Ready to take charge of your financial destiny, but not sure how to invest 20k? The good news is that with $20,000 at your disposal, you have plenty of opportunities to invest wisely.

But it’s important to do your research on different asset classes before you invest. Every investment has its own set of risks, and its own unique return potential.

Luckily for you, I reveal the risk level and potential returns of every best way to invest 20k below.

Here’s how to invest $20000:

The 10 Best Ways to Invest $20k in 2025

Whether you’re looking for the best ways to invest $20K (or even looking into ways to invest $50K), consider this list a great starting point.

1. Alternative Assets

- Risk level: 3/5

- Potential returns: Medium to High

An alternative investment is basically anything beyond your traditional investment vehicles (stocks and bonds). They can provide exciting opportunities — but the sheer amount of investment platforms and options can be intimidating.

If you’re wondering how to invest 20k and you’re interested in alternatives, consider:

- Art

- Transportation

- Legal finance

- Private equity

- Private credit

These asset classes can provide diversification and potentially higher returns.

If art sounds up your alley, there’s a platform that I think stands out — Masterworks. Why? Because it allows both accredited and non-accredited investors to buy fractional shares in valuable artwork by names that even non-aficionados will recognize, like Warhol and Banksy.

With Masterworks, you can participate in the art market without needing to purchase an entire artwork yourself. Plus, the platform’s track record is mighty compelling. Here’s an example of why.

Recently, investors were able to collect a 77.3% annualized net return in less than a year through an exited work offered by the fractional art investment platform Masterworks. Of course, those results are exceptional, but investors have recently secured 14.6%, 16.4%, and 17.6% annualized returns from other offerings.

I should mention — you don’t need to be an accredited investor, but you might need to wait — Masterworks has a waitlist. But you can click below to skip it and get started.

2. Stocks

- Risk level: Varies

- Potential returns: High

Stocks are a key component of any diversified portfolio. Happily, you can choose your own adventure with how much you invest and what you invest in.

If you’re wondering how to invest 20000 dollars in the stock market, you have no shortage of options, including:

- Individual stocks

- Dividend stocks

- Index funds

- Actively managed funds

The main advantage of individual stock investing is that this method allows you to handpick companies you believe in. Index funds, on the other hand, provide instant diversification across the broader market.

Stock trading can be risky — so it’s essential to research and select companies with strong fundamentals.

Want to know what stocks pro analysts like? WallStreetZen’s Top Analysts, you can.

Our algorithm ranks analysts so you can follow the top performers and see their most recent updates. It’s a premium feature on our site — try it today!

