Got $2 to $3 million to invest? Lucky you.

Now that you’ve got the money, here’s the next important topic: How to invest 2 million dollars. Or, how to invest 3 million dollars (depending on what level you’re at, moneybags).

In this article, I’ll guide you through what to do with 2 million dollars (or more) — including important considerations like diversification and risk tolerance, and how to preserve capital while generating income.

Below, you’ll learn the best ways to invest 2 (or 3) million dollars so you can generate passive income and reach your financial goals.

At-a-Glance: Best Ways to Invest $2 or $3 Million

We’ll talk about all of these assets + platforms in more detail below, but here’s a quick guide to some of the best ways to invest $2 to $3 million…

Asset / Investment | Suggested Platform |

|---|---|

Dividend Stocks + ETFs | |

Master Limited Partnerships (MLPs) | |

Private Credit | |

Private, Pre-IPO Companies | |

Real Estate – Under $200k minimum | |

Real Estate – Over $200k | |

Fine Art | |

Farmland | |

Gold | |

Professional Money Management | |

High-Yield Savings | |

Fixed Income |

The 11 Best Ways to Invest $2 to $3 Million in 2025

Wondering what to do with 2 million dollars (or better yet, what to do with 3 million dollars)? Start here.

1. Invest in Stocks, ETFs, and Funds

Wondering what to do with 3 million dollars? Don’t YOLO your entire account into GameStop Corp. (NYSE: GME). After all, it’s not 2021 anymore.

If you’re curious about how to invest 2 million dollars (or how to invest 3 million dollars) to live off the interest, dividend stocks could be a winning addition to your portfolio.

Companies like Pepsi (NASDAQ: PEP), Johnson & Johnson (NYSE: JNJ), Coca-Cola (NYSE: KO), and International Business Machines (NASDAQ: IBM) have consistently shared company profits with shareholders over the years — Coca-Cola has been paying a dividend to shareholders for over 100 consecutive years!

(Of course, dividends depend on company profits.)

The long-term growth secret to dividend investing? Reinvest dividend payments — this lets you compound your investment over time.

Looking for great dividend stocks? Check out WallStreetZen’s Dividend Stock Screener, where we track the top dividend stocks for long-term investors.

Prefer a vehicle that gives you build-in diversification? Consider exchange-traded funds (ETFs for short) — you could think of them as a bucket of securities that holds assets like stocks and bonds.

Here are some popular ETFs:

- The Vanguard S&P 500 ETF (VOO) – Tracks the S&P 500 index

- The Invesco QQQ (QQQ) – Tracks the Nasdaq 100 index, primarily containing tech stocks

- iShares US Real Estate ETF (IYR) – Tracks real estate investment trusts

- iShares MSCI Japan Index (EWJ) – Tracks the Japanese foreign stock exchange

By tracking an index, most ETFs can maintain lower expense ratios (cost to operate a fund) since they are passively managed. On the other hand, actively managed funds can have higher fees.

If you’re ready to invest in dividend stocks and ETFs, eToro is one of the best platforms out there. It’s great for new stock investors, featuring tools like paper trading feature where you can test out strategies and execute trades with virtual money before you put your hard-earned cash on the line. It also has an innovative CopyTrader feature that lets you follow the trades of top-rated traders.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

2. Invest in Master Limited Partnerships (MLPs)

In our current heavy inflation environment, you may want to look for investments to hedge against inflation. Master Limited Partnerships are viewed as an inflation hedge since cash distributions are higher than other asset classes.

MLPs are publicly traded infrastructure assets in the natural resources and real estate sectors. The main appeal to investors? Potential high yields and tax advantages.

An MLP is structured as a limited partnership and therefore, shareholders are called ‘limited partners’ or ‘unit holders.’ The MLP makes distributions to unitholders and earnings are taxed once based on the investor’s ordinary income tax rate.

