (or your child’s pocket) just because you started earlier.

In the U.S., you need to be at least 18 years old to open an investment account. Vanguard, however, will let you open what’s known as a custodial account. A custodial account is an investment account that a guardian opens on your behalf.

You can also use Fidelity, TD Ameritrade, or Charles Schwab to open a custodial account. You may want to check out our list of the best apps to buy and sell stocks.

Price: Free

3. Greenlight – The Best Banking + Investing App for Kids

Greenlight Max is an investment account for kids that comes with a debit card and bank account.

Greenlight was founded as a banking platform, but now doubles as an investing app. Its banking and investing services have plenty of parental controls, so you can approve every money move your child makes.

In addition to providing access to banking and investing, Greenlight teaches teens about financial skills like money management and stock market investing, incorporating real money, real stocks, and real-life lessons.

Given the massive gap in our education system, these resources are critically important.

Plus, it’s also got some cool features.

For example, the Chores and Allowance feature lets you create a set payment plan for chores that your kids do around the house.

The primary downside is that Greenlight doesn’t have physical locations that you can visit when you have a question.

Price: $4.99/month (after a free 30-day trial)

4. Chase Bank – The Best Traditional Bank App for Teens

There are many benefits to open a traditional bank account with a national bank:

- Physical locations

- Free

- Accessible

While these banks don’t necessarily target kids, they’ve been working well for a long time. In addition to their physical locations, there are a lot of features that Chase gives you access to:

- Debit cards

- Account alerts

- Spending/withdrawal limits

- Goal setting for saving

- A mobile app

Most major U.S. banks will let a teenager open a bank account as long as you have a parent or guardian present.

We recommend Chase just because it’s the largest. But, other options like Bank of America, Wells Fargo, Citi, or U.S. Bank will likely give you a similar experience.

While they’re not specifically advertised as money apps for teens, simply opening an account with a major bank is one of the best ways to start your financial journey off on the right foot.

Price: Free

5. Copper Banking – The Best Alternative to Greenlight

Copper Banking describes itself as “the bank that you wish you had growing up”.

Like Greenlight, it offers a banking platform that’s built entirely for kids and offers services like:

- A debit card

- Free access to 55,000 ATMs

- Extensive resources to learn about money

- Early payments

- Smart savings goals

Copper Banking also realizes that financial literacy isn’t taught in the American school system. They’re taking it upon themselves to teach America’s youth about money.

While Copper Banking is a great example of an awesome digital bank, it does not offer physical locations which is why it’s ranked below Chase and other national banks. Additionally, Copper Banking only has 800,000 members, compared to over 5 million on Greenlight.

Copper Banking is incredibly similar to Greenlight, with a slightly different user experience. If you’re interested in one, I would try both and choose which one works best for you.

Price: Free

6. Stash – The Best Mobile-Friendly Investment App for Teens

Stash is another one of the best stock apps for teens that gears itself towards helping beginners get started investing in the stock market.

Like Vanguard, Stash has a specific feature for creating custodial accounts.

What separates Stash from other investment accounts is that its mobile app is incredibly easy to use. Legacy brokers, like Vanguard, have a complicated investing experience and a poorly designed app.

The user experience on Stash is the opposite.

Additionally, it will ask you about your financial goals and help put your savings and investing on autopilot.

On top of that, it’s got plenty of educational resources if you’re new to investing.

Price: Stash offers $3/month or $9/month plans depending on your needs

7. EarlyBird – The Best Teen Investment App for Gifting

EarlyBird is a money app for teens that specializes in helping parents invest on their kid’s behalf and allows friends and family to gift money to a child.

EarlyBird offers 5 ETF-only portfolios with investing goals ranging from conservative to aggressive.

Its “Moments” feature allows parents to attach photos or videos on their child’s timeline to capture special milestones to go alongside their investments. This is a unique feature, especially considering friends and relatives can also record messages when gifting investments.

EarlyBird also has one of the only crypto wallets for kids. So, if you’re a big believer in the future of crypto then you’ll definitely want to check out this money app.

Price: $2.95/month for one child or $4.95/month for a family

8. UNest – The Best Alternative to EarlyBird

UNest is another app that presents itself as one of the go-to investment apps for minors.