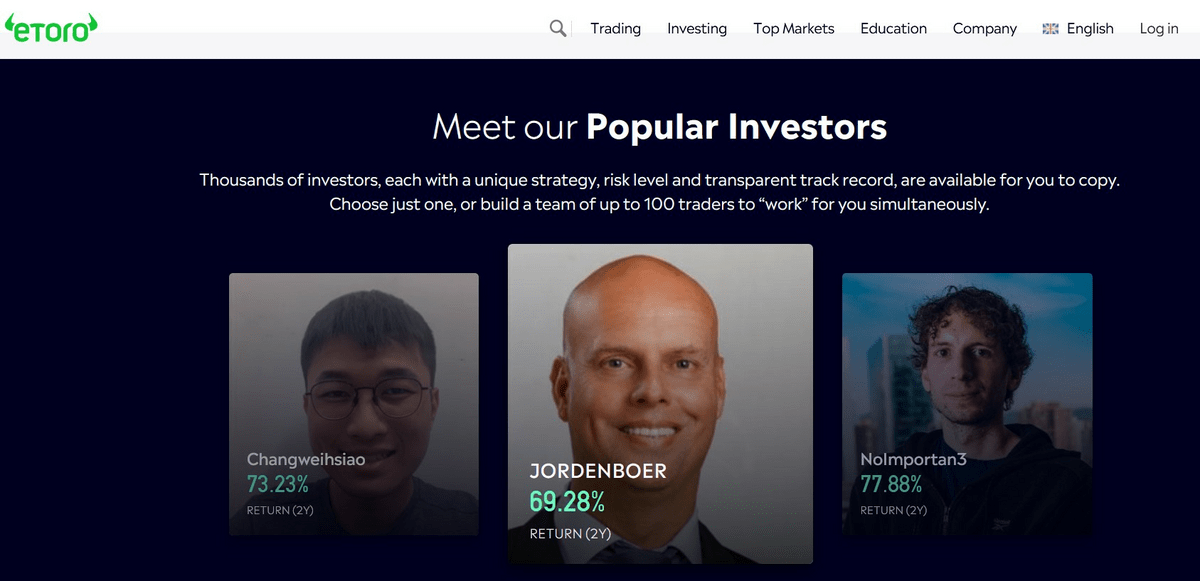

A platform like eToro can be an excellent choice for trading stocks, as it provides a user-friendly interface and access to a wide range of investment options.

With eToro, you can even follow other traders and clone the moves they’re making in their portfolio. It’s a great way to watch and learn from the pros.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Then again, if you’re not interested in stock research, the best way to invest 20k is likely by choosing index funds for the majority of your stock market exposure.

3. Bonds

- Risk level: 1/5

- Potential returns: Low

Wondering how to invest 20k and looking for stability and fixed income? Consider investing in bonds.

Bonds are debt securities issued by governments or corporations. They pay periodic interest and return the principal amount at maturity.

Two of the most popular types of bonds are government and corporate bonds:

- Government bonds are generally considered safer

- Corporate bonds offer higher yields but come with slightly higher risk.

What’s the right mix for you? Depends on your goals.

For example, if you’re wondering where to invest 20k because your net worth is $20-25k, you’re likely on the younger side. Bonds are almost certainly NOT the best way to invest 20k for younger people, as they can slow your portfolio growth. (I’ll talk about allocation more later on.)

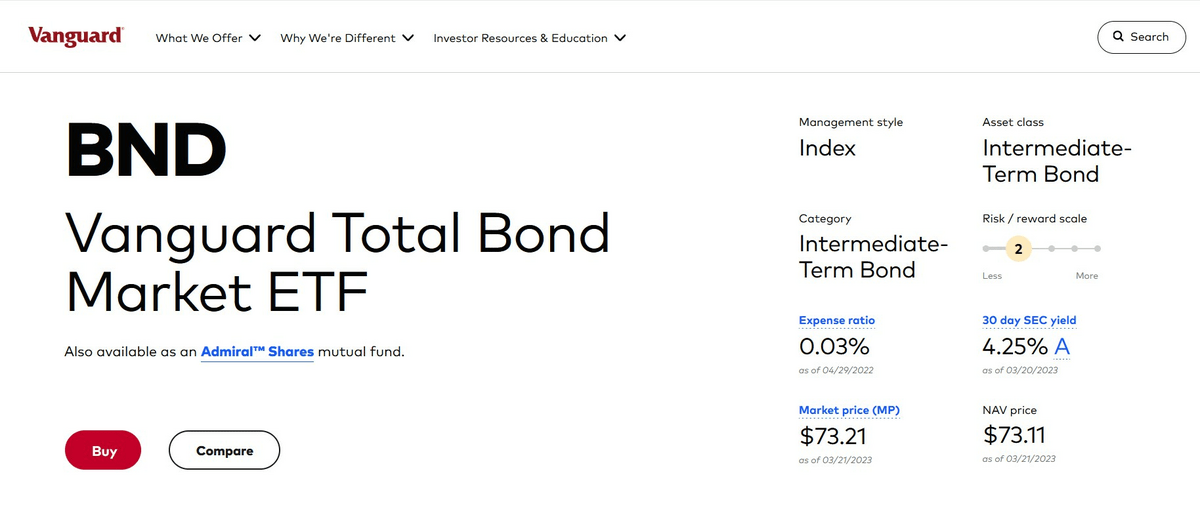

As for how to invest in bonds, you can actually buy individual bonds and treasuries from the government, but I prefer to keep it simple with a bond fund. A solid choice is Vanguard’s BND, which gives you exposure to the total US bond market:

You can invest in BND and other bond funds on brokerage apps like M1 Finance.

