These days, you don’t have to be a brandy-sipping, mustache-twirling Bond villain to invest in art. The advent of online art investing platforms like Masterworks and Public puts investing in artwork within reach of anyone — even people who don’t own white cats.

If you’re looking for a new investment with excellent historical performance and a low correlation to stocks, artwork should be high on your list of assets to consider. Let me tell you why you should invest in art and how to do it safely.

Investing in Artwork: The Bottom Line

Artwork is one of the best alternative investments to pair with a traditional stock portfolio. It has historically high returns and is uncorrelated with the stock market, which helps diversify your investments.

The primary drawback to art investing — that it’s hard to get into — isn’t the case anymore due to the rise of online art investing platforms that are accessible to everyday investors.

In general, the advantages of modern art investing are:

- Historically high returns

- Diversification

- Low correlation with the stock market

- Easy to get started

Art Investment Companies: An Easier Way to Invest in Art

The barrier to entry to investing in artwork used to be very high. Nowadays, online platforms like Masterworks (devoted completely to art + collectibles) and Public (an all-in-one investing site that allows you to invest in stocks, bonds, and assets like art) let anyone invest in art shares, so you can capture the benefits of investing in artwork without having to shell out tons of money.

I’ll cover online platforms later in the article, but first, I want to talk about why you should seriously consider adding a fine art investment to your portfolio.

Why Invest in Art?

Investing in art is a good idea if you typically only invest in ordinary assets like stocks and bonds. Art investments add diversification to your investment portfolio and could potentially produce high returns.

Diversification

One of the best reasons to invest in art is because it is uncorrelated to the stock market. That means that it is unlikely for both your stock investments and your art investments to be down at the same time.

Having both art and stocks in your portfolio smooths out your returns over time and reduces your portfolio’s overall volatility, which is good for peace of mind and predictability.

High Potential Returns

Blue chip artwork has historically returned hundreds to thousands of percent. Now, that isn’t likely to happen and shouldn’t be your main focus with art investing, but it is always good to expose yourself to the potential for tremendous upside.

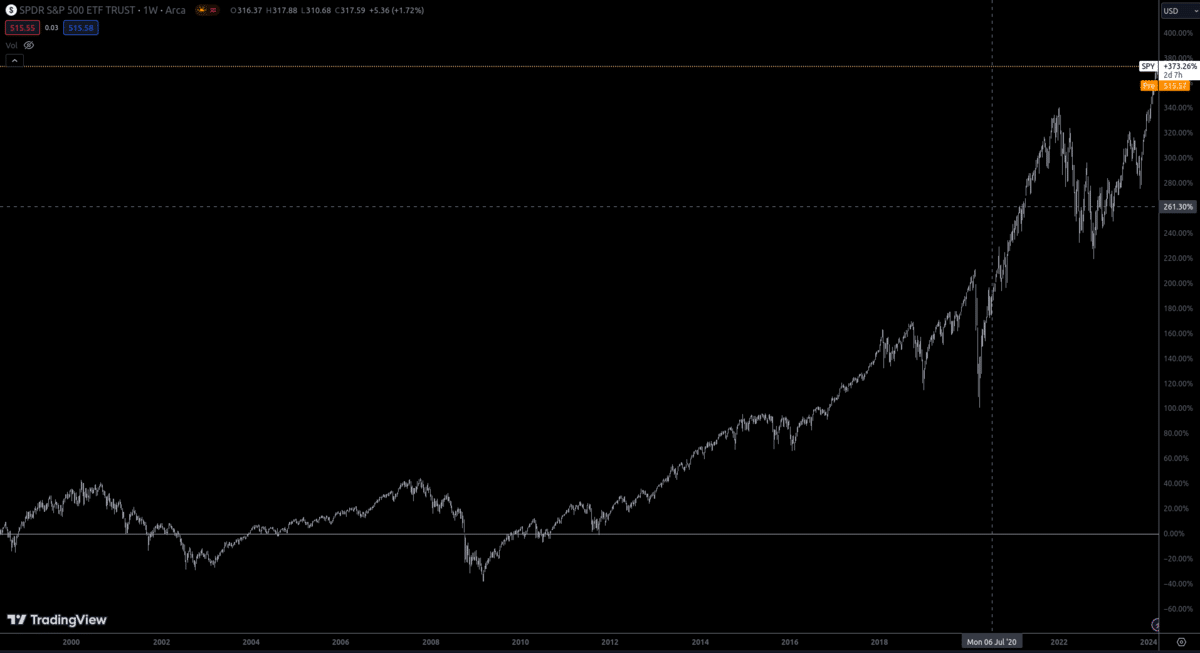

Even without astronomical returns, a well-selected collection of art investments tends to outperform stocks. For example, the Artprice100 Index has gained 360% since 2000, while the S&P 500 has returned about 247% over the same period.