It works very similarly to EarlyBird, where a parent or guardian can open an investment account on your behalf. It even has the “gifting” functionality of EarlyBird as well as the ability to buy crypto.

The primary benefit of UNest is its partner program. It has an extensive rewards program that helps you save with brands like Disney+, Doordash, Uber, or Nike.

Price: $2.99/month for one child or $5.98/month for a family

9. GoHenry – The Best Budgeting App for Teens

GoHenry is a money app that doubles as both a debit card and a hub for learning about money.

GoHenry is a banking app for teens that links your online bank account to a debit card for each of your children. You can manage the money held in each account and set parental controls from the app or online account portal.

After signing up for GoHenry, you will receive your children’s debit cards in the mail 7 business days later. From there, you can set up automatic weekly transfers, set weekly spending limits, choose which stores your kids can shop, and block/unblock each card.

There are no overdraft fees or accruing debt.

Additionally, through its Money Missions feature, GoHenry turns learning about money into a game by allowing your kids to earn badges, points, and level up as they watch videos, listen to stories, and complete quizzes.

There are 3 different levels in GoHenry depending on your child’s age:

- Level 1: Money basics (ages 6+)

- Level 2: Created for ages 12-14

- Level 3: Created for ages 15-18 (still in development)

GoHenry is easily one of the best budgeting apps for teens in 2025.

Price: $4.99/month for one child or $9.98/month for a family (after a free 30-day trial)

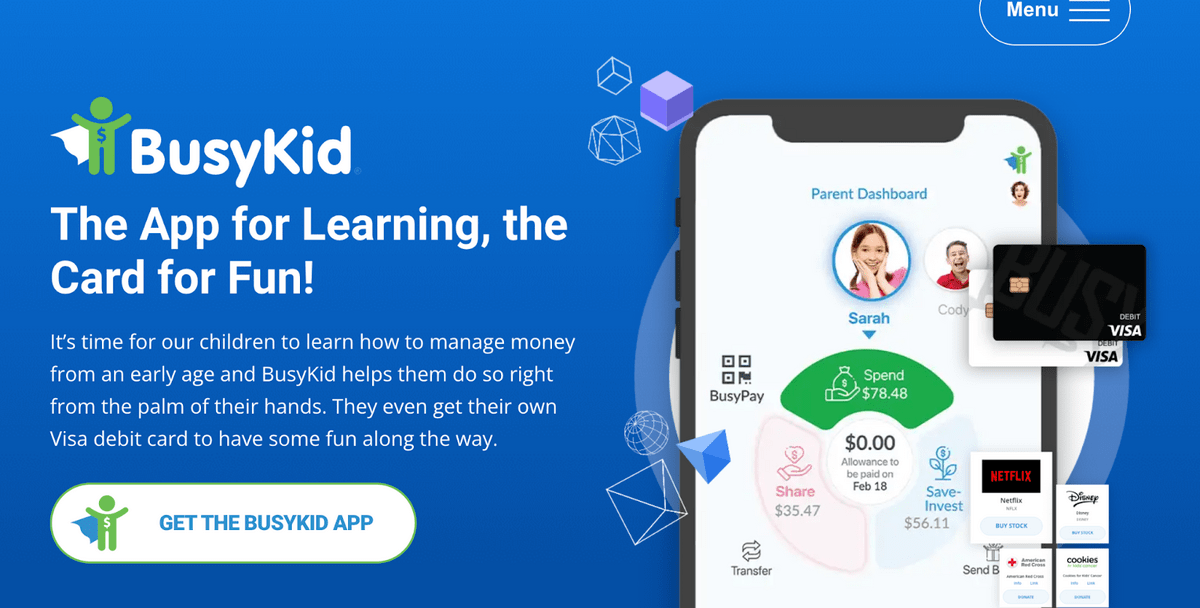

10. BusyKid – The Best Budgeting App for Kids (who do chores!)

BusyKid is a kids money app and another one of the best budget apps for teens and pre-teens that will teach them real life lessons about managing money.

BusyKid is best known for its Chores feature, where you can set a chore chart and automatically reward your kids for completing their work.

Additionally, BusyKid integrates allowances, (light) investing, bonuses, and charitable giving.

