If you don’t wear a monocle or routinely ask Jeeves to bring the car around, you might think that blue chip art is not for you. I’m here to tell you that you’re wrong.

Blue chip art investment is more accessible than it’s ever been before, thanks to online platforms like Masterworks. The sites I’m going to cover in this article let you buy shares of blue chip art — not unlike how you purchase shares of companies on the stock market.

Intrigued? Keep reading. I’ll explain why you should consider blue chip art investment as a means of diversifying, how to get started, and some specific examples to paint a clear picture in your mind.

The Bottom Line: Blue Chip Art

If you only take one thing away from this article, let it be this: blue chip art is an excellent, accessible way to diversify your portfolio.

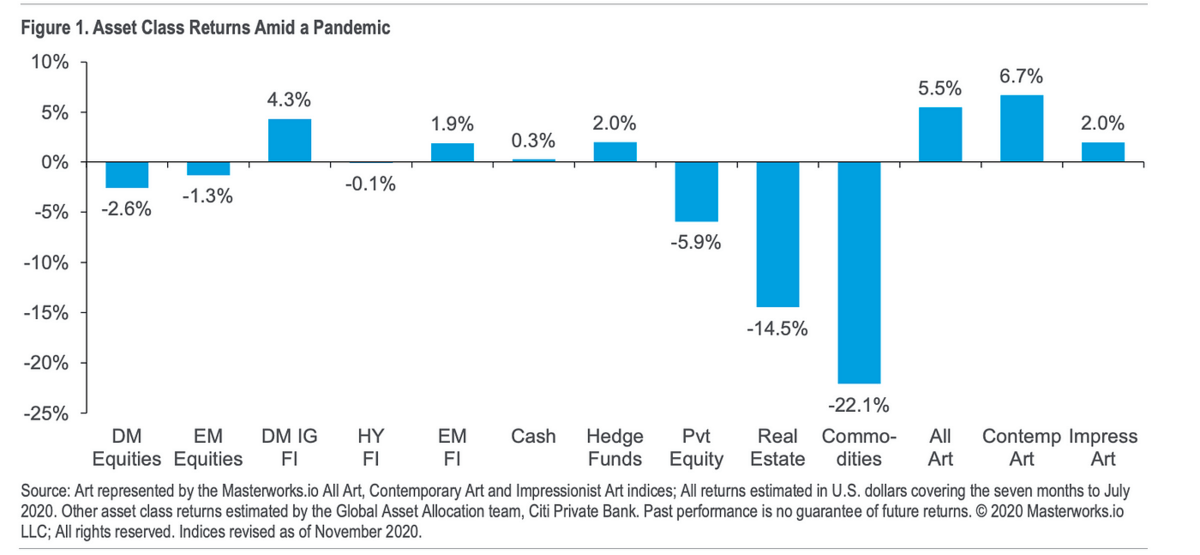

Art adds the potential for big gains to your investments without tethering you to the stock market. That last part is important. Here’s an example of why…

As we saw during the pandemic, blue chip art continuously performed well, even when other asset classes took a downturn. While this isn’t always guaranteed to be the case, it does demonstrate that these markets operate without too much influence on each another.

(Source)

What is Blue Chip Art?

Blue chip art is a broad term that refers to high-quality art that represents a relatively safe investment. The term “blue chip art” is derived from “blue chip stocks” — a stock market term for well-performing, high-quality, proven companies. “Blue chip stocks” is in turn derived from poker, where the most valuable chip used to place bets is usually blue.

Blue chip art is usually made by famous artists who have historical significance. Of course, at some point, every famous artist was unknown, but investing in art from unknown artists is much riskier than investing in blue chip art from well-known people.

Blue Chip Art Vs. Red-Chip Art

Using the same poker metaphor as earlier, red-chip art is generally less valuable than blue chip art and is usually made by relatively unknown artists.

Compared to blue chip art investment, red chip art investment is much riskier with the potential for big gains and big losses.