4. Real Estate

- Risk level: (2.5/5)

- Potential returns: Medium to High

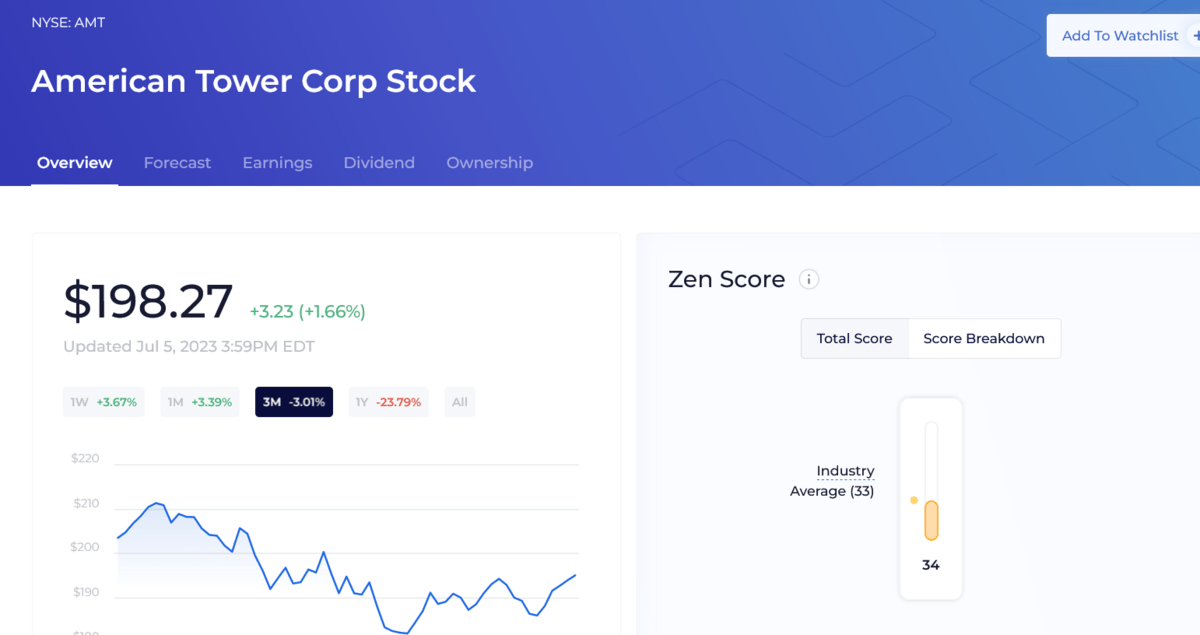

If you’re wondering how to invest 20k in real estate, you have two primary avenues: REITs (Real Estate Investment Trusts) or rental properties.

REITs allow you to invest in real estate without the hassle of property management, providing instant access to a diversified portfolio of income-generating properties.

The cool thing about REITs is they give you access to types of real estate that might be very difficult for you to invest in privately — from cell towers to farmland to luxury shopping malls.

Using WallStreetZen, you can easily find REITs in different subsectors and do your own due diligence on the financials and analyst estimates:

On the other hand, owning rental properties can offer you more control, and potentially more cash flow and appreciation. Of course, this comes with more responsibility.

Another downside with owning properties yourself: if you’re wondering the best way to invest 25k, you probably don’t have the hundreds of thousands of dollars that are required to get exposure to some deals on the private real estate market.