The periodic distribution aspect of MLPs is similar to how a dividend stock operates. While dividend stocks are available across many sectors, an MLP must generate at least 90% of its gross income from the below qualifying sources:

- Oil, Coal, Biofuels, Natural Gas – Activities include mining, refining, storage, and marketing

- Real Estate – Activities include rents and sale of real property

You can purchase MLPs directly or through a fund. If you go the latter route, I once again like eToro as a platform — its got $0 commission trades and a social investing feed where you can see what other investors are up to.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

3. Invest in Private Credit

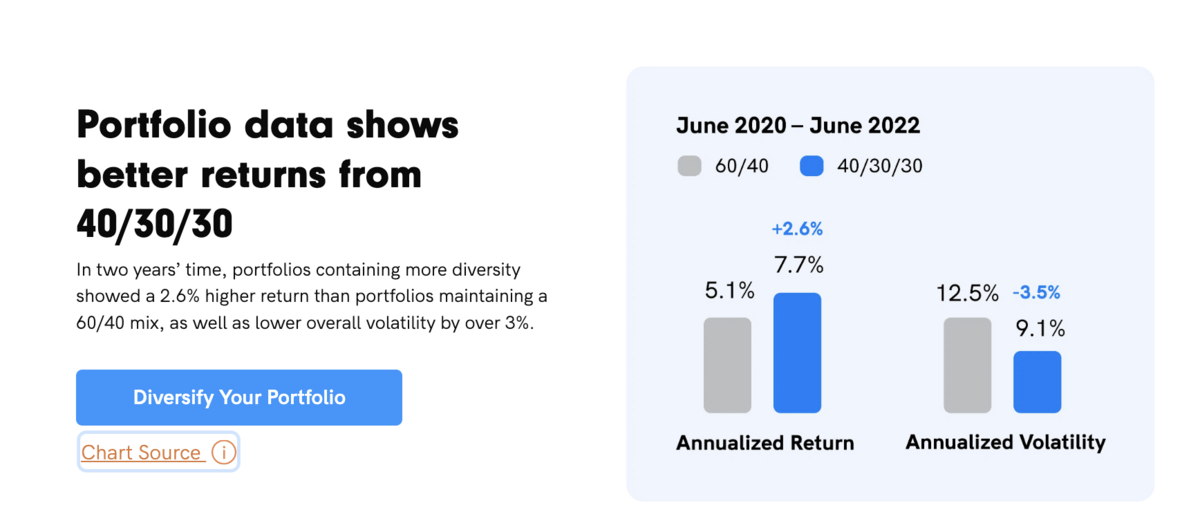

Traditionally, a mix of stocks and bonds has composed the classic “60/40” portfolio. But if we’re talking about how to invest $2 million in 2025‘s market, it’s worth considering alternatives. After all, the classic allocation could leave opportunities (and potential returns) on the table in the current market climate.

Consider a recent study from investment giant KKR that examined the benefits of adding alternative investments into the mix over almost a century of returns. Their findings?

The 40/30/30 portfolio (including real estate, infrastructure, and private credit assets)…

Offered both higher returns — with lower volatility — during periods of high inflation.

Until recently, private credit was only accessible to an elite population of well-connected individuals and institutions.