Sometimes, red chip art will increase to many times its initial value, but counting on that is like investing in unknown cryptocurrencies or penny stocks and hoping to get lucky.

I should mention that the term red-chip art is fairly new and is not used by most of the art community, although it is gaining popularity in some art investment circles.

Examples of Blue Chip Art

Theoretical discussions are great and all, but what is blue chip art, specifically? I’m glad you asked! Here are some examples of blue chip art:

- Pablo Picasso’s “Guernica”

- Vincent van Gogh’s “Starry Night”

- Andy Warhol’s “Marilyn Diptych”

- Jackson Pollock’s “Blue Poles”

You probably recognize a few of those paintings (and definitely a few of those artists). The hallmark of blue chip art is that it’s made by reputable artists who are practically household names.

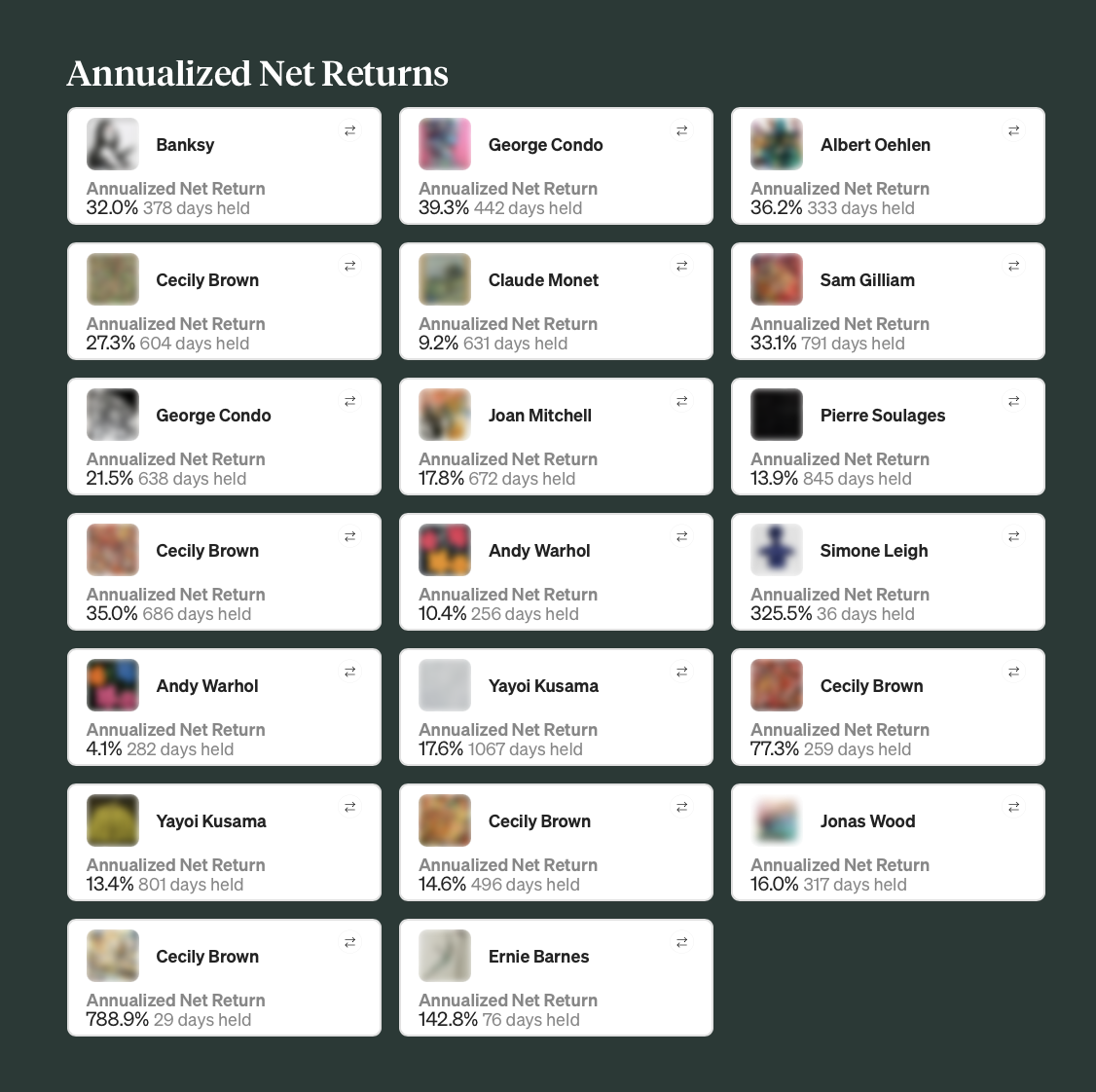

The returns on some of these pieces are downright incredible. (See image below.)

To date, Masterworks has completed 20 exits and sold over $49 million worth of art.

How to Get Started