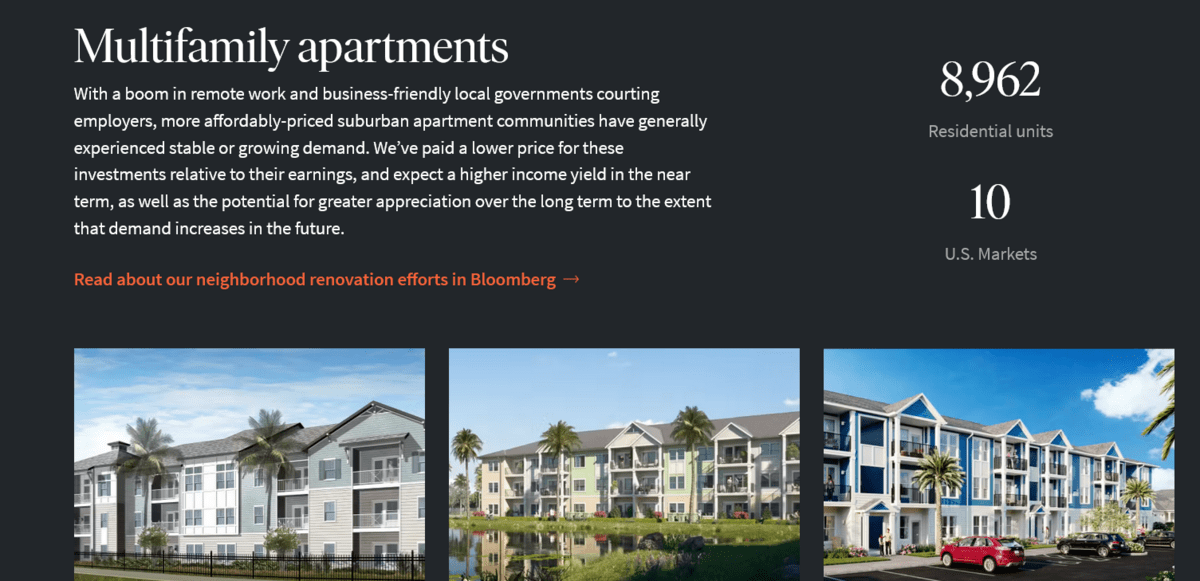

Luckily, there are several real estate investing platforms like Fundrise, which let you invest in private real estate without having to face the hassle of doing everything yourself.

Fundrise gives you access to real estate assets that would be difficult to invest in on your own… like big multifamily apartment complexes:

Note: We earn a commission for this endorsement of Fundrise.

5. High-Yield Savings

- Risk level: (1/5)

- Potential returns: Low

The best way to invest 25k if you prioritize safety and liquidity over everything else is with a high-yield savings account. They offer higher interest rates than traditional savings accounts so your money can grow faster.

While the potential returns may be lower compared to other investment options, high-yield savings accounts serve as a reliable place to park your cash for short-term goals or emergencies.

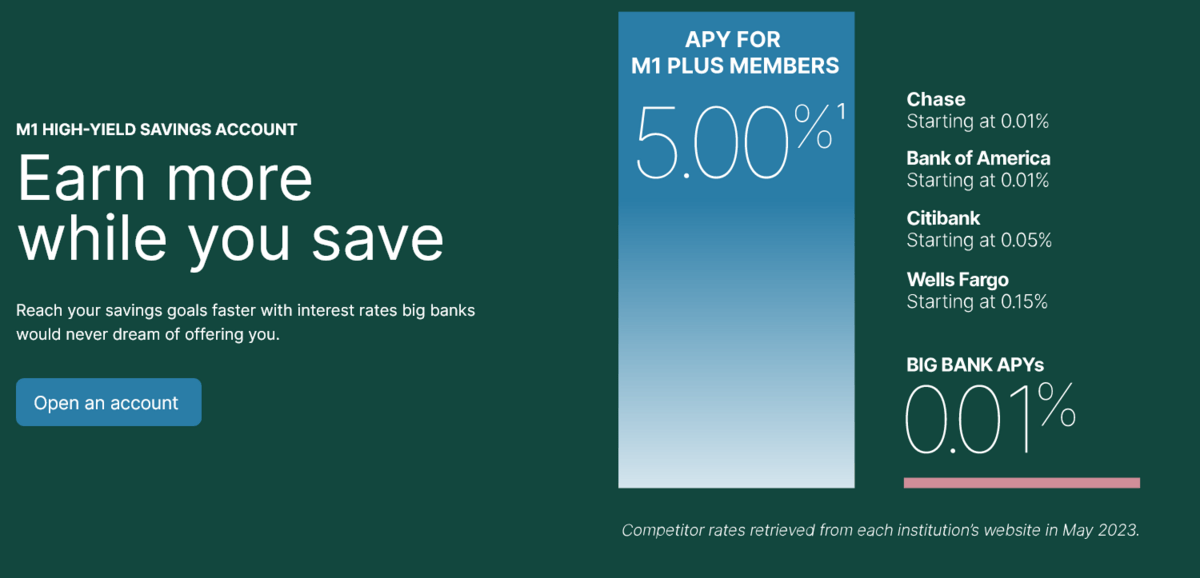

Platforms like M1 Finance provide high-yield cash accounts with competitive interest rates, making it a great place to park cash if you’re wondering how to invest $25000 with very little risk.

