Billionaires like Bill Gates and John Malone have been buying up U.S. farmland like there’s no tomorrow. Why?

- Farmland is a valuable part of a portfolio

- It can hedge against inflation.

- It holds value over time.

But if you’re not a billionaire, how can you get farmland exposure? That’s where farmland REITs come in.

In this article, I’ll walk you through the best farmland REITs and farmland stocks below, as well as some other unique ways to invest in farmland that you might not have considered.

Prefer a different approach?

Farmland REITs do have plenty of benefits, but they’re not for everyone. If you’re looking for alternatives that don’t require buying farmland outright, consider some of our favorite crowdfunded platforms:

What is a Farmland REIT?

A farmland REIT (short for real estate investment trust) is a company that owns and manages farmland properties and generates revenue from leasing this land to farmers.

Investing in farmland REITs is a great way to get exposure to the agriculture industry without having to deal with the logistics of owning and managing farmland directly. And since farmland REITs are publicly traded like any other stock, they’re very liquid and easily accessible for investors.

As a farmland REIT shareholder, you have voting rights and can receive dividends based on your percentage ownership. However, keep in mind that the value of your shares can fluctuate based on market conditions.

REITs are publicly traded. To trade them, you’ll need a broker. Our top pick? moomoo.

Check out more of our top brokers in this article.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate. The experiences of the influencer may not be representative of the experiences of other moomoo users. Any comments or opinions provided are their own and not necessarily the views of MFI, MTI or moomoo. Moomoo and its affiliates do not endorse any strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation of a security or to engage in any investment strategy. Investing involves risk and the potential to lose principal. Investment and financial decisions should be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any images shown are strictly for illustrative purposes. Past performance does not guarantee future results. U.S. residents trading in U.S. securities may trade commission-free using the moomoo app through Moomoo Financial Inc. (MFI). Please see our pricing page for other fees. Level 2 data is free to moomoo users that have an approved MFI brokerage account. Trading during Extended Hours Trading Sessions carries unique risks, such as greater price volatility, lower liquidity, wider bid/ask spreads, and less market visibility, and may not be appropriate for all investors.

The 2 Best Farmland REITS

Investors looking for the best farmland REIT luckily won’t have to research or screen dozens of companies. There are only two real options. However, both of these farmland stocks have important differences you need to be aware of before making an investment.

Here are the two best farmland REITs, and the pros and cons of each:

1. Gladstone Land (NASDAQ: LAND)

The first farmland REIT to consider is Gladstone Land (NASDAQ: LAND), which currently owns over 140,000 acres of farmland across 14 states in the U.S.

Gladstone Land’s properties are primarily used for growing fruits, vegetables, and nuts.

The company’s top crops include:

- Blueberries

- Pistachios

- Almonds

By investing in Gladstone Land, investors can gain exposure to these lucrative agricultural products, which have demonstrated strong demand in recent years.

Just note that Gladstone’s focus on specialty crops like blueberries and pistachios can limit its overall diversification, potentially making it more vulnerable to market fluctuations in those specific products.

The other thing to keep in mind with Gladstone is that the company’s portfolio is concentrated in just a few states, which could also pose risks.

2. Farmland Partners (NYSE: FPI)

If you’re looking for the best farmland REIT, the other noteworthy player in the industry is Farmland Partners (NYSE: FPI).

This agriculture REIT owns over 158,000 acres of farmland across 17 states, leased to farmers who grow a variety of crops, including:

- Corn

- Soybeans

- Wheat

By diversifying their farmland holdings across multiple states and crops, Farmland Partners aims to provide stable cash flow and long-term appreciation for investors.

Compared to Gladstone, FPI is arguably the more diversified company, clocking in with approximately 26 different crop types and over 100 tenants.

It’s also worth noting that FPI’s business model is slightly different from Gladstone’s. Even though it’s an agriculture REIT, FPI also offers loans and financing to farmers. This extra revenue stream arguably adds some diversification, but also throws more complex financials into the mix and potentially raises the risk.

Pros and Cons of Farmland REIT Investing:

Pros | Cons |

|---|---|

Passive | Market volatility |

Instant diversification | Lack of direct control over the land |

Expert management | |

Inflation hedge | |

Liquidity: easily buy and sell shares |

Alternatives to Farmland REITs:

1. Invest in Farmland Directly

If you have a significant amount of capital to invest, one option to consider is investing in farmland directly. This is the most direct way to gain exposure to the agriculture industry, but it comes with its own set of challenges:

- Buying farmland can be an expensive endeavor. Depending on the location and quality of the land, prices can range from a few thousand to millions of dollars per acre.

- Owning farmland also requires ongoing maintenance, such as soil testing, irrigation, and equipment repairs. This can be time-consuming and expensive, especially if you’re not familiar with the industry.

- Selling farmland can also be a challenge, especially if you need to liquidate your assets quickly. Real estate transactions can take months to complete, and you may have to deal with local zoning laws and regulations.