Ready to invest in blue chip art online? These platforms make it easy to get started and are aimed at people who are new to blue chip art investing.

Our Top Pick: Masterworks

Masterworks is my favorite online platform for investing in blue chip art. Let me tell you why.

First off, the platform is extremely user-friendly. Once you’re approved for an account, it’s easy to get started browsing potential investments.

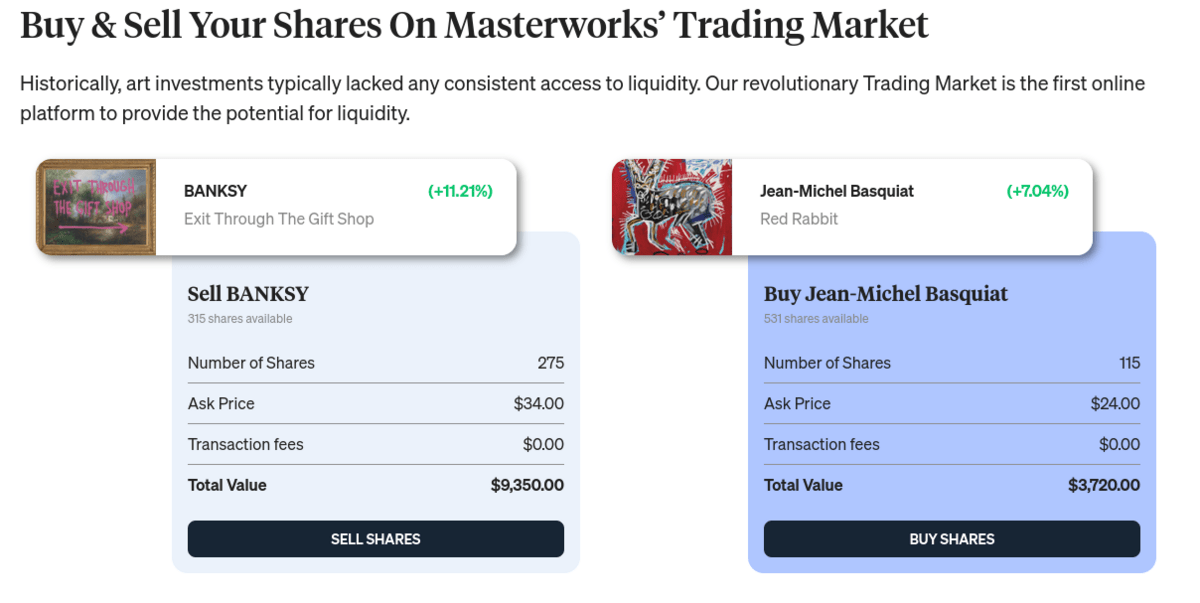

Actually buying and selling is straightforward, too. You can deposit funds and trade with a brokerage account provided by Templum, a platform that specializes in trading alternative assets.

With your account, you can trade on the secondary market with other art investors, as well as invest in new paintings in the primary market.

I also find the way the company operates to be efficient and intelligent:

- The company owns 300+ pieces of fine art from “blue chip” artists.

- Masterworks handles all of the acquisition, storage, insurance, and selling of the art pieces, and distributes the profits (net of fees) to investors if the artwork is sold for a profit.