6. Pay off Debt

- Risk level: (1/5)

- Potential returns: Medium to Very High

Paying off debt might not sound like an investment decision. But it can actually be one of the wisest investment decisions you can make if you’re wondering how to invest 20k.

By reducing high-interest debt, you effectively earn a guaranteed return equal to the interest rate saved.

In other words, say you owe $3000 at a 12% interest rate. By paying off that debt, you are effectively “earning” a 12% return on the $3000 (in this case, you’d earn $360).

So starting off your investing journey by tackling debts with the highest interest rates, such as credit card debt or personal loans, is actually one of the best ways to invest 25k. Once you eliminate high-interest debts, you can redirect the money you were paying in interest toward other investments.

7. Invest in Your Family

- Risk level: (2/5)

- Potential returns: Very High

There’s no single best way to invest 25k for your family because the strategy can look completely different depending on you and your family’s situation.

As a rule of thumb, though, it’s always a good idea to build an emergency fund to protect against unexpected expenses or income disruptions. Especially if you have dependents.

Speaking of dependents, if you’re wondering how to invest 25k and you have a young family, you can consider giving them a head start. Consider starting a college savings plan or opening a custodial investment account for your children.

Acorns and similar platforms offer easy ways to invest small amounts regularly, making it convenient to invest in your family’s financial well-being.

Acorns Early is also one of the best ways to educate your kids about savings and investing from an early age. It allows them to set savings goals, track their progress, and visually see how their investments grow over time.

8. Private Credit

- Risk level: (3/5)

- Potential returns: Medium

Private credit involves lending directly to businesses or individuals. It can also potentially offer higher returns than traditional fixed-income investments like bonds.

Platforms like Percent provide access to private credit opportunities with varying risk levels. As an investor, you’ll gain access to a wide variety of high-yield, short-duration (9-month average) offerings that have historically paid over $28 million in interest.

And even though we’re talking about how to invest 25k, you can invest as little as $500 with Percent and unlock yields up to 20% APY.

That said, It’s crucial to carefully evaluate each opportunity when considering where to invest 20k.

Also, Percent is only available to accredited investors. So if you’re wondering where to invest 20k because your net worth is around 20k … the platform likely isn’t a fit for you.

9. Gold

- Risk level: (2/5)

- Potential returns: Medium

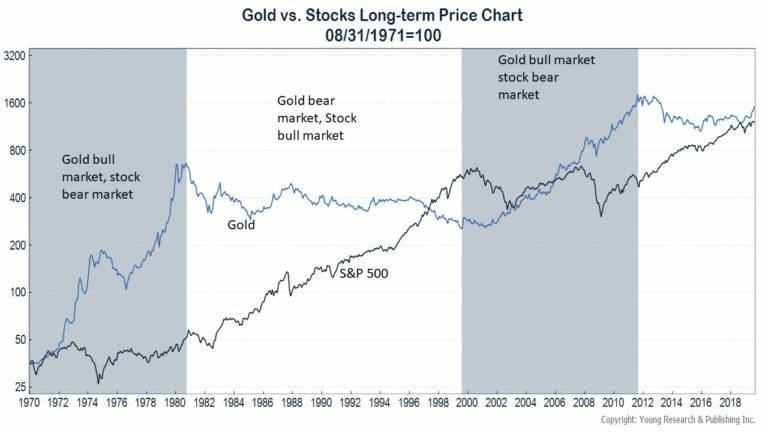

Gold has historically held its value and is considered a safe haven asset, so it’s another option if you’re wondering where to invest 20k.

More importantly, including gold in your investment portfolio can add diversification and act as a hedge against market volatility, as it tends to rise while stocks are in extended bear markets:

Wondering how to invest 25k in gold?

The first step is choosing between physical gold or paper investments such as gold exchange-traded funds (ETFs) like GLD.

So, where to invest 25k: Physical gold, or ETFs?

Here are the main pros and cons to weigh:

- Physical gold provides the advantage and security of owning a tangible asset

- Gold ETFs offer convenience and liquidity.

If you decide to opt for physical gold, platforms like Silver Gold Bull provide a trusted source for purchasing physical gold at great prices.

10. Retirement

- Risk level: (2/5)

- Potential returns: Medium to High

Whether you’re wondering how to invest 25k or 250k, don’t overlook the advantages of retirement accounts.