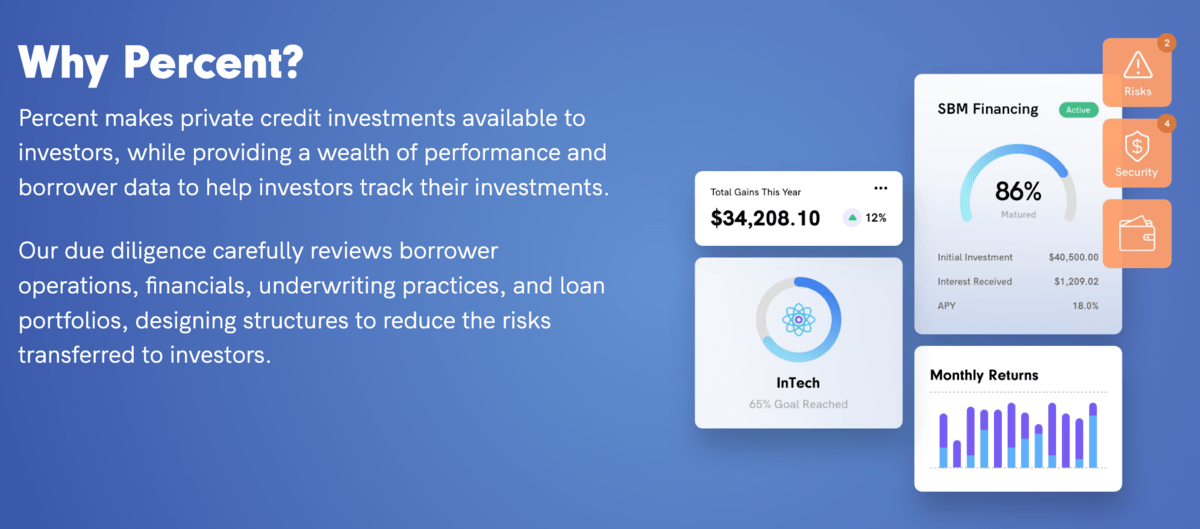

But that’s changing, thanks to platforms like Percent, which offer accredited investors access to private credit investments.

As an investor, you’ll gain access to a wide variety of high-yield, short-duration (9-month average) offerings that have historically paid over $28 million in interest.

You can invest as little as $500 and unlock yields up to 20% APY.

Interested in private credit investing? As a WallStreetZen reader, you can also earn up to a $500 bonus with your first investment on Percent. (Terms and conditions apply)

But this opportunity won’t last…

Click below to find out more.

4. Invest in Private Companies

Imagine having the opportunity to invest in Apple or Amazon before their IPOs. The upside potential can be exponential with pre-IPO companies. But, with reward comes risk, and one major difference between public and private investment is transparency.

Hiive is marketplace for buying and selling shares of private, pre-IPO companies. The platform offers real-time pricing and a transparent order book, allowing users to see live bids and asks for each company.

This transparency facilitates direct negotiation between buyers and sellers, aiming to streamline transactions.

When it comes to high-quality companies with name-brand recognition, Hiive’s list is extensive. Hiive gives accredited investors access to shares in some of the world’s leading private companies, including Discord, Grammarly, and Open AI.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

5. Invest in Real Estate

For many, the best way to invest 2 million dollars (or the best way to invest 3 million dollars) is through real estate. There’s no other investment where you can purchase an asset and make money in 4 different ways:

- Appreciation – The increase in property value over time due to changes in the real estate market

- Depreciation – Making annual deductions in the asset to reduce your tax liability

- Cash Flow – The monthly collection of rent minus operating expenses

- Mortgage paydown – Each principal and interest payment increases your equity in the property

With 2-3 million to invest, a realistic investment would be purchasing a small apartment complex in the $800k – $1 million range. Out of pocket, it would require a 20-25% down payment plus closing costs.

While location is one of the most critical factors when buying a property, here are a few additional factors to consider:

- Local job market – Multiple industries and low unemployment will draw a strong renter pool

- Population growth – Strong rental demand will be driven by local population growth

- Property management – A reputable property management company can handle the day-to-day operations to make the investment more passive (Typically costs 6-10% of gross monthly revenue)

- Historical financials – Looking at the last 12 months of a profit & loss will help analyze things like rent income and expenses, and find opportunities to increase profitability

Investment Options

The beauty of real estate is the wide range of investment options. You could purchase an apartment complex, a commercial building, an Airbnb, or a single-family home. There’s no right answer, but with any purchase, I’d recommend doing your due diligence by analyzing financials, the local market, etc.

If You Want to Invest Under $200k

If you’re early on your real estate investing journey, you can get started with a platform like RealtyMogul, a high-end platform for investing in commercial real estate through non-traded REITs and commercial real estate.