- It focuses exclusively on contemporary art pieces (post-World War 2) which they believe have the most potential for price appreciation.

But what should you invest in on Masterworks?

While ultimately that’s your call, Masterworks has helpful educational material about art investing on its website, so you don’t need to have any experience to get started.

Even better, Masterworks publishes past sales in a price database, so you can see the real-world performance of past art investments. Of course, past performance is not an indication of future performance, but it’s still nice to see.

I also like that Masterworks is solely focused on art investing. In my experience, platforms that offer art investing and other assets tend to fall into “jack of all trades, master of none” territory. Masterworks focuses on one thing, and does it well.

Check out our detailed Masterworks review for more information.

Runners-Up

Neither of these platforms comes close to Masterworks for my top spot, but it’s important to have options, so here are two other platforms to consider:

Public

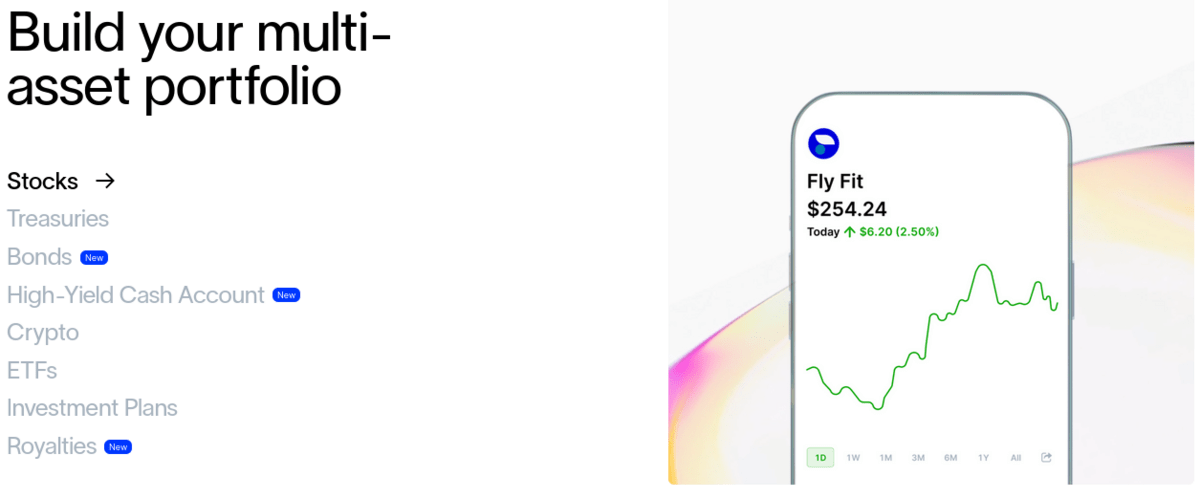

Public is a multi-asset online investing platform that offers stock trading, bond investing, crypto, and fine art.

Public’s blue chip art offerings are much more limited than Masterworks — at writing there are only 6 fine art offerings. But the site’s goal isn’t necessarily to be a comprehensive art investing platform. It is mostly focused on being a one-stop shop for all kinds of investments.

