When it comes to rolling over your 401(k) into an IRA, choosing the right account is crucial.

Here’s why. Even the best IRA brokerages have different fee structures and different investment options within their accounts. It’s important to understand what you’re signing up for.

Lucky you: I’ve done the hard work on your behalf and gathered the best IRA rollover accounts that offer diverse investment options, competitive fees, and exceptional customer service.

Let’s jump right. What’s the best rollover IRA? Keep reading to learn about the best 401k rollover companies:

Best Rollover IRA: The Bottom Line

The best rollover IRA ultimately depends on your own goals and what you’re looking for in a platform. Below, I’ll dive deeper into the pros and cons of each platform.

You should also double-check if the platform you’re interested in offers IRA rollover deals or IRA promotions with a quick Google search before signing up.

That said, here are some quick facts on the best 401k rollover companies:

Company | Top Features | Rollover Bonus? |

|---|---|---|

Automated Investing, Great User Interface | No | |

Fidelity | Wide range of services, wide range of account types | No |

Schwab | Best customer service and investor education resources | No |

Passive investing via robo-advisor | No | |

Alternative assets including both precious metals and crypto | No | |

Best gold IRA rollover for physical gold and silver | No | |

Self-directed IRA offering crypto and bonuses | Yes – get $50 in your CryptoIRA for opening an account | |

Best diversified crypto IRA with access to 60+ cryptos | No |

Best IRA Rollover Accounts

Let’s dive into the best IRA rollover accounts…

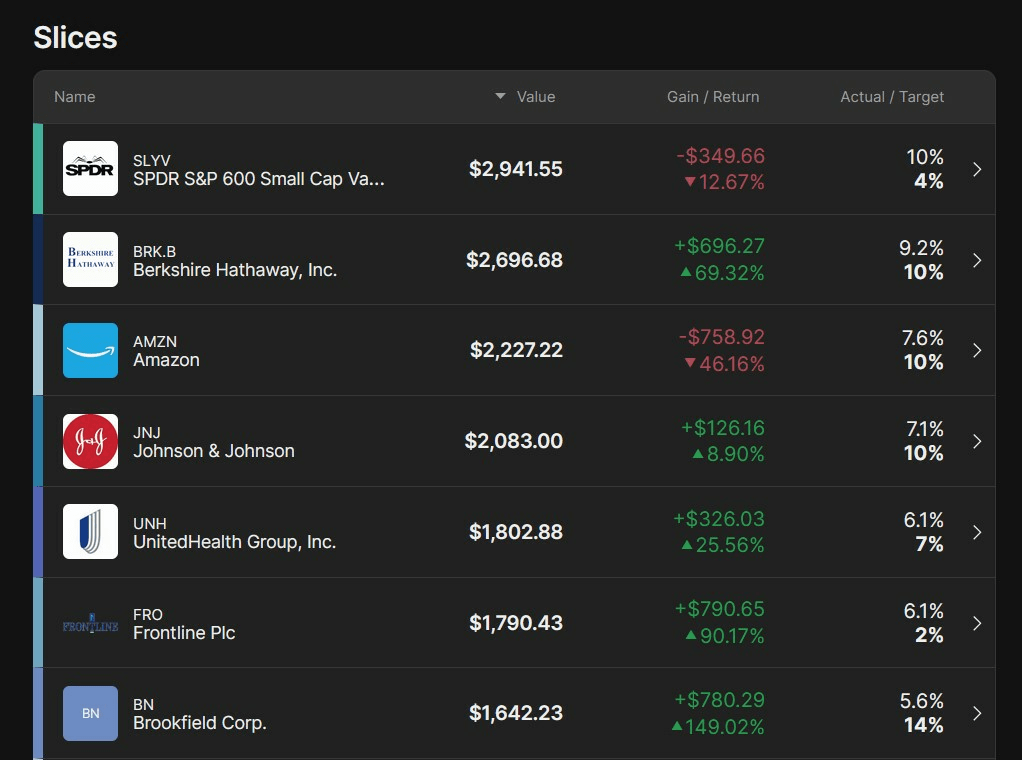

1. M1 Finance – Best All-Around Brokerage

- Overall rating: ⭐⭐⭐⭐⭐

- Pricing/fees: No fees

- Bonus? No

- Requirements: $500 minimum deposit

M1 Finance is a comprehensive brokerage platform that caters to investors seeking a well-rounded IRA rollover solution.

With a user-friendly interface, customizable portfolios, and automated investing, it appeals to both beginners and experienced investors.

M1 Finance offers a wide selection of investment options and allows for seamless portfolio management, which easily makes it one of the best IRA accounts for rollover or transfers.

Psst! This is too good not to share…

M1 Finance isn’t just great for IRA rollovers. M1 is currently offering a high-yield savings account with a staggering 5% APY for M1 Plus members ($10/month).

