Whether we are in a bull market or a recession, a well-crafted portfolio can be one of the greatest gifts parents can give to their children.

Plus, child investment plans have benefits compared to regular retail investing, including…

- They come with big tax advantages.

- The magic of compound interest. If you stick with it, in a decade or two, a little money can become a golden nest egg.

But how to get started? Good news: you don’t have to Google “Best investment plan for child future” and hope for the best. I’ve got you. In this article, we will go through all the types of investment assets, custodial accounts, and other tools that can help you build an efficient and safe portfolio for your kids.

The best FREE resource to teach children financial literacy is…

Modak is an invaluable (and FREE) tool to help teach children essential money management skills. Designed with a kid-friendly interface, it introduces financial literacy through interactive lessons, games, and real-life budgeting scenarios, making complex concepts like saving, spending, and earning understandable and fun.

Modak encourages responsible financial behavior by allowing kids to set savings goals, earn “allowance” through tasks, and even track their spending with parental guidance. Smarter financial health starts here — create your FREE account today.

The 6 Best Investments for Kids:

1. Stocks

Owning a stock means participating directly in the success or failure of a company.

Stocks are the asset class with the highest growth potential but they also carry risk—if a company starts performing poorly or goes bankrupt, its shares will lose value.

If you believe a particular company will do well in the future, by all means, buy its shares. But also consider diversifying into multiple stocks or buying an ETF to minimize any risks.

As for a broker? Depends on your goals. If you want to invest the money yourself and save it for your kids, we suggest eToro*, which offers free stock trading and a popular CopyTrader feature where you can follow professional traders’ real-life trades.

If you’re interested in a custodial account, consider M1 Finance or Acorns Early. For more ideas, check out our article about stocks for kids.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Interested in investing for your kids? Check out some of these top-rated brokerage accounts:

Best interface: Acorns Early

Best features: Fidelity

Best for advanced features: M1 Finance

Best for flexibility: UNest

2. Exchange-Traded Funds (ETFs)

Getting a bundle of different stocks is much safer than putting all your eggs in one basket. That’s why many people consider ETFs the best investment for kids.

A single ETF represents a grouping of different stocks that are meant to give you an average stock market return, rather than tying all your cash to one company.

An ETF can track the overall performance of the market or be focused on a particular industry like tech or healthcare. You can also use ETFs to bet on commodity prices. For example, the ETF ticker WOOD tracks the lumber industry.

Worth noting: ETFs may charge small yearly fees that are usually less than 1% of your position with the fund.

Note: If you are looking for a super intuitive online investment platform with free stock and ETF trading, check out M1 Finance — I think the simplicity of this platform makes it one of the best tools to build a child’s portfolio.

3. Mutual Funds

Like ETFs, mutual funds are companies that invest in different stocks on behalf of their shareholders, giving you a diversified position in the market.

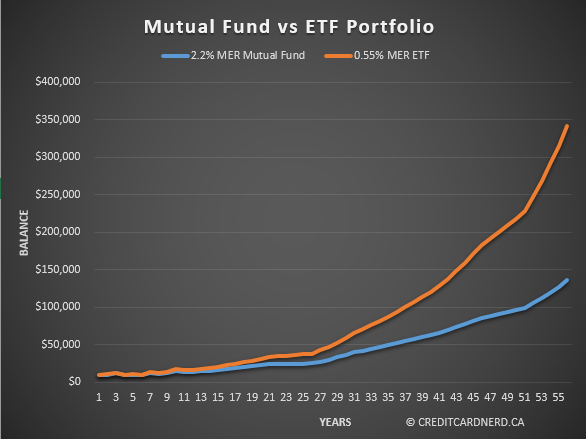

Unlike ETFs, mutual funds are actively managed—they regularly readjust their positions and strive to optimize performance. They also charge more in fees than ETFs.

But do your research before buying mutual funds. Despite being actively managed, mutual funds have been underperforming ETFs on average for the past couple of decades. Oftentimes, a mutual fund isn’t worth the higher fees and you can just get an ETF.

Note: If you went to put some of your money into good mutual funds, check out Fidelity. This major brokerage has its own professionally-managed funds and offers better prices than nearly all of its competitors.

4. Life Insurance Policy

First and foremost, a life insurance policy is financial protection for your family in case the worst comes to pass.

But insurance policies are also the safest investment vehicles, and they can generate good returns with no risk. Here is how:

- When you deposit money into your insurance policy, the insurers use it to buy investment assets like bonds or options on equity indices. These policies can generate from 1% to 10% in an average year.