Its aim is to help your kids become motivated, accountable, responsible, and money smart. It’s easily one of the best apps for teens to make money.

Where was this when I was a kid?

Price: $4/month

11. FamZoo – The Best BusyKid Alternative

FamZoo is another kids money app whose main product is prepaid debit cards for kids.

These debit cards allow you to easily spend money, get paid for chores that you do around the house, and track/budget your spending.

FamZoo also doubles as a financial literacy app, which it does better than BusyKid.

Price: $3.33/month

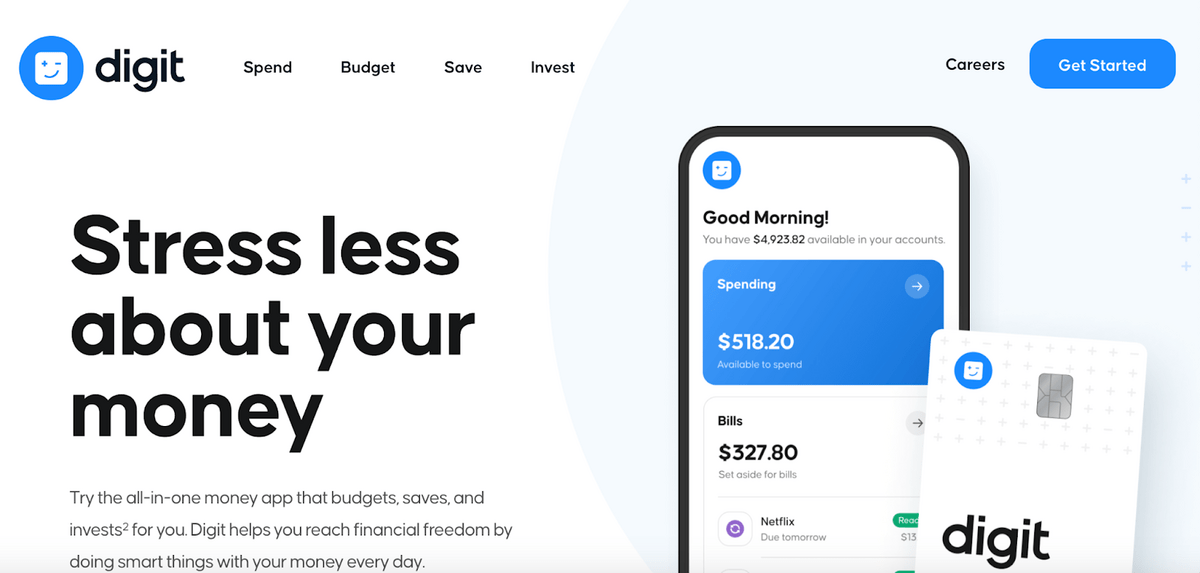

12. Digit – The Best Automated Money App for Teens

Digit is an all-in-one financial app that helps you spend, budget, save, and invest via automation.

Digit analyzes your income, account balances, upcoming bills, recent spending, and personalized preferences to calculate how much you can save and invest.

Then, it automatically transfers that amount into your Digit savings account. This eliminates the guesswork on how much you can safely save and forces you to be responsible with your money.

It has an easy-to-use interface and is ranked #6 on our list of the best money saving apps.

Price: $5/month

13. Cash App – The Best Money App for Teens for Sending Money

Cash App is one of the most popular money-sending apps in the U.S. and if you’re looking for a way to send and receive money, it’s one of the best money apps for teens.

While most payment apps are reserved for people 18+, Cash App will let teens 13+ sign up as long as they have approval from a parent/guardian.

For teens, Cash App is perfect for sending money to friends or siblings.

For parents, it’s a convenient way to send your kids spending money without constantly needing to take out cash.