Non-traded REITs (as the name implies) can’t be traded on the stock exchange; you must hold them for several years before they can be sold, and they can only be re-purchased by RealtyMogul themselves.

RealtyMogul offers both income-focused funds and growth-focused funds. The former pays out in monthly or quarterly dividends; the latter aims for higher returns through improvements and capital appreciation.

If you’d like to allocate more funds to real estate, RealtyMogul also offers direct investments in individual properties, but this requires a much higher initial investment.

If You Want To Invest Over $200k

If you’d like to allocate more cash to real estate but aren’t inclined to own or manage property yourself, DLP Capital is a high-quality platform that offers access to a variety of real estate investment opportunities.

Since its inception in 2006, the platform has attracted thousands of investors, and currently maintains an impressive 18,000 housing units and over $5.25 billion in assets under management.

Primarily built to serve affluent investors, DLP Capital offers access to a variety of real estate funds:

- The DLP Housing Fund offers access to build-to-rent and multifamily communities

- The DLP Building Communities Fund offers access o equity and preferred equity investments in entities or senior mortgage loans or mezzanine loans for developing new rental communities

- The DLP Lending Fund offers access to debt investments for the construction, acquisition, and repositioning of attainable rental housing

- The DLP Preferred Credit Fund offers access to debt investments (senior mortgage loans and/or mezzanine loans) and preferred equity in RV and vacation luxury parks, manufactured housing, and rental housing properties.

Here’s what makes the platform truly unique:

- DLP primarily focuses on impact-based investment strategies, attempting to profit while also benefiting society for the greater good. This is not a common feature.

- Transparent fee structure: DLP has a transparent 2.0% management fee, with potential rebates for higher account balances.

- Impressive historical returns: For example, the DLP Housing Fund currently lists a 19.47% compounded DRIP IRR Since Inception (2020) as of December 31, 2023, and currently targets a 10-12% annual net return. Other funds report 12.28%, 13.10%, and 10.99% DRIP IRR since Inception.

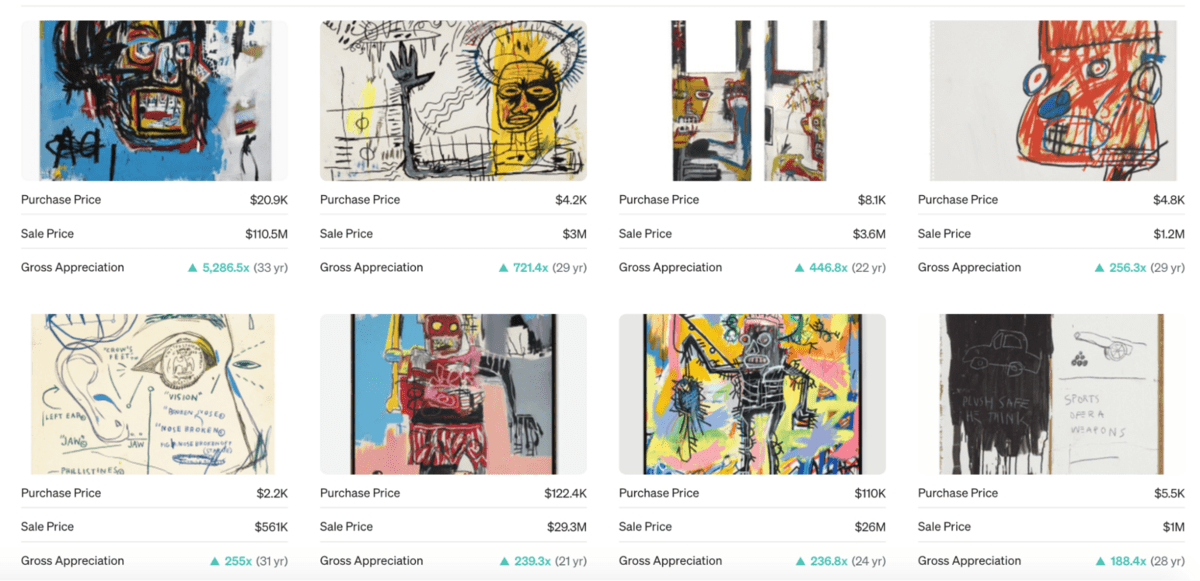

6. Invest in Fine Art

Similar to real estate, art is a long-term play and is a non-liquid asset. The subjective nature of art valuation puts it in a market of its own. Realizing gains in your art assets takes time and patience as the value is determined by an artist’s reputation and brand.