Take advantage of tax-advantaged accounts such as IRAs (Individual Retirement Accounts) or 401(k)s offered by your employer. (Related: Check out our best rollover IRA article.)

All of these accounts provide tax benefits and allow your investments to grow tax-free or tax-deferred. By maximizing contributions to your retirement accounts, you can harness the power of tax-advantaged compounding over time.

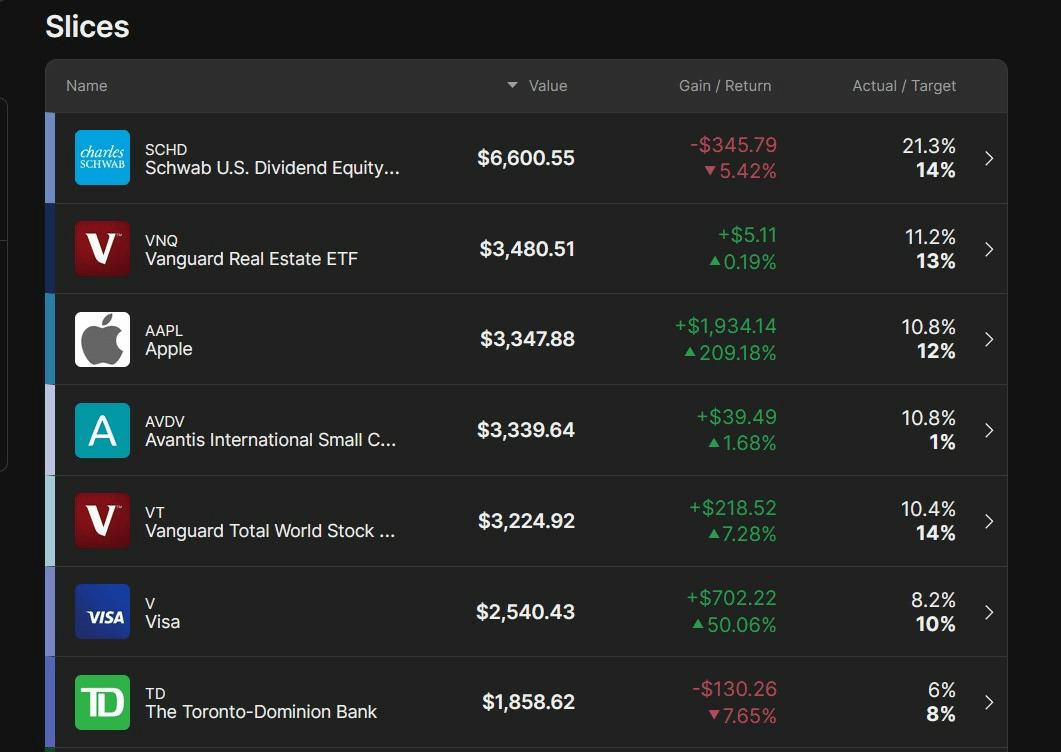

Many brokerages offer IRA accounts, but personally, I use M1 Finance for my Roth IRA:

I like that M1 offers automated investing options, fractional share investing, and the ability to invest in “pies” that you create, which makes it easy to visualize your investments.

The Importance of Tax-Advantaged Accounts

Why the emphasis on tax-advantaged accounts like IRAs?

The bottom line is that minimizing your tax liabilities is a way to maximize your investment returns. So if you’re wondering where to invest 25k, the best way to do so for the very long term is within these vehicles.

Here are a few reasons why tax-advantaged accounts can help fuel extra growth in your account over time:

- Tax-deferred Growth: With tax-advantaged accounts, you can grow your investments on a tax-deferred basis. Meaning you won’t pay taxes on the investment gains or dividends earned in the account until you withdraw funds. By deferring taxes, your investments have more potential to compound and grow over time.

- Tax-Free Withdrawals: Tax-advantaged accounts like Roth IRAs, offer tax-free withdrawals in retirement. This means you can enjoy investment earnings without having to pay taxes on them. Tax-free withdrawals can be a significant advantage, especially if you anticipate being in a higher tax bracket during retirement.

- Potential Tax Deductions: Contributing to certain tax-advantaged accounts, such as Traditional IRAs or 401(k)s, may offer tax deductions in the year of contribution. You can essentially write off contributions against your income (double-check with your account first, of course). These deductions can reduce your taxable income, potentially lowering your overall tax bill.