That said, investing in farmland directly also has unique advantages, like the ability to negotiate leases directly with farmers and potentially earn higher returns than other types of farmland investments. Ultimately, it’s important to weigh the potential benefits and drawbacks before deciding if direct farmland investment is right for you.

2. Crowdfunded Farmland Investing Platforms

Crowdfunded farmland platforms allow investors to pool their resources together to invest in farmland and access fractional ownership in farmland properties. This way, you get access to private deals but you don’t have to go in on a property alone and lay out a ton of capital.

Two popular crowdfunded farmland investing platforms are AcreTrader and FarmTogether.

AcreTrader

AcreTrader provides accredited investors with access to pre-vetted U.S. farmland investments starting from $10,000. The platform offers investments in a variety of crops, including row crops, permanent crops, and timberland.

AcreTrader also provides due diligence materials, such as soil reports and water rights information, to help investors make informed decisions.

FarmTogether

FarmTogether offers accredited investors the opportunity to invest in high-quality U.S. farmland with investments starting at $15,000. The platform provides investors with a diversified portfolio of farmland across different crops, geographies, and farm managers.

FarmTogether also offers due diligence materials and reports on each farm, as well as regular updates on the performance of each investment.

3. Invest in Farmland ETFs

Direct investment in farmland is a lot of work. And the crowdfunding farmland platforms require you to be an accredited investor.

Another option? Invest in a farm land ETF.

Farmland ETFs offer exposure to the agriculture industry with relatively low investment costs and greater liquidity than direct farmland ownership.

ETFs can also provide greater diversification since they invest in a variety of companies or commodities, potentially reducing risk.

However, there’s a catch here as well: there’s not really a “pure play” farm land ETF.

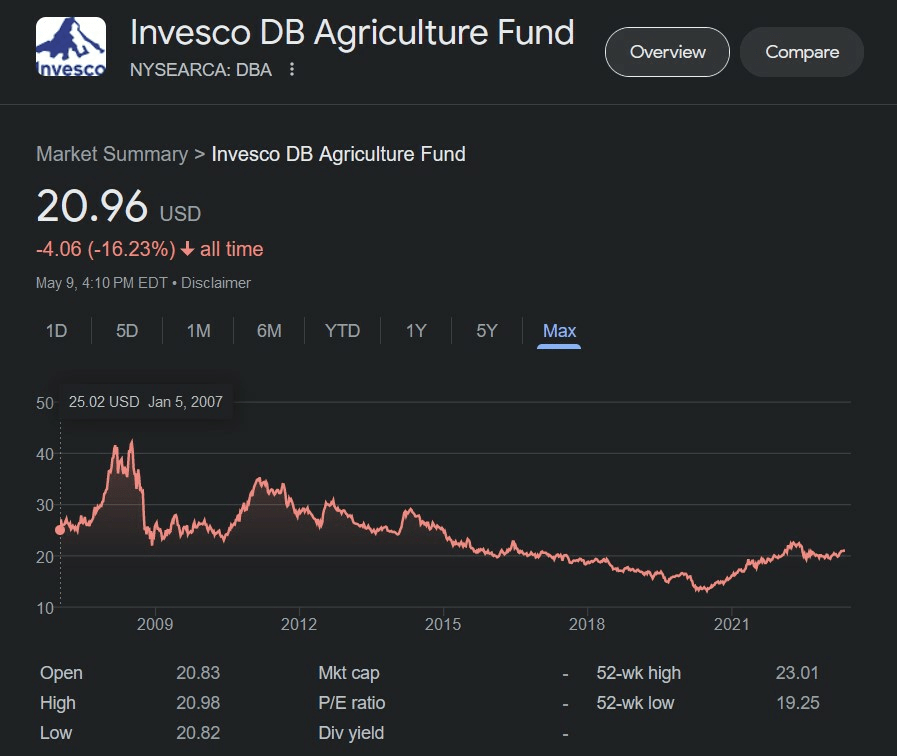

The closest thing is the Invesco DB Agriculture Fund (NYSE: DBA):