But if you’re looking for how to invest $2 million, it might not get you far in the art world.

An alternative is a platform like Masterworks. Their art experts carefully select contemporary artwork for purchase and allow investors to buy shares. Masterworks will source, store, and sell the art on your behalf. They earn a 20% profit share at the time of the sale and a 1.5% management fee is distributed in the form of equity.

For all the art enthusiasts, Masterworks is great for taking care of the heavy lifting — sourcing, researching, networking, and selling.

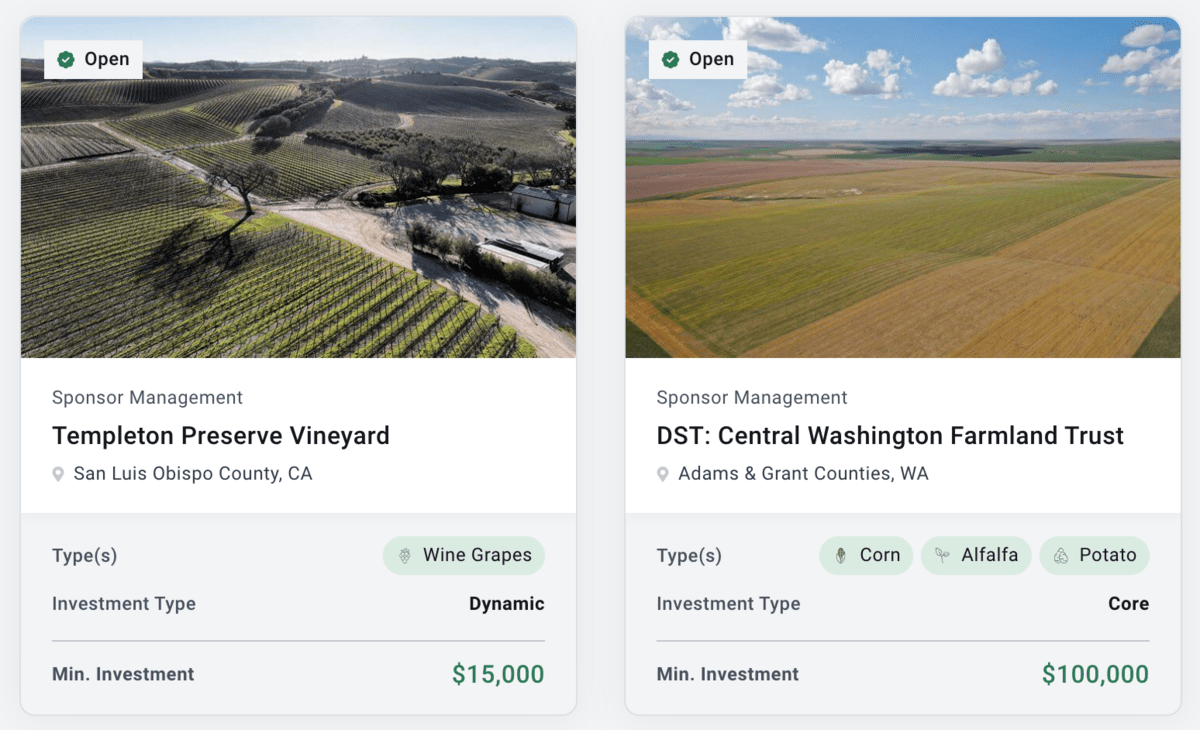

7. Invest in Farmland

Two of the biggest benefits of investing in farmland are diversification and a hedge against inflation. The illiquid nature of farmland investing has a low correlation to the stock market, making it a great addition to your portfolio.