- Risks are minimal because the money is mainly in bonds. The insurer can invest in equity options using a part of your returns — if they lose, you still won’t go into negative because options have a fixed maximum loss.

- If you want to use your policy money, you don’t have to withdraw it — you can typically borrow that amount from the insurer and pay them back an interest rate lower than what they are asking.

All in all, it is wise to store a part of your child’s portfolio in something like universal indexed life insurance (UIL) because it can generate solid returns while being practically risk-free and liquid (due to the borrowing option).

The best way to find a good life insurance deal like this is probably through an insurance broker.

5. Cash

It is always good to have some cash ready for any emergencies or investment opportunities. But the value of cash can be eaten by inflation, which can present a problem over time.

To fix this problem, store your cash savings in a high-yield savings bank account. That way, the money earns interest that will offset the effect of inflation, but you can easily access it when needed.

One of the highest-yield accounts you can get right now is at CIT Bank, which offers individual and custodial accounts. If you have more than $5,000 to invest, you could score up to 4.35% APY with their Platinum Savings account; even their Savings Connect Account, which has a $100 minimum, offers a respectable 4.00% APY.

To put that in perspective, even big banks like Capital One only offer about 4.15%. That might not seem like a big difference, but it does start making a difference over time:

- $10K account, 4.15% interest ➡️ 10 years: $15,017.33

- $10K account, 4.35% interest ➡️ 10 years: $15,308.49

Hey, every bit matters!

6. Bonds

Are bonds the best investment for kids? Maybe not, but they are probably the safest — especially U.S. Treasury bonds.

Here is how they work: Let’s say you buy a 5-year bond with a 5% yield for $1,000. This means the bond will pay you 5% per year ($50 in this case) for 5 years. After that, you get your full premium of $1,000 back.

That’s a total of $1,250 after 5 years.

Other investments might have better returns, but with bonds, you know what you will get. The returns are guaranteed by the U.S. government.

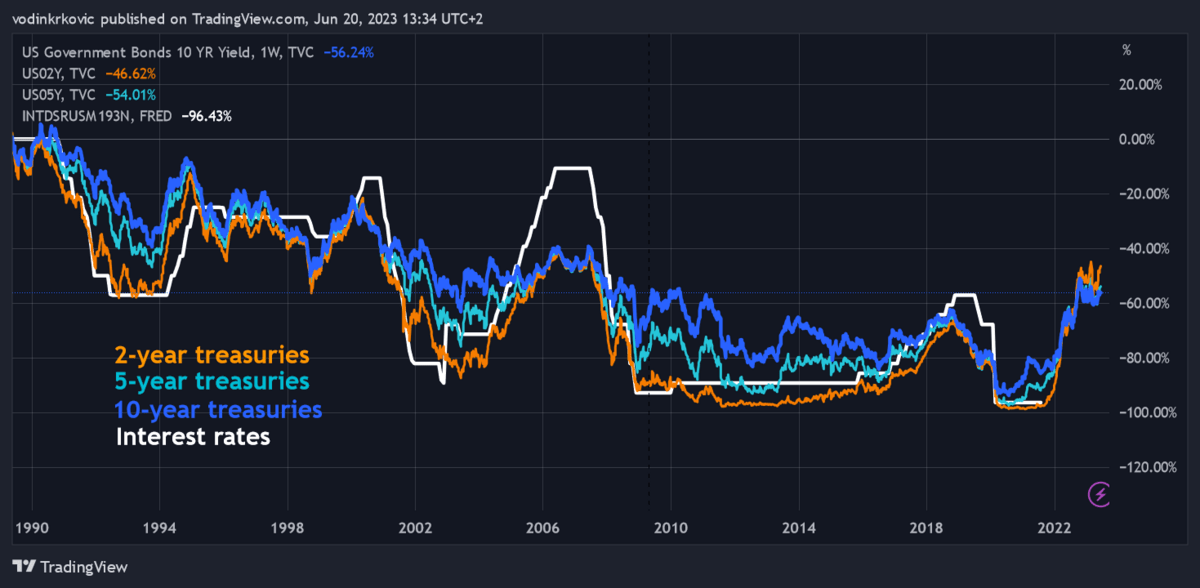

Plus, market turmoil and changes in interest rates may give you the opportunity to sell your bonds at a higher price than what you paid for them—high-yield bonds are usually in demand when stocks are going down.