How to Invest in Art

If you want to invest in artwork the old-fashioned way by purchasing art directly, you have a lot of work to do. The following sections cover the painstaking process of finding the right piece to invest in, bidding, and storing the piece if you’re lucky enough to get it.

Research

Art investing and stock investing both require research, but the research needed for art investing is much more labor-intensive.

To begin with, you have to find pieces for sale. If you decide you want to invest in a stock, you can buy shares from someone who wants to sell their shares on the stock market. Most of the time, the transaction is quick and easy. Not so with art investing.

You have to contact art dealers and auction houses to find artwork for sale, and often, you’ll have to wait to speak with someone unless you are playing with serious cash.

Once you have a repository of available pieces, you still need to figure out which ones might be good investments. Unless you’re an art expert, you’ll have to hire an expert to advise you.

Seek Out Experts

Finding an art appraiser is another step that you don’t have to do when you invest in stocks. If you can’t judge the authenticity of a piece yourself, you need an expert to assess the art for you.

This adds to the effective cost of the fine art investment, especially because you probably want to hire more than one expert to take a look.

Expert advice isn’t strictly necessary, but not consulting someone who knows art is asking for trouble. Without an expert opinion, art investing becomes much riskier.

Establish a Budget

Even if you don’t mind doing tons of research and hiring an art expert to help you appraise a piece, budget is where most people lose their enthusiasm for traditional art investing.

You can, of course, invest in art from emerging artists for just a few hundred or a few thousand dollars, but the pieces in that price range are unlikely to appreciate.

In some ways, artwork in the $100–$2,500 range is the equivalent of penny stocks: it’s great when it works out, but you’re essentially buying a lottery ticket.

Art from established artists is going to be much more expensive, typically in the $10,000 to $100,000 range. And if you want something from a famous artist, you better have millions to drop. Top-of-the-line artwork can easily fetch $100 million or more at auction.

And speaking of auctions, you’ll have to pay an additional 10% to 25% on top of the price of the piece if you buy art at an auction. These additional fees cover the cost of running the auction and quickly add up when you’re talking about art north of $10,000.

Keep the Art Safe

Let’s say you find a piece you’re interested in, get it inspected by an expert, and have the budget to make the purchase. Then what? You can’t just keep an expensive piece of art on the wall in your living room.

Some people display art they invest in, but most people store it somewhere safe. Fine art investments are often stored in specialized facilities with climate controls and round-the-clock security.

If the piece you invest in is smaller, you could also keep it at home or in a safety deposit box at your bank, but neither of those locations have careful climate controls.

If you’re Mr. or Mrs. Moneybags and can afford to invest in a priceless piece of art, you could also loan your piece to a museum.

Art collectors often loan pieces from their collections to museums in exchange for the museum maintaining and protecting the art. If this sounds like something you want to do, let’s be real: this isn’t the article for you.

Where to Find Investment-Grade Art

The easiest places to find investment-grade art are art galleries and auctions. Galleries routinely sell their pieces to generate revenue, and auction houses are in the business of selling expensive items like investment-grade artwork.

If you’re unsure of where to find art galleries and auction houses, the experts I mentioned before should be able to help. Anyone with experience in art circles can tell you about reputable places to find high-quality — ahem, expensive — art you can invest in.

The Risks of Fine Art Investing

Investing in fine art comes with several risks. Forgeries and frauds are a real concern since it can be hard to distinguish the best fakes from the originals, even for experts.

Another risk is that art is a highly illiquid asset. That means that you won’t be able to sell your priceless painting for cash quickly if you need the money. Stock investments are very liquid, so quickly selling them is usually a non-issue.

Safer Ways to Invest in Art

In my opinion, the safest way to get into art investing safely is to use an online platform like Public. These platforms let you partially own pieces of art instead of owning an entire piece yourself.

That means you don’t need as much money to get started and can lower your risk by investing in multiple pieces.

It would be great if there were an art ETF you could invest in, but unfortunately, there isn’t one. Artwork is highly illiquid, so it’s all but impossible to create an ETF that tracks the prices of art.

The fair price for art isn’t known until a sale is made, which means the ETF’s price would be flat most of the time and experience big swings suddenly when one of the pieces in the fund gets sold — not exactly what most investors are looking for.

Seek Out an Art Investment Platform

Art investment companies make art investing accessible to everyone by treating art investments like regular stock investments.