Prices of commodities from farmland are positively correlated to inflation. So, when food prices rise, land values also rise and provide a long-term hedge against inflation.

In my opinion, farmland is somewhat overlooked as an asset class. You may agree that if you’re not the owner-operator, then how do you invest in farmland? Here are some other challenges with farmland investing:

- Lack of transparency – Most farmland stays within the family, and farming requires a unique skill set to be profitable (knowledge in soil cultivation, preparation, heavy machinery)

- Capital requirement – Reserves and prepaid crops, livestock, and machinery are required to achieve economies of scale

- Operational risk – Weather, pest damage and local regulations can impact day-to-day operations

If you’re trying to figure out how to invest 2 million dollars, keep farmland on your radar. Despite the risks, future food demand and historical returns prove it’s a solid alternative asset.

According to the NCREIF Farmland Income Index (which tracks the value of U.S. farmland), farmland has an average return of 10.71% from 1992-2022. U.S. stocks and real estate during that time frame had returns of 9.58% and 8.39%.

Happily, you don’t have to be an experienced farmer to invest in farmland. Newer platforms like AcreTrader are providing transparency and lowering the barrier to access farmland investing.

AcreTrader individually evaluates farmland parcels, then investors can purchase fractional shares. They will handle all administration and property management to help ensure you make money in two ways — land value appreciation and annual cash flow.

8. Invest in Gold

Investing in gold has long been considered a strategy to hedge against inflation and add portfolio diversification. In times of economic uncertainty investors look to gold as a wealth safeguard due to its low correlation to other asset classes.

In addition to the benefit of preserving capital, gold is highly liquid and can be bought and sold in the following forms:

Physical gold – Through a brokerage, you can purchase gold bars and coins which are held by third parties. The need for safe storage and insurance can result in additional costs when purchasing physical gold.

Gold ETFs – Purchase gold via funds is a way to gain exposure without the burden of physical storage. Gold funds can directly track the price of gold or invest in mining companies.

Mining companies – This can present the highest risk when investing in gold because companies may mine other precious metals. Investing directly in companies, like traditional stocks, exposes the investor to company-related risks.

Investing in gold also comes with its disadvantages. Gold’s value is entirely dependent on price appreciation, so storage and insurance costs can eat into profits. Although you can get around this by purchasing gold ETFs or mutual funds, the biggest disadvantage of gold is the inability to produce income.

If you’re interested in adding gold to your portfolio, Silver Gold Bull is my choice to help ‘build your wealth in ounces.’ They not only have a wide selection of gold bars and coins but also provide peace of mind by ensuring your asset is properly stored and insured.

9. Professional Money Management

Confused about the best way to invest 3 million dollars (or even one or 2 mil)? A financial professional can help speed up the financial freedom process by developing a customized plan for your 7-figure nest egg. Here are a few other ways a professional money manager can help you determine the best way to invest 2 million dollars:

- Comprehensive approach to retirement – Take taxes, investing, estate planning, time horizon and risk tolerance into account

- Direct access to money professionals – Work 1-on-1 with financial professionals to make sure you’re staying on track and getting your questions answered

These sound like great services, but you may be wondering – what is the fee to work with a financial advisor? According to Forbes, advisors on average are compensated up to 1% of the annual assets under management.

With platforms like Empower, a 2-3 million dollar investment will put you in the private wealth client category. Enjoy the benefit of a team constructing a personalized portfolio with annual asset management fees of around 0.80% (the national average is 1-2%).

That might not seem like a big deal at first. But let me frame it this way: Say you invested $1 million with a legacy money manager. Your annual fee might be 2%, or $20,000. With Empower, the annual fee would be in the $8,000 range. That’s a big difference!