This is one of the reasons why inventors use bonds to hedge against market crashes.

Note: You can buy Treasury bonds directly at TreasuryDirect.gov, but my favorite way to invest is with Public’s Bond Account, which currently offers yields over 6%.

The way it works is pretty simple:

- Fund your account — your deposit will go toward a portfolio of 10 investment-grade and high-yield corporate bonds.

- Get paid monthly! Public’s Bond Account generates a monthly yield; when your income reaches $1,000, it’s automatically reinvested.

- If you hold to the maturity date, you’ll receive the highest yield; however, you can withdraw early.

One caveat? While a Bond Account is currently fee-free on Public, it will carry a $3.99 monthly fee starting in 2025 unless you upgrade your account. Take advantage of the high rates now!

The 4 Best Investment Accounts for Kids:

1. Custodial Roth IRA

This is a joint retirement account where the parents help their working-age child prepare their retirement portfolio with regular contributions.

Investable assets:

- Stocks

- Bonds

- ETFs

- Mutual funds

- Cash

Best for: Families where the child has some form of income and wants to start saving for retirement early.

Taxes: Contributions are made with after-tax money, so they don’t affect your taxable income. All withdrawals (including early withdrawals) are tax-free and penalty-free—note that regular IRAs typically incur a 10% penalty if you withdraw funds before retirement.

Legal conditions: Contributions in a custodial Roth IRA are limited — for example, in 2023, the limit was $6,500 per year. There is no age requirement for the child, but they need to have earned income to qualify for this account.

Note: The best broker for this type of account is M1 Finance — they even got an award for having the best Roth IRA Accounts in 2020.

2. Joint Brokerage Account

This is a regular taxable brokerage account you share with your child—it is easy to rebalance and manage your portfolio through this account as it has no restrictions like some tax-advantaged accounts. Plus, it offers the most in terms of investment options.

Investable assets:

- Stocks

- Bonds

- ETFs

- Mutual funds

- Cash

- Commodities

- Options

- Futures

Best for: Parents who want to manage their child’s portfolio actively or want to invest in instruments like options and futures (which are not available in other account types). A joint brokerage account can be sold off and withdrawn quickly and used for any purpose, but isn’t ideal for retirement investing.

Taxes: The adult is taxed for all income, gains, and losses made through this account—this can push the adult into a higher tax bracket.

Legal conditions: Only an adult (parent, trusted adult, or legal guardian) can open a joint brokerage account for a child. The portfolio belongs to the child but only the adult can make transactions up until the child reaches the age of majority.

Note: If you want the full flexibility of a joint brokerage account with minimal hassle, M1 Finance is probably for you. On the other hand, if you want to manage the portfolio actively, a broker like Fidelity is probably a better choice.

3. UTMA/UGMA Trust Account

Uniform Transfers to Minors Act (UTMA) and Uniform Gifts to Minors Act (UGMA) accounts are custodial accounts that let parents save and invest on behalf of their kids. They can hold a variety of investments and come with tax advantages

Assets:

- Stocks

- Bonds

- ETFs

- Mutual funds

- Cash

- Annuities (depending on provider)

- Life insurance policies (depending on provider)

- Real estate

- Fine art

- Patents

Who it is best for: Parents who want to invest passively into a young child’s portfolio (child who doesn’t have any income). Also, parents who want to invest in alternative assets.

Taxes: These accounts are subject to the “kiddie tax” which changes slightly from year to year. Namely, in 2023, the first $1,250 of the portfolio’s income (cap. Gains, interest, and dividends) is tax-free. The next $1,250 is taxed according to the child’s rate, and anything above $2,500 is taxed at the parent’s rate.

Legal conditions: For both accounts, the child becomes the sole owner of the account upon reaching the legal age of majority.

Acorns Early is a top UTMA/UGMA account offered by American fintech company Acorns.

The platform makes it easy to manage your investments and your kids’ in one place. Plus, you get access perks like their Round Up feature, which allows you to round up to the next dollar on purchases and invest small change that you probably won’t even miss.

4. 529 College Savings Plan

This is a tax-advantaged account designed specifically for education savings. Usually, it’s composed of:

- A limited number of mutual funds

- Some ETFs

- Cash

- FDIC-protected money market accounts

Who it is best for: Parents who want to invest money specifically for a child’s education.