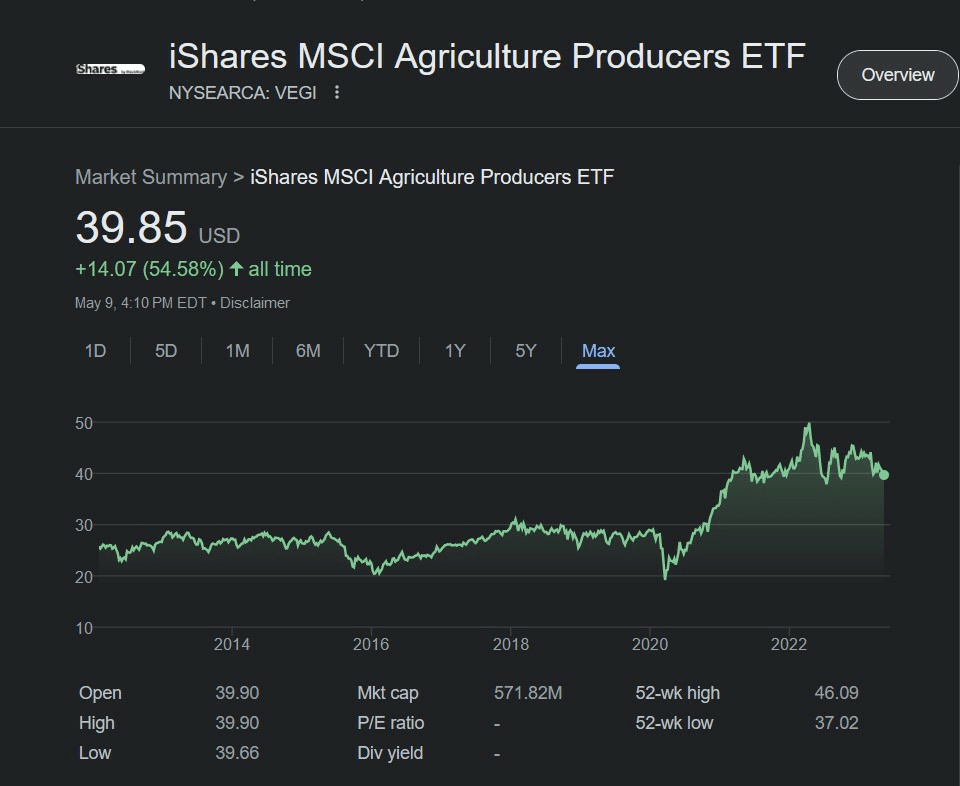

… Or the iShares MSCI Global Agriculture Producers ETF (NYSE: VEGI):

These ETFs provide exposure to the agriculture industry through investments in companies engaged in the production and distribution of agricultural products, including farmland owners and operators.

However, each farm land ETF has important differences:

The iShares MSCI Global Agriculture Producers ETF (NYSE: VEGI) tracks the performance of the MSCI ACWI Select Agriculture Producers Investable Market Index. This ETF invests in companies across the globe that are involved in agricultural production, such as seed and fertilizer producers, farm machinery manufacturers, and animal health companies. The fund’s top holdings include Archer-Daniels-Midland, Deere & Co, and Nutrien.

The Invesco DB Agriculture Fund (NYSE: DBA) seeks to track changes in the DBIQ Diversified Agriculture Index Excess Return. This ETF invests in futures contracts on a range of agricultural commodities, such as corn, wheat, soybeans, and sugar. The fund’s top holdings include corn futures, soybean futures, and wheat futures.

In my opinion, VEGI is going to be the better choice for most people. You’re getting direct exposure to the biggest and best companies involved in agriculture. DBA is full of wide-ranging futures contracts relating to the price of the actual commodities themselves. If you don’t know what you’re doing with futures, I’d stay far away. Besides, typical REITs historical returns are far higher than those of DBA.

Either way, remember that ETFs come with management fees, which can impact returns over time. Like all farmland investments, ETFs are also subject to market volatility, and their performance can be affected by a range of factors, such as weather conditions, commodity prices, and global economic conditions.

Interested in trading ETFs? While many brokers support ETF trading, three that shine are:

I’d give Fidelity the edge overall — because it gives you so much more data on its Summary pages.

Final Word: Farmland REITs

Farmland REITs can be an excellent investment opportunity if you want to gain exposure to the agriculture industry without owning and managing farmland directly. They’re an easily accessible and liquid option, and their properties can provide an inflation hedge and long-term value.

- If you are considering investing in farmland REITs, it’s important to do your research and understand the potential risks and rewards. Gladstone Land (NASDAQ: LAND) and Farmland Partners (NYSE: FPI) are the two best farmland REIT options, with different approaches to diversification and revenue streams.

- Investing in farmland directly can also provide unique advantages, like negotiating leases directly with farmers and potentially earning higher returns, but it also has its own challenges, like ongoing maintenance and difficulty selling assets.

- Crowdfunded farmland platforms, like AcreTrader and FarmTogether, offer a way to pool resources together to invest in farmland properties with fractional ownership. But you need to be accredited.

- You can also consider an agriculture / farm land REIT like the iShares MSCI Global Agriculture Producers ETF (NYSE: VEGI).

With these options in mind, the best investment strategy for farmland will ultimately come down to your individual financial goals and risk tolerance.

FAQs:

How to invest in farmland REIT?

To invest in a farmland REIT, you can buy shares of a publicly traded farmland REIT like Gladstone Land (NYSE: LAND) or Farmland Partners (NYSE: FPI) through a brokerage account.

What is the best farmland REIT?

There is no one best farmland REIT, as each REIT has its unique investment strategy, geographic focus, and risk profile. It is best to research and compare farmland REITs like Gladstone Land (NYSE: LAND) or Farmland Partners (NYSE: FPI) to find one that aligns with your investment goals and risk tolerance.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.