10. Set Up a High-Yield Savings Account (or a Few)

According to bankrate.com, the national average yield for a traditional savings account is 0.59% APY. Nothing to write home about…

In a high-interest-rate environment, you may want to consider a high-yield savings account. Current rates are approximately 5.5%, nearly 10x higher than a traditional savings account. Sounds like a no-brainer!

You can think of using a traditional savings account for daily expenses, whereas a high-yield account represents an emergency fund. So, it’s still accessible, but earning a higher return. Both accounts are more flexible than certificates of deposit (CDs may charge withdrawal penalty), and are typically FDIC-insured up to $250,000.

You may be wondering, when is a high-yield account better than a traditional savings account? In most cases, probably. If you park cash in a typical bank savings account, it might earn the national average of 0.59%.

On the flip side, a high-yield savings account with CIT Bank can earn you 4% APY or more. For example, their Platinum Savings Account currently offers up to 4.35% APY for accounts over $5,000.

Setting up a few accounts could help you grow your cash passively, and with less risk than stock investing.

11. Invest in Fixed Income

Interested in how to invest 2 million dollars to live off the interest?

A diversified portfolio typically includes fixed-income investments. The most famous fixed-income investment is probably bonds, which represent a loan (no ownership rights) made by an investor to a borrower — typically corporations or governments. You are essentially lending the institution money in exchange for a steady stream of interest payments.

Common types of fixed income include:

- Certificates of Deposit – Issued by banks for terms between 3 months to several years, FDIC-insured up to $250,000, one of the safest fixed-income investments

- Treasury Bills – Government securities issued for terms less than 1 year, backed by the U.S. government

- Treasury Notes – Government securities issued for 2-10 year terms, backed by U.S. government

- Treasury Bonds – Government securities issued for 10-30 year terms, backed by U.S. government

- Corporate Bonds – Issued by companies raising money to fund new products or projects, pay higher interest (higher risk) since they’re not FDIC-insured bank products or treasury-issued

- Municipal Bonds – Issued by states, cities, and counties and used to fund school and public projects, most terms range from 2-5 years

Annuities

Another type of fixed income is an annuity, which is another method for how to invest 2 million dollars to live off the interest. Both bonds and annuities are great vehicles for providing a steady stream of income. The biggest difference between them is how the contractual nature of annuities protects them from interest rate fluctuations.

Bonds are more sensitive to changes in interest rates, whereas insurance companies offering annuities take on the risk and in exchange, can offer steady payments based on the length of a contract. If you’re trying to figure out how to invest 2 million dollars in a crazy interest rate environment, you may want to consider an annuity.

Annuities are a great tool if you’re not trying to ‘outlive your money,’ where bonds have a maturity date. Annuities are also more flexible than bonds, with the ability to negotiate the contract to include riders or life insurance.

While there are many differences between bonds and annuities, they share the following benefits when looking for fixed-income investments:

- Steady stream of income

- Capital preservation

- Portfolio diversification

- Product variety

Both fixed-income vehicles offer a wide range of products to fit your goals, time horizon and risk tolerance.

If you want to explore your options, platforms like Charles Schwab are a great place to find the right product at the right price.

If you’re specifically interested in CDs, CIT Bank has a lot of great options, including a “jumbo CD” starting at $100K.

Bonus: Crypto

Crypto appears to be making a comeback. But does that mean it’s investment-worthy?

Maybe. It depends on your risk tolerance and goals.

Before buying or selling crypto, here are some key factors to consider:

Lacking legal protection – Unlike debit card purchases, crypto transactions have no legal protection if something goes wrong. Transactions are irreversible and are not backed by a government or central bank.

Cryptocurrency is volatile – Early stages of Bitcoin have proven that crypto can be very volatile. This is because the lack of trust from either party of what is being exchanged can cause skepticism in its long-term value.

Cryptocurrency is unregulated – In the event of an exchange bankruptcy or criminal hack, lack of regulation means your assets could be at risk.