If you were to invest $10K in a 5% APY savings account, here’s what your investment might look like down the line when you factor in compound interest:

- 1 year: $10,511.62

- 5 years: $12,833.59

- 10 years: $16,470.09

2. Fidelity – Best for Comprehensive Retirement Services

- Overall rating: ⭐⭐⭐⭐⭐

- Pricing/fees: No fees

- Bonus? No

- Requirements: No minimum deposit required

Fidelity is renowned for its extensive range of retirement services, making it an ideal choice for comprehensive IRA rollover solutions.

They offer:

- A diverse array of investment options

- Robust research tools

- Exceptional customer support

In addition to being one of the best place to rollover 401k, Fidelity is also an ideal broker to house multiple retirement accounts in one place. This is because they also offer SEP IRAs and HSAs, which are accounts not offered by many other brokers.

Fidelity caters to investors at all levels of experience and offers valuable resources to help plan for retirement, making it a best place to rollover 401k accounts.

3. Schwab – Best for Expert Guidance and Support

- Overall rating: ⭐⭐⭐⭐⭐

- Pricing/fees: No fees

- Bonus? No

- Requirements: No minimum deposit required

Schwab is a trusted name in the investment industry for a reason: it stands out for its expert guidance and exceptional customer service.

With a wide range of investment options, low fees, and a strong emphasis on investor education, Schwab offers a reliable platform for IRA rollovers.

It provides access to professional advice and resources to help investors make informed decisions, making it another easy choice for the best place to rollover 401k accounts.

4. Betterment – Best Robo-Advisor

- Overall rating: ⭐⭐⭐⭐⭐

- Pricing/fees: 0.25% annually

- Bonus? No

- Requirements: 10$ minimum deposit

If you’re a passive investor who prefers a hands-off approach to your investing, Betterment is an excellent choice for an IRA rollover.

As a leading robo-advisor, Betterment offers automated portfolio management, personalized investment strategies, and tax-efficient strategies. It provides a user-friendly platform and digital tools to simplify the investment process.

Once Betterment determines your risk tolerance and financial goals, all you have to do is deposit money. Betterment will do the rest, allocating to the best assets for your personal situation. It’s the best way to put investing on autopilot.

5. iTrustCapital – Best for Alternative Investments

- Overall rating: ⭐⭐⭐⭐

- Pricing/fees: 1% Transaction fee for trading crypto · $50 over spot per ounce for gold

- Bonus? No

- Requirements: $1000 minimum deposit

iTrustCapital specializes in offering self-directed IRA accounts that allow for alternative investments such as cryptocurrencies and precious metals.

With a seamless digital platform and comprehensive security measures, iTrustCapital enables investors to diversify their retirement portfolios beyond traditional assets.

If you’re looking to rollover your IRA into one platform that offers both precious metals and crypto, iTrust offers one of the best IRA accounts for rollover.

6. Augusta Precious Metals – Best Gold IRA Rollover

- Overall rating: ⭐⭐⭐⭐

- Pricing/fees: Custodian and storage fees cost $100 each, totaling $200 annually

- Bonus? No

- Requirements: $50,000 minimum order requirement

Augusta Precious Metals is an industry leader in gold IRA rollovers, catering specifically to investors interested in adding precious metals to their retirement portfolios.

With a focus on gold and silver investments, Augusta Precious Metals provides personalized guidance, transparent pricing, and secure storage options for precious metals.

They’re one of the best IRA accounts for rollover if you’re looking to diversify your retirement into physical gold and silver. However, their minimum deposit/order requirement is quite high. If you’re rolling over a significant-sized 401k, though, this could be a good fit.

Note: Keen on gold IRAs? Here are some more gold IRA companies to consider:

7. Alto Crypto IRA – Best IRA Rollover Bonus

- Overall rating: ⭐⭐⭐⭐

- Pricing/fees: $10/month or $100/year

- Bonus? Yes – get $50 in your CryptoIRA for opening an account

- Requirements: $10 investment minimum

Alto Crypto IRA is one of the best IRA accounts for rollover if you’re looking to include cryptocurrencies in your IRA.

Alto is a self-directed IRA platform where you can use your retirement dollars—like your 401(k) from a former employer, other IRAs, or even new contributions to invest in alternative assets.

Alto also offers arguably the best IRA rollover bonus, as it’s the only brokerage on this list offering IRA rollover deals right now.

Alto’s IRA rollover bonus gives you $50 in your CryptoIRA for opening an account.