Taxes: Earnings grow tax-free and withdrawals are also tax-free if the money is used for a qualified educational expense. Some states even offer income tax deductions if you make contributions to your child’s 529.

Legal Conditions: The penalty for withdrawing money for anything outside of education can be as high as 10% and you would also need to pay regular taxes on all your capital gains and income.

5. Custodial Bank Account

This is the simplest way to save up cash for your child. It is essentially a regular bank account (controlled by the parent for the child) with some tax advantages.

- Cash

- Certificates of Deposit (CDs)

Who it is best for: Parents who want to have an emergency cash fund specifically for their child.

Taxes: Interest earned is taxed via the same “kiddie tax” that applies to UTMA/UGMA accounts.

Legal conditions: Once the child reaches the age of majority, they gain control over the account.

Note: If you are looking for a user-friendly custodial bank account, consider checking out Varo Bank — it offers low fees, above-average interest rates, and a very intuitive online app.

Why Investing for Kids is Important

Here are 3 reasons to convince you that investing for your kids is crucial:

1. Financial Safety Net

The baseline ambition of every person is to be healthy, have a home, and have a decent education.

Nowadays, all of these things are becoming prohibitively expensive — mortgages take decades to pay off, healthcare is insane, and student loans are even worse.

A solid portfolio can be a safety net, but also a foundation your child can build upon without having to spend their 20s and 30s paying off loans.

2. The Power of Compounding Interest Over Time

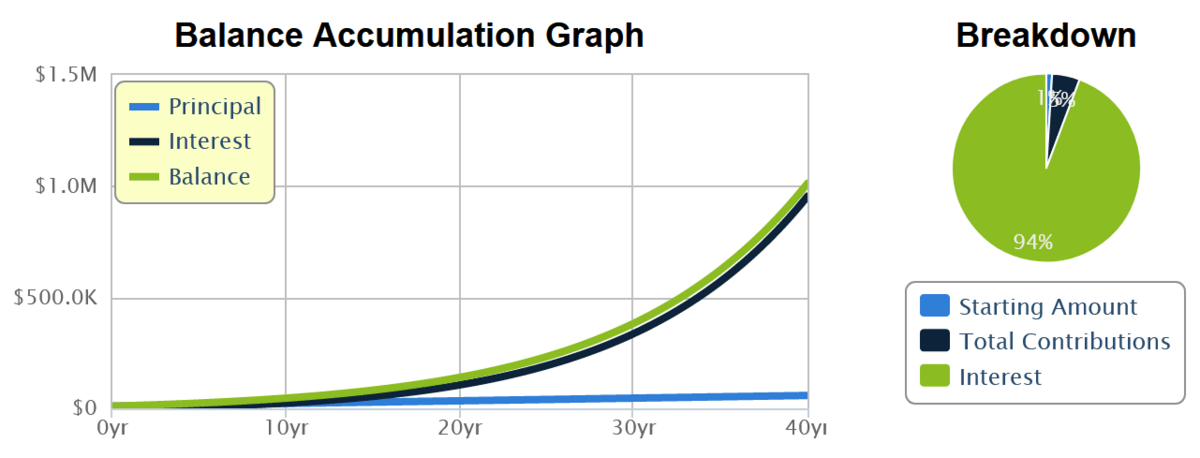

Say you have a child on the way and $10,000 saved up. You put the money into a balanced portfolio that tracks the average performance of the stock market — historically, that has been about 10% per year.

If you do the math, it turns out that by the time your child turns 20, that $10,000 has turned into $67,274.

Not a bad safety net. But if you’ve been depositing $100 per month to the portfolio since day one, it will be almost $140,000 by your child’s 20th birthday. In 10 more years, that turns to $382,000, and by the time the child is 40 years old, that turns to a little over $1 million.

It is not exciting, it is not quick, but it works. The earlier you start, the better.

3. It Sets a Powerful Example

By investing for your kids, you teach them the importance of financial planning.

They will likely learn the basics of investing and financial literacy. This education can be transformative as it will equip them with the ability to manage and grow their finances throughout their lives.

4. It Helps Kids Adapt to a New Environment

The world is changing, and every year that change is becoming faster. How will the economy look 20 years from now with all the new technology and aging population?

Who knows… The future is uncertain, and an investment portfolio should help your family adapt to whatever new environment the future may bring.

The Best Long-Term Investment for Child

No asset class is risk-free. They all have ups and downs.

Therefore, the best long-term investment for your child is probably a portfolio diversified over various asset classes and industries. This approach can generate average returns but keeps your risk levels low.