By utilizing tax-advantaged accounts strategically, you can optimize your investment returns and keep more of your hard-earned money in your pocket.

Best Way to Invest $20K: What About Allocation?

Deciding how to allocate your $20,000 investment depends on your financial goals, risk tolerance, and time horizon.

Diversifying your investments across various asset classes helps spread risk and optimize returns.

For example, when considering where to invest 25, you will likely want to diversify across a few of the following assets rather than concentrate entirely in just one:

- Alternatives

- Stocks

- Bonds

- Real estate

- High-yield savings

- Debt payoff

- Family investments

- Private credit

- Gold

- Retirement accounts

Generally speaking, if you have high-interest debt it’s best to pay that off first. This is because it’s the only investment return that is truly 100% guaranteed (you’re guaranteed to wipe out the interest you’d otherwise owe).

After that, you’re best off researching the ideal mix of different investments to provide you with your needed stability and growth potential.

For example, even if two people were both wondering where to invest 25k, the answer might be completely different depending on their goals:

- If you’re 60 years old and about to retire, you’ll likely want a higher percentage of your portfolio in bonds

- If you’re investing for your kids, these funds could be invested 100% in stocks because their time horizon is so long (20+ years)

- If you’re saving to buy a house, it’s best to keep this money in a high-yield savings account so that you aren’t exposed to large drawn downs

Bottom line: Deciding how to allocate your $20,000 investment depends on your financial goals, risk tolerance, and time horizon.

But how can you diversify your portfolio without being a slave to it?

Enter Empower (formerly Personal Capital). They have a FREE Investment Checkup tool that’s tailor-made to help you assess and manage your investments.

With the Investment Checkup tool, you can:

- Assess portfolio risk

- Review and analyze past performance

- Create individualized asset allocations.

Ultimately, the Investment Checkup tool helps you assess your personal mix of stocks, bonds, and other investments — and gives you feedback on whether or not your mix is aligned with your goals, risk tolerance, and current financial situation.

Once again — this tool is FREE.

Empower offers services for investors at any and every level, ranging from free tools like a Budget Planner and the aforementioned Investment Checkup tool to Financial Planning and Wealth Management services.

Regardless of where you’re at, it’s well worth signing up for the FREE dashboard. Your future self will thank you!

Final Word: How to invest $20k

So, what is the best investment for 20k? It depends entirely on you!

When it comes to investing $20,000, the key is to diversify your portfolio and consider your risk tolerance, investment goals, and time horizon. By spreading your investment across the different asset classes I detailed above, you can mitigate risks and maximize potential returns.

Here are some of the biggest takeaways to keep in mind if you’re still wondering where to invest 25k:

- Consider allocating a portion of your funds to alternative investments, such as art, transportation, legal finance, private equity, or private credit.

- Stocks should also be a part of your investment strategy. Whether you choose individual stocks or index funds, stocks offer the potential for high returns. Platforms like eToro make it easy to trade stocks and even learn from other successful investors.

- If you’re older, don’t overlook the stability and income potential of bonds. Vanguard’s BND is a solid choice for exposure to the total US bond market. You can invest with platforms like M1 Finance.

Remember, before making any investment decisions, it’s important to do your research and understand your risk tolerance. You can even consult with a financial advisor on how to invest 20k wisely. By diversifying your investments and aligning them with your goals, you can set yourself on the path to long-term financial success.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

FAQs:

How can I double 20K?

Investing in high-growth assets with strong return potential, such as stocks, can help you double your $20,000 investment over time.

Is $20,000 enough to invest?

Yes, $20,000 is a substantial amount to start investing and can provide opportunities for growth and wealth accumulation.

How to make passive income with $20,000?

When considering how to invest 20k for passive income or how to invest 20k for cash flow, you have a few options. You can generate passive income with $20,000 by investing in dividend stocks, real estate investment trusts (REITs), or peer-to-peer lending platforms.

What if I invest $200 a month for 20 years?

Investing $200 a month for 20 years can accumulate significant wealth through the power of compounding, especially if invested in growth-oriented assets such as stocks or index funds. For example, Investing $200 a month for 20 years with an average stock market return of 8% would result in approximately $118,615.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.