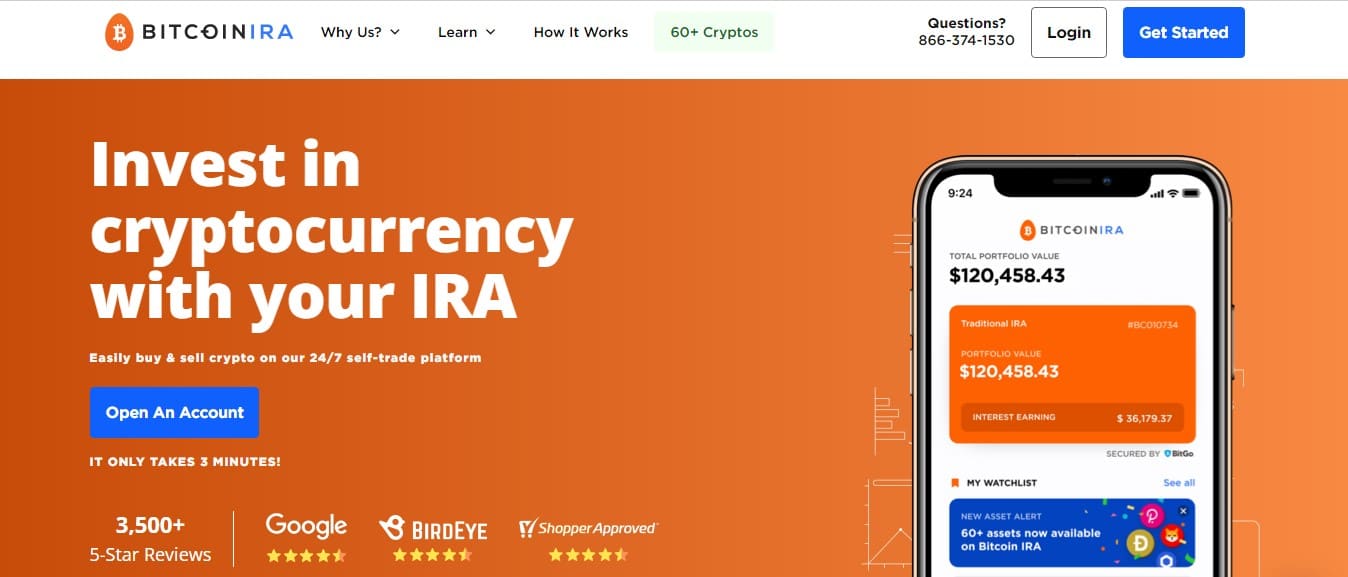

8. Bitcoin IRA – Best Crypto IRA

- Overall rating: ⭐⭐⭐⭐

- Pricing/fees: 0.99-4.99% depending on your initial investment amount

- Bonus? No

- Requirements: $3000 minimum investment

Bitcoin IRA specializes in cryptocurrency-focused IRA rollovers, offering a secure and compliant platform for investing in cryptocurrencies like Bitcoin, Ethereum, and more.

With a streamlined account setup process and robust security measures, Bitcoin IRA caters to crypto enthusiasts seeking to include digital assets in their retirement portfolios.

And don’t let the name fool you – Bitcoin IRA offers more than just Bitcoin. You’re able to invest in over 60 different cryptocurrencies using their platform, making it the best place to rollover 401k for crypto investments.

Why Should You Roll Over Your 401(k) Into an IRA?

Rolling over your 401(k) into an Individual Retirement Account (IRA) offers several benefits.

- An IRA generally gives you greater control and flexibility than a 401(k) plan. This is partly because IRAs often offer wider ranges of investment options, allowing you to diversify based on your investment preferences and risk tolerance. Many 401(k)s, on the other hand, restrict your investing to mutual funds or ETFs.

- Rolling over into an IRA can also simplify your retirement planning by consolidating multiple retirement accounts into a single, easy-to-manage account. If you already have a 401(k) and an IRA, you could roll the 401(k) into the IRA to simplify things and have everything in one account.

- By rolling over into an IRA instead of cashing out your 401(k) balance, you may also avoid potential tax implications. That said, you should still make sure to do your research to decide if rolling over your 401(k) into an IRA is right for you.

Is an IRA Cheaper Than a 401(k)?

Whether an IRA is cheaper than a 401(k) will depend on the specific investment options and providers you choose, and which ones you’re switching from.

Generally speaking, IRAs offer a broader range of investment options, including low-cost index funds and exchange-traded funds (ETFs).

If your 401(k) restricts you to mutual funds, it’s likely that the index funds and ETFs available in IRAs will come with lower fees and thus be cheaper than a 401(k).

Some IRAs may also have lower administrative fees compared to certain 401(k) plans.

However, it’s important to compare the fee structures and expenses associated with both options before making a decision.

To determine the cost-effectiveness of your current and future retirement account, look at factors like:

- Account management fees

- Transaction fees

- Fund expense ratios.

Types of IRAs

If you choose one of the best IRA rollover accounts above, you’ll have to decide between two primary types of IRAs: Traditional IRAs and Roth IRAs.