Yieldstreet

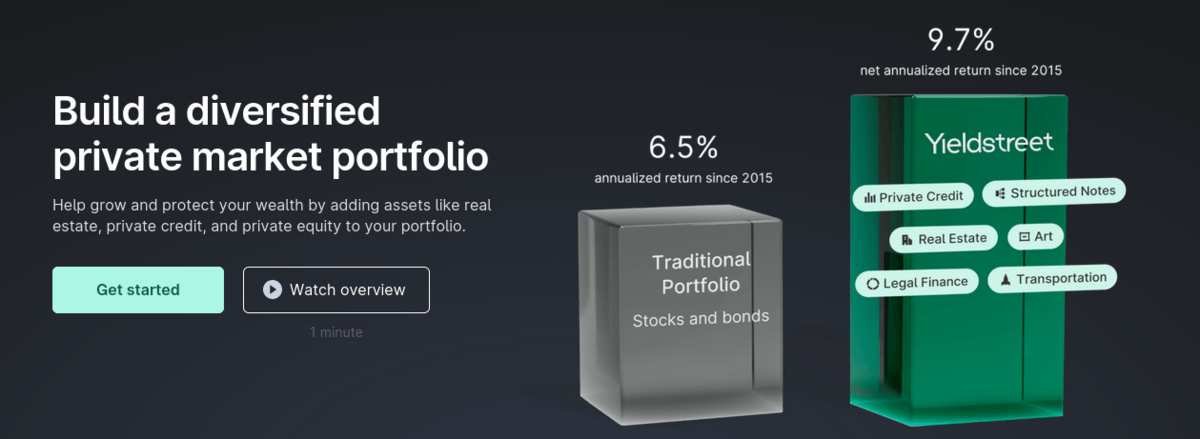

Yieldstreet is similar to Public in that it offers general investment services for a variety of assets. The company allows you to build a diversified portfolio of real estate, private credit, blue chip art, and other alternative assets all in one place.

Like Public, Yieldstreet’s blue chip art investment options are more limited than Masterworks’ — they feature various art-focused funds.

But here’s what I don’t necessarily like about Yieldstreet for fine art:

The company doesn’t have a wide selection of art investment opportunities, especially if you want to hold them in an IRA.

The art-focused funds have pretty high minimums ($10K and $15K respectively) and pretty long hold periods (44 months and 5 years, respectively).

But if you’re looking for a platform where you can invest in multiple assets at once and can deal with the limited blue chip art offerings, it may be worth considering.

Is Blue Chip Art a Good Investment?

Like any investment, there are no guarantees that blue chip art will appreciate in value. Even low-risk investments don’t pan out sometimes, so it’s up to you to do your own due diligence before you invest in blue chip art.

One strength of blue chip art is that it offers considerable upside that’s completely uncorrelated with the stock market. Most people hold stocks and bonds as their primary investments.

Allotting some money to fine art can help smooth out your returns and make it easier to hold through stock market downturns.

Historical Performance of Blue Chip Art

The historical performance of blue chip art is quite good, and art portfolios often outperform broad market indexes … and a lot of people know it.

For example, in March of 2023, Masterworks released a piece by Banksy (“Home Sweet Home”) as an exclusive to its investors. The piece was valued at nearly $2,250,000, and it sold out in just over a half-hour.

The historical appreciation of similar pieces of art? A whopping 18.8%! Chances are those members that did invest were probably pretty happy with that decision.