Instead of purchasing art directly, these platforms let you purchase art shares. The process is just like stock investing, except you’re buying shares in a piece of valuable art instead of buying shares of a valuable company.

If you’re interested in investing in artwork but don’t have the capital to buy a piece outright — and, let’s be honest, who does? — you should check out the following platforms. I’ve found that they’re the easiest to use and are great for art investing beginners.

Masterworks

How has the art investing platform Masterworks been able to realize a profit for investors with each of its 21 exits to date?

Here’s an example: An exited Banksy was offered to investors at $1.03 million after acquisition. As Banksy’s market took off, Masterworks received an offer of $1.5 million from a private collector. Resulted in 32% net annualized gain for investors in the offering.

Every artwork performs differently but overall, their exits have delivered median returns of 17.6%, 17.8%, and 21.5%.

Masterworks takes care of all the heavy lifting from buying the paintings, to storing them, to selling them opportunistically for you – no art experience required.

How can you get involved in Masterworks’ next offering? It’s easy, just use this exclusive link to unlock VIP access.

Public

Public is an online investment platform focused on stocks, crypto, treasuries, and other traditional investment classes. It also provides limited access to fine art investments.

As of this writing, Public only has six art stocks available. If you’re just looking to dip your toe into the art investment pool, that might not be an issue for you, but there are hardly enough options to satisfy a more serious investor.

One thing that Public has going for it is that you can invest in traditional and alternative investments on the same platform.

Public lets you buy stocks, ETFs, crypto, and alternative asset classes like fine art all in one place. That’s very convenient and makes managing your portfolio much simpler.

Speaking of alternative asset classes, another cool thing about Public is that it has less common investment opportunities. You can, for example, invest in a rare sneaker collection.

That’s not something you’ll find on most investment platforms and makes Public stand out.

Yieldstreet

Another platform you should consider is Yieldstreet. The only thing you need to be aware of is that the minimum investment on Yieldstreet is $10,000, so it’s not a great place to start if you don’t have a lot of money to invest in art.

Yieldstreet offers art investing in both individual pieces and diversified art funds. These art funds have different minimum values and contain different pieces of art. I like that they’re automatically diversified, but I don’t love the fact that you can’t choose your own investments.

As of this writing, Yieldstreet is offering its Art Equity Fund V, which has a minimum investment of $15,000 and a 60-month term.

If you’re serious about art investing, Yieldstreet is a good choice. But if you’re just starting out, the high minimums and rigidity of investing in one of their pre-made funds make it more intimidating than Public, in my opinion.

Final Word: Investing in Artwork

Adding art investments to your portfolio of stocks, bonds, and other traditional asset classes is the perfect way to capture more upside than you’ll find in those markets and diversify your portfolio.

Returns on art investments are historically higher than returns on traditional stocks and bonds, although you do take on more risk to capture those returns.

The safest — and easiest — way to get started investing in artwork is to sign up for an online art investing platform like Masterworks, Public and Yieldstreet. These platforms let you invest in shares of art instead of purchasing pieces outright, making art investing more accessible to everyone.

FAQs:

Are artworks a good investment?

Artwork can be a good investment, depending on your investment goals. Art investments add diversification and upside potential to your portfolio, so they’re an excellent addition to a portfolio of traditional asset classes.

Directly investing in art is difficult since the art market is illiquid and fraught with risks from fraud and forgeries. Investing in art through a platform like Public or Yieldstreet captures most of the benefits of art investing and eliminates the downsides that come from investing in artwork directly.

How do I start investing in artwork?

Getting started in art investing is easy if you do it through an online art investment platform like Public or Yieldstreet. If you want to purchase art the old-fashioned way, you’ll have to find a gallery or auction near you, consult art experts to avoid buying low-quality or faked pieces, and shell out anywhere from a few thousand to a few million dollars.

Why is investing in artwork a risky investment?

Artwork is expensive, hard to sell quickly, and subject to unpredictable returns, which makes it a suitable investment only for people with a lot of money. If you can’t afford to lose $10,000 or more on a speculative art investment, fine art investing is not for you.

A much better way to invest in art is to use an online platform that lets you buy shares of artwork instead of buying entire pieces. This limits your risk to your initial investment and lets you get started with far less capital.

Why do millionaires invest in art?

Millionaires invest in art for several reasons. One reason is that it has the potential to generate outsized returns. If you invest in a piece of art from a new artist and that artist becomes world-renowned, you could wind up with a return of 1,000% or more. Another reason is because they can buy a piece of art and donate it to a museum.

This can save them a lot of money on taxes since donations reduce taxable income. Some millionaires might invest in art because they can and view it as a status symbol.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.