- Traditional IRA: Contributions to a Traditional IRA are typically tax-deductible, and the funds grow tax-deferred until retirement. Withdrawals during retirement are subject to income tax. This type of IRA is suitable if you anticipate being in a lower tax bracket during retirement.

- Roth IRA: Contributions to a Roth IRA are made with after-tax dollars, meaning they aren’t tax-deductible. However, qualified withdrawals during retirement are tax-free. A Roth IRA is beneficial if you expect to be in a higher tax bracket during retirement or if you prefer tax-free growth.

Note that the Roth IRA comes with income limits. If you make over $153,000 as a single tax filer, or more than $228,000 for those married and filing jointly, you can’t contribute to a Roth IRA in 2023.

Best IRA Rollover Accounts: What to Look For

When choosing an IRA rollover account, there are a few key factors to keep in mind:

- Investment Options: Look for a provider that offers a diverse range of investment options. This may include stocks, bonds, mutual funds, ETFs, and alternative investments like crypto and precious metals.

- Fees and Expenses: Consider the fee structure of the IRA provider, including account maintenance fees, transaction fees, and fund expense ratios. Look for competitive fees that align with the value and services offered. Some platforms will offer an IRA rollover bonus to offset fees.

- Customer Service and Support: Choose a provider that offers excellent customer service and support, including access to financial advisors or experts who can provide guidance on retirement planning and investment strategies.

- User-Friendly Interface: Opt for a platform that you find easy to navigate and that offers intuitive tools and resources for managing your IRA rollover account efficiently.

Best 401k Rollover Companies: Broker Vs. Robo-Advisor

When it comes to IRA rollovers, you have the option to work with either a traditional brokerage firm or a robo-advisor like Betterment. Here’s a brief comparison:

- Brokerage Firm: Traditional brokerage firms often provide a wider range of investment options, personalized advice, and access to research tools. They’re a good choice if you prefer a hands-on approach to managing your investments or if you value human interaction.

- Robo-Advisor: Robo-advisors are digital platforms that use algorithms to create and manage investment portfolios based on your risk tolerance and financial goals. They’re a good choice if you prefer automated portfolio management and a more hands-off approach.

Can You Rollover any Employer-Sponsored Program?

While rolling over a 401(k) is the most common scenario, you can also roll over other types of employer-sponsored retirement accounts, such as:

- 403(b) plans (for employees of non-profit organizations and schools)

- 457 plans (for government employees)

- Thrift Savings Plans (for federal employees)

If you have a traditional pension plan, you may also have the option to roll it over into an IRA or another qualified retirement account, depending on the specific rules and regulations of your pension plan.

Final Word: Best Rollover IRA

So, there you have it – a comprehensive guide to the best IRA rollover accounts.

Now, it’s time to take action…

- If you’re looking for a user-friendly platform with customizable portfolios and automated investing, M1 Finance might be your top pick.

- On the other hand, if you value comprehensive retirement services and a diverse array of investment options, Fidelity could be the right fit for you.

- For those interested in alternative investments like cryptocurrencies and precious metals, iTrustCapital has you covered.

- But if you’re a hardcore crypto purist, you’ll probably prefer BitcoinIRA, which gives you access to over 60 cryptos.

The main takeaway? Rolling over your 401(k) into an IRA can offer greater control, flexibility, and potential tax advantages. By consolidating your retirement accounts, you can simplify your financial life.

Just remember to keep an eye out for factors like investment options, user interface, fees and expenses, customer service, and IRA promotions and bonuses.

Take the time to explore your options, do your research, and check if your favorite platforms offer an IRA rollover bonus. Then, select the IRA rollover account that aligns with your goals and priorities.

FAQs:

Are rollover IRAs a good idea?

Rollover IRAs can be a smart move for many individuals, because they offer greater control, investment flexibility, and potential tax advantages compared to leaving funds in a former employer's retirement plan.

Is it better to transfer or rollover IRA?

The choice between transferring and rolling over an IRA depends on your specific circumstances. Transferring an IRA involves moving funds directly between financial institutions, while a rollover involves receiving funds and then depositing them into a new IRA within 60 days. It's crucial to follow the IRS guidelines to avoid penalties and tax implications.

What is the average return on a rollover IRA?

The average return on a rollover IRA can vary widely depending on the investment strategy, market conditions, and individual choices. It's essential to consider a diversified portfolio and consult with a financial advisor to maximize potential returns.

What is the best type of IRA to get?

The best type of IRA depends on your financial goals, tax situation, and preferences. Traditional IRAs offer potential tax deductions but tax the withdrawals, while Roth IRAs provide tax-free growth and tax-free qualified withdrawals. Evaluating your current and future tax situation can help determine the most suitable type of IRA for you.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.