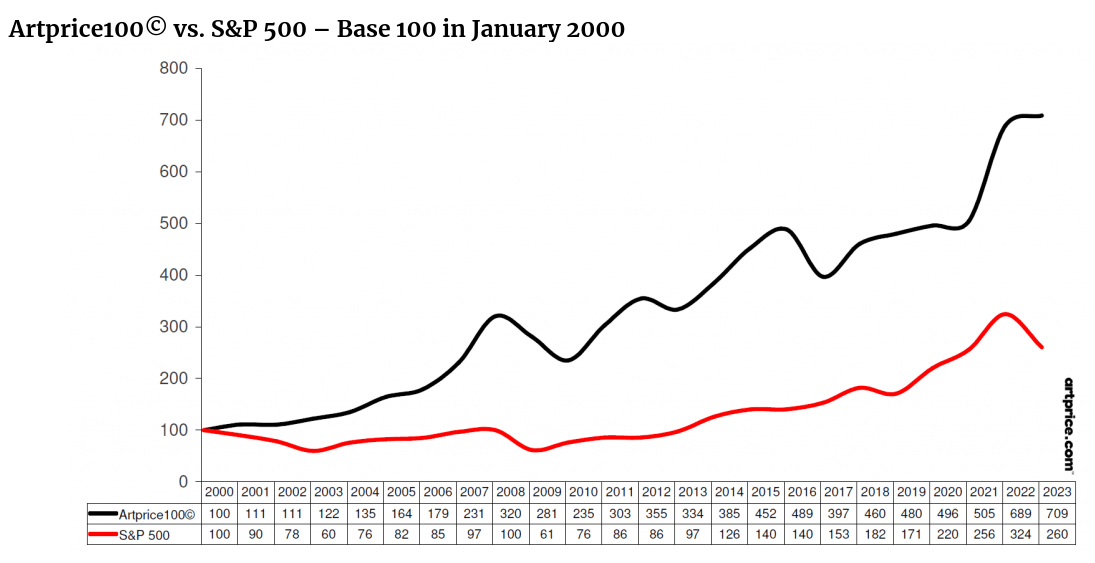

For a more analytical look, check out the following figure from Artprice:

There are two features of the graph that I want to point out. First, the Artprice100 index of blue chip art gained significantly more over the last 23 years than the S&P 500, demonstrating that fine art can be an excellent investment.

Second, the black line has more and larger ups and downs than the red line. That’s called volatility, and it means that art value fluctuates more than index fund prices. For potential art investors like you, it means that you need to have a strong stomach to withstand the market swings in blue chip art investing.

Investing in Blue Chip Art Vs. Stocks

Building off the previous section, there are some key differences between investing in blue chip art and investing in stocks. For starters, there is less information available for art investing than there is for stock investing, so you’ll have to do more of the leg work yourself.

You’ll also have to hold art for longer periods to avoid selling during one of those big downturns you see in the figure from the previous section. In general, the lower the volatility an asset has, the less likely you are to get stuck wanting to sell when the asset is down.

On the flip side, the high volatility of art assets means that potentially, your asset can appreciate soon after you buy some shares. I don’t recommend making it your goal to catch a big move right before it happens, but it is possible.

I like to think of art investing as a supplement to my regular stock investing, much like how people treat cryptocurrencies. The potential for big gains means that you can allocate less of your portfolio to art and still experience sizable gains.

Blue Chip Art: Pros and Cons

Here’s a quick look at the main pros and cons of blue chip art investing:

Pros | Cons |

|---|---|

Potential for outsized gains | Less information available online |

Uncorrelated from the stock market | Higher volatility than a broad market index |

Great for diversification | |

Easy thanks to platforms like Masterworks |

Final Word: Investing in Blue Chip Art

Now is an excellent time to get into blue chip art investing. Platforms like Masterworks are making it easier than ever to dip your toes into the art investing pool.

Blue chip art investments help diversify your portfolio since they’re not correlated with most other asset classes. They’re also a great way to add some potential upside to your portfolio.

FAQs:

What is the meaning of blue-chip art?

What is blue-chip art? Blue-chip art refers to artwork that is high-quality and made by famous artists. The term blue-chip art is directly analogous to blue-chip stock. It means art that is valuable and safe to invest in. Blue-chip art gains value slowly and steadily, with the potential for high gains. It is not considered a risky investment, although investing in any alternative asset like art comes with some risk.

What is red-chip art?

Red-chip art is the opposite of blue-chip art. It is art made by less well-known artists and may or may not gain value. Red-chip art isn’t necessarily low-quality artwork, but the likelihood that it gains value is lower than blue-chip art. Red-chip art is a much riskier investment than blue-chip art. You can think of it as being similar to gambling on penny stocks, hoping to catch a huge gain; it’s great when it happens, but it doesn’t happen often.

How to invest in blue-chip art?

By far, the easiest way to invest in blue-chip art is to use an online platform like Masterworks or Public. Those sites make investing in blue-chip art as easy as investing in stocks. They have user-friendly interfaces that are easy to understand for beginners. They also let you invest small amounts to get started, so you can ease into art investing without having to drop big bucks.

Why is it called blue-chip?

In poker, the blue chips are usually the most valuable. The term blue-chip stock originated in the 1920s and was used to mean a valuable stock that represents a solid investment. The art investing world borrowed the phrase, using blue-chip art to mean any piece of art that is valuable and worth investing in.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.