What is the Best Investment for a Child’s Future?

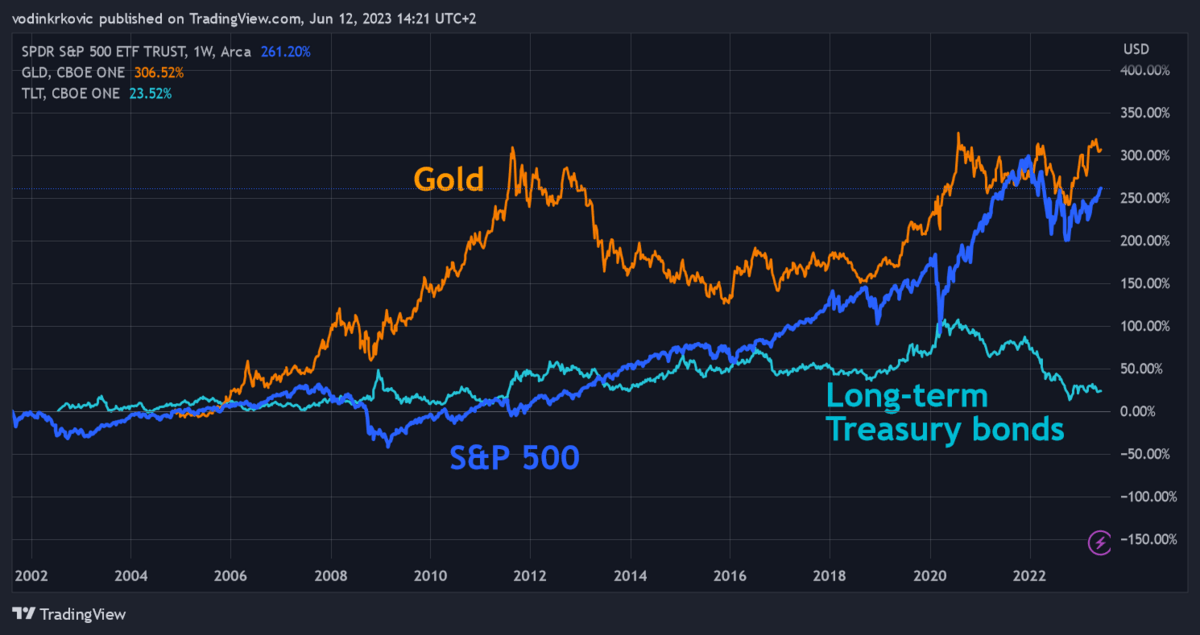

The simplest way to diversify is to buy ETFs for all industries and assets you think will be relevant in the future.

A balanced selection of equity, commodities, fixed income, and gold will give you a portfolio that works like a team:

For example, gold and bonds usually do well if the stock market crashes. When stocks are doing well, the money moves to them — and commodities are not correlated to either.

That can help you get a steady average return over a long period and avoid losing too much in a bear market.

Pro tip: To make sure you don’t pay much in taxes or brokerage fees, consider getting a Custodial Roth IRA with M1 Finance — this award-winning broker has almost every ETF on the market (commission-free), and has one of the most intuitive passive investing platforms.

Final Word: Best Investment for Kids

I’ve offered several examples of investment strategies for kids in this article — the right mix of investments will depend on your investing style and objectives.

No matter what approach you choose, don’t delay. The earlier you start and the more strategic you are, the quicker your child’s portfolio will grow.

FAQs:

What is the Best Investment Plan for My Child?

A combo of investment plans is usually the best option. For example, 529 plans are best for college savings, UGMA/UTMA accounts are great for passive investment for underaged children, and a custodial IRA is made for children who earn an income.

How to Invest $1,000 for My Child?

Small investments make the most sense when they are fairly aggressive. Investing $1,000 in ETFs that give broad market exposure with a tax-advantaged UGMA/UTMA account is one of the most growth-oriented methods for casual investors.

Can You Start a 401k for Your Child?

No, a 401k is an employer-sponsored retirement plan, so you cannot start one for your child. However, you can contribute to a custodial Roth IRA if your child has income. The best investment plan for a child’s future is usually an UGMA or UTMA account.

What’s the best investment for child future?

The best investment for a child’s future often involves a portfolio diversified over multiple asset classes and putting it in a tax-advantaged custodial account. This method should give you average returns that can add up given enough time.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.