Crucial resources for crypto investors

1. Education. Start by learning the basics. Not only will these top-rated courses improve your understanding of crypto, but they might make these shows more enjoyable!

Check out these Udemy courses to expand your knowledge:

2. A secure crypto wallet. SecuX is one of the undisputed leaders in safe crypto storage. The company has made a name for itself owing to top-level security measures — notably, the Flash CC EAL5+ Secure Element chip that comes with most wallets in their lineup, a feature that helps protect your private key from potential threats.

To get started with crypto you’ll need to choose a broker or crypto exchange, like eToro. Once you choose a platform, you’ll set up and fund an account so you can begin trading. Most platforms will allow you to use the U.S. Dollar to purchase crypto.

Once you purchase a cryptocurrency, like Bitcoin or Dogecoin, you’ll need to store it in a wallet to prevent hacks or theft. A crypto wallet is a software used to securely store your private crypto keys. Our top pick? Wallets by SecuX.

The ability to use crypto to purchase everyday items has not yet materialized. Currently, crypto is accepted as an exchange medium on some e-commerce websites, online luxury retailers, and some car dealerships.

If you’re looking to get started, take advantage of eToro’s social investing feature to mimic the portfolio of seasoned crypto traders.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

How Important Are Tax-Advantaged Accounts?

Tax-advantaged accounts are savings or investment accounts that allow you to reduce taxable income now, or defer paying taxes on earnings until later. Some examples of tax-advantage accounts are a 401(K), IRA, health savings accounts, and 529 college savings plans.

“Tax-advantaged” generally refers to controlling the timing of your tax liability. Here are three concepts to understand under the tax-advantage umbrella:

Pre-tax contributions – Typically in the form of a 401(K), this will reduce your taxable income in the year you contribute.

Tax-deferred earnings – In an IRA and 401(K), dividends and interest are taxed later, or when you take a withdrawal.

Tax-exempt earnings – Roth IRA contributions are made with after-tax money, and earnings are tax-exempt – meaning tax-free at the time of withdrawal. Health savings accounts allow for pre-tax contributions AND tax-exempt growth, as long as the money is used for qualified health expenses.

A Note About Allocation…

Allocation refers to how you divide up your investments in stocks, bonds, cash, and other assets. Personal asset allocation will depend on your investment time horizon, risk tolerance, and retirement goals.

For instance, if your goal is to learn how to invest 2 million dollars to live off the interest — or how to invest 3 million dollars to live off the interest, for that matter — you’ll want to invest in investments that issue regular interest.

Final Word: Best Ways to Invest $2 to $3 Million Dollars

There are several ways to invest $2 to $3 million dollars. To figure out what’s best for your financial situation, consider the following factors:

- Time horizon

- Risk tolerance

- Retirement goals

- Current finances

- Current health

Overall, the most important concept is to understand your current situation so you can set goals for the future to make the most of your finances. The best way to invest $2 to $3 million dollars will depend on the goals and actions taken by the individual.

FAQs:

Can you live off 2 million dollars invested?

Yes, it’s possible to live off 2 million dollars invested. With the right mix of investment strategies, you could expect to live off 2 million dollars in retirement. This will largely depend on your retirement lifestyle and expenses.

Are you rich if you have 2 million dollars?

Whether or not you’re rich if you have 2 million dollars is subjective. In a survey of 1,000 Americans by Logica Research, respondents said they needed a $2.2 million net worth to feel rich. However, time horizon is one of the main factors to help determine what dollar amount represents personal wealth.

How much interest can I earn on 2 million dollars?

Many investors want to know how to invest 2 million dollars to live off the interest. The amount of interest you earn on 2 million dollars will depend on how you invest your money. As an example, a conservative return of 4% on principal can generate an annual income of $80,000 on 2 million dollars.

How much does a 2 million dollar annuity pay?

A 2 million dollar annuity payout could range from $10,000-$20,000 per month. The specific amount will depend on the type of annuity and when you prefer payments to start.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.