Price: Free

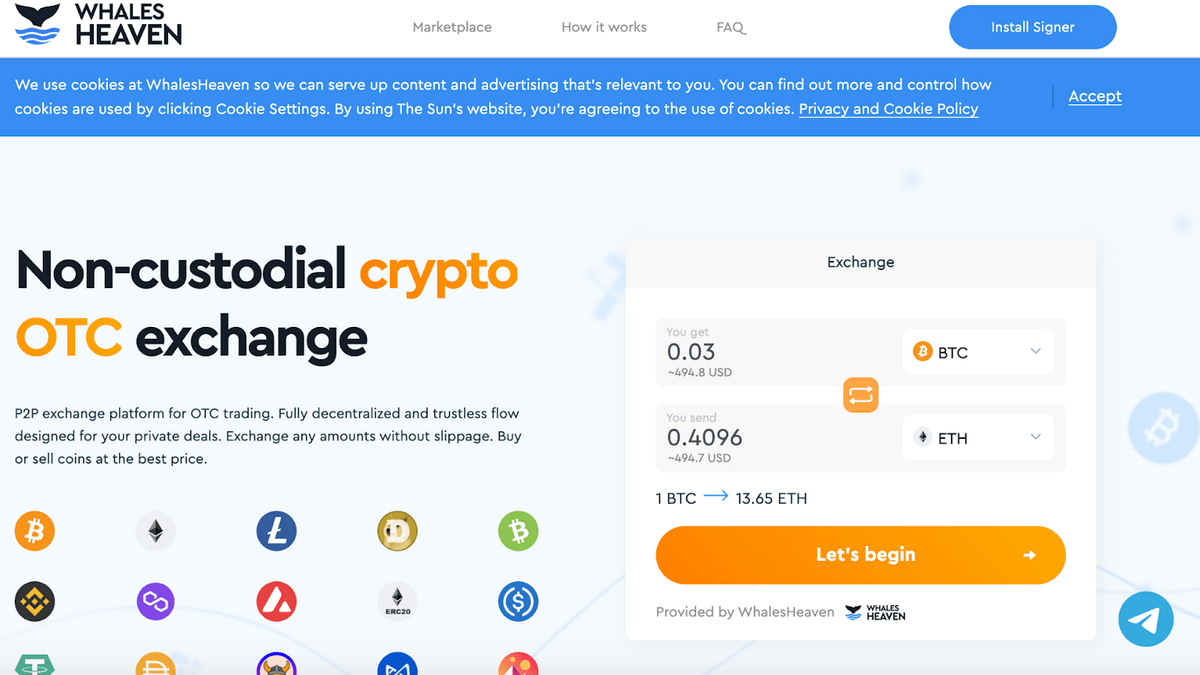

14. WhalesHeaven – The Best Non-Custodial Crypto App

WhalesHeaven is a cryptocurrency exchange that allows minors (under 18 years old) to invest in cryptocurrencies like Bitcoin and Ethereum.

If you’re bullish on the future of digital currency, you may want to look into WhalesHeaven.

This investment app for teens is not higher on the list for obvious reasons: Cryptocurrency is quite volatile and more than a little complicated.

If you’re a teenager, please talk to your parents before you sign up and start buying crypto. Additionally, you should only ever buy crypto with money that you’d be comfortable losing.

Price: Free

Final Word: The Best Money Apps for Under 18 Years Old

This article has laid out plenty of options for apps that excel in budgeting, investing, spending, crypto, and financial education.

Now, it’s just a matter of trying out a few and picking the one that works best for you!

FAQs:

What money app can I use under 18?

You can use Vanguard, Fidelity, EarlyBird, UNest, GoHenry, BusyKid, Copper Bank, FamZoo, Digit, and Cash App are all money apps that you can use under 18.

You may need a parent or guardian to help you open a custodial account.

What money app can a 14 year old use?

EarlyBird, UNest, GoHenry, BusyKid, Copper Bank, FamZoo, Digit, and Cash App are all money apps that you can use as a 14 year old.

My personal favorites are GoHenry and BusyKid.

Is there a money app for kids?

EarlyBird, UNest, GoHenry, BusyKid, Copper Bank, FamZoo, Digit, and Cash App are all money apps for kids.

What app can I use to invest at 16?

Acorns, Stash, Vanguard, Digit, and EarlyBird are all apps that you can use to invest at 16.

What are the best money apps for teens?

Some of the best money apps for teens are Vanguard, Fidelity, Acorns, Greenlight, Stash, Digit, GoHenry, CopperBank, and EarlyBird.

Be sure to read the details of each to find the best app for you